The Monthly Rental Income Excel Template for Property Managers streamlines tracking rental payments and expenses, ensuring accurate financial management. This template provides a clear overview of monthly cash flow, tenant details, and payment history, enhancing efficiency in property management. Automating calculations and generating reports help property managers stay organized and maximize rental income.

Monthly Rental Income Tracker for Property Managers

A Monthly Rental Income Tracker is a document used by property managers to systematically record rental payments received each month. It typically contains details such as tenant names, property addresses, payment amounts, and due dates. This tracker helps ensure accurate financial monitoring and timely follow-ups on overdue payments.

Important elements to include are clear columns for rent received, payment dates, outstanding balances, and notes for any discrepancies. Incorporating a summary section for total income and late payments enhances quick status reviews. Automating calculations and reminders can greatly improve efficiency and reduce errors.

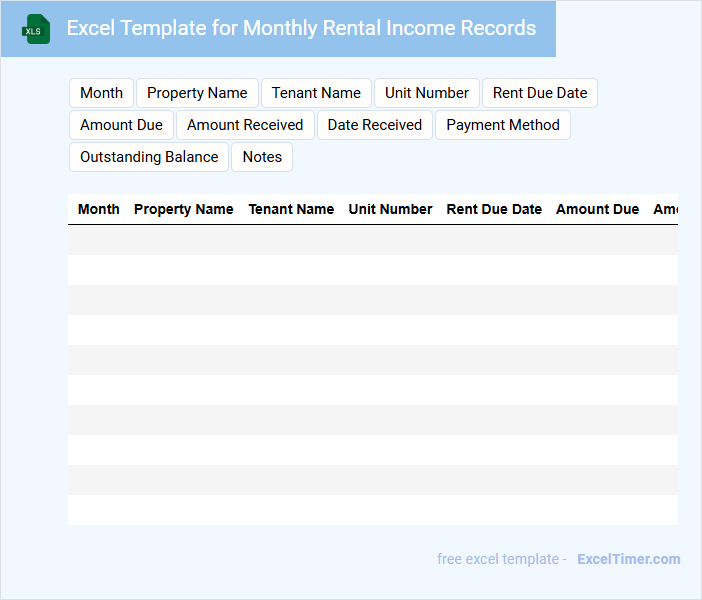

Excel Template for Monthly Rental Income Records

What information is typically included in an Excel Template for Monthly Rental Income Records? This document usually contains details such as tenant names, rental amounts, payment dates, and outstanding balances. It helps landlords track monthly income, monitor payments, and manage rental properties efficiently.

What are the important features to consider in such a template? It should have clear columns for each data type, built-in formulas for automatic calculations, and sections for notes or maintenance records to ensure comprehensive financial management.

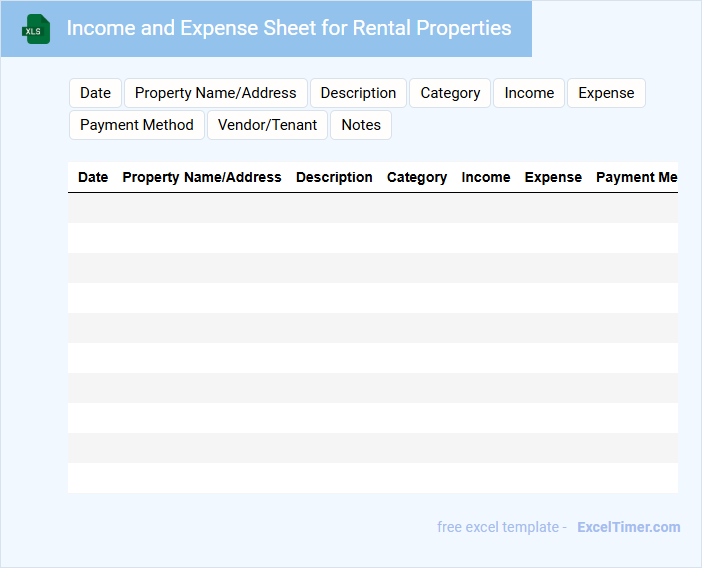

Income and Expense Sheet for Rental Properties

An Income and Expense Sheet for Rental Properties typically contains detailed financial records summarizing rental income and related expenses over a specific period.

- Income tracking: It includes all rental payments received from tenants to monitor cash flow.

- Expense categorization: It lists costs such as maintenance, property management fees, and utilities to calculate net profit.

- Financial analysis: It helps identify trends and areas for cost reduction to maximize property profitability.

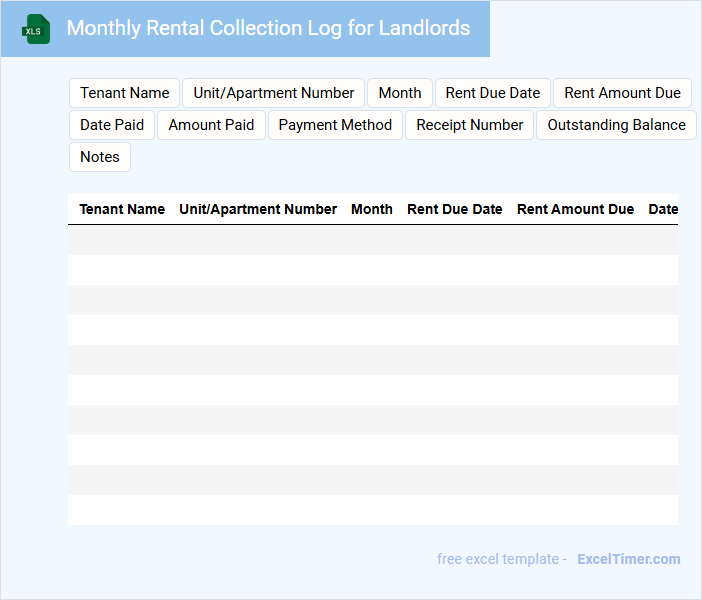

Monthly Rental Collection Log for Landlords

A Monthly Rental Collection Log for landlords is a crucial document used to track rent payments throughout the month. It typically contains tenant names, payment dates, amounts received, and any outstanding balances. Maintaining this log helps landlords manage their properties efficiently and ensures accurate financial records.

Important aspects to include are clear columns for payment status, notes on late payments, and space for signatures to confirm receipt. Consistently updating the log prevents disputes and aids in financial planning. Additionally, digital backups are recommended for secure and easy access.

Rental Income Analysis Spreadsheet with Expense Tracking

What information is typically included in a Rental Income Analysis Spreadsheet with Expense Tracking? This document usually contains detailed records of rental income received and comprehensive tracking of related expenses such as maintenance, utilities, and property management fees. It helps landlords or property managers monitor cash flow, assess profitability, and make informed financial decisions.

Why is it important to carefully maintain this spreadsheet? Accurate and up-to-date entries allow for effective budgeting, tax preparation, and identification of areas to optimize costs. Consistent tracking ensures maximum return on investment and helps avoid financial discrepancies.

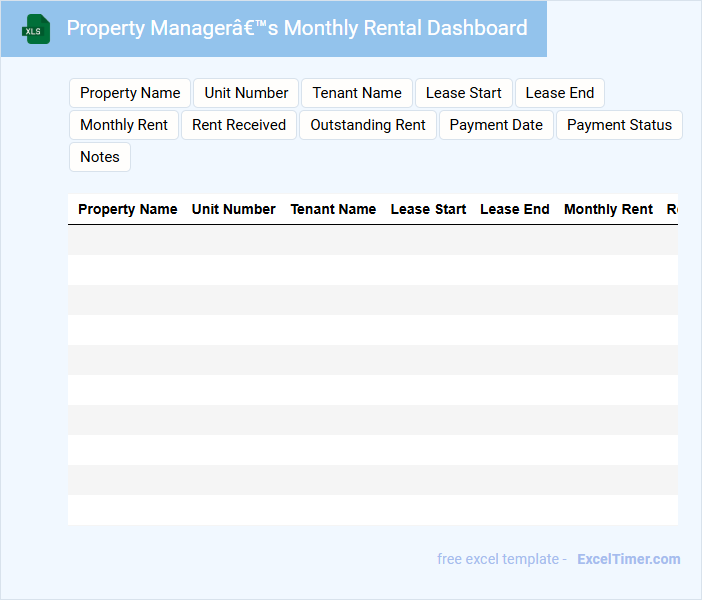

Property Manager’s Monthly Rental Dashboard

The Property Manager's Monthly Rental Dashboard typically contains detailed insights into rental income, occupancy rates, and maintenance requests for the month. It provides a comprehensive overview of the financial performance and tenant satisfaction trends.

This document is essential for tracking rent collection, identifying late payments, and monitoring property expenses. Regular review ensures timely decision-making and enhances property management efficiency.

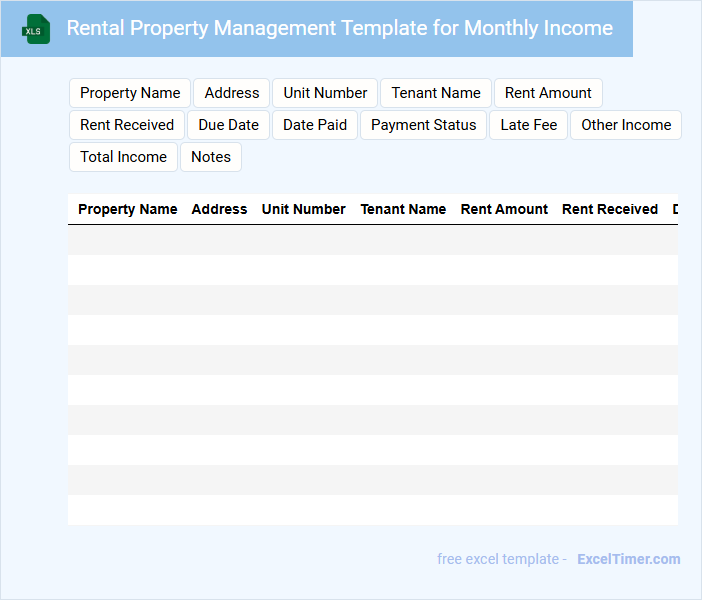

Rental Property Management Template for Monthly Income

This document typically includes a detailed record of monthly rental income, tenant information, and expense tracking. It helps landlords maintain accurate financial management for their rental properties.

Important components to consider are clear income entries, expense categorization, and tenant payment history. Ensuring organized and updated data supports effective property management and financial planning.

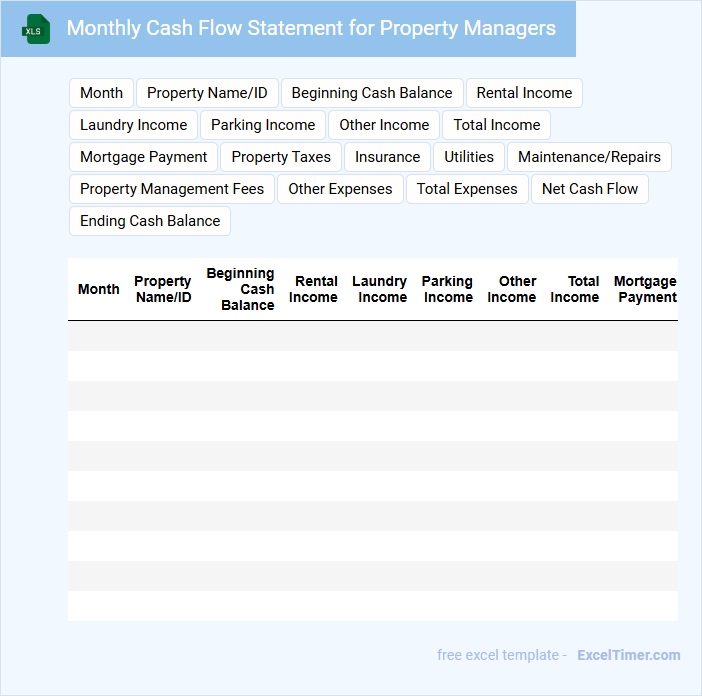

Monthly Cash Flow Statement for Property Managers

The Monthly Cash Flow Statement for property managers is a financial document that tracks the inflow and outflow of cash related to property operations within a given month. It typically includes rental income, maintenance expenses, and other property-related costs. This statement helps property managers monitor liquidity and ensure financial stability. An important aspect to focus on is the accurate categorization of expenses to identify cost-saving opportunities and improve profitability.

Tenant Payment Tracker with Monthly Income Summary

A Tenant Payment Tracker document typically contains a detailed log of rent payments made by tenants, including dates, amounts, and any outstanding balances. It also often summarizes monthly rental income to help landlords monitor cash flow efficiently.

In addition to payment records, this document may include tenant details, lease terms, and payment methods for accuracy and accountability. Regularly updating the tracker ensures timely rent collection and aids in financial planning for property management.

Important suggestions include maintaining consistent entries, reconciling payments with bank statements, and highlighting overdue payments to prevent revenue loss.

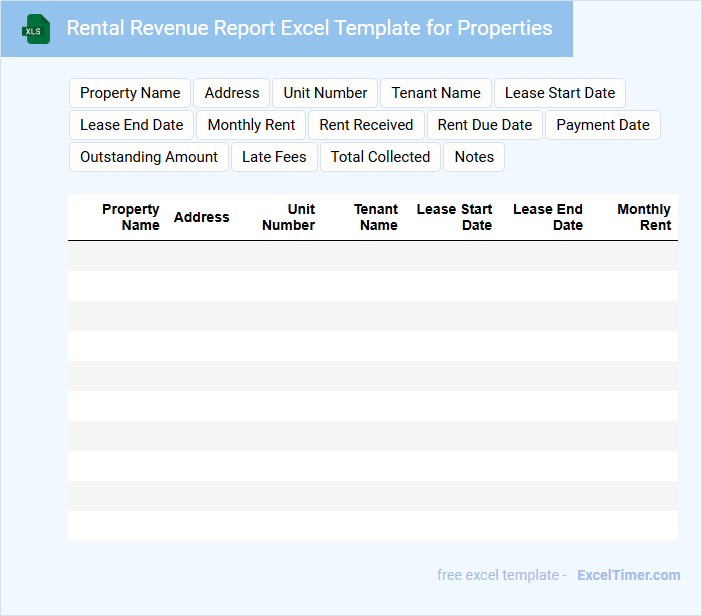

Rental Revenue Report Excel Template for Properties

What information does a Rental Revenue Report Excel Template for Properties typically contain?

This type of document usually includes detailed records of rental income, tenant payment dates, property addresses, and expense tracking. It helps landlords and property managers monitor revenue streams and identify financial trends efficiently.

Important elements to include are accurate rent amounts, payment status, lease terms, and expense categories to ensure comprehensive financial analysis and effective property management.

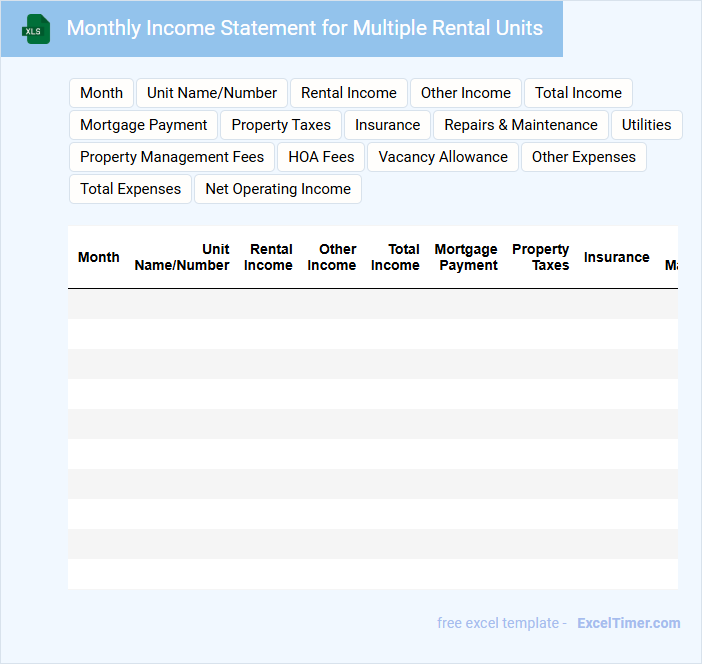

Monthly Income Statement for Multiple Rental Units

What information does a Monthly Income Statement for Multiple Rental Units typically contain? This document usually includes detailed revenue and expense records for each rental unit, providing a clear picture of the overall financial performance. It helps landlords track income, monitor expenses, and assess profitability on a monthly basis for all rental properties combined.

What important elements should be emphasized in this statement? It is essential to include rental income, maintenance costs, vacancy losses, and any additional fees or charges. Clear categorization and accurate tracking of these items ensure informed decision-making and effective property management.

Excel Ledger of Monthly Rental Payments

An Excel Ledger of Monthly Rental Payments typically contains detailed records of payment dates, amounts, and tenant information. It is designed to track financial transactions related to monthly rent efficiently.

This document is essential for maintaining accurate accounting and ensuring timely rent collection. Including columns for due dates, payment status, and any outstanding balances is highly recommended.

Monthly Rent Roll Spreadsheet for Property Management

A Monthly Rent Roll Spreadsheet is a crucial document in property management used to track rental income and tenant information. It typically contains data such as tenant names, leased unit details, rent amounts, payment statuses, and lease terms. This organized record helps landlords and property managers monitor cash flow and maintain accurate financial reporting.

Important features to include are detailed tenant contact information, clear due dates for rent payments, and a column for notes on any late or missing payments. Additionally, incorporating automatic calculations for total rent collected and outstanding balances enhances efficiency. Regularly updating this spreadsheet ensures accurate tracking of rental income and tenant compliance.

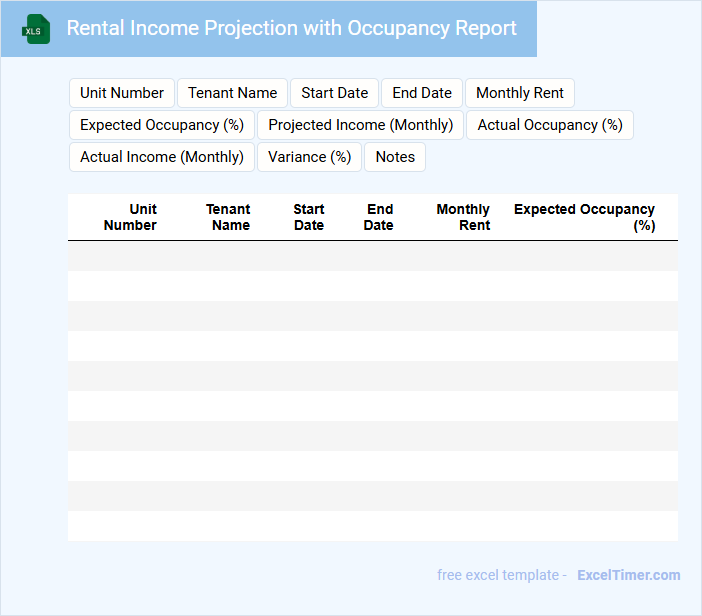

Rental Income Projection with Occupancy Report

A Rental Income Projection with Occupancy Report typically outlines the expected rental income based on projected occupancy rates over a specific period. It helps landlords and investors assess potential revenue and property performance.

- Include historical occupancy data to provide context for projections.

- Detail assumptions about market trends and rental rates.

- Highlight risks such as vacancy periods and maintenance costs.

Monthly Income & Expense Tracker for Landlords

This Monthly Income & Expense Tracker for Landlords document typically contains detailed records of rental income and all related expenses to help manage property finances efficiently.

- Rental Income: Record all received payments from tenants including rent, late fees, and other charges.

- Expenses Tracking: Document maintenance costs, repairs, property taxes, and utility bills.

- Summary & Analysis: Include monthly totals and net income calculations for clear financial overview and planning.

What columns should be included to accurately track monthly rental income in an Excel document for property managers?

Include columns for Property ID, Tenant Name, Rent Amount, Payment Due Date, Payment Received Date, Payment Status, Late Fees, and Total Monthly Income. Track Payment Method and Notes for additional details. Use clear headers to ensure accurate and efficient rental income management.

How can Excel formulas be used to automatically calculate total monthly rental income from multiple properties?

Excel formulas like SUM and SUMPRODUCT automatically calculate total monthly rental income by summing rent values across multiple property cells. Using cell references for each property's rental income ensures updates reflect in the total income calculation instantly. Incorporating structured tables also enhances clarity and scalability in managing multiple property data.

What data validation techniques help ensure accurate rental payment entry in the Excel document?

Utilize data validation rules such as setting rental payment cells to accept only positive numerical values within a realistic range, ensuring amounts fall between the minimum and maximum expected rent. Implement drop-down lists for payment status options like "Paid," "Pending," or "Overdue" to maintain consistency. Apply date validations to confirm payment dates align with the correct rental periods.

How can an Excel document highlight overdue or missing rental payments for property managers?

An Excel document can highlight overdue or missing rental payments by using conditional formatting to automatically color-code late entries based on due dates and payment status. Formulas such as IF and TODAY help track and flag payments past their deadline, allowing you to quickly identify tenants with outstanding balances. This visual alert system improves your efficiency in managing monthly rental income and ensures timely follow-ups.

What methods in Excel can be used to generate monthly income reports for property managers' review?

Excel offers powerful methods like PivotTables to summarize rental data, and SUMIFS functions to calculate total monthly income based on specific criteria. Using dynamic charts and conditional formatting helps visualize income trends and highlight key metrics effectively. You can automate reports with macros to streamline your monthly rental income analysis for property managers' review.