The Monthly Cash Flow Excel Template for Real Estate Agents helps track income and expenses meticulously, ensuring accurate financial management. It simplifies budgeting by categorizing commissions, fees, and operational costs for clearer cash flow visibility. This tool is essential for maintaining profitability and planning future investments in a competitive real estate market.

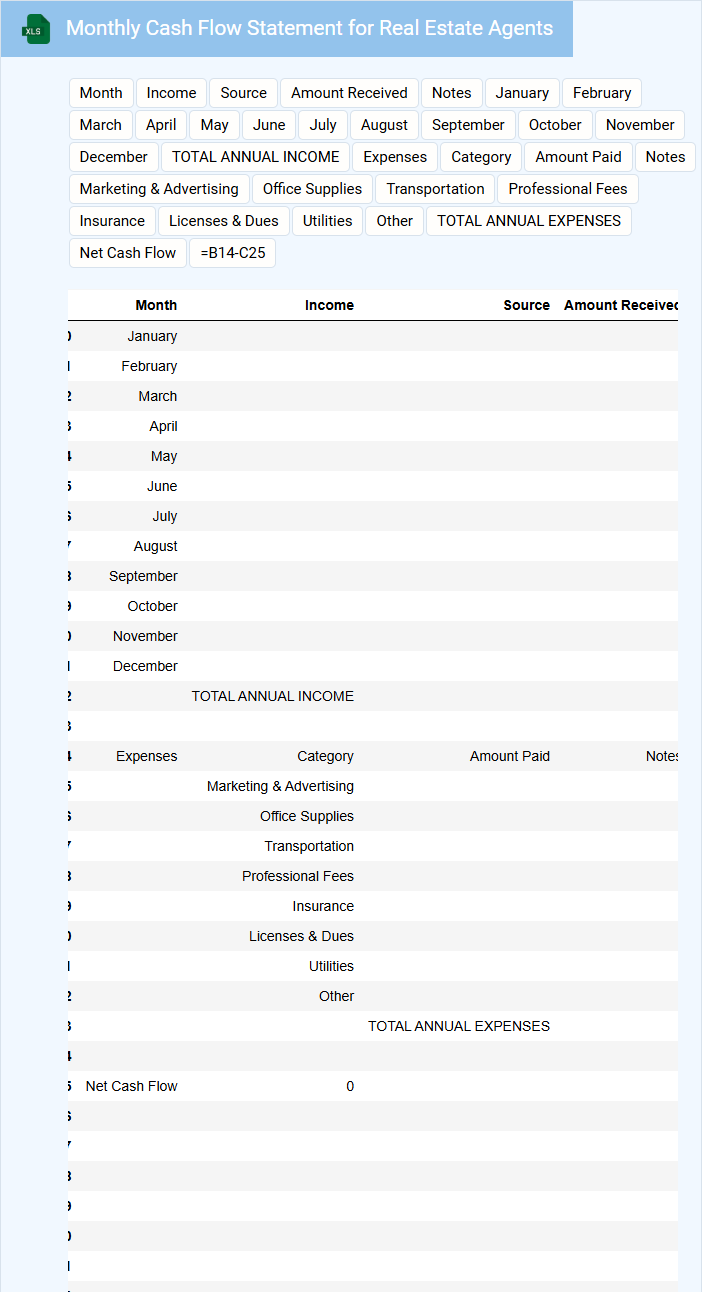

Monthly Cash Flow Statement for Real Estate Agents

The Monthly Cash Flow Statement for real estate agents is a financial document tracking all cash inflows and outflows during a specific month. It helps agents monitor their income from commissions and expenses related to property sales and marketing. This statement is essential for managing liquidity and planning for future financial needs.

Excel Cash Flow Tracking Sheet for Real Estate Businesses

An Excel Cash Flow Tracking Sheet is a vital document used by real estate businesses to monitor and manage the inflows and outflows of cash. It details rental incomes, expenses, loan payments, and other transactions critical for financial health.

This sheet helps identify trends, forecast future cash needs, and ensure liquidity for day-to-day operations and investments. To maximize its effectiveness, regularly update the sheet and categorize all income and expenses accurately.

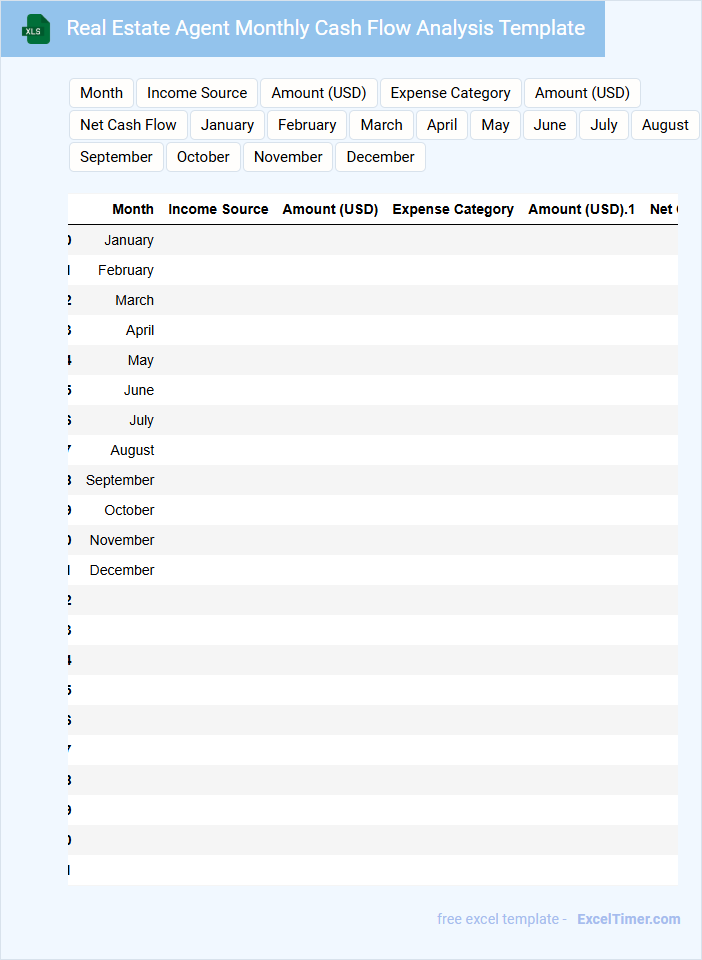

Real Estate Agent Monthly Cash Flow Analysis Template

The Real Estate Agent Monthly Cash Flow Analysis Template typically contains detailed records of income, expenses, and net cash flow related to a real estate agent's business activities. It helps track financial performance and identify areas of profitability or loss.

This document usually includes sections for commission earnings, marketing costs, office expenses, and other operational outlays critical to cash flow management. Maintaining accurate and up-to-date information within this template is essential for effective financial planning.

It's important to regularly update the template with real transactions and review trends to make informed business decisions and optimize profitability.

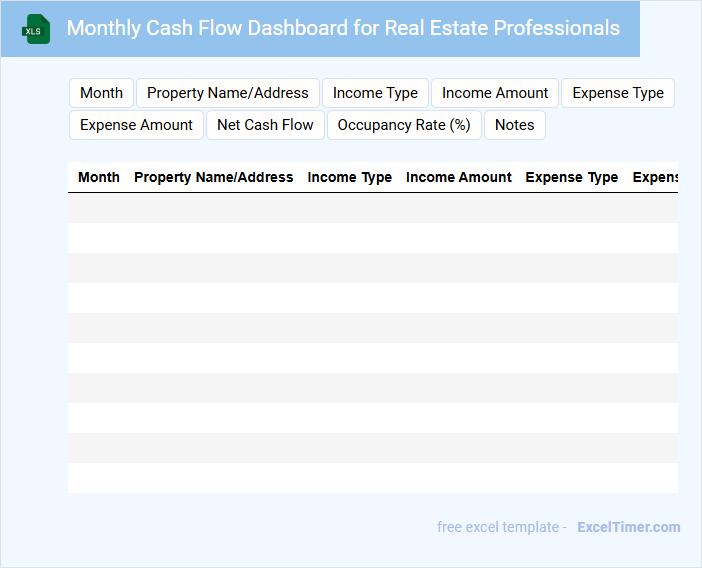

Monthly Cash Flow Dashboard for Real Estate Professionals

A Monthly Cash Flow Dashboard for Real Estate Professionals typically contains detailed tracking of income, expenses, and net cash flow over the course of a month. It provides visual representations such as graphs and charts to help identify trends and make informed financial decisions. Key components include rental income, mortgage payments, maintenance costs, and other operational expenses.

To maximize effectiveness, important considerations include regularly updating data, ensuring accuracy in expense categorization, and incorporating predictive analytics for future cash flow estimation. Including a comparison against budgeted figures can also highlight areas for improvement. Clear, concise visuals and real-time data integration are essential for quick insights.

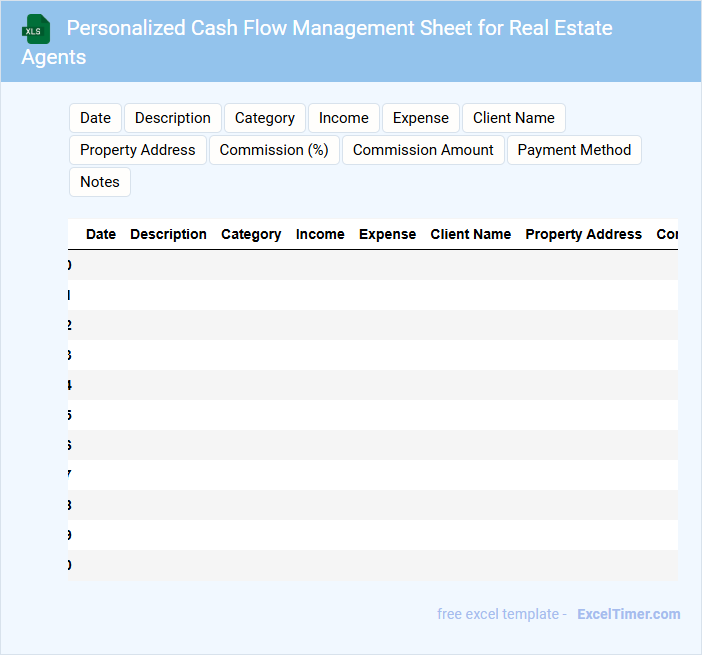

Personalized Cash Flow Management Sheet for Real Estate Agents

A Personalized Cash Flow Management Sheet is a vital tool for real estate agents to efficiently track and manage their income and expenses. This document typically contains detailed records of commissions, operational costs, and projected earnings. It helps agents maintain financial stability and make informed decisions about their business.

Key elements to include are accurate transaction records, categorized expenses, and monthly or quarterly summaries. Incorporating visual aids like graphs or charts can enhance understanding of cash flow trends. Regular updates and reviews ensure the sheet remains a practical resource for financial planning.

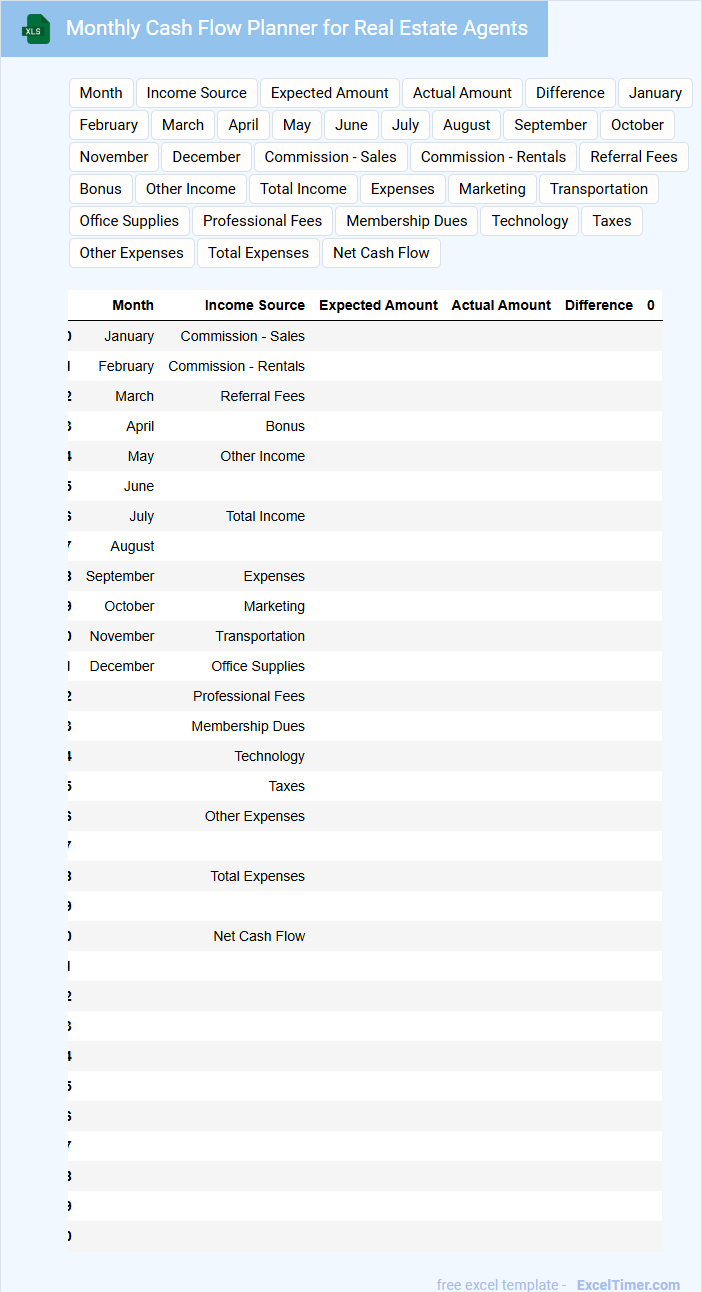

Monthly Cash Flow Planner for Real Estate Agents

What key information does a Monthly Cash Flow Planner for Real Estate Agents typically contain? This document usually includes detailed records of all income sources such as commissions and rental earnings, as well as all expenses including marketing, office fees, and client-related costs. It helps agents track their financial health by providing a clear overview of cash inflows and outflows each month.

What is an important consideration when using a Monthly Cash Flow Planner for Real Estate Agents? It is crucial to regularly update the planner with accurate data to ensure effective budgeting and financial forecasting. Additionally, incorporating contingency funds for unexpected expenses can help maintain stability in fluctuating market conditions.

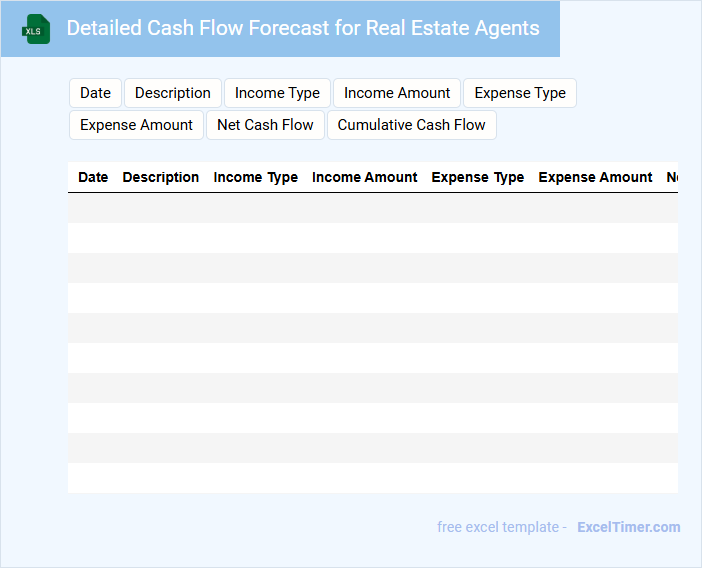

Detailed Cash Flow Forecast for Real Estate Agents

What information is typically included in a Detailed Cash Flow Forecast for Real Estate Agents? This document usually contains projected income from property sales, commissions, and rental yields alongside expected expenses such as marketing costs, office fees, and commission splits. It helps real estate agents manage their finances by anticipating cash inflows and outflows over a specific period.

What is an important consideration when preparing a Detailed Cash Flow Forecast for Real Estate Agents? It is crucial to include realistic timelines for payments and receipts to avoid cash shortages and ensure continuous operation. Additionally, regularly updating the forecast with actual data improves accuracy and financial decision-making.

Excel Template for Monthly Cash Flow of Real Estate Agents

This document is typically a structured Excel template designed to help real estate agents track their monthly cash inflows and outflows efficiently. It provides an organized way to monitor financial performance and maintain budget control.

- Include sections for commission income, operating expenses, and loan payments.

- Add fields for categorizing different property sales and rental commissions.

- Incorporate charts or graphs for visualizing cash flow trends over time.

Monthly Cash Flow Record for Real Estate Agent Earnings

The Monthly Cash Flow Record is a crucial document for real estate agents to track their income and expenses over a given month. It helps in understanding the financial health and liquidity of their business operations.

This record typically contains details of commissions earned, office expenses, marketing costs, and other related financial transactions. Maintaining accurate entries ensures better budgeting and tax preparation.

It is important to consistently update the record and review it monthly to identify trends and make informed financial decisions.

Simple Cash Flow Spreadsheet for Real Estate Agents

A Simple Cash Flow Spreadsheet for real estate agents is a financial tool designed to track income and expenses related to property transactions. It typically includes sections for commissions, operating costs, and periodic expenses to give a clear view of net cash flow. This document helps agents manage their finances efficiently and make informed business decisions.

Important elements to include are accurate commission tracking, expense categorization, and monthly cash flow summaries. Ensuring that all income sources and deductions are regularly updated improves the spreadsheet's reliability. Additionally, integrating visual charts can help agents quickly assess their financial health.

Monthly Cash Flow Statement with Income Tracking for Real Estate

The Monthly Cash Flow Statement is a financial document that tracks the inflow and outflow of cash within a specific month, highlighting the net cash position. It is essential for monitoring liquidity and ensuring that operational expenses are covered. This type of document often includes rental income, mortgage payments, maintenance costs, and other real estate-related expenses.

When combined with Income Tracking for Real Estate, it provides a comprehensive view of revenue streams and profitability from property investments. Accurate income tracking helps identify trends and forecast future cash flow needs. Regular updates and detailed categorization of income sources are crucial for effective financial management in real estate portfolios.

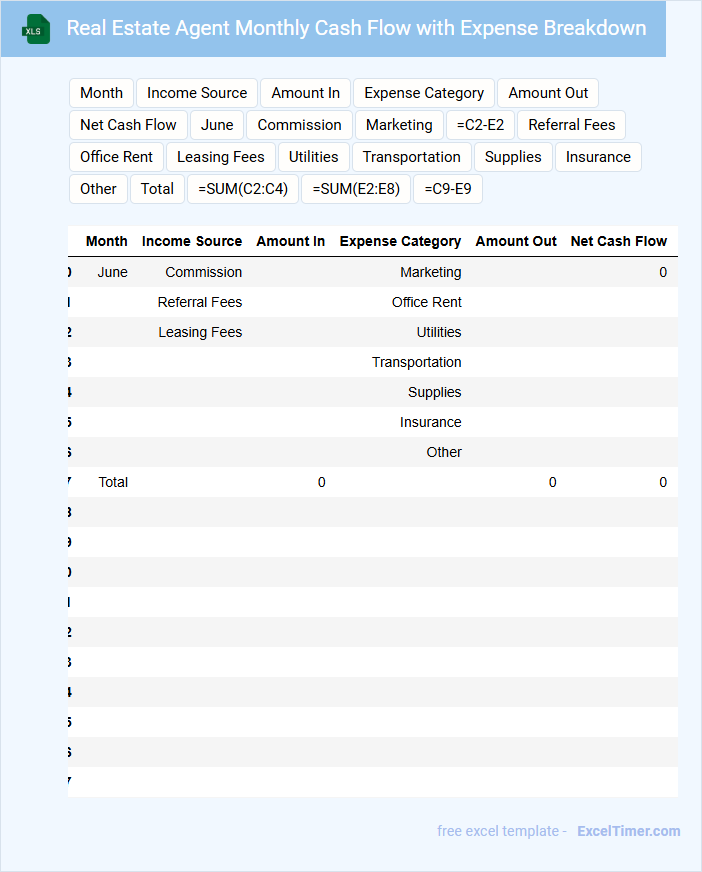

Real Estate Agent Monthly Cash Flow with Expense Breakdown

This document typically contains a detailed overview of a real estate agent's monthly income sources and expense categories.

- Income Tracking: Records all commissions and fees earned during the month.

- Expense Categorization: Breaks down operational costs such as marketing, transportation, and office expenses.

- Cash Flow Analysis: Highlights net profit or loss to help manage financial health effectively.

Organized Cash Flow Excel Template for Real Estate Agents

An Organized Cash Flow Excel Template for real estate agents is designed to help visualize and manage income and expenses efficiently. It typically contains sections for tracking commissions, operating costs, and monthly cash inflows and outflows.

Having a clear overview of cash flow is essential for maintaining financial stability and planning future investments. Including detailed transaction records and customizable categories can greatly enhance the template's usefulness.

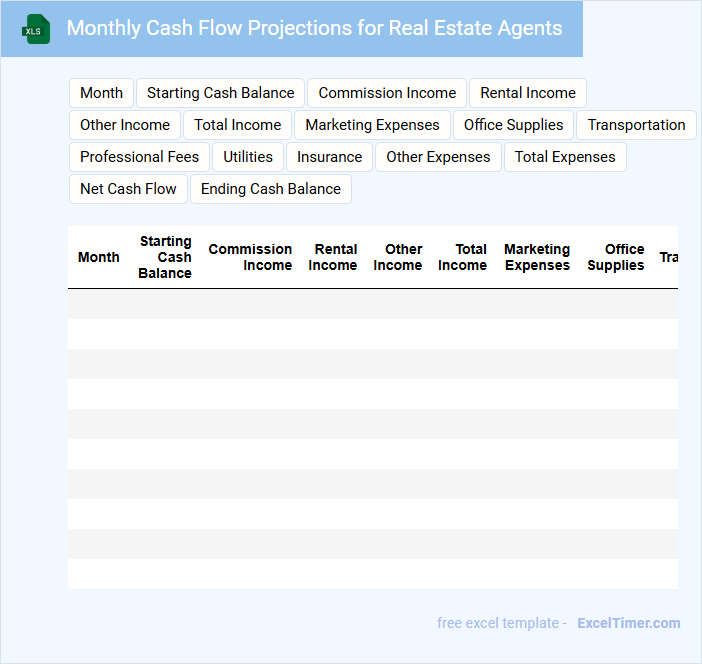

Monthly Cash Flow Projections for Real Estate Agents

A Monthly Cash Flow Projection for real estate agents provides an estimate of incoming and outgoing funds over a month, helping agents manage their finances effectively. This document typically contains expected commission income, operating expenses, and marketing costs. It is essential for forecasting liquidity and making informed financial decisions.

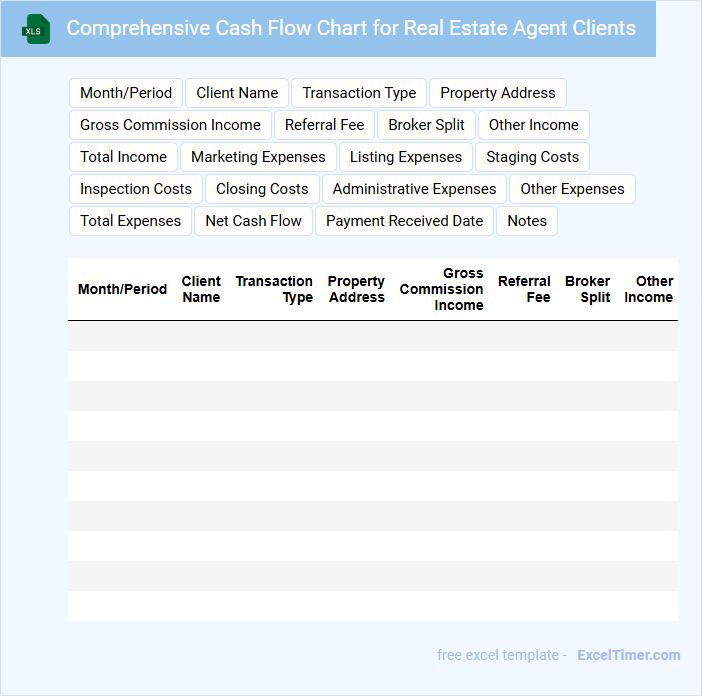

Comprehensive Cash Flow Chart for Real Estate Agent Clients

A Comprehensive Cash Flow Chart for Real Estate Agent Clients details the inflows and outflows of funds related to property transactions. It typically includes income from sales, commissions, and operating expenses such as marketing and administrative costs. This document is essential for tracking financial health and ensuring transparent client communication.

When preparing this chart, it is important to accurately categorize all cash movements to reflect true profitability and liquidity. Incorporating projected future cash flows can help clients plan better and make informed investment decisions. Always update the chart regularly to capture real-time financial status and maintain trust.

Highlighting key performance indicators such as net cash flow and return on investment within the chart adds significant value. Additionally, using clear labels and consistent formatting improves readability and usability for clients. Ensuring data accuracy and thoroughness fosters confident financial management for real estate clients.

What are the key components of a real estate agent's monthly cash inflow and outflow in an Excel cash flow document?

A real estate agent's monthly cash inflow in an Excel document typically includes commissions from property sales, rental income, and referral fees. Key outflow components consist of marketing expenses, office fees, travel costs, and commission splits. Your cash flow analysis should track these inflows and outflows accurately to maintain financial stability and optimize profitability.

How do you categorize variable and fixed expenses when tracking monthly cash flow for real estate agents?

Categorize fixed expenses as consistent monthly costs like office rent, MLS fees, and insurance premiums. Variable expenses include commission splits, marketing costs, and client entertainment, which fluctuate based on transaction volume. Accurate distinction ensures precise cash flow management and financial forecasting for real estate agents.

What formulas or Excel functions can be used to automate monthly income and expense calculations?

You can use SUM and SUMIF functions to automate monthly income and expense calculations in your Excel document for Monthly Cash Flow. The SUM function adds total income or expenses, while SUMIF calculates specific categories, such as commissions or marketing costs. Incorporating these formulas ensures accurate tracking of your real estate cash flow each month.

How can you visually analyze monthly cash flow trends using charts or graphs in Excel?

Create a line chart in Excel to plot monthly income and expenses, highlighting cash flow trends over time. Use conditional formatting on the data table to emphasize positive and negative cash flow months for quick visual assessment. Implement a combination chart with bars for cash inflows and outflows alongside a line representing net cash flow to compare values effectively.

What methods can you implement in Excel to forecast and manage periods of irregular income typical for real estate agents?

Use Excel functions like FORECAST.ETS and moving averages to predict irregular income patterns for real estate agents. Implement dynamic cash flow models with scenario analysis using financial templates and pivot tables to track and manage monthly fluctuations. Integrate conditional formatting and data validation to highlight critical cash shortages and ensure accurate forecasting.