![]()

The Monthly Expense Tracker Excel Template for Small Businesses helps efficiently monitor and organize all business expenditures on a monthly basis. It provides customizable categories, automatic calculations, and visual summaries to simplify budgeting and financial analysis. Using this template ensures small business owners maintain accurate records, control cash flow, and make informed financial decisions.

Monthly Expense Tracker Excel Template for Small Businesses

A Monthly Expense Tracker Excel Template typically contains detailed records of business expenditures categorized by type, date, and amount. It provides a clear overview of a small business's financial outflows, helping to monitor and control costs effectively.

The template usually includes columns for fixed and variable expenses, notes on transactions, and summary sections for total spending. For best results, ensure consistent updating and accurate data entry to maintain reliable financial insights.

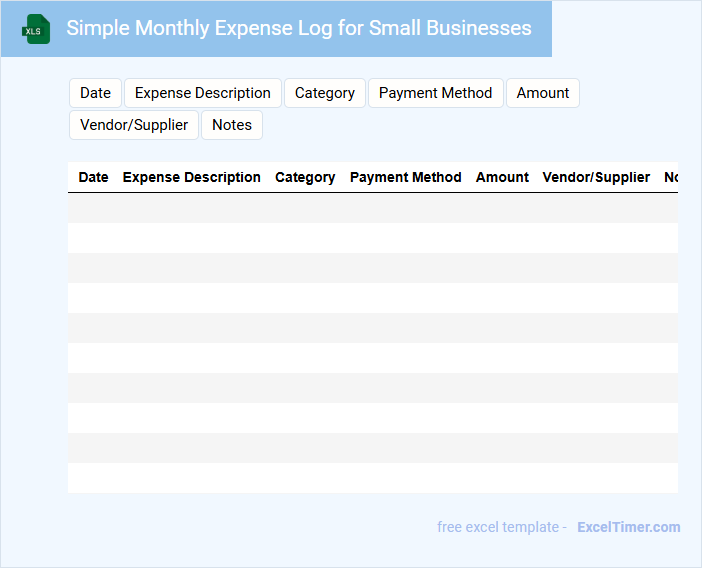

Simple Monthly Expense Log for Small Businesses

A Simple Monthly Expense Log for small businesses is a crucial document that tracks all monthly expenditures to help manage cash flow effectively. It typically contains categories such as rent, utilities, office supplies, and miscellaneous expenses. Regularly updating this log supports better budgeting and financial decision-making.

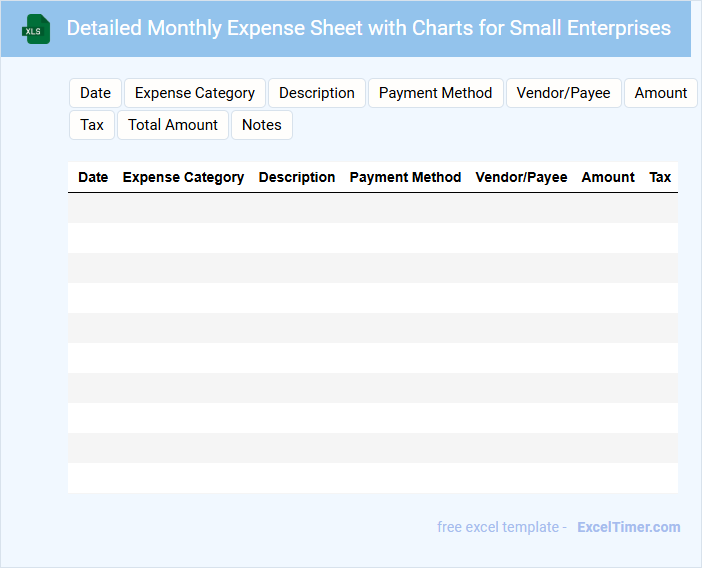

Detailed Monthly Expense Sheet with Charts for Small Enterprises

A Detailed Monthly Expense Sheet with Charts for Small Enterprises typically contains itemized records of all expenditures categorized by type and date, providing clarity on financial outflows each month. It is designed to help small business owners track spending patterns and identify areas for cost optimization.

- Include categories such as office supplies, utilities, payroll, and marketing to ensure comprehensive tracking.

- Incorporate visual charts like pie charts or bar graphs to illustrate expense distribution clearly.

- Regularly update and review the sheet to maintain accurate financial insights and support budgeting decisions.

Monthly Business Expense Tracker with Category Filters

A Monthly Business Expense Tracker document typically contains detailed records of all business-related expenses categorized by type, such as utilities, office supplies, and travel. It allows for easy monitoring and management of finances across specific periods.

Category filters enhance this document by enabling quick sorting and analysis of expenses, helping identify spending patterns and potential cost-saving opportunities. Incorporating clear date entries and accurate receipt references is essential for maintaining reliable records.

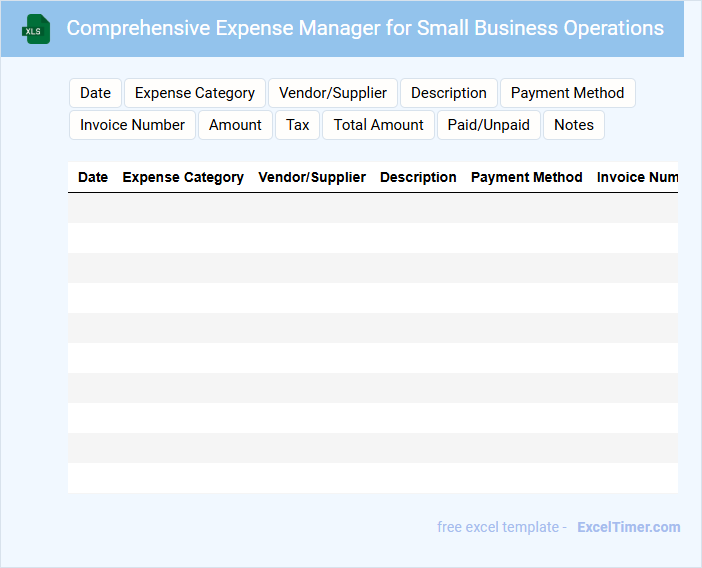

Comprehensive Expense Manager for Small Business Operations

This document typically outlines the structure and key features of a Comprehensive Expense Manager tailored for small business operations, designed to streamline financial tracking and reporting. It serves as a guideline to ensure efficient budget management and expense control.

- Include detailed categories for various expense types to enhance tracking accuracy.

- Incorporate automated reporting tools for real-time financial insights.

- Ensure user-friendly interfaces for easy adoption by non-financial staff.

Monthly Expense Monitoring Sheet with Summary for Small Firms

A Monthly Expense Monitoring Sheet is a financial document used by small firms to track their expenses over a specific period. It normally contains detailed entries of costs, categorized by type, date, and amount, facilitating easy analysis.

The document also includes a summary section that consolidates total expenditures, highlights significant spending patterns, and helps in budgeting decisions. Regular updates and accuracy are crucial for effective expense management.

Automated Monthly Expense Report for Small Businesses

What information is typically included in an Automated Monthly Expense Report for Small Businesses? This type of document usually contains detailed records of all business-related expenditures over the month, categorized by type such as office supplies, utilities, and payroll. It provides a clear overview of spending patterns, helping small business owners track expenses efficiently and make informed financial decisions.

What are important considerations when creating an Automated Monthly Expense Report? Ensuring accuracy through automatic data imports and categorization is crucial for reliability. Additionally, including visual summaries like graphs and providing customizable filters can enhance the report's usability and clarity for better financial analysis.

Monthly Budget and Expense Tracker with Projections

A Monthly Budget and Expense Tracker with Projections is a financial document used to monitor income, expenses, and forecast future financial status. It helps individuals or businesses plan spending and savings effectively.

- Include detailed categories for income sources and expense types to ensure accurate tracking.

- Incorporate projections based on past data to anticipate future financial outcomes.

- Regularly update the document to reflect actual spending and adjust budgets accordingly.

Cash Flow and Expense Tracker for Small Business Owners

What information is typically included in a Cash Flow and Expense Tracker for Small Business Owners? This document usually contains detailed records of all incoming cash flow and outgoing expenses to monitor the financial health of the business. It helps owners manage liquidity, plan budgets, and identify spending patterns crucial for making informed decisions.

What is an important feature to consider when using this tracker? Accuracy and timeliness in recording transactions are essential to provide a clear and up-to-date financial picture, enabling proactive business management and effective cash flow forecasting.

Monthly Expense Management Template with Receipts Section

This type of document typically contains a detailed monthly expense log to track all outgoing payments systematically. It often includes categorized entries for bills, groceries, and other recurring costs for easier financial oversight.

One crucial component is the receipts section, which helps to store physical or digital proofs of purchases for accuracy and future reference. Including a summary or total expense calculation will aid in quick financial review and budgeting adjustments.

Expense Tracking Spreadsheet for Startup Businesses

An Expense Tracking Spreadsheet for startup businesses is a vital document used to record and monitor all financial transactions efficiently. It typically contains categorized expenses, dates, payment methods, and vendor details to ensure proper financial management. Maintaining this spreadsheet helps startups control costs, prepare budgets, and generate accurate financial reports.

It is important to regularly update the spreadsheet, ensure clear categorization of expenses, and reconcile it with bank statements for accuracy. Using formulas to automatically calculate totals and analyze trends can enhance its usefulness. Additionally, safeguarding this document with backups is essential to prevent data loss.

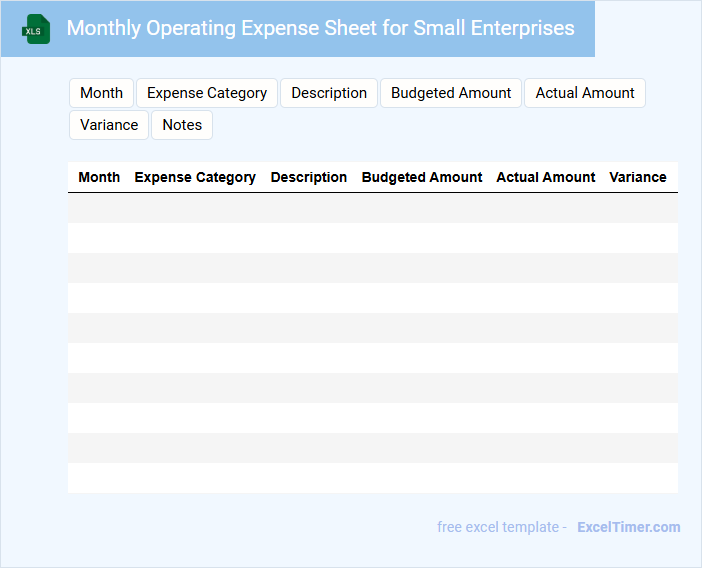

Monthly Operating Expense Sheet for Small Enterprises

A Monthly Operating Expense Sheet is a crucial document that details all the regular costs incurred by a small enterprise within a month. It typically includes categories such as rent, utilities, salaries, supplies, and marketing expenses. Maintaining an accurate and updated sheet helps businesses monitor cash flow and make informed financial decisions.

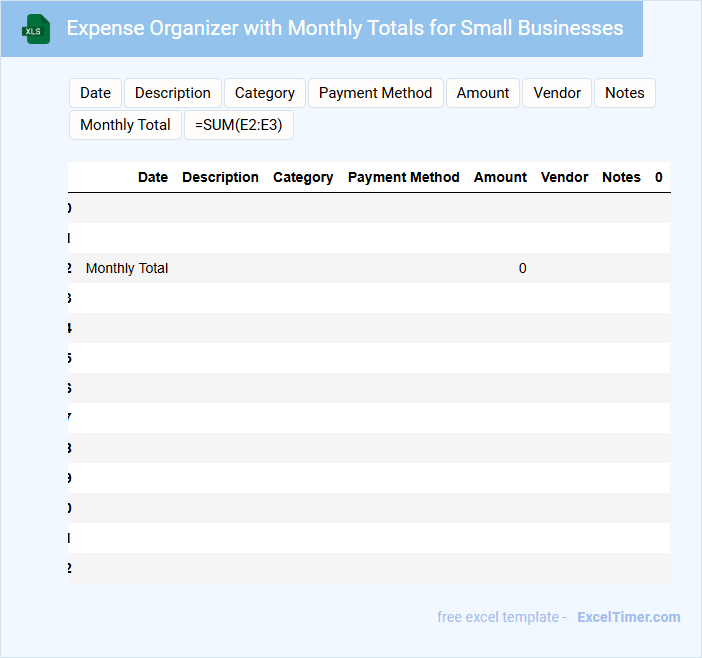

Expense Organizer with Monthly Totals for Small Businesses

An Expense Organizer for small businesses typically contains detailed records of daily expenditures categorized by type, such as supplies, utilities, and payroll. It includes monthly totals to provide a clear overview of spending trends and financial health. This document helps business owners track and manage their cash flow effectively.

To optimize its usefulness, ensure consistent and accurate data entry, categorize expenses clearly, and regularly review monthly totals for budgeting and tax purposes. Including notes for unusual expenses can also aid in future financial analysis. Utilizing digital tools or spreadsheets can enhance organization and ease of updates.

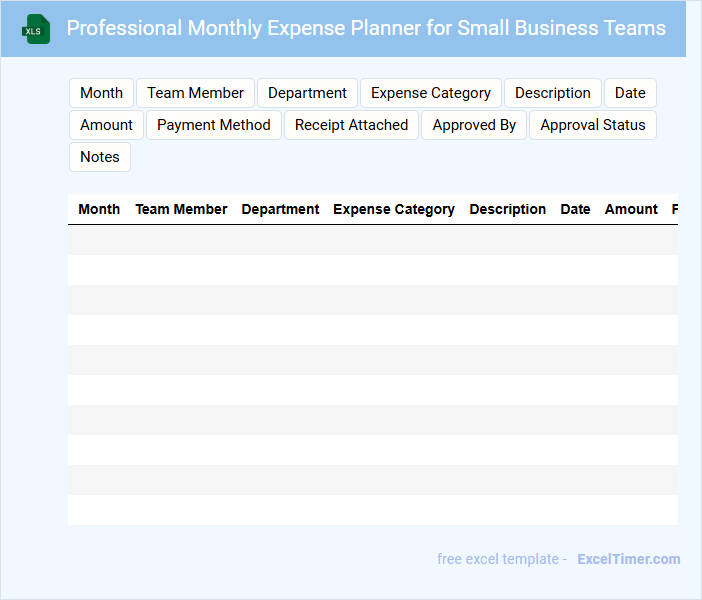

Professional Monthly Expense Planner for Small Business Teams

A Professional Monthly Expense Planner is a structured document designed to help small business teams systematically track and manage their expenses. It provides detailed categories and areas for recording costs, ensuring transparency and accountability within the team.

This type of planner typically includes sections for fixed expenses, variable costs, and unexpected expenditures to help maintain accurate budgeting. Regular updates and clear communication among team members are vital to maximize the planner's effectiveness.

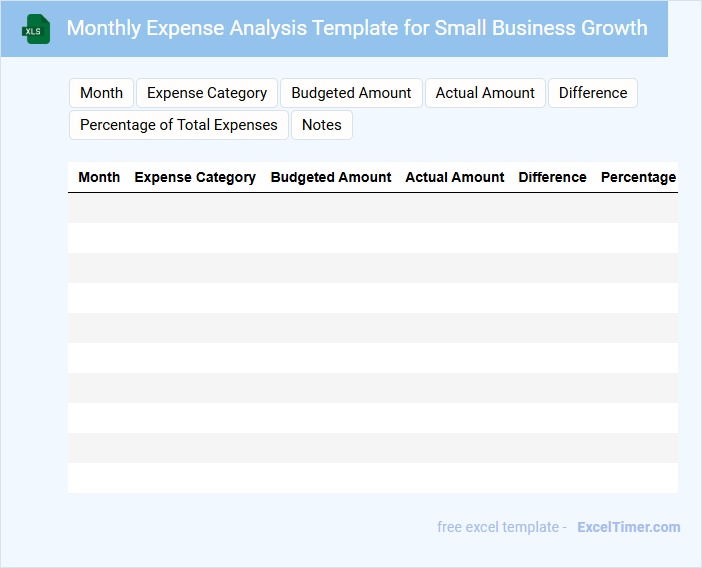

Monthly Expense Analysis Template for Small Business Growth

What does a Monthly Expense Analysis Template for Small Business Growth typically contain? This document usually includes detailed records of all expenses incurred by the business within a month, categorized by type such as operational, marketing, and administrative costs. It also highlights expense trends and variances to help business owners track spending and identify potential areas for cost optimization.

Why is it important to use this template for small business growth? Utilizing this template allows businesses to maintain financial discipline, monitor cash flow effectively, and make informed budgeting decisions. Regular analysis of expenses supports strategic planning and helps ensure sustainable growth by preventing overspending and enhancing profitability.

What are the essential categories to include in a small business monthly expense tracker?

Essential categories in a small business monthly expense tracker include Rent or Lease, Utilities, Payroll and Employee Benefits, Marketing and Advertising, Supplies and Equipment, Travel and Transportation, and Taxes and Licenses. Your tracker should also account for Loan Payments, Insurance, and Miscellaneous Expenses to ensure comprehensive oversight. Tracking these categories helps you manage cash flow and identify cost-saving opportunities effectively.

How can formulas in Excel automate expense totals and category breakdowns?

Excel formulas automate expense totals by using SUM functions to add monthly expenditures, while category-specific SUMIF formulas break down costs by expense type. PivotTables further enhance automation by summarizing and visualizing category spending dynamically. Your monthly expense tracker becomes efficient and accurate, reducing manual calculation errors.

What methods can be used in Excel to visualize spending trends over multiple months?

Excel offers various methods to visualize spending trends over multiple months, including Line Charts and PivotCharts, which effectively display changes in expenses over time. Conditional Formatting can highlight significant spending patterns, while Sparklines provide compact trend visuals within cells. Utilizing these tools enables small businesses to track and analyze monthly expenses efficiently for better financial decisions.

How should recurring versus one-time expenses be differentiated in an Excel tracker?

In an Excel Monthly Expense Tracker for Small Businesses, recurring expenses should be categorized in a separate column or tab to track consistent monthly costs like rent or subscriptions. One-time expenses require individual entries with distinct dates and descriptions to capture non-regular spending such as equipment purchases or repairs. Your tracker will provide clearer financial insights by distinctly labeling and summarizing these two expense types for better budgeting and cash flow analysis.

What data validation techniques can ensure accurate entry of expenses in monthly tracking sheets?

Data validation in monthly expense trackers for small businesses can include dropdown lists for expense categories, date range restrictions to match the specified month, and numerical limits to prevent negative or excessively high values. Using custom formulas to flag inconsistent or duplicate entries enhances accuracy. Implementing these techniques minimizes errors and ensures reliable expense data for financial analysis.