The Monthly Loan Payment Excel Template for Homeowners simplifies tracking mortgage payments, interest rates, and loan balances in an efficient spreadsheet format. This template helps homeowners accurately calculate monthly loan payments, plan budgets, and monitor amortization schedules with ease. Customizable fields ensure it fits various loan terms and supports better financial management throughout the loan period.

Monthly Loan Payment Tracker for Homeowners

A Monthly Loan Payment Tracker for Homeowners is a document used to monitor loan repayments over time, helping manage financial obligations effectively. It typically includes payment dates, amounts, and outstanding balances to ensure timely payments and avoid penalties.

- Record each monthly payment with date and amount to maintain accurate financial records.

- Track remaining loan balance to understand progress toward full repayment.

- Include notes on any changes in interest rates or payment terms for reference.

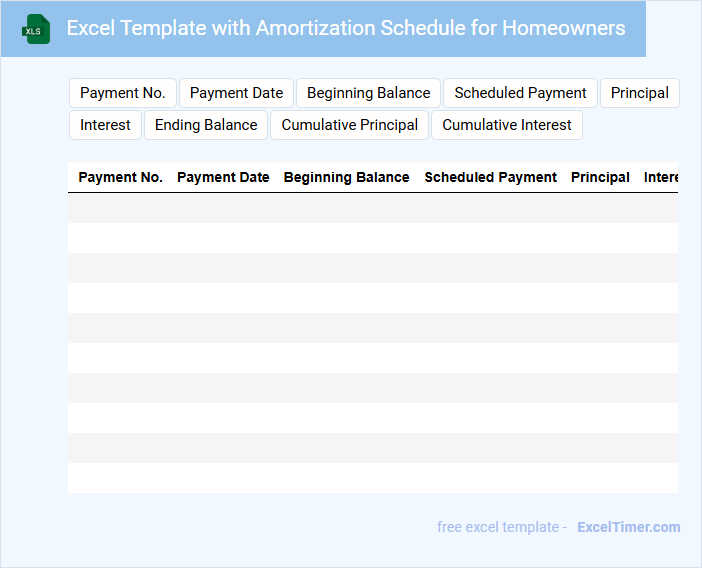

Excel Template with Amortization Schedule for Homeowners

An Excel template with an amortization schedule typically contains a detailed breakdown of loan payments, including principal and interest amounts over time. It helps homeowners understand their mortgage repayment structure clearly. This document often includes input fields for loan amount, interest rate, and loan term to customize the schedule.

Such templates are essential for managing and planning mortgage payments efficiently, making it easier for homeowners to track progress towards paying off their loan. Accurate data entry and regular updates are important to ensure the amortization schedule reflects the current loan status. Remember to verify formulas to avoid errors in payment calculations.

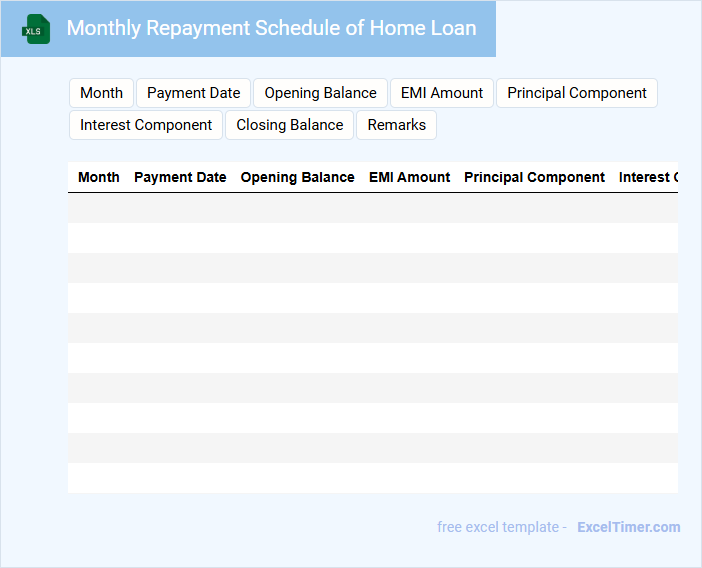

Monthly Repayment Schedule of Home Loan

A Monthly Repayment Schedule of Home Loan typically contains detailed information about the borrower's monthly installment amounts over the loan tenure.

- Principal and Interest Breakdown: It shows how much of each payment goes toward the principal and how much covers the interest.

- Payment Due Dates: The schedule includes specific dates when each monthly payment is due to avoid late fees.

- Remaining Balance: It displays the outstanding loan balance after each payment to track progress toward full repayment.

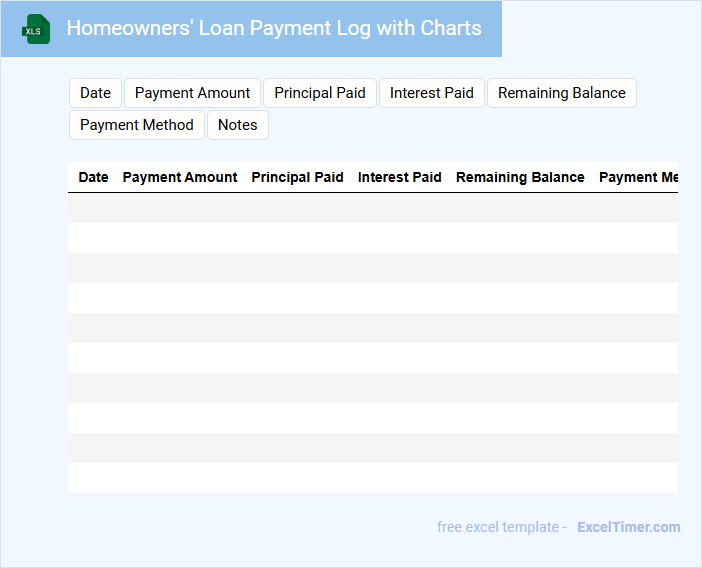

Homeowners' Loan Payment Log with Charts

A Homeowners' Loan Payment Log with Charts typically contains detailed records of loan payments, tracking amounts, dates, and balances, alongside visual representations for easier financial monitoring.

- Accurate Payment Records: Ensure every payment entry includes the date, amount, and remaining balance to maintain clear financial tracking.

- Consistent Updates: Regularly update the log to reflect new payments and changes in loan terms for up-to-date information.

- Visual Charts: Use charts to illustrate payment progress and outstanding loan balance, helping homeowners understand their repayment status at a glance.

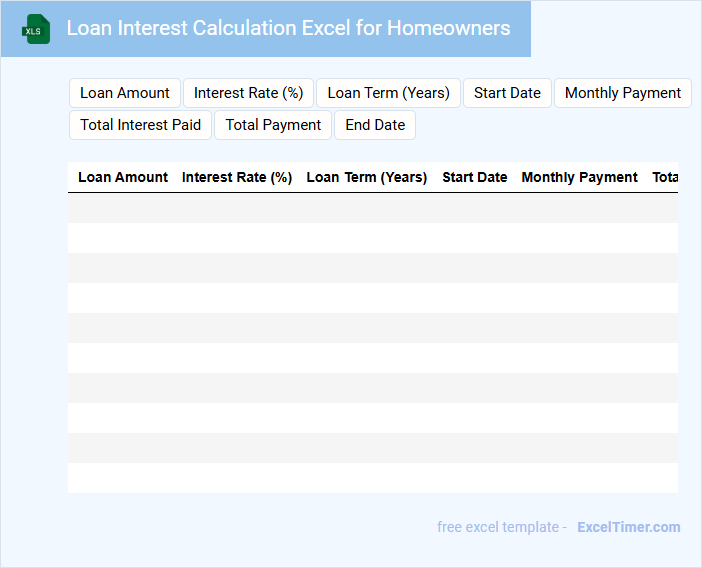

Loan Interest Calculation Excel for Homeowners

This Loan Interest Calculation Excel document is designed to help homeowners easily track and compute the interest on their mortgage loans. It typically contains input fields for loan amount, interest rate, and loan tenure, along with formulas to automatically calculate monthly and total interest payments. The spreadsheet provides a clear overview of repayment schedules and helps in financial planning.

An important element to include is an amortization table that breaks down each payment into principal and interest portions. Adding conditional formatting to highlight upcoming payment due dates ensures timely management. Finally, providing space for extra payments helps users see the impact on loan duration and interest savings.

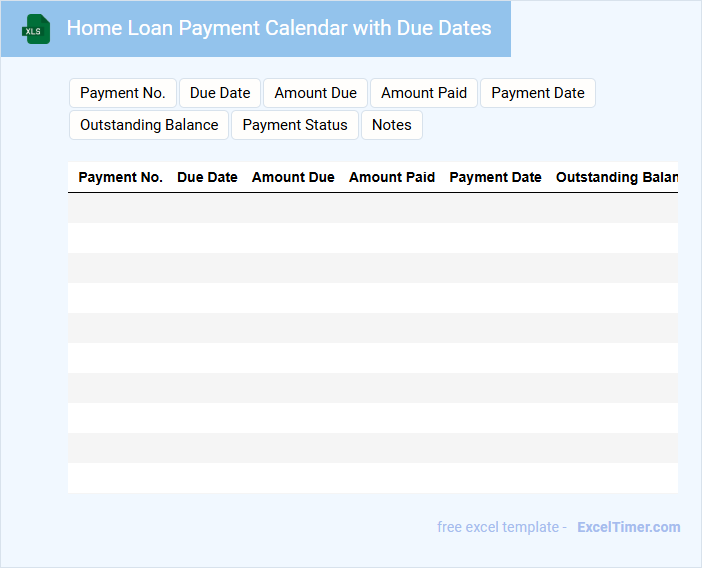

Home Loan Payment Calendar with Due Dates

What information is typically included in a Home Loan Payment Calendar with Due Dates? This document usually contains a schedule of all the payment due dates for a home loan, including principal and interest amounts. It helps borrowers keep track of when payments are due to avoid late fees and maintain good credit standing.

What is an important consideration when using a Home Loan Payment Calendar with Due Dates? Ensuring accuracy and timely updates of the payment dates is crucial to prevent missed payments. Additionally, including reminders and contact details for loan servicing can improve financial management and communication.

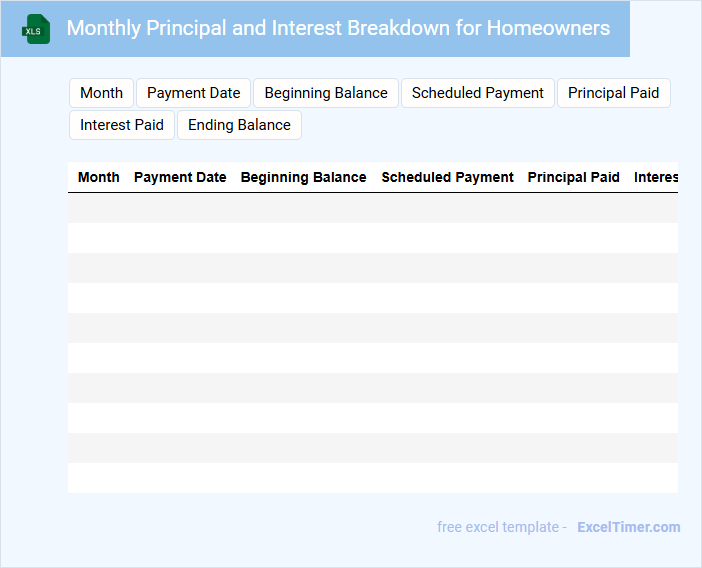

Monthly Principal and Interest Breakdown for Homeowners

What information is typically included in a Monthly Principal and Interest Breakdown for Homeowners? This document usually contains detailed figures showing the portion of your monthly mortgage payment that goes toward the principal balance and the interest cost. It helps homeowners understand how their payments reduce the loan over time and the interest charged each month.

Why is it important to review this breakdown regularly? Regular review allows homeowners to track their loan amortization progress and identify opportunities for additional principal payments to reduce interest costs. Staying informed helps in planning finances and making strategic decisions about the mortgage.

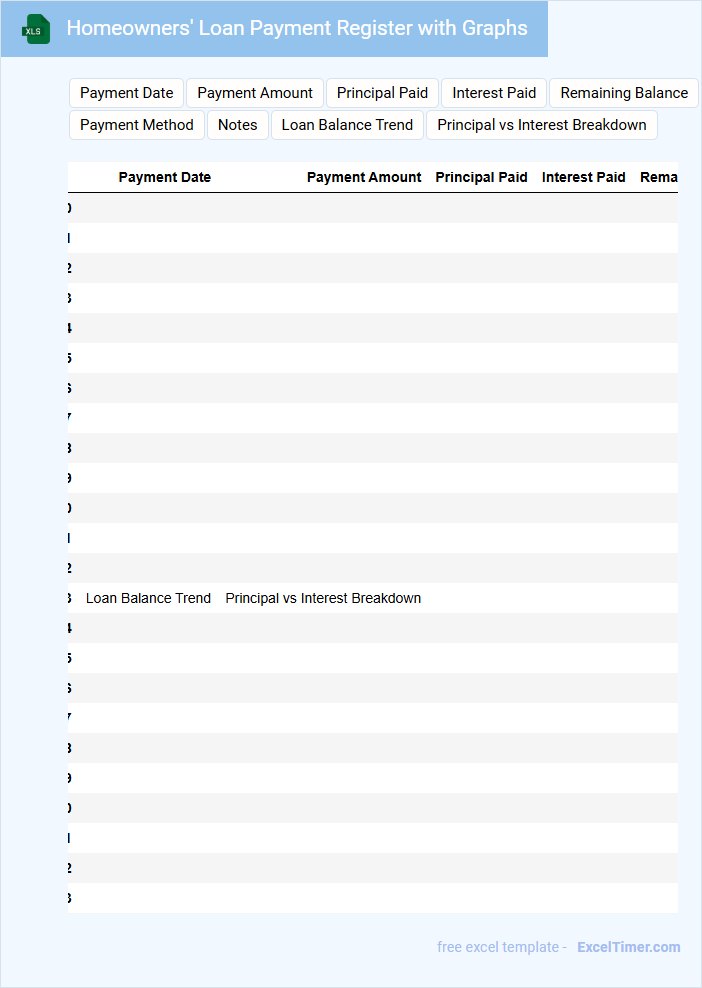

Homeowners' Loan Payment Register with Graphs

A Homeowners' Loan Payment Register typically contains detailed records of all loan payments made by a homeowner, including dates, payment amounts, and outstanding balances. This document helps track the progress of loan repayment over time and ensures accuracy in financial records.

Graphs in the register visually represent payment trends, outstanding balance reductions, and interest accumulations, making it easier to analyze financial status at a glance. It is essential to regularly update the register and include clear, concise labels in the graphs for effective monitoring.

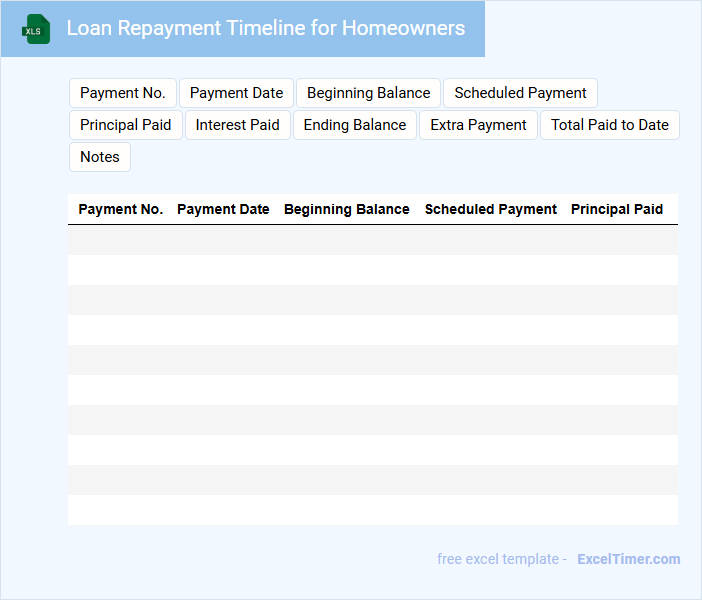

Loan Repayment Timeline for Homeowners

A Loan Repayment Timeline for homeowners typically outlines the schedule and conditions for repaying a home loan. It includes key details such as payment amounts, due dates, and interest rates over the loan period. Understanding this document helps borrowers manage their finances and meet obligations efficiently.

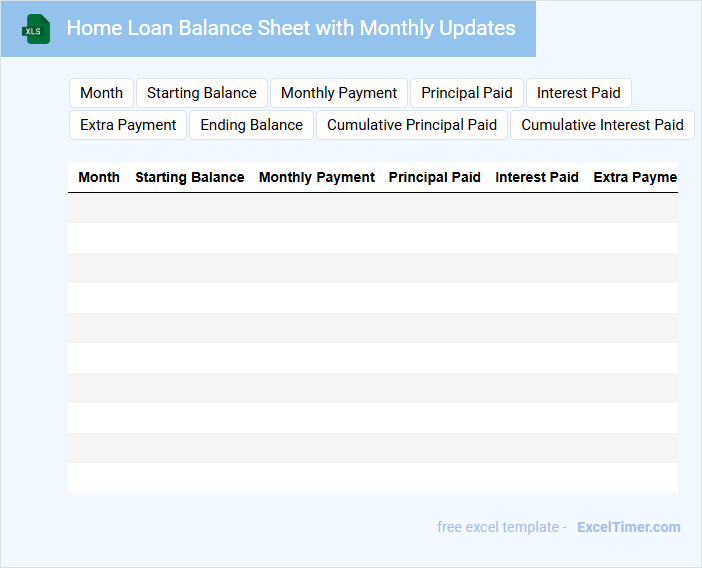

Home Loan Balance Sheet with Monthly Updates

A Home Loan Balance Sheet typically contains detailed information about the outstanding loan amount, monthly payments, and accrued interest. It provides an organized snapshot of the borrower's financial obligations related to their home loan. Monthly updates help track payment progress and changes in the loan balance over time.

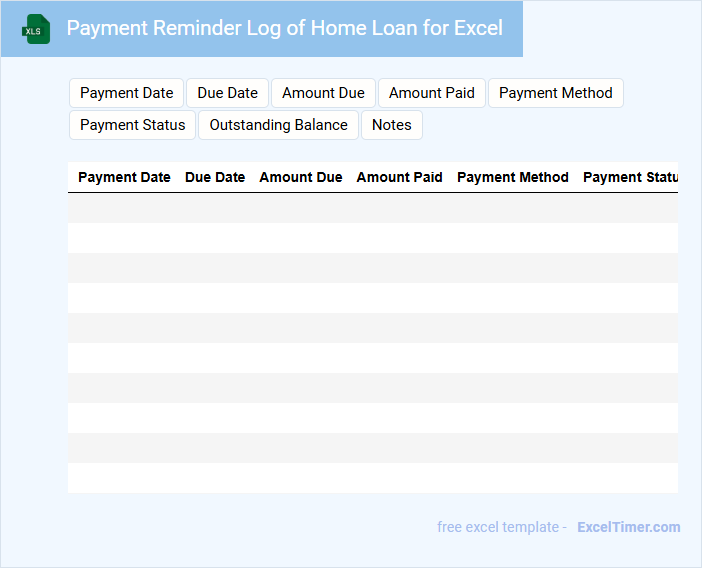

Payment Reminder Log of Home Loan for Excel

A Payment Reminder Log for a Home Loan in Excel typically contains records of scheduled payment dates, amounts due, and payment statuses to ensure timely payments and avoid penalties. It acts as a financial tracking tool for borrowers managing their loan repayments.

- Include columns for payment due date, amount, and confirmation of payment received.

- Use conditional formatting to highlight overdue payments for immediate attention.

- Maintain a summary section showing total paid, pending amounts, and next due date.

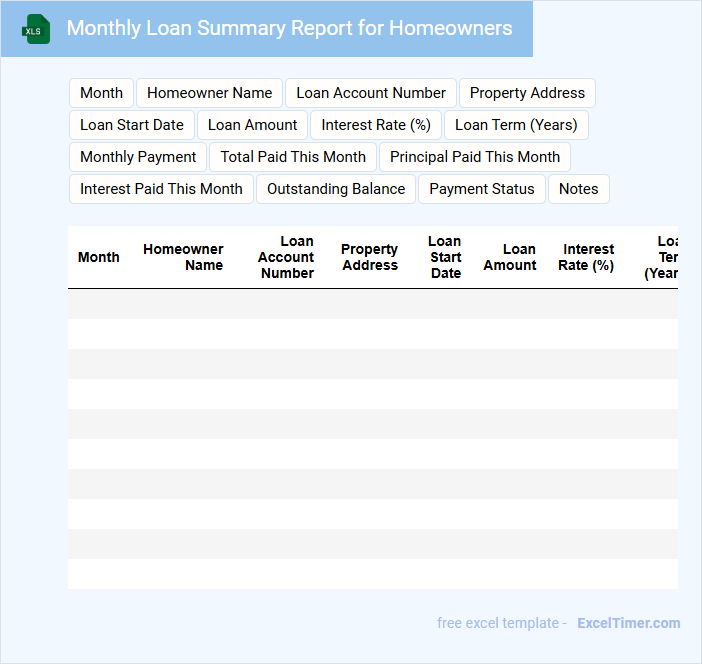

Monthly Loan Summary Report for Homeowners

The Monthly Loan Summary Report for homeowners provides a detailed overview of all loan activities within the month, including payments made, outstanding balances, and any changes in loan terms. It helps homeowners stay informed about their financial obligations and track their loan progress efficiently.

This document typically contains essential information such as payment dates, amounts, interest accrued, and remaining principal. To maximize its usefulness, homeowners should regularly review the report and compare it with their bank statements for accuracy.

Homeowners' Loan Repayment Tracker with Extra Payments

A Homeowners' Loan Repayment Tracker typically contains detailed records of loan payments, including principal, interest, and remaining balance. It often highlights extra payments made to reduce the loan term or interest costs effectively.

Such a tracker is essential for monitoring financial progress and ensuring timely repayments. Including notes on payment dates and sources of extra payments improves accuracy and budgeting efficiency.

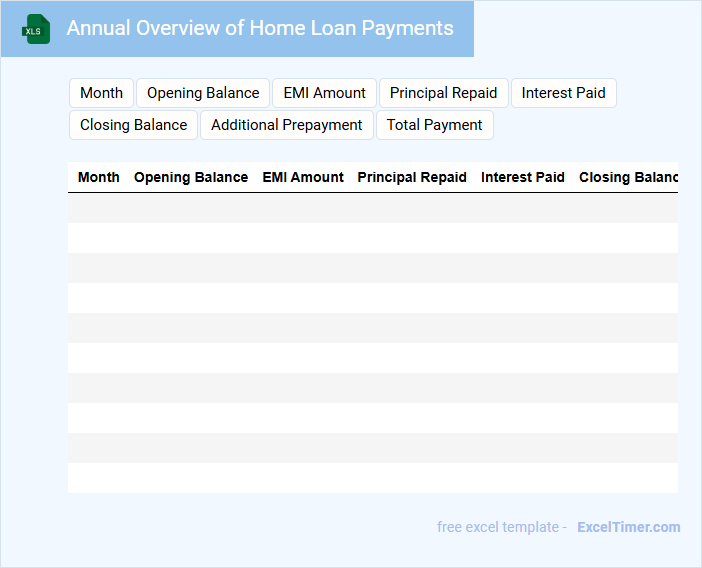

Annual Overview of Home Loan Payments

The Annual Overview of Home Loan Payments is a comprehensive summary that details the total payments made towards a mortgage throughout the year. It typically includes information on principal, interest, and any additional fees paid. This document is essential for understanding loan progress and financial planning.

Important elements to focus on include the remaining balance, interest rate changes, and any prepayment penalties. Reviewing this overview can help homeowners adjust their budget and plan for future payments. It also serves as a useful record for tax purposes and refinancing discussions.

Keeping track of the annual loan payments allows for better financial management and ensures that repayments are on schedule. Homeowners should regularly review this summary to identify any discrepancies or opportunities for savings. Staying informed helps in making timely decisions about the mortgage.

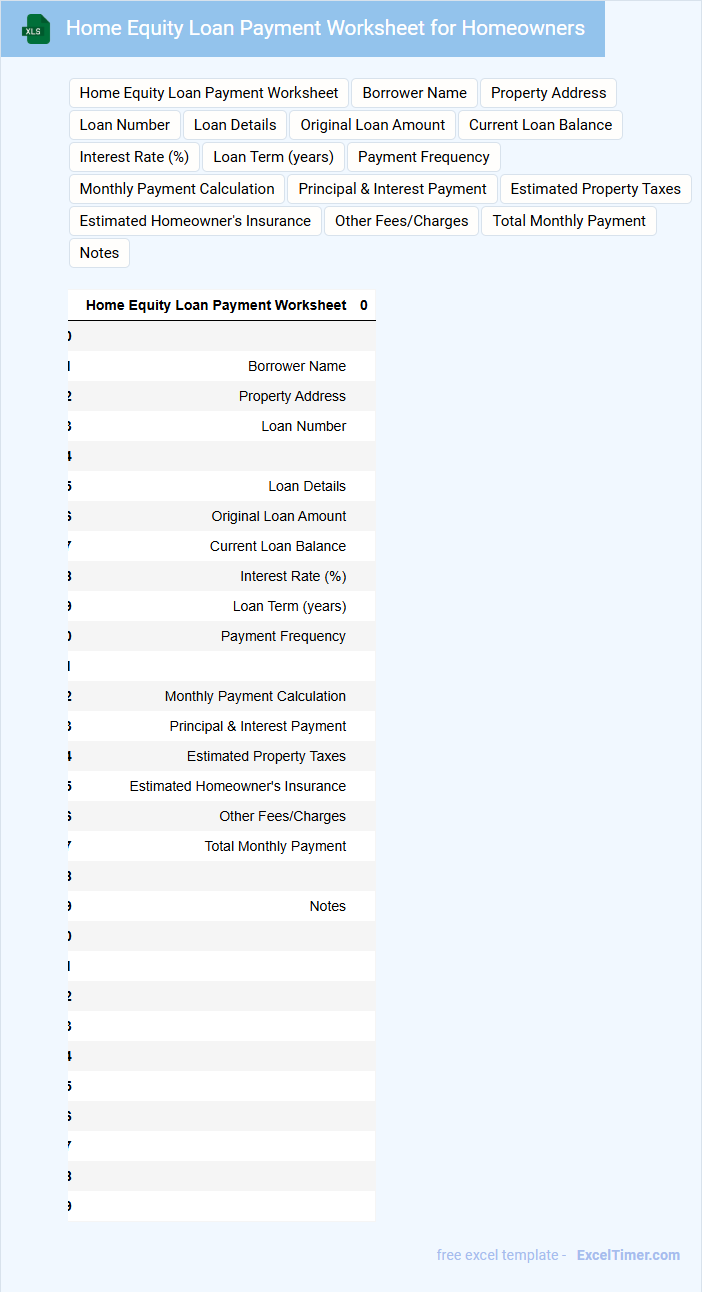

Home Equity Loan Payment Worksheet for Homeowners

What information is typically included in a Home Equity Loan Payment Worksheet for Homeowners? This document usually contains details about the loan amount, interest rate, payment schedule, and total repayment amount. It helps homeowners organize and track their payment obligations clearly and efficiently.

What important elements should homeowners focus on when using this worksheet? Homeowners should pay special attention to the breakdown of principal versus interest payments, any fees or penalties, and the due dates to avoid late payments and manage their finances effectively.

What input values are required to calculate the monthly loan payment in Excel (e.g., loan amount, interest rate, loan term)?

To calculate the monthly loan payment in Excel, you need the loan amount, annual interest rate, and loan term in years. The loan amount represents the principal borrowed, the interest rate is divided by 12 to reflect monthly interest, and the loan term is multiplied by 12 to convert years into months. Using these inputs, the PMT function accurately determines the fixed monthly payment for the loan.

How do you use the PMT function in Excel to determine monthly mortgage payments?

Use the PMT function in Excel to calculate your monthly mortgage payments by entering the interest rate divided by 12 as the rate, the total number of monthly payments as nper, and the loan amount as pv. For example, =PMT(annual_interest_rate/12, loan_term_in_months, -loan_amount) outputs your fixed monthly payment. This function factors in loan principal, interest rate, and loan term for accurate Home Loan payment planning.

Why is it important to distinguish between interest rate per year and per month in the calculation?

Distinguishing between the annual and monthly interest rates in your monthly loan payment calculation ensures accuracy in determining the true cost of your mortgage. Using the monthly interest rate aligns the payment schedule with interest accrual, preventing underestimation of interest expenses. Accurate rate conversion directly impacts your loan amortization schedule and financial planning as a homeowner.

How does changing the loan term affect the monthly payment in an Excel calculation?

Changing the loan term in an Excel calculation directly affects the Monthly Loan Payment by altering the number of payment periods used in the PMT function. A longer loan term decreases the monthly payment amount but increases total interest paid over time. Your monthly loan payment is calculated by dividing the loan amount, interest rate, and term, making term length a key factor in affordability.

What role do extra payments play in adjusting the amortization schedule in the Excel document?

Extra payments in the Excel document reduce your loan principal faster, shortening the loan term and decreasing total interest paid. The amortization schedule automatically recalculates to reflect lower monthly interest costs and updated balances. This adjustment helps homeowners visualize the financial benefits of making additional payments.