The Monthly Budget Excel Template for Personal Finance helps users track income, expenses, and savings efficiently. It features customizable categories and automatic calculations to maintain financial control. Using this template promotes disciplined spending and aids in achieving financial goals.

Monthly Budget Planner for Personal Finance

A Monthly Budget Planner is typically a document designed to help individuals track their income, expenses, and savings throughout the month. It usually contains detailed categories for various spending areas such as housing, food, transportation, and entertainment. An effective planner also includes sections for setting financial goals and monitoring progress to maintain a balanced personal finance.

When creating a Monthly Budget Planner, it is important to ensure clarity and ease of use by incorporating clear labels and logical organization. Including a section for unexpected expenses or emergency funds can provide a more comprehensive financial overview. Regularly updating the planner ensures accuracy and helps in better managing personal finances over time.

Excel Template for Personal Monthly Expense Tracking

An Excel template for personal monthly expense tracking typically contains categorized sections for income, expenses, and savings, allowing users to monitor their financial activities easily. It includes predefined formulas to calculate totals and differences automatically, helping to maintain an updated budget overview. This document serves as a practical tool for financial planning and improving spending habits over time.

When using this template, ensure to regularly update your entries for accuracy and consistency. Include columns for date, description, category, and amount to maintain clear records. Additionally, consider setting monthly budget limits within the template to effectively control your expenses and achieve financial goals.

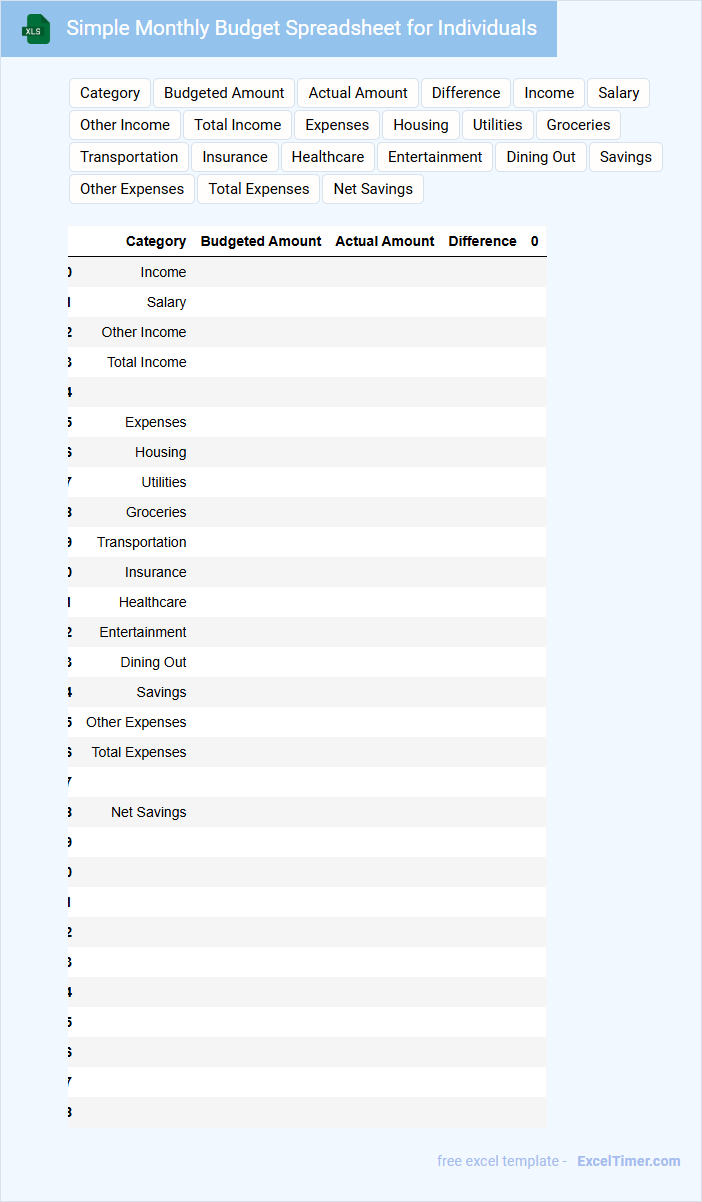

Simple Monthly Budget Spreadsheet for Individuals

A Simple Monthly Budget Spreadsheet is a document that typically contains sections for income, expenses, and savings for individuals. It helps track financial inflows and outflows, making it easier to manage personal finances.

The spreadsheet usually includes categories like rent, utilities, groceries, transportation, and discretionary spending. An important suggestion is to regularly update the spreadsheet to maintain accuracy and ensure effective budgeting.

Monthly Income and Expense Tracker for Personal Use

What is typically included in a Monthly Income and Expense Tracker for Personal Use? This document usually contains detailed records of all income sources and categorized expenses for each month. It helps individuals monitor their financial health by providing a clear overview of where money is coming from and where it is going.

Why is it important to maintain a Monthly Income and Expense Tracker? Keeping an accurate tracker enables better budgeting, financial planning, and spotting spending patterns that can be adjusted to save more money. Consistency and categorization are key to ensuring the tracker is useful and actionable.

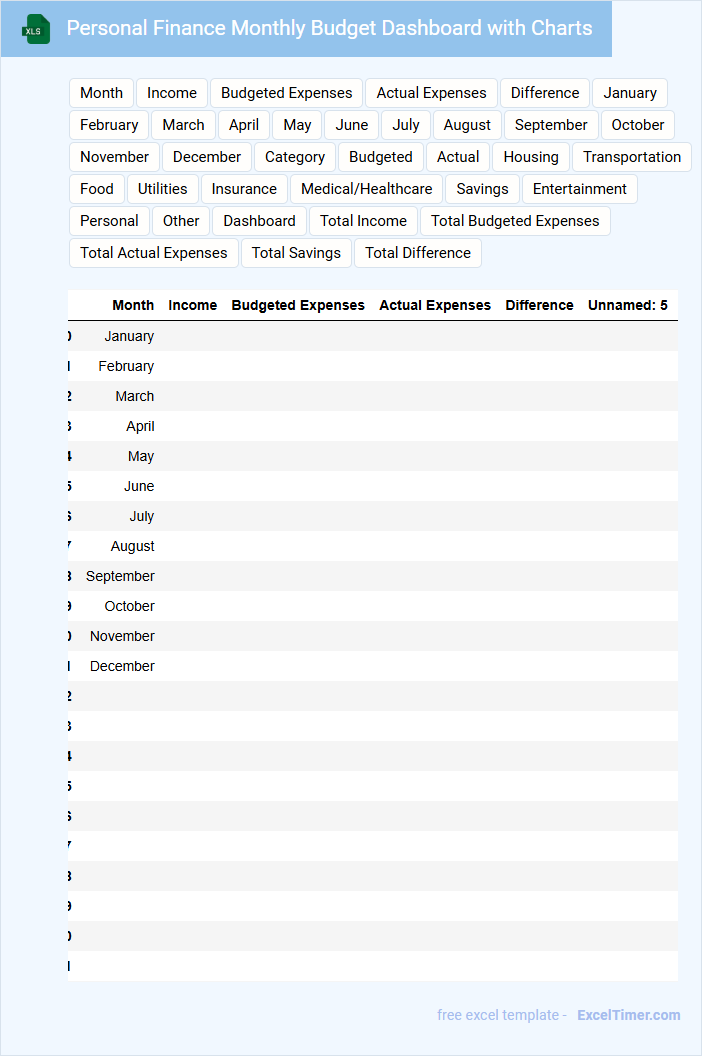

Personal Finance Monthly Budget Dashboard with Charts

What does a Personal Finance Monthly Budget Dashboard with Charts usually contain?

This type of document typically includes categorized income and expenses, savings goals, and visual charts like pie charts or bar graphs to display financial data trends. It helps users track spending habits, monitor budget adherence, and make informed decisions to improve financial health.

What is an important aspect to consider when designing a Personal Finance Monthly Budget Dashboard?

Ensuring clear data visualization and user-friendly layout is crucial to facilitate quick insights. Incorporating real-time updates and customizable categories allows for personalized budgeting and better financial management.

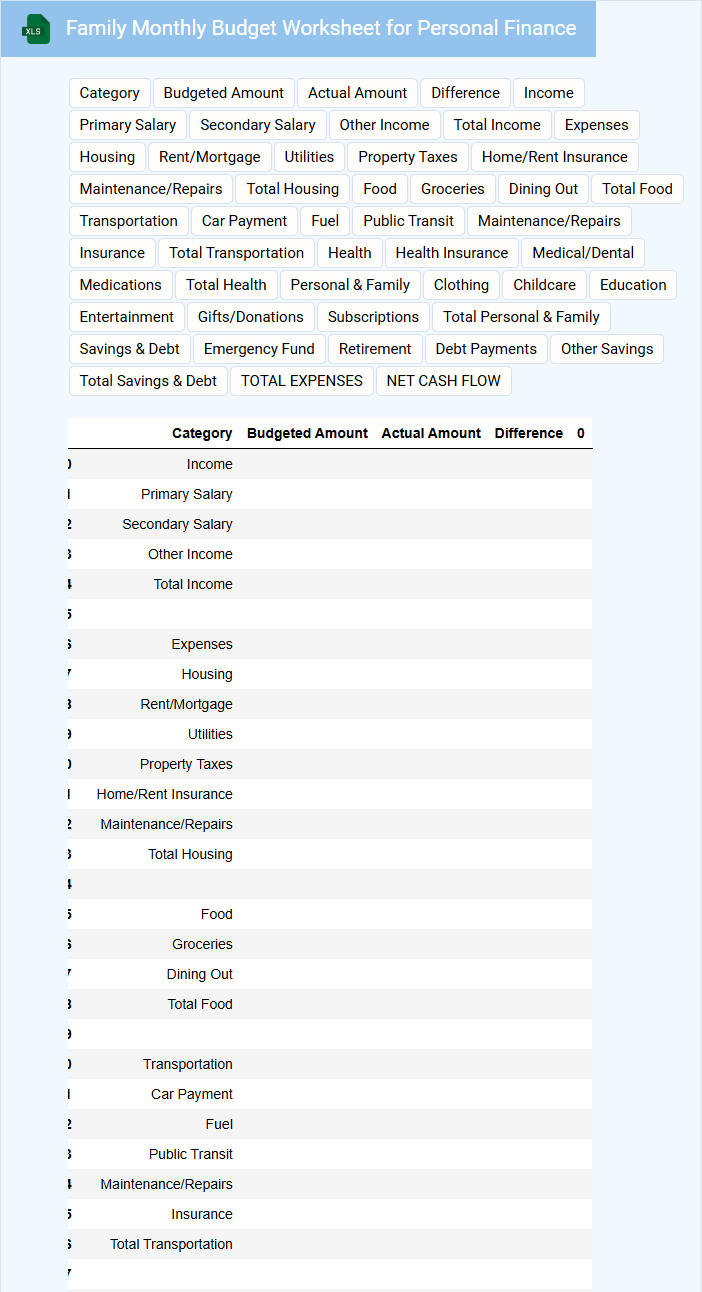

Family Monthly Budget Worksheet for Personal Finance

The Family Monthly Budget Worksheet is typically used to track all sources of income and categorize monthly expenses to manage personal finances effectively. It helps families understand their spending habits and identify areas where they can save money.

Important elements to include in the worksheet are fixed costs like rent or mortgage, utilities, groceries, and discretionary spending. Regularly updating and reviewing the budget ensures better financial control and goal achievement.

Monthly Personal Budget Calculator in Excel

A Monthly Personal Budget Calculator in Excel is typically a spreadsheet designed to help individuals track their income, expenses, and savings on a monthly basis. It usually contains categories for fixed and variable expenses, income sources, and a summary of net savings or deficits. Using formulas and charts, this document aids in maintaining financial discipline and planning future budgets effectively.

For optimal use, it is important to regularly update income and expense entries, categorize expenditures accurately, and review budget variances monthly. Additionally, incorporating alerts for overspending and setting realistic savings goals can enhance financial control. Ensuring the calculator is user-friendly and visually clear will improve long-term engagement with the budgeting process.

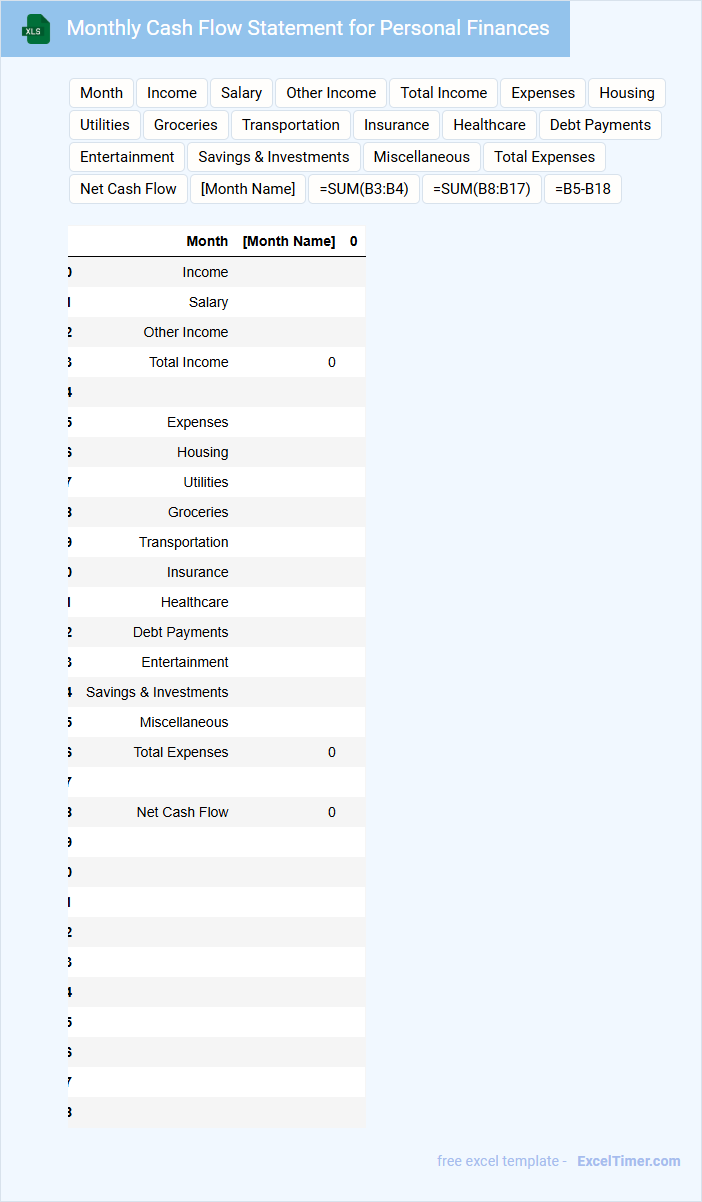

Monthly Cash Flow Statement for Personal Finances

A Monthly Cash Flow Statement for Personal Finances is a document that tracks all income and expenses within a month. It helps individuals understand their spending habits and manage their money more effectively. Key components typically include total income, total expenses, and the resulting net cash flow.

Personal Savings Tracker with Monthly Budget Sheet

A Personal Savings Tracker helps individuals monitor their savings progress by recording amounts saved regularly. It typically includes fields for tracking income, expenses, and the balance left to save each month.

The Monthly Budget Sheet is essential for planning and controlling monthly finances by categorizing income and expenditures. It promotes better financial decisions and identifies areas where spending can be optimized.

For effective use, ensure consistency in updating the tracker and setting realistic savings goals aligned with your monthly budget.

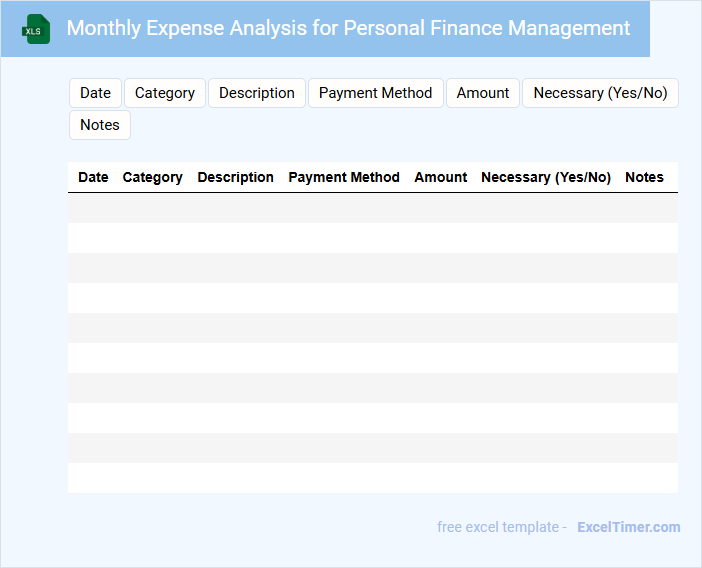

Monthly Expense Analysis for Personal Finance Management

A Monthly Expense Analysis document typically contains detailed records of all personal expenditures categorized by type, such as housing, food, transportation, and entertainment. It helps identify spending patterns and areas where costs can be reduced.

This analysis is essential for effective Personal Finance Management, enabling individuals to budget wisely and set financial goals. Regular review of this document promotes better savings and debt control.

Incorporating summary charts and comparison with previous months can enhance clarity and decision-making.

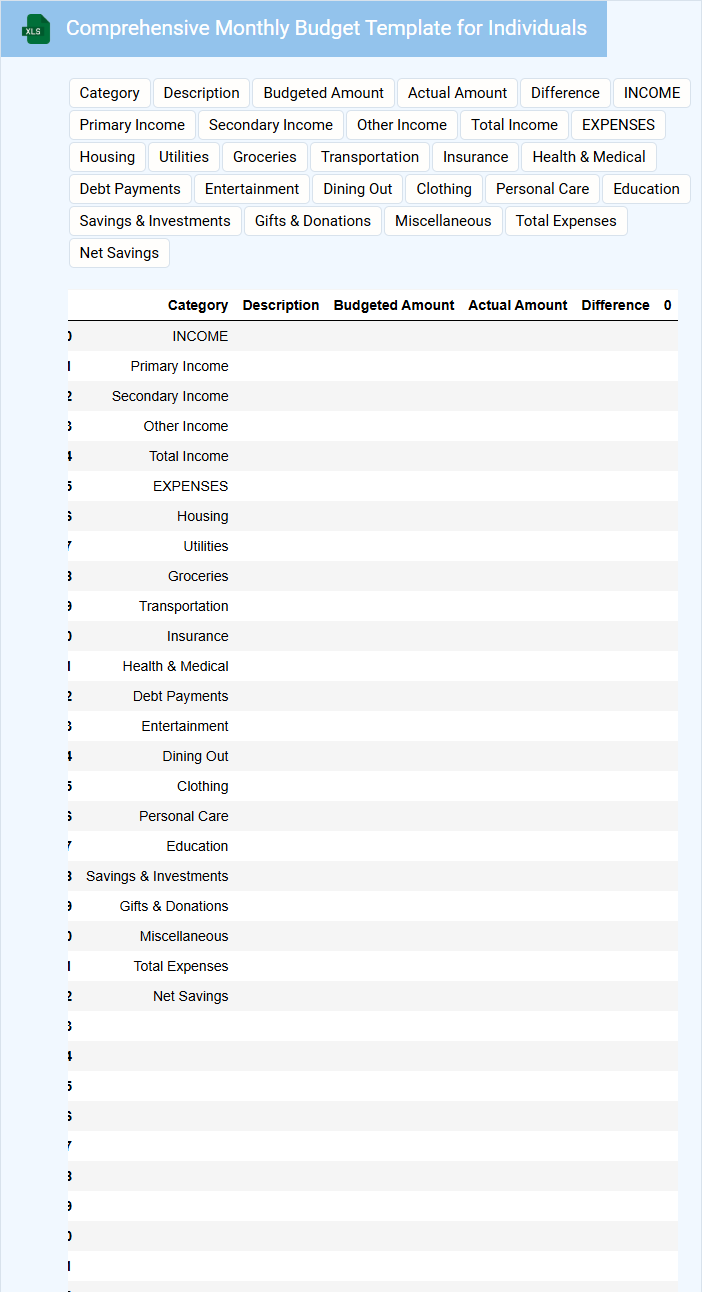

Comprehensive Monthly Budget Template for Individuals

A Comprehensive Monthly Budget Template for individuals typically contains detailed sections for tracking income, fixed expenses, variable expenses, and savings goals. It provides a clear overview of financial inflows and outflows to help manage personal finances effectively.

Important elements to include are categories for debt repayment, emergency funds, and discretionary spending to ensure a balanced budget. Using this template regularly can improve financial awareness and support better money management decisions.

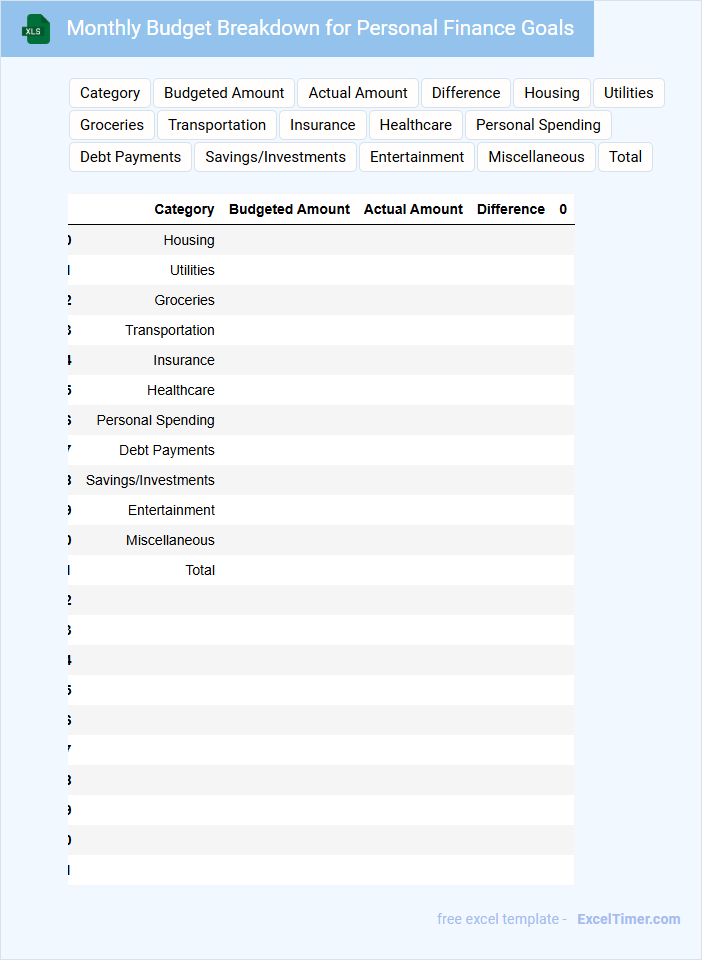

Monthly Budget Breakdown for Personal Finance Goals

A Monthly Budget Breakdown for Personal Finance Goals typically contains detailed records of income, expenses, and savings plans to help individuals manage their finances effectively. It is designed to provide a clear overview of where money is going and how budgets align with financial objectives.

- Include all sources of income to have an accurate baseline for budgeting.

- Track and categorize expenses to identify areas for potential savings.

- Set realistic savings goals to ensure steady progress toward financial targets.

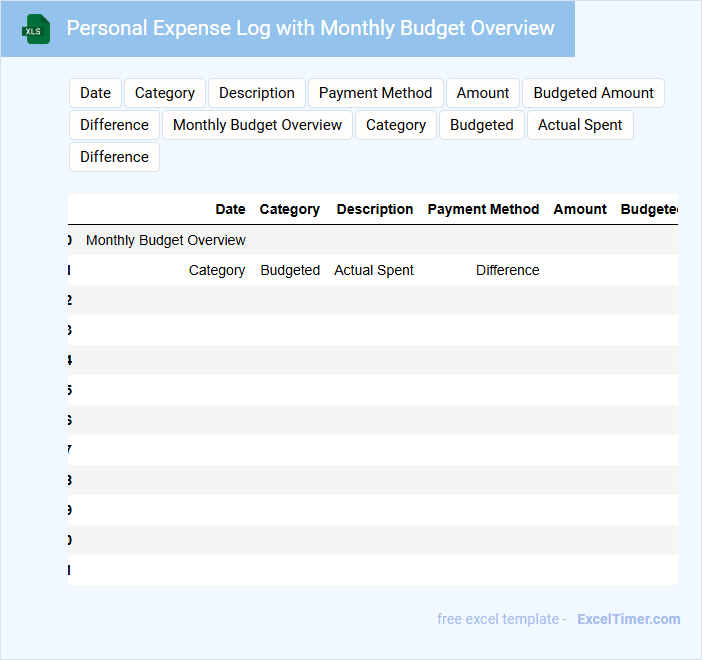

Personal Expense Log with Monthly Budget Overview

This type of document typically contains detailed records of daily expenses along with a summarized monthly budget overview to help track and manage personal finances effectively.

- Consistent entries: Ensure daily expenses are logged promptly for accurate tracking.

- Category breakdown: Use clear expense categories to identify spending patterns.

- Budget comparison: Regularly compare actual expenses against budgeted amounts to control overspending.

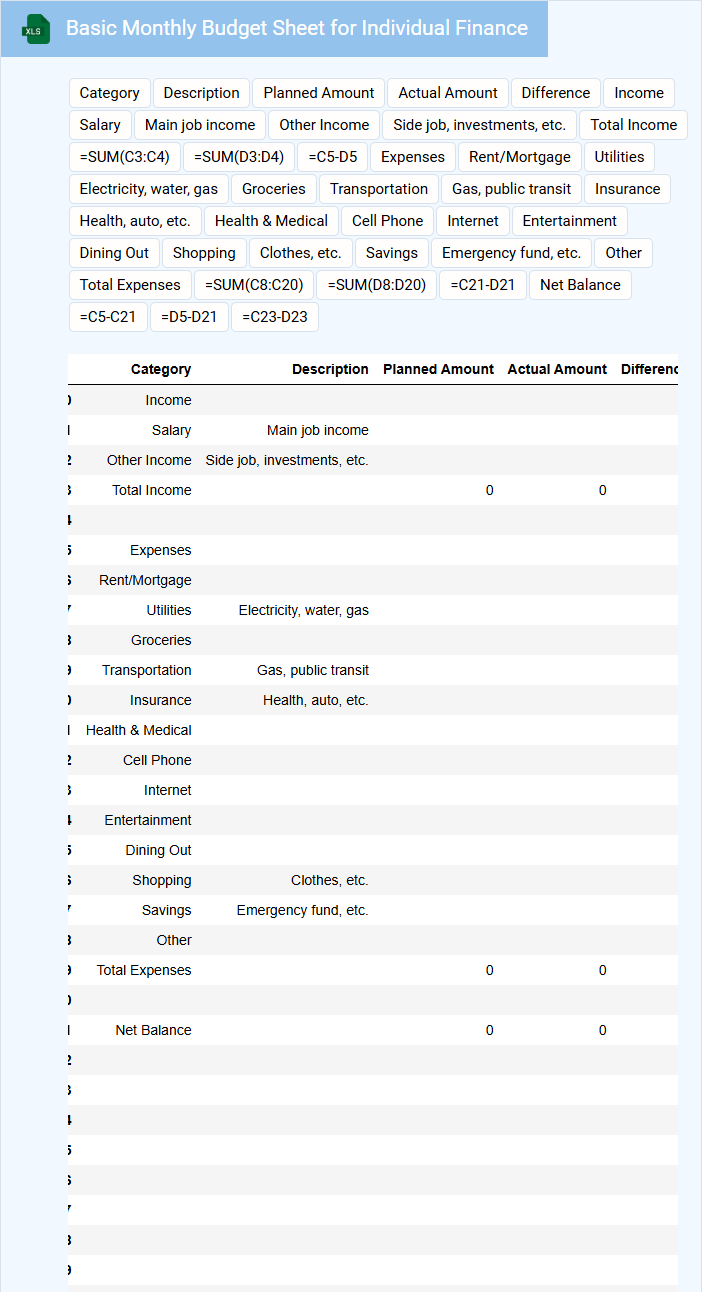

Basic Monthly Budget Sheet for Individual Finance

A Basic Monthly Budget Sheet for Individual Finance typically contains detailed records of income, expenses, and savings goals to help manage personal finances effectively. It is designed to track monthly cash flow and ensure financial stability by monitoring spending habits.

- Include all sources of income with accurate amounts to have a clear financial overview.

- List fixed and variable expenses separately to identify essential and discretionary spending.

- Set realistic savings targets to promote consistent financial growth and emergency fund buildup.

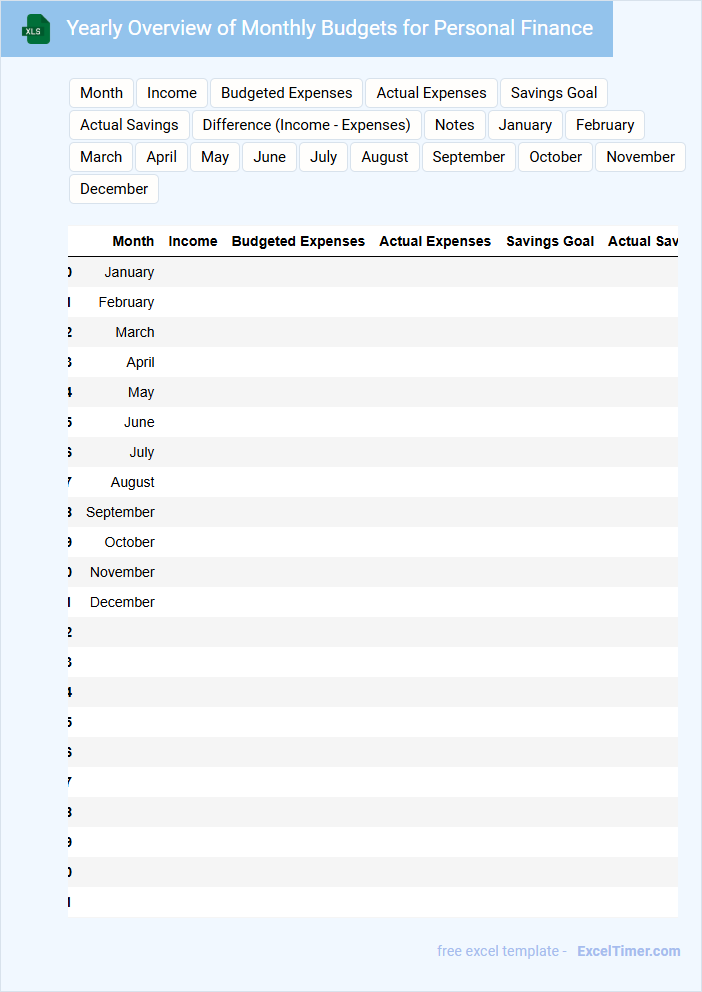

Yearly Overview of Monthly Budgets for Personal Finance

A yearly overview of monthly budgets for personal finance is a comprehensive summary that tracks income, expenses, and savings across all months. It helps identify spending patterns and areas where budgeting adjustments are necessary. Regularly reviewing this document ensures better financial control and goal achievement.

What are the essential categories to include when creating a monthly personal budget in Excel?

Your monthly personal budget in Excel should include essential categories such as Income, Housing (rent or mortgage), Utilities, Food, Transportation, Healthcare, Debt Payments, Savings, and Entertainment. Tracking these categories helps ensure a comprehensive understanding of your financial situation and supports effective money management. Including detailed subcategories like groceries and dining out under Food or car payments and fuel under Transportation enhances accuracy.

How do you accurately track and calculate monthly income versus expenses using Excel formulas?

Use the SUM function to total monthly income and expenses separately by referencing specific cells or ranges. Apply the formula =SUM(income_range) to calculate total income and =SUM(expense_range) for total expenses. Subtract total expenses from total income with =SUM(income_range)-SUM(expense_range) to determine net monthly savings or deficit.

Which Excel tools or features are most effective for monitoring budget variances each month?

Excel features like PivotTables enable detailed analysis of monthly budget variances by summarizing income and expenses. Conditional Formatting highlights overspending or savings, providing instant visual cues on budget deviations. Data Validation restricts input errors, ensuring accurate tracking of financial data for precise monthly variance monitoring.

How can you automate savings calculations within your monthly budget spreadsheet?

Automate savings calculations in your monthly budget spreadsheet by using Excel formulas like SUM and IF to track income and expenses dynamically. Incorporate predefined savings goals as percentages of your income to update savings amounts automatically each month. Your spreadsheet can then provide real-time insights into how much you save versus spend.

What methods can you use in Excel to visualize monthly spending trends and identify areas for improvement?

You can use Excel's built-in chart features such as line charts and bar graphs to visualize monthly spending trends clearly. Conditional formatting helps highlight overspending in specific categories. PivotTables summarize data efficiently, making it easier to identify areas for budgeting improvements.