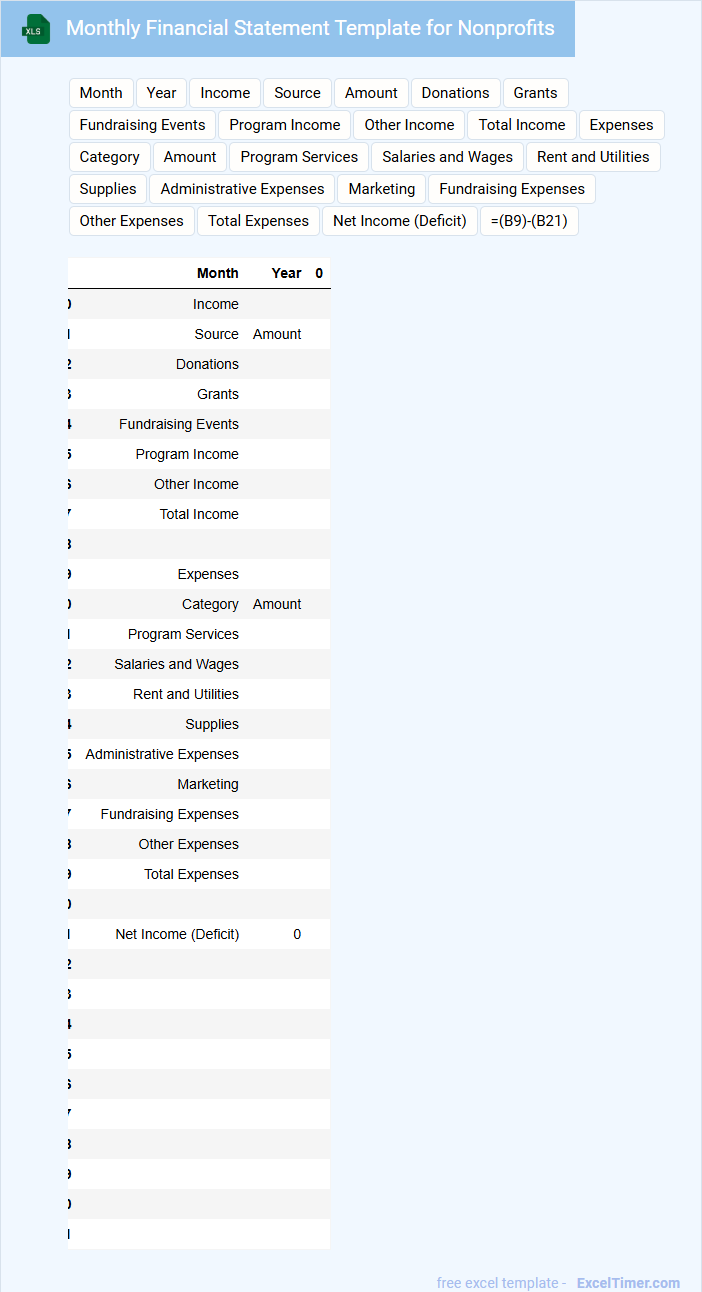

The Monthly Financial Statement Excel Template for Nonprofits helps organizations track income, expenses, and budget performance efficiently. It provides customizable categories tailored to nonprofit accounting needs, ensuring accurate financial reporting. Maintaining detailed monthly records supports transparency and informed decision-making for stakeholders.

Monthly Financial Statement Template for Nonprofits

A Monthly Financial Statement Template for nonprofits typically contains detailed records of income, expenses, assets, and liabilities for the organization. It provides a clear overview of the financial health to stakeholders and ensures transparency. Utilizing this template regularly helps maintain accurate financial tracking and compliance with regulatory standards.

Important elements to include are categorized revenue sources, expense breakdowns, and a summary of net assets. Accurate data entry and timely updates are crucial for effective financial management and decision-making. Consistent use of this template supports budget monitoring and future financial planning.

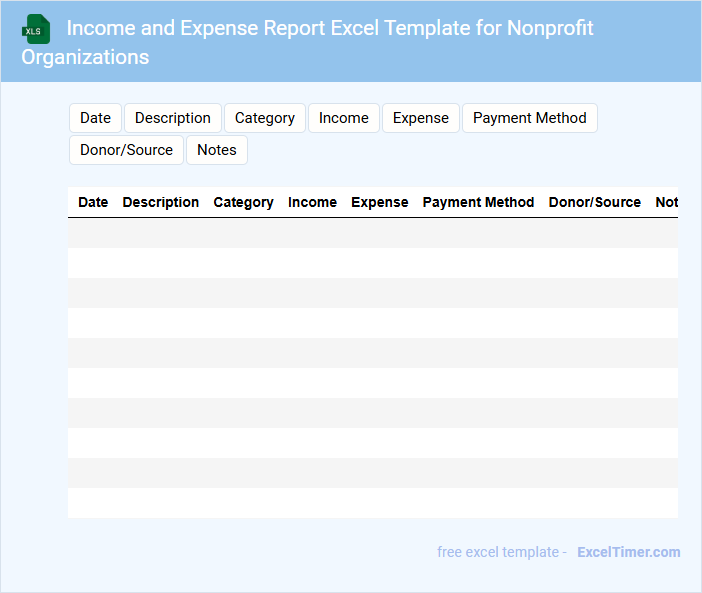

Income and Expense Report Excel Template for Nonprofit Organizations

Income and Expense Report Excel Template for Nonprofit Organizations is a document designed to track financial transactions and monitor the organization's financial health. It helps ensure transparency and accountability by organizing income and expenses clearly.

- Include detailed categories for income sources such as donations, grants, and fundraising events.

- Track expenses by program, administration, and fundraising activities to analyze cost distribution.

- Regularly update the template to maintain accurate and up-to-date financial records.

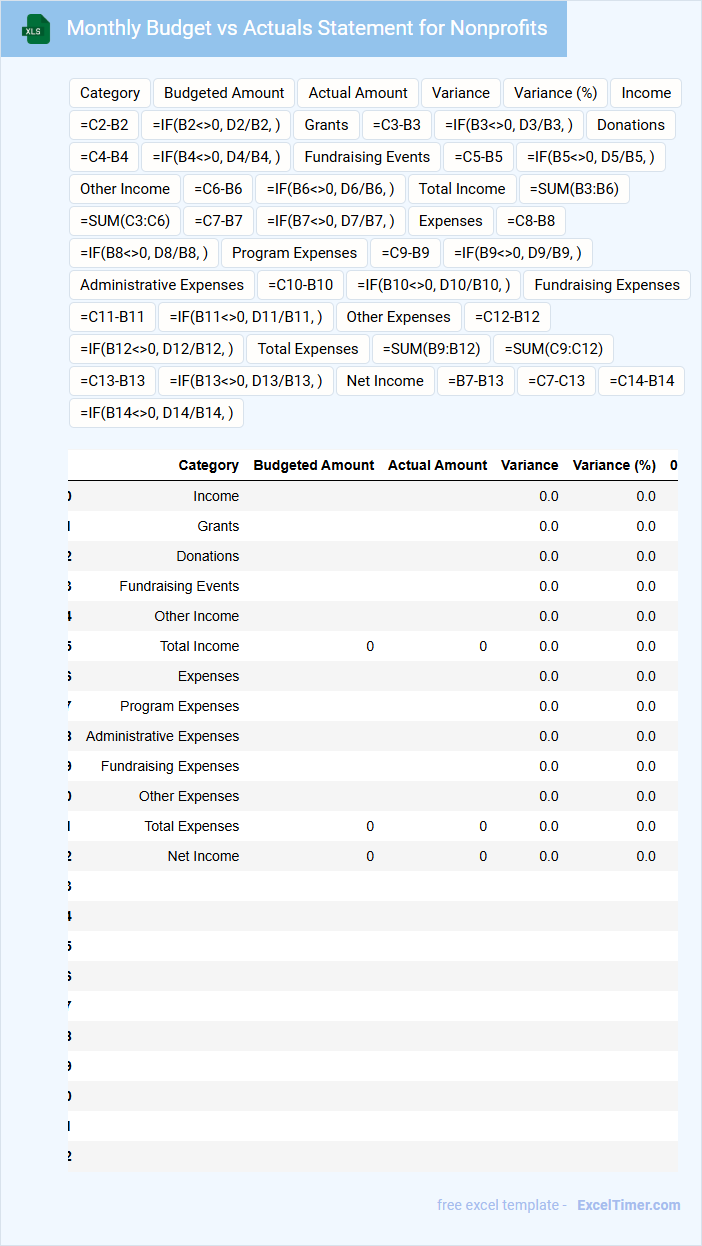

Monthly Budget vs Actuals Statement for Nonprofits

The Monthly Budget vs Actuals Statement for nonprofits is a financial document that compares the planned budget with the actual income and expenses for the month. It helps organizations track financial performance and identify variances to ensure accountability and effective resource management. Monitoring this statement is crucial for maintaining transparency and achieving the nonprofit's mission within budgetary constraints.

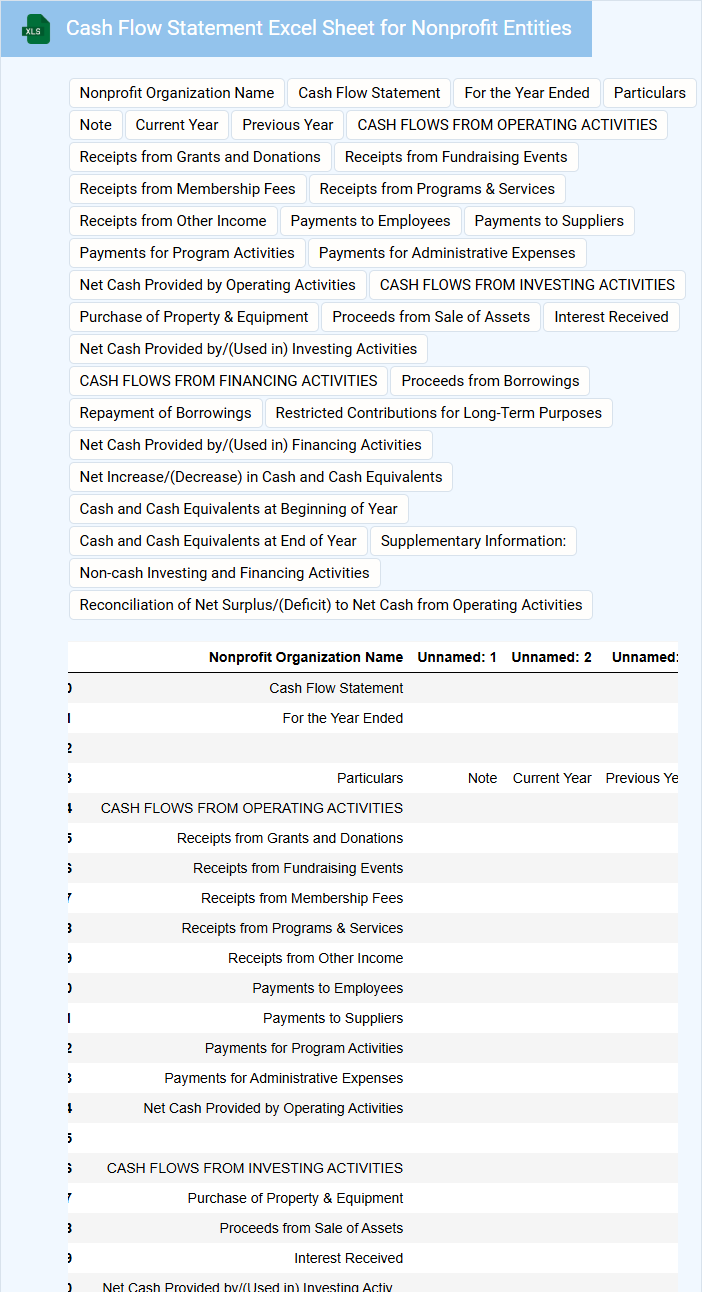

Cash Flow Statement Excel Sheet for Nonprofit Entities

What information is typically included in a Cash Flow Statement Excel Sheet for Nonprofit Entities? This document usually contains detailed records of cash inflows and outflows categorized by operating, investing, and financing activities specific to nonprofit organizations. It helps track how cash is generated and utilized to ensure financial sustainability and accountability.

What is an important consideration when preparing this statement for nonprofit entities? It is crucial to accurately classify cash flows related to donations, grants, program services, and fundraising activities to provide clear insight into financial health and compliance with donor restrictions. Properly designed Excel sheets should include automated calculations, clear labeling, and space for notes to aid transparency and decision-making.

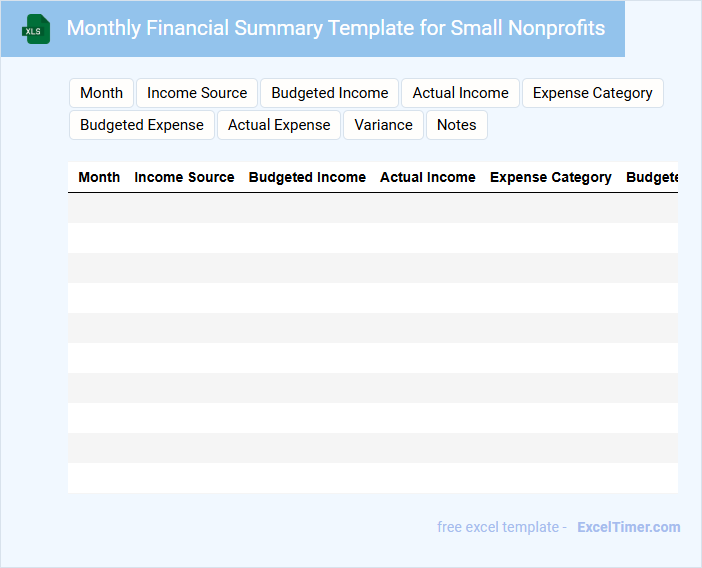

Monthly Financial Summary Template for Small Nonprofits

A Monthly Financial Summary Template for small nonprofits typically includes an overview of income, expenses, and the resulting net balance. It helps track financial health and ensures transparency for stakeholders throughout the month.

Important elements to include are detailed revenue sources, categorized expenses, and a comparison to the previous month's figures. Consistently updating and reviewing this document supports accurate budgeting and informed decision-making.

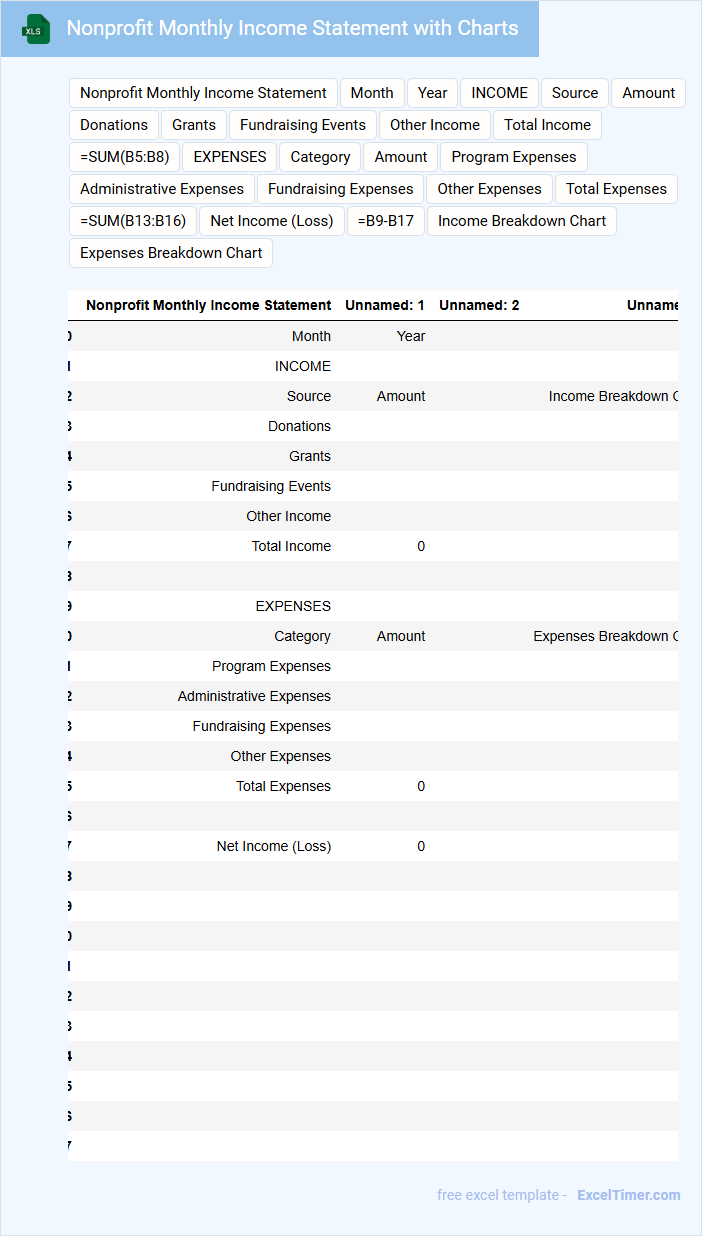

Nonprofit Monthly Income Statement with Charts

A Nonprofit Monthly Income Statement typically contains detailed records of all revenues and expenses incurred over the month, providing a clear snapshot of the organization's financial health. It highlights donations, grants, program income, and operational costs, helping stakeholders understand where funds are generated and allocated.

Charts are crucial for visualizing trends in income and expenses, making complex data more accessible and actionable. Including graphical representations such as bar graphs or pie charts aids in quickly identifying financial patterns and potential areas for budget adjustments.

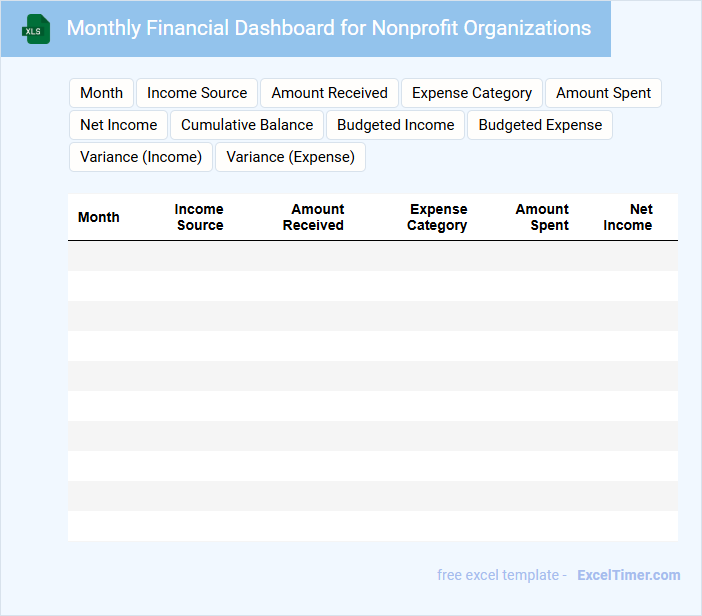

Monthly Financial Dashboard for Nonprofit Organizations

A Monthly Financial Dashboard for Nonprofit Organizations is a report that summarizes key financial metrics to help track the organization's fiscal health and funding performance. It provides an at-a-glance view to support informed decision-making and transparency.

- Include revenue sources and donation trends to monitor funding stability.

- Highlight expense categories to identify cost management opportunities.

- Show cash flow and budget variance for accurate financial forecasting.

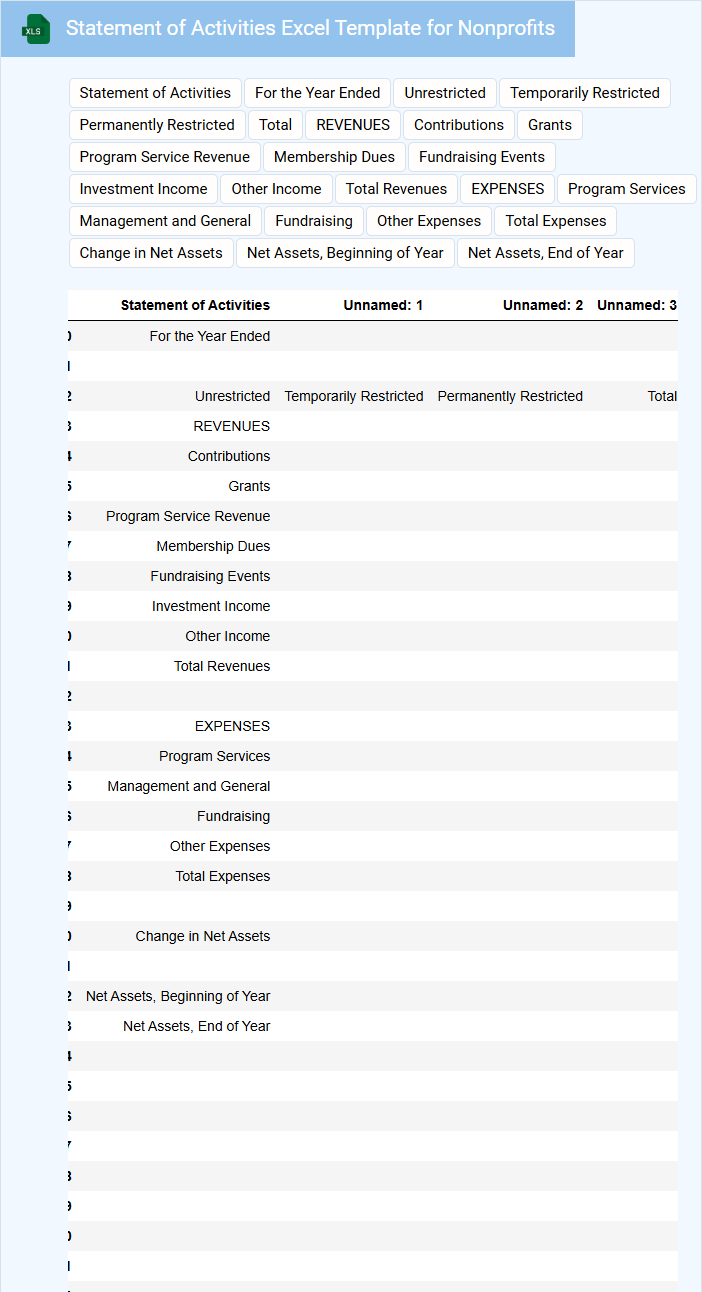

Statement of Activities Excel Template for Nonprofits

A Statement of Activities Excel Template for Nonprofits is typically used to track and report an organization's financial performance over a specific period, detailing revenues, expenses, and changes in net assets.

- Accurate Revenue Tracking: Ensure all income sources such as donations, grants, and fundraising are clearly categorized.

- Detailed Expense Classification: Break down expenses by program services, management, and fundraising to provide transparency.

- Regular Updates: Maintain timely data entry to reflect current financial status and support informed decision-making.

Monthly Fund Tracking Spreadsheet for Nonprofits

A Monthly Fund Tracking Spreadsheet for nonprofits is a crucial document used to monitor and manage incoming donations and outgoing expenses on a regular basis. It typically contains detailed entries of funding sources, allocation categories, and monthly financial summaries.

This spreadsheet helps organizations maintain transparency and accountability, ensuring proper use of funds according to donor intentions and organizational goals. Key components to include are dates, donor names, donation amounts, fund categories, and expenditure records.

To maximize its effectiveness, regularly update the spreadsheet, cross-check data for accuracy, and use clear labels to facilitate easy reporting and decision-making.

Financial Performance Report with Monthly Breakdown for Nonprofits

What information is typically included in a Financial Performance Report with Monthly Breakdown for Nonprofits? This document usually contains detailed financial data presented on a month-by-month basis, including revenue sources, expenses, and net income. It provides nonprofits with clear insights into their financial health and helps track budget adherence and funding allocation over time.

What important elements should be highlighted in this report? Key components include monthly income and expenditure summaries, comparison against budget forecasts, and notes on any significant variances. Additionally, including visual charts and narratives explaining fluctuations can enhance transparency and guide strategic financial decisions.

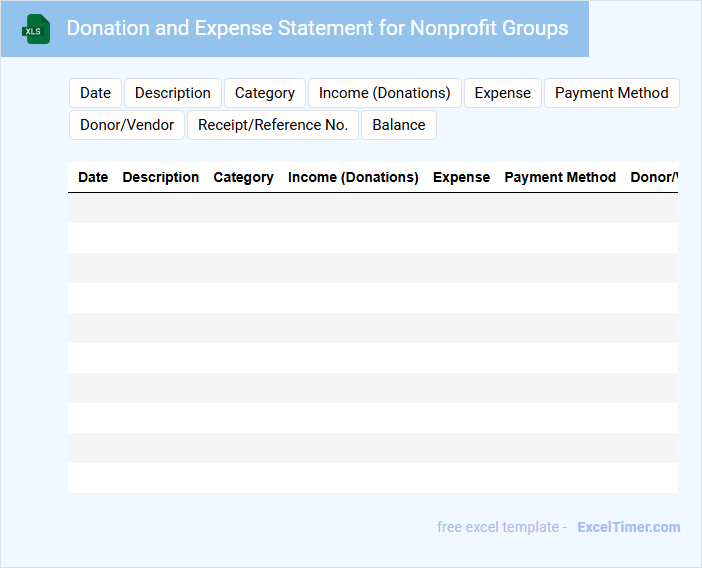

Donation and Expense Statement for Nonprofit Groups

A Donation and Expense Statement for nonprofit groups typically contains detailed records of all contributions received and expenditures made during a specific period. This document ensures transparency and accountability by clearly outlining how funds are allocated and spent. It is essential for maintaining donor trust and fulfilling regulatory requirements.

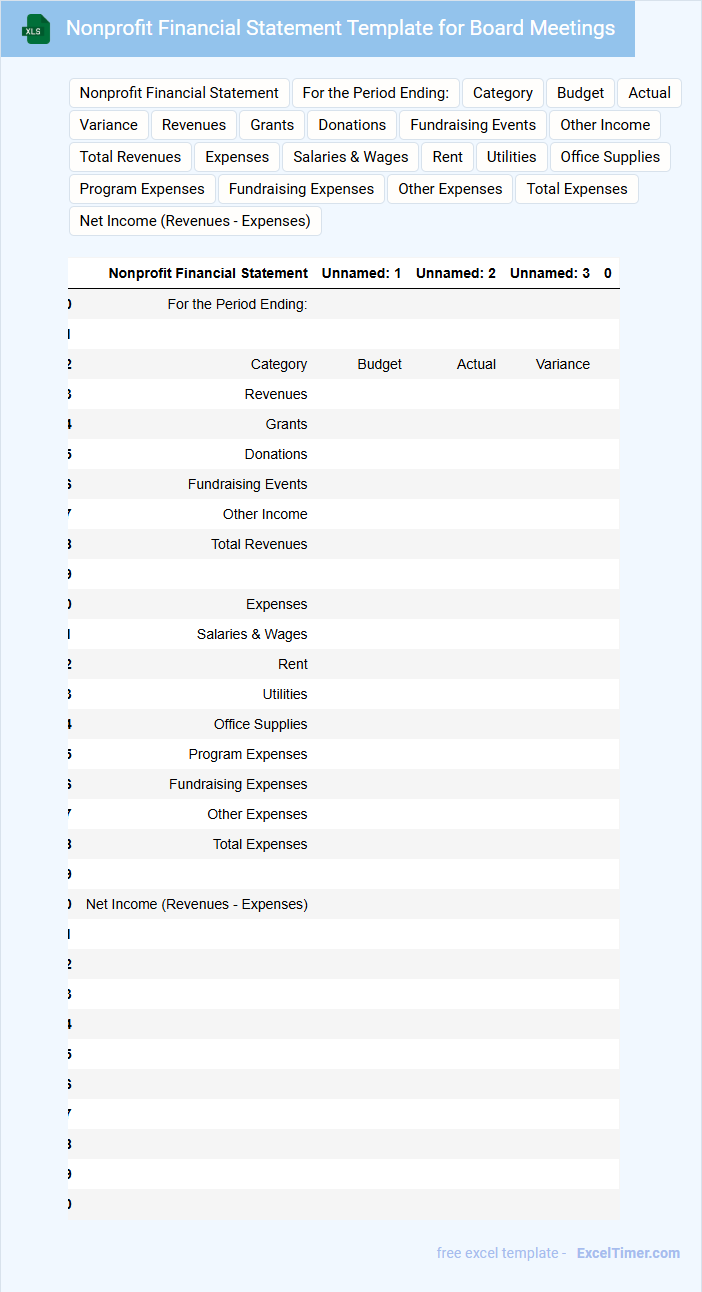

Nonprofit Financial Statement Template for Board Meetings

A Nonprofit Financial Statement template for board meetings typically contains key financial data including income, expenses, assets, and liabilities. It provides a clear and concise overview of the organization's financial health, aiding transparency and accountability. Ensuring accuracy and including comparative figures for previous periods is crucial for meaningful analysis during board discussions.

Monthly Grant Management Report for Nonprofits

What information is typically included in a Monthly Grant Management Report for Nonprofits? This type of document usually contains detailed updates on grant expenditures, progress on grant objectives, and compliance with funding requirements. It helps organizations track financial accountability and demonstrate the impact of the grant to stakeholders.

What is an important aspect to focus on in a Monthly Grant Management Report? Ensuring accuracy and clarity in financial reporting is crucial, along with highlighting any challenges or changes in the project timeline. This transparency supports continued funding and fosters trust with grant providers.

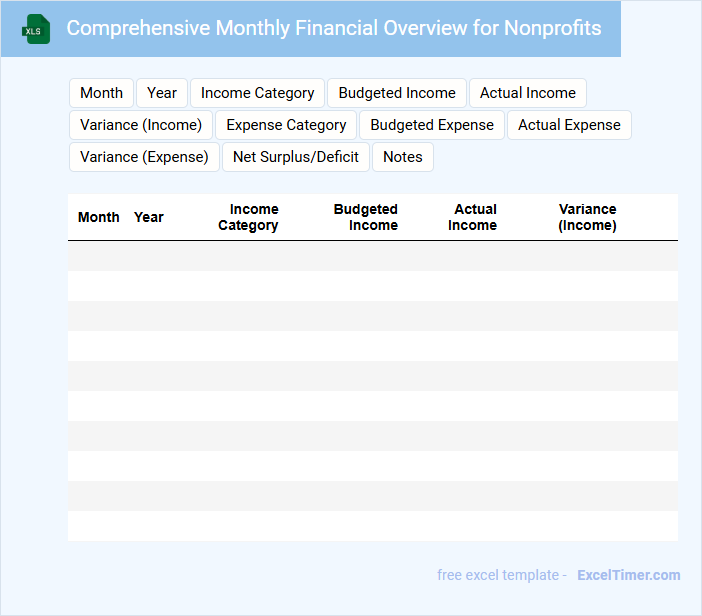

Comprehensive Monthly Financial Overview for Nonprofits

A Comprehensive Monthly Financial Overview for nonprofits typically contains detailed reports on income, expenses, and budget variances to provide a clear picture of the organization's financial health. It includes cash flow statements, grant tracking, and donation summaries to ensure transparency and accountability.

Key elements to focus on are accurate data presentation and timely updates to support informed decision-making by stakeholders. Additionally, incorporating visual aids like charts enhances understanding and communication of financial trends.

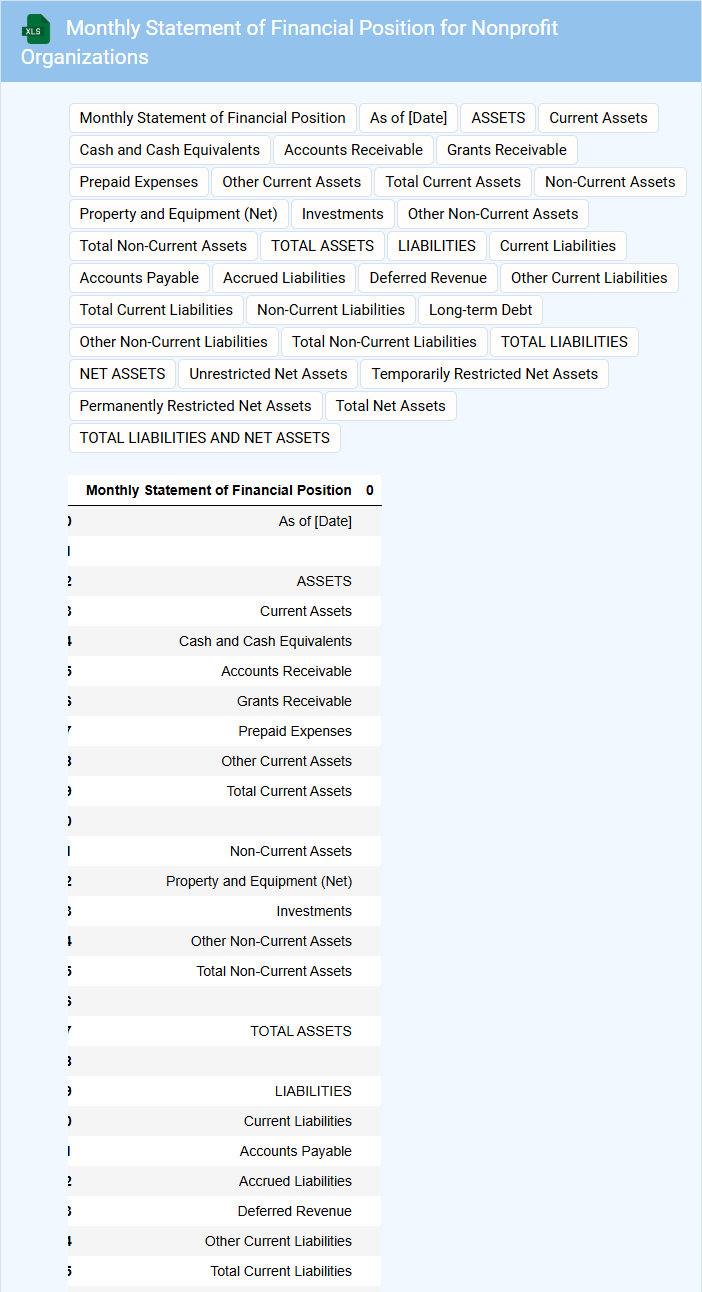

Monthly Statement of Financial Position for Nonprofit Organizations

The Monthly Statement of Financial Position for nonprofit organizations is a crucial document that provides a snapshot of the organization's financial health at a specific point in time. It typically contains detailed information about assets, liabilities, and net assets, offering insights into the financial stability and liquidity of the nonprofit. This statement helps stakeholders, including board members and donors, to assess how well the organization is managing its financial resources.

Important elements to include are accurate categorization of current and long-term assets, clear distinction between restricted and unrestricted net assets, and timely reconciliation of liabilities. Regular monitoring through these statements allows for proactive financial decision-making and ensures compliance with accounting standards. Transparency in reporting enhances trust and supports effective governance within the nonprofit.

What key revenue and expense categories should be included in a nonprofit's monthly financial statement?

A nonprofit's monthly financial statement should include key revenue categories such as donations, grants, program service revenue, and fundraising income. Essential expense categories encompass program expenses, administrative costs, fundraising expenses, and salaries. Tracking these revenue and expense categories ensures accurate financial monitoring and compliance for nonprofit organizations.

How does the statement distinguish between restricted and unrestricted funds?

The Monthly Financial Statement for Nonprofits clearly categorizes restricted funds as those designated for specific purposes by donors, while unrestricted funds remain available for general operational use. It provides separate columns or sections to track income, expenses, and balances for each fund type. This distinction ensures transparent financial reporting and accountability in compliance with nonprofit accounting standards.

What is the process for reconciling actuals against the approved budget in a monthly report?

To reconcile actuals against the approved budget in your Monthly Financial Statement for Nonprofits, start by comparing recorded expenses and revenues with budgeted amounts for each category. Identify variances by calculating the difference between actual and budgeted figures, highlighting any discrepancies exceeding predetermined thresholds. Document explanations for significant variances and update the report to reflect accurate financial positioning for informed decision-making.

Which financial ratios or indicators are most relevant for assessing the health of a nonprofit?

Key financial ratios for assessing a nonprofit's health include the operating margin, program expense ratio, and liquidity ratio. These indicators reveal Your organization's efficiency in managing funds, allocation toward mission-related programs, and ability to meet short-term obligations. Monitoring these metrics monthly ensures transparent and effective financial stewardship in your Excel financial statement.

How is donor or grant income tracked and reported in the monthly financial statement?

Donor and grant income is tracked in the monthly financial statement by recording each contribution in specific revenue accounts, categorized by source and date. Your nonprofit can generate detailed reports that summarize total income from donors and grants, allowing for transparent and accurate financial oversight. This ensures compliance with funding requirements and supports informed decision-making.