The Monthly Income Statement Excel Template for Small Businesses simplifies tracking revenue, expenses, and net profit on a monthly basis. It provides a clear, organized format that helps business owners monitor financial performance and make informed decisions. Customizable features allow users to tailor the template to specific business needs, enhancing accuracy and efficiency.

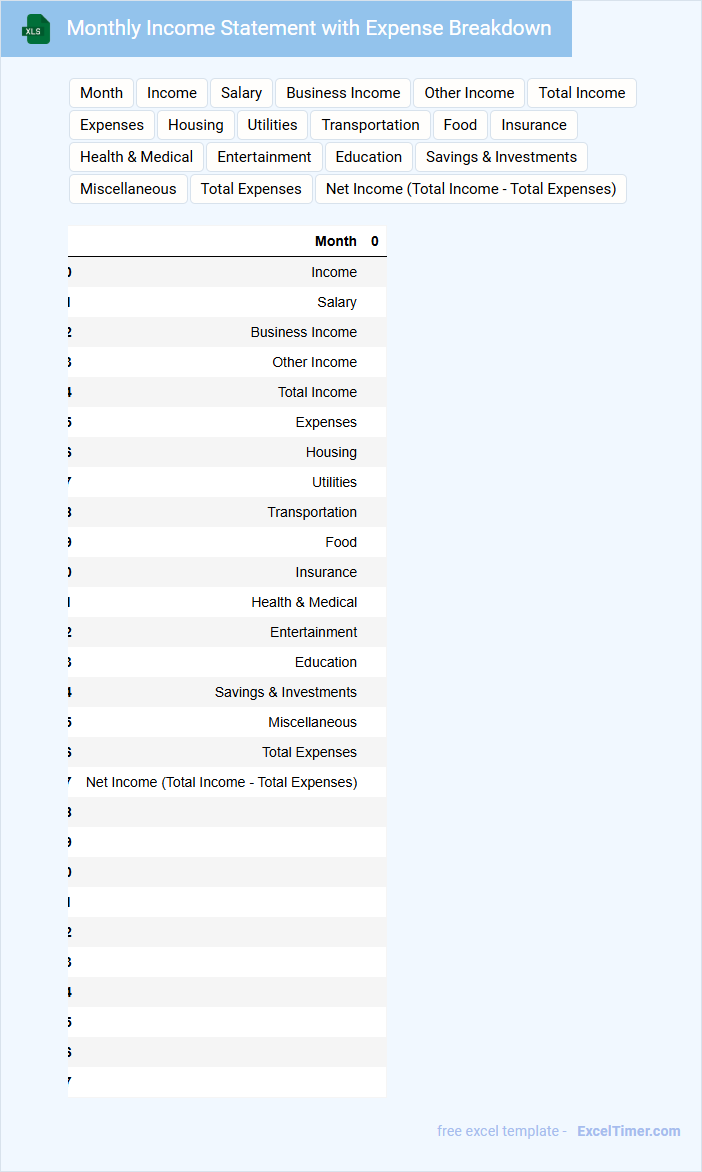

Monthly Income Statement with Expense Breakdown

A Monthly Income Statement typically contains detailed records of revenues, costs, and expenses for a given month. It provides a clear snapshot of a business's financial performance, highlighting profits or losses. Including an expense breakdown helps identify major cost centers and opportunities for budget optimization.

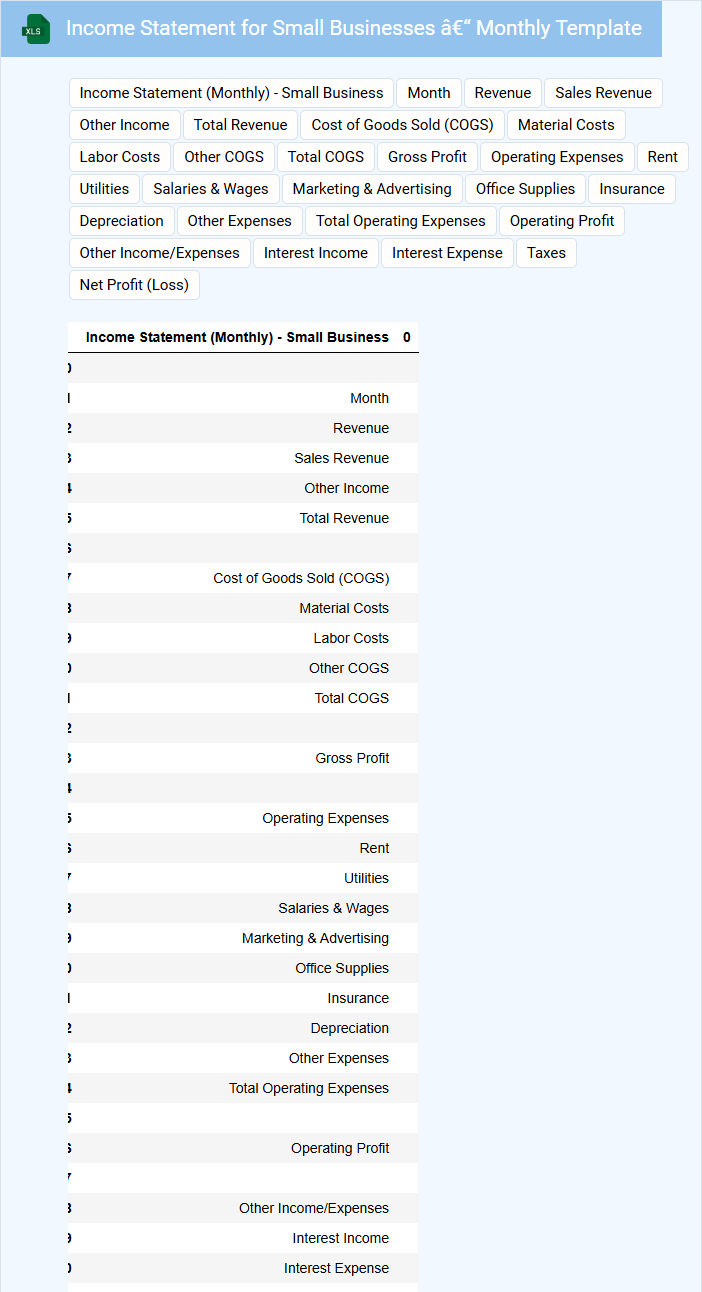

Income Statement for Small Businesses – Monthly Template

An Income Statement for small businesses is a financial document that summarizes revenue, expenses, and profits over a specific month. It helps owners assess their monthly financial performance and make informed decisions. Regularly updating this template ensures accurate tracking of business growth and operational efficiency.

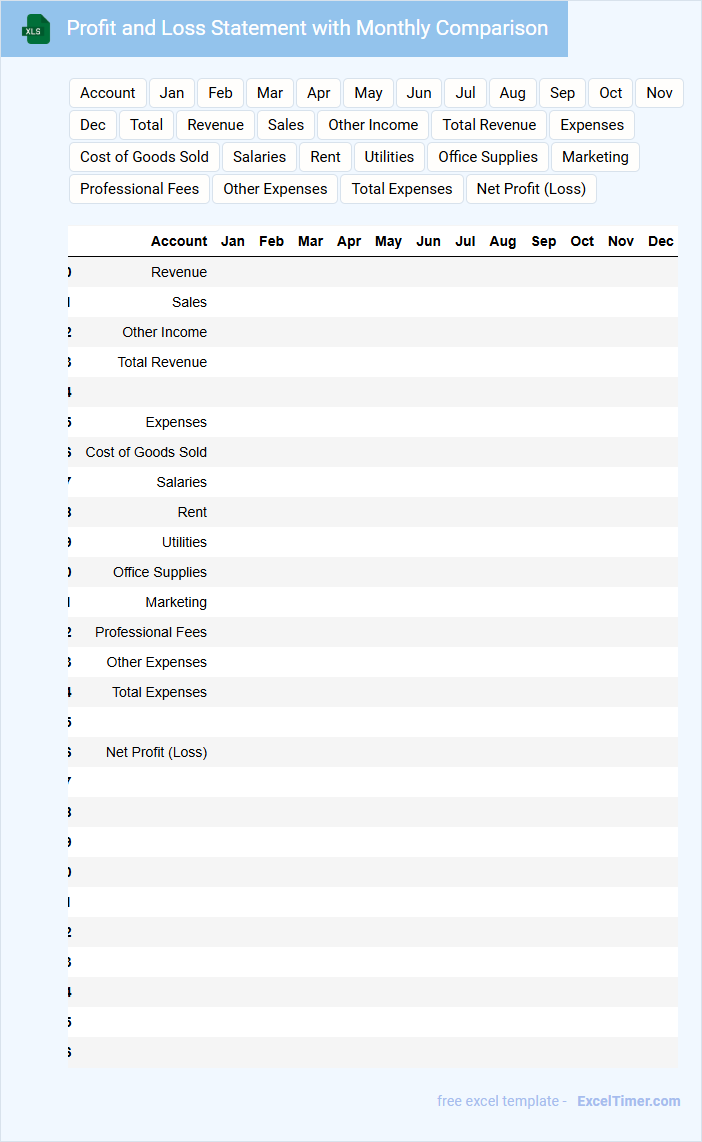

Profit and Loss Statement with Monthly Comparison

A Profit and Loss Statement with Monthly Comparison typically contains financial performance data segmented by month to track revenues, expenses, and net profit over time.

- Revenue tracking: It highlights monthly income streams to analyze sales trends and seasonal variations.

- Expense details: It compares monthly costs, allowing identification of cost-saving opportunities.

- Net profit analysis: It provides insights on profitability fluctuations, crucial for strategic decision making.

Monthly Income and Expense Tracker for Small Companies

The Monthly Income and Expense Tracker is a crucial document for small companies that records all financial transactions within a specific month. It categorizes income and expenses to provide a clear view of cash flow and profitability.

This document usually contains detailed entries of sales revenue, operational costs, payroll expenses, and other financial activities. Accurate tracking helps in budgeting, financial planning, and identifying areas to reduce costs.

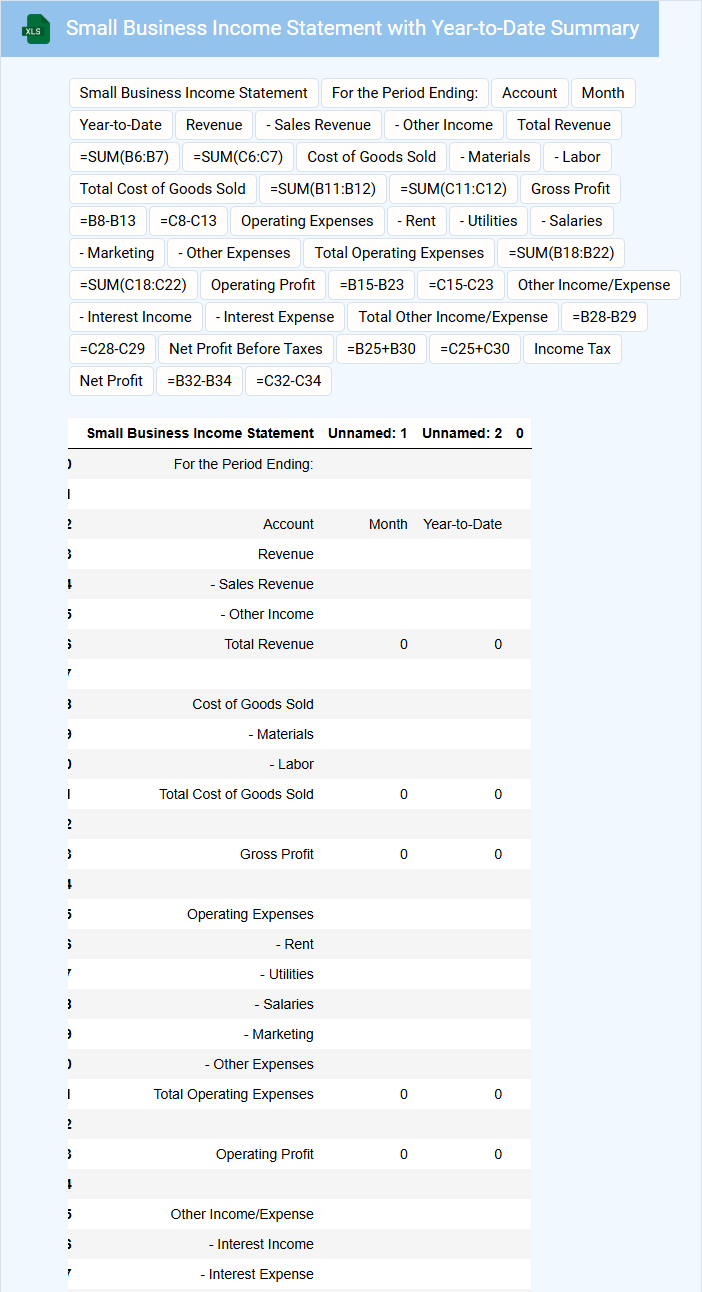

Small Business Income Statement with Year-to-Date Summary

A Small Business Income Statement typically contains detailed revenue and expense information that illustrates the company's profitability over a specific period. It includes categories like sales, cost of goods sold, operational expenses, and net income. The Year-to-Date Summary aggregates this data to offer a cumulative perspective for informed financial decision-making.

Monthly Financial Statement for Small Business Owners

What information does a Monthly Financial Statement for Small Business Owners usually contain? It typically includes detailed records of income, expenses, assets, liabilities, and equity to provide a comprehensive overview of the business's financial health. These documents help owners track cash flow, assess profitability, and make informed decisions for future growth.

What is an important consideration when preparing a Monthly Financial Statement for Small Business Owners? Accuracy and timeliness are crucial to ensure the data reflects the current financial situation, allowing for effective budgeting and detecting potential issues early. Additionally, categorizing expenses and revenues clearly improves clarity and aids in financial analysis.

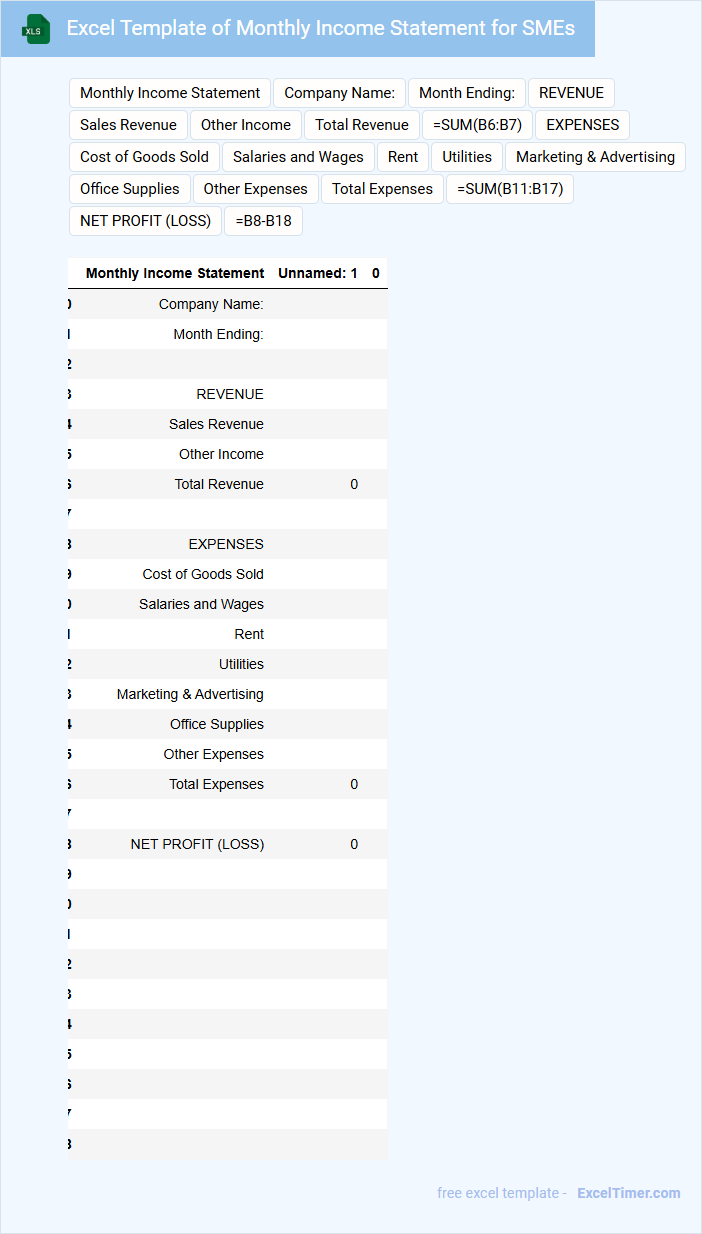

Excel Template of Monthly Income Statement for SMEs

This Excel template for a Monthly Income Statement is designed to help SMEs accurately track their financial performance over the course of a month.

- Revenue Tracking: It is essential to include detailed revenue streams to understand sources of income clearly.

- Expense Categorization: Proper classification of expenses allows for better cost management and profitability analysis.

- Net Profit Calculation: Automatically calculating net profit helps SMEs monitor financial health and make informed decisions.

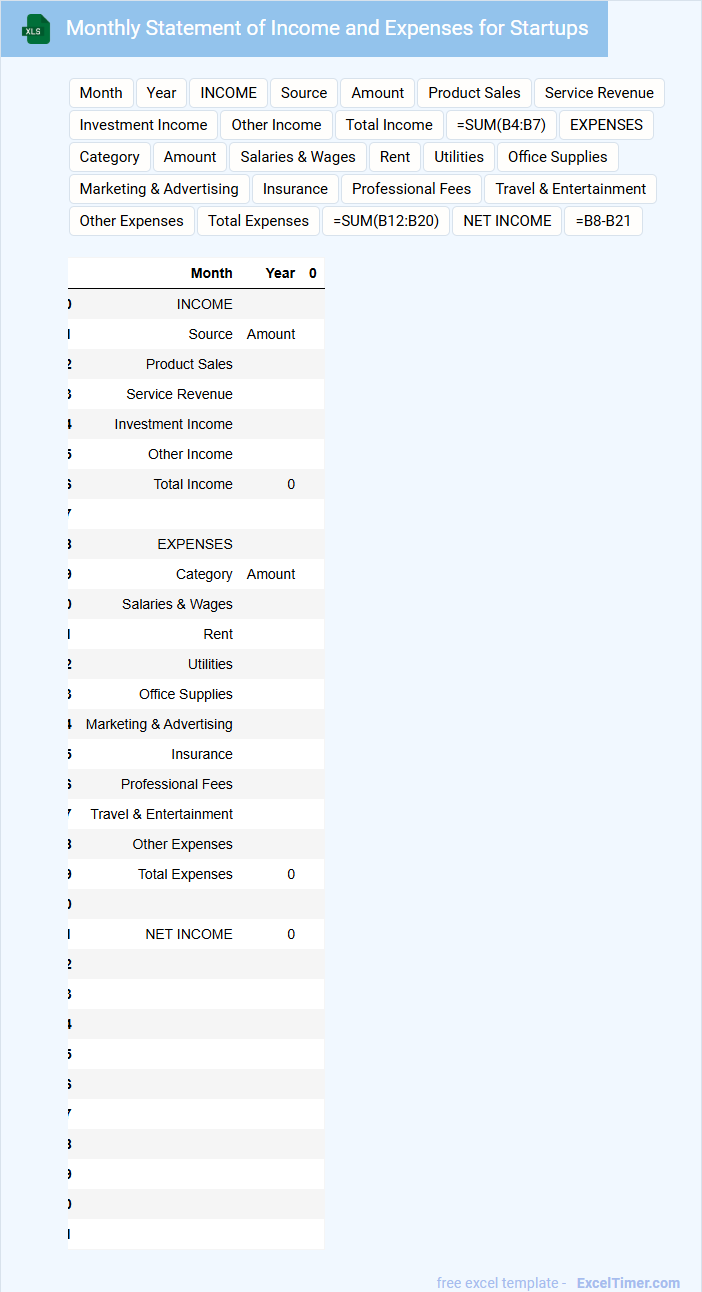

Monthly Statement of Income and Expenses for Startups

The Monthly Statement of Income and Expenses for startups is a financial document that summarizes all revenues earned and costs incurred during a specific month. It provides a snapshot of the startup's financial health by comparing income against expenses.

This report is crucial for tracking budget adherence and cash flow management. Regular review of this statement helps identify spending patterns and areas for potential cost reduction.

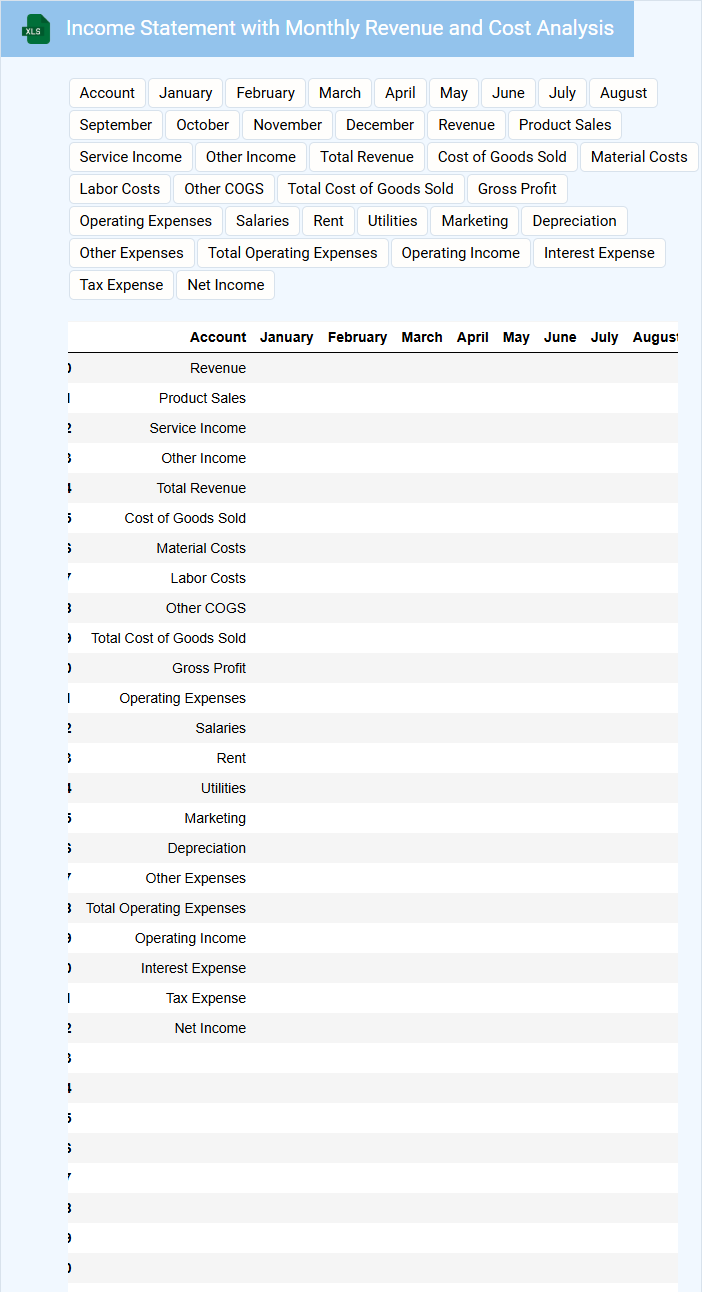

Income Statement with Monthly Revenue and Cost Analysis

What information is typically contained in an Income Statement with Monthly Revenue and Cost Analysis? This document usually includes detailed monthly records of revenue streams and associated costs, providing a clear overview of financial performance over time. It helps businesses track profitability, identify trends, and make informed financial decisions.

What should be considered important when reviewing this document? It is crucial to ensure accuracy in revenue recognition and cost allocation for each month, as well as to analyze fluctuations to understand underlying causes. Consistent categorization and timely updates enable effective budgeting and strategic planning.

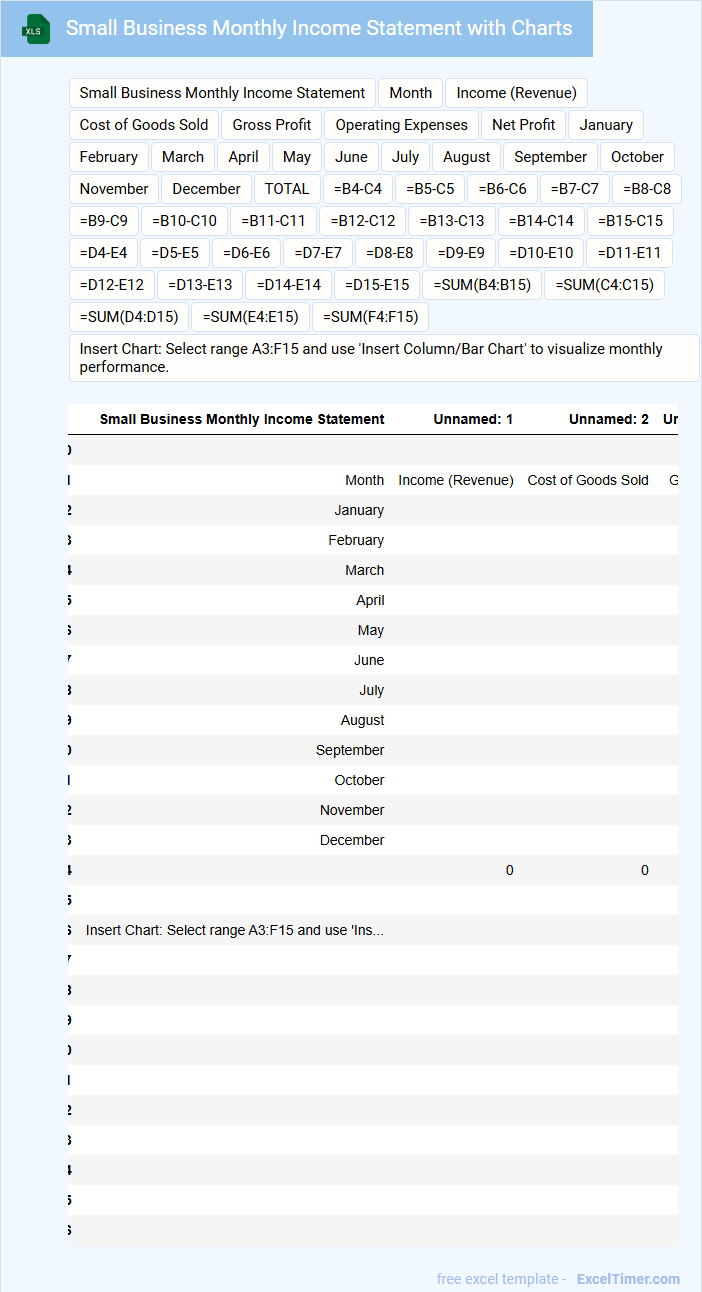

Small Business Monthly Income Statement with Charts

A Small Business Monthly Income Statement typically contains detailed revenue, expenses, and net profit or loss data for a specific month. It provides a clear financial snapshot to track business performance and cash flow trends.

Including charts such as bar graphs and pie charts enhances the visualization of income sources and expense categories. These visuals help identify patterns, making financial analysis more accessible and actionable.

Ensure accuracy in data entry and regularly compare monthly reports to monitor growth and address financial issues promptly.

Monthly Statement for Tracking Income and Costs

A Monthly Statement for Tracking Income and Costs typically contains detailed records of all financial transactions within a month. It includes sources of income, itemized expenses, and the resulting balance to provide a clear financial overview. This document helps individuals and businesses monitor cash flow and make informed budgeting decisions.

Key elements to include are categorized income entries, detailed cost breakdowns, and summaries highlighting net profit or loss. Consistency and accuracy in recording transactions are essential for reliable financial analysis. Including visual aids like charts or graphs can enhance understanding and quick assessment of financial health.

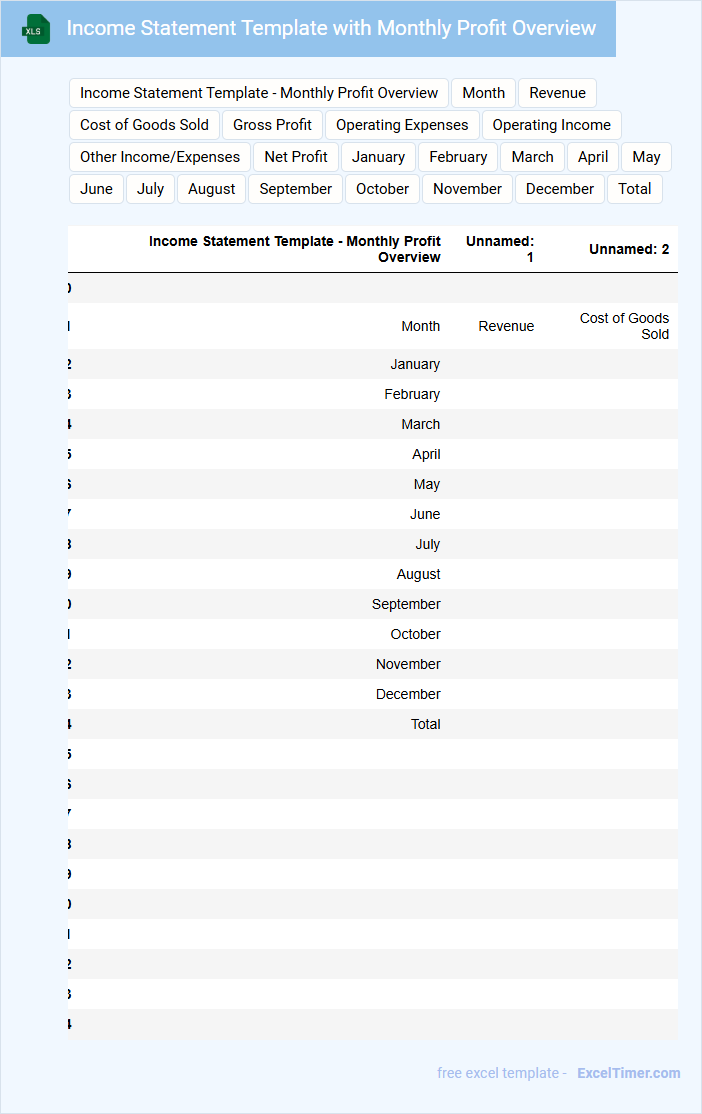

Income Statement Template with Monthly Profit Overview

The Income Statement Template is a financial document that summarizes revenues, expenses, and profits over a specific period, providing a clear snapshot of a company's financial performance. It typically includes detailed categories such as sales, cost of goods sold, operating expenses, and net income.

The Monthly Profit Overview section highlights the profit trends and variations across each month to help identify seasonal patterns and growth opportunities. This template aids stakeholders in making informed decisions by presenting organized and timely financial data.

Ensure accuracy in recording all financial transactions and regularly update the template to reflect current performance for meaningful insights.

Monthly Financial Overview for Small Business Operations

A Monthly Financial Overview for Small Business Operations typically contains key financial statements such as the income statement, balance sheet, and cash flow statement. This document highlights revenue trends, expense breakdowns, and profitability to provide a clear snapshot of the business's financial health. It is essential for tracking performance, budgeting, and making informed strategic decisions.

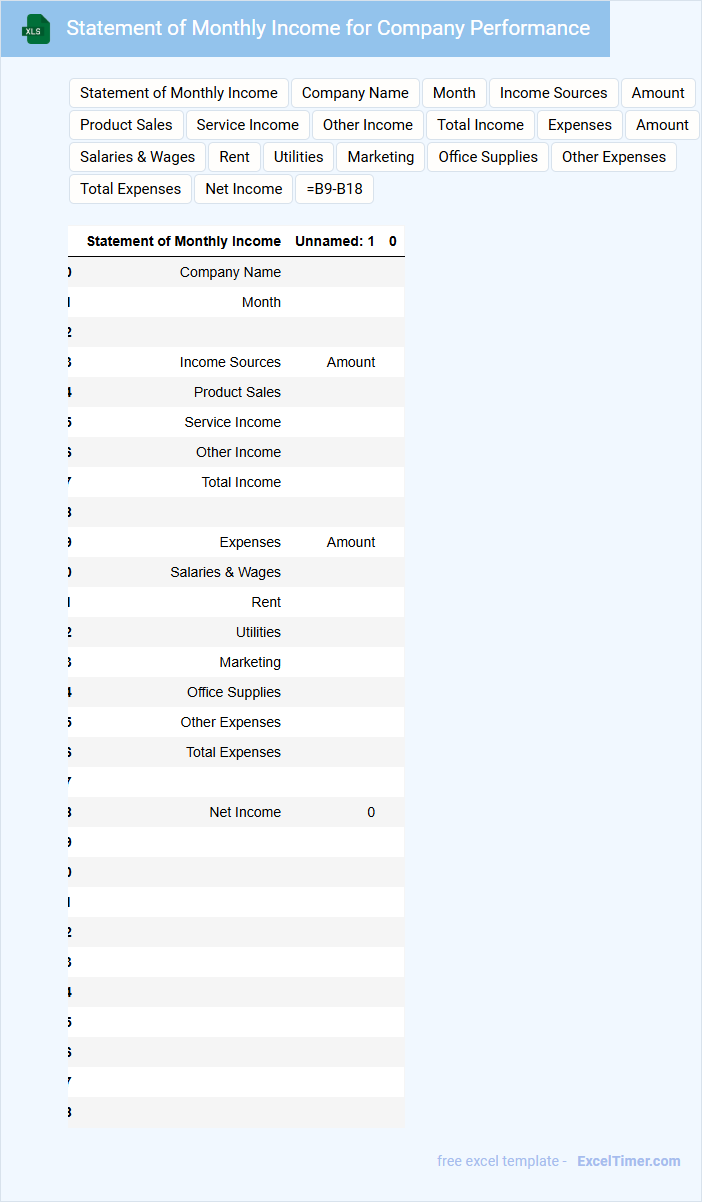

Statement of Monthly Income for Company Performance

A Statement of Monthly Income is a financial document that outlines a company's revenues, expenses, and net profit over a specific month. It typically includes detailed breakdowns of sales, cost of goods sold, operating expenses, and other income or losses. This document is essential for assessing the company's financial performance and making informed business decisions.

Important elements to include are accurate recording of all income sources, clear categorization of expenses, and a comparison with previous months to identify trends. Ensuring timely preparation and review by management enhances its usefulness in monitoring business health. Additionally, including notes on any significant financial events during the month can provide valuable context.

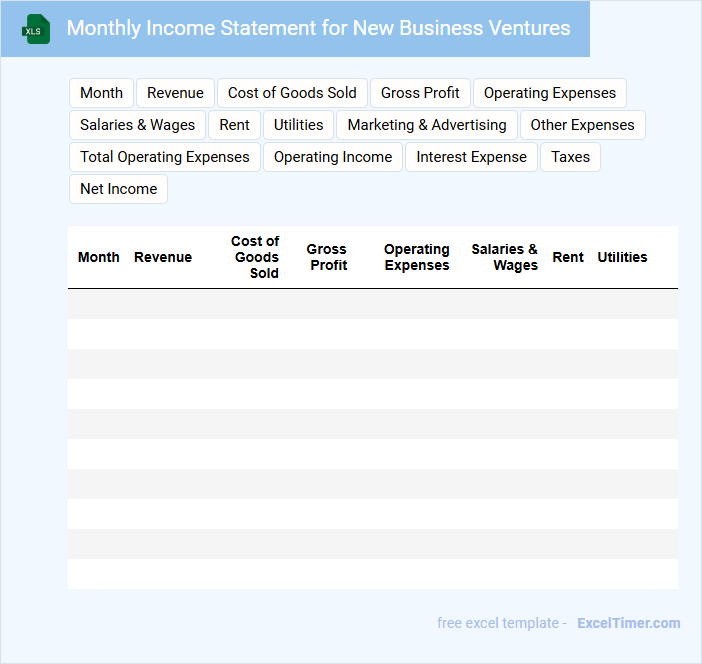

Monthly Income Statement for New Business Ventures

The Monthly Income Statement summarizes the revenues, expenses, and profits or losses for a new business venture within a specific month. It provides key financial insights that help stakeholders assess the business's operational efficiency and profitability.

Typically, this document contains detailed listings of income sources, operating costs, taxes, and net income. For new ventures, it is important to track cash flow closely and highlight any unexpected expenses to ensure sustainability and growth.

What key components should be included in a monthly income statement for small businesses in Excel?

Your monthly income statement in Excel should include key components such as total revenue, cost of goods sold (COGS), gross profit, operating expenses, and net income. Accurate tracking of sales, returns, and discounts is essential for reflecting true revenue. Including categories like salaries, rent, utilities, and marketing expenses helps you analyze your business profitability and financial performance effectively.

How do you categorize and input revenue and expense data for accurate monthly reporting?

To categorize and input revenue and expense data accurately in your Monthly Income Statement for Small Businesses, organize entries by specific categories such as sales revenue, operating expenses, and cost of goods sold. Use consistent date formats and detailed descriptions to ensure clarity and traceability. Accurate categorization improves financial analysis and helps you make informed business decisions.

What Excel formulas or functions are essential for calculating net profit or loss each month?

Essential Excel functions for calculating monthly net profit or loss include SUM to total revenue and expenses, and SUBTRACT or simple subtraction formulas to find the difference between total income and total costs. The SUMIF function helps categorize and sum specific income or expense items, while basic arithmetic formulas ensure accurate net calculations. Using these formulas in your Monthly Income Statement allows you to track your small business's profitability efficiently.

How can you use Excel tools to visualize monthly income statement trends (e.g., charts, conditional formatting)?

Excel tools like charts and conditional formatting help you visualize monthly income statement trends by highlighting revenue, expenses, and profit fluctuations. Create line or bar charts to track income and cost patterns over time for small businesses. Use conditional formatting to quickly identify key financial performance indicators and outliers.

Which best practices ensure the accuracy and consistency of monthly income statements in Excel?

To ensure accuracy and consistency in your monthly income statements in Excel, use structured templates with predefined formulas and consistent data entry formats. Implement data validation rules to minimize input errors and regularly reconcile statements with bank records and invoices. Automate calculations for revenue, expenses, and net income to maintain reliable financial reporting.