The Monthly Invoice Excel Template for Freelancers streamlines billing processes by offering an easy-to-use format for tracking hours, rates, and payments. It ensures accuracy and professionalism in invoicing, helping freelancers maintain clear financial records and prompt payments. Customizable features allow tailoring the template to specific client needs and project requirements.

Monthly Invoice Excel Template for Freelancers

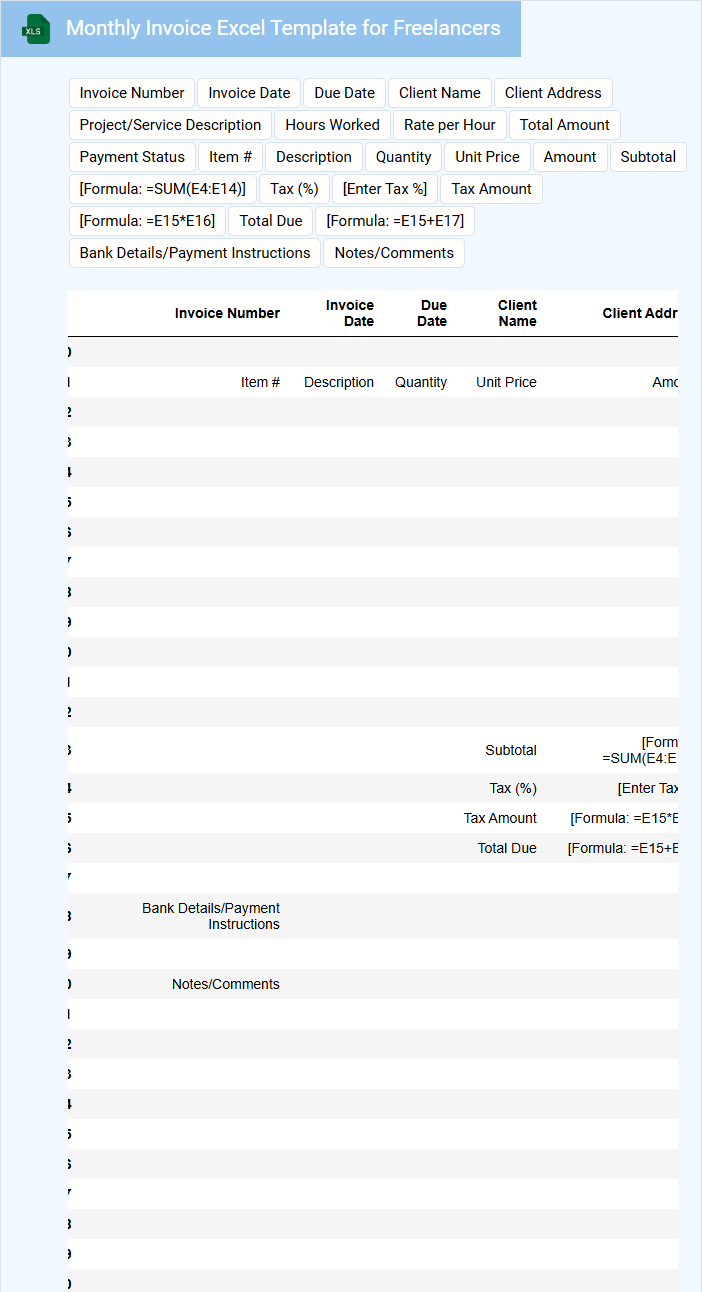

What does a Monthly Invoice Excel Template for Freelancers usually contain?

A Monthly Invoice Excel Template for Freelancers typically includes fields for client details, a list of services provided, hours worked, rates, and the total amount due. It is designed to help freelancers organize their billing information clearly and professionally. This template often incorporates formulas to automate calculations and ensure accuracy.

What are important suggestions for using this template effectively?

It is important to customize the template with your branding and payment terms to maintain professionalism and clarity. Ensure all formulas are correct and update client information regularly to avoid errors. Additionally, including a section for notes or payment instructions can improve communication and foster prompt payments.

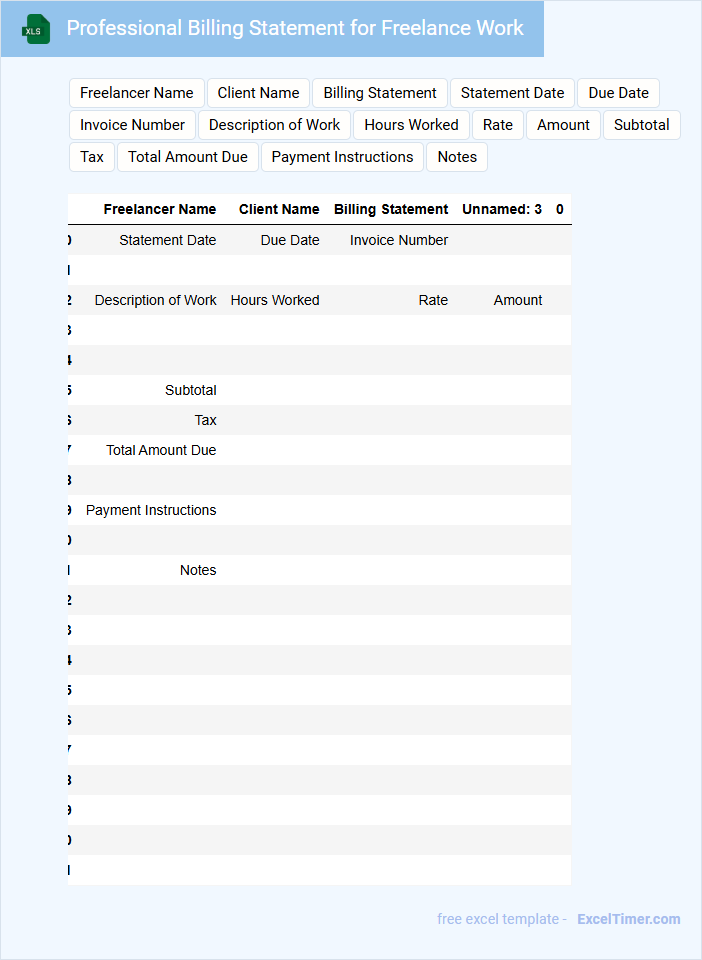

Professional Billing Statement for Freelance Work

A Professional Billing Statement for Freelance Work typically outlines the services provided, payment details, and terms agreed upon between the freelancer and the client. It serves as a formal request for payment and a record of the work completed.

- Include a detailed breakdown of services rendered with corresponding dates and rates.

- Clearly state payment terms, due dates, and accepted payment methods.

- Provide contact information for both the freelancer and the client for easy communication.

Simple Invoice Spreadsheet with Payment Tracker

What information is typically included in a simple invoice spreadsheet with a payment tracker? This type of document usually contains essential invoice details such as the invoice number, date, client name, item descriptions, quantities, prices, and total amounts. Additionally, it features a payment tracker section to monitor payment status, due dates, and any outstanding balances for efficient financial management.

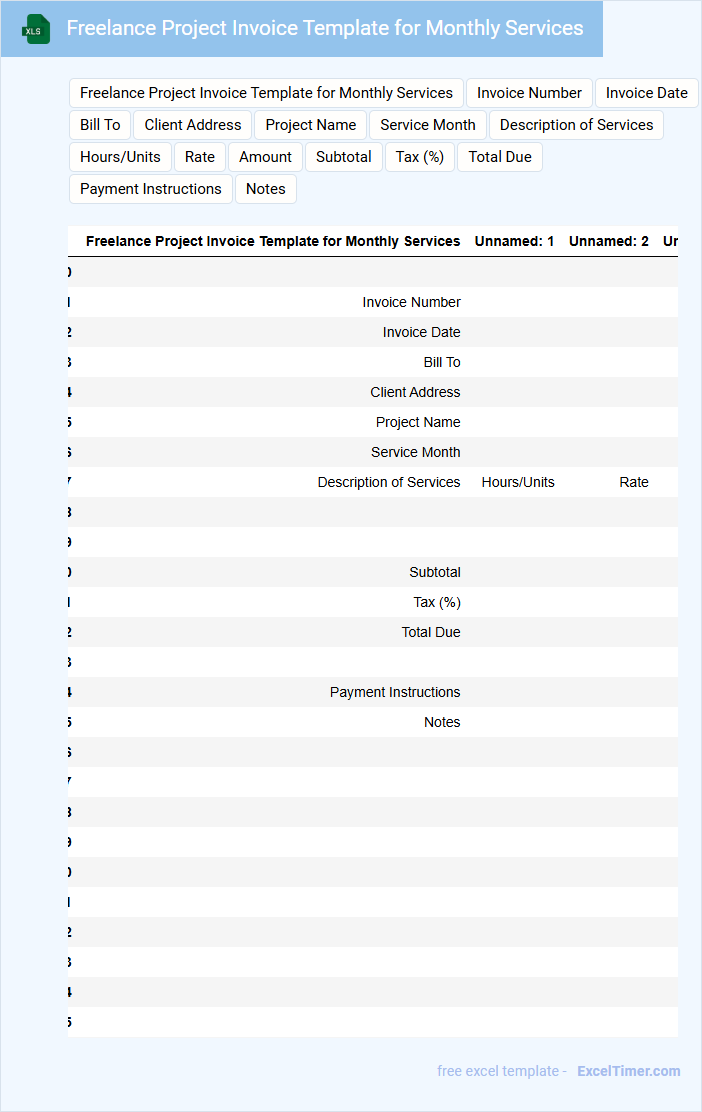

Freelance Project Invoice Template for Monthly Services

A Freelance Project Invoice Template for monthly services typically contains detailed billing information, including a breakdown of the services provided each month, payment terms, and the total amount due. It serves as a formal request for payment between freelancers and their clients, ensuring clarity and professional communication. Key components often include project descriptions, hourly or flat rates, and contact details for both parties.

To optimize such a template, it's important to include a clearly stated payment deadline, precise invoice numbering for easy tracking, and an itemized list of services reflecting the monthly progress. Additionally, incorporating a section for any applicable taxes or discounts can help avoid confusion. Including your terms and conditions regarding late payments can further protect your interests.

Ensuring the template is easy to customize and visually clean can enhance client experience and increase timely payments. Use consistent formatting and maintain a professional tone throughout the document. Remember to update it regularly to reflect any changes in your services or rates.

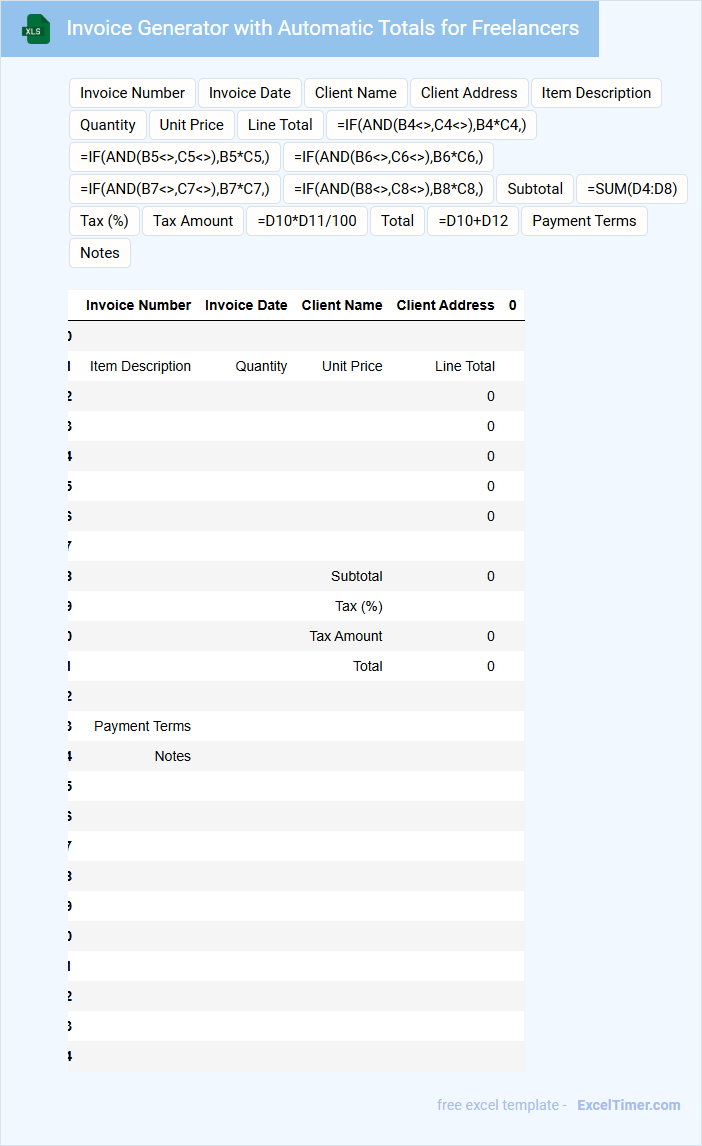

Invoice Generator with Automatic Totals for Freelancers

An Invoice Generator with Automatic Totals is a digital tool designed to create professional invoices quickly and accurately. It typically includes fields for client details, itemized services, and payment terms. This type of document helps freelancers ensure timely payments and maintain organized financial records.

Important features to include are automatic calculation of totals and taxes, customizable templates, and the ability to save or export invoices for future reference. Ensuring clarity and accuracy in each section will improve client trust and reduce payment delays. Additionally, integrating reminders for overdue payments can streamline the freelancer's workflow.

Time Tracking and Invoice Sheet for Freelance Jobs

The Time Tracking and Invoice Sheet is an essential document for freelancers to accurately record hours worked and bill clients. It typically contains detailed entries of tasks performed, hours spent, and corresponding rates. Keeping this document updated ensures transparent communication and timely payments.

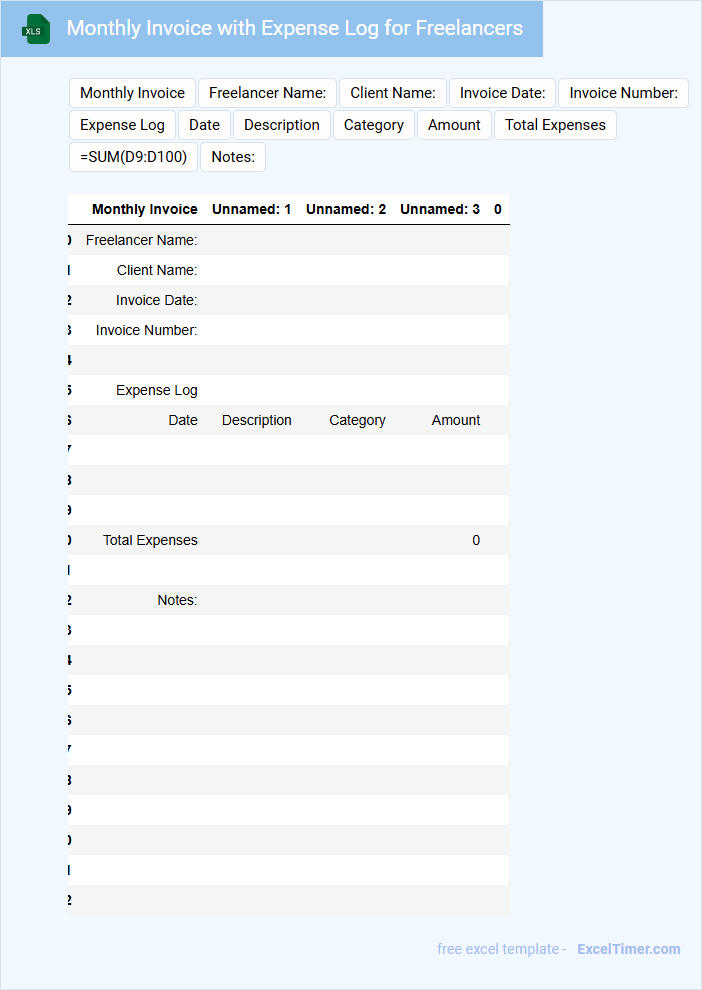

Monthly Invoice with Expense Log for Freelancers

A Monthly Invoice with Expense Log for Freelancers typically contains detailed billing information for services rendered along with a record of reimbursable expenses incurred during the month.

- Clear service descriptions: Provide precise and itemized details of the work performed to ensure transparency and avoid disputes.

- Accurate expense tracking: Record all receipts and costs clearly to facilitate reimbursement and maintain financial accountability.

- Payment terms: Specify the due date, payment methods, and any late fees to encourage timely payments.

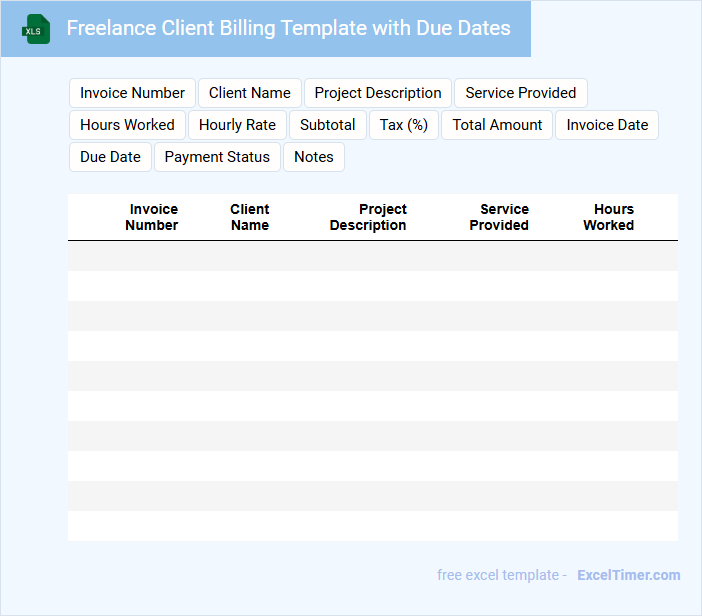

Freelance Client Billing Template with Due Dates

A Freelance Client Billing Template typically contains details such as the client's information, a breakdown of services provided, and the total amount due. It includes clear due dates to ensure timely payment and helps both parties keep track of financial transactions. Using a well-structured template promotes professionalism and accuracy in invoicing.

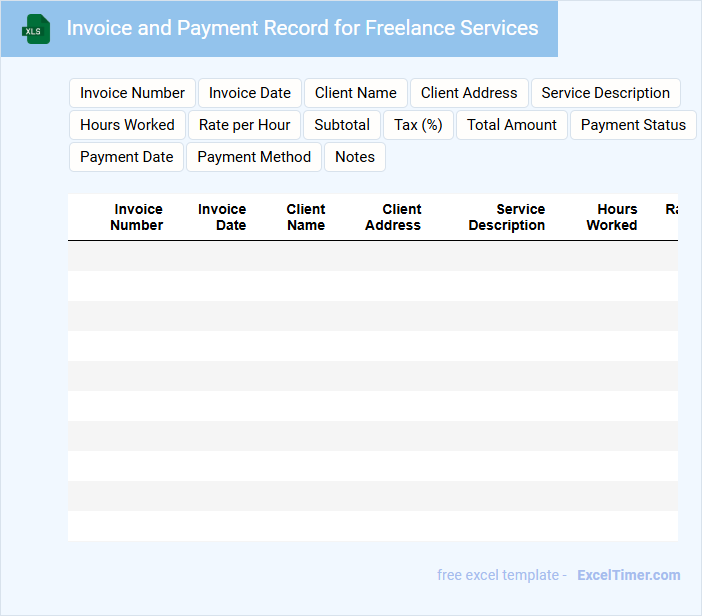

Invoice and Payment Record for Freelance Services

An Invoice and Payment Record for freelance services typically contains detailed information about the services provided, including the description, quantity, and agreed rates. It also includes payment terms, such as due dates and accepted payment methods, ensuring clarity between the freelancer and the client. Keeping accurate records of these documents is essential for tracking payments and managing finances effectively.

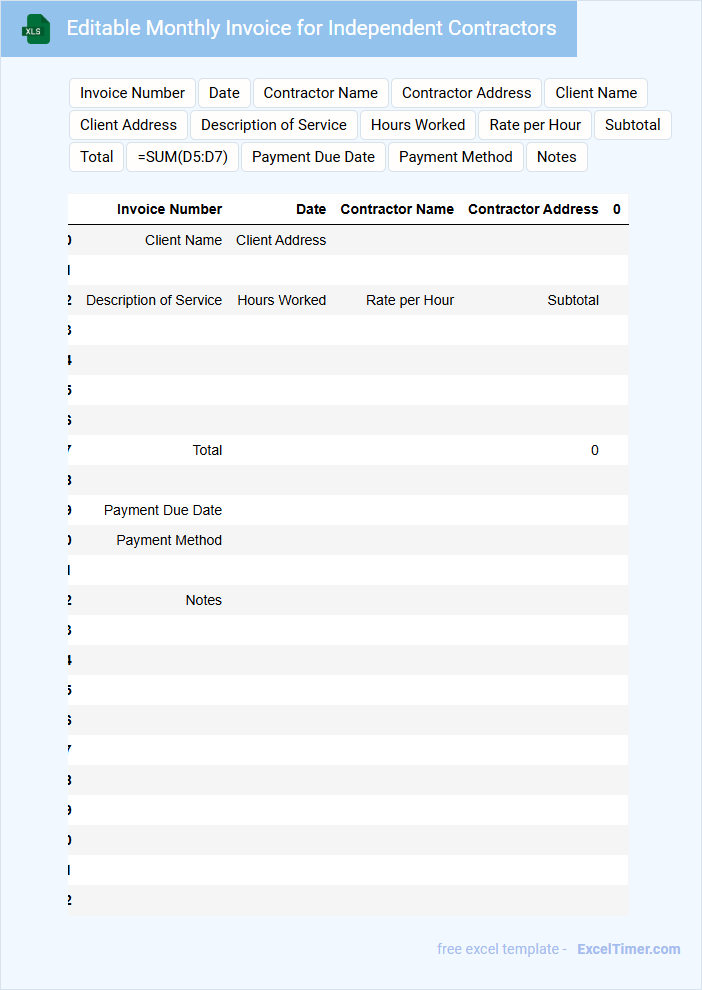

Editable Monthly Invoice for Independent Contractors

An Editable Monthly Invoice for independent contractors typically contains essential information such as billing details, services rendered, and payment terms. It serves as a formal request for payment and allows customization for specific contractual agreements. Ensuring accurate client info and clear itemization is crucial for prompt and error-free payments.

Important elements to include are the contractor's name, invoice number, date, detailed description of services, hours worked or project milestones, rate, subtotal, taxes, total amount due, and payment instructions. Providing contact information for both parties helps streamline communication. Additionally, incorporating payment due dates and accepted payment methods enhances the invoice's effectiveness.

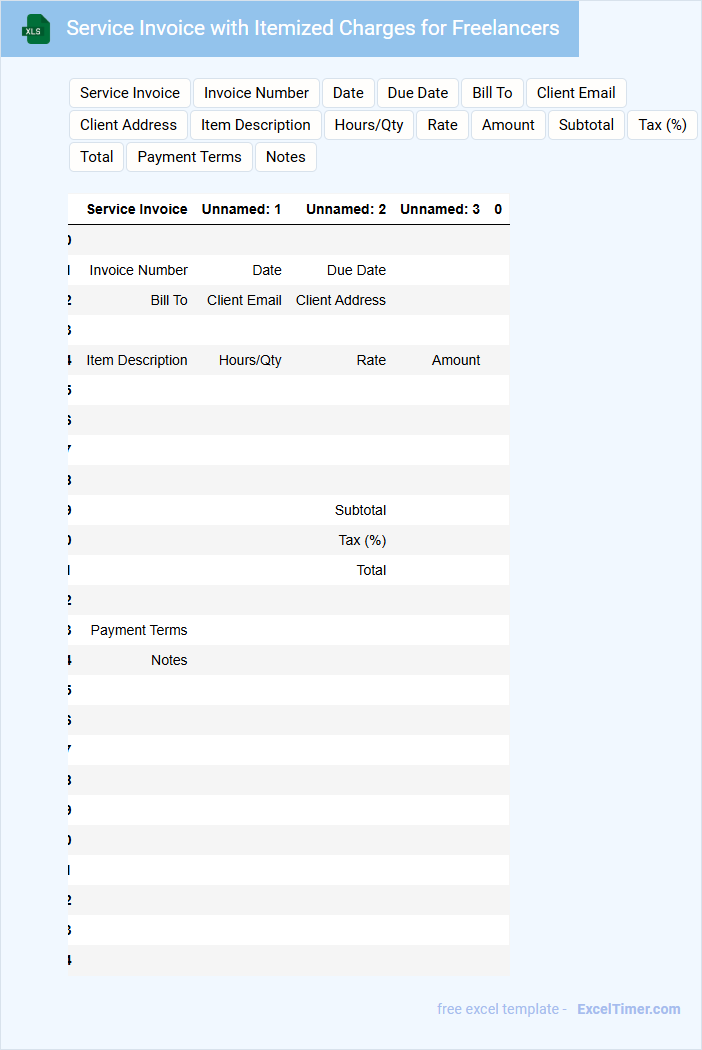

Service Invoice with Itemized Charges for Freelancers

A Service Invoice with itemized charges for freelancers typically details the specific services rendered along with the cost for each task. It provides clear documentation for both the freelancer and client, ensuring transparency and accountability. Including payment terms and contact information is essential for smooth transactions and clear communication.

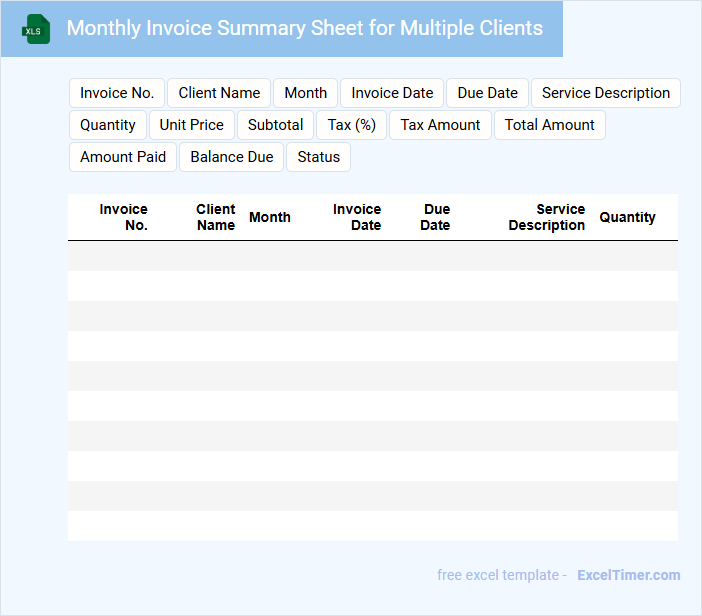

Monthly Invoice Summary Sheet for Multiple Clients

What information is typically included in a Monthly Invoice Summary Sheet for Multiple Clients? This type of document usually contains detailed records of all invoices issued to various clients within the month, including invoice numbers, dates, amounts, and payment statuses. It provides a clear overview of financial transactions to help track payments and outstanding balances efficiently.

What important consideration should be made when creating a Monthly Invoice Summary Sheet for Multiple Clients? It is crucial to ensure accuracy and consistency in client details and invoice amounts to avoid discrepancies. Additionally, incorporating sorting and filtering features can greatly enhance the document's usability and quick retrieval of specific client information.

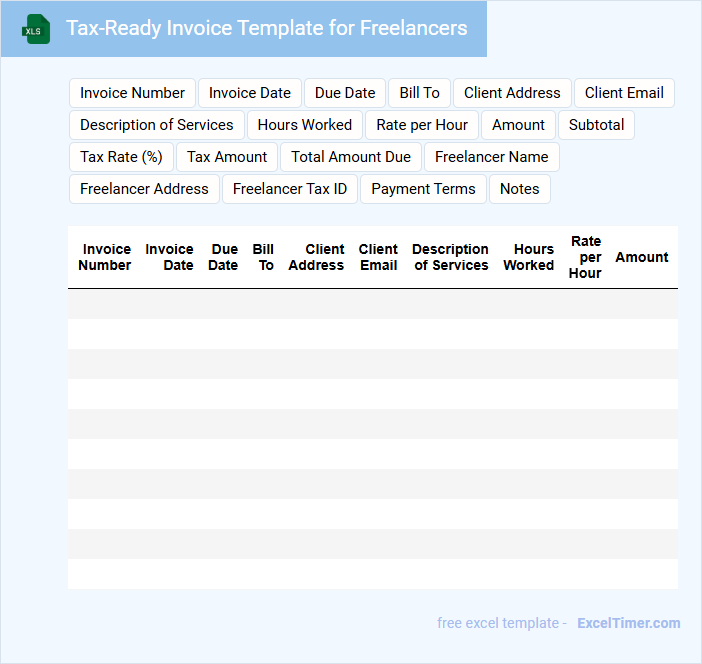

Tax-Ready Invoice Template for Freelancers

A Tax-Ready Invoice Template for freelancers typically contains key details such as client information, a detailed list of services provided, and the total amount due including applicable taxes. It ensures compliance with local tax regulations by clearly displaying tax rates and identification numbers. Freelancers benefit from this template by maintaining organized financial records and facilitating timely tax submissions.

Important elements to include are the freelancer's tax ID, payment terms, and a breakdown of taxable and non-taxable items. Using a template tailored for tax readiness helps reduce errors and supports accurate bookkeeping. Always update the template based on current tax laws and customized invoice needs.

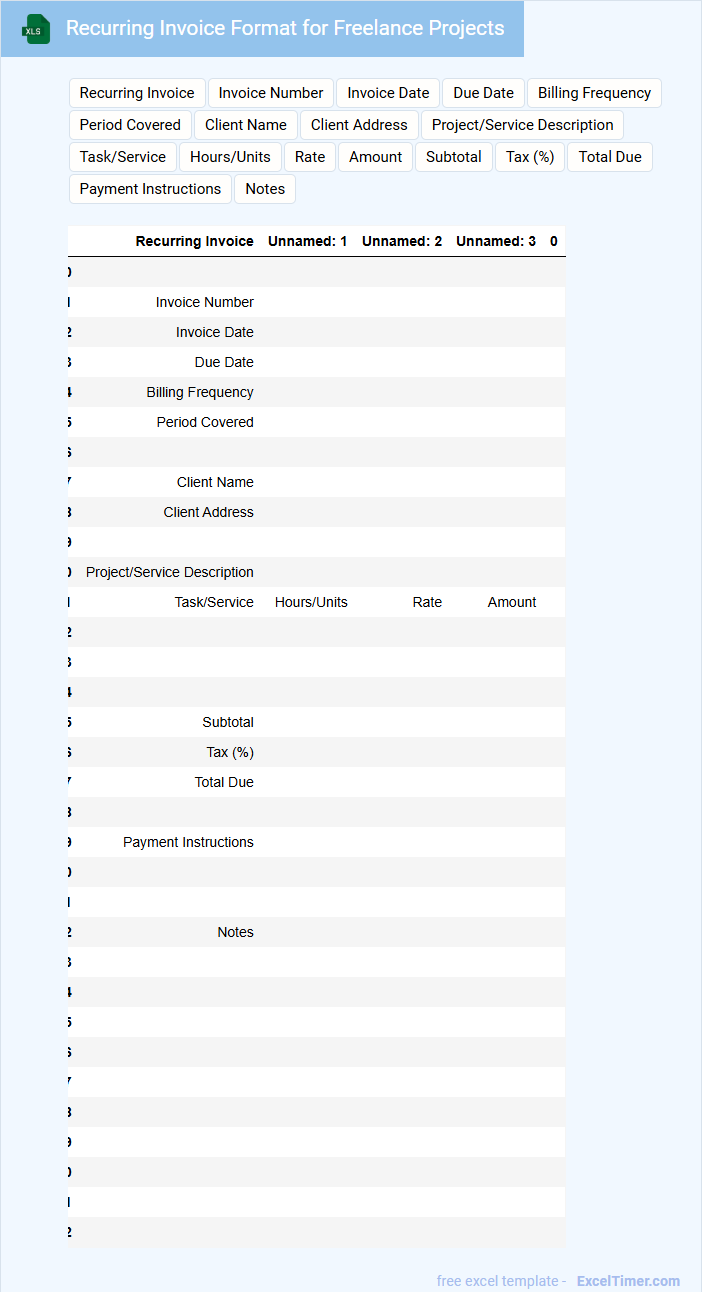

Recurring Invoice Format for Freelance Projects

What information is typically included in a recurring invoice format for freelance projects? A recurring invoice usually contains details such as the freelancer's contact information, client details, a description of the services rendered, payment terms, and the invoice frequency. It is designed to streamline billing for ongoing freelance work, ensuring timely payments and clear communication between the freelancer and client.

What are important considerations when creating a recurring invoice for freelance projects? Ensure the invoice clearly specifies the payment schedule, amount due, and any late payment penalties. Including a unique invoice number and maintaining consistent formatting helps in tracking payments and managing records effectively.

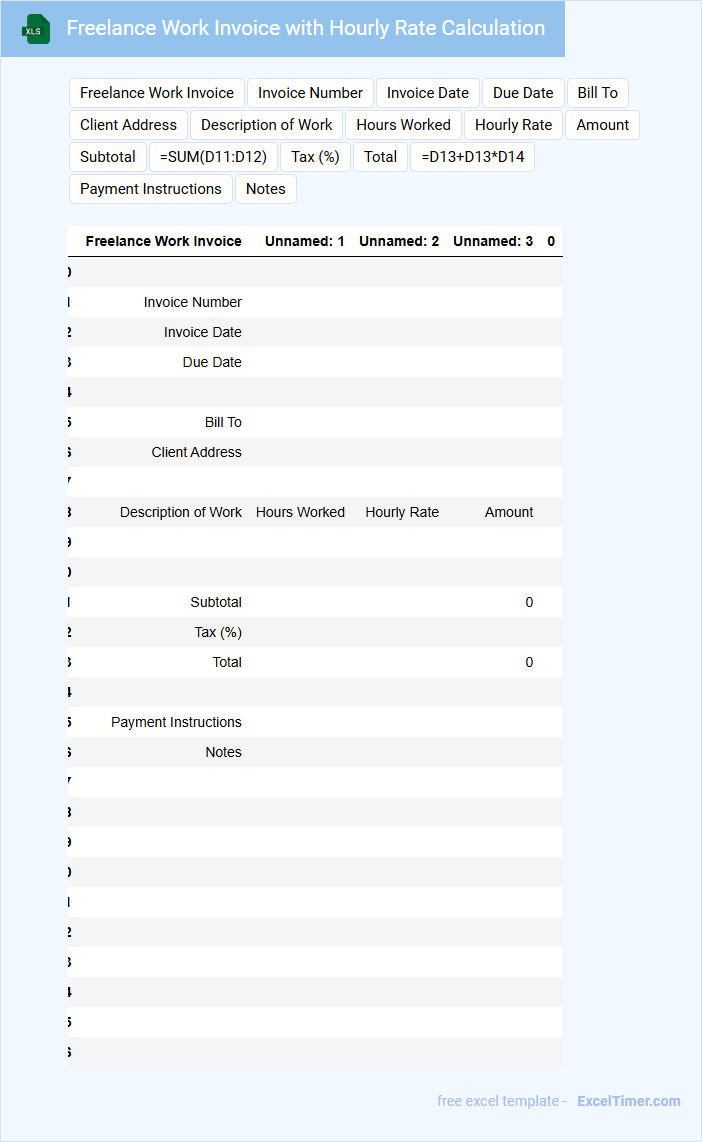

Freelance Work Invoice with Hourly Rate Calculation

What information is typically included in a freelance work invoice with hourly rate calculation? Such an invoice usually contains details like the freelancer's contact information, the client's details, an itemized list of services rendered, hours worked, hourly rate, and the total amount due. It also often includes payment terms, invoice number, and date to ensure clear communication and prompt payment.

What is important to include to ensure clarity and timely payment? It is crucial to provide a transparent breakdown of hours worked and corresponding rates to avoid disputes, along with clear payment instructions and deadlines. Including a polite note expressing gratitude for the client's business can also foster positive professional relationships.

What essential details should be included in a freelancer's monthly invoice (e.g., client name, invoice number, payment terms)?

A freelancer's monthly invoice should include essential details such as client name, invoice number, invoice date, payment terms, detailed description of services rendered, hours worked or deliverables, rate per hour or project cost, subtotal, taxes if applicable, total amount due, and payment instructions. Including freelancer's contact information and tax identification number ensures clear communication and compliance. Incorporating these elements guarantees accurate billing and timely payments.

How can you use Excel formulas to automatically calculate total hours worked and payment due in a monthly invoice?

Use the SUM formula to automatically calculate total hours worked by summing the daily hours input in a designated column. Apply the multiplication formula by multiplying total hours by the hourly rate to determine the payment due. Incorporate IFERROR to handle any errors in calculations, ensuring accurate invoice totals in the Excel document.

What is the importance of itemizing services or deliverables in an Excel monthly invoice for freelancers?

Itemizing services or deliverables in Your Excel monthly invoice ensures clear communication of work performed and payment expectations. Detailed entries help prevent payment disputes by providing transparency. Accurate itemization also facilitates efficient financial tracking and reporting.

How can conditional formatting in an Excel invoice help highlight overdue payments or unbilled hours?

Conditional formatting in an Excel invoice automatically highlights overdue payments by changing cell colors based on due dates, improving payment tracking efficiency. It flags unbilled hours by identifying empty or zero-value cells in time-tracking columns, ensuring accurate billing. These visual cues streamline invoice review and reduce errors in freelancer payment management.

Why is it important for freelancers to track and update monthly invoices in Excel for effective financial management?

Tracking and updating monthly invoices in Excel allows freelancers to maintain accurate records of payments, deadlines, and client details, enhancing financial clarity. Your organized invoice data supports timely billing, tax preparation, and cash flow analysis. Consistent invoice management in Excel empowers freelancers to optimize income tracking and business decision-making.