The Monthly Payroll Excel Template for Nonprofit Organizations streamlines payroll management by organizing employee salaries, deductions, and benefits accurately within a single spreadsheet. This template is essential for maintaining compliance with tax regulations and ensuring timely payment processing while tracking employee hours and compensation details. Its user-friendly design supports budget control and financial transparency crucial for nonprofit operations.

Monthly Payroll Sheet for Nonprofit Organizations

The Monthly Payroll Sheet for Nonprofit Organizations typically contains detailed records of employees' salaries, taxes, deductions, and net pay for the month. It ensures accurate compensation tracking and compliance with legal requirements.

Including clear breakdowns of benefits and contributions specific to nonprofit employees is crucial. This document helps maintain transparency and supports efficient financial management.

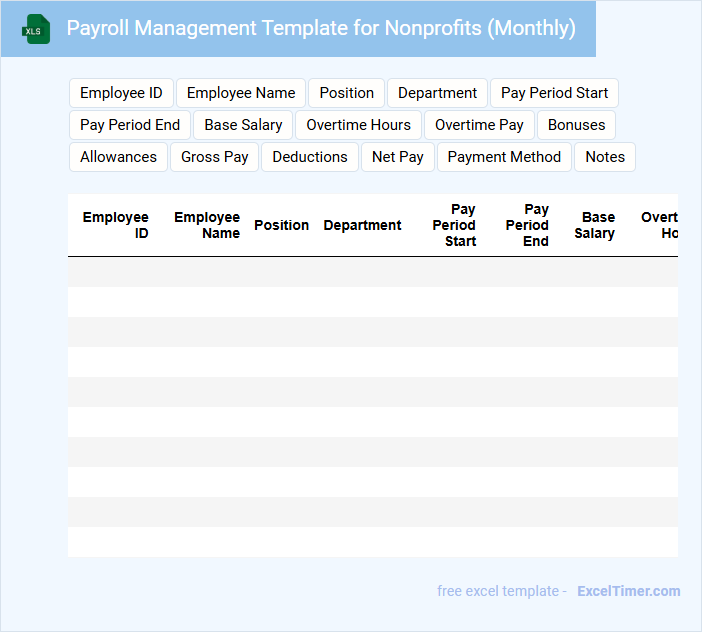

Payroll Management Template for Nonprofits (Monthly)

This Payroll Management Template for Nonprofits (Monthly) typically contains detailed records of employee salaries, deductions, and payment schedules to ensure accurate and timely payroll processing.

- Employee Information: Includes names, roles, employee IDs, and payment details.

- Payroll Calculations: Tracks gross pay, taxes, benefits, and net pay each month.

- Compliance Records: Ensures adherence to nonprofit-specific tax laws and reporting requirements.

Employee Payroll Tracker with Benefits for Nonprofit

What information does an Employee Payroll Tracker with Benefits for Nonprofit usually contain?

This type of document typically includes detailed records of each employee's salary, hours worked, and benefits such as health insurance, retirement plans, and paid leave tailored for nonprofit organizations. It helps ensure accurate payroll processing while tracking compliance with nonprofit-specific regulations and benefit structures.

What is an important consideration when maintaining this document?

It is crucial to regularly update the tracker to reflect changes in employee status, benefit eligibility, and organization budget constraints. Accurate record-keeping supports transparency, simplifies audits, and helps manage nonprofit resources efficiently.

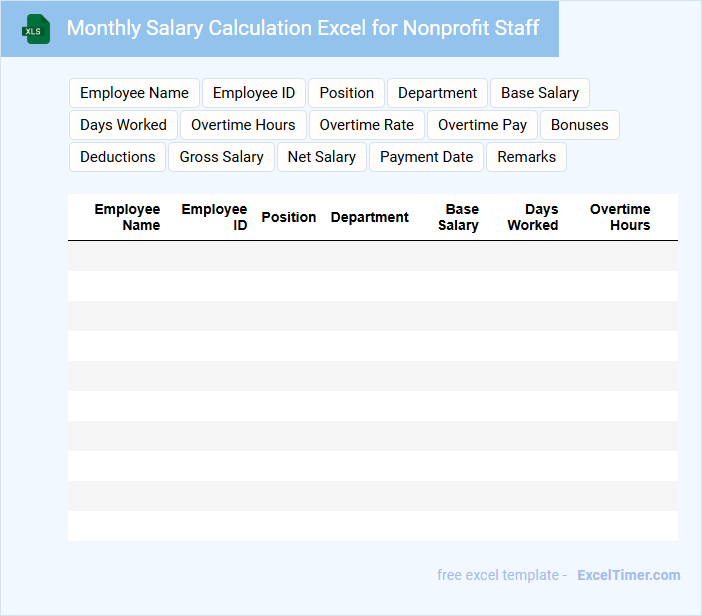

Monthly Salary Calculation Excel for Nonprofit Staff

The Monthly Salary Calculation Excel for nonprofit staff typically contains detailed records of employee hours, salary rates, and deductions. It helps streamline payroll processes while ensuring accurate compensation.

Important elements to include are tax withholdings, benefits, and any grant-specific funding allocations. Maintaining transparency and compliance with nonprofit regulations is crucial for effective salary management.

Payroll Register for Nonprofit Organizations (Monthly)

A Payroll Register for Nonprofit Organizations (Monthly) is a detailed record of employee wages and deductions for each pay period. It typically includes information such as employee names, hours worked, gross pay, tax withholdings, and net pay. Maintaining accurate payroll registers is essential for financial transparency and compliance with labor laws.

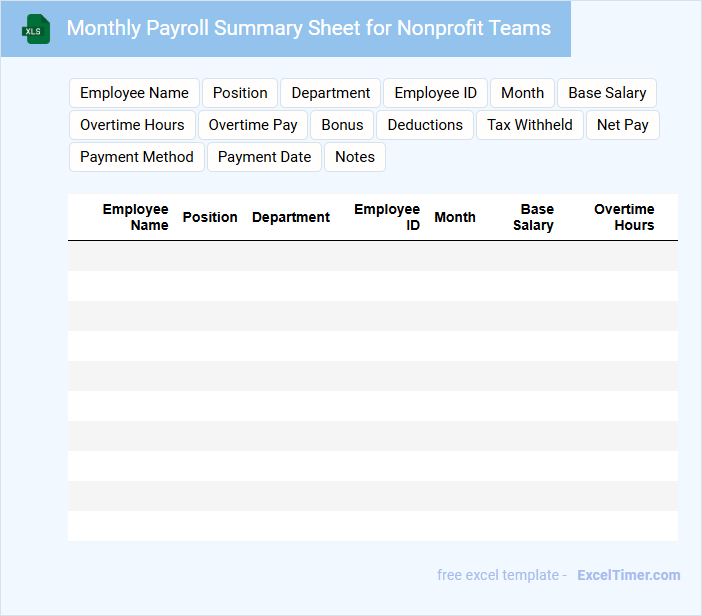

Monthly Payroll Summary Sheet for Nonprofit Teams

What information is typically included in a Monthly Payroll Summary Sheet for Nonprofit Teams? This document usually contains detailed records of employees' wages, hours worked, deductions, and net pay for the month. It provides a clear summary of payroll expenses to ensure accurate financial tracking and compliance with nonprofit regulations.

What is an important consideration when preparing this payroll summary sheet? It is essential to verify the accuracy of employee classifications and benefit deductions to avoid discrepancies. Additionally, maintaining transparency and confidentiality is crucial to protect sensitive payroll data within the nonprofit organization.

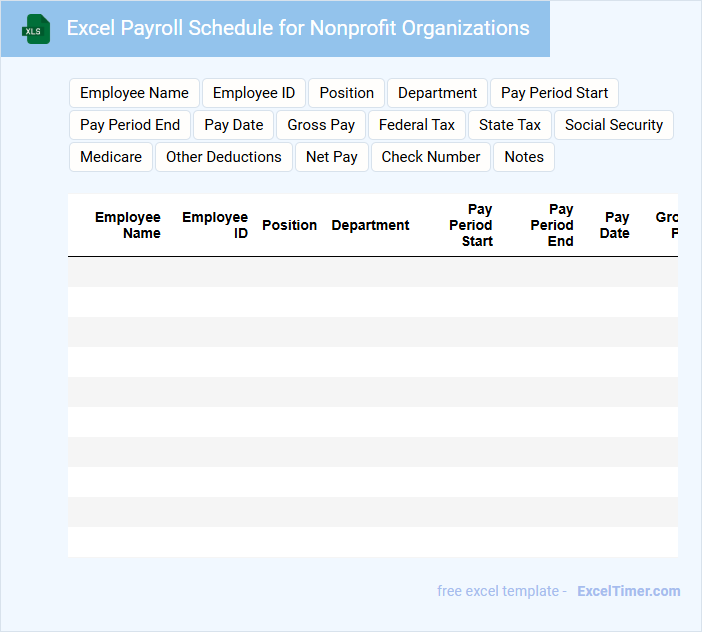

Excel Payroll Schedule for Nonprofit Organizations

An Excel Payroll Schedule for Nonprofit Organizations is a structured document used to organize and track employee payment dates, hours worked, and salary details. It typically includes columns for employee names, pay periods, gross pay, deductions, and net pay. Maintaining accuracy and consistency in this schedule is crucial for compliance with financial regulations and ensuring timely payments.

Payroll Statement with Deductions for Nonprofit Staff

A Payroll Statement for nonprofit staff typically contains detailed information about an employee's earnings, including gross pay and various deductions. It outlines mandatory and voluntary deductions such as taxes, retirement contributions, and health insurance premiums. Ensuring accuracy and transparency in these statements is crucial for maintaining trust and compliance within nonprofit organizations.

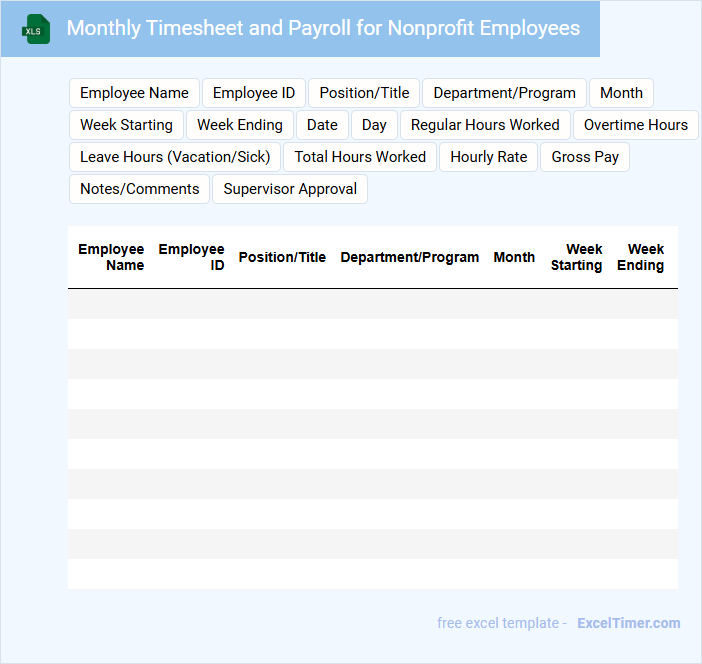

Monthly Timesheet and Payroll for Nonprofit Employees

A Monthly Timesheet and Payroll document for nonprofit employees typically records work hours and calculates compensation for the month. It ensures accurate payment and compliance with organizational policies and labor laws.

- Include detailed employee hours to maintain transparency and accountability.

- Verify payroll calculations to avoid errors in employee compensation.

- Keep records compliant with nonprofit regulations and tax requirements.

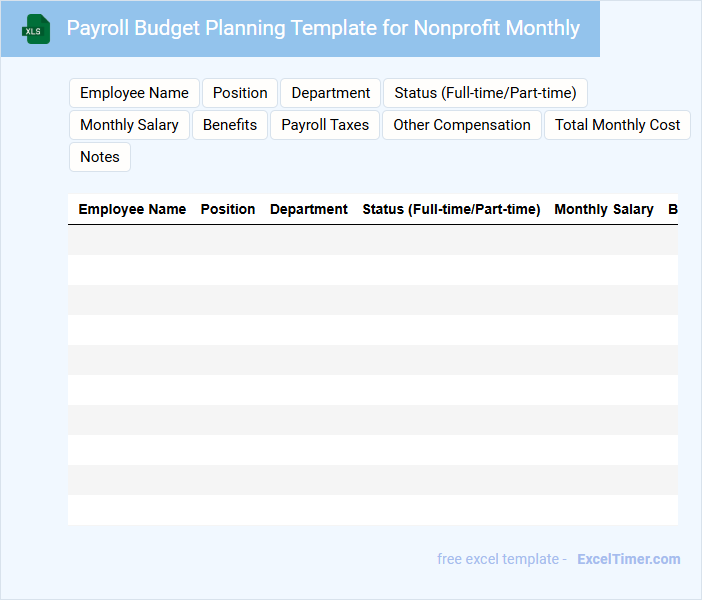

Payroll Budget Planning Template for Nonprofit Monthly

What key information does a Payroll Budget Planning Template for Nonprofit Monthly typically contain? This document usually includes detailed salary estimates, employee benefits costs, and projected payroll taxes for each month. It helps organizations plan their financial resources effectively by outlining expected payroll expenses in advance.

Why is it important to regularly update and review the Payroll Budget Planning Template for Nonprofit Monthly? Regular updates ensure accuracy in reflecting staffing changes, salary adjustments, and compliance with tax regulations. This ongoing review supports sustainable budgeting and prevents unexpected payroll shortfalls.

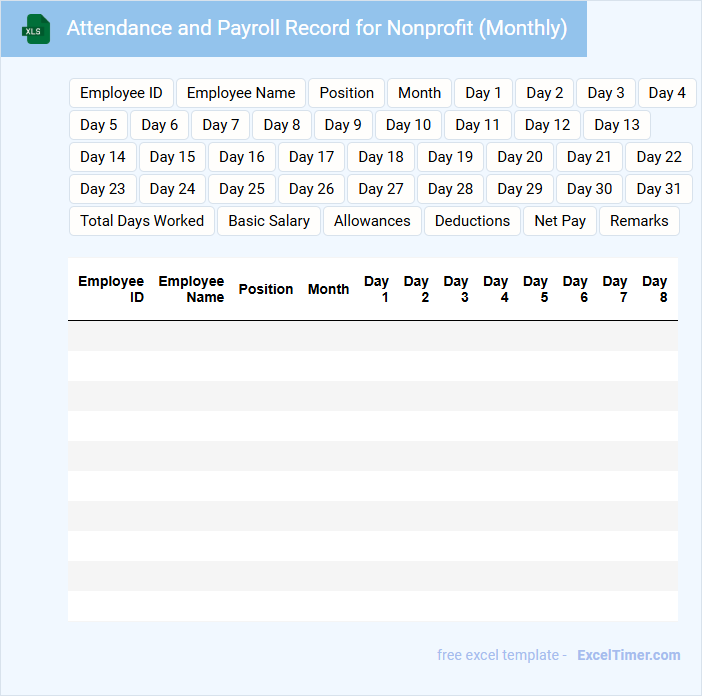

Attendance and Payroll Record for Nonprofit (Monthly)

An Attendance and Payroll Record for nonprofits is a document that typically includes employee attendance details and monthly payroll calculations. It tracks hours worked, leaves taken, and salary disbursements to ensure transparency and accurate payment. Maintaining this record is crucial for compliance with labor laws and financial auditing.

Important factors to include are accurate timekeeping methods, clear documentation of volunteer vs. paid staff hours, and timely updates to reflect any changes in compensation or attendance. Ensure the record supports nonprofit-specific reporting requirements and budget constraints. Consistent review and secure storage of these records will safeguard organizational integrity and employee trust.

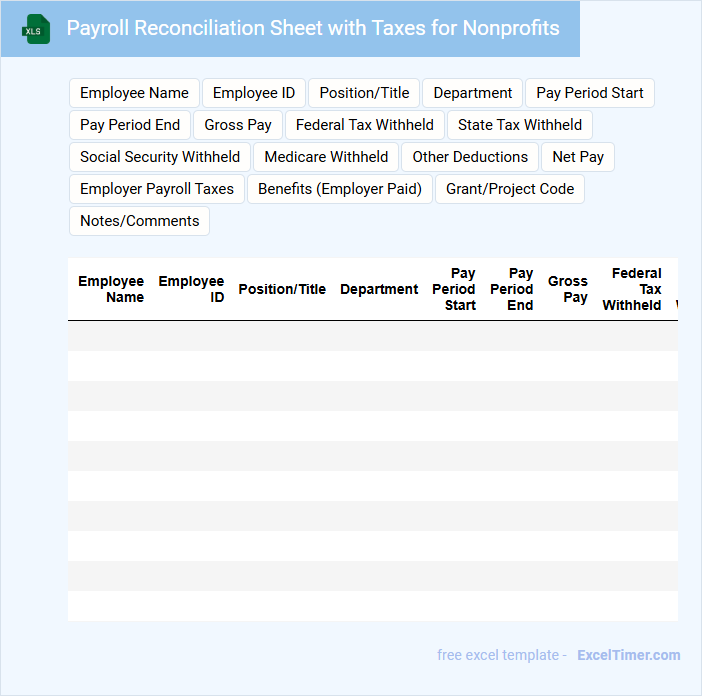

Payroll Reconciliation Sheet with Taxes for Nonprofits

The Payroll Reconciliation Sheet is a critical document used by nonprofits to ensure all payroll amounts are accurate and align with tax filings. It typically contains employee wages, deductions, employer tax contributions, and total tax liabilities. This sheet helps maintain compliance with tax regulations and provides transparency in financial reporting.

For nonprofits, accurately tracking taxes such as federal, state, and local contributions is essential to avoid penalties and ensure proper fund allocation. Important items to include are detailed tax categories, payment schedules, and adjustments for tax credits or exemptions. Regular updates and audits of the reconciliation sheet enhance accountability and fiscal responsibility.

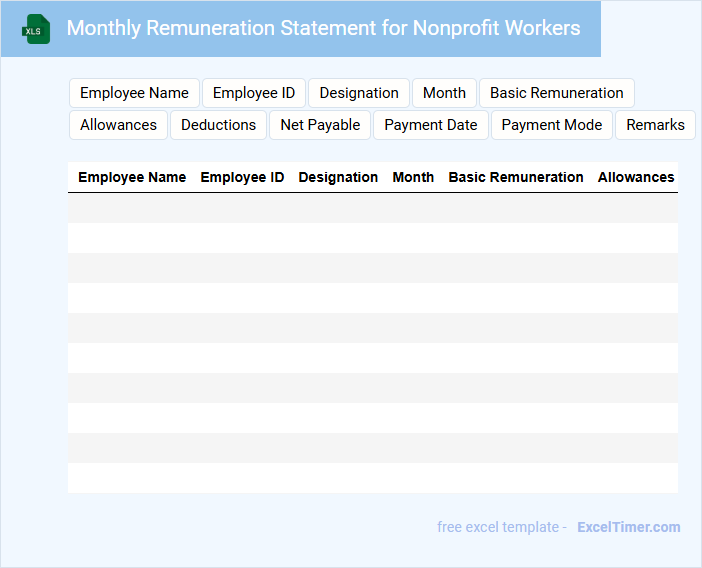

Monthly Remuneration Statement for Nonprofit Workers

A Monthly Remuneration Statement for nonprofit workers typically details the regular earnings and deductions for employees within a nonprofit organization. This document outlines gross pay, withholdings, and net salary to ensure transparency and compliance with labor laws. It is crucial for both record-keeping and verifying accurate compensation.

Important elements to include are employee details, payment period, salary breakdown, and any applicable benefits or deductions. Ensuring clarity and accuracy is essential to maintain trust and adhere to nonprofit financial standards. Regularly updating the statement format to reflect current regulatory requirements enhances its reliability.

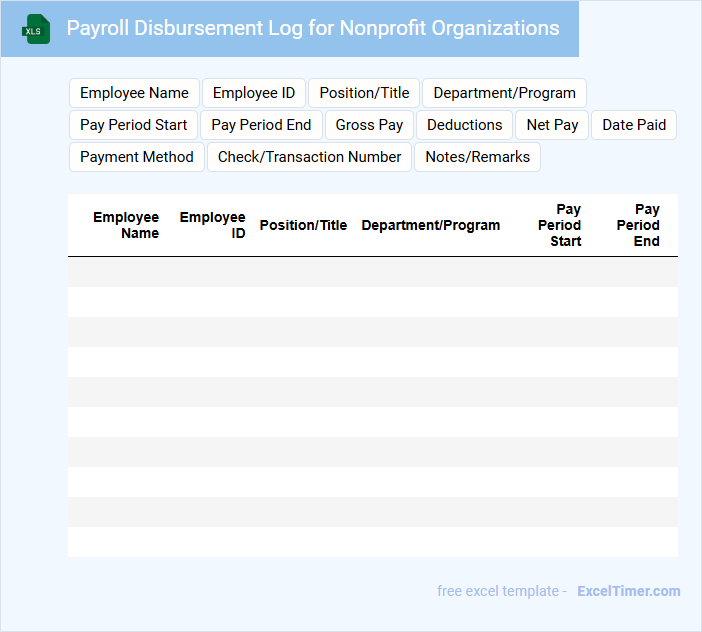

Payroll Disbursement Log for Nonprofit Organizations

The Payroll Disbursement Log is a critical document for nonprofit organizations, tracking all salary payments made to employees and contractors. It ensures transparency and accountability by detailing payment dates, amounts, and recipient information. Maintaining an accurate and up-to-date log helps in auditing and compliance with regulatory requirements.

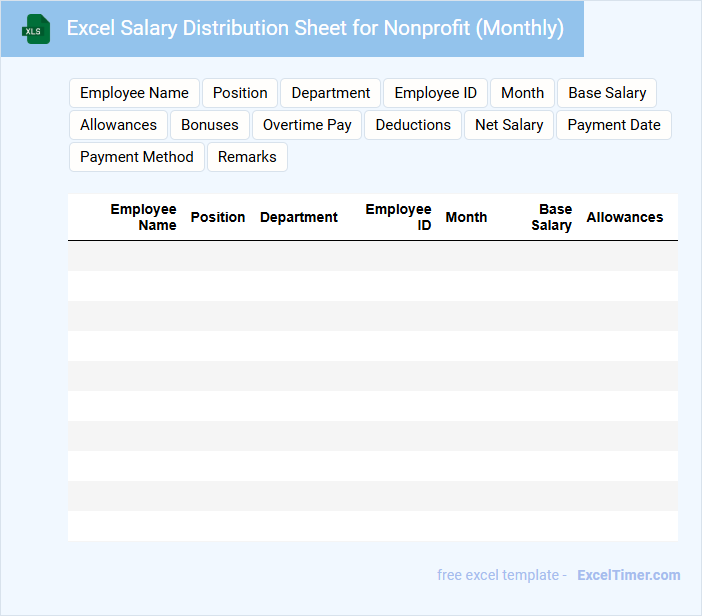

Excel Salary Distribution Sheet for Nonprofit (Monthly)

An Excel Salary Distribution Sheet for Nonprofit (Monthly) typically contains detailed salary allocation data organized by employee roles and departments.

- Employee Information: Includes names, positions, and identification numbers for accurate payroll processing.

- Salary Breakdown: Displays base pay, bonuses, deductions, and total monthly compensation.

- Budget Tracking: Helps in monitoring salary expenses against the nonprofit's financial plan.

What key data fields are essential in an Excel monthly payroll sheet for nonprofit organizations?

Key data fields essential in an Excel monthly payroll sheet for nonprofit organizations include Employee Name, Position, Hours Worked, Hourly Rate or Salary, Deductions, and Net Pay. Accurate tracking of Tax Withholdings, Benefits, and Grant Fund Sources ensures compliance and proper fund allocation. Your payroll sheet should also feature Payment Date and Department for detailed financial reporting.

How can Excel formulas be used to automate salary calculations, deductions, and net pay for nonprofit staff?

Excel formulas automate salary calculations for nonprofit staff by using functions like SUM for total hours worked and multiplication formulas to compute gross pay based on hourly rates. Deductions such as taxes, retirement contributions, and health benefits are calculated using percentage-based formulas linked to gross salary cells. Net pay is determined by subtracting total deductions from gross pay with simple subtraction formulas, ensuring accurate and efficient payroll processing.

Which Excel features help track grant-funded versus general payroll costs for accurate nonprofit reporting?

Excel features like PivotTables enable detailed analysis of grant-funded versus general payroll expenses by summarizing data efficiently. The use of conditional formatting highlights discrepancies or budget overruns in payroll allocations. Data validation ensures accurate entry of payroll categories aligning with nonprofit grant reporting requirements.

What is the best way to structure an Excel payroll template to ensure compliance with nonprofit tax and reporting requirements?

Structure Your Excel payroll template by including distinct columns for employee details, hours worked, pay rates, and tax deductions aligned with nonprofit tax codes. Incorporate automated formulas to calculate gross pay, federal and state withholdings, and any applicable nonprofit-specific contributions. Maintain separate sheets for monthly summaries and IRS reporting forms to streamline compliance and audits.

How can Excel be used to generate summarized payroll reports for nonprofit board reviews and audits?

Excel can generate summarized payroll reports for nonprofit board reviews and audits by using pivot tables to aggregate employee salary data, benefits, and tax withholdings by department or pay period. Formulas and formatting tools enable clear visualization of total payroll expenses and compliance with budget limits. Automating these summaries enhances transparency and simplifies auditing by providing accurate, up-to-date payroll records.