The Monthly Budget Planner Excel Template for Students helps efficiently track income, expenses, and savings each month. It features customizable categories tailored to student life, making it easy to manage finances and avoid overspending. Using this template promotes financial discipline and supports achieving budgeting goals effectively.

Monthly Budget Planner with Expense Tracker for Students

A Monthly Budget Planner with Expense Tracker for Students is a document designed to help students manage their finances effectively by recording income and tracking daily expenses. It aims to promote financial discipline and awareness to avoid overspending.

- Include sections for fixed income such as allowances or part-time job earnings.

- Track variable expenses like food, transportation, and entertainment.

- Regularly review savings goals and adjust spending habits accordingly.

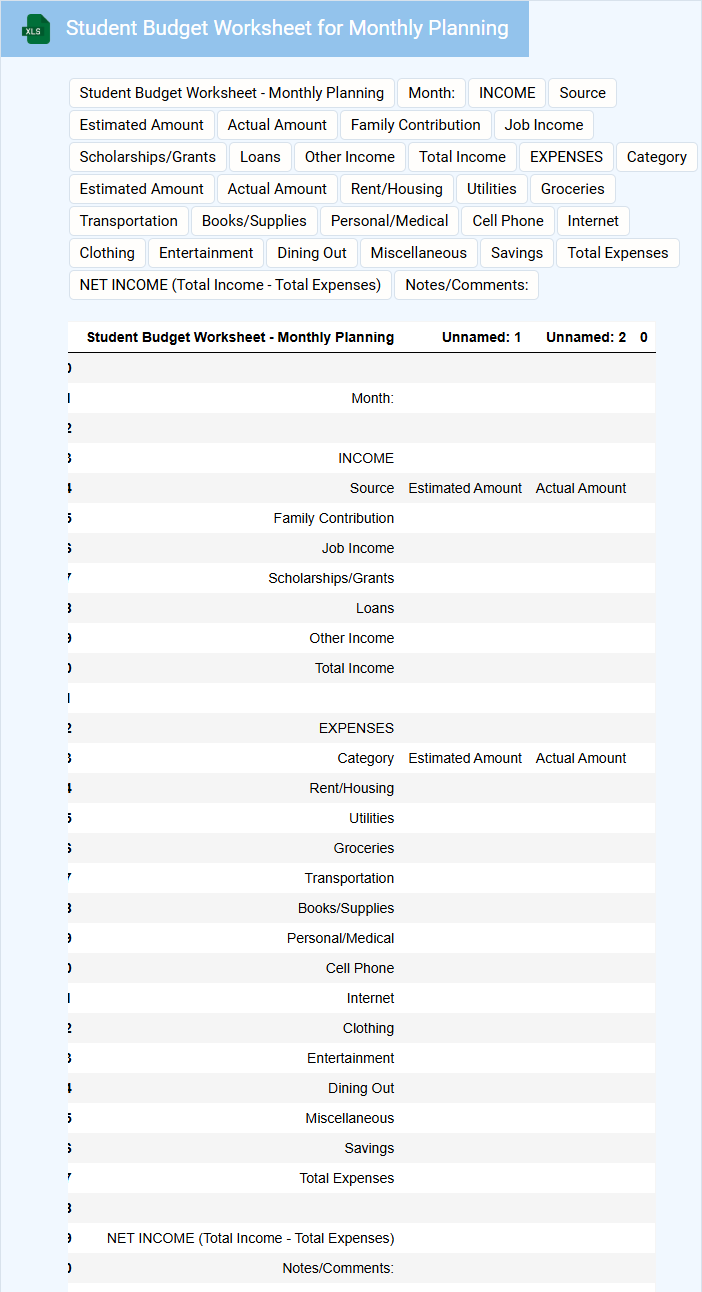

Student Budget Worksheet for Monthly Planning

A Student Budget Worksheet for monthly planning typically contains sections for tracking income, fixed expenses, and variable costs. It helps students organize their finances by listing sources of income and essential monthly expenditures.

Important elements include categories for rent, utilities, groceries, transportation, and discretionary spending. This worksheet encourages careful monitoring to avoid overspending and ensures effective money management throughout the month.

Excel Monthly Budget Tracker for College Students

An Excel Monthly Budget Tracker for College Students typically contains detailed financial data to help manage income and expenses efficiently.

- Income sources: Records all monthly earnings such as part-time jobs, scholarships, and allowances.

- Expense categories: Tracks spending on essentials like rent, food, transportation, and entertainment.

- Savings goals: Helps set and monitor monthly savings targets to encourage financial discipline.

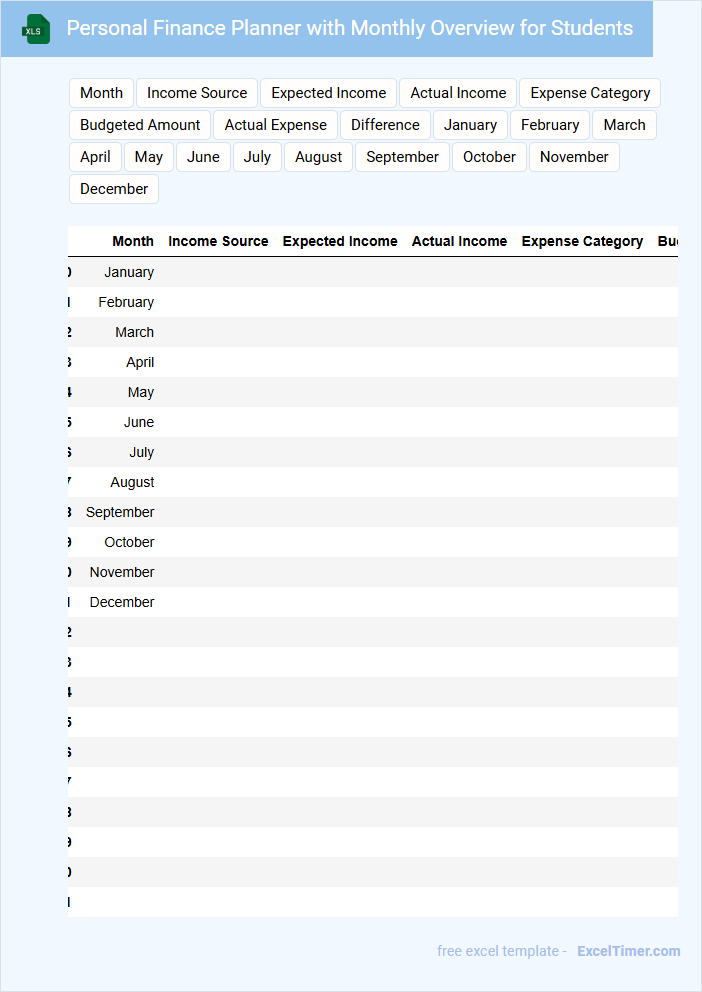

Personal Finance Planner with Monthly Overview for Students

What does a Personal Finance Planner with Monthly Overview for Students usually contain? This document typically includes sections for budgeting income, tracking expenses, and setting financial goals tailored to a student's lifestyle. It helps students organize their finances by providing a clear monthly snapshot of their spending and savings habits, promoting better money management skills.

Why is it important for students to use this type of planner? Using a Personal Finance Planner encourages responsible financial behavior early on, preventing debt accumulation and ensuring funds are allocated wisely. It also assists students in identifying unnecessary expenses and prioritizing essential costs like tuition, rent, and groceries, fostering financial independence.

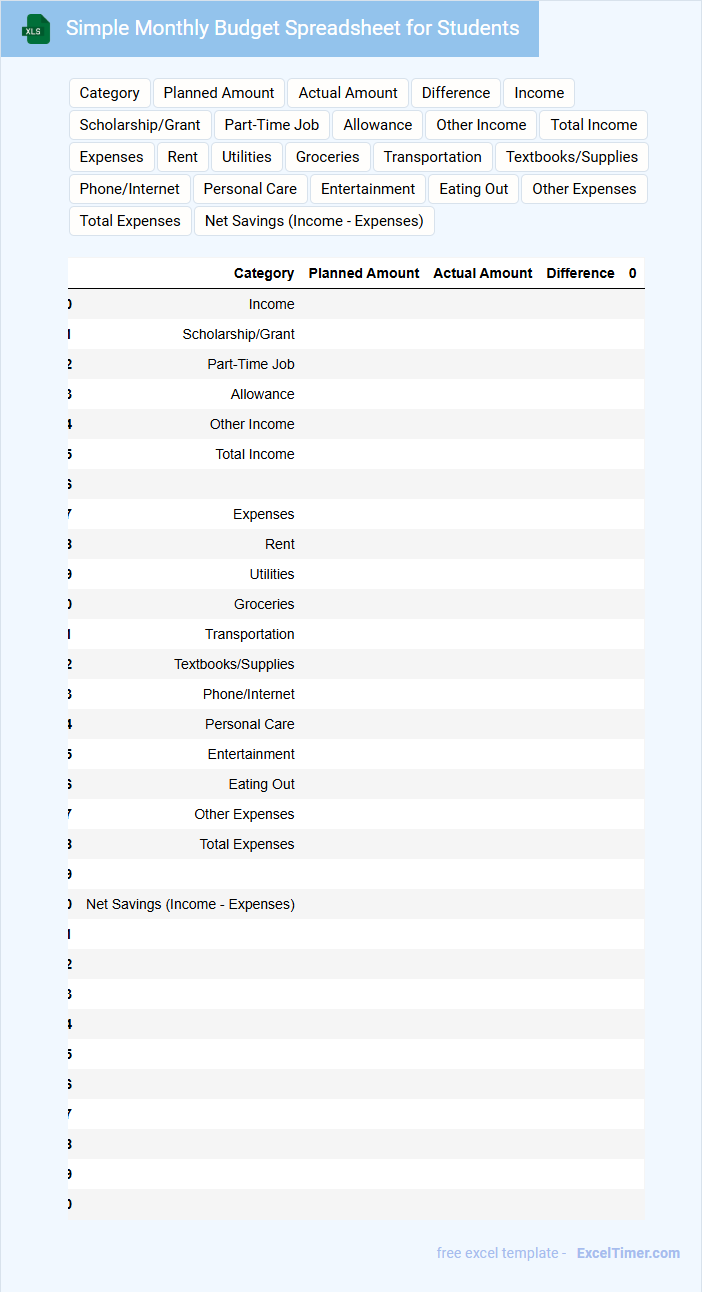

Simple Monthly Budget Spreadsheet for Students

A Simple Monthly Budget Spreadsheet for students typically contains categories such as income sources, fixed expenses, variable expenses, and savings goals. This document helps students track their spending habits and manage their finances effectively.

Important elements to include are clear labels for each category, spaces for actual and planned amounts, and a summary of total income versus expenses. Ensuring ease of use and regular updates will maximize the spreadsheet's usefulness for financial planning.

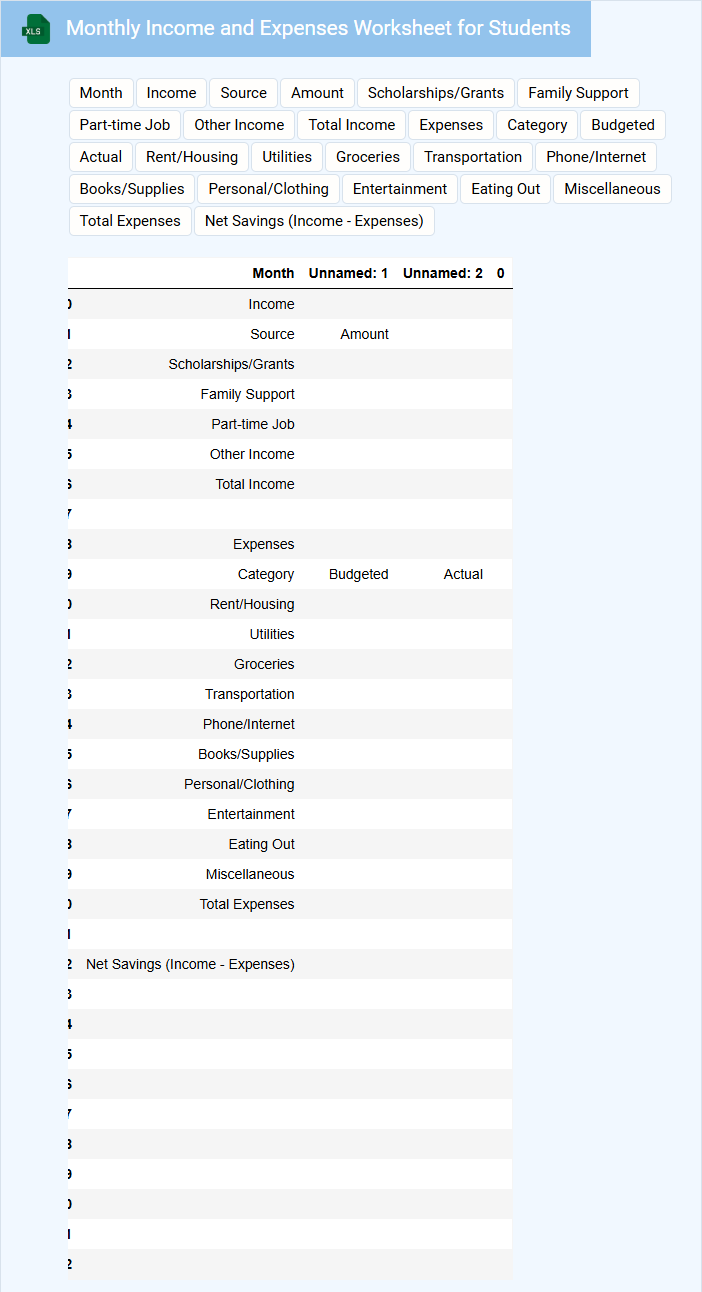

Monthly Income and Expenses Worksheet for Students

A Monthly Income and Expenses Worksheet for students typically includes sections to record all sources of income such as allowances, part-time job earnings, and scholarships. It also tracks various expenses like tuition, books, food, and entertainment to help students monitor their financial health.

This type of document assists students in managing their budget effectively by providing a clear overview of their finances monthly. Including categories for fixed and variable expenses is important to get an accurate financial picture and identify potential savings.

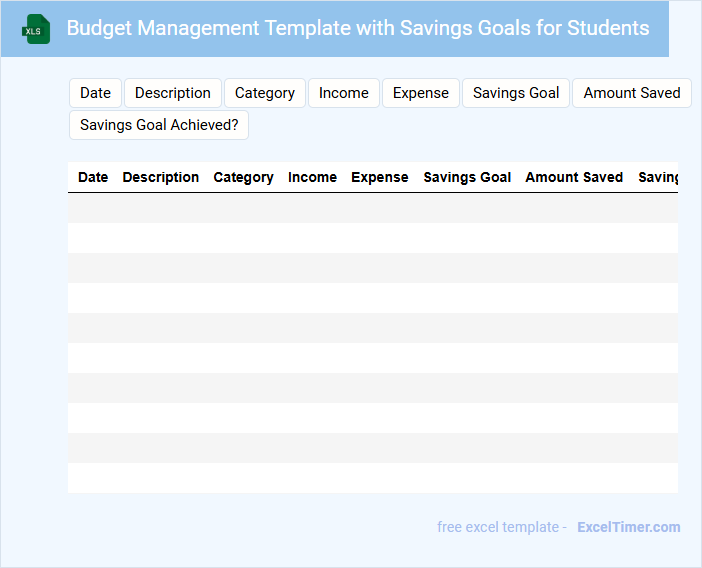

Budget Management Template with Savings Goals for Students

A Budget Management Template with Savings Goals for Students typically contains sections for tracking income, expenses, and setting specific savings targets. It helps students plan their finances effectively to avoid overspending while aiming for their financial goals.

- Include a clear breakdown of monthly income sources and fixed versus variable expenses.

- Set realistic savings goals based on the student's priorities and timeline.

- Regularly update the template to monitor progress and adjust the budget accordingly.

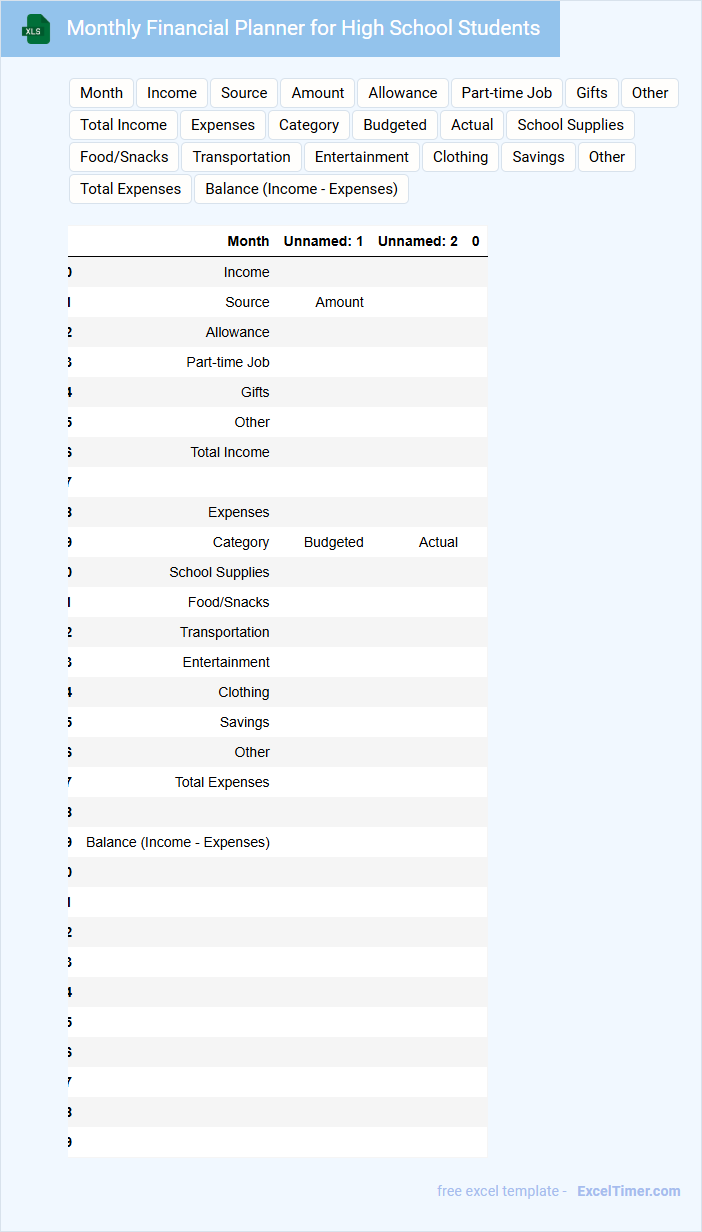

Monthly Financial Planner for High School Students

A Monthly Financial Planner for High School Students typically contains sections to track income, expenses, and savings goals. It helps young individuals develop responsible money management habits by organizing their finances clearly each month. Additionally, it often includes budgeting tips and reminders to encourage consistent financial review and adjustment.

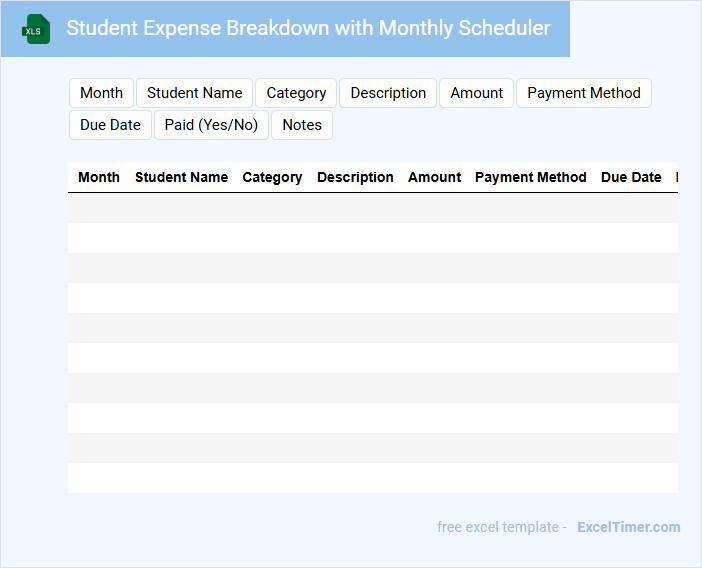

Student Expense Breakdown with Monthly Scheduler

What information does a Student Expense Breakdown with Monthly Scheduler typically contain?

This document usually includes detailed categories of student expenses such as tuition fees, accommodation, food, transportation, and personal expenses, organized on a monthly basis. It helps students plan and manage their finances effectively throughout the academic year by tracking income and expenditures systematically.

To optimize its usefulness, ensure it incorporates clear itemization, realistic budgeting, and a calendar view for monthly due dates to avoid late payments and financial surprises.

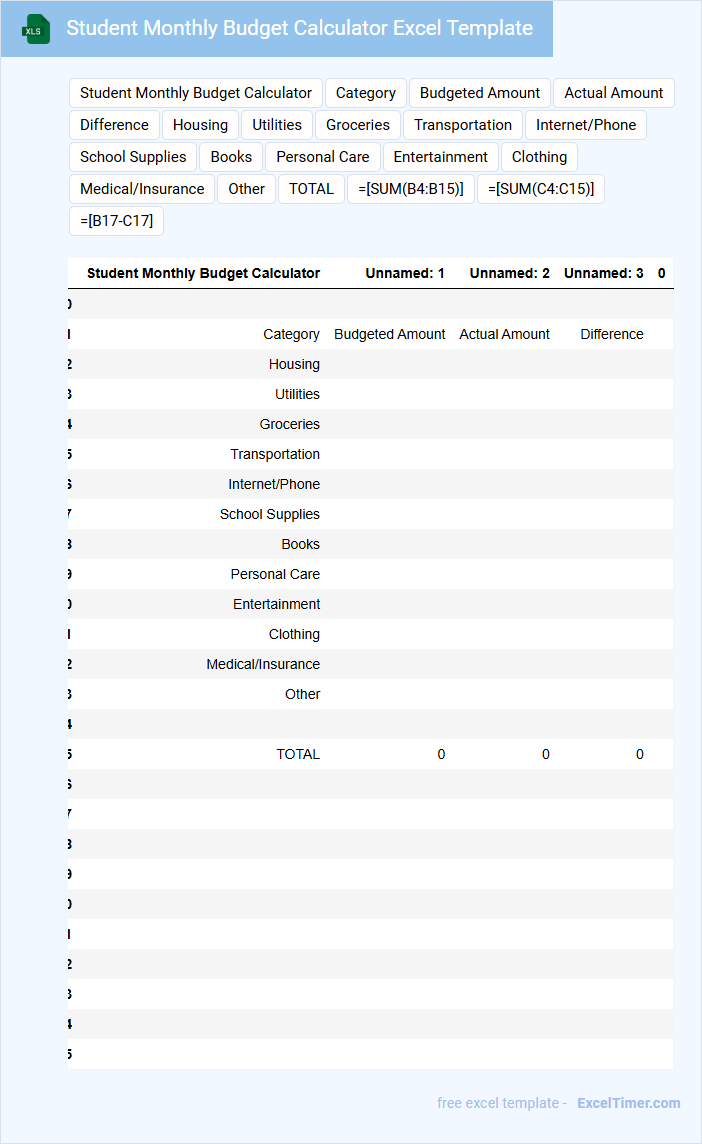

Student Monthly Budget Calculator Excel Template

What does a Student Monthly Budget Calculator Excel Template usually contain? This type of document typically includes categories for income sources, fixed and variable expenses, and savings goals to help students track their finances. It provides structured tables and formulas that automatically calculate totals and balances, enabling effective budgeting and financial planning.

What important features should be included in a Student Monthly Budget Calculator Excel Template? It should have clear input fields for rent, utilities, groceries, transportation, and entertainment expenses, along with sections to record scholarships, part-time job income, and any other funding sources. Additionally, incorporating visual aids like charts for expense breakdowns and customizable categories enhances usability and financial awareness.

Monthly Allowance Tracker for Students

A Monthly Allowance Tracker for Students is a document used to monitor and manage personal finances effectively. It helps students keep track of their income, expenses, and savings on a monthly basis.

- Include categories for different types of expenses such as food, transportation, and entertainment.

- Record the date, amount, and description of each transaction to maintain accurate records.

- Review the tracker regularly to adjust spending habits and stay within budget.

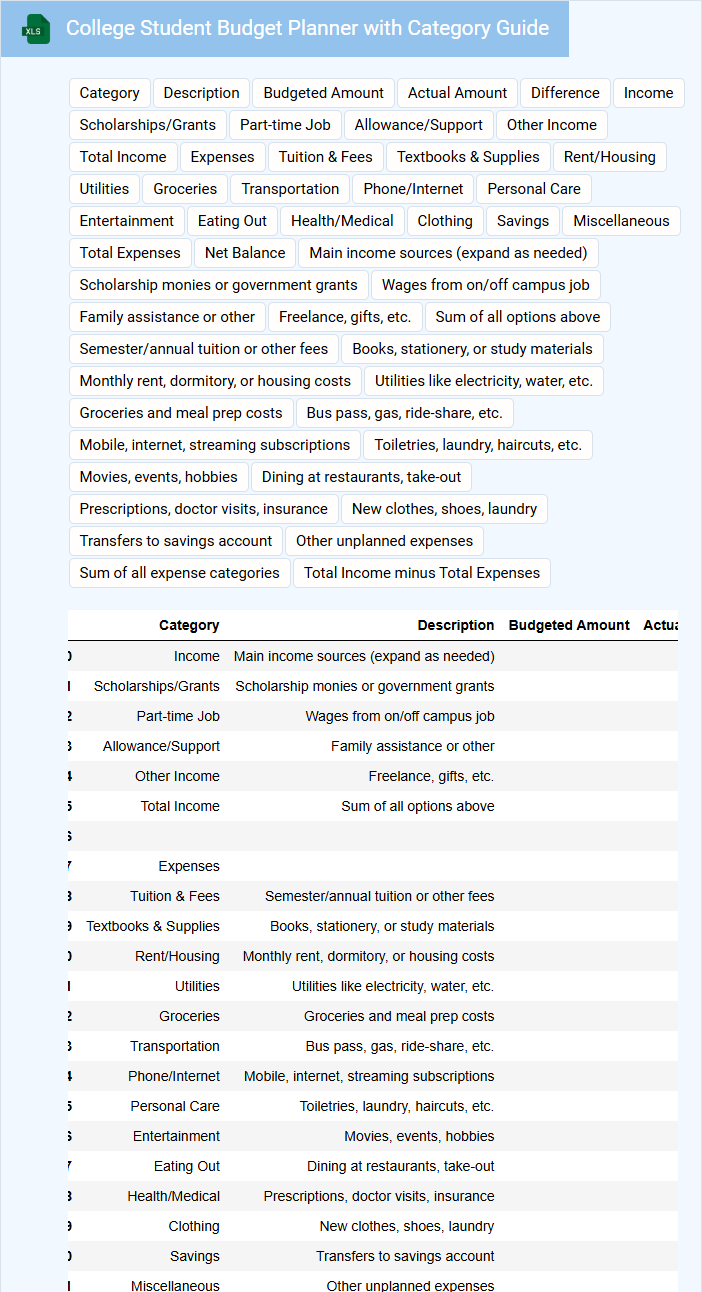

College Student Budget Planner with Category Guide

A College Student Budget Planner with Category Guide is typically a document designed to help students manage their finances effectively by outlining income, expenses, and savings categories.

- Income Tracking: It includes sections to record all sources of income such as scholarships, part-time jobs, and allowances.

- Expense Categories: The planner groups expenses into key categories like tuition, housing, food, transportation, and entertainment for better organization.

- Savings and Goals: It encourages setting financial goals and tracking savings to promote responsible budgeting habits.

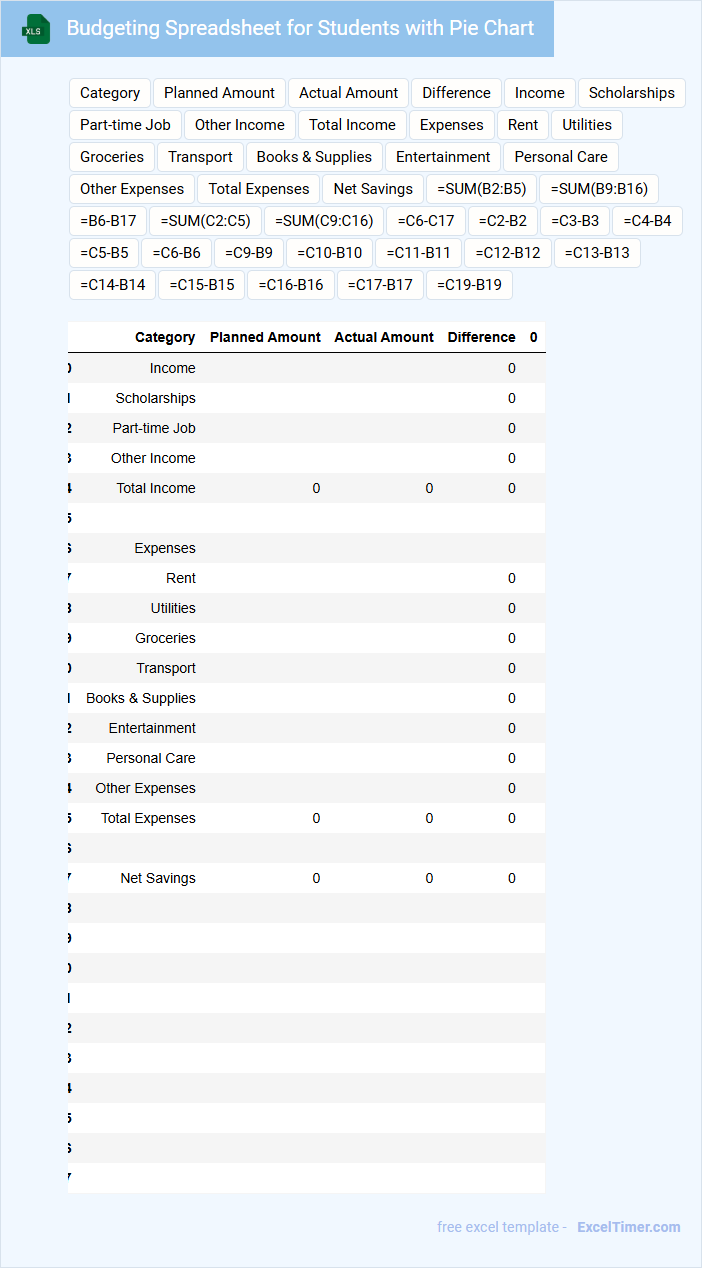

Budgeting Spreadsheet for Students with Pie Chart

What information does a budgeting spreadsheet for students typically contain? A budgeting spreadsheet for students usually includes sections for tracking income, expenses, savings goals, and monthly totals. It helps students visualize their spending patterns and manage finances efficiently using tools like pie charts for easy data interpretation.

What is an important aspect to consider when creating a budgeting spreadsheet with a pie chart? It is crucial to categorize expenses clearly and ensure data accuracy for meaningful visual representation. Additionally, keeping the spreadsheet user-friendly and regularly updated helps students maintain control over their budget effectively.

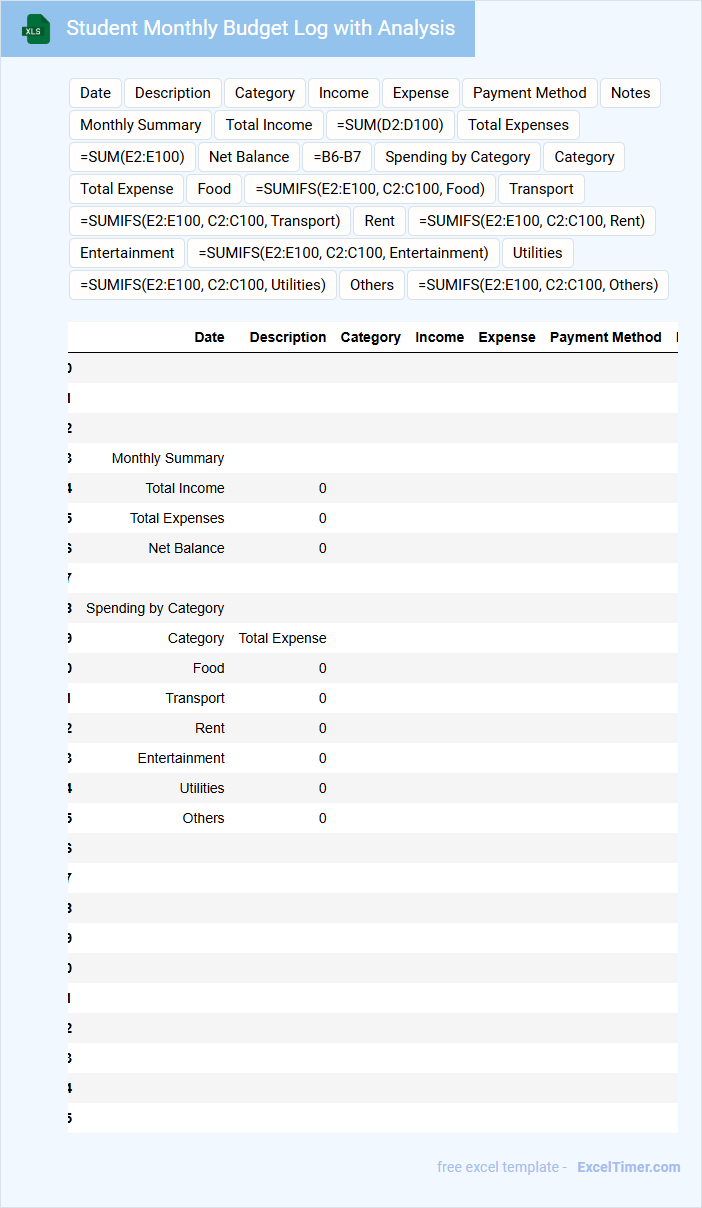

Student Monthly Budget Log with Analysis

A Student Monthly Budget Log with Analysis typically contains detailed records of a student's income, expenses, and financial adjustments over a month to help manage personal finances effectively.

- Income Tracking: Record all sources of monthly income clearly to understand financial inflows.

- Expense Categorization: Categorize expenses such as tuition, meals, transport, and entertainment for better analysis.

- Monthly Analysis: Review and compare expenses against income to identify saving opportunities and budget improvements.

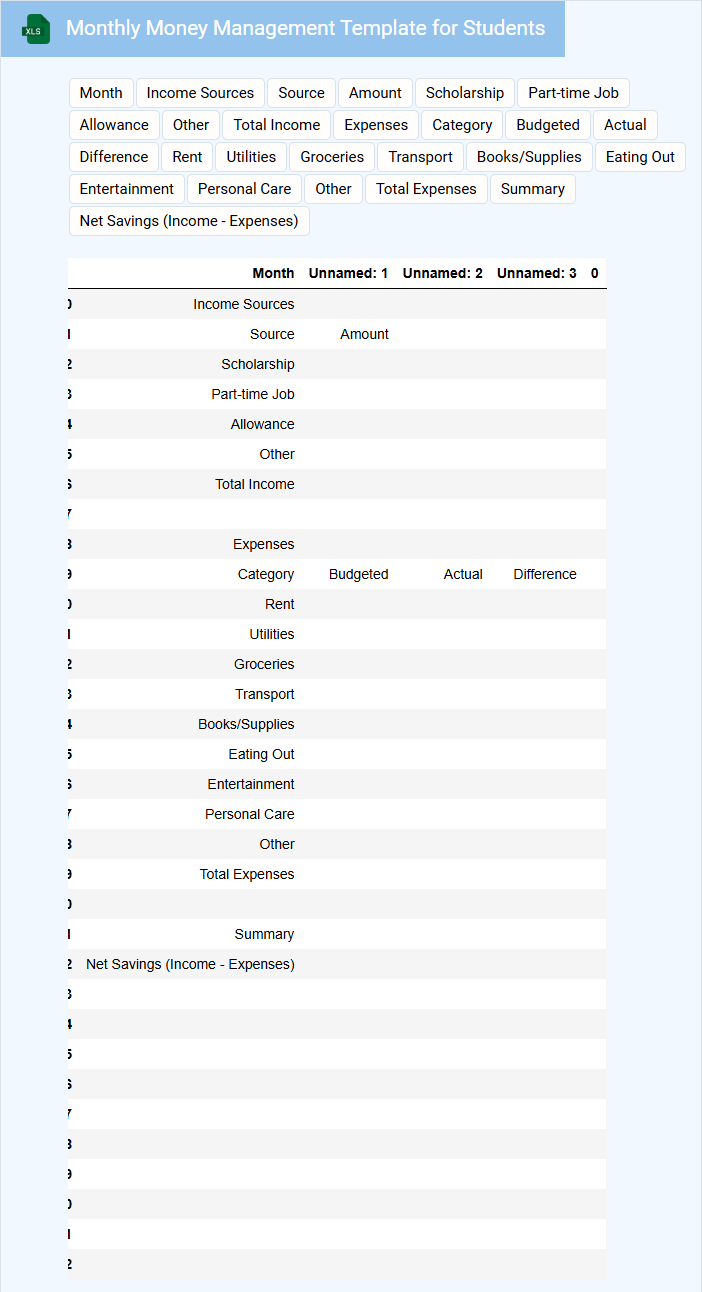

Monthly Money Management Template for Students

This document typically contains a structured layout to help students track and manage their monthly income and expenses efficiently.

- Income Tracking: Record all sources of monthly income including part-time jobs and allowances.

- Expense Categorization: Organize spending into categories like food, transportation, and entertainment for better clarity.

- Savings Goal Setting: Set and monitor monthly savings targets to encourage financial discipline.

What are the key expense categories to include in a student Monthly Budget Planner?

Key expense categories for a student Monthly Budget Planner include tuition fees, textbooks and supplies, rent or housing, utilities, groceries, transportation, and entertainment. Incorporate categories for personal care, mobile/internet bills, and savings to ensure comprehensive financial management. Tracking these expenses helps students maintain control over their finances and identify areas for potential savings.

How does the planner help track and compare actual spending versus budgeted amounts?

The Monthly Budget Planner for Students provides a structured worksheet to input both budgeted and actual expenses across categories such as tuition, groceries, and entertainment. It automatically calculates variances, highlighting overspending or savings for each category. Visual charts summarize spending patterns, enabling informed financial decisions and better money management.

What formulas should be used to automatically calculate total income, expenses, and savings?

Use the SUM formula to calculate total income and total expenses by adding relevant cell ranges, such as =SUM(B2:B10) for income and =SUM(C2:C10) for expenses. Apply the formula =B11-C11 to compute savings by subtracting total expenses from total income. Implementing these formulas ensures dynamic updates in the Monthly Budget Planner for Students as data changes.

How can students highlight or flag overspending within the Excel document?

Students can highlight overspending in the Monthly Budget Planner by using conditional formatting to automatically flag expenses that exceed budgeted amounts. Your Excel document can be set to color-code cells red when spending surpasses limits, making it easy to spot areas that require adjustment. This feature helps maintain financial awareness and control over monthly expenses.

What methods can be integrated to visualize spending trends over time (e.g., charts or graphs)?

Your Monthly Budget Planner for Students can integrate line charts and bar graphs to effectively visualize spending trends over time. Pivot tables combined with clustered column charts allow detailed comparison of categories by month. Interactive slicers enhance data exploration, enabling you to filter and analyze expenses dynamically.