The Monthly Profit and Loss Excel Template for Cafes is an essential financial tool designed to help cafe owners track income, expenses, and net profit efficiently. This template provides clear categories for sales, cost of goods sold, and operating expenses, enabling accurate monthly financial analysis. Regular use of this template supports informed decision-making to improve profitability and manage budget effectively.

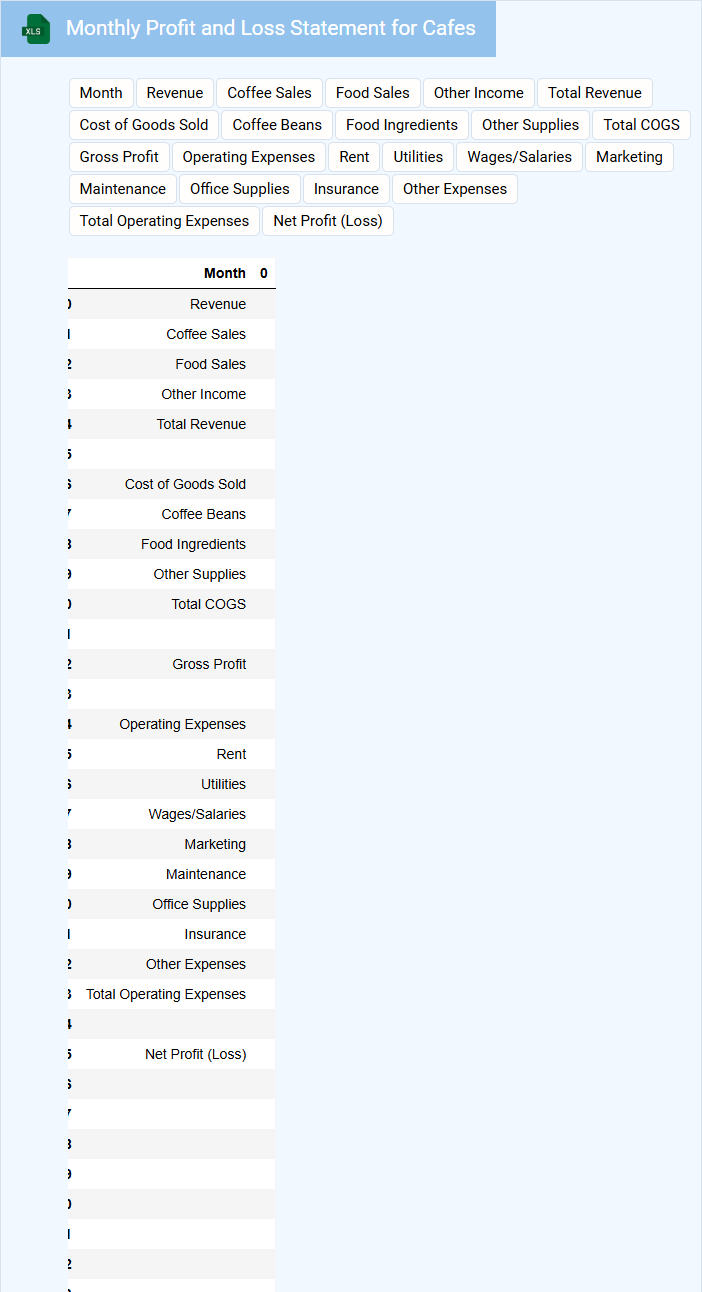

Monthly Profit and Loss Statement for Cafes

A Monthly Profit and Loss Statement for Cafes typically contains detailed financial information reflecting the cafe's income, expenses, and net profit over the month.

- Revenue Breakdown: Tracks sales from different sources like food, beverages, and other services to identify key income streams.

- Expense Categorization: Includes fixed and variable costs such as rent, utilities, payroll, and cost of goods sold to analyze spending patterns.

- Net Profit Analysis: Summarizes the overall profitability for the month, aiding in financial decision-making and budget adjustments.

Profit and Loss Report Template for Cafe Businesses

A Profit and Loss Report Template for cafe businesses typically contains detailed records of revenues, costs, and expenses over a specific period. This document helps cafes track financial performance and identify areas for improvement.

It usually includes sections for sales, cost of goods sold, operating expenses, and net profit calculations. Including clear category breakdowns ensures accurate and actionable financial insights.

Excel Template for Monthly Cafe Income and Expenses

An Excel Template for Monthly Cafe Income and Expenses is a structured document designed to track financial activities over a specific period. It typically contains sections for recording daily sales, various expense categories, and summary calculations for net profit or loss. This template is essential for maintaining organized and clear financial records, enabling better cash flow management and informed decision-making.

For optimal use, ensure the template includes clearly defined categories for income and expenses and incorporates automatic calculations like totals and variances. Additionally, regular updating and backup of data will help maintain accuracy and security. Lastly, visual aids such as charts or graphs can enhance understanding of financial trends.

Monthly Financial Summary for Cafes

What information is typically contained in a Monthly Financial Summary for Cafes? This document usually includes detailed records of income, expenses, and profits generated throughout the month. It helps cafe owners track financial performance, monitor cash flow, and make informed business decisions.

What is an important consideration when preparing this summary? Accuracy in recording all financial transactions is crucial, as is categorizing expenses and revenues correctly to identify cost-saving opportunities and assess overall profitability effectively.

Cafe Monthly P&L with Expense Tracking

The Cafe Monthly P&L with Expense Tracking is a financial document that summarizes total revenues, costs, and expenses incurred during a specific month. It typically includes detailed breakdowns of sales, cost of goods sold, and various operational expenses to assess profitability. This type of document is essential for monitoring business performance and identifying areas for cost control.

Important aspects to include are accurate categorization of all expenses, timely recording of transactions, and comparison against budgeted figures. Consistent updating ensures better financial planning and decision-making. Proper usage of this document helps the cafe maintain financial health and optimize profit margins.

Income Statement Template for Cafes (Monthly)

What information does an Income Statement Template for Cafes (Monthly) usually contain? This document typically includes detailed records of all revenues generated and expenses incurred by the cafe during a month, such as sales, cost of goods sold, labor costs, and operating expenses. It provides a clear snapshot of the cafe's financial performance, helping owners monitor profitability and manage cash flow effectively.

What are the important factors to consider when using this template? Accuracy in recording daily sales and expenses is crucial, as is categorizing costs properly to identify areas for improvement. Additionally, regularly updating and reviewing the statement can enable timely financial decisions and support budgeting for future growth.

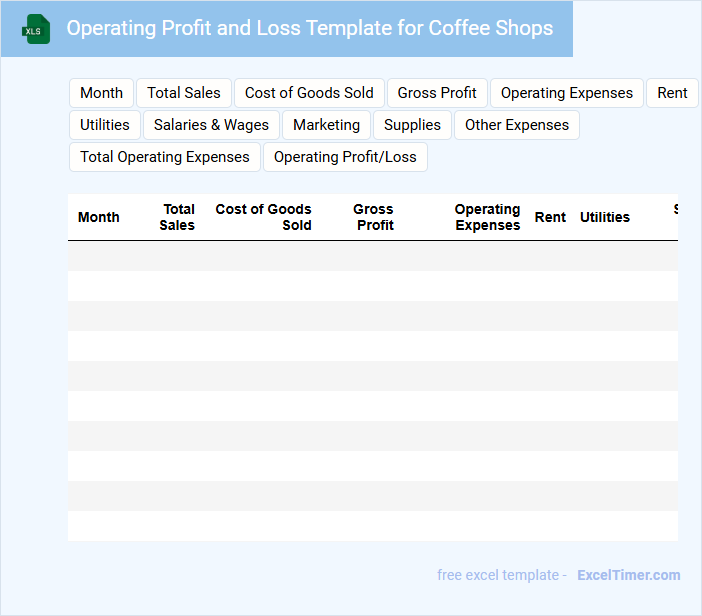

Operating Profit and Loss Template for Coffee Shops

Operating Profit and Loss Template for Coffee Shops is a crucial financial document that provides a detailed summary of revenues, costs, and expenses during a specific period. It helps coffee shop owners track profitability and make informed business decisions. Ensure accurate data entry to maintain clarity and usefulness of the report. This template typically includes sales revenue, cost of goods sold, operating expenses, and net profit or loss. Emphasizing expense categorization assists in identifying cost-saving opportunities. Regularly updating and reviewing this document supports financial health and growth of the coffee shop.

Monthly Profit and Loss Dashboard for Cafes

What information does a Monthly Profit and Loss Dashboard for Cafes typically contain? This type of document usually includes detailed financial metrics such as total revenue, cost of goods sold, operating expenses, and net profit for the month. It provides a clear overview of the cafe's financial health to help owners make informed business decisions.

What is an important element to focus on in this dashboard? It's crucial to highlight trends in sales and expenses over time to identify peak performance periods and areas where costs can be optimized. Including visual aids like charts and graphs enhances understanding and allows quicker assessment of profitability.

Excel Sheet for Cafe Monthly Earnings and Costs

What does an Excel sheet for Cafe Monthly Earnings and Costs typically contain? This document usually includes detailed records of daily sales, categorized income sources, and all expense entries such as ingredients, wages, and utilities. It helps cafe owners monitor financial performance, control costs, and make informed decisions to improve profitability.

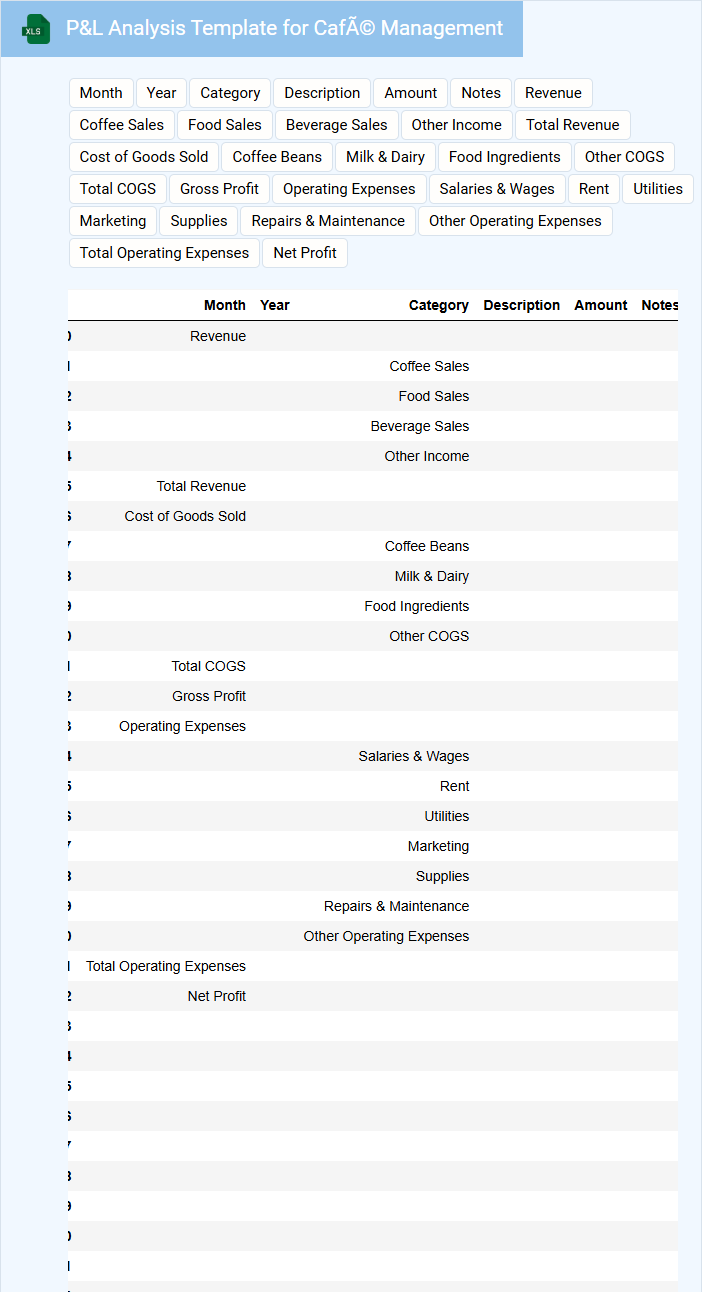

P&L Analysis Template for Café Management

A P&L Analysis Template for Café Management typically contains detailed financial data such as revenue, costs, and expenses. It helps in tracking profitability and identifying areas where the café can improve operational efficiency. Key elements include sales breakdown, cost of goods sold, and fixed and variable expenses.

Monthly Profit & Expense Tracker for Cafes

A Monthly Profit & Expense Tracker for Cafes is typically a document used to record, analyze, and monitor financial transactions to ensure business profitability and cost management.

- Income Sources: Track all revenue streams including sales of food, beverages, and any additional services.

- Expense Categories: Record fixed and variable costs such as rent, utilities, inventory, and labor costs.

- Profit Calculation: Calculate net profit by subtracting total expenses from monthly income to evaluate financial performance.

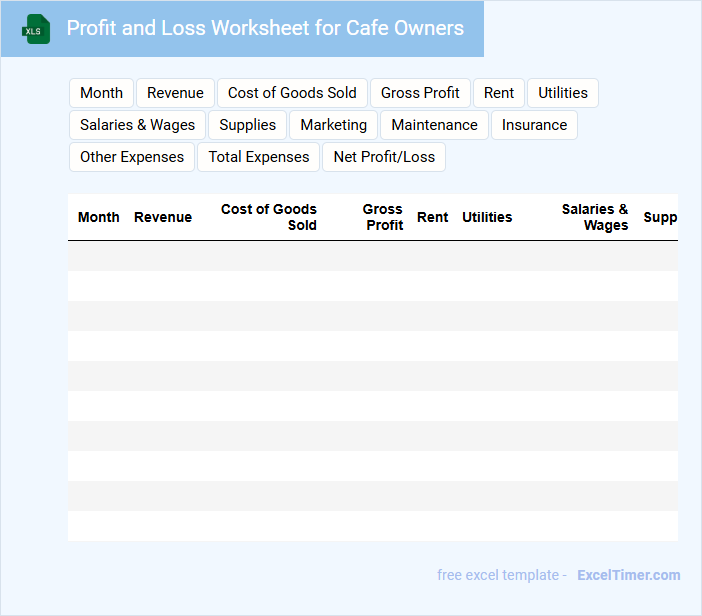

Profit and Loss Worksheet for Cafe Owners

A Profit and Loss Worksheet for Cafe Owners typically contains detailed records of income, expenses, and net profit to help track financial performance.

- Revenue Streams: Document all sources of income including sales from food, beverages, and other services.

- Expense Categories: Record all operating costs such as inventory, labor, rent, and utilities accurately.

- Net Profit Calculation: Ensure the worksheet clearly shows total revenue minus total expenses for effective financial analysis.

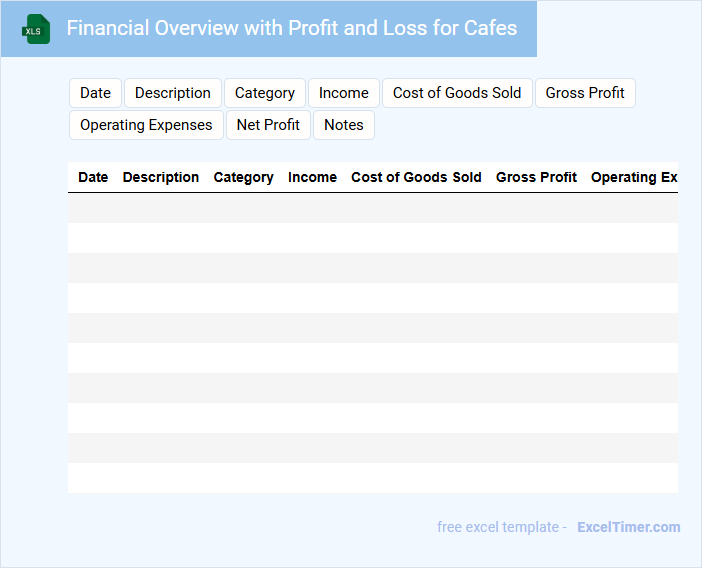

Financial Overview with Profit and Loss for Cafes

Financial Overview with Profit and Loss for Cafes typically contains a summary of income, expenses, and net profit or loss to assess the financial health of the business.

- Revenue Breakdown: Detailed tracking of daily sales from food, beverages, and other services.

- Expense Categories: Clear documentation of fixed costs like rent and variable costs such as ingredients and labor.

- Profit Analysis: Regular comparison of income versus expenses to identify profitability trends and opportunities for cost savings.

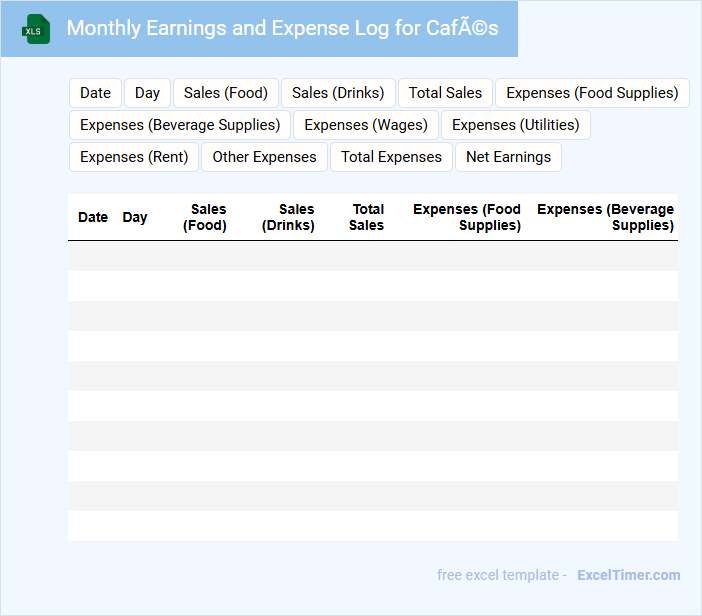

Monthly Earnings and Expense Log for Cafés

What information is typically included in a Monthly Earnings and Expense Log for Cafés? This type of document usually records all income generated and expenses incurred by a café throughout the month. It helps to track profits, manage budgets, and identify financial trends for better business decisions.

What important details should be emphasized in this log? Key elements should include daily sales, cost of goods sold, operational expenses like rent and utilities, employee wages, and any miscellaneous costs. Accurate and timely entries ensure effective financial management and support informed planning.

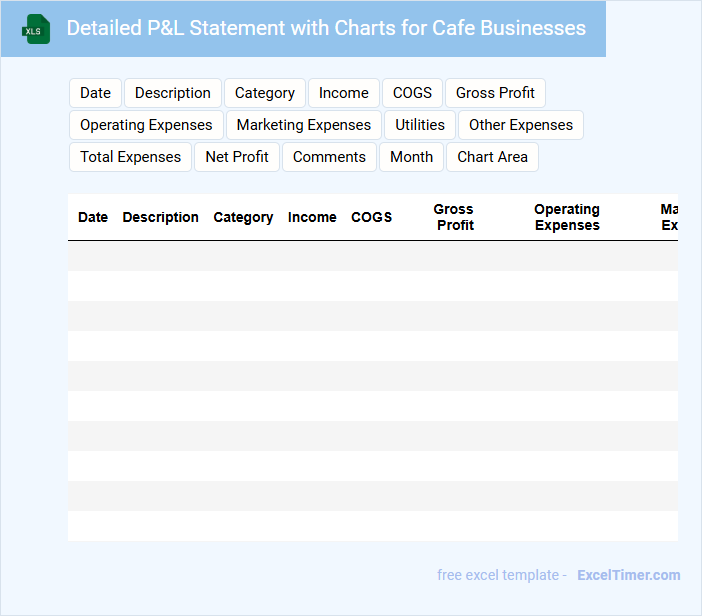

Detailed P&L Statement with Charts for Cafe Businesses

What does a detailed Profit and Loss (P&L) statement with charts typically contain for cafe businesses? It usually includes comprehensive financial data such as revenues, costs, and expenses broken down by categories like food, beverages, labor, and overhead. Visual charts further illustrate trends, profit margins, and cash flow to help owners make informed business decisions and optimize operations.

What are important elements to focus on in such a document? Key aspects include accurately tracking daily sales, cost of goods sold, employee wages, and monthly utilities, alongside visualizing monthly profit trends and expense proportions. This detailed approach aids in identifying cost-saving opportunities and boosting overall profitability.

How do you categorize and track income streams specific to a cafe (e.g., food, beverages, merchandise) in a monthly profit and loss Excel document?

In your monthly profit and loss Excel document for cafes, categorize income streams by creating separate columns for food sales, beverage sales, and merchandise revenue. Use detailed transaction entries and formulas to sum each category, enabling clear tracking of monthly performance. This approach helps you analyze profitability across distinct revenue sources effectively.

What are the essential cost categories (e.g., cost of goods sold, labor, rent, utilities) that must be included for accurate monthly profit and loss reporting for cafes?

To ensure accurate monthly profit and loss reporting for your cafe, essential cost categories include cost of goods sold, labor expenses, rent, and utilities. Tracking these key expenses allows you to analyze profitability and manage operational costs effectively. Properly categorizing costs helps identify areas for financial improvement and supports strategic decision-making.

How do you set up formulas in Excel to automatically calculate monthly gross profit, operating expenses, and net profit for a cafe?

In Excel, set gross profit by subtracting "Cost of Goods Sold" from "Total Sales" using the formula `=Total_Sales - COGS`. Calculate operating expenses by summing all expense categories with `=SUM(Expense1:ExpenseN)`. Determine net profit by subtracting operating expenses from gross profit using `=Gross_Profit - Operating_Expenses`.

What methods can you use in Excel to visualize monthly profit and loss trends (e.g., charts, conditional formatting) for a cafe business?

You can use Excel's line charts and column charts to clearly visualize monthly profit and loss trends for your cafe business. Conditional formatting highlights profit increases or losses with color scales or data bars, making financial patterns easier to interpret. PivotTables combined with slicers offer interactive data analysis for detailed insight into revenue and expenses.

How can you use Excel to compare monthly budgeted versus actual profit and loss figures to identify variances and improve cafe financial performance?

Use Excel's built-in formulas like SUM and IF to calculate monthly budgeted versus actual profit and loss figures for your cafe. Create variance columns to highlight differences between budgeted and actual amounts, using conditional formatting to quickly identify significant discrepancies. Analyzing these variances helps you pinpoint areas for cost control and revenue enhancement, improving your cafe's financial performance.