The Daily Expense Log Excel Template for Personal Finances is a practical tool to track and manage daily spending efficiently, helping to maintain a clear record of income and expenses. It allows users to categorize expenses, set budgets, and generate summaries for better financial decision-making. Using this template ensures accurate monitoring of personal finances, promoting savings and reducing unnecessary expenditures.

Daily Expense Tracker with Automatic Summaries

A Daily Expense Tracker with Automatic Summaries is a document designed to record and categorize daily financial transactions efficiently. It automatically calculates totals and provides insights to help manage personal finances better.

- Include clear categories for expenses to ensure detailed tracking.

- Implement automatic summation for daily and monthly totals.

- Incorporate visual summaries like charts to highlight spending patterns.

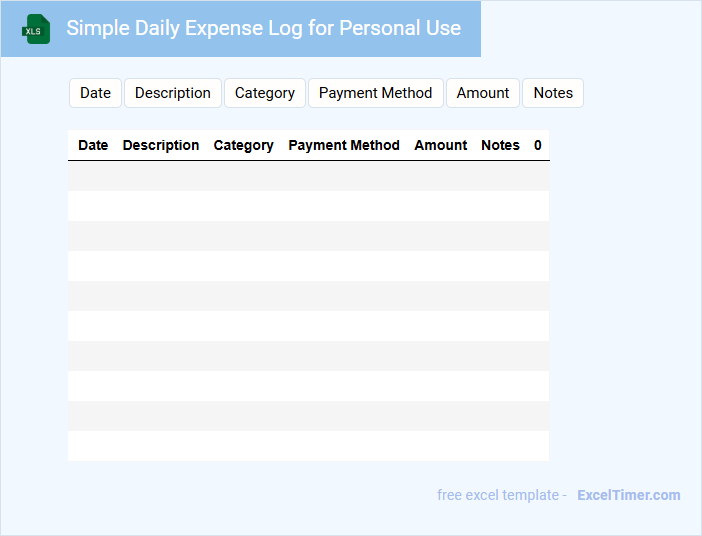

Simple Daily Expense Log for Personal Use

A Simple Daily Expense Log is a tool used to record daily expenditures in a clear and organized manner. It typically contains entries such as date, description, amount spent, and category of expense. Maintaining this log helps individuals track spending patterns and manage personal finances more effectively.

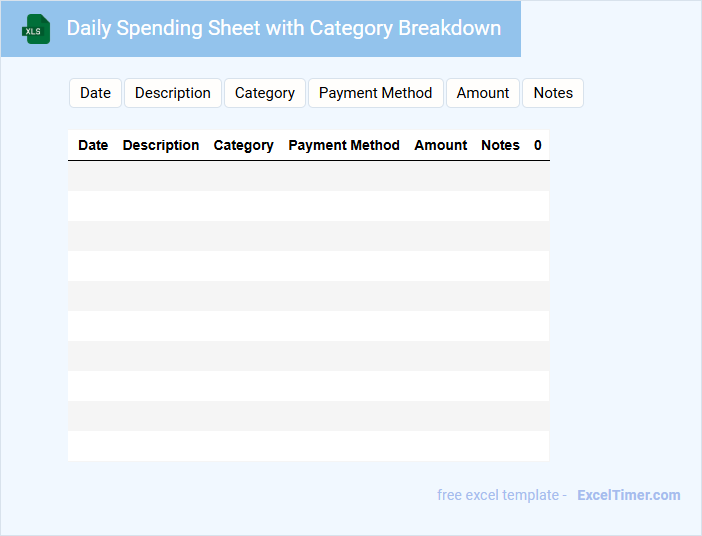

Daily Spending Sheet with Category Breakdown

A Daily Spending Sheet with Category Breakdown is a document used to track personal or business expenses on a daily basis. It usually contains detailed entries including date, description, amount, and expense categories such as food, transportation, or utilities. This breakdown helps users identify spending patterns and manage their budgets more effectively.

Personal Finances Daily Expense Report

What does a Personal Finances Daily Expense Report typically contain?

This document usually includes detailed records of daily expenditures, categorized by type such as food, transportation, and utilities. It helps track and manage spending habits for better budgeting and financial planning.

Important elements to include are date, description of the expense, amount spent, and payment method. Consistent updates and review of the report are crucial for maintaining accurate financial awareness and control.

Daily Cash Flow Tracker for Individuals

A Daily Cash Flow Tracker is a personal finance document that records daily income and expenses to monitor financial health. It helps individuals understand spending habits and manage their money more effectively.

Typically, this document contains categories for income sources, expense types, dates, and running balances. An important suggestion is to regularly update the tracker to ensure accurate financial insights and support budgeting goals.

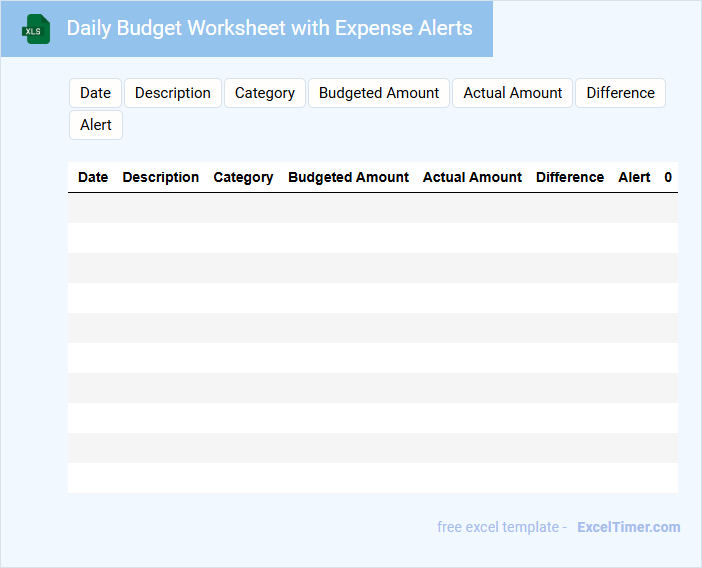

Daily Budget Worksheet with Expense Alerts

A Daily Budget Worksheet with Expense Alerts is a document designed to help individuals track their daily spending and stay within their financial limits. It typically includes sections for recording various expenses and automated alerts when nearing budget thresholds.

- Include clear categories for different types of daily expenses to improve accuracy.

- Set customizable alert thresholds to avoid overspending.

- Use visual indicators like color codes to highlight budget status quickly.

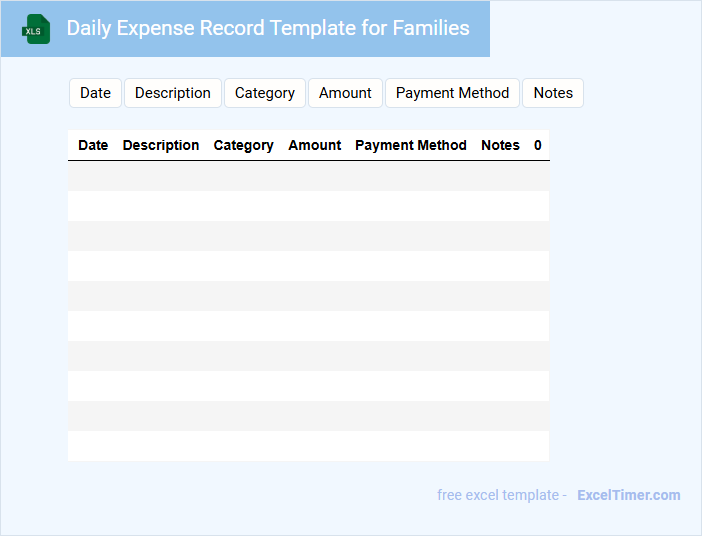

Daily Expense Record Template for Families

A Daily Expense Record Template for Families typically contains sections for tracking daily spending, including categories like groceries, utilities, transportation, and entertainment. It helps families monitor their financial habits and manage budgets efficiently.

This document is essential for maintaining financial awareness and planning future expenses. It is important to include clear categories, date fields, and space for notes to ensure comprehensive tracking.

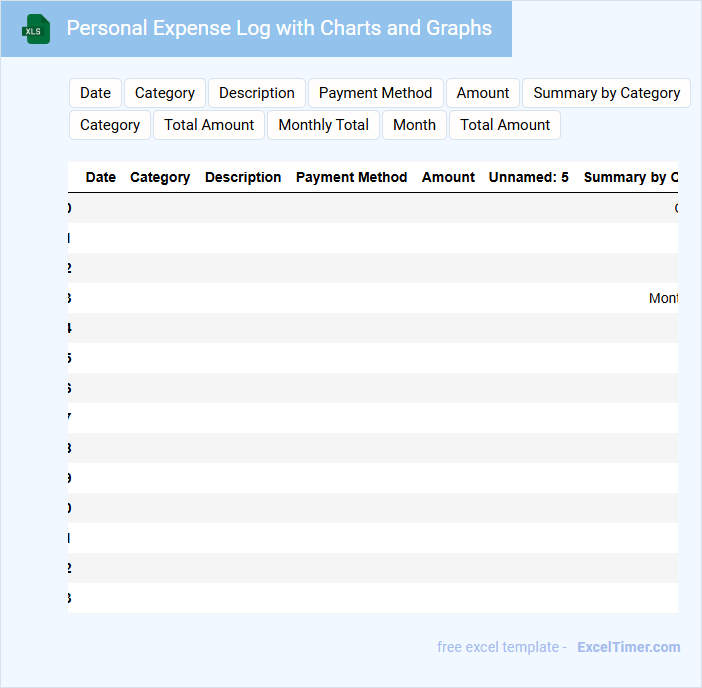

Personal Expense Log with Charts and Graphs

A Personal Expense Log with Charts and Graphs is a document that records individual financial transactions and visually represents spending patterns. It helps users track expenses, budget effectively, and identify areas for saving.

- Include detailed and categorized expense entries for accurate tracking.

- Use clear and colorful charts to highlight spending trends and comparisons.

- Regularly update the log to maintain current and useful financial insights.

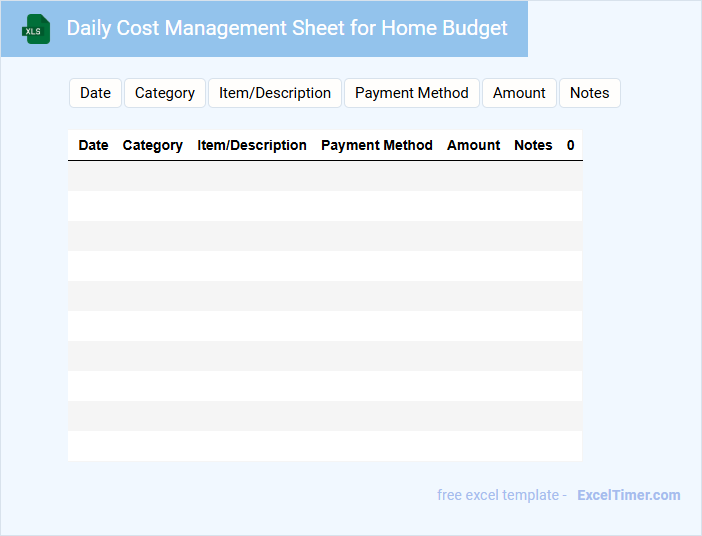

Daily Cost Management Sheet for Home Budget

What information is typically included in a Daily Cost Management Sheet for Home Budget? This document usually contains detailed daily records of household expenses, categorized by type such as groceries, utilities, and transportation. It helps track spending patterns and manage the family budget effectively by providing clear visibility on where money is being allocated.

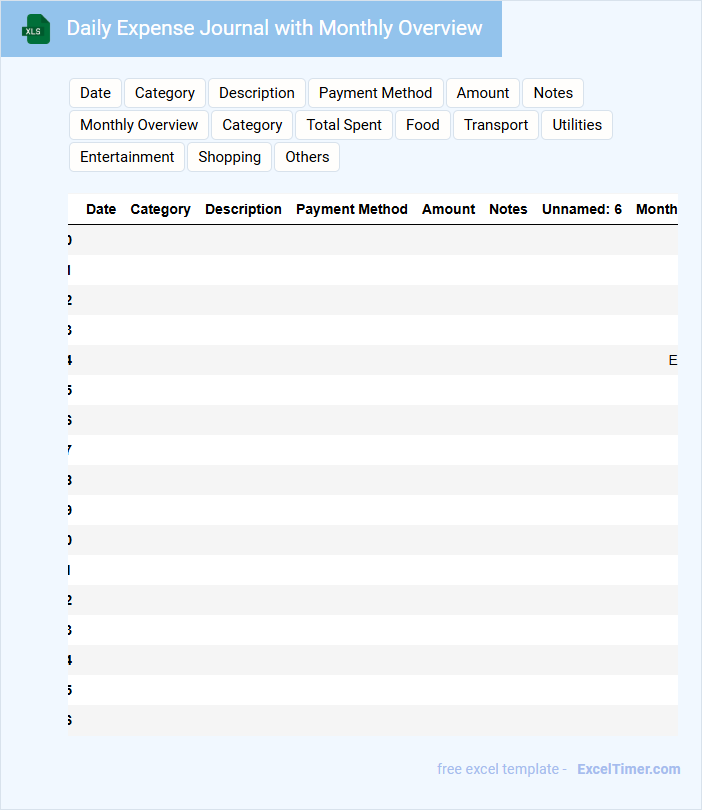

Daily Expense Journal with Monthly Overview

What information does a Daily Expense Journal with Monthly Overview typically contain? This document usually records daily spending details, including the amount, category, and description of each expense. It also provides a summarized monthly overview to track total expenses and identify spending patterns and budget adherence.

Why is it important to maintain accurate and consistent entries? Consistent recording helps in monitoring financial habits, preventing overspending, and making informed decisions for budgeting and saving. Including categories and notes in each entry ensures clarity and helps analyze where money is being spent most frequently.

Daily Spending Register for Personal Finances

A Daily Spending Register for Personal Finances is a document used to record and track daily expenses to manage budgeting effectively. It helps individuals monitor their spending habits and maintain financial discipline.

- Include the date, description, and amount of each expense for accurate tracking.

- Categorize expenses (e.g., food, transportation, entertainment) to identify spending patterns.

- Regularly review and update the register to stay informed about your financial status.

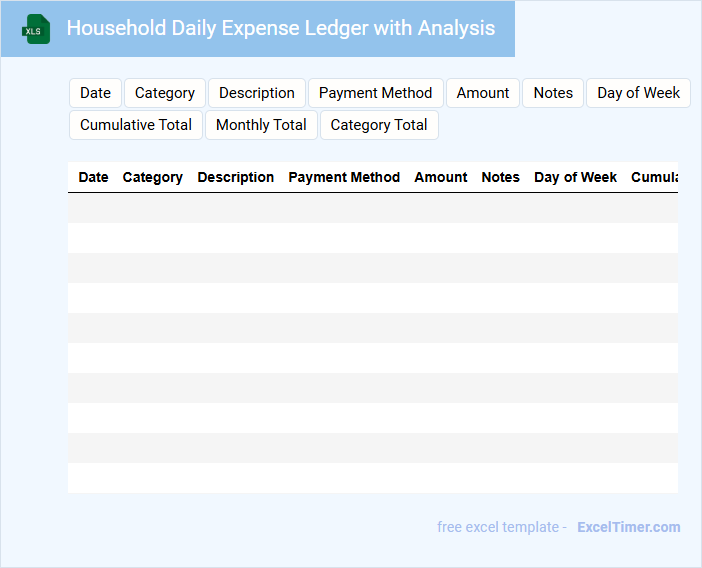

Household Daily Expense Ledger with Analysis

A Household Daily Expense Ledger typically contains records of daily expenditures, categorized by type such as groceries, utilities, and entertainment. It helps track spending patterns over time for better budget management.

Including an analysis section provides insights into spending trends and highlights areas for potential savings. Regular review of this data supports informed financial decisions and goal setting.

For effective use, ensure accuracy in entries and consistency in categorization.

Daily Expense Calendar for Budget Planning

A Daily Expense Calendar for Budget Planning typically contains detailed records of daily spending and income to help manage finances effectively.

- Accurate Tracking: It is essential to log every expense to maintain a clear financial overview.

- Categorization: Organizing expenses into categories like food, transport, and utilities improves budget analysis.

- Consistent Review: Regularly reviewing the calendar helps adjust spending habits and meet financial goals.

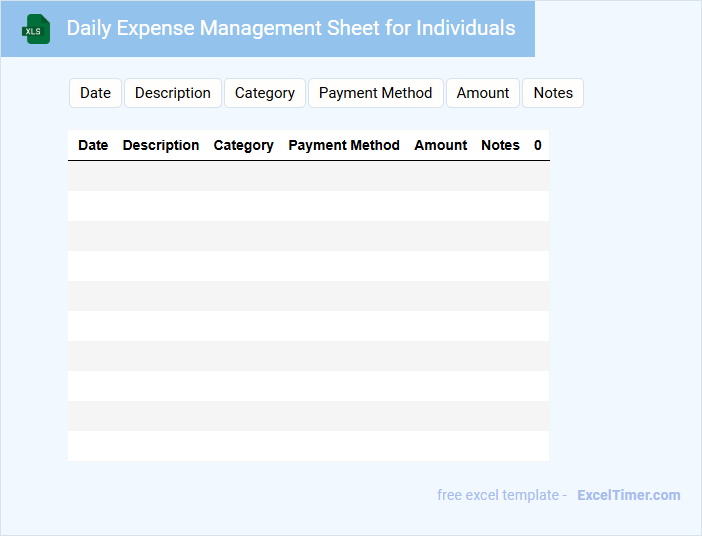

Daily Expense Management Sheet for Individuals

A Daily Expense Management Sheet is a document used to track and record individual daily spending. It helps in monitoring financial habits and identifying unnecessary expenditures.

Typically, this sheet contains categories such as food, transportation, bills, and entertainment, along with amounts spent and dates. Maintaining consistency is crucial for accurate financial analysis and budgeting.

It is important to regularly update the sheet and review expenses to ensure effective money management and achieve financial goals.

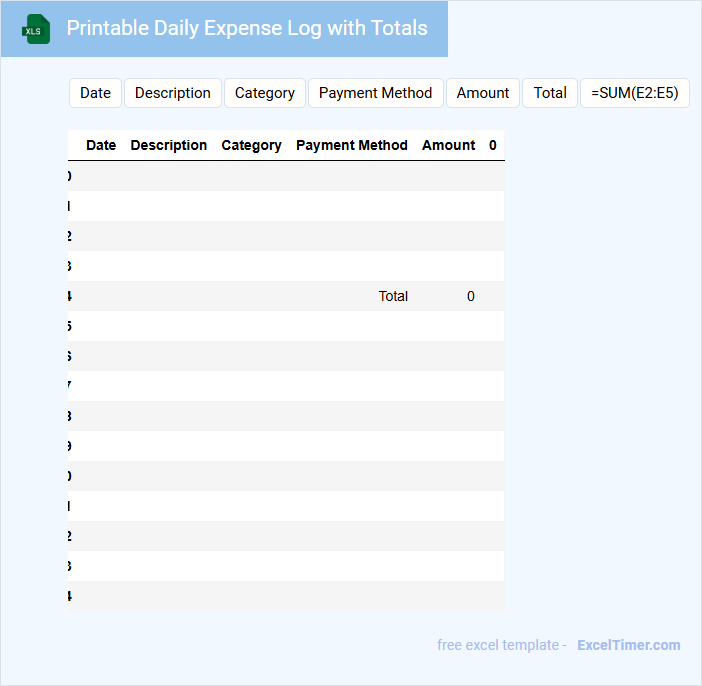

Printable Daily Expense Log with Totals

What does a Printable Daily Expense Log with Totals usually contain? This type of document typically includes sections for date, description of expense, category, payment method, and amount spent. It also provides a running total to help users keep track of their daily spending effectively.

Why is it important to use this document? Using a Printable Daily Expense Log with Totals helps individuals monitor their financial habits, identify spending patterns, and manage budgets more efficiently. Including clear categories and a section for notes can improve accuracy and provide better insights into daily expenses.

What key categories should be included in a daily expense log for effective personal finance tracking?

A daily expense log for personal finance tracking should include key categories such as Date, Expense Description, Category (e.g., Food, Transportation, Utilities), Payment Method (Cash, Credit Card, Debit Card), and Amount Spent. Including a Notes section allows for additional details or context about each transaction. Categorizing expenses helps analyze spending patterns and manage budgets effectively.

How can using a daily expense log help identify spending patterns and potential savings opportunities?

Using a daily expense log in Excel allows you to track all your personal finances accurately, revealing detailed spending patterns over time. This log categorizes expenses, highlighting areas where you consistently overspend and identifying opportunities for budget adjustments. Your awareness of these patterns supports smarter financial decisions and uncovers potential savings.

What are the best practices for organizing and updating daily entries in an Excel expense log?

Organize your Excel Daily Expense Log by categorizing expenses into clear, consistent columns such as date, description, category, and amount. Update entries promptly each day to ensure accuracy and avoid backlog, using data validation to minimize errors. Utilize Excel features like tables, filters, and formulas to analyze spending patterns effectively.

How can formulas and data validation in Excel improve the accuracy and analysis of a daily expense log?

Formulas in Excel automate calculations for total expenses, category summaries, and monthly trends, enhancing accuracy by reducing manual errors. Data validation restricts input types, ensuring consistent and reliable entries for dates, amounts, and categories. Together, these features enable precise expense tracking and insightful financial analysis.

What visualization tools in Excel can best summarize daily expenses for financial review and planning?

Excel offers PivotTables and PivotCharts as powerful tools to summarize your daily expenses, enabling detailed financial review and planning. Conditional Formatting highlights spending patterns, while Sparklines provide compact visual trends directly within cells. These visualization features help you quickly identify expense categories and track budget adherence.