The Monthly Expense Excel Template for Freelancers is an essential tool designed to help freelancers track and manage their income and expenses efficiently. It offers customizable categories, automatic calculations, and visual summaries to simplify budgeting and financial planning. Accurate expense tracking ensures better tax preparedness and improved cash flow management for freelance professionals.

Monthly Expense Tracker for Freelancers

A Monthly Expense Tracker for Freelancers is a document used to record and monitor all financial expenditures on a monthly basis. It helps freelancers manage their budget, track business expenses, and ensure financial stability.

- Include detailed categories such as office supplies, software subscriptions, and travel expenses for clarity.

- Regularly update the tracker to maintain accurate and up-to-date records.

- Review the tracked expenses monthly to identify potential savings and optimize spending.

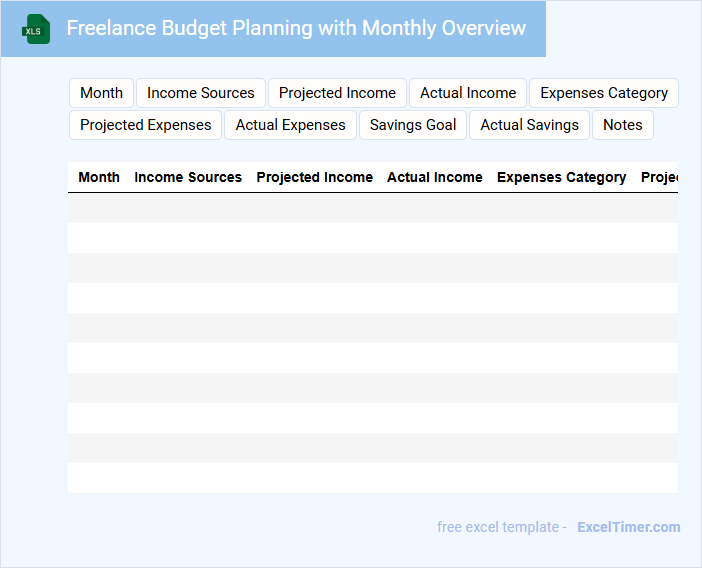

Freelance Budget Planning with Monthly Overview

Freelance Budget Planning with Monthly Overview documents typically outline income, expenses, and financial goals to ensure sustainable freelance business management. This type of document helps freelancers monitor their cash flow and prepare for irregular income periods.

- Track monthly income and categorize all sources for clear financial insight.

- List fixed and variable expenses to control spending effectively.

- Set aside savings or emergency funds to manage unpredictable costs.

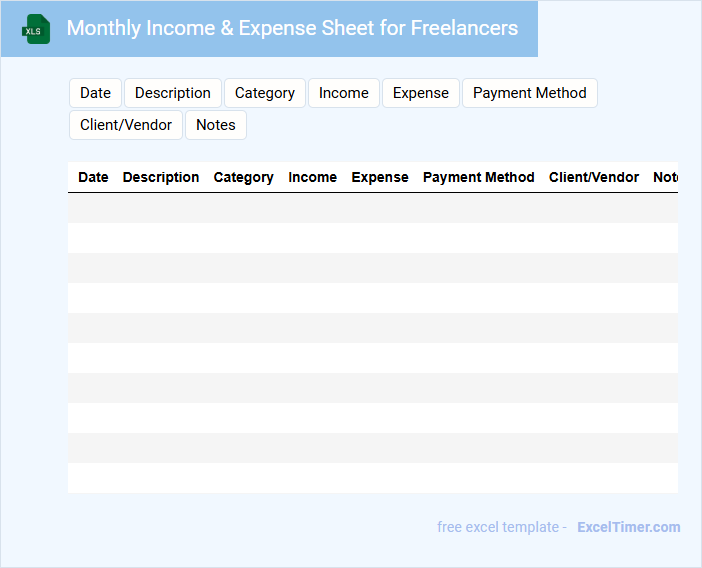

Monthly Income & Expense Sheet for Freelancers

A Monthly Income & Expense Sheet for freelancers is a financial document that tracks all sources of income and expenses over a month. It helps freelancers maintain a clear overview of their cash flow and financial health. Consistently updating this sheet ensures accurate budgeting and tax preparation.

Important elements to include are a detailed breakdown of income streams and categorized expenses to identify spending patterns. This enhances financial awareness and aids in making informed decisions. Regular review of the sheet can highlight opportunities for cost-saving and revenue growth.

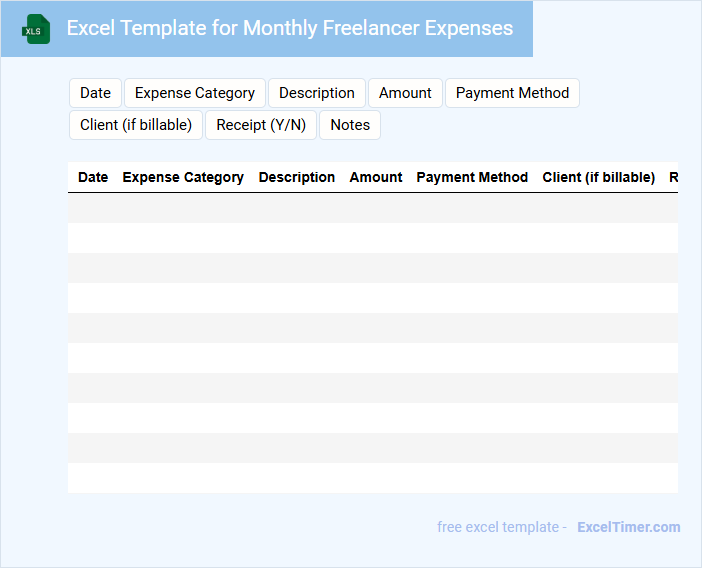

Excel Template for Monthly Freelancer Expenses

An Excel template for monthly freelancer expenses is a structured document used to track and organize all financial transactions related to freelance work on a monthly basis.

- Expense categories: Clearly defined sections for different types of expenses such as software, office supplies, and travel.

- Automated calculations: Formulas to total expenses and calculate monthly spending to simplify financial management.

- Backup and update: Regularly save and update the template to maintain accurate and current expense records.

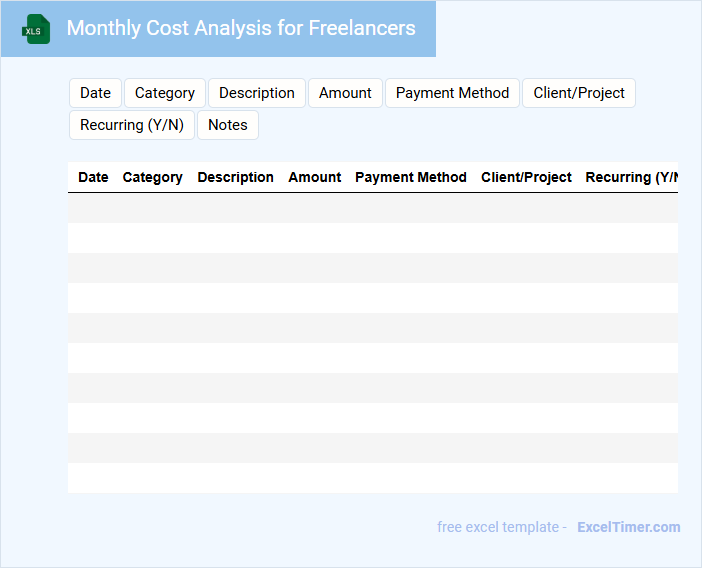

Monthly Cost Analysis for Freelancers

Monthly Cost Analysis for Freelancers is a document that tracks and evaluates all expenses incurred during a month to help manage finances effectively.

- Expense Categorization: Break down costs into essential groups like equipment, software, and living expenses.

- Income Comparison: Compare monthly income against total expenses to determine profitability.

- Budget Adjustment: Identify areas to cut costs or invest more based on spending patterns.

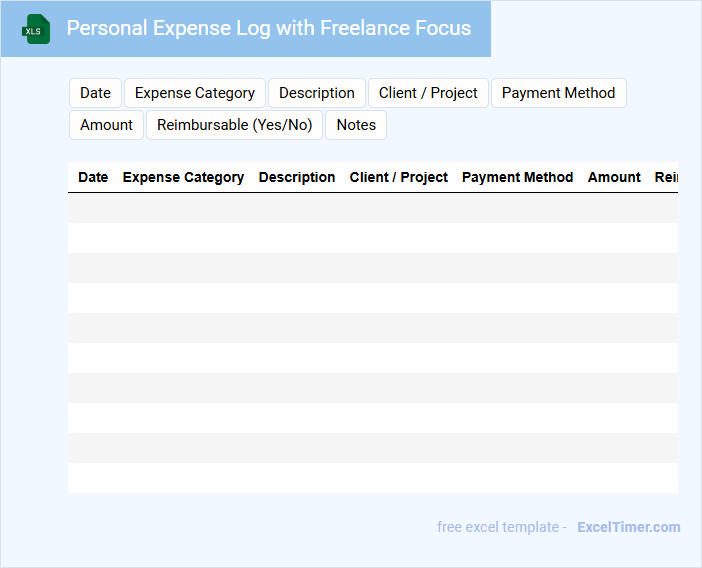

Personal Expense Log with Freelance Focus

A Personal Expense Log with a freelance focus is a specialized financial document designed to track individual spending, particularly related to freelance income and expenses. It typically contains categories such as client payments, business expenses, tax deductions, and miscellaneous personal costs. Maintaining this log helps freelancers manage cash flow and simplify tax filing.

Important suggestions include consistently recording all income sources and expenses immediately, distinguishing between business and personal transactions clearly, and periodically reviewing the log to adjust budgets and forecast future earnings. Utilizing categories that reflect freelance-specific expenses like software subscriptions, equipment, and travel enhances accuracy. Finally, backing up the log digitally ensures data security and accessibility.

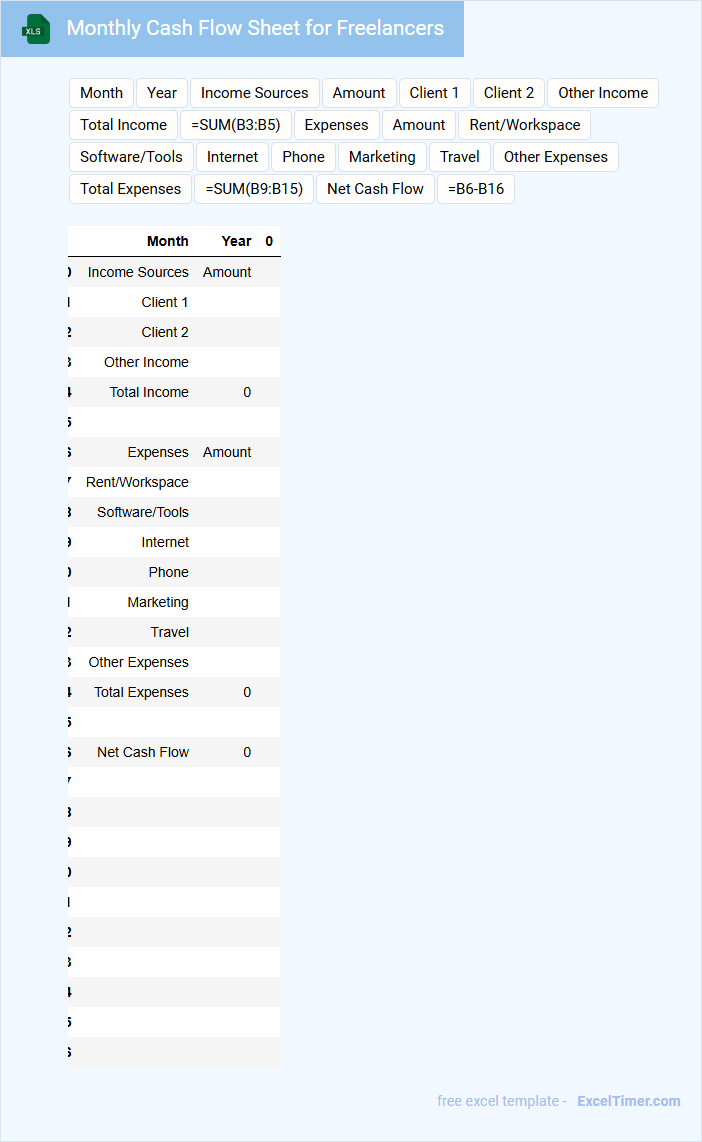

Monthly Cash Flow Sheet for Freelancers

A Monthly Cash Flow Sheet for freelancers is a financial document that tracks income and expenses over a specific month to manage cash flow effectively. It typically contains sections for recording various revenue streams, fixed and variable expenses, and the resulting net cash flow. To optimize financial stability, freelancers should regularly update this sheet and review it to identify spending patterns and forecast future cash needs.

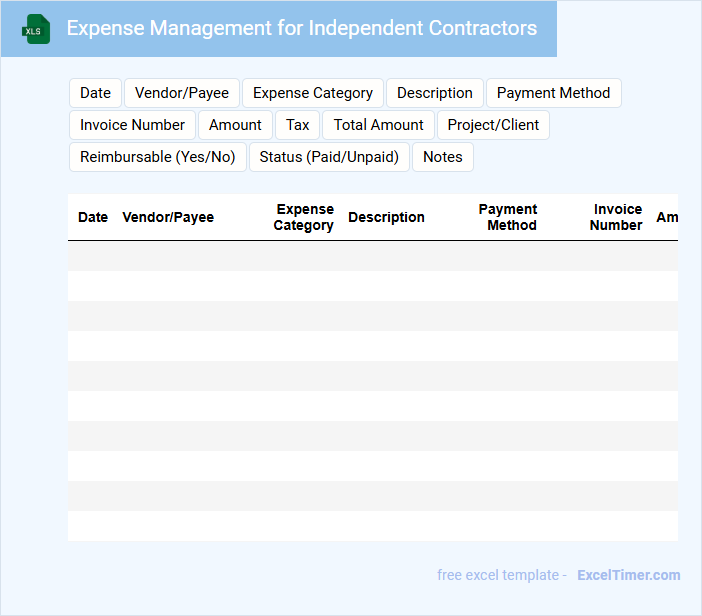

Expense Management for Independent Contractors

What does an Expense Management document for Independent Contractors typically contain? This type of document usually includes detailed records of all business-related expenses incurred by the contractor, such as travel, supplies, and equipment costs. It helps track expenditures for accurate reimbursement and tax reporting purposes.

What important factors should be considered in Expense Management for Independent Contractors? Maintaining clear receipts and categorizing expenses properly are crucial to ensure transparency and compliance with tax regulations. Additionally, setting a consistent process for submitting and approving expenses can streamline financial management and reduce errors.

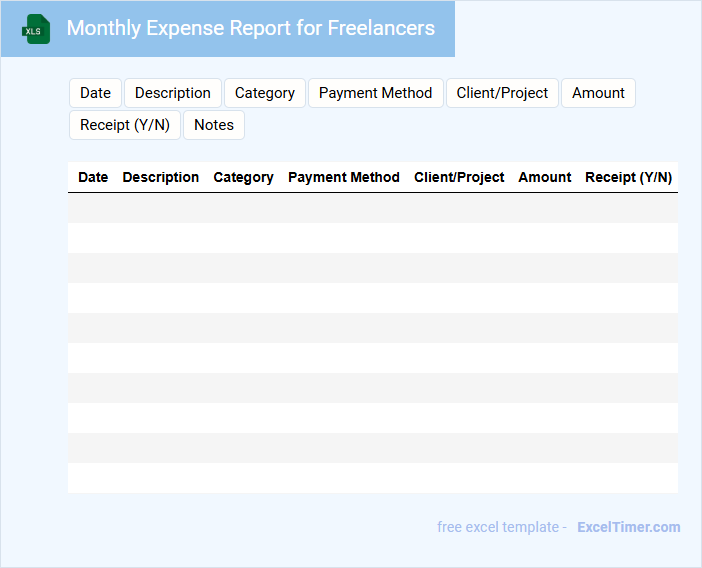

Monthly Expense Report for Freelancers

What information is typically included in a Monthly Expense Report for Freelancers? This document usually contains detailed records of all business-related expenses incurred during the month, such as office supplies, travel costs, and software subscriptions. It helps freelancers track their spending, manage budgets effectively, and prepare accurate tax filings.

What is an important aspect to focus on when preparing this report? Accuracy and thoroughness are essential; freelancers should keep all receipts and categorize expenses clearly to ensure correct financial tracking and compliance. Consistently updating the report can prevent missed deductions and improve financial insight.

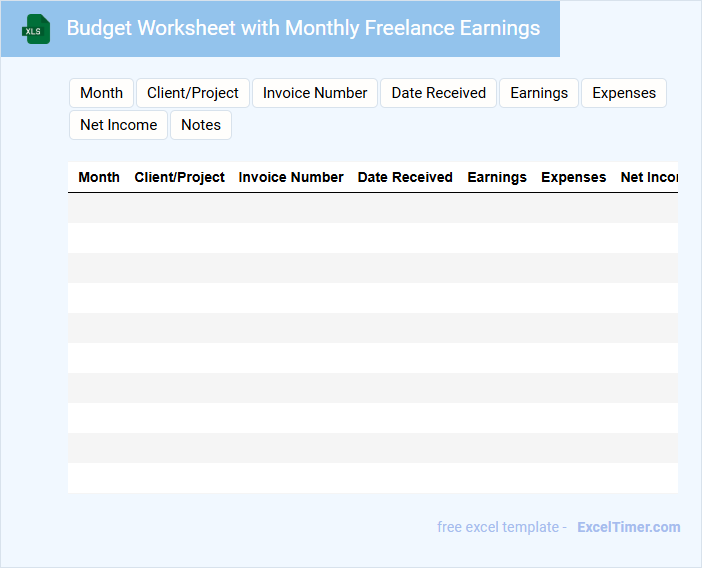

Budget Worksheet with Monthly Freelance Earnings

A Budget Worksheet with Monthly Freelance Earnings is a document used to track and manage income and expenses for freelance work on a monthly basis. It helps freelancers maintain financial stability and plan future budgets effectively.

- Include all sources of freelance income to get an accurate monthly total.

- Track fixed and variable expenses separately for clearer budgeting.

- Set aside a portion for taxes and savings to avoid financial surprises.

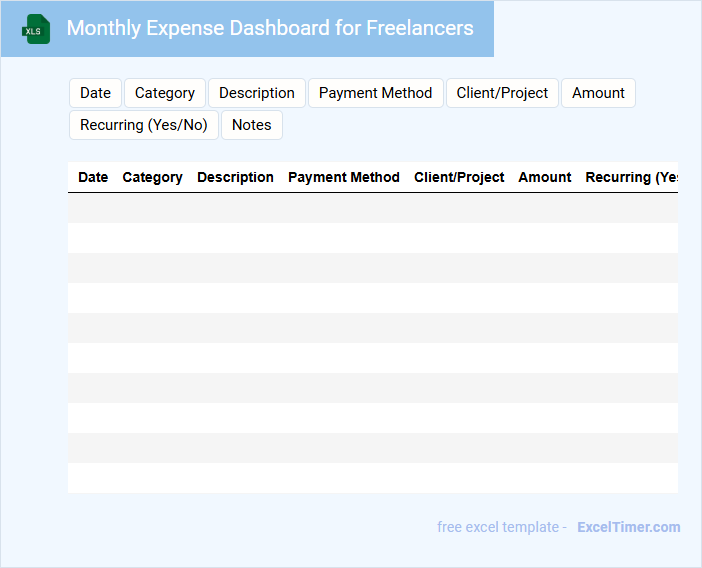

Monthly Expense Dashboard for Freelancers

A Monthly Expense Dashboard for freelancers is a comprehensive document used to track and analyze all financial outflows within a month. It typically contains sections for categorizing expenses, visual summaries like charts, and comparisons against budgeted amounts. This tool helps freelancers maintain financial clarity and make informed budgeting decisions.

Key suggestions for this document include ensuring accurate categorization of all expenses, integrating automated data updates, and including customizable visual reports. Using such features enhances the freelancer's ability to monitor cash flow and identify cost-saving opportunities promptly.

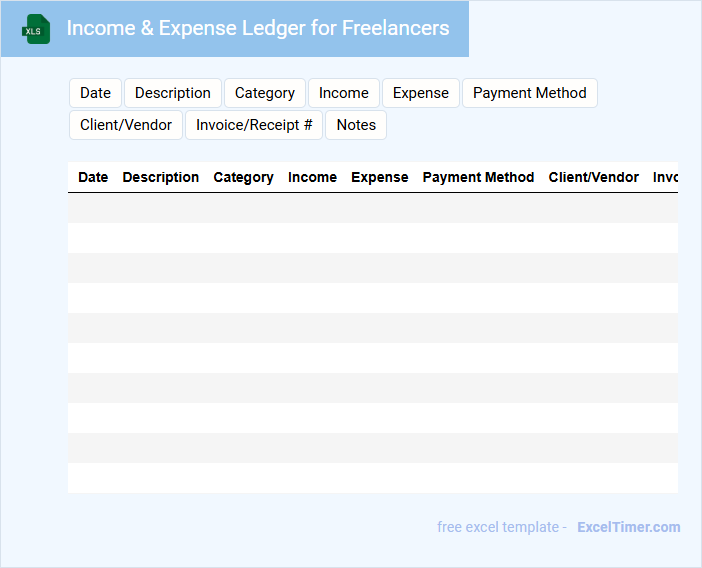

Income & Expense Ledger for Freelancers

An Income & Expense Ledger for freelancers is a vital financial document that tracks all sources of income and expenditures. It helps in maintaining organized records for tax purposes and budgeting. This ledger allows freelancers to have a clear view of their financial health.

Important aspects to include are detailed transaction dates, categories, and amounts to ensure accuracy and ease of reporting. Consistently updating this ledger aids in identifying spending patterns and potential tax deductions. Using digital tools can enhance tracking efficiency and reliability.

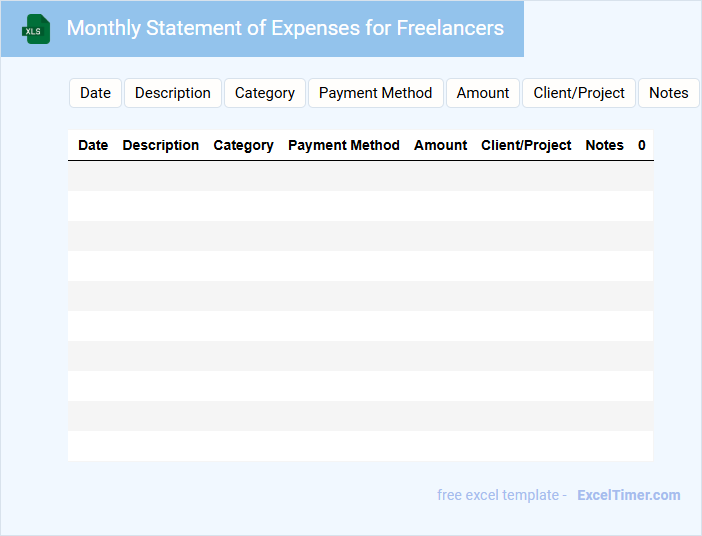

Monthly Statement of Expenses for Freelancers

A Monthly Statement of Expenses for Freelancers typically includes detailed records of all costs incurred throughout the month related to business activities. This document helps in tracking spending, budgeting, and preparing for tax filing.

It is important to categorize expenses clearly, including receipts and dates for accuracy. Consistently updating this statement ensures better financial management and accountability.

Simple Monthly Expense Tracker with Freelance Categories

A Simple Monthly Expense Tracker is a document designed to help individuals monitor and manage their monthly spending efficiently. It typically contains categorized sections for different types of expenses, such as rent, groceries, and utilities, making it easier to identify spending patterns. For freelancers, including dedicated categories like client payments, business expenses, and tax reserves is crucial for accurate financial tracking and planning.

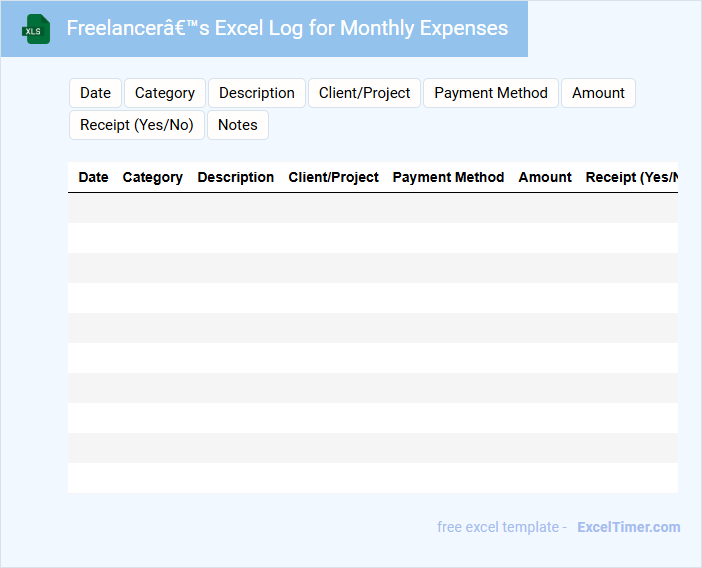

Freelancer’s Excel Log for Monthly Expenses

What information is typically included in a Freelancer's Excel Log for Monthly Expenses? This document usually contains detailed records of all business-related expenditures categorized by date, type, and amount. It helps freelancers track their spending, manage budgets efficiently, and prepare accurate financial reports for tax purposes.

Why is maintaining an organized and regularly updated expenses log important? Keeping a well-structured log ensures clarity in financial management, aids in identifying deductible expenses, and simplifies tax filing. It is essential to include receipts, payment methods, and project associations to maximize accuracy and accountability.

What are the essential categories to include in a freelancer's monthly expense Excel document?

Essential categories for a freelancer's monthly expense Excel document include Office Supplies, Software & Subscriptions, Internet & Phone, Marketing & Advertising, Professional Development, Travel & Meals, Taxes & Insurance, and Miscellaneous Expenses. Tracking each category helps optimize budgeting and cash flow management. Detailed records improve tax preparation and financial analysis.

How can you use Excel formulas to automatically calculate total monthly expenses?

Use the SUM formula (e.g., =SUM(B2:B30)) in an Excel cell to automatically calculate total monthly expenses by adding all individual expense entries within a specified range. Implement data validation features and cell formatting to ensure accurate input and clear presentation of expense amounts. Combine functions like SUMIF to categorize and sum specific types of expenses for detailed financial tracking in the freelancer's monthly budget.

Which Excel features help track and compare monthly expense trends over time?

Excel features such as PivotTables enable detailed analysis and comparison of monthly expense trends by summarizing large datasets efficiently. The conditional formatting tool highlights spending patterns and variances in expenses across different months. Chart tools, including line and bar charts, visually represent expense trends, making it easier to track changes over time.

How does categorizing fixed versus variable expenses improve monthly budgeting in Excel?

Categorizing fixed versus variable expenses in an Excel monthly expense document enhances budgeting accuracy by clearly distinguishing consistent costs like rent from fluctuating costs such as materials. This separation allows freelancers to forecast cash flow more effectively and identify areas for potential savings. Tracking these categories improves financial decision-making and ensures better control over monthly spending patterns.

What methods in Excel can alert freelancers to overspending or approaching budget limits?

Excel offers conditional formatting to highlight cells when expenses exceed set budget limits, enabling quick visual alerts for freelancers. Data validation rules can trigger pop-up warnings if entered amounts surpass predefined thresholds. You can also use Excel formulas like SUM with IF statements to track cumulative spending and flag approaching budget boundaries automatically.