The Monthly Investment Portfolio Excel Template for Individual Investors offers a streamlined way to track and analyze investment performance on a monthly basis. It enables users to monitor asset allocation, calculate returns, and assess risk exposure with customizable charts and formulas. Regular updates to the portfolio data help individual investors make informed decisions and optimize their investment strategies effectively.

Monthly Investment Portfolio Tracker for Individual Investors

A Monthly Investment Portfolio Tracker for Individual Investors is a document designed to monitor and analyze the performance of personal investments over time. It helps investors make informed decisions by providing a clear overview of asset allocation and growth trends.

- Include key financial metrics such as portfolio value, returns, and asset diversification.

- Update regularly to reflect market changes and investment activity.

- Incorporate visual aids like charts and graphs for easier performance tracking.

Excel Template for Monthly Investment Portfolio Management

An Excel Template for Monthly Investment Portfolio Management typically contains organized sheets for tracking asset allocation, monthly contributions, and portfolio performance. It includes tables for recording individual investments, dividends, and gains or losses. This type of document helps investors maintain a clear overview of their financial progress and adjust strategies accordingly.

Investment Portfolio Monitoring Sheet for Individuals (Monthly)

What information does an Investment Portfolio Monitoring Sheet for Individuals (Monthly) typically contain? It generally includes a detailed record of all investments, such as stocks, bonds, mutual funds, and other assets, along with their current values and monthly performance metrics. This document helps individuals track their portfolio growth, assess risks, and make informed decisions about buying or selling assets.

Why is it important to regularly update and review this monitoring sheet? Regular updates ensure accurate tracking of investment performance and help identify trends or issues early. Consistent review allows investors to adjust their strategies, rebalance asset allocations, and optimize returns while mitigating potential losses.

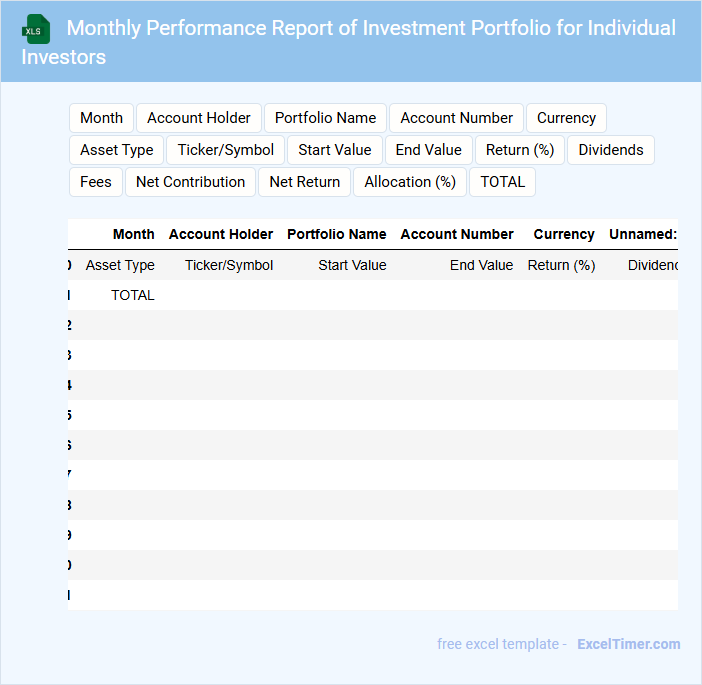

Monthly Performance Report of Investment Portfolio for Individual Investors

A Monthly Performance Report of Investment Portfolio for Individual Investors typically summarizes the portfolio's returns, risk metrics, and asset allocation within the given month.

- Portfolio Returns: Clearly present the monthly and year-to-date returns to track investment performance over time.

- Risk Assessment: Include risk indicators such as volatility and drawdowns to highlight portfolio stability.

- Asset Allocation: Show the breakdown of investments by asset class to ensure diversification and alignment with investment goals.

Portfolio Allocation Overview with Monthly Tracking for Investors

What information is typically included in a Portfolio Allocation Overview with Monthly Tracking for Investors? This type of document usually contains a detailed summary of the investor's current asset allocation across various categories such as stocks, bonds, and cash, along with historical monthly performance data. It highlights trends, risk levels, and adjustments made to maintain or improve portfolio balance, helping investors make informed decisions.

Why is it important to include monthly tracking and clear allocation data in such a document? Monthly tracking allows investors to monitor portfolio changes over time and quickly identify deviations from target allocations. Clear, semantic presentation ensures the information is accessible and actionable, promoting better portfolio management and strategic investment planning.

Monthly Growth Analysis of Investments for Individual Portfolios

Monthly Growth Analysis of Investments typically contains detailed insights into the performance of individual portfolios, highlighting returns and risk factors. It offers a comprehensive review of asset allocation, market trends, and portfolio adjustments over the month. Important considerations include consistency in reporting, clear visualization of growth metrics, and actionable recommendations for portfolio optimization.

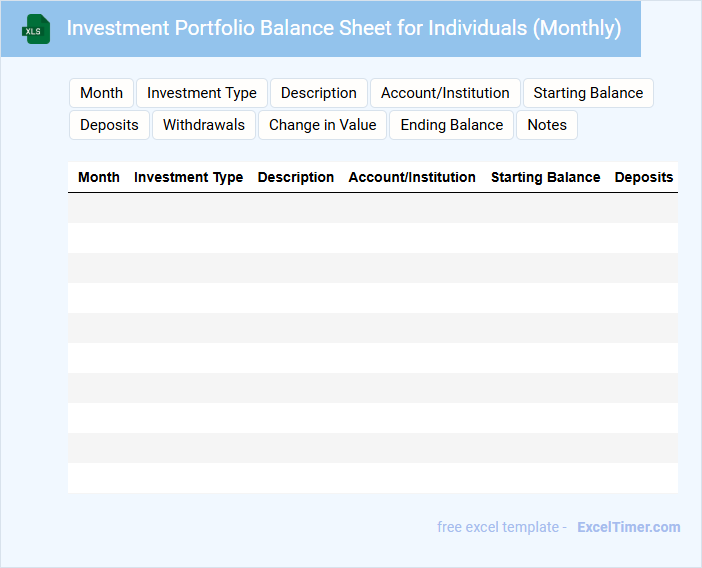

Investment Portfolio Balance Sheet for Individuals (Monthly)

The Investment Portfolio Balance Sheet for individuals is a financial document that summarizes the current value of all investment assets and liabilities on a monthly basis. It typically contains details about stocks, bonds, mutual funds, cash holdings, and any outstanding debts related to investments. Keeping this sheet updated helps investors monitor their financial health and make informed decisions.

Expense and Return Tracker with Monthly Portfolio Updates

What information is typically contained in an Expense and Return Tracker with Monthly Portfolio Updates? This document usually includes detailed records of expenses and returns associated with investments, organized on a monthly basis to track financial performance over time. It helps users monitor their portfolio growth, understand spending patterns, and make informed decisions based on updated financial data.

What is an important aspect to consider when maintaining this document? Consistency in updating data each month is crucial to ensure accuracy and reliability, enabling clear trend analysis and effective portfolio management. Additionally, categorizing expenses and returns clearly aids in identifying areas for cost reduction and optimizing investment strategies.

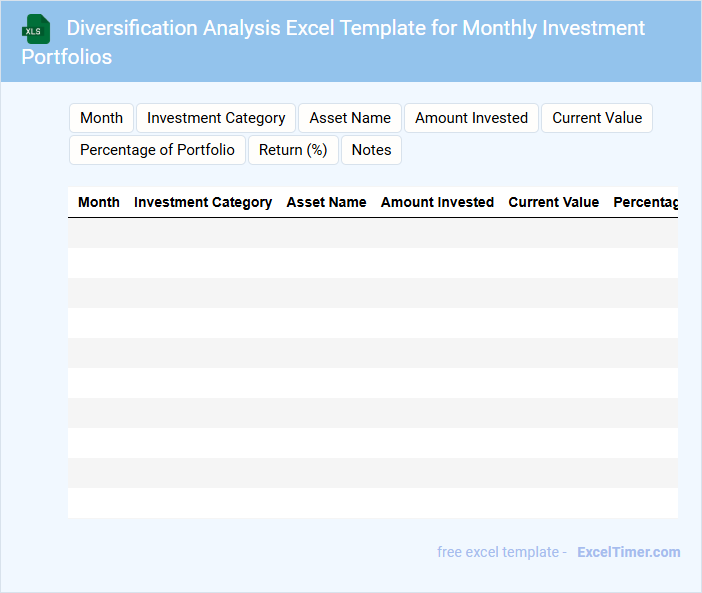

Diversification Analysis Excel Template for Monthly Investment Portfolios

A Diversification Analysis Excel Template for Monthly Investment Portfolios is a structured document used to evaluate the distribution of assets across various categories. It typically contains data entries for asset classes, monthly performance figures, and allocation percentages. This template helps investors identify risk concentrations and optimize portfolio balance.

Key elements to include are asset allocation breakdowns, risk assessment metrics, and visual charts for trend analysis. Ensuring up-to-date data entry each month is crucial for accurate insights. Additionally, incorporating conditional formatting highlights potential overexposure or under-diversification areas.

For optimal use, users should focus on maintaining correct formula links and reviewing diversification scores regularly. Including benchmarks for comparison improves decision-making effectiveness. Regular backups and version control safeguard against data loss during ongoing portfolio adjustments.

Capital Gains Summary with Monthly Updates for Individual Investors

A Capital Gains Summary document provides an overview of investment profits or losses realized over a specific period. It typically includes monthly updates detailing transactions, asset sales, and gain calculations to help investors track their portfolio performance.

For individual investors, this summary is crucial for accurate tax reporting and strategic financial planning. Important considerations include regularly reviewing the document for accuracy and understanding how gains impact taxable income.

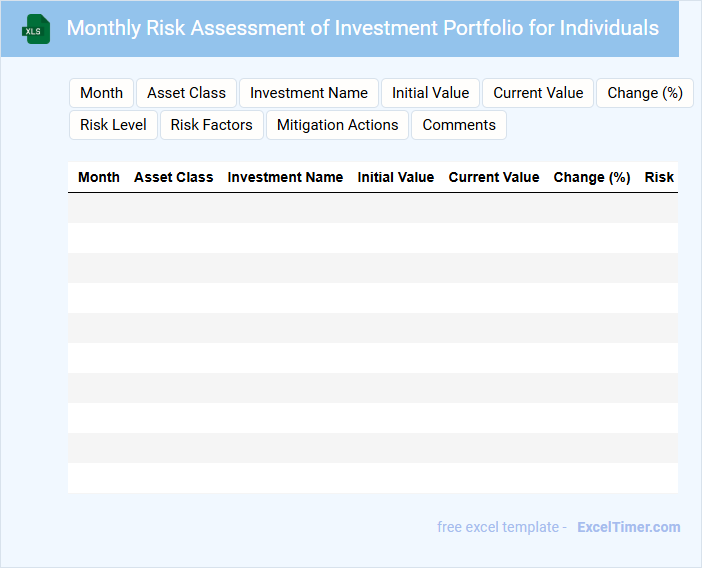

Monthly Risk Assessment of Investment Portfolio for Individuals

This document typically contains an evaluation of potential risks associated with an individual's investment portfolio on a monthly basis.

- Portfolio Diversification: Analyzes the distribution of assets to minimize exposure to any single investment.

- Market Volatility Impact: Assesses how recent market fluctuations might affect portfolio value and stability.

- Risk Mitigation Strategies: Suggests actionable steps to reduce identified risks and protect investments.

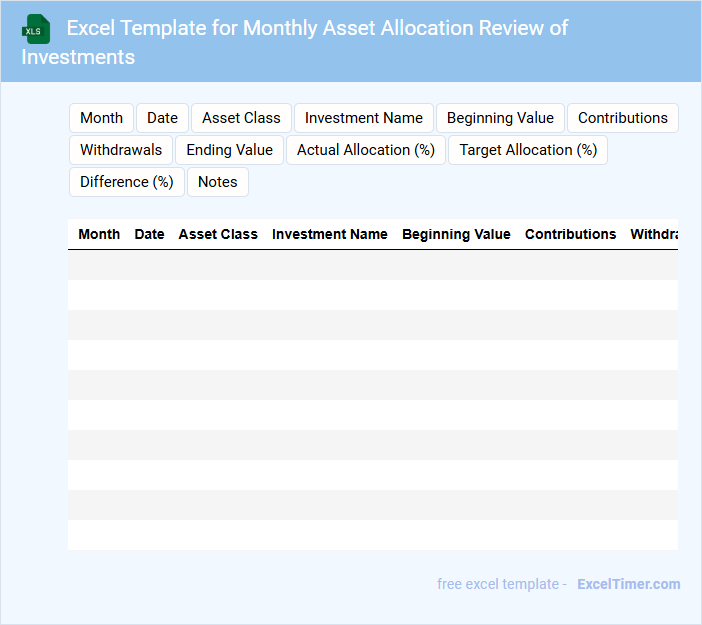

Excel Template for Monthly Asset Allocation Review of Investments

The Excel Template for Monthly Asset Allocation Review of Investments typically contains detailed tabs for asset categories, performance metrics, and transaction histories. It is designed to track the distribution and changes in investment portfolios over time efficiently.

Regularly updating the allocation percentages and comparing them against target benchmarks is crucial to maintain balance and optimize returns. Ensuring accurate data input and including visual charts enhances clarity and decision-making.

Income Report with Monthly Portfolio Overview for Investors

What information is typically included in an Income Report with Monthly Portfolio Overview for Investors? This document usually contains detailed financial data such as income statements, profit and loss summaries, and portfolio performance metrics for the month. It provides investors with transparent insights into earnings and key investment activities to help them make informed decisions.

What important aspects should be highlighted in such a report? The report should emphasize net income changes, dividend distributions, asset allocation, and risk assessments to present a clear financial status. Including comparative analysis with previous months and market trends further enhances its value to investors.

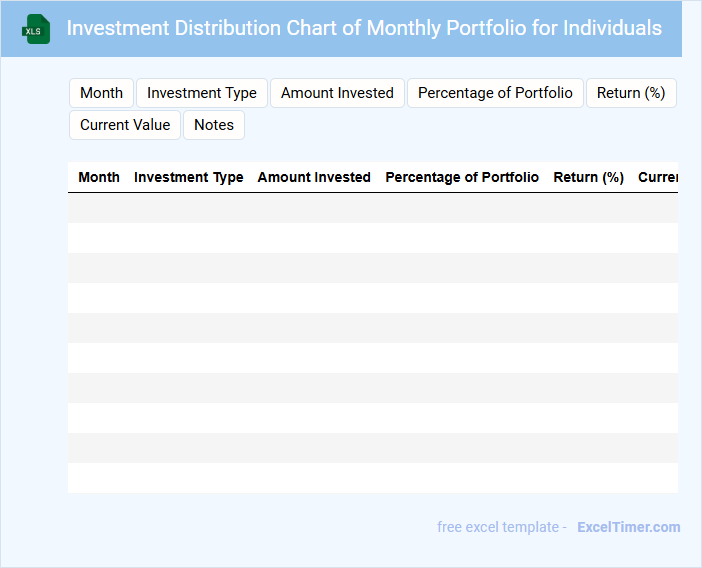

Investment Distribution Chart of Monthly Portfolio for Individuals

Investment Distribution Chart of Monthly Portfolio for Individuals typically displays the allocation of various asset classes and sectors within an individual's investment portfolio over a month.

- Asset Allocation: Highlights the proportion of investments in stocks, bonds, real estate, and cash equivalents to balance risk and return.

- Performance Trends: Shows monthly changes in value and growth patterns of different assets to guide investment decisions.

- Diversification: Emphasizes a varied mix of assets to reduce risk and maximize potential returns over time.

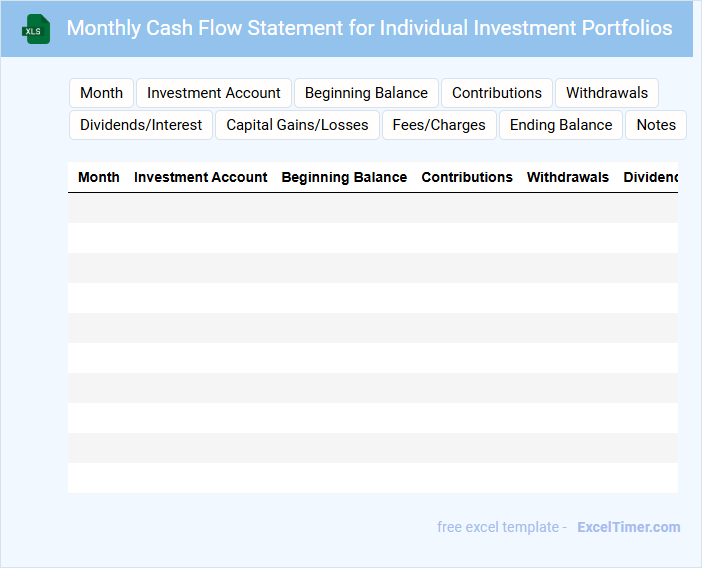

Monthly Cash Flow Statement for Individual Investment Portfolios

A Monthly Cash Flow Statement for Individual Investment Portfolios typically contains a detailed record of all inflows and outflows of cash within a given month. It documents sources such as dividends, interest, and sales of assets, as well as expenses like fees and new investments. This statement is essential for tracking liquidity and ensuring financial stability over time.

What essential data fields should be included in a Monthly Investment Portfolio Excel document for individual investors?

A Monthly Investment Portfolio Excel document for individual investors should include essential data fields such as Asset Name, Asset Type, Purchase Date, Quantity, Purchase Price, Current Market Price, Total Investment Value, Monthly Dividends or Interest, Capital Gains or Losses, and Portfolio Allocation Percentage. Tracking these fields enables accurate performance analysis, risk assessment, and informed decision-making. Including columns for Transaction Type and Notes can provide additional context for specific trades or investment strategies.

How can asset allocation categories (stocks, bonds, cash, etc.) be effectively structured in the spreadsheet?

Organize your Monthly Investment Portfolio spreadsheet by creating distinct columns for each asset allocation category such as stocks, bonds, and cash, allowing clear tracking of percentage or dollar amounts. Use separate rows to list individual investments within each category, enabling detailed analysis and performance comparison. Incorporate formulas to automatically calculate total allocation percentages and portfolio diversification metrics for accurate, real-time asset distribution insights.

What formulas are necessary to automatically calculate monthly gains, losses, and overall portfolio performance?

To calculate monthly gains and losses in an Excel investment portfolio, use the formula: =(Ending Value - Beginning Value) for each asset. Determine overall portfolio performance by calculating the weighted average return with =SUMPRODUCT(Asset Returns, Portfolio Weights). Use =IF to handle dividends or additional contributions for accurate monthly net gains.

Which visualization tools (charts, graphs) best summarize portfolio value trends over time?

Line charts effectively display your portfolio value trends over time by highlighting continuous changes and growth patterns. Area charts emphasize the cumulative value, providing a clear visual of total portfolio appreciation. Combining these with bar charts for monthly contributions offers comprehensive insights into investment performance and cash flow.

How can risk and diversification levels be tracked and displayed in the monthly report?

Track risk levels using metrics such as standard deviation, beta, and Value at Risk (VaR) displayed in the monthly report. Display diversification by showing the allocation percentages across asset classes, sectors, and geographic regions. Use visual tools like pie charts and heat maps to illustrate the portfolio's risk exposure and diversification status clearly.