![]()

The Monthly Expense Tracker Excel Template for Freelancers helps manage and monitor personal and business expenses efficiently, ensuring accurate budgeting. It features customizable categories, automatic calculations, and easy-to-read charts that highlight spending patterns. Utilizing this tool promotes financial discipline and aids in maximizing tax deductions by maintaining organized expense records.

Monthly Expense Tracker with Income Overview for Freelancers

What does a Monthly Expense Tracker with Income Overview for Freelancers typically contain? It usually includes detailed records of all income sources and categorizes expenses incurred throughout the month. This document helps freelancers monitor financial health by comparing earnings against spending, ensuring better budgeting and tax preparedness.

What is an important aspect to focus on when using this tracker? Maintaining accurate and timely entries is essential to provide a clear financial picture. Additionally, including categories for recurring and variable expenses improves spending analysis and supports strategic financial planning.

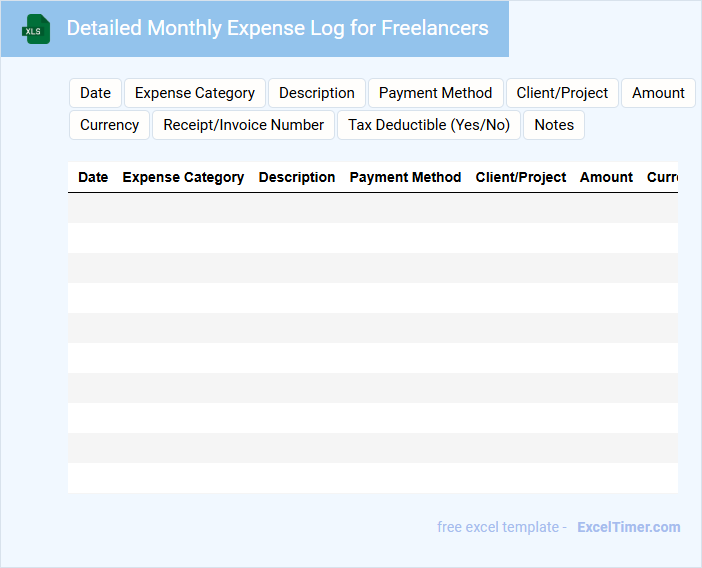

Detailed Monthly Expense Log for Freelancers

The Detailed Monthly Expense Log for freelancers is a comprehensive record of all monthly expenditures related to their work. It usually contains categorized expenses such as office supplies, software subscriptions, and client-related costs. Maintaining this log helps freelancers track spending and manage their finances effectively.

It is important to include accurate dates, detailed descriptions, and amounts for each transaction to ensure clarity and proper budgeting. Keeping digital or physical receipts attached can provide proof of expenses for tax deductions and audits. Regularly updating the log ensures no expense is overlooked and aids in financial planning.

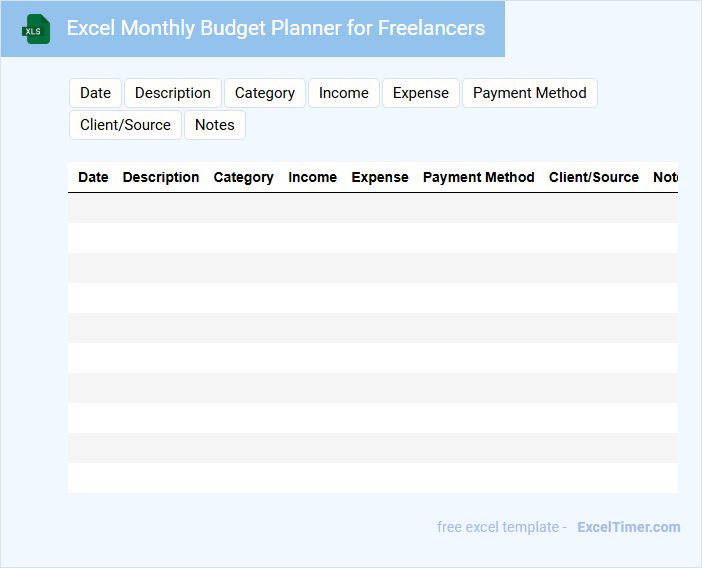

Excel Monthly Budget Planner for Freelancers

An Excel Monthly Budget Planner for Freelancers typically contains detailed income and expense tracking to help manage personal and business finances effectively.

- Income Sources: Track various freelance payments and other revenue streams to monitor overall earnings.

- Expense Categories: Categorize recurring and occasional expenses to identify spending patterns and optimize budget allocation.

- Savings & Taxes: Allocate funds for savings and set aside money for tax obligations to maintain financial stability.

Freelancer Monthly Expense and Invoice Tracker

A Freelancer Monthly Expense and Invoice Tracker is a document designed to monitor and organize all financial transactions related to freelance work. It typically includes sections for recording income, expenses, invoice details, and payment statuses. This helps ensure accurate budgeting and timely payments.

Key features often involve detailed expense categorization and invoice tracking to maintain financial clarity. Regular updates to this tracker support better tax preparation and cash flow management. Including reminders for due invoices can improve payment collection efficiency.

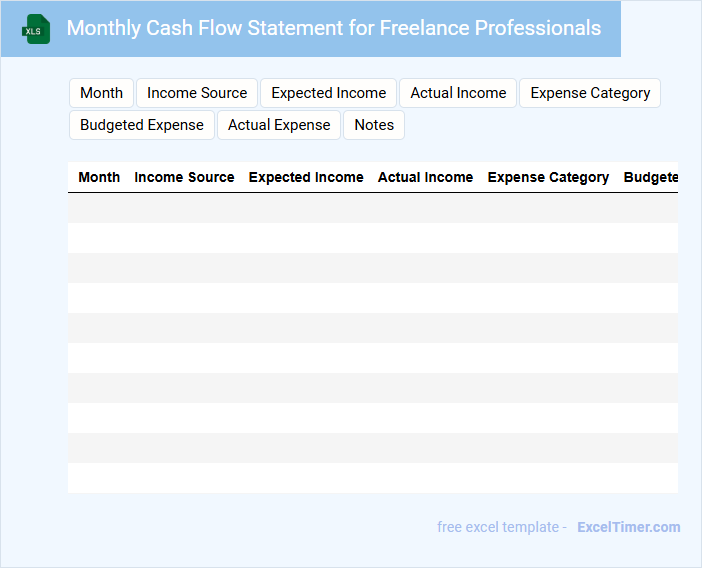

Monthly Cash Flow Statement for Freelance Professionals

The Monthly Cash Flow Statement for freelance professionals typically contains detailed records of all income and expenses within a given month. This document helps track the net cash flow, indicating financial health and liquidity.

Important elements include categorizing earnings from various projects and listing fixed and variable expenses separately. Freelancers should also ensure timely updates to maintain accurate financial insights and plan for taxes and savings effectively.

Expense Tracking Worksheet with Tax Categories for Freelancers

An Expense Tracking Worksheet for freelancers is a crucial document designed to organize and record all business-related expenditures. It typically categorizes expenses by tax types to simplify the filing process and ensure accurate deductions. Maintaining this worksheet helps freelancers monitor their spending, prepare for tax season, and optimize financial management.

Simple Monthly Expense Sheet for Freelancers

A Simple Monthly Expense Sheet for freelancers is a document that tracks income and all outgoing costs on a monthly basis. It typically includes categories such as utilities, software subscriptions, office supplies, and client-related expenses. This sheet helps freelancers maintain financial clarity and prepare for tax obligations efficiently.

For optimal use, it is important to regularly update expenses, categorize costs accurately, and review the sheet at the end of each month to identify saving opportunities.

Freelancer Monthly Personal and Business Expense Tracker

What information is typically included in a Freelancer Monthly Personal and Business Expense Tracker? This type of document generally contains detailed records of both personal and business expenses incurred throughout the month, organized by date and category. It helps freelancers monitor cash flow, prepare accurate tax filings, and manage budgets effectively.

What important features should a Freelancer Monthly Personal and Business Expense Tracker include? It should have clear categorization for expenses, easy input fields for dates and amounts, and summaries that highlight total spending and potential tax deductions. Incorporating visual charts and notes sections can also enhance clarity and financial planning.

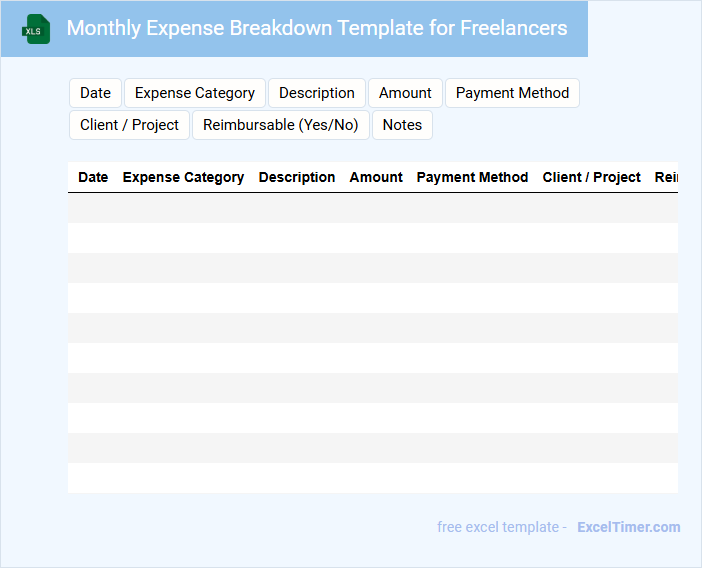

Monthly Expense Breakdown Template for Freelancers

A Monthly Expense Breakdown Template for Freelancers typically contains detailed records of income and expenditures to help manage finances effectively.

- Income Tracking: Allows freelancers to log all sources of monthly income for accurate financial insights.

- Expense Categorization: Helps organize expenses into categories such as office supplies, software subscriptions, and travel costs.

- Budget Analysis: Enables comparison between actual expenses and budgeted amounts to maintain financial control.

Budget and Savings Tracker with Charts for Freelancers

What information does a Budget and Savings Tracker with Charts for Freelancers typically contain? This type of document usually includes detailed records of income, expenses, and savings goals, providing freelancers with a clear overview of their financial status. It also features visual charts that help track spending patterns and progress towards savings targets effectively.

What is an important feature to include in such a tracker? Incorporating customizable categories for different types of freelance work and variable income streams is essential. Additionally, automated calculations and monthly summaries help ensure accurate budgeting and financial planning.

Project-Based Expense Tracker for Freelancers

A Project-Based Expense Tracker for Freelancers is a document designed to record and monitor expenses related to individual projects to ensure accurate budgeting and profitability. It helps freelancers manage their financials project-wise for better cost control and invoicing.

- Include categories for different types of expenses such as materials, software, and travel costs.

- Track dates and descriptions to maintain detailed records for each incurred expense.

- Incorporate a summary section to compare total costs against the project budget.

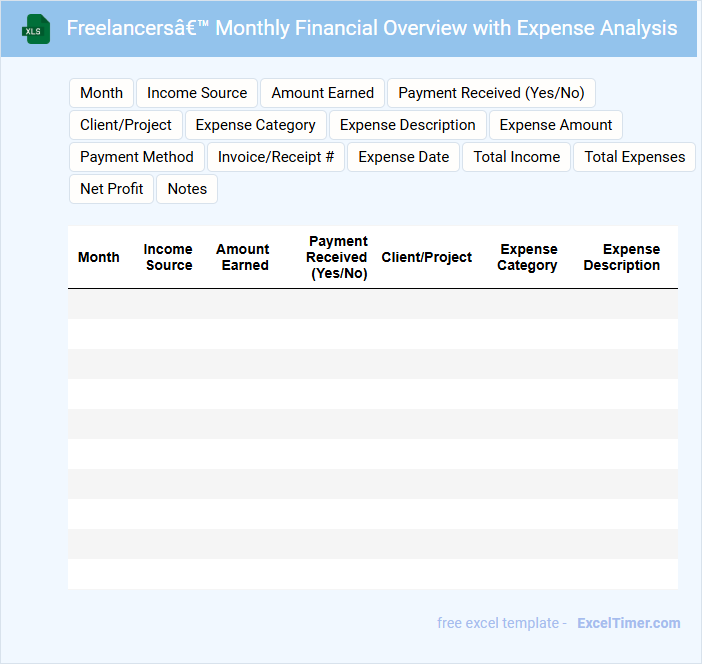

Freelancers’ Monthly Financial Overview with Expense Analysis

The Freelancers' Monthly Financial Overview document typically contains a summary of income, expenses, and net profit for the month, offering clear insights into financial health. It includes detailed expense analysis to identify spending patterns and optimize budget management. Regular review of this report helps freelancers maintain financial stability and plan for future projects effectively.

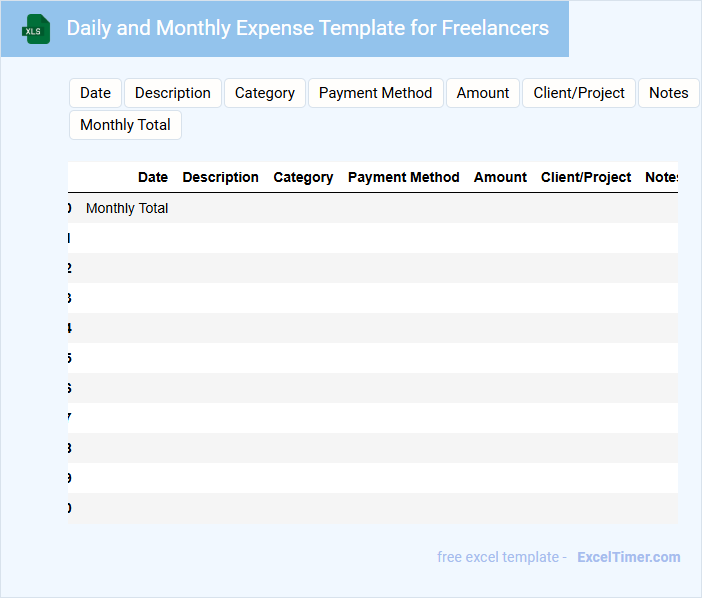

Daily and Monthly Expense Template for Freelancers

What information is typically included in a Daily and Monthly Expense Template for Freelancers? This document usually contains detailed records of daily expenditures, income sources, and categorization of expenses to help freelancers track their financial activities. Additionally, it summarizes monthly totals to provide an overview of spending habits and profitability patterns.

Why is it important to include both daily and monthly expense tracking? Including daily tracking ensures accuracy and helps identify spending trends or unusual costs early, while monthly summaries allow freelancers to plan budgets better and make informed financial decisions. Ensuring clear categorization and consistent updates are crucial for maximizing the template's effectiveness.

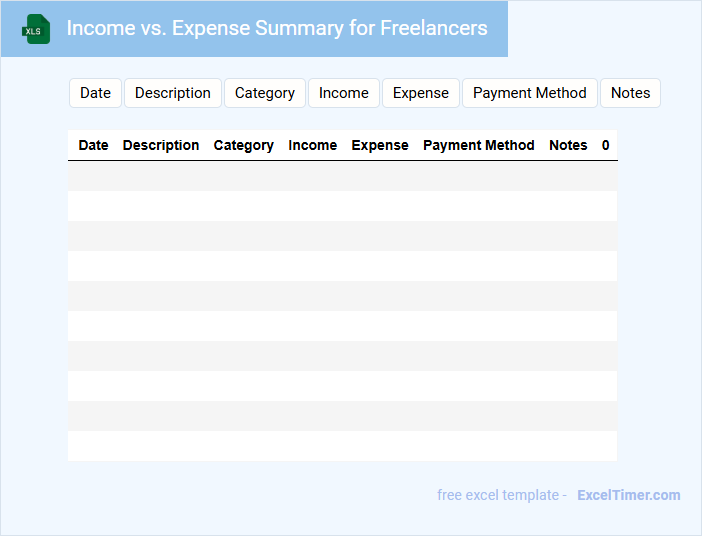

Income vs. Expense Summary for Freelancers

An Income vs. Expense Summary for freelancers typically contains detailed records of all earnings and expenditures over a specific period. This document helps track financial health and manage budgeting efficiently.

It is essential to categorize income sources and expense types clearly to identify profitable projects and deductible costs. Consistently updating this summary ensures accurate tax reporting and better financial planning.

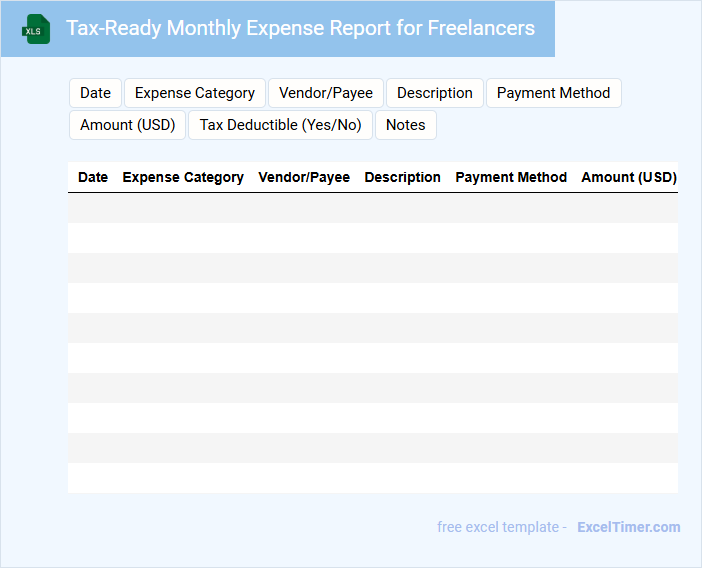

Tax-Ready Monthly Expense Report for Freelancers

A Tax-Ready Monthly Expense Report for Freelancers is a document that tracks all business-related expenses incurred during a month, organized for easy tax filing and financial management. It helps freelancers ensure accurate deductions and maintain compliance with tax regulations.

- Include detailed categorization of expenses such as supplies, travel, and home office costs.

- Record dates, amounts, and descriptions for each expense to support tax claims.

- Keep digital or physical receipts attached or referenced for verification purposes.

What key expense categories should a freelancer include in a Monthly Expense Tracker?

A Monthly Expense Tracker for freelancers should include key categories such as Office Supplies, Software Subscriptions, Marketing, Utilities, and Professional Services. Tracking Travel Expenses, Taxes, and Health Insurance is essential for comprehensive financial management. Your organized tracking helps optimize budgeting and improves tax preparation.

How can conditional formatting in Excel help highlight overspending in specific categories?

Conditional formatting in Excel allows you to set rules that automatically highlight cells where expenses exceed your budget in specific categories. This visual cue helps you quickly identify overspending patterns by changing cell colors based on predefined thresholds. Using this feature in your Monthly Expense Tracker improves expense management and financial awareness.

What is the importance of using Excel formulas (e.g., SUM, AVERAGE) when tracking monthly expenses?

Using Excel formulas like SUM and AVERAGE in your Monthly Expense Tracker enhances accuracy by automatically calculating totals and averages, saving time on manual math. These formulas provide clear insights into spending patterns, helping freelancers manage budgets more effectively. You gain precise control over finances, enabling smarter decision-making for your business growth.

How do you set up a monthly budget comparison to actual expenses in an Excel sheet?

Create columns for Budgeted Amount, Actual Expenses, and Variance in your Excel sheet. Input your planned budget for each category, track actual spending throughout the month, and use formulas like =Actual-Budget to calculate variances. This setup highlights overspending or savings, enabling efficient budget management for freelancers.

What methods can be used in Excel to visualize spending trends over several months?

Excel offers various methods to visualize spending trends over several months, such as using line charts to track expense fluctuations, bar charts to compare monthly categories, and pivot charts to summarize data dynamically. Conditional formatting highlights significant changes in your spending patterns directly within your monthly expense tracker. Creating slicers and timelines enables interactive filtering, helping you analyze specific periods with ease.