The Monthly Financial Statement Excel Template for Startups simplifies tracking income, expenses, and cash flow, allowing founders to maintain clear visibility on their financial health. This user-friendly template helps startups monitor key financial metrics, manage budgets effectively, and prepare accurate reports for investors and stakeholders. Consistent use of this tool ensures better decision-making and supports sustainable business growth.

Monthly Financial Statement Excel Template for Startups

Monthly Financial Statement Excel Template for Startups typically contains a summary of income, expenses, and cash flow to help new businesses track their financial health.

- Revenue Tracking: Record all sources of income to monitor growth and forecast future earnings.

- Expense Management: Categorize and track expenses to control costs and improve profitability.

- Cash Flow Analysis: Analyze cash inflows and outflows to ensure sufficient liquidity for operations.

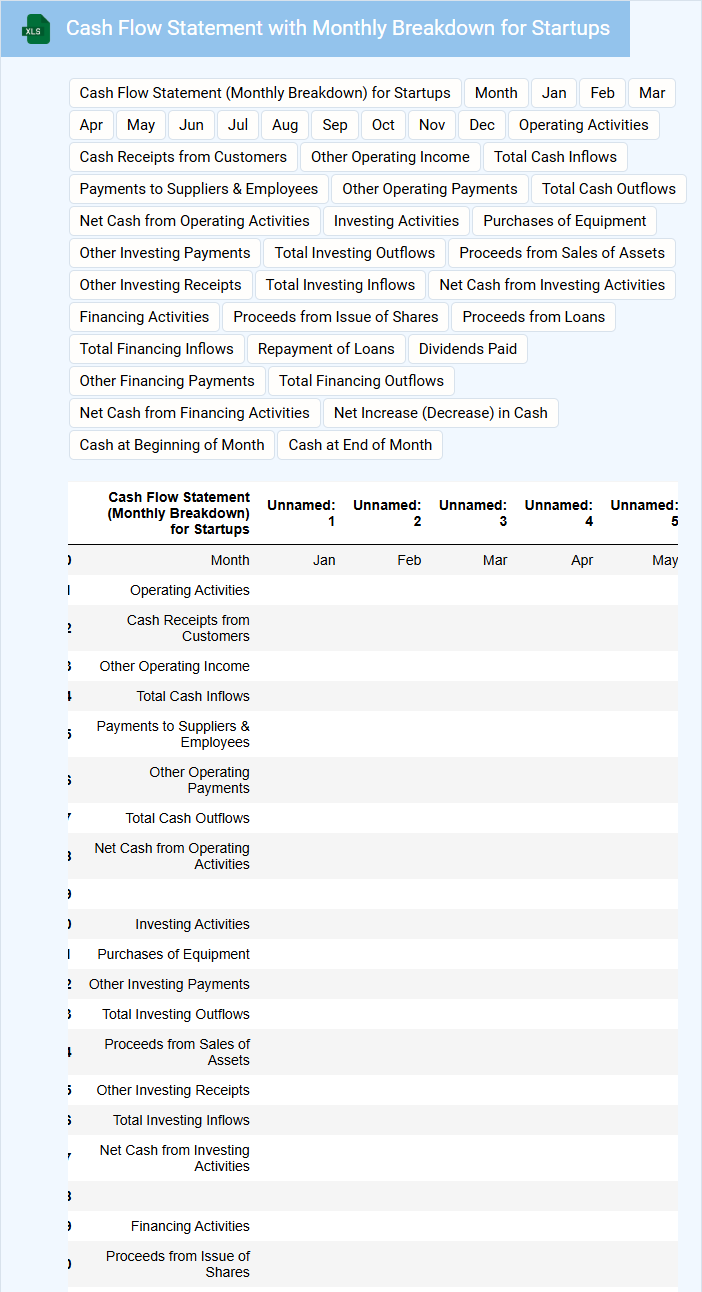

Cash Flow Statement with Monthly Breakdown for Startups

A Cash Flow Statement with monthly breakdown is essential for startups to monitor the inflow and outflow of cash on a month-to-month basis. It typically contains detailed records of operating, investing, and financing activities, highlighting how cash moves through the business. This document helps startups maintain liquidity, forecast future cash needs, and make informed financial decisions.

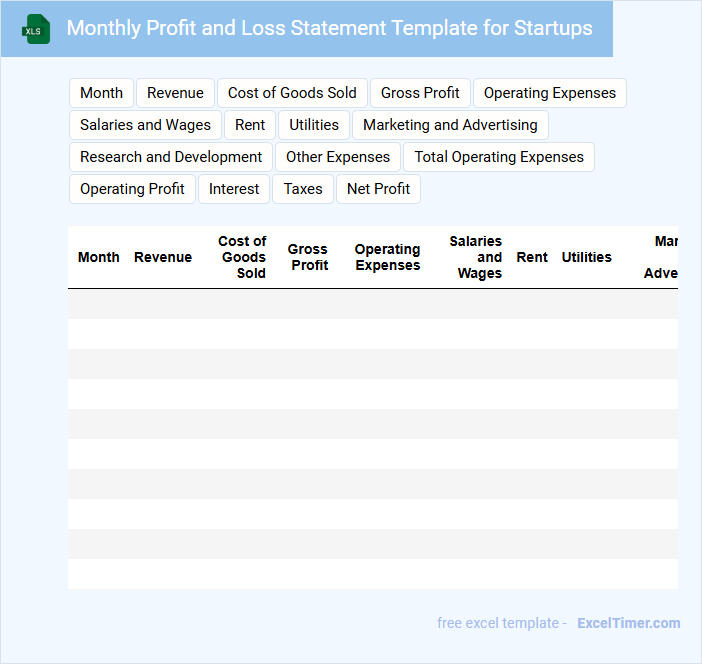

Monthly Profit and Loss Statement Template for Startups

The Monthly Profit and Loss Statement template for startups typically contains detailed records of revenue, expenses, and net profit or loss over a specific month. It helps track financial performance and cash flow to ensure the business remains solvent and profitable. This document is essential for understanding where money is coming from and where it is being spent.

Startups should focus on the accuracy of expense categorization and revenue recognition to provide clear insights into financial health. Timely updates and consistent review are crucial to make informed business decisions and adjust strategies as needed. Including projections alongside actuals can also enhance financial planning effectiveness.

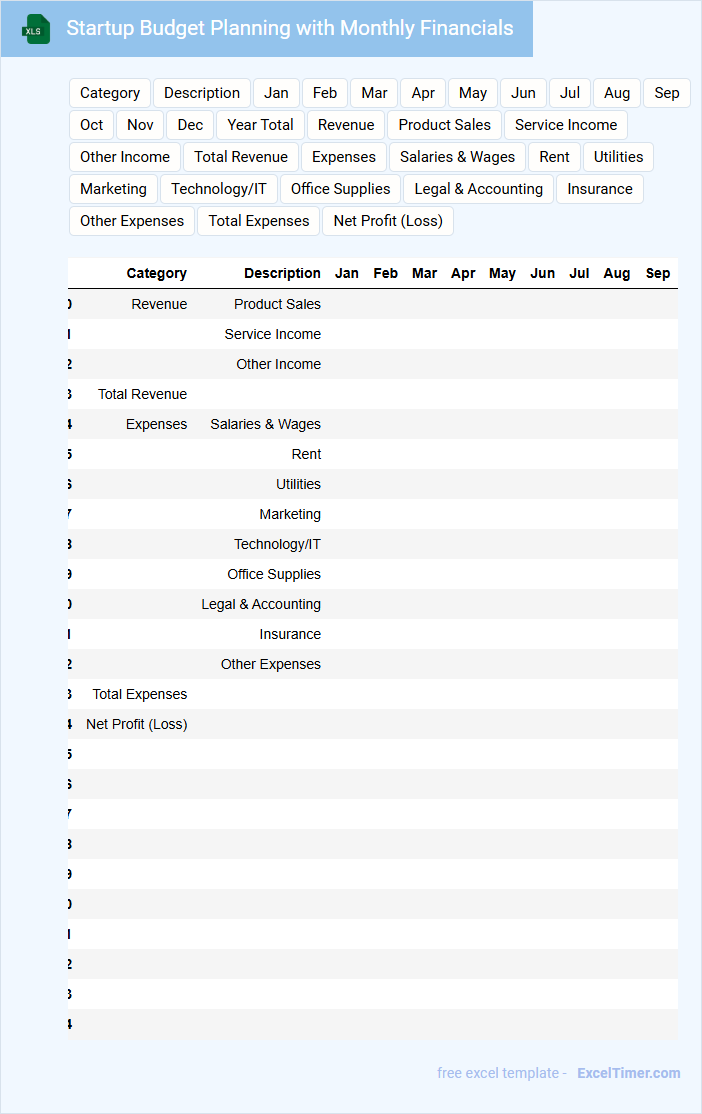

Startup Budget Planning with Monthly Financials

Startup Budget Planning with Monthly Financials is a crucial document that outlines the financial projections for a new business, including detailed monthly income, expenses, and cash flow forecasts. It helps entrepreneurs manage resources effectively and anticipate funding needs. Including contingency plans is essential to handle unexpected costs.

This type of document typically contains revenue estimates, fixed and variable costs, and investment requirements broken down on a monthly basis for at least the first year. Accurate financial tracking and regular updates ensure realistic planning and support decision-making. Using software tools can enhance precision and efficiency in managing these financials.

Monthly Expense Tracker for Startup Financial Management

What information is typically contained in a Monthly Expense Tracker for Startup Financial Management? This document usually includes detailed records of all company expenditures categorized by type, date, and amount to monitor cash flow effectively. It helps startups maintain organized financial data, enabling better budgeting and cost control strategies.

What is an important consideration when using a Monthly Expense Tracker for startups? Ensuring consistent and accurate entry of all expenses, including recurring and unexpected costs, is crucial for reliable financial analysis. Additionally, reviewing the data regularly helps identify spending patterns and areas for potential savings.

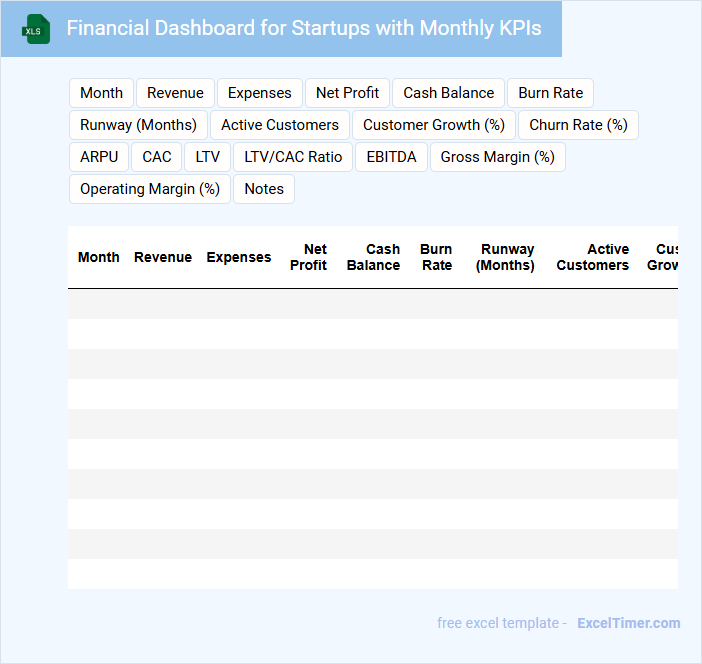

Financial Dashboard for Startups with Monthly KPIs

What key information does a Financial Dashboard for Startups with Monthly KPIs typically contain? This type of document usually presents critical financial metrics such as revenue, expenses, cash flow, and profitability on a monthly basis to help startups track their financial health. It also includes visual representations like charts and graphs to provide clear insights and facilitate data-driven decision-making.

What important elements should be included to maximize its effectiveness? It is essential to highlight key performance indicators (KPIs) relevant to the startup's growth stage, such as burn rate, customer acquisition cost, and monthly recurring revenue. Additionally, ensuring real-time data updates and easy-to-understand visualizations helps stakeholders quickly assess performance and make timely strategic decisions.

Monthly Revenue Tracker Excel Template for Startups

What information is typically included in a Monthly Revenue Tracker Excel Template for Startups? This document usually contains detailed records of monthly sales, income sources, and revenue streams, allowing startups to monitor financial performance closely. It is designed to help businesses identify trends, manage cash flow, and make informed decisions for sustainable growth.

What key elements should be included for optimal use of this template? Important features include customizable income categories, automated calculations for total revenue, and visual charts to illustrate financial progress. Incorporating space for notes on unexpected expenses or revenue fluctuations also enhances the template's practicality for dynamic startup environments.

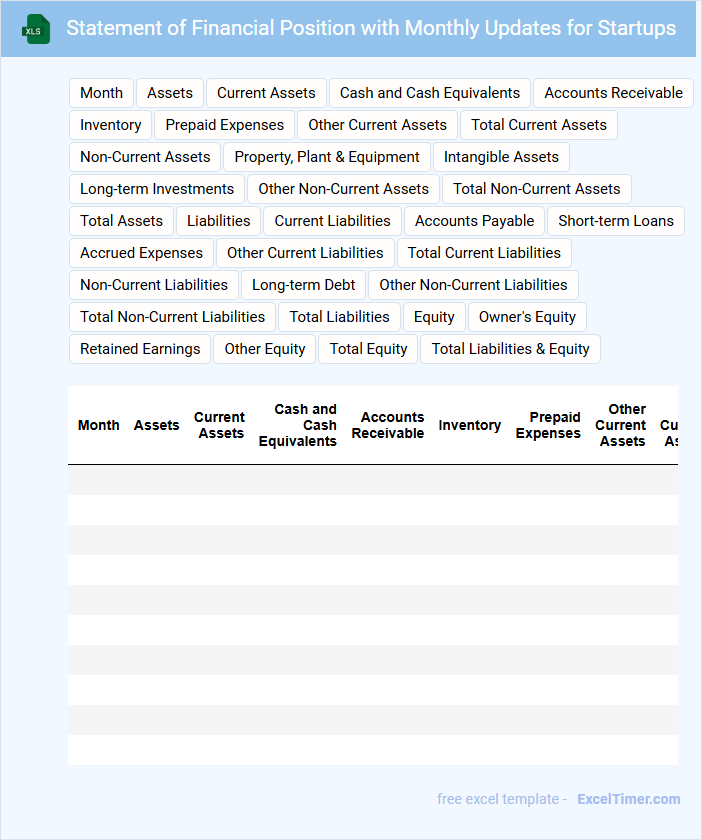

Statement of Financial Position with Monthly Updates for Startups

The Statement of Financial Position with monthly updates is a vital document for startups that provides a snapshot of the company's assets, liabilities, and equity at a specific point in time. It helps stakeholders understand the financial health and liquidity of the business. Regular monthly updates ensure timely insights for better decision-making and financial planning.

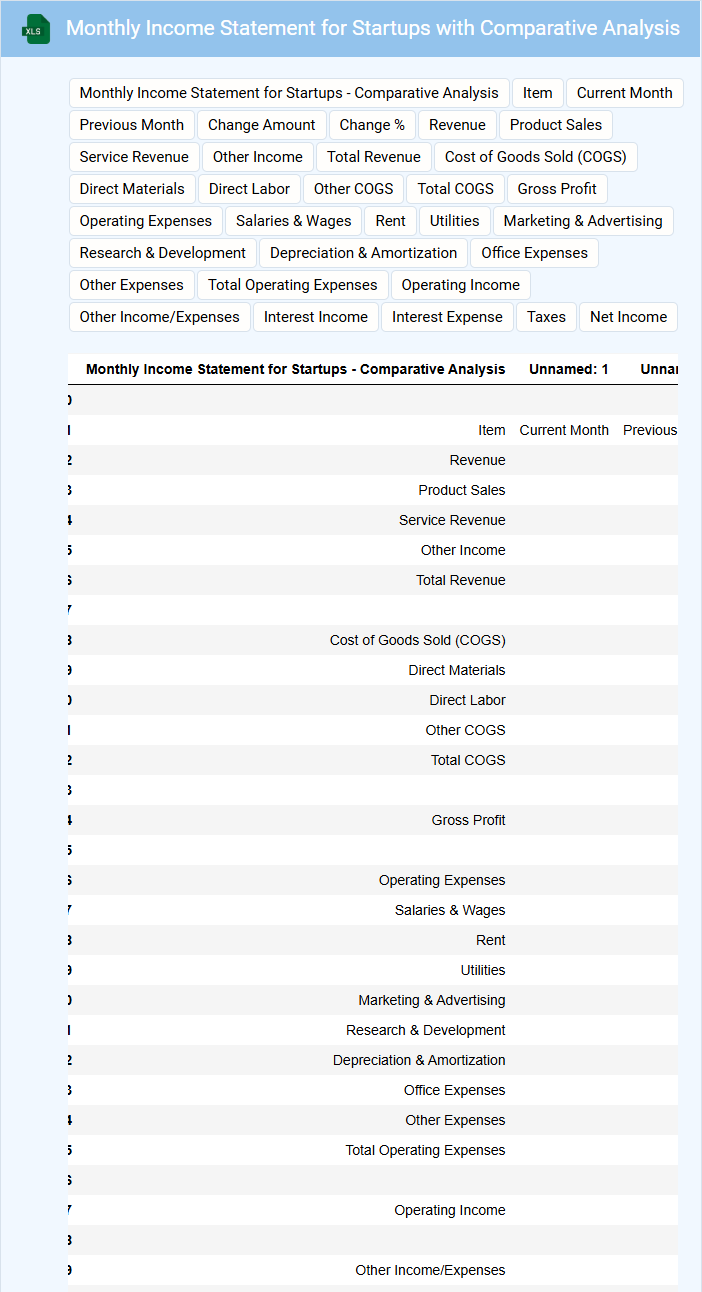

Monthly Income Statement for Startups with Comparative Analysis

What information is typically included in a Monthly Income Statement for Startups with Comparative Analysis? This document generally contains detailed records of revenues, expenses, and net income for the current month alongside data from previous months to identify financial trends. It helps startups assess profitability and make informed decisions by comparing performance over time.

Why is it important to focus on specific elements when preparing this statement? Key items such as revenue streams, cost of goods sold, operating expenses, and unusual one-time costs should be carefully analyzed to highlight areas of growth or concern. Accurate categorization and consistency in reporting periods ensure meaningful comparative analysis for better financial planning.

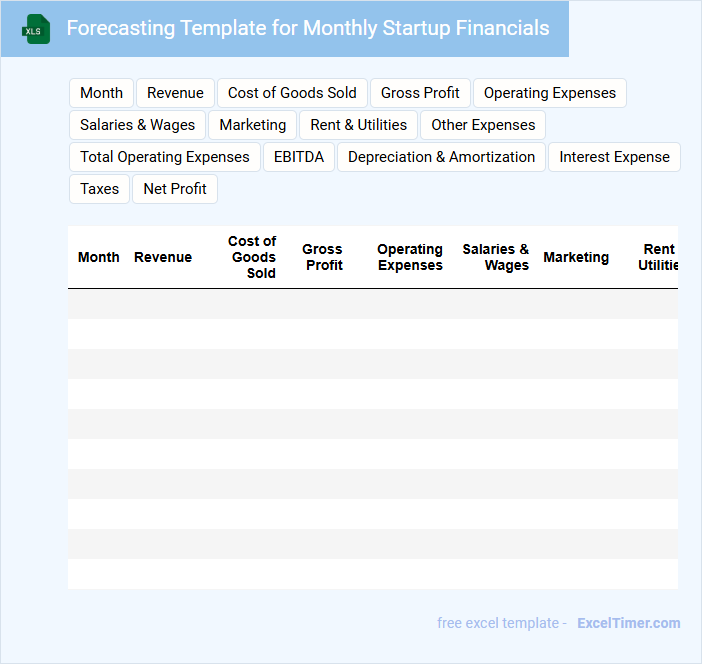

Forecasting Template for Monthly Startup Financials

What does a Forecasting Template for Monthly Startup Financials typically contain? This document usually includes projected income statements, cash flow forecasts, and balance sheets tailored for startups to monitor financial performance. It provides a structured layout to input expected revenues, expenses, funding rounds, and key financial metrics.

Why is it important to include accurate assumptions and regularly update the template? Accurate assumptions ensure realistic projections that guide decision-making and investor communications. Regular updates reflect actual performance, allowing startups to adjust strategies and maintain financial health effectively.

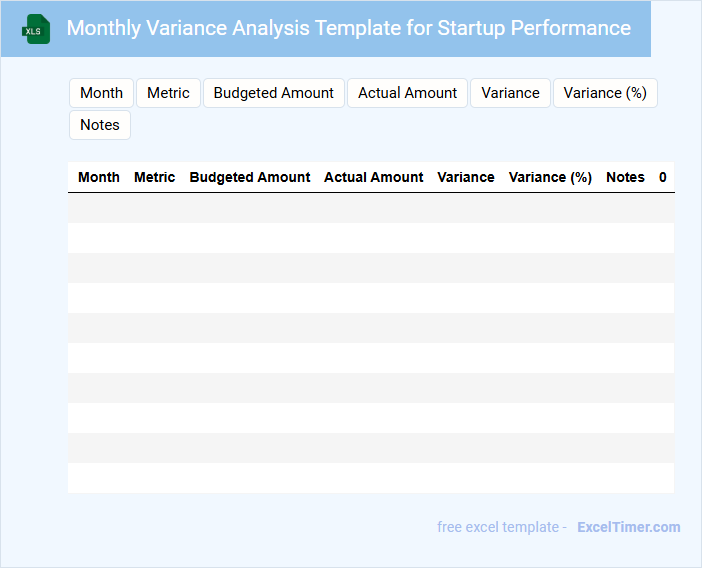

Monthly Variance Analysis Template for Startup Performance

What information does a Monthly Variance Analysis Template for Startup Performance typically contain? This type of document usually includes key financial metrics such as budgeted versus actual revenues, expenses, and profit margins. It helps startups identify variances, understand their causes, and make data-driven decisions to improve financial performance.

What is an important suggestion when using this template? It is crucial to regularly update the data and include qualitative explanations for significant variances to provide context and support decision-making processes effectively.

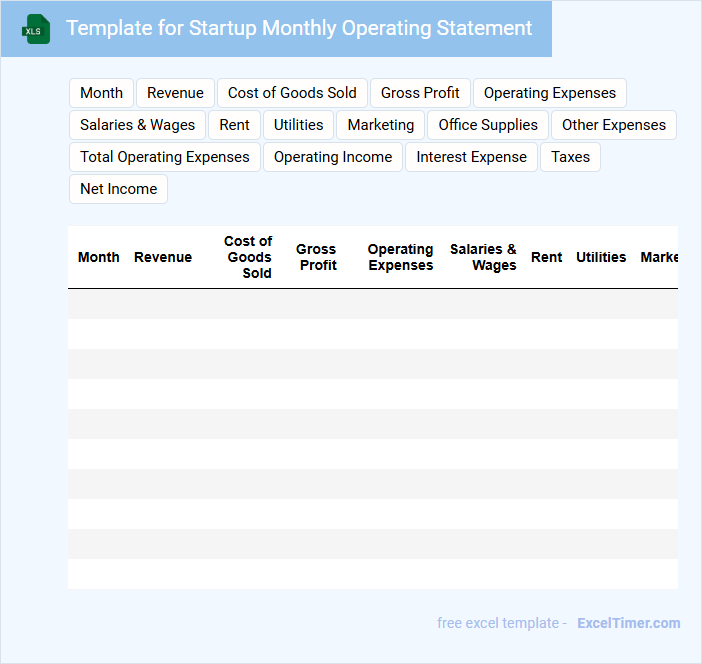

Template for Startup Monthly Operating Statement

This document typically contains a detailed summary of a startup's financial performance and key operational metrics for the month.

- Revenue and Expenses: Track all income streams and expenditures to monitor cash flow.

- Key Performance Indicators (KPIs): Include important metrics such as customer acquisition, burn rate, and runway.

- Financial Projections: Update forecasts based on current data to inform strategic decisions.

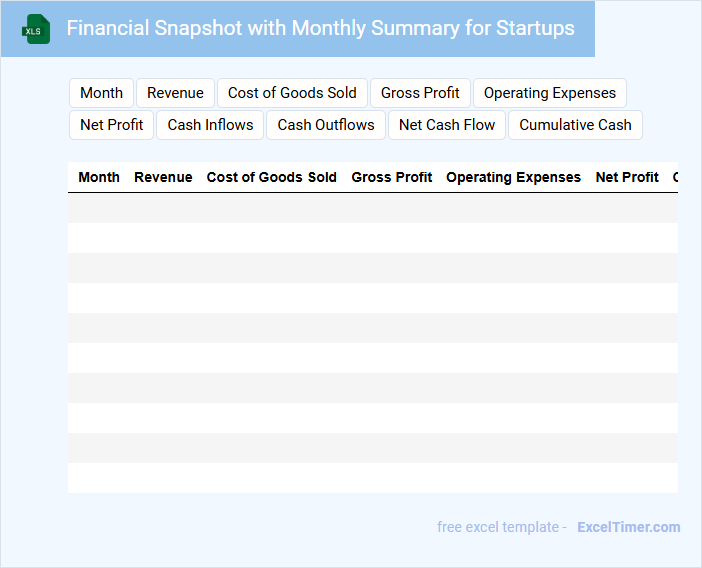

Financial Snapshot with Monthly Summary for Startups

A Financial Snapshot with a monthly summary for startups typically contains key financial metrics such as revenue, expenses, cash flow, and profit margins. It provides a concise overview of the financial health and operational performance within a specific period.

This document is essential for tracking progress, identifying trends, and making informed strategic decisions. Including clear graphs and comparison against budgeted goals is highly recommended for better insight.

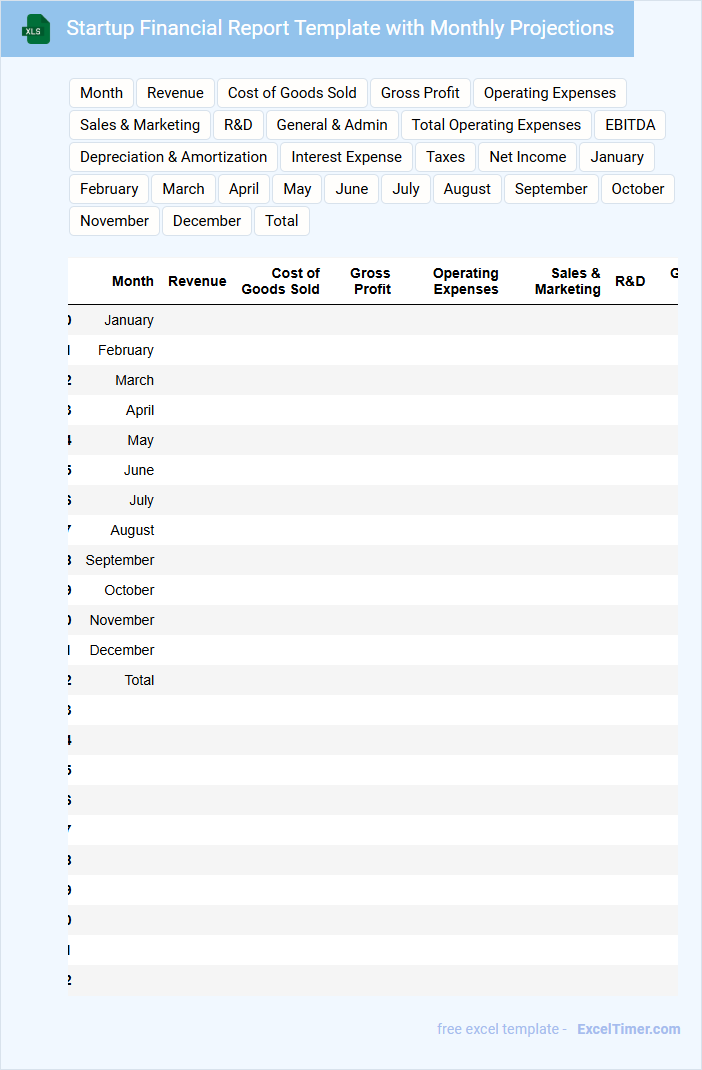

Startup Financial Report Template with Monthly Projections

A Startup Financial Report Template with Monthly Projections typically contains detailed financial data and forecasts to help founders and investors track and plan the company's financial health.

- Revenue Projections: Clear monthly revenue forecasts based on realistic growth assumptions.

- Expense Breakdown: Detailed and categorized monthly expenses to ensure budget control.

- Cash Flow Analysis: Comprehensive tracking of cash inflows and outflows to maintain liquidity.

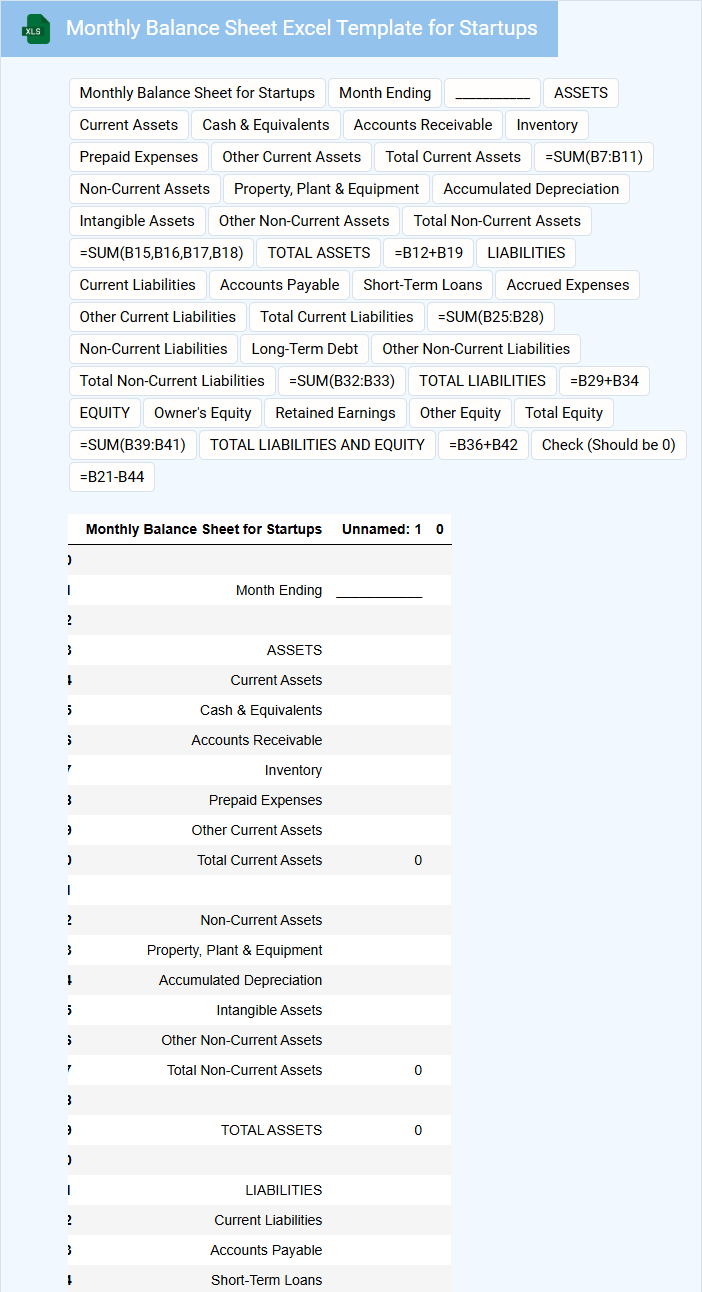

Monthly Balance Sheet Excel Template for Startups

A Monthly Balance Sheet Excel Template for startups typically contains sections for assets, liabilities, and equity, providing a snapshot of the company's financial position each month. It helps entrepreneurs track their financial health, ensuring that resources are properly allocated and liabilities are managed. This document is essential for monitoring growth and preparing for investor presentations.

Important elements to include are current assets, fixed assets, short-term and long-term liabilities, and equity details. Incorporate automatic calculations and charts to visualize trends easily. Ensure the template is customizable to fit the unique financial structure of different startups.

What are the key components included in a monthly financial statement for startups in Excel?

A monthly financial statement for startups in Excel includes key components such as the income statement, balance sheet, and cash flow statement. It also contains sections for revenue, expenses, assets, liabilities, and equity to provide a comprehensive overview of financial performance. Detailed tracking of budget versus actual figures helps monitor financial health and support strategic decision-making.

How do you differentiate between revenue and profit in your monthly Excel financial report?

Revenue in a monthly Excel financial report represents the total income generated from sales or services before any expenses are deducted. Profit is calculated by subtracting all operating expenses, taxes, and costs from the total revenue, reflecting the actual earnings of the startup. Clearly separating these figures helps in assessing financial health and making informed business decisions.

Which Excel functions or formulas are essential for tracking cash flow on a monthly basis?

Essential Excel functions for tracking monthly cash flow include SUM to total income and expenses, IF for conditional calculations, and SUMIF to aggregate specific categories like revenue or costs. Utilizing VLOOKUP or INDEX-MATCH helps match transactions with relevant accounts, enhancing accuracy. Your monthly financial statement benefits from automation by incorporating these formulas, ensuring precise, up-to-date cash flow tracking.

How can you use Excel to monitor and categorize recurring versus one-time expenses?

Excel helps monitor and categorize recurring versus one-time expenses by using separate columns or tags to label each expense type. Formulas like SUMIF or PivotTables aggregate and analyze data based on these categories for clear financial insights. Conditional formatting highlights patterns, enabling startups to track cash flow and optimize budgeting effectively.

What methods can be used in Excel to visualize financial trends and performance over multiple months?

Excel offers various methods to visualize financial trends and performance over multiple months, including line charts, bar charts, and sparklines for quick trend analysis. PivotTables combined with slicers allow you to dynamically filter and summarize data for detailed insights. You can customize these visual tools to highlight key metrics in your Monthly Financial Statement and better understand your startup's financial trajectory.