The Monthly Budget Excel Template for Households is a practical tool designed to help families track income, expenses, and savings efficiently. This template provides customizable categories, automatic calculations, and visual charts to monitor spending habits and manage finances effectively. Using this template ensures better financial planning, reduces overspending, and helps achieve budgeting goals consistently.

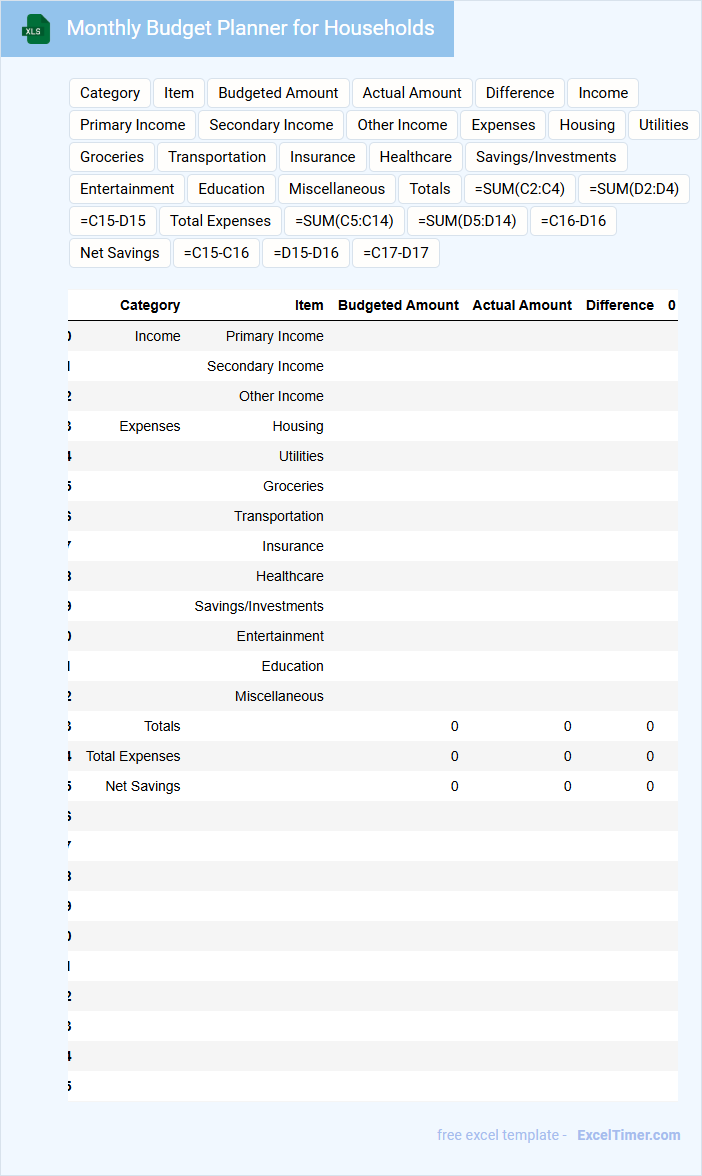

Monthly Budget Planner for Households

A Monthly Budget Planner for households typically contains detailed sections for income, fixed expenses, and variable costs. It helps individuals track their spending habits and plan savings effectively. Including categories like groceries, utilities, and entertainment ensures comprehensive financial management.

Important elements to consider are setting realistic goals, regularly updating actual expenses, and reviewing the budget to adjust for any changes. Prioritizing emergency funds and debt repayments can enhance financial stability. Using clear and organized layouts with charts or tables improves usability and clarity.

Household Expenses Tracker Excel Template

A Household Expenses Tracker Excel Template is designed to help users systematically record and monitor their daily, weekly, or monthly expenditures. This document typically contains categories such as rent, utilities, groceries, and discretionary spending to provide a clear financial overview. Using this template ensures better budgeting, helps identify spending patterns, and aids in achieving financial goals.

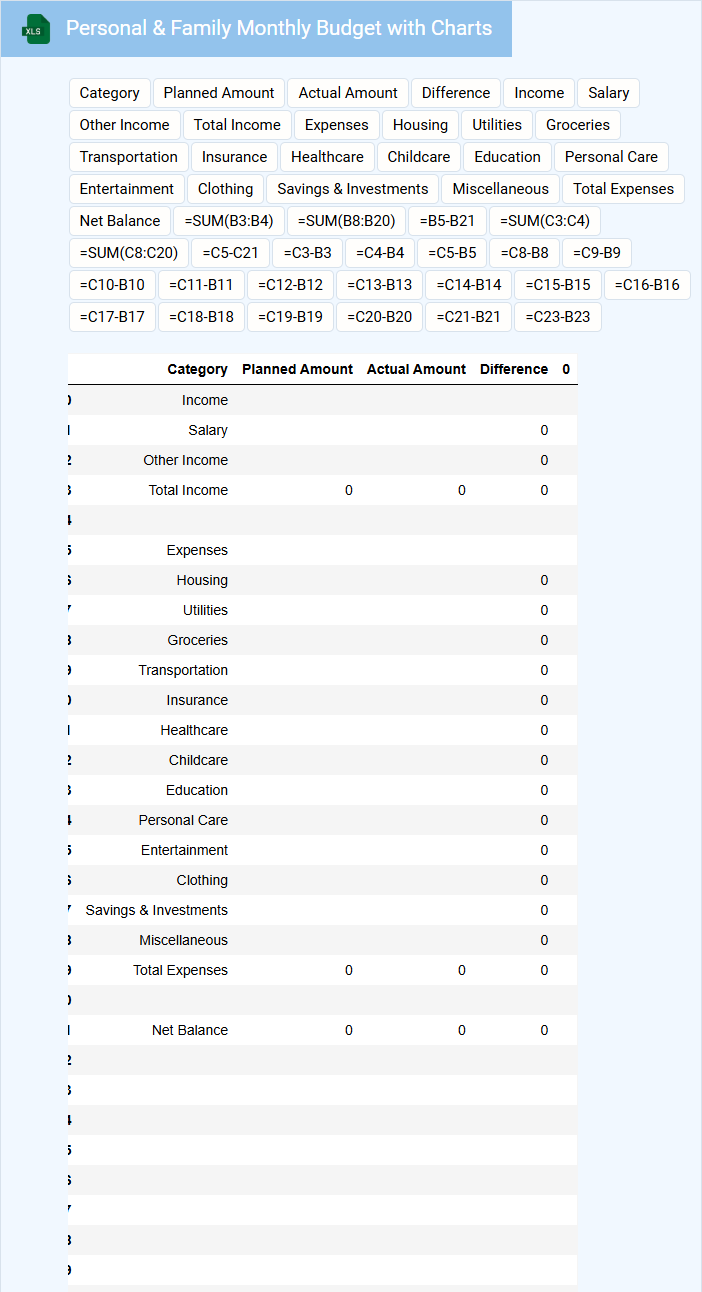

Personal & Family Monthly Budget with Charts

A Personal & Family Monthly Budget document typically contains detailed income and expense categories to track financial inflows and outflows each month. It often includes charts and graphs that visually represent spending patterns and savings progress. An important suggestion is to regularly update the budget and review the charts to identify areas for cost reduction and improve financial planning.

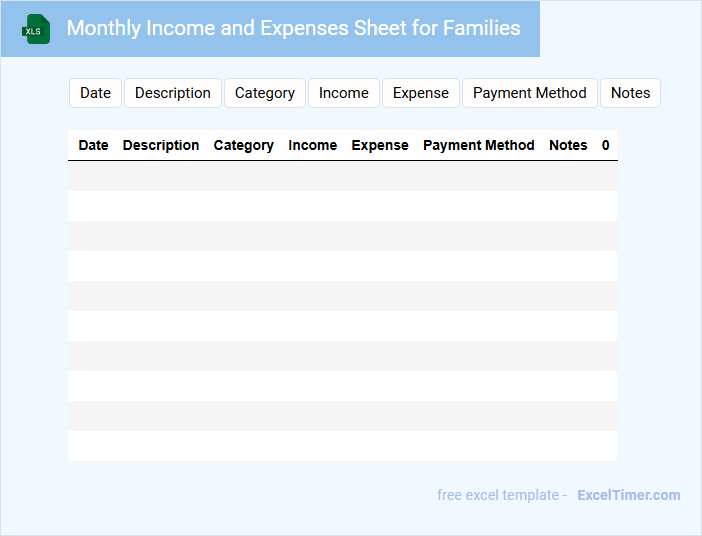

Monthly Income and Expenses Sheet for Families

A Monthly Income and Expenses Sheet for families typically contains detailed records of all sources of income and various expenses incurred throughout the month. This document helps families track their financial activities and ensures accountability in managing household budgets.

It is important to categorize expenses clearly and update the sheet regularly to reflect accurate financial standing. Using this sheet can assist families in identifying areas to save money and plan for future financial goals effectively.

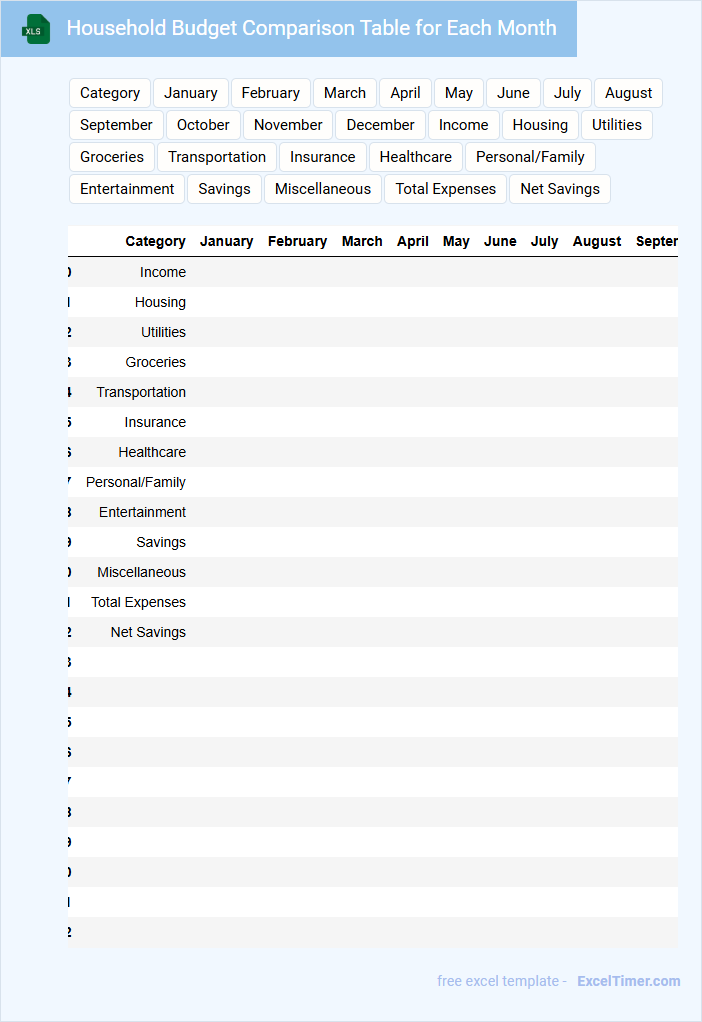

Household Budget Comparison Table for Each Month

A Household Budget Comparison Table typically contains detailed monthly income and expense data, categorized to track spending habits effectively. It helps identify patterns in household expenditures and areas for potential savings.

Such a document is essential for maintaining financial discipline and planning future budgets based on realistic monthly comparisons. Regularly updating the table ensures accuracy and better financial decision-making.

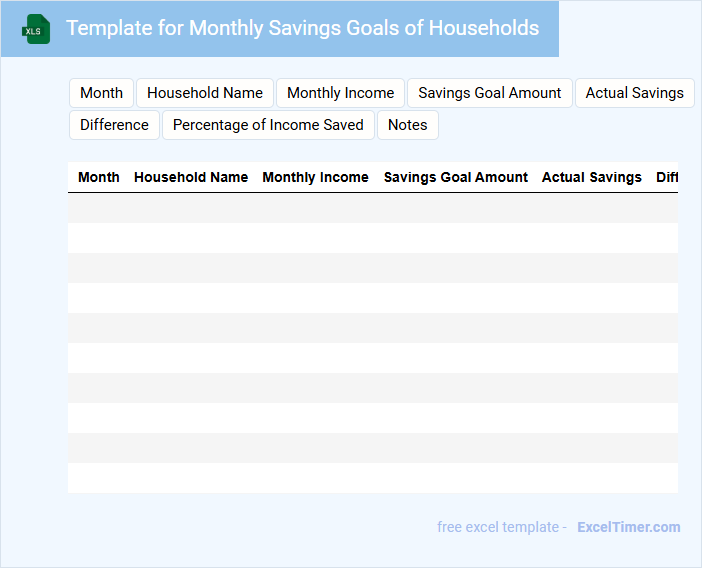

Template for Monthly Savings Goals of Households

A template for monthly savings goals of households typically includes structured financial targets and tracking elements to help manage and optimize personal savings.

- Clear financial objectives to define specific monthly savings targets based on household income and expenses.

- Detailed expense categories to monitor spending and identify areas for potential savings.

- Progress tracking tools to review savings achievements and adjust goals accordingly.

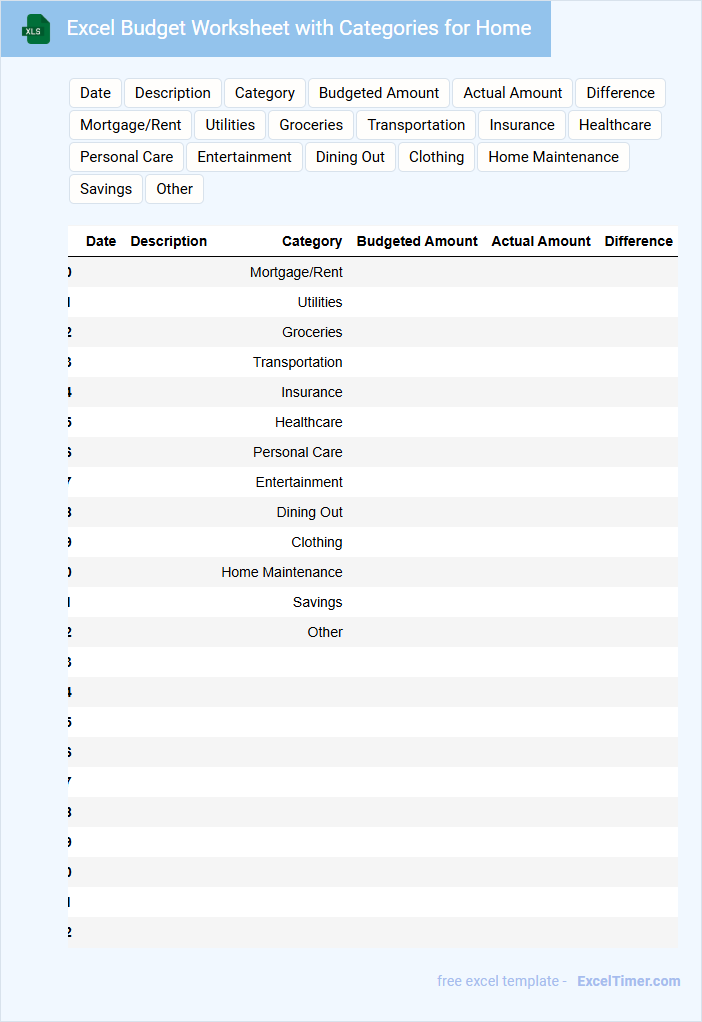

Excel Budget Worksheet with Categories for Home

An Excel Budget Worksheet for home typically contains various categories such as income, fixed expenses, variable expenses, and savings goals. It allows users to track monthly spending and manage finances efficiently.

Important elements include clearly defined categories and regularly updated amounts to ensure accurate budgeting. Including a summary section to highlight total expenses versus income helps maintain financial control.

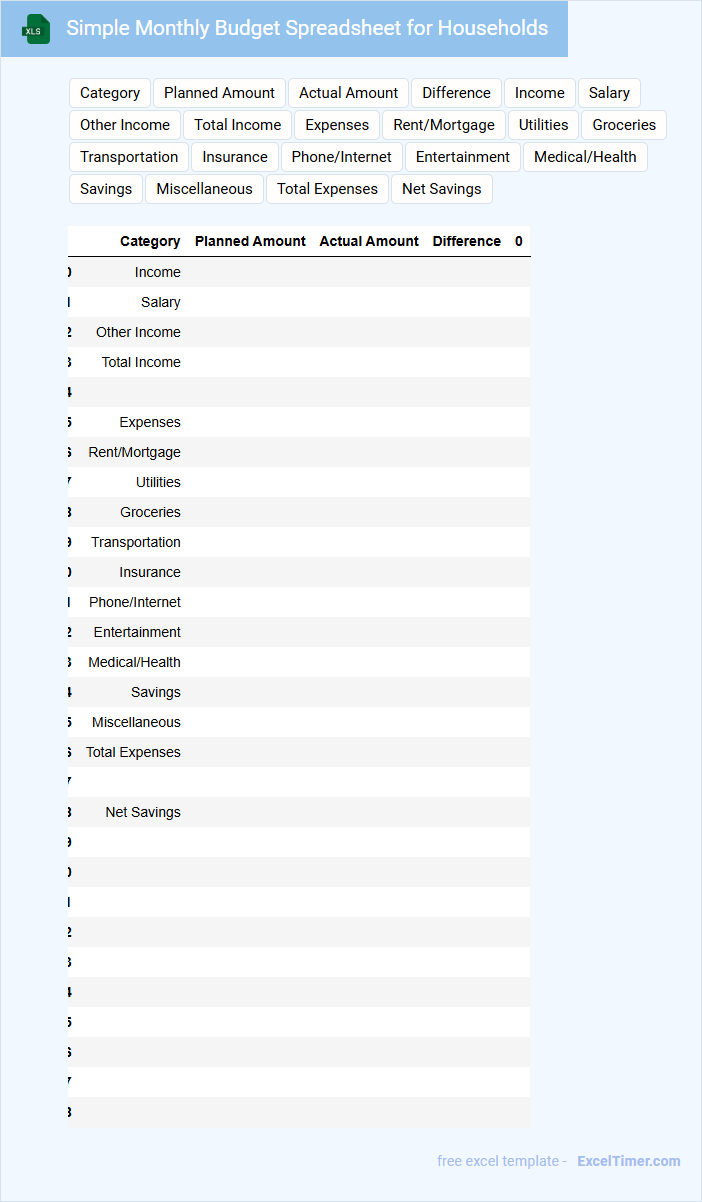

Simple Monthly Budget Spreadsheet for Households

What information does a Simple Monthly Budget Spreadsheet for Households usually contain? This type of document typically includes sections for income, fixed expenses, variable expenses, and savings goals. It helps users track their financial activity, ensuring better money management and planning for future needs.

What important elements should be included in such a spreadsheet? Essential components include clear categories for all sources of income, detailed expense tracking with dates and amounts, and a summary section that calculates total income versus total expenses to highlight surplus or deficit each month.

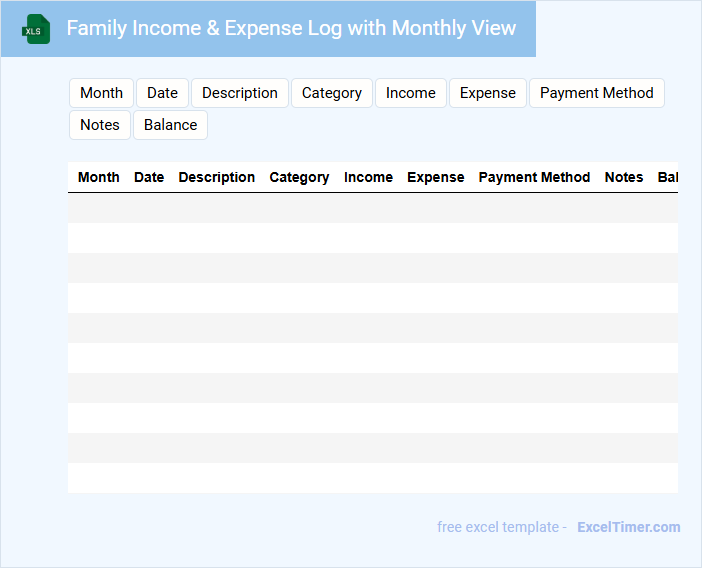

Family Income & Expense Log with Monthly View

What information is typically included in a Family Income & Expense Log with Monthly View? This document usually contains detailed records of all income sources and categorized expenses for each month, helping families track their financial flow. It provides a clear overview of monthly earnings and spending habits to identify areas for budgeting and savings.

What is an important consideration when using a Family Income & Expense Log with Monthly View? Ensuring accuracy and consistency in recording every transaction is crucial for gaining meaningful insights. Additionally, regularly reviewing and updating the log helps families make informed financial decisions and maintain control over their budget.

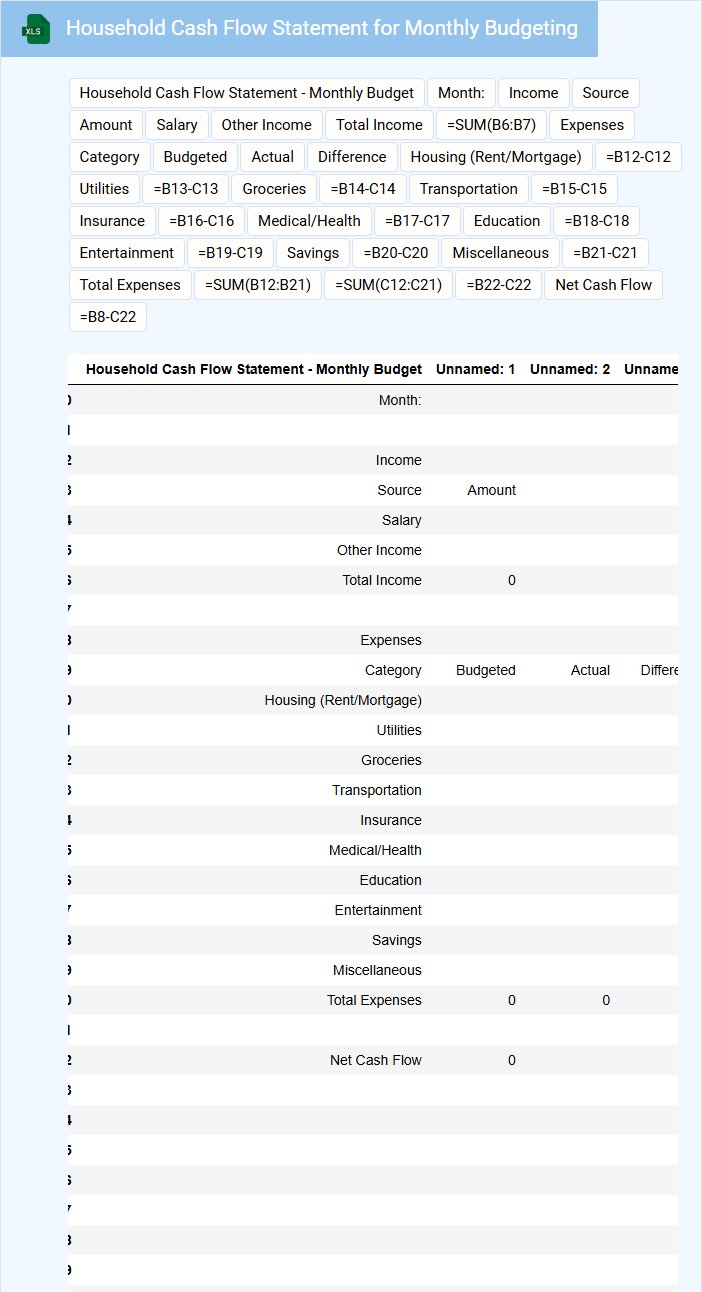

Household Cash Flow Statement for Monthly Budgeting

Household Cash Flow Statements for Monthly Budgeting typically contain detailed records of income, expenses, and savings to help manage personal finances effectively.

- Income Sources: List all regular and irregular income streams to understand total monthly earnings.

- Expense Categories: Categorize expenses into fixed, variable, and discretionary to identify spending patterns.

- Savings and Surplus: Track savings goals and remaining balance to ensure financial stability and future planning.

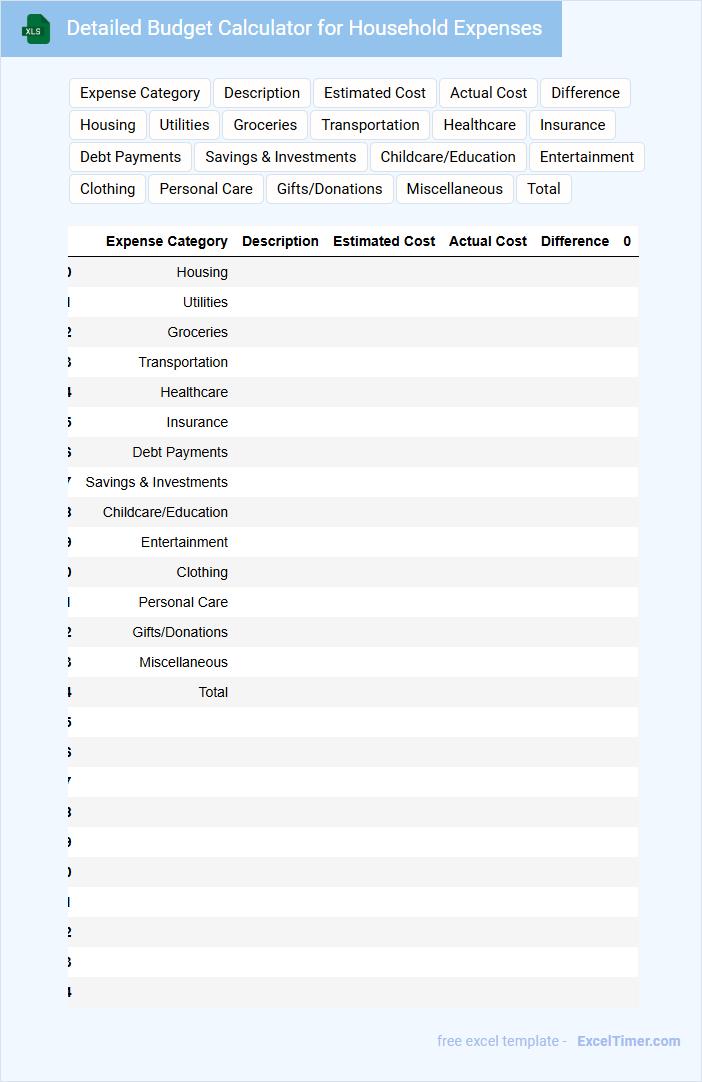

Detailed Budget Calculator for Household Expenses

A Detailed Budget Calculator for household expenses is a tool designed to help users track and manage their monthly income and expenditures efficiently. It typically contains categories such as housing, utilities, groceries, transportation, and discretionary spending. This document aims to provide a clear overview of financial health and promote better money management habits.

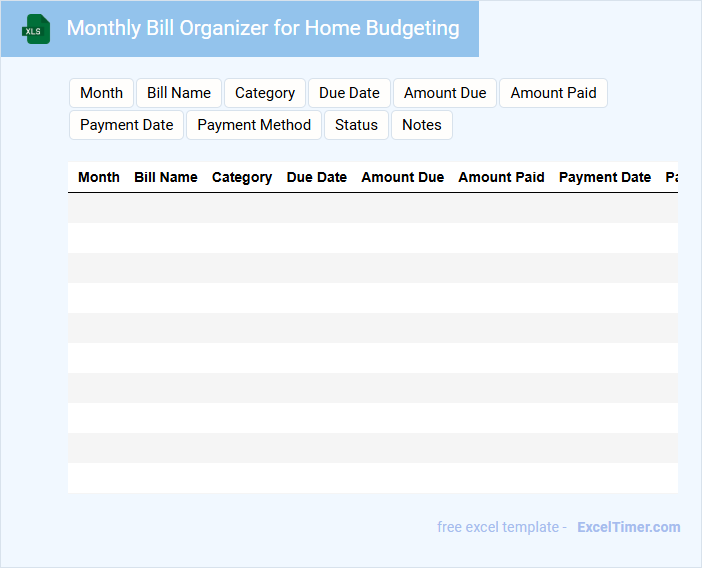

Monthly Bill Organizer for Home Budgeting

A Monthly Bill Organizer is a document designed to track and manage all household expenses in one place. It typically contains sections for due dates, payment methods, and amounts for each bill. This helps ensure timely payments and better control over the home budget.

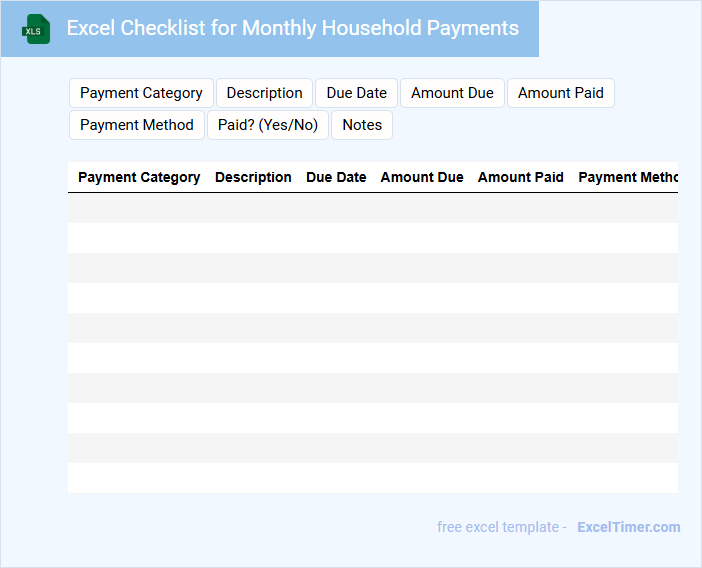

Excel Checklist for Monthly Household Payments

This document typically contains a detailed, organized list of all recurring monthly household expenses to assist in budgeting and financial tracking.

- Payment categories: Clearly define each household expense such as utilities, rent/mortgage, and subscriptions.

- Due dates: Include specific payment deadlines to ensure timely settlements and avoid penalties.

- Payment methods: Specify the mode of payment for each expense to streamline transactions and record-keeping.

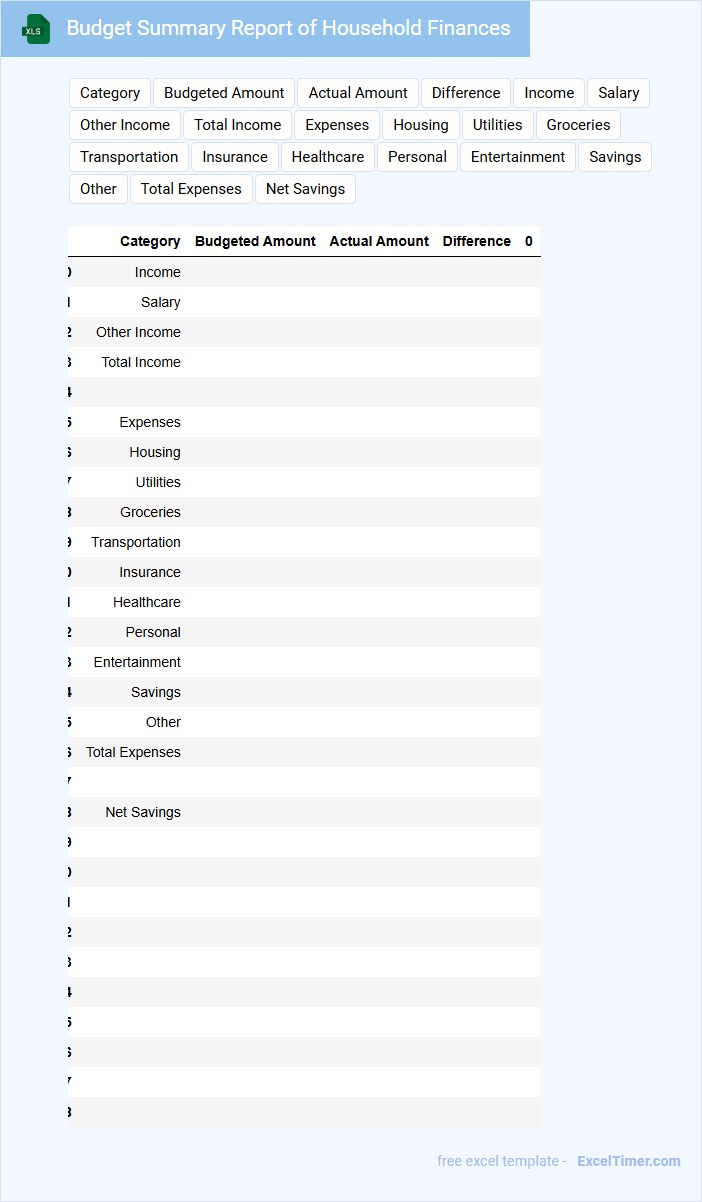

Budget Summary Report of Household Finances

What information is typically included in a Budget Summary Report of Household Finances? This type of document usually contains an overview of income sources, detailed categories of expenses, and a comparison between income and expenditures over a specific period. It summarizes financial health, highlights spending patterns, and helps identify areas for savings or budget adjustments.

What important aspect should be highlighted in such a report? Emphasizing clear categorization of expenses and accurate recording of income ensures the report's effectiveness. Additionally, including visual aids like charts or graphs can improve comprehension and decision-making for better household financial management.

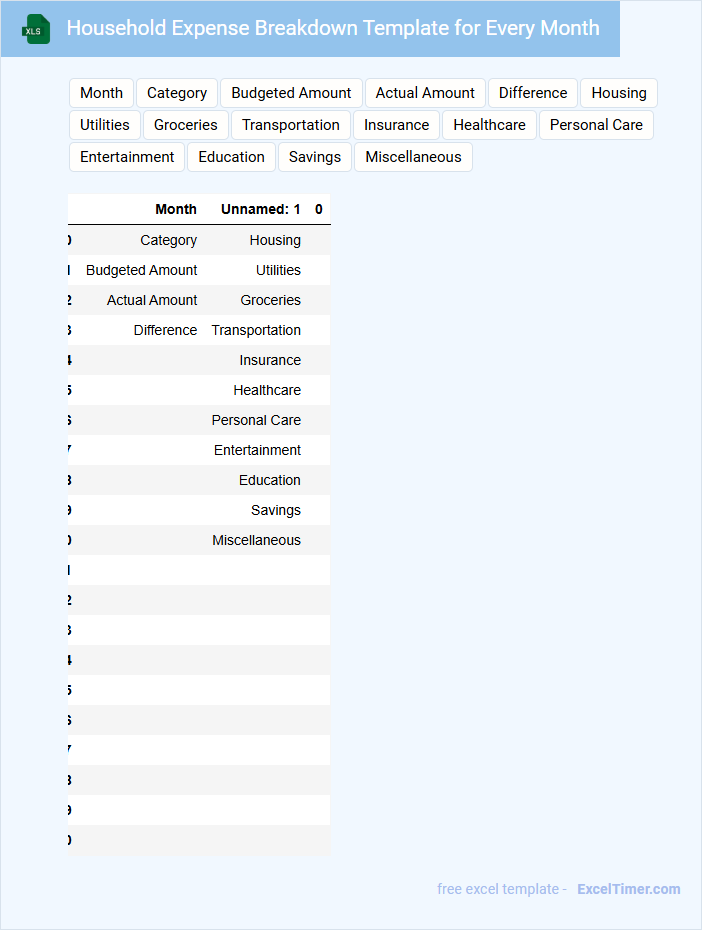

Household Expense Breakdown Template for Every Month

A Household Expense Breakdown Template is a structured document that helps individuals track and organize their monthly spending efficiently. It typically includes categories such as rent, utilities, groceries, transportation, and entertainment to provide a complete overview of where money is allocated. Using this template regularly can aid in budgeting, identifying savings opportunities, and ensuring financial stability.

What are the essential categories to include in a household monthly budget spreadsheet?

A household monthly budget spreadsheet should include essential categories such as housing expenses, utilities, groceries, transportation costs, and debt repayments. Incorporate savings, insurance, and entertainment to provide a comprehensive financial overview. This structure helps you track spending and manage your monthly finances effectively.

How can you track actual expenses versus planned expenses using Excel formulas?

Use Excel formulas like SUMIF to total actual expenses by category and compare them to your planned budget amounts. Apply the formula =SUMIF(range, criteria, sum_range) to aggregate expenses that match specific categories or dates. This approach allows you to monitor deviations and adjust your monthly household budget accordingly.

What method can you use in Excel to automatically calculate total monthly income and expenses?

You can use the SUM function in Excel to automatically calculate total monthly income and expenses by selecting the relevant income and expense cells. This method quickly aggregates values, ensuring accurate budget tracking and financial planning. Applying SUM formulas enhances your household budget management by providing clear, real-time totals.

How can conditional formatting help highlight overspending in your household budget document?

Conditional formatting in your Monthly Budget for Households Excel document can automatically highlight budget categories where spending exceeds set limits, using color-coded cells. This visual cue allows quick identification of overspending areas, enabling timely adjustments to manage expenses effectively. Applying rules based on amounts or percentages ensures that financial data remains organized and actionable.

What Excel tools or functions enable easy visualization of budgeting trends over several months?

Excel's PivotTables and PivotCharts enable easy visualization of budgeting trends over several months by summarizing and displaying data dynamically. Conditional formatting highlights key spending patterns and deviations in your monthly budget. Using the line graph function illustrates fluctuations in income and expenses, making it simple to track your household financial trends visually.