![]()

The Monthly Bill Payment Tracker Excel Template for Seniors provides an easy-to-use format to monitor and organize monthly expenses, ensuring timely payments. It features clear categories tailored to typical senior expenses, promoting financial stability and reducing stress. This template helps seniors maintain independence by offering a straightforward way to track bills and avoid late fees.

Monthly Bill Payment Tracker with Reminders for Seniors

This document is typically a Monthly Bill Payment Tracker designed to help seniors keep an organized record of their monthly expenses and due dates. It often includes sections for listing bills, payment amounts, due dates, and confirmation of payments made. To enhance usability, the tracker may also have integrated reminders to ensure timely payments and avoid late fees.

Excel Template for Tracking Monthly Bills of Seniors

An Excel template for tracking monthly bills of seniors typically contains organized columns for due dates, bill types, amounts, and payment statuses. This structured format helps in easily monitoring and managing various recurring expenses.

Important features include automated calculations and reminders to avoid missed payments. Ensuring clarity and simplicity is essential for ease of use by seniors or their caregivers.

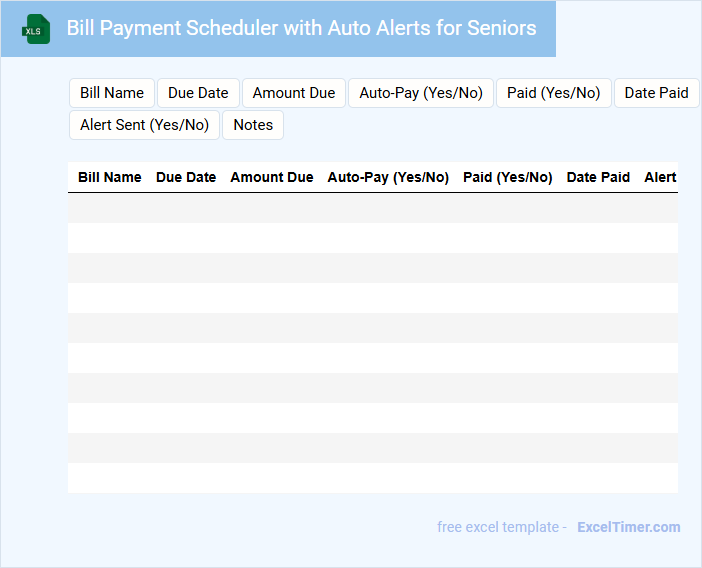

Bill Payment Scheduler with Auto Alerts for Seniors

This document outlines the features and functionalities of a Bill Payment Scheduler with Auto Alerts designed specifically for seniors. It ensures timely bill payments and reduces the risk of late fees through automated reminders.

- Include clear instructions on how to set up and manage payment schedules.

- Highlight the importance of accessible alert notifications tailored for seniors.

- Emphasize data security and privacy measures to protect sensitive financial information.

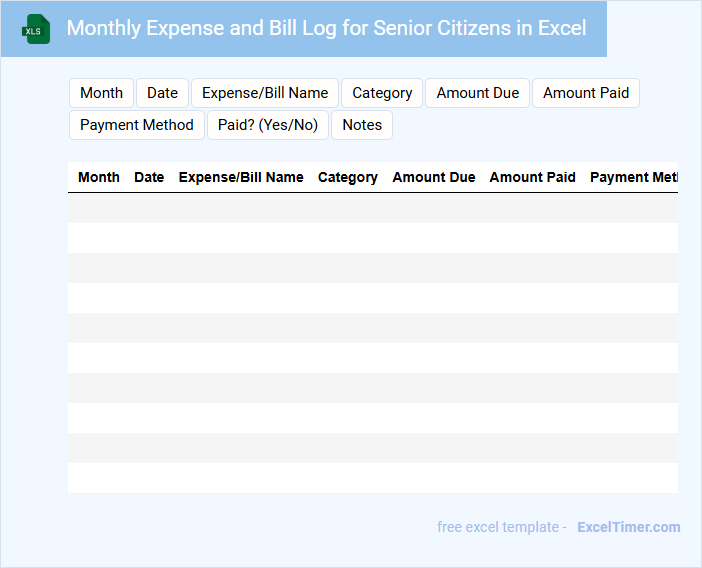

Monthly Expense and Bill Log for Senior Citizens in Excel

This document is typically used to track monthly expenses and bill payments, helping senior citizens manage their finances efficiently. It includes detailed records of all expenditures and due dates to ensure timely payments.

- Include categories for housing, utilities, healthcare, and groceries to organize expenses effectively.

- Use clear headings and easy-to-read fonts to accommodate visual limitations.

- Incorporate automatic calculations and reminders to minimize errors and missed payments.

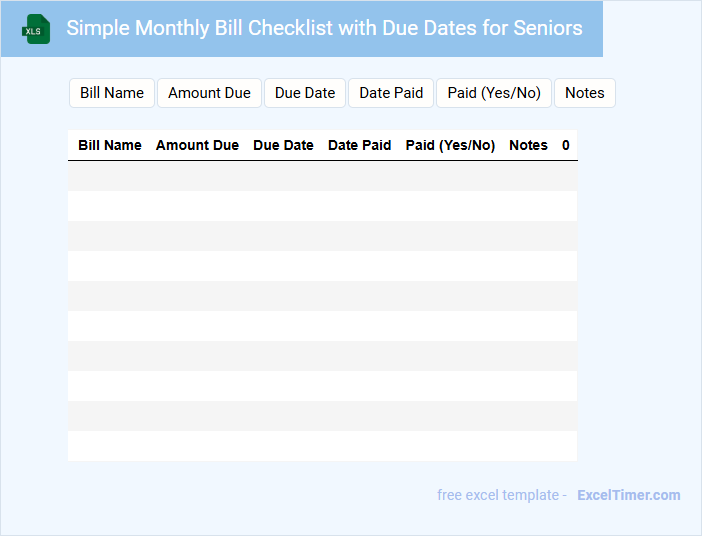

Simple Monthly Bill Checklist with Due Dates for Seniors

A Simple Monthly Bill Checklist is typically a structured document outlining various recurring expenses and their due dates, aimed at helping seniors manage their finances efficiently. It ensures no payments are missed by providing a clear overview of bills such as utilities, rent, and subscriptions.

For seniors, including reminders for due dates and payment methods is particularly important. This helps maintain financial stability and avoid late fees or service interruptions.

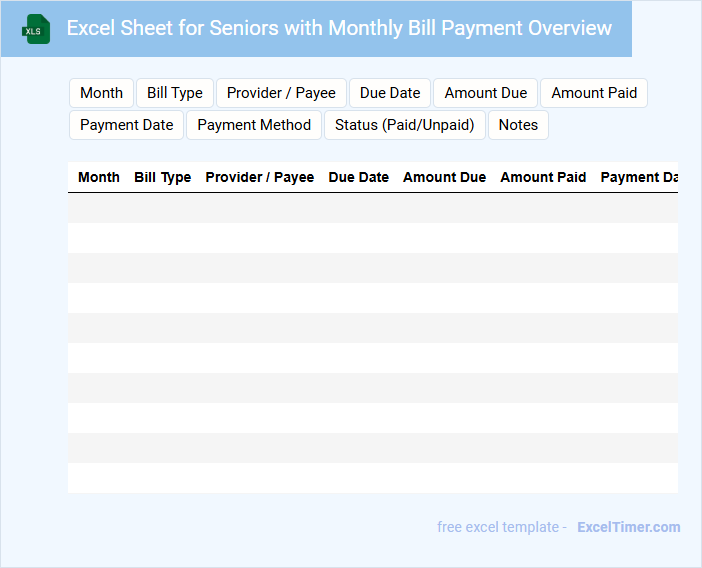

Excel Sheet for Seniors with Monthly Bill Payment Overview

An Excel Sheet designed for seniors typically contains organized tables of monthly expenses, due dates, and payment statuses. It helps in tracking utilities, subscriptions, and other recurring bills efficiently.

The sheet often includes categories for bill type, amount, and payment method to ensure clarity and easy reference. Creating reminders and highlighting overdue payments are important features for managing finances proactively.

Ensuring the document is simple, readable, and uses large fonts can greatly enhance usability for seniors.

Monthly Utility Bill Tracker with Payment Status for Seniors

Monthly Utility Bill Tracker with Payment Status for Seniors is a practical document designed to help seniors monitor their utility bills and payment statuses efficiently.

- Clear organization: The tracker should categorize bills by utility type and due date for easy reference.

- Payment status indicators: It must include columns or checkboxes to mark paid and pending bills promptly.

- Accessible design: Use large fonts and simple layouts to accommodate seniors' readability needs.

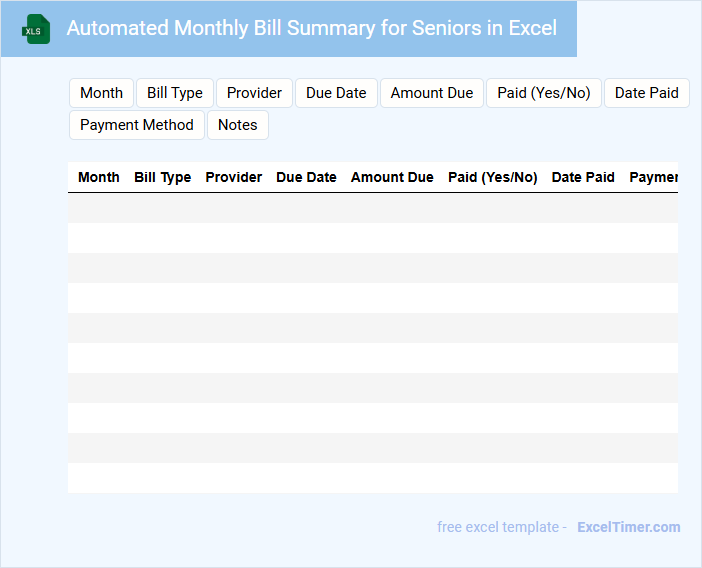

Automated Monthly Bill Summary for Seniors in Excel

What information is typically included in an Automated Monthly Bill Summary for Seniors in Excel? This document usually contains a detailed list of monthly expenses such as utilities, healthcare, subscriptions, and other recurring bills. It helps seniors track and manage their finances efficiently by providing a clear and organized overview of their spending.

What important features should be considered for an effective summary? Incorporating automated calculations, easy-to-read charts, and clear categorization of expenses are essential for usability. Additionally, including reminders for due dates and a summary of total expenses and savings can help seniors stay financially informed and avoid late payments.

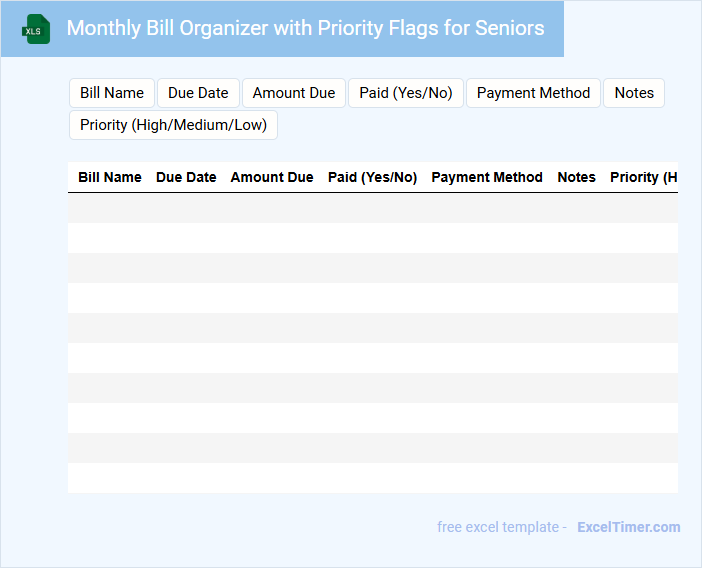

Monthly Bill Organizer with Priority Flags for Seniors

A Monthly Bill Organizer is a document designed to help seniors manage their recurring expenses efficiently. It typically contains sections for due dates, payment amounts, and biller details to ensure timely payments.

Including Priority Flags allows users to highlight urgent or important bills, aiding in better financial planning and stress reduction. This organizer promotes independence and helps prevent missed or late payments.

For seniors, it is crucial to ensure the layout is clear and the text is large enough for easy readability.

Excel Budget and Bill Tracker for Retired Seniors

This document typically contains a detailed financial plan and a record of monthly expenses aimed at helping retired seniors manage their income and bills efficiently. It is designed to simplify budgeting by categorizing expenses and tracking payments over time.

- Include clear sections for monthly income, fixed expenses, and variable spending.

- Incorporate easy-to-read charts or summaries for quick financial overview.

- Ensure space for noting due dates and payment methods to avoid missed bills.

Seniors’ Monthly Financial Tracker with Payment Logs

This document typically contains detailed records of monthly incomes, expenses, and payment histories tailored for seniors to efficiently manage their finances.

- Income Tracking: It records all sources of monthly income, ensuring clarity on funds available.

- Expense Monitoring: It logs recurring and one-time payments for better budget oversight.

- Payment Logs: It documents payment dates and confirmations to avoid missed bills.

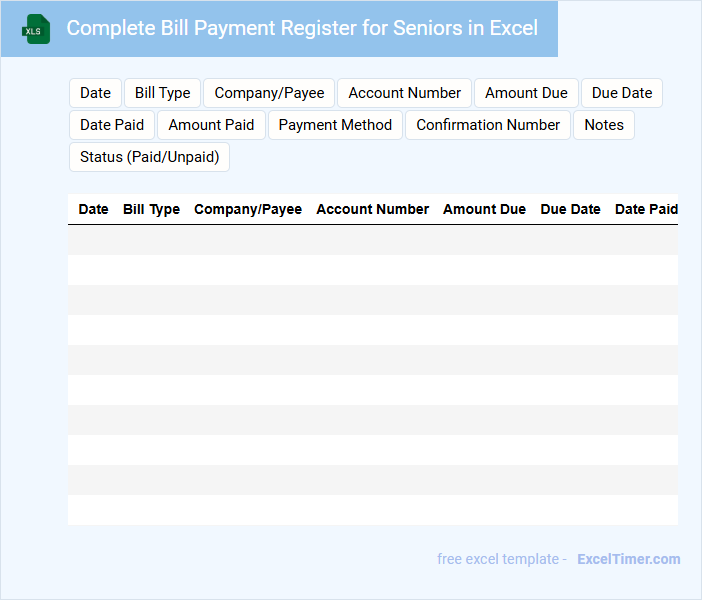

Complete Bill Payment Register for Seniors in Excel

A Complete Bill Payment Register for seniors in Excel is a crucial document that helps track all monthly expenses and bill payments systematically. It typically contains due dates, payment amounts, and payment status to avoid missed or late payments.

This register ensures financial organization and transparency, making it easier for seniors or caregivers to manage finances effectively. Important suggestions include setting up reminders and categorizing bills for quick reference and better budget control.

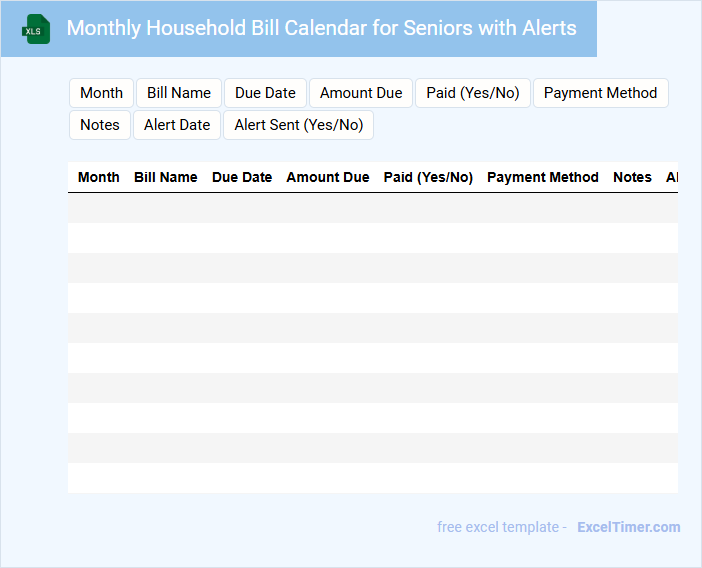

Monthly Household Bill Calendar for Seniors with Alerts

A Monthly Household Bill Calendar for Seniors is a helpful tool designed to organize and track monthly expenses such as utilities, rent, and insurance payments. It typically contains important dates, payment amounts, and reminders to prevent late fees. Including alert notifications ensures seniors stay on top of their bills efficiently and stress-free.

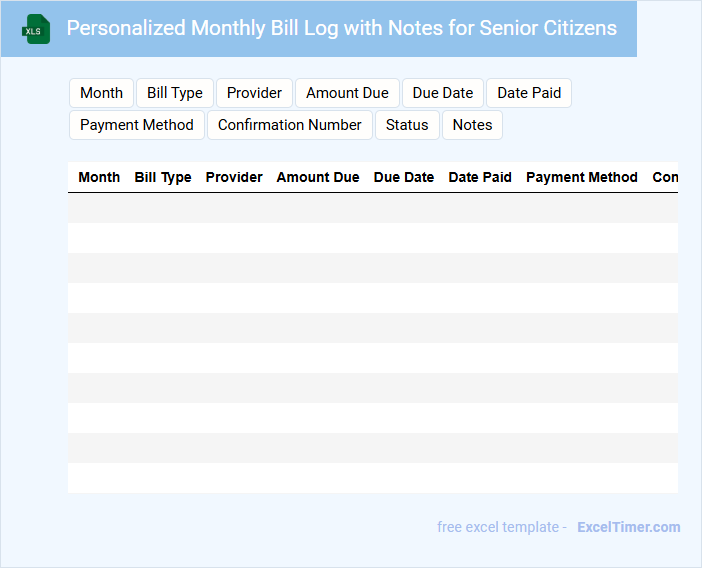

Personalized Monthly Bill Log with Notes for Senior Citizens

A Personalized Monthly Bill Log with Notes for Senior Citizens is typically a record-keeping document that tracks monthly expenses and payments. It helps seniors manage their finances effectively by providing a clear overview with additional notes for reminders or important details.

- Include sections for bill categories, due dates, and payment statuses.

- Incorporate a notes area for special instructions or observations.

- Use large, readable fonts and simple language for accessibility.

Seniors’ Monthly Bill Payment Dashboard in Excel

The Seniors' Monthly Bill Payment Dashboard in Excel is a specialized document designed to help elderly users track and manage their recurring expenses efficiently. It typically contains sections for income, various bills like utilities and medical expenses, and visual summaries such as charts and payment status indicators. Ensuring simplicity and clear labeling is important so seniors can easily interpret their financial information and avoid missed payments.

How does the Excel tracker automate reminders for upcoming monthly bill due dates?

The Monthly Bill Payment Tracker for Seniors uses Excel's built-in conditional formatting and formula functions, like TODAY() and IF, to highlight upcoming due dates automatically. It generates visual alerts by changing cell colors as bill due dates approach within a set timeframe, such as 7 days. The tracker can also create dynamic reminder lists by filtering bills due soon, helping seniors manage their payments efficiently.

What columns are essential for seniors to easily record and monitor each bill payment status?

Essential columns for a Monthly Bill Payment Tracker for seniors include Bill Name, Due Date, Amount Due, Payment Date, Payment Method, Confirmation Number, and Status. These fields help you easily record and monitor each bill's payment status and avoid late fees. Including Notes allows seniors to add reminders or important details for better expense management.

How is overdue payment highlighted or flagged in the tracker for easy identification?

Overdue payments in the Monthly Bill Payment Tracker for Seniors are highlighted using red cell shading and bold text for immediate visibility. A conditional formatting rule triggers this flag when the payment due date is past the current date without a recorded payment. This system ensures quick identification of outstanding bills to help seniors manage finances effectively.

What formulas or functions are used to calculate total monthly expenses and outstanding balances?

In a Monthly Bill Payment Tracker for Seniors, the SUM function calculates total monthly expenses by adding all individual bill amounts. The OUTSTANDING BALANCE is computed using a simple subtraction formula, such as =Total Expenses - Payments Made. Functions like SUMIF help track specific categories or overdue payments for more detailed expense analysis.

How can the tracker ensure the security and privacy of sensitive financial information for seniors?

The Monthly Bill Payment Tracker for Seniors employs encryption and password protection to safeguard sensitive financial information. You have control over data access through user authentication and secure cloud storage options. Regular software updates and privacy settings help maintain confidentiality and prevent unauthorized access.

What key information should be included in a senior-friendly Monthly Bill Payment Tracker Excel document?

A senior-friendly Monthly Bill Payment Tracker Excel document should include columns for bill name, due date, payment amount, payment status, and payment method. It should feature clear fonts, large cells, and color-coded categories to enhance readability and ease of use. Including reminders or alerts for upcoming due dates ensures timely payments and helps seniors manage their finances effectively.

How can the Excel sheet visually indicate due dates and overdue bills for easy recognition?

Use conditional formatting in the Excel sheet to highlight upcoming due dates in yellow and overdue bills in red for seniors to quickly identify payment statuses. Incorporate icons such as warning triangles for due soon and red crosses for overdue to enhance visual cues. Apply a clear, large font and contrasting colors to ensure readability for senior users.

What Excel features (e.g., conditional formatting, drop-down lists) can simplify bill tracking for seniors?

Excel features like conditional formatting highlight overdue bills in red, making it easier for seniors to spot upcoming payments. Drop-down lists allow you to select payment statuses quickly, reducing data entry errors. Simple formulas can automatically calculate total monthly expenses and remaining balances for convenient tracking.

How should recurring payments versus one-time bills be organized and differentiated?

Organize recurring payments in a dedicated section with fixed dates and amounts to ensure timely tracking each month. One-time bills should be listed separately with flexible dates and amounts for accurate monitoring. Your Monthly Bill Payment Tracker can use color-coding or labels to clearly differentiate these categories, enhancing clarity and preventing missed payments.

What security and privacy measures should be considered when storing personal financial information in Excel?

Implement password protection and encryption in the Excel file to safeguard personal financial data for seniors. Restrict access by using permissions and store the file in secure, backed-up locations such as encrypted drives or trusted cloud services. Regularly update software and educate seniors on identifying phishing attempts to further enhance data privacy and security.