The Monthly Bill Payment Excel Template for Landlords streamlines tracking rent payments, utility bills, and maintenance expenses in one organized spreadsheet. This template helps landlords maintain accurate financial records, ensuring timely payments and easy expense management. Customizable features allow landlords to monitor cash flow and generate clear reports for tax purposes.

Monthly Bill Payment Tracker for Landlords

A Monthly Bill Payment Tracker for landlords is a document that systematically records all expenses related to property management. It typically includes details such as due dates, payment amounts, and payment status for each bill. This ensures timely payments and helps maintain accurate financial records.

Important aspects to include are a clear categorization of bills, reminders for upcoming payments, and a summary section to review total monthly expenditures. This document aids landlords in budgeting effectively and preventing missed payments. Consistent updating of the tracker ensures comprehensive oversight of property expenses.

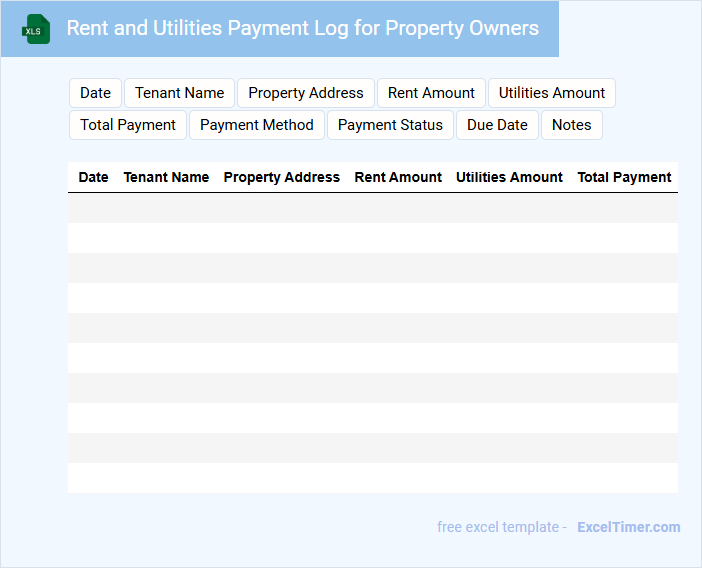

Rent and Utilities Payment Log for Property Owners

What information is typically included in a Rent and Utilities Payment Log for Property Owners? This document usually contains detailed records of rent payments and utility bills submitted by tenants, including dates, amounts, and payment methods. It helps property owners track financial transactions and ensure timely payments for effective property management.

What is an important consideration when maintaining this log? Accuracy and consistency in recording payment details are crucial to avoid disputes and maintain clear financial records. Additionally, it's beneficial to update the log regularly and securely store it for future reference and audit purposes.

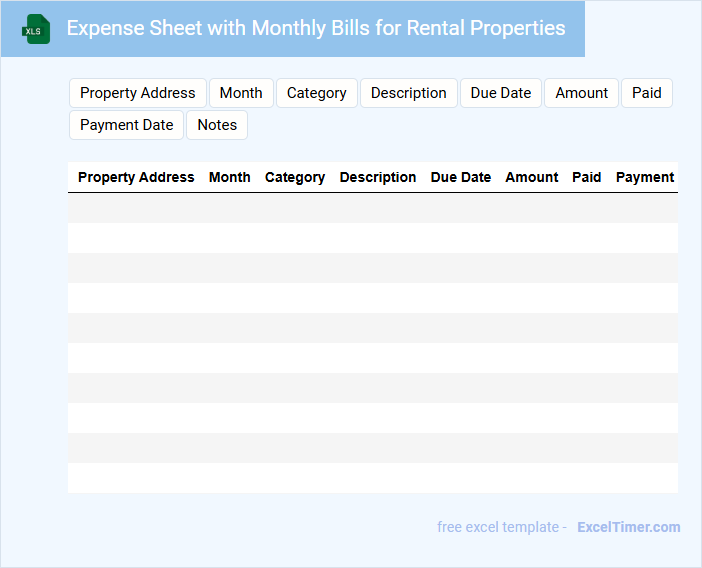

Expense Sheet with Monthly Bills for Rental Properties

An Expense Sheet with Monthly Bills for Rental Properties typically contains detailed records of all costs associated with maintaining and managing rental units. It helps landlords track payments and monitor property-related expenses efficiently.

- Include rent received, utility bills, maintenance costs, and property taxes for clear financial tracking.

- Organize expenses by month to easily compare and analyze spending trends over time.

- Ensure accuracy by attaching receipts and invoices to verify all recorded transactions.

Monthly Payment Schedule for Rental Property Owners

What information is typically included in a Monthly Payment Schedule for Rental Property Owners? This document usually contains details of rent payments due each month, including tenant names, payment amounts, and due dates. It helps owners track incoming payments and manage their rental income effectively.

Why is it important to maintain an accurate payment schedule? Keeping a clear and updated schedule ensures timely rent collection, helps avoid disputes with tenants, and provides a reliable financial overview for property management and tax purposes.

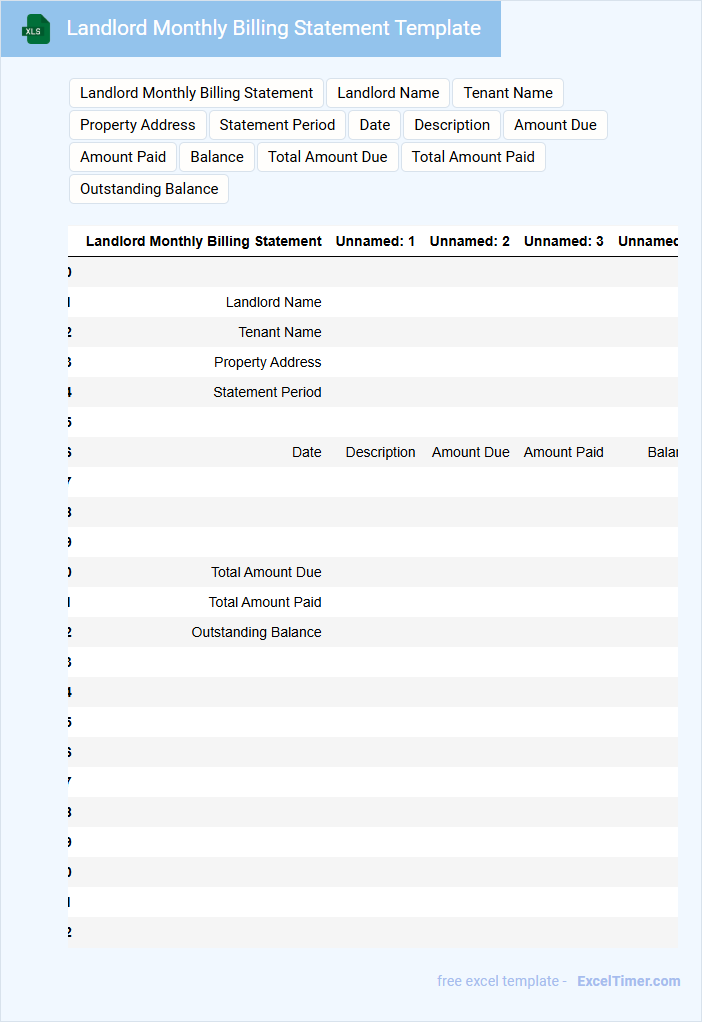

Landlord Monthly Billing Statement Template

A Landlord Monthly Billing Statement typically contains detailed records of rent payments, utilities, and any additional charges incurred by tenants during the month. It serves as an official document to track financial transactions between landlords and tenants.

Important elements include tenant information, payment due dates, and a clear breakdown of costs to avoid disputes. Ensuring accuracy and clarity helps maintain transparent landlord-tenant relationships and supports proper financial management.

Properties Expense Tracker with Monthly Payment Columns

A Properties Expense Tracker is a document designed to monitor and manage all expenses related to property maintenance and operations. It typically includes detailed monthly payment columns to help track recurring costs such as utilities, repairs, and taxes. Maintaining this organized format ensures accurate budgeting and financial planning for property owners or managers.

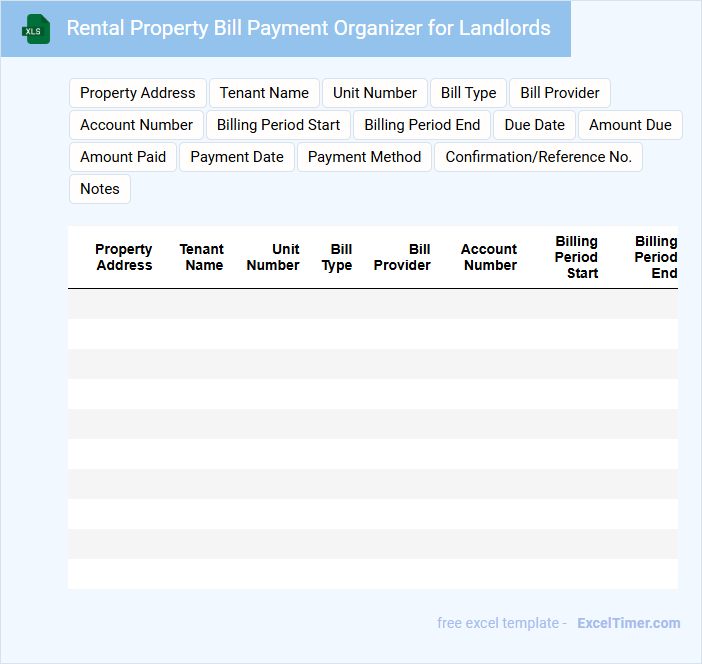

Rental Property Bill Payment Organizer for Landlords

What information does a Rental Property Bill Payment Organizer for Landlords typically include? This document usually contains details about all incoming rent payments, scheduled bills, and expenses related to property maintenance and management. It helps landlords keep track of financial transactions and ensures timely payment of bills.

What is important to include when using a Rental Property Bill Payment Organizer? It is essential to list each tenant's payment status, due dates for utilities, mortgage, and other fees, and maintain accurate records for tax and budgeting purposes. Organizing this data clearly improves financial management and reduces the risk of missed payments.

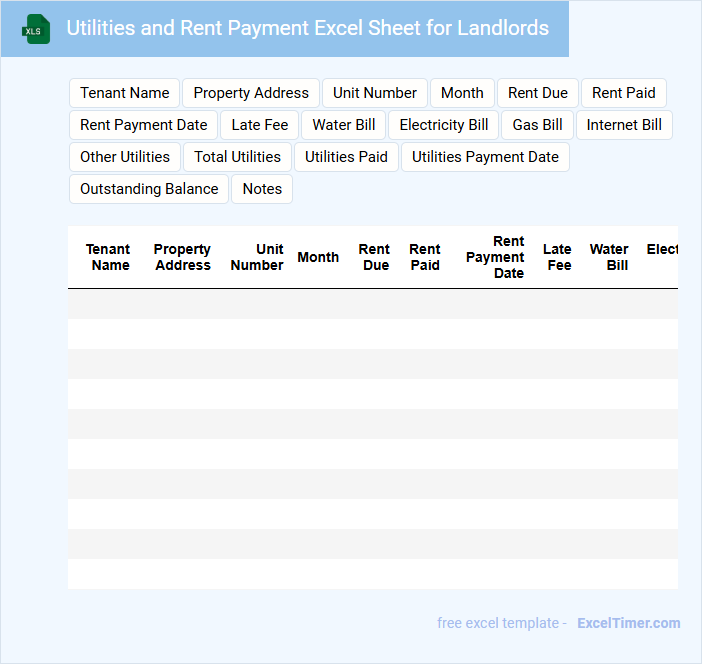

Utilities and Rent Payment Excel Sheet for Landlords

This document is an essential Utilities and Rent Payment Excel Sheet designed for landlords to efficiently track tenant payments. It typically contains columns for rent amounts, utility bills, payment dates, and tenant details. Using this sheet helps landlords maintain organized financial records and ensures timely rent collection.

Payment Tracking Spreadsheet for Monthly Bills of Landlords

What information is typically included in a Payment Tracking Spreadsheet for Monthly Bills of Landlords? This document usually contains details such as tenant names, due dates, payment amounts, and payment statuses to effectively monitor rent collection. It helps landlords organize financial records and ensures timely payments, reducing the risk of missed or late rents.

What important elements should be considered when creating this spreadsheet? Important features include clear categorization of bills, automated reminders for upcoming payments, and a simple method for recording partial or late payments. Additionally, incorporating summary totals and visual charts can provide quick insights into overall payment trends and outstanding balances.

Monthly Expense Log with Bill Due Dates for Landlords

A Monthly Expense Log with Bill Due Dates for Landlords is a document used to track rental income, expenses, and payment deadlines to maintain organized financial records.

- Expense Tracking: Record all monthly expenditures related to property maintenance, utilities, and management fees for accurate budgeting.

- Bill Due Dates: Clearly list due dates for mortgages, insurance, and other recurring payments to avoid late fees.

- Income Monitoring: Log rental payments received and outstanding balances to manage cash flow efficiently.

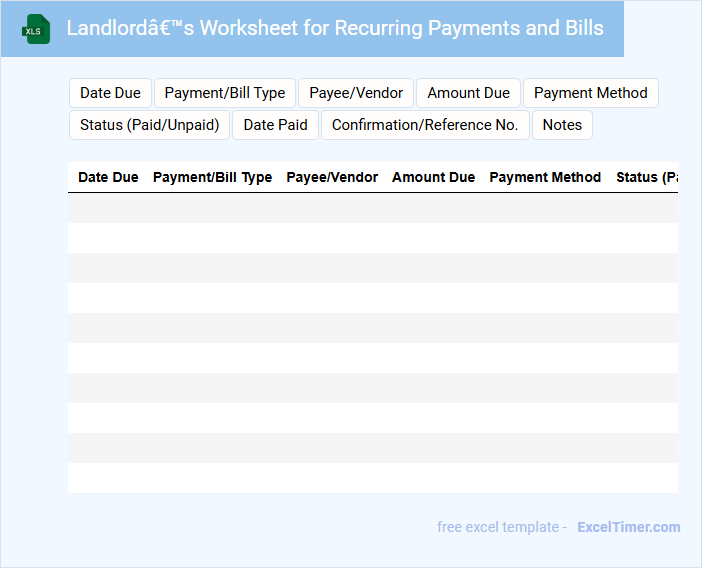

Landlord’s Worksheet for Recurring Payments and Bills

This document typically outlines the landlord's recurring payments and bills for property management.

- Payment Tracking: Ensure all recurring payments such as mortgage, utilities, and maintenance are accurately recorded.

- Expense Categorization: Clearly categorize bills to monitor and manage costs effectively.

- Regular Updates: Maintain the worksheet regularly to reflect any changes in payment amounts or new charges.

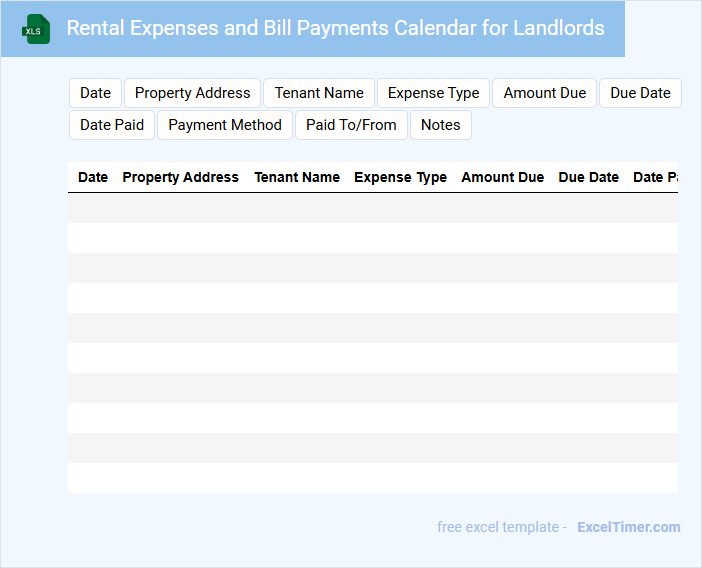

Rental Expenses and Bill Payments Calendar for Landlords

The Rental Expenses and Bill Payments Calendar is an essential document for landlords to track all outgoing financial obligations related to their rental properties. It typically contains due dates for rent payments, utility bills, maintenance costs, and other periodic expenses. This calendar helps landlords ensure timely payments, avoid late fees, and maintain accurate financial records.

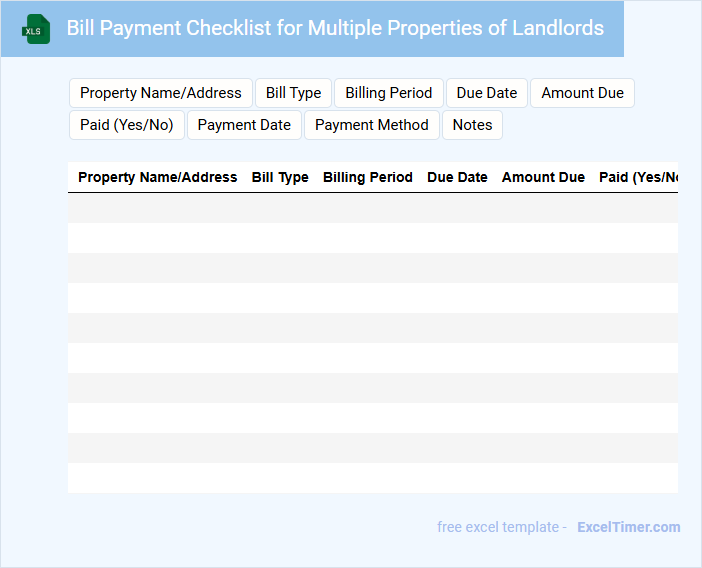

Bill Payment Checklist for Multiple Properties of Landlords

This Bill Payment Checklist for Multiple Properties of Landlords document typically outlines essential payments and due dates to ensure timely management of multiple rental properties.

- Comprehensive Payment Details: A clear list of all recurring and one-time bills required for each property.

- Due Dates and Reminders: Specific deadlines and notification prompts to avoid late fees.

- Verification and Record-Keeping: Instructions for confirming payments and maintaining organized receipts.

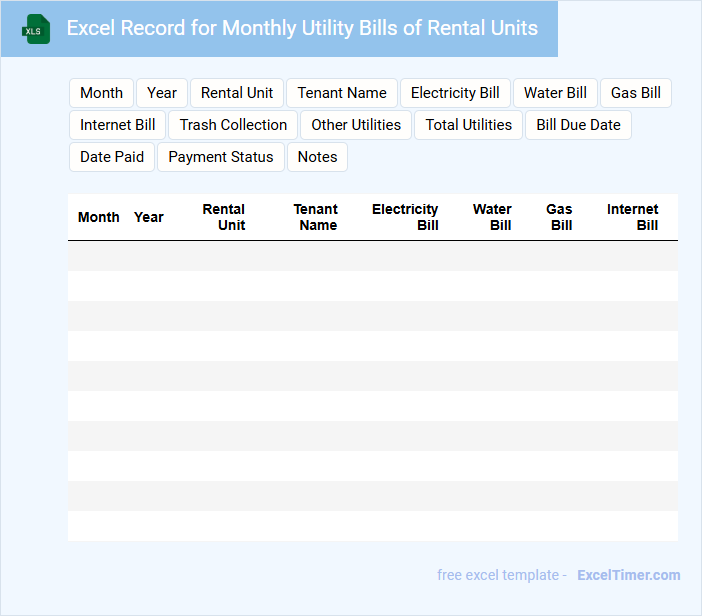

Excel Record for Monthly Utility Bills of Rental Units

An Excel Record for Monthly Utility Bills of Rental Units typically contains detailed entries of various utility expenses such as water, electricity, gas, and internet associated with each rental property. It organizes data by month and unit, facilitating easy tracking and comparison of costs over time. Maintaining accurate records is essential for budgeting, expense management, and dispute resolution with tenants.

Important elements to include are clear column headers for date, unit number, utility type, amount billed, and payment status. Incorporating formulas to calculate totals and averages can streamline monthly reviews and financial analysis. Regular updates and backups of the file ensure data integrity and accessibility when needed.

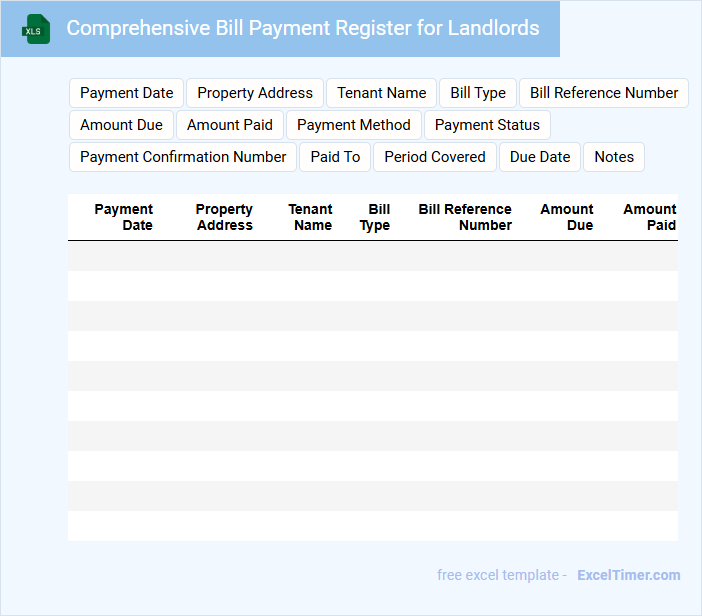

Comprehensive Bill Payment Register for Landlords

A Comprehensive Bill Payment Register for landlords typically contains detailed records of all payments made for property-related expenses, including maintenance, utilities, and taxes. This document helps landlords track their financial obligations and ensures timely payments to avoid penalties. Maintaining accurate and organized entries in the register is crucial for transparent property management and effective financial planning.

What key information should be included in a landlord's monthly bill payment tracking spreadsheet?

A landlord's monthly bill payment tracking spreadsheet should include tenant names, property addresses, due dates, payment amounts, payment status, and payment methods. It should also track late fees, total monthly income, and notes for any discrepancies or special arrangements. Incorporating automated calculations for total payments and outstanding balances improves accuracy and efficiency in financial management.

How can Excel formulas automate the calculation of total expenses and outstanding amounts each month?

Excel formulas automate the calculation of total expenses by summing monthly bill payments using functions like SUM. Outstanding amounts are tracked by subtracting paid bills from the total due with simple subtraction formulas. Your spreadsheet updates automatically each month, ensuring accurate and efficient financial management.

What columns are essential for monitoring payment status and due dates for each bill?

Essential columns for monitoring payment status and due dates in your Monthly Bill Payment Excel document include Bill Name, Due Date, Amount Due, Payment Date, Payment Status, and Notes. These columns help you track when each bill is due, the amount owed, and whether payments have been made on time. Accurate data in these fields ensures efficient bill management and prevents missed payments.

How can conditional formatting highlight overdue or unpaid bills in the document?

Conditional formatting in Excel can highlight overdue or unpaid bills by applying color-coded rules based on due dates and payment status. Set a rule to format cells red if the "Payment Date" is blank or the "Due Date" is past today's date without a corresponding payment recorded. This visual cue helps landlords quickly identify pending payments and manage monthly bill collections efficiently.

What methods can be used in Excel to generate monthly summaries or reports for bill payments?

Excel pivot tables efficiently summarize monthly bill payments by grouping data by date or landlord. Formulas like SUMIFS calculate total payments based on specified criteria to track your expenses. Conditional formatting highlights overdue payments, ensuring you manage your landlord bills effectively.