The Monthly Cash Flow Excel Template for Landlords is designed to help property owners efficiently track rental income, expenses, and net cash flow on a monthly basis. This template provides a clear overview of financial performance, enabling landlords to monitor profitability and manage budgets effectively. Accurate record-keeping through this tool is crucial for informed decision-making and maximizing rental property returns.

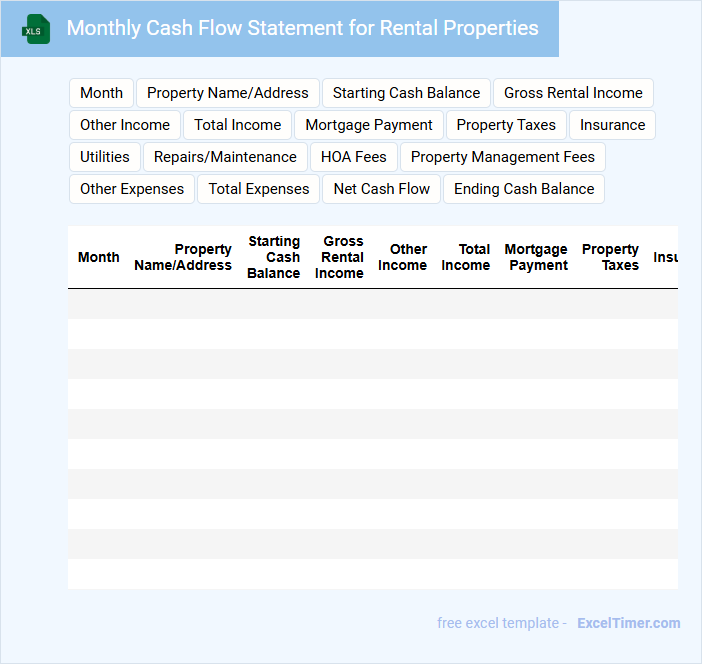

Monthly Cash Flow Statement for Rental Properties

A Monthly Cash Flow Statement for Rental Properties provides a detailed record of all cash inflows and outflows related to rental income and expenses within a specific month. It helps property owners track profitability and manage financial health effectively.

- Include rental income, maintenance expenses, mortgage payments, and other operational costs.

- Highlight net cash flow to understand property profitability.

- Compare monthly data to identify trends or irregularities over time.

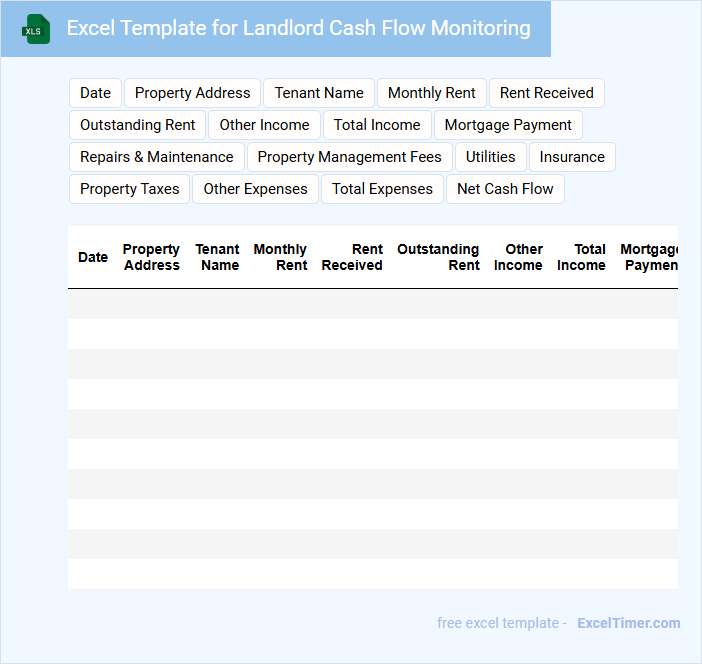

Excel Template for Landlord Cash Flow Monitoring

An Excel Template for Landlord Cash Flow Monitoring typically contains a structured layout to track rental income, expenses, and overall financial performance of rental properties.

- Income Tracking: It records monthly rent payments and other income sources to monitor total revenue.

- Expense Management: It logs all property-related expenses such as maintenance, taxes, and utilities to ensure accurate cost assessment.

- Cash Flow Analysis: It provides a summary of net cash flow to help landlords evaluate profitability and make informed decisions.

Monthly Cash Flow Tracker for Landlords

What information is typically included in a Monthly Cash Flow Tracker for Landlords? This document usually contains detailed records of rental income, expenses such as maintenance costs and property management fees, and net cash flow calculations. It helps landlords monitor the financial performance of their rental properties and make informed decisions about budgeting and investments.

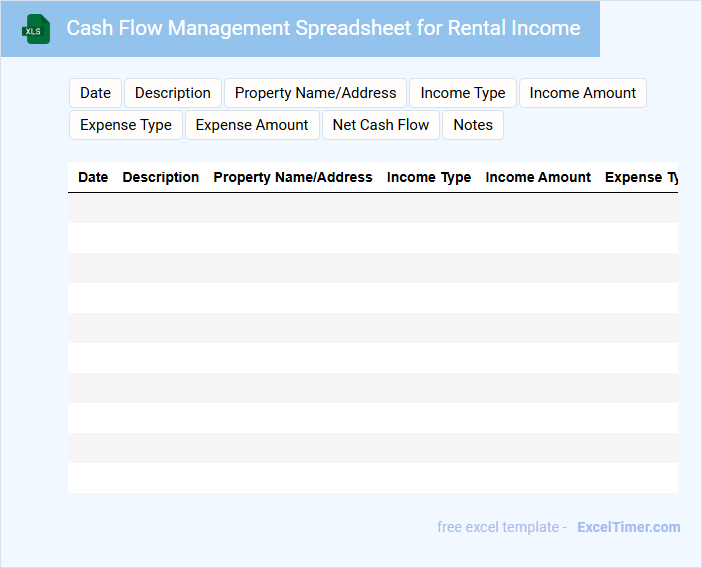

Cash Flow Management Spreadsheet for Rental Income

A Cash Flow Management Spreadsheet for rental income typically contains detailed records of income and expenses related to rental properties, including rent payments, maintenance costs, and utilities. It helps landlords track monthly cash inflows and outflows to ensure positive cash flow and financial stability. This document is essential for making informed decisions about property management and investment strategies.

For optimal use, include clear categories for all income sources and expenses, regularly update the spreadsheet, and monitor key metrics such as net cash flow and vacancy periods to identify potential financial issues early.

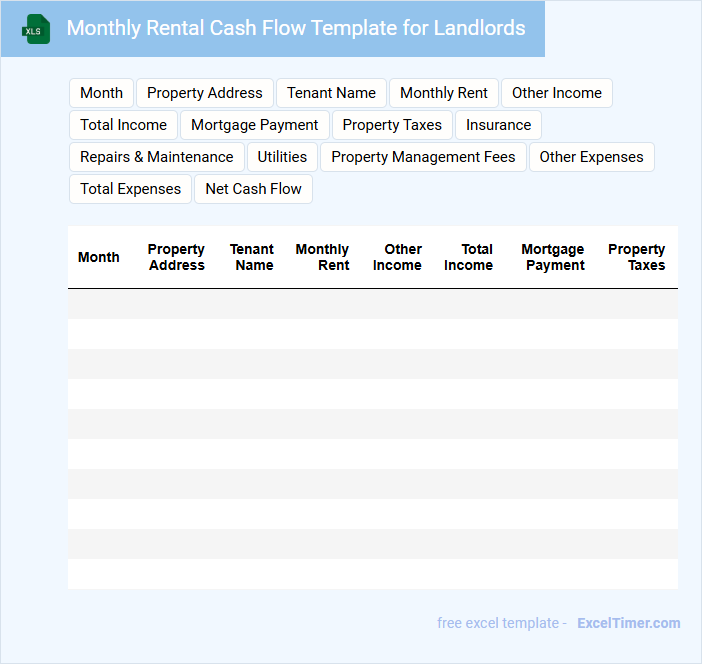

Monthly Rental Cash Flow Template for Landlords

This Monthly Rental Cash Flow Template for landlords typically contains detailed records of rental income, expenses, and net cash flow for each month. It helps landlords track financial performance and identify trends or discrepancies in their rental properties. Including important elements such as rent received, maintenance costs, property taxes, and vacancy periods is essential for accuracy and effective property management.

Excel Sheet for Tracking Monthly Cash Flow of Properties

An Excel sheet for tracking monthly cash flow of properties typically contains detailed records of rental income, expenses, and net cash flow for each property. It helps property owners and managers monitor financial performance and identify trends over time. Essential elements include columns for dates, transaction types, amounts, and summary totals to provide clear and organized financial insights.

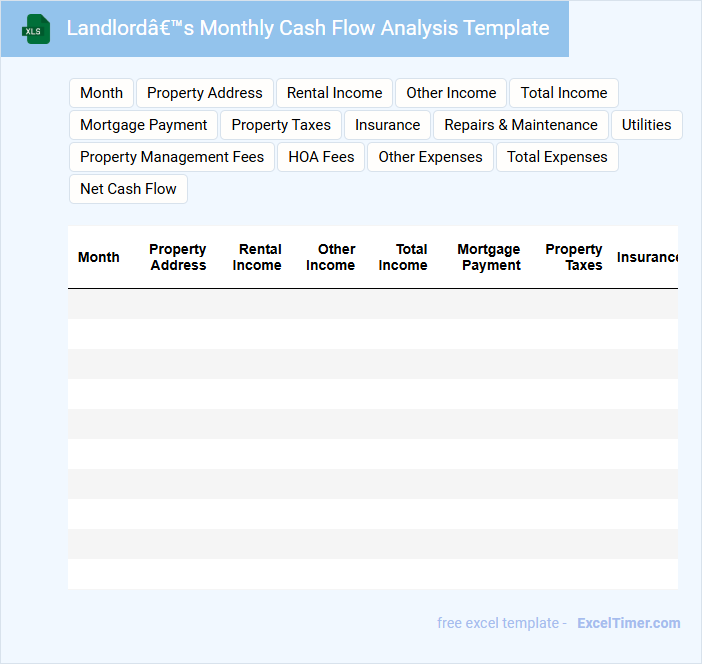

Landlord’s Monthly Cash Flow Analysis Template

A Landlord's Monthly Cash Flow Analysis Template is designed to help property owners track rental income and expenses on a monthly basis. It provides a clear overview of the financial performance of rental properties to ensure profitability and informed decision-making.

- Include all sources of rental income and recurring expenses for accuracy.

- Regularly update and review the template to identify trends or issues.

- Incorporate contingency funds for unexpected repairs or vacancies.

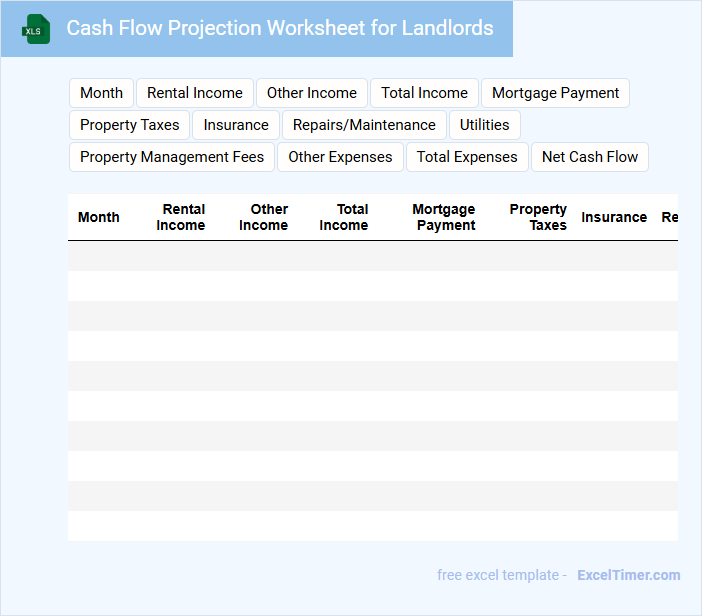

Cash Flow Projection Worksheet for Landlords

Cash Flow Projection Worksheets for Landlords typically contain detailed financial information to help forecast rental income and expenses over a specific period.

- Rental Income: A clear breakdown of expected monthly rental payments from tenants.

- Operating Expenses: All recurring costs such as maintenance, property management fees, and utilities.

- Net Cash Flow: The difference between total income and total expenses to assess profitability.

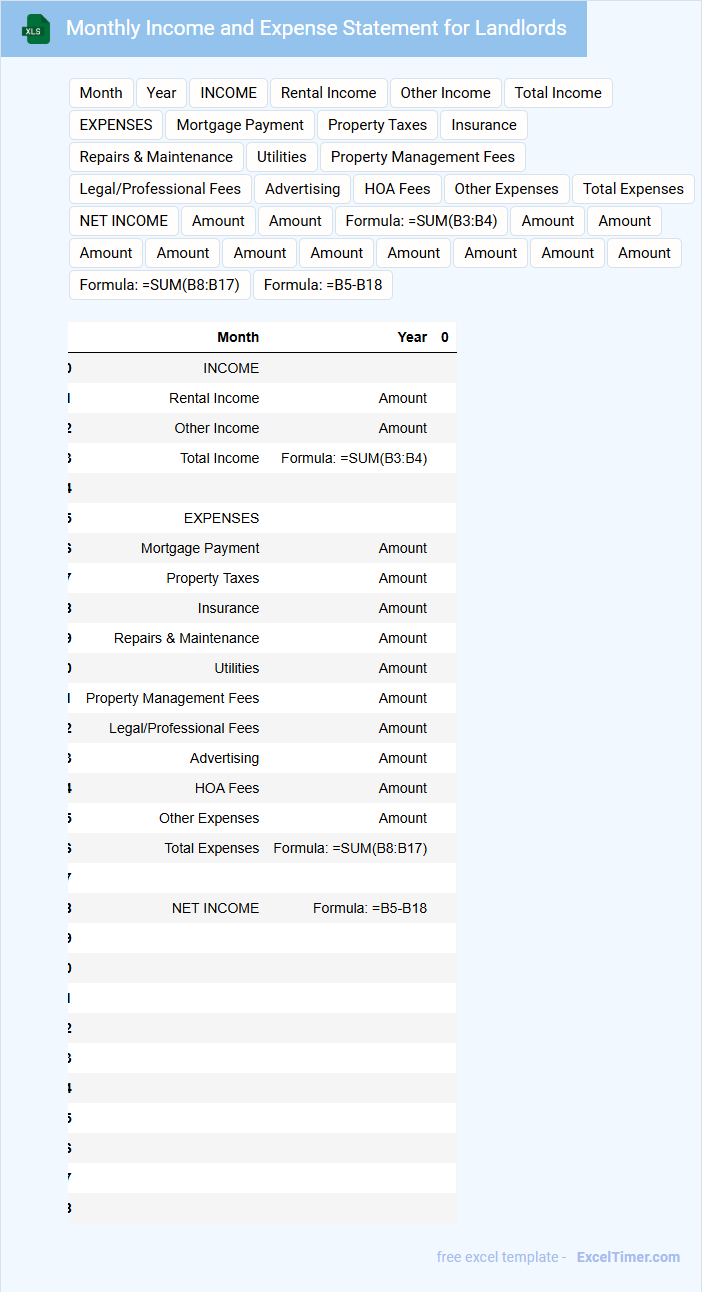

Monthly Income and Expense Statement for Landlords

A Monthly Income and Expense Statement for Landlords typically summarizes rental income and associated property expenses to track profitability and financial health.

- Income Tracking: Accurately record all rental payments and additional income sources for the property.

- Expense Documentation: Include detailed expenses such as maintenance, utilities, taxes, and management fees.

- Financial Analysis: Review net income monthly to assess cash flow and identify cost-saving opportunities.

Excel Template for Monthly Rental Property Cash Flow

An Excel Template for Monthly Rental Property Cash Flow typically contains sections for income, expenses, and net cash flow calculations. It allows landlords to track rent payments, maintenance costs, mortgage payments, and other financial details efficiently.

This document is crucial for monitoring the financial health of rental properties and making informed investment decisions. It is important to regularly update the template to ensure accurate and timely financial analysis.

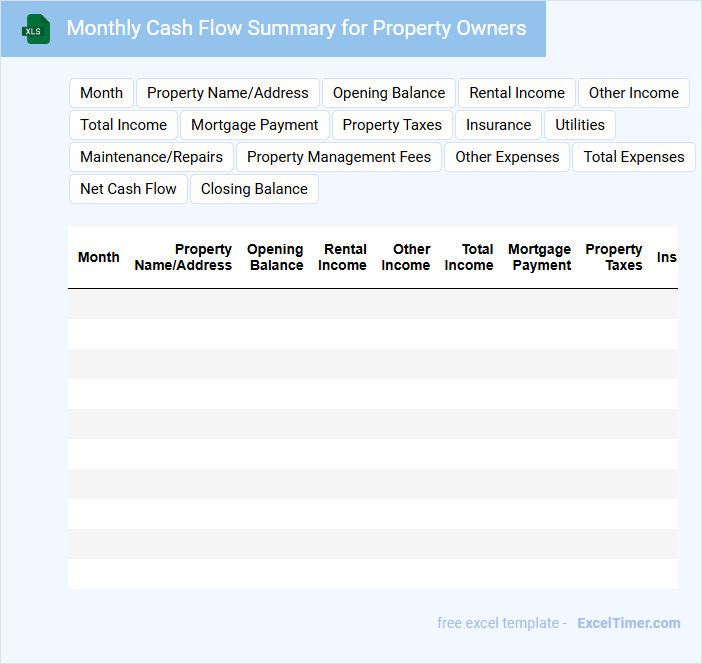

Monthly Cash Flow Summary for Property Owners

A Monthly Cash Flow Summary for Property Owners typically details the inflows and outflows of cash related to property management and investment performance within a given month.

- Income sources such as rent payments, late fees, and other revenue streams should be clearly itemized.

- Expense categories like maintenance costs, mortgage payments, and property taxes must be accurately recorded.

- Net cash flow should be calculated to assess the overall profitability and liquidity for the property owner.

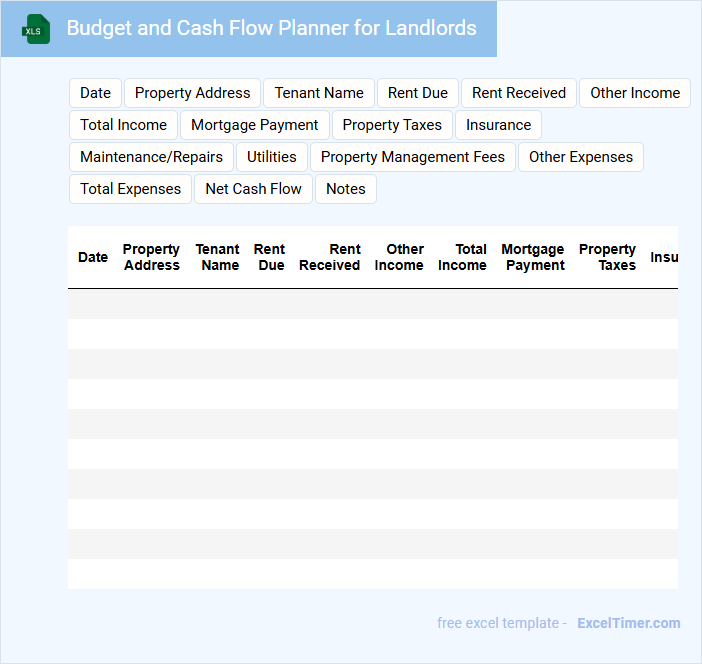

Budget and Cash Flow Planner for Landlords

A Budget and Cash Flow Planner for Landlords is a crucial document that helps property owners track income and expenses related to their rental properties. It typically contains detailed records of rent payments, maintenance costs, mortgage payments, and other financial transactions. This tool enables landlords to forecast cash flow and make informed financial decisions for their investments.

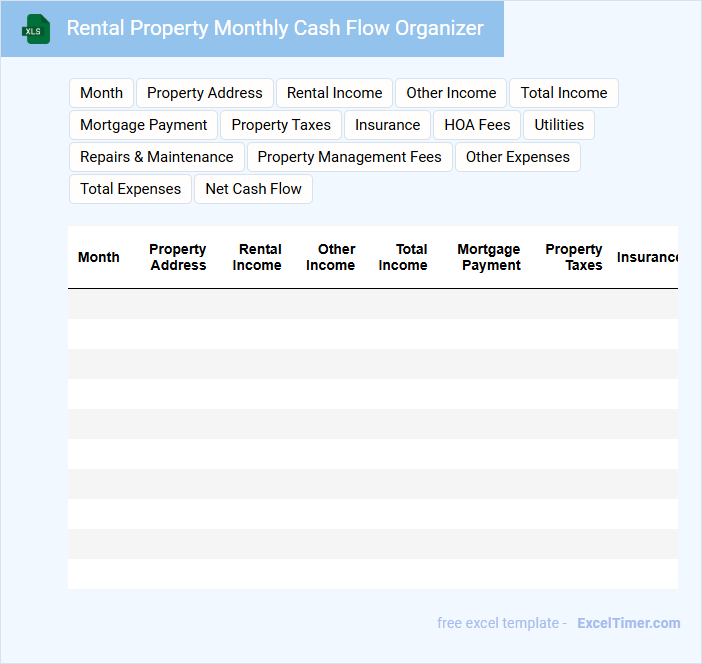

Rental Property Monthly Cash Flow Organizer

A Rental Property Monthly Cash Flow Organizer is a crucial document for landlords and property managers. It typically contains detailed records of rental income, expenses, and net cash flow for each property. This organizer helps in tracking financial performance and ensuring profitability. Important things to include are accurate rent collection dates, itemized expense categories such as maintenance, utilities, and mortgage payments, and a summary section for total income versus total expenses. Consistently updating this document can improve budgeting, tax preparation, and investment decision-making for property owners.

Landlord Excel Template for Monthly Cash Flow Tracking

This Landlord Excel Template is designed to help property owners efficiently track their monthly cash flow. It typically contains sections for rental income, expenses, and net profit calculations.

Accurate financial tracking enables landlords to monitor their investments and make informed decisions. Important features include rent due dates, maintenance costs, and income summaries.

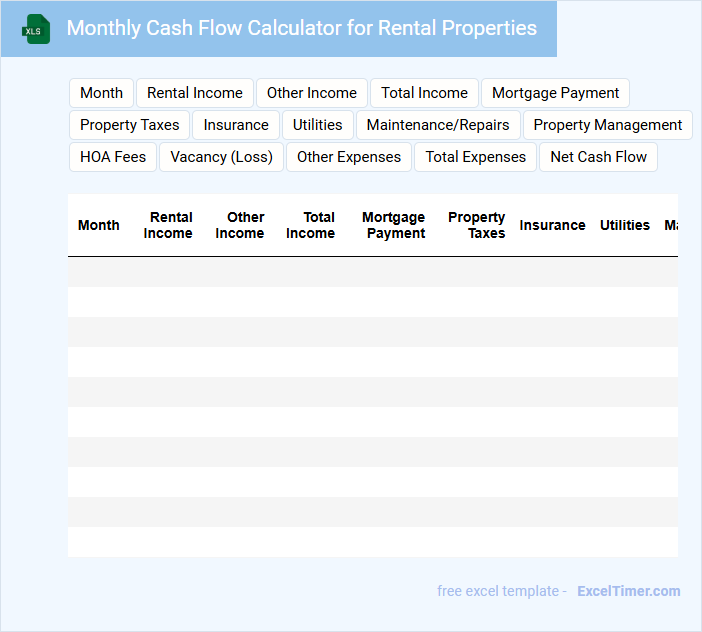

Monthly Cash Flow Calculator for Rental Properties

A Monthly Cash Flow Calculator for rental properties is a financial tool designed to help landlords and investors estimate their monthly income and expenses related to rental units. It typically includes fields for rental income, mortgage payments, taxes, insurance, maintenance costs, and other expenses. This document aids in determining the profitability and sustainability of rental investments.

What are the key income sources to include in a landlord's monthly cash flow Excel document?

Key income sources to include in a landlord's monthly cash flow Excel document are rental income from tenants, late fees, and charges for utilities or amenities when applicable. Additional revenue streams may consist of parking fees, laundry or vending machine profits, and pet fees. Accurately tracking these inputs helps landlords assess financial health and forecast cash flow trends effectively.

Which expense categories should consistently be tracked for accurate monthly cash flow analysis?

Track mortgage payments, property taxes, insurance, maintenance, and utilities consistently to ensure accurate monthly cash flow analysis. Your rental income and vacancy rates should also be monitored closely. Accurate tracking of these expense categories helps landlords make informed financial decisions.

How can you use Excel formulas to automatically calculate total net cash flow each month?

Use Excel formulas like SUM to add all income sources, such as rent payments, and subtract expenses including maintenance and mortgage to calculate your total net cash flow each month. Incorporate functions like SUMIF to categorize and track specific cash inflows and outflows automatically. This approach ensures accurate, real-time financial insights for landlord monthly cash flow management.

What columns are essential for clear monthly tracking: date, description, category, amount, paid/unpaid status, or others?

Essential columns for a landlord's Monthly Cash Flow Excel document include Date to record transaction timing, Description for detailing income or expense sources, Category to classify cash flow types like rent or maintenance, Amount to quantify funds, and Paid/Unpaid Status to track payment completion. Including a Tenant Name column enhances clarity when managing multiple tenants. A Running Balance column provides real-time financial status for precise monthly tracking.

How often should a landlord update and review their Excel cash flow document for effective financial management?

Landlords should update and review their Excel monthly cash flow document at least once a month to accurately track rental income and expenses. Regular monthly reviews help identify cash shortfalls or surpluses, ensuring timely financial decisions. Consistent updates improve budgeting accuracy and long-term rental property profitability.