The Monthly Payroll Excel Template for Contractors streamlines payment tracking by organizing hours worked, rates, and deductions in a clear and accessible format. It enhances accuracy and efficiency, reducing payroll errors and saving time on manual calculations. This template is essential for contractors needing a reliable and easy-to-use tool to manage their monthly payroll.

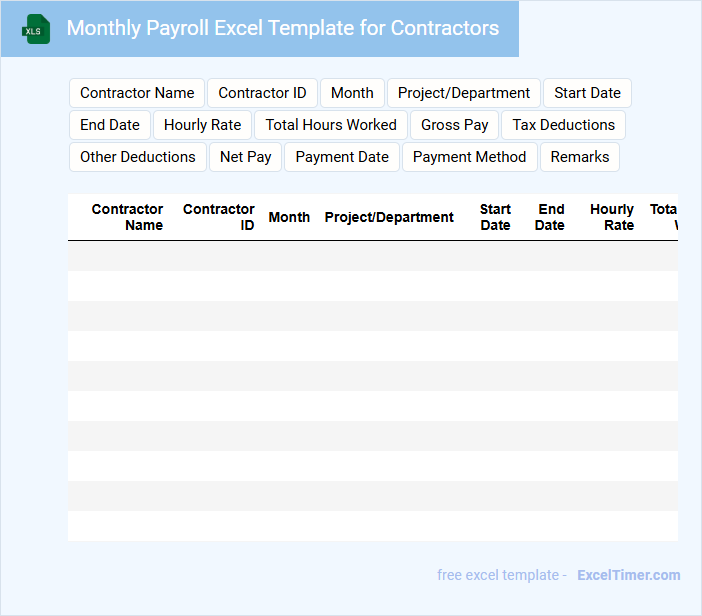

Monthly Payroll Excel Template for Contractors

A Monthly Payroll Excel Template for Contractors typically contains detailed information about contractor payments for a given month. It includes fields such as contractor names, hours worked, rates, gross pay, taxes, and net pay. This document ensures accurate and organized payroll processing for freelance or contract workers.

Important aspects to consider when using this template include verifying contractor payment rates, ensuring proper tax deductions, and maintaining up-to-date contact information. Regularly updating the template helps prevent errors and streamlines payroll management. Additionally, securely storing this document protects sensitive financial data.

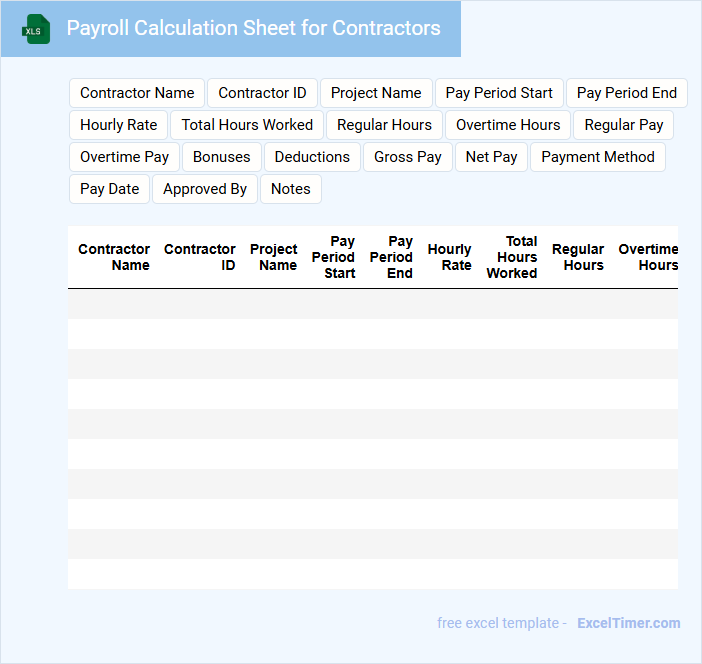

Payroll Calculation Sheet for Contractors

A Payroll Calculation Sheet for Contractors typically contains detailed information about payments owed to contractors, including hours worked, rate per hour, and total earnings. It also tracks deductions, taxes, and any additional reimbursements or bonuses applicable.

Ensuring accuracy in tax withholdings is crucial to comply with legal regulations and avoid penalties. Furthermore, clear documentation of payment terms and contract details supports transparency and efficient bookkeeping.

Monthly Salary Tracker for Contract Workers

A Monthly Salary Tracker for contract workers is a document designed to record and monitor the payment details of temporary or freelance employees systematically. It typically includes fields for worker names, contract duration, hours worked, pay rate, and total salary paid.

This type of document helps in ensuring timely payments and maintaining transparent financial records for both employers and workers. Including a clear column for payment dates and any deductions is an important suggestion to enhance accuracy and accountability.

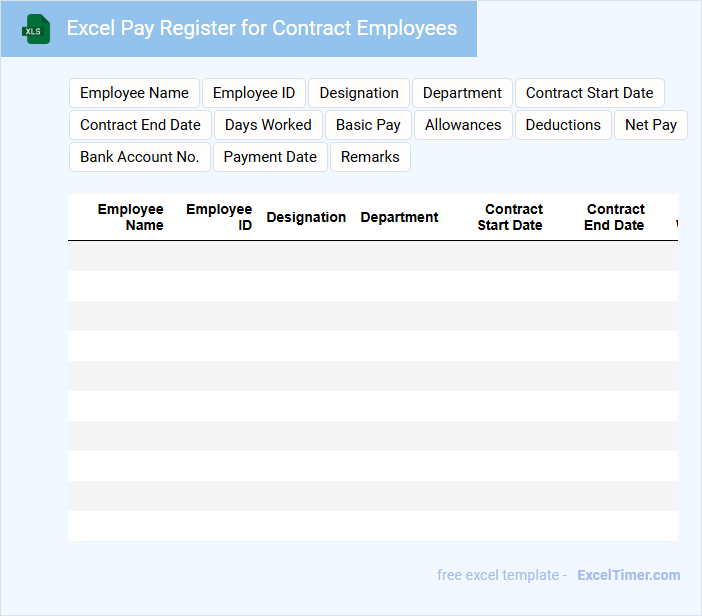

Excel Pay Register for Contract Employees

An Excel Pay Register for Contract Employees typically contains detailed records of payments made to each contract worker, including their working hours, daily rates, and total earnings. It helps in maintaining transparent and accurate payroll data for audits and financial reconciliation. Regular updates and error checks are crucial to ensure the accuracy of this document.

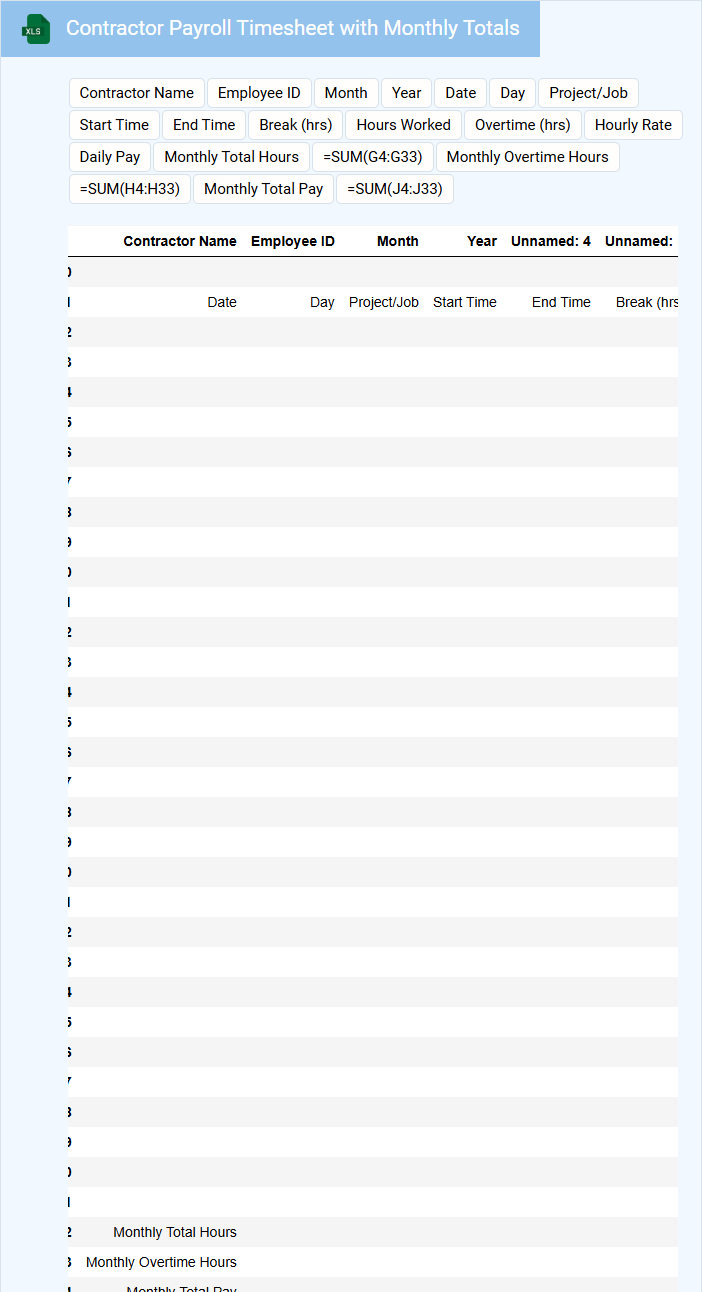

Contractor Payroll Timesheet with Monthly Totals

What information is typically included in a Contractor Payroll Timesheet with Monthly Totals? This document usually contains detailed records of hours worked by contractors, including daily time entries and job codes. It also summarizes monthly totals to facilitate accurate payroll processing and compliance with labor regulations.

Why is maintaining a Contractor Payroll Timesheet with Monthly Totals important? Accurate tracking ensures proper payment, supports audit requirements, and helps manage labor costs effectively. It is crucial to verify hours and ensure timely submission for smooth payroll operations.

Monthly Payment Schedule for Contractors

The Monthly Payment Schedule for contractors outlines the planned payments to be made each month, detailing amounts, due dates, and payment methods. It serves as a financial roadmap ensuring timely and organized compensation.

This document usually contains contractor names, invoice numbers, payment amounts, and payment deadlines. Clear terms and conditions regarding penalties or early payments are important to include for transparency.

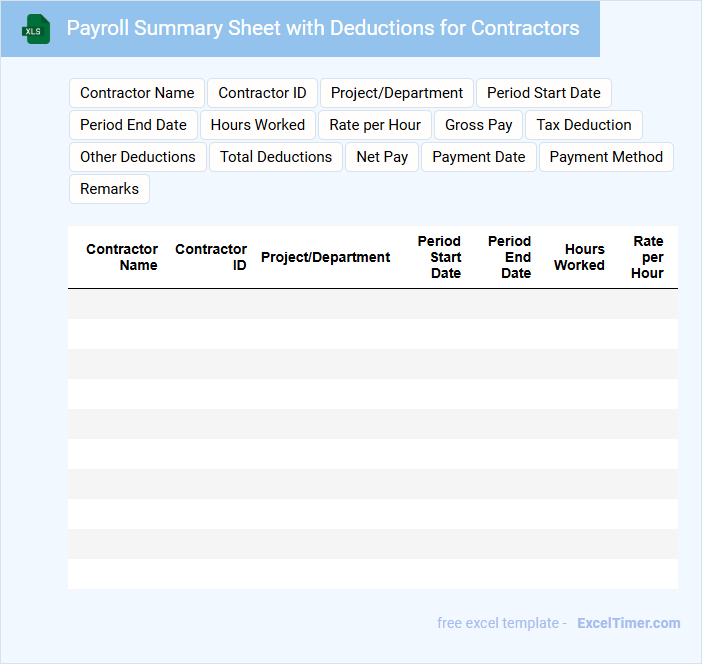

Payroll Summary Sheet with Deductions for Contractors

A Payroll Summary Sheet with Deductions for Contractors typically contains detailed records of payments made to contractors, including gross earnings and various deductions such as taxes and insurance contributions. It provides a clear overview of net pay after all deductions, helping in accurate record-keeping and compliance with tax regulations. This document is essential for both contractors and employers to ensure transparency and proper financial management.

Payment Tracker for Monthly Contractor Payroll

A Payment Tracker for Monthly Contractor Payroll typically contains detailed records of payments made to contractors, including payment dates, amounts, and payment methods. It ensures accuracy and transparency in compensation management.

This document also includes contractor details, project names, invoicing status, and any deductions or bonuses applied. Regularly updating the tracker helps avoid payment delays and discrepancies.

Ensure to include a clear due date column and a verification step to confirm payments have been received and processed.

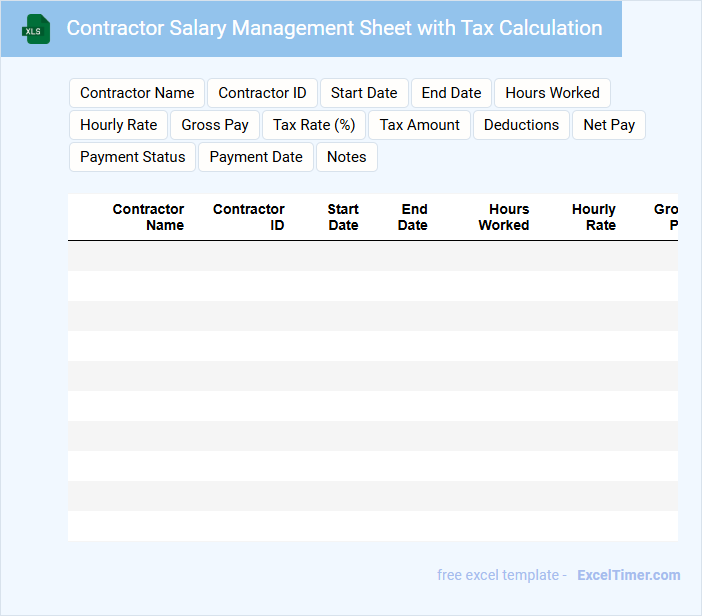

Contractor Salary Management Sheet with Tax Calculation

What information is typically included in a Contractor Salary Management Sheet with Tax Calculation? This document usually contains details such as the contractor's personal information, work hours, agreed rates, gross salary, applicable taxes, deductions, and net salary. It helps in tracking payments accurately and ensuring compliance with tax regulations.

Why is it important to include precise tax calculation in this sheet? Accurate tax calculations prevent legal issues and financial discrepancies by ensuring that the correct amount of tax is deducted and reported. Including tax breakdowns and maintaining up-to-date tax rates are essential for transparency and proper financial management.

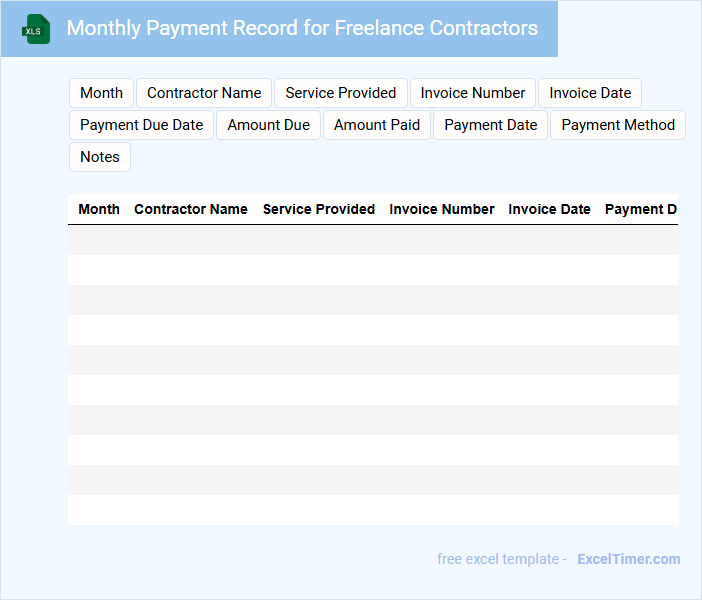

Monthly Payment Record for Freelance Contractors

A Monthly Payment Record for Freelance Contractors typically contains detailed information about the payments made each month, including dates, amounts, and payment methods. It serves as a crucial financial document for tracking income and ensuring timely compensation.

Important elements include the contractor's name, invoice numbers, and payment status to maintain clear and organized records. Regularly updating this document helps prevent payment disputes and supports accurate tax reporting.

Payroll Expense Report for Contractor Payments

A Payroll Expense Report for contractor payments typically details all financial transactions made to independent contractors within a specific period. It includes payment amounts, dates, contractor names, and the nature of services provided. This document is crucial for tracking expenses, ensuring compliance, and budgeting accurately.

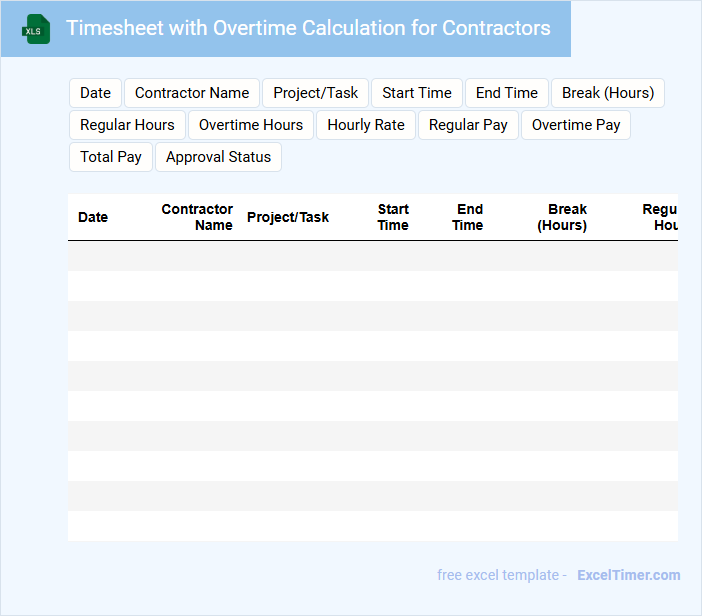

Timesheet with Overtime Calculation for Contractors

What information is typically included in a Timesheet with Overtime Calculation for Contractors? This document usually contains detailed records of hours worked each day, including regular and overtime hours, along with the dates and contractor identification. It helps ensure accurate payment and compliance with contract terms by clearly calculating extra hours worked beyond standard shifts.

What is an important aspect to consider for this type of timesheet? Ensuring precise tracking of start and end times, breaks, and overtime rules specific to the contract is crucial. Additionally, including a clear method for approval and submission enhances transparency and accountability.

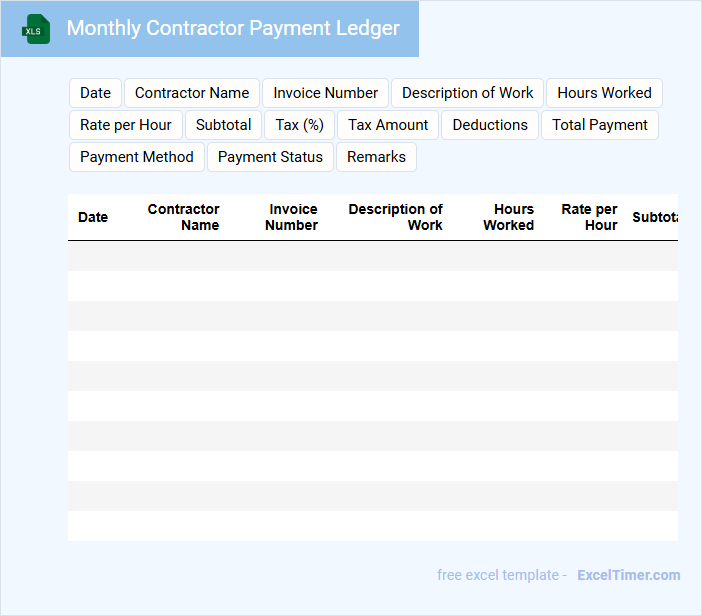

Monthly Contractor Payment Ledger

A Monthly Contractor Payment Ledger is a detailed financial record that tracks payments made to contractors within a specific month. It ensures transparency and accuracy in managing contractual expenses.

- Include contractor names, payment dates, and amounts to maintain clarity.

- Regularly update the ledger to reflect partial payments and outstanding balances.

- Verify all entries against invoices and payment receipts for accuracy.

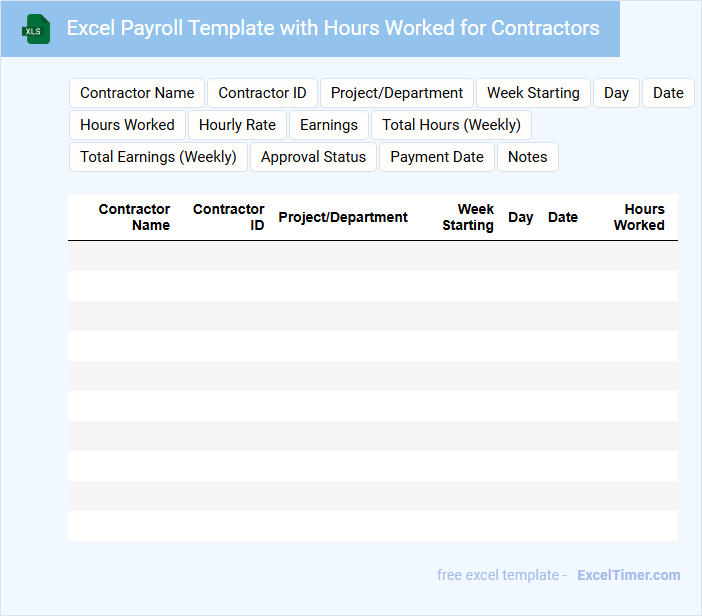

Excel Payroll Template with Hours Worked for Contractors

An Excel Payroll Template designed for contractors typically contains detailed records of hours worked, payment rates, and total earnings. It helps streamline payroll calculations by organizing timesheets and payment information efficiently. Such documents often include tax deductions, overtime calculations, and payment summaries to ensure accurate and transparent payment processing.

For contractors, it is important to ensure the template includes flexible date ranges, clear hourly rate fields, and automated calculation formulas. Additionally, recording hours accurately and tracking different tasks or projects can improve invoice accuracy. Regularly updating the template to comply with relevant tax rules and labor laws is also essential.

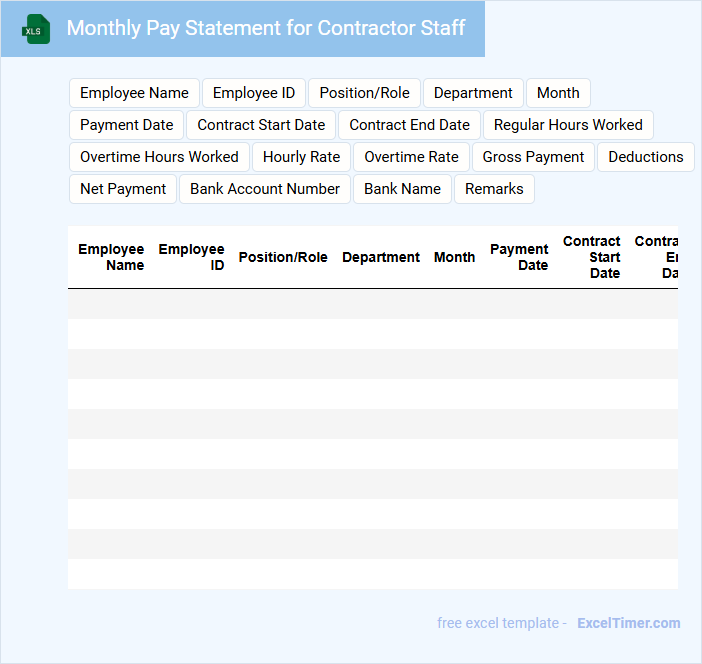

Monthly Pay Statement for Contractor Staff

What information is typically included in a Monthly Pay Statement for Contractor Staff? A Monthly Pay Statement for Contractor Staff usually contains details such as hours worked, rate of pay, deductions, and net payment. It serves as a transparent record for both the contractor and employer, ensuring clarity on compensation and compliance with contractual agreements.

What key information should be included in a monthly payroll Excel document for contractors?

A monthly payroll Excel document for contractors should include contractor names, payment rates, hours worked, total earnings, tax deductions, and payment dates. It should also track invoice numbers, payment status, and any reimbursable expenses. Accurate records ensure compliance with tax regulations and facilitate timely payments.

How do you accurately calculate and record contractor payment amounts in Excel?

To accurately calculate and record contractor payment amounts in Excel, input each contractor's hourly rate or fixed fee alongside the total hours worked or deliverables completed. Use formulas such as SUMPRODUCT to multiply hours by rates, ensuring all payments reflect agreed terms. You can then organize and update payroll data in structured tables for easy tracking and reporting.

Which Excel formulas or functions are essential for automating monthly payroll totals for contractors?

To automate monthly payroll totals for contractors in Excel, use the SUMIF function to add earnings based on contractor names or project codes. Incorporate the IF function to handle conditional payroll entries like bonuses or deductions. You can optimize your spreadsheet by combining these formulas to ensure accurate and efficient payroll calculations.

How should tax deductions and withholdings for contractors be documented in the payroll Excel file?

Tax deductions and withholdings for contractors should be documented in your Monthly Payroll Excel file by including separate columns for each type of deduction, such as federal tax, state tax, and Social Security contributions. Ensure each contractor's gross pay is listed alongside their respective deductions to calculate the net pay accurately. This organized approach allows for clear tracking and compliance with tax regulations.

What is the best way to organize contractor contracts, payment dates, and invoice status within the payroll spreadsheet?

To efficiently manage contractor contracts, payment dates, and invoice status in your Monthly Payroll Excel document, create separate columns for each data point with clear headers. Use data validation to standardize payment dates and dropdown lists for invoice status to ensure accuracy. Organize entries by contractor names, allowing quick filtering and tracking of payment cycles and contract terms.