The Monthly Expense Excel Template for Homeowners helps track and manage all home-related costs efficiently, including mortgage payments, utilities, maintenance, and property taxes. This template provides clear categories and customizable fields that simplify budgeting and financial planning for homeowners. Accurate monthly expense tracking supports better financial decisions and long-term savings.

Monthly Expense Tracker for Homeowners

A Monthly Expense Tracker for homeowners is a document used to record and monitor all household expenses systematically. It typically contains categories such as utilities, mortgage or rent, maintenance, and groceries to help users understand where their money is going. An important suggestion is to regularly update the tracker to ensure accurate financial planning and budgeting.

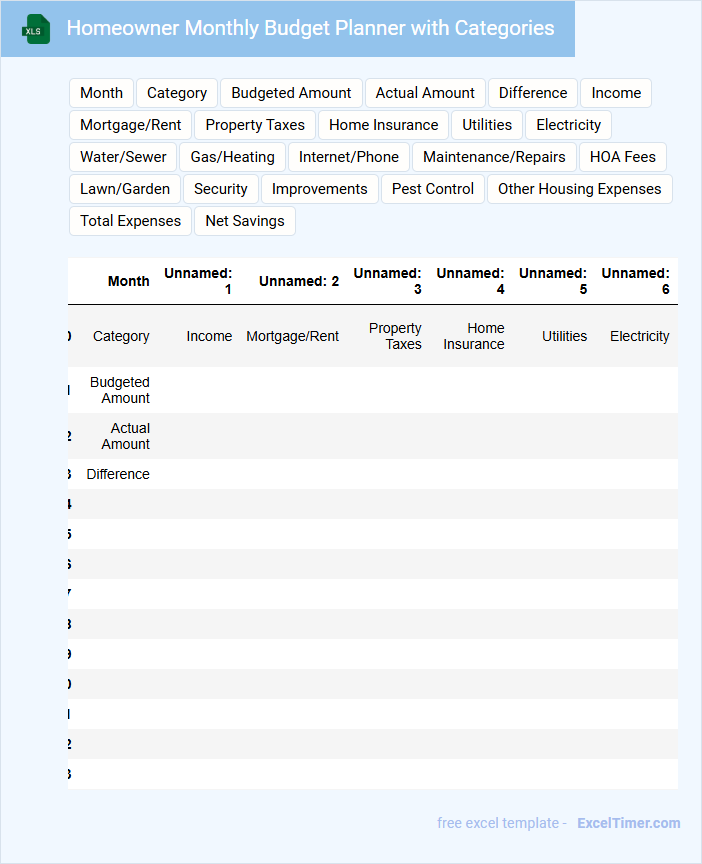

Homeowner Monthly Budget Planner with Categories

A Homeowner Monthly Budget Planner is typically used to track income, expenses, and savings on a monthly basis. It contains categorized sections such as mortgage or rent, utilities, maintenance, insurance, and discretionary spending. This organized approach helps homeowners manage their finances efficiently and avoid overspending. It is important to include detailed expense categories relevant to homeownership for accurate tracking and better financial planning. Setting realistic budget limits and regularly updating the planner improves financial control and foresight. Consistent review of past months' data aids in identifying spending patterns and optimizing savings.

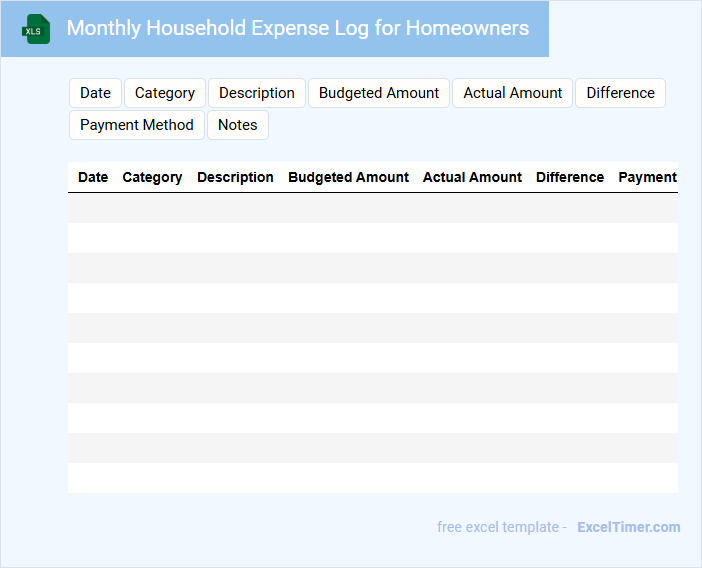

Monthly Household Expense Log for Homeowners

A Monthly Household Expense Log for Homeowners typically contains detailed records of all household-related expenditures to help manage and track monthly spending effectively.

- Accurate Categorization: Ensure all expenses are categorized clearly by type such as utilities, maintenance, and groceries for easier analysis.

- Consistent Updates: Regularly update the log to maintain accurate financial records and avoid missing important expenses.

- Summary and Review: Include a monthly summary to review total expenses and identify areas to reduce costs.

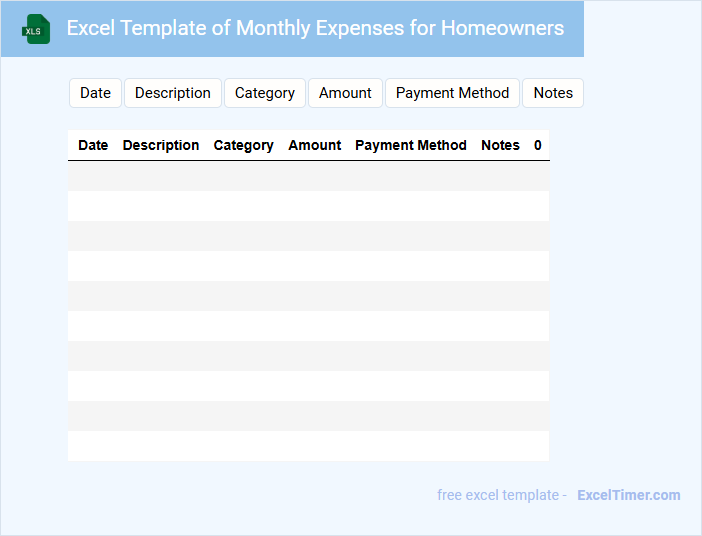

Excel Template of Monthly Expenses for Homeowners

An Excel Template of Monthly Expenses for Homeowners typically includes detailed categories such as mortgage payments, utilities, maintenance, and insurance costs. This document helps homeowners track and manage their recurring expenses efficiently every month. It is essential for budgeting and ensuring financial stability by providing clear insights into spending patterns.

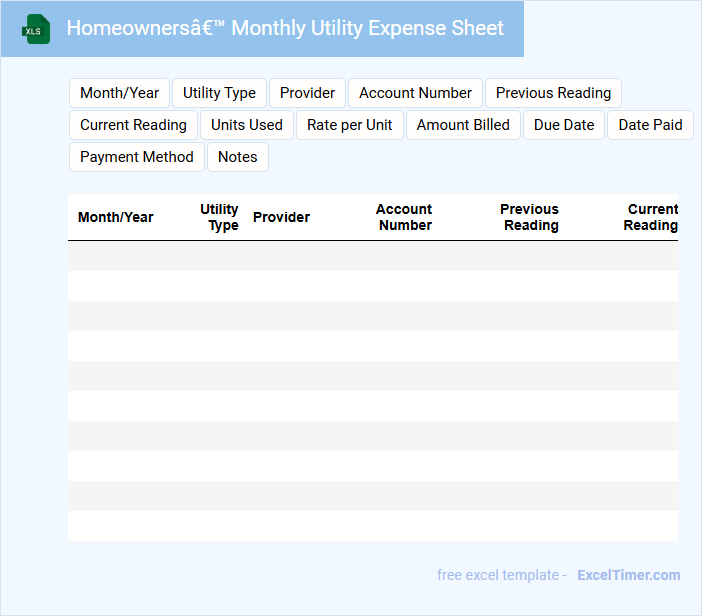

Homeowners’ Monthly Utility Expense Sheet

Homeowners' Monthly Utility Expense Sheet is a document used to track and manage monthly utility costs for a household.

- Expense Tracking: Record monthly costs for utilities such as electricity, water, and gas.

- Budget Management: Compare monthly expenses to budget limits to control spending.

- Usage Monitoring: Identify patterns to help reduce unnecessary consumption.

Monthly Expense Report with Mortgage Tracking

A Monthly Expense Report with Mortgage Tracking typically contains detailed records of monthly expenditures alongside information about mortgage payments to help manage personal finances efficiently.

- Income Tracking: It is important to record all sources of income to accurately assess the budget.

- Expense Categorization: Categorize expenses such as utilities, groceries, and entertainment for clearer financial insights.

- Mortgage Details: Include principal, interest, and remaining balance to monitor loan progress effectively.

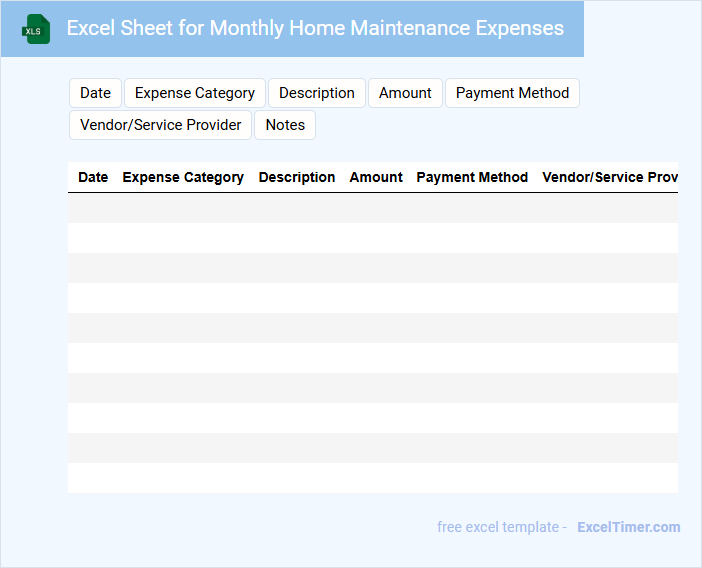

Excel Sheet for Monthly Home Maintenance Expenses

This type of document typically contains detailed records of monthly home maintenance expenses to help track and manage household budgets effectively.

- Expense Categories: Clearly define and separate costs such as repairs, utilities, and cleaning supplies for accurate tracking.

- Monthly Totals: Include calculated totals each month to monitor spending trends over time.

- Notes Section: Add space for remarks to record special maintenance events or irregular expenses for future reference.

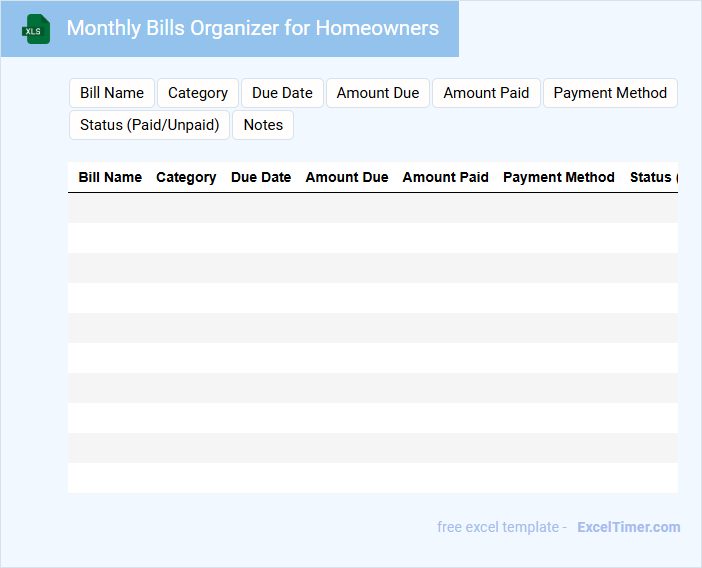

Monthly Bills Organizer for Homeowners

A Monthly Bills Organizer for homeowners typically contains a detailed list of all recurring expenses such as mortgage payments, utilities, insurance, and maintenance fees. It helps in tracking due dates and amounts to avoid late payments and manage cash flow effectively.

This document is essential for maintaining financial stability and planning future budgets with accuracy. It is suggested to regularly update the organizer and include reminders for upcoming payments to ensure timely settlements.

Expense Summary with Savings Tracker for Homeowners

An Expense Summary with Savings Tracker for Homeowners is a document that details monthly expenditures and savings specifically related to homeownership. It typically includes categories such as mortgage payments, utilities, maintenance, and improvements.

This summary helps in monitoring spending habits and identifying opportunities to increase savings. To optimize its effectiveness, ensure it includes regular updates and clear categorization for accurate financial planning.

Homeowners’ Monthly Expense Tracker with Charts

Homeowners' Monthly Expense Trackers typically contain detailed records of all monthly expenses related to home maintenance, utilities, mortgages, and other recurring costs. These documents help homeowners monitor spending patterns and plan budgets effectively.

They often include visual charts to display trends and comparisons, making it easier to identify areas for cost-saving. Incorporating reminders for payment due dates ensures timely management and avoids penalties.

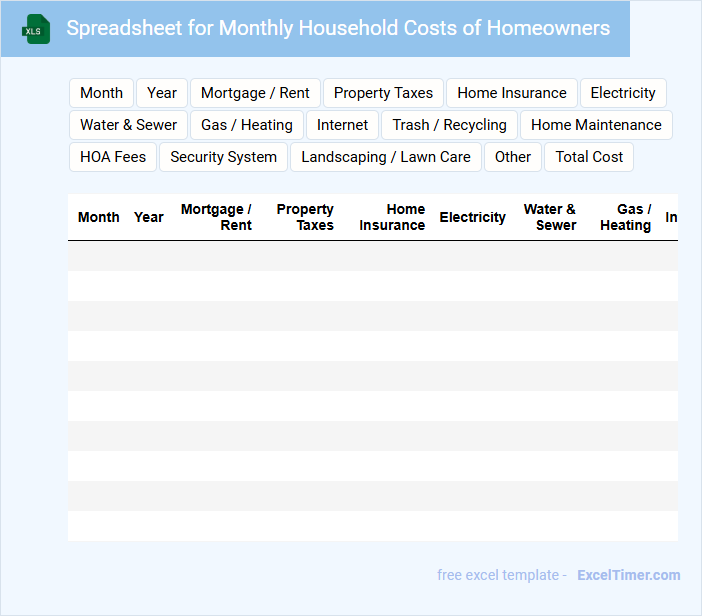

Spreadsheet for Monthly Household Costs of Homeowners

What information is typically included in a Spreadsheet for Monthly Household Costs of Homeowners? This type of document usually contains detailed records of recurring monthly expenses such as mortgage or rent payments, utility bills, maintenance costs, and property taxes. It helps homeowners track their spending, budget effectively, and identify opportunities to save money over time.

What is an important consideration when creating this spreadsheet? It is essential to categorize expenses clearly and update the document consistently each month to ensure accurate financial tracking and planning. Including a summary section with totals and charts can also provide a quick overview of spending patterns and highlight areas for cost reduction.

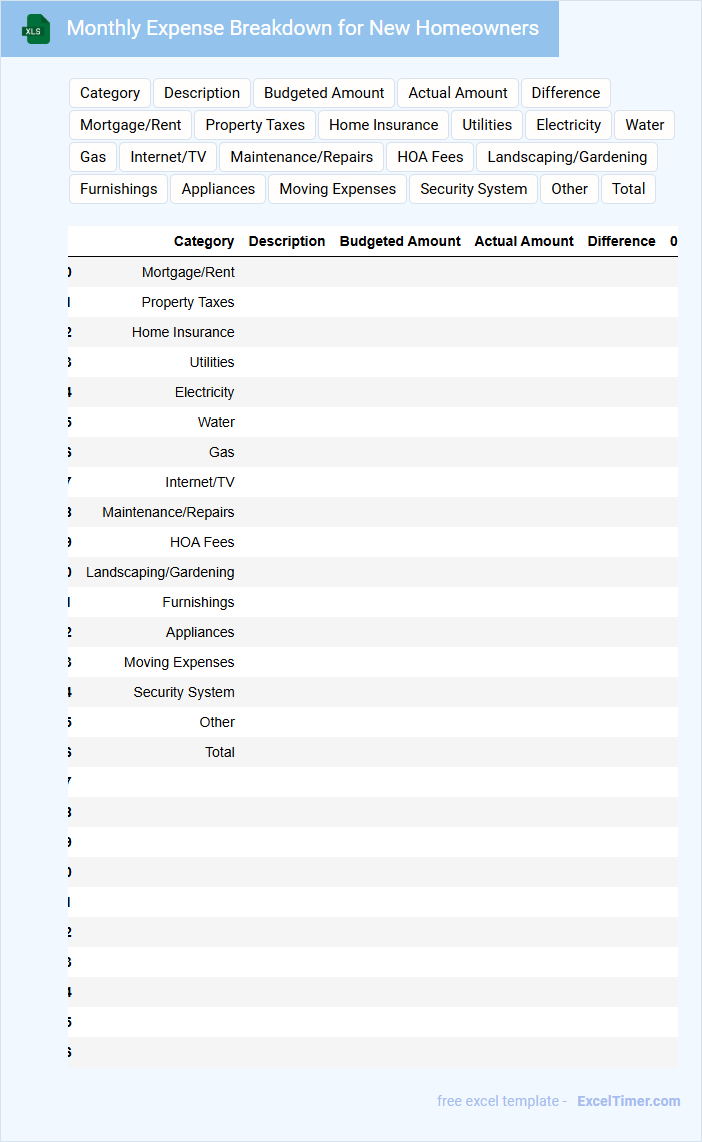

Monthly Expense Breakdown for New Homeowners

A Monthly Expense Breakdown for New Homeowners is a detailed financial document outlining typical costs incurred each month after purchasing a home. It helps in budgeting and managing household finances effectively.

- Include major recurring expenses such as mortgage payments, utilities, and property taxes.

- Account for variable costs like maintenance, groceries, and insurance premiums.

- Highlight any potential emergency funds or savings for unexpected repairs.

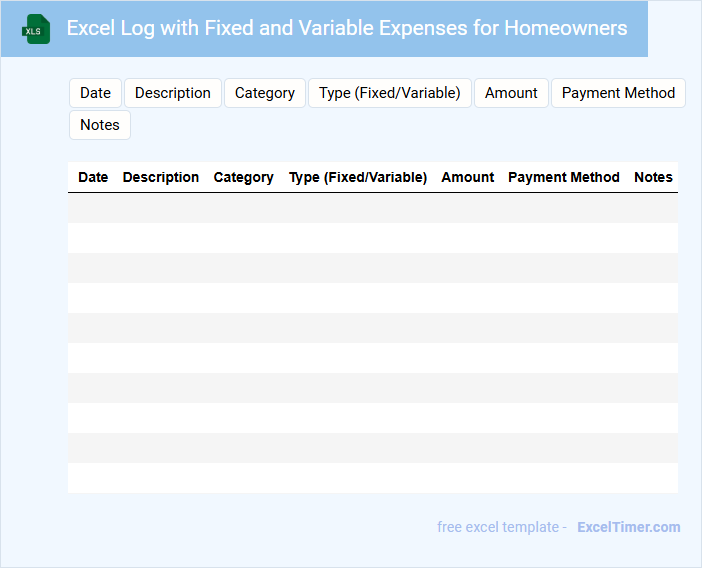

Excel Log with Fixed and Variable Expenses for Homeowners

An Excel Log for fixed and variable expenses is a comprehensive spreadsheet designed to track and categorize homeowners' monthly costs, helping manage budgets effectively. It typically includes sections for rent or mortgage payments, utility bills, maintenance fees, and fluctuating expenses like groceries and entertainment.

Maintaining accurate entries in the log ensures better financial planning and highlights spending patterns over time. To maximize its usefulness, it is important to regularly update the log and review expense trends for informed decision-making.

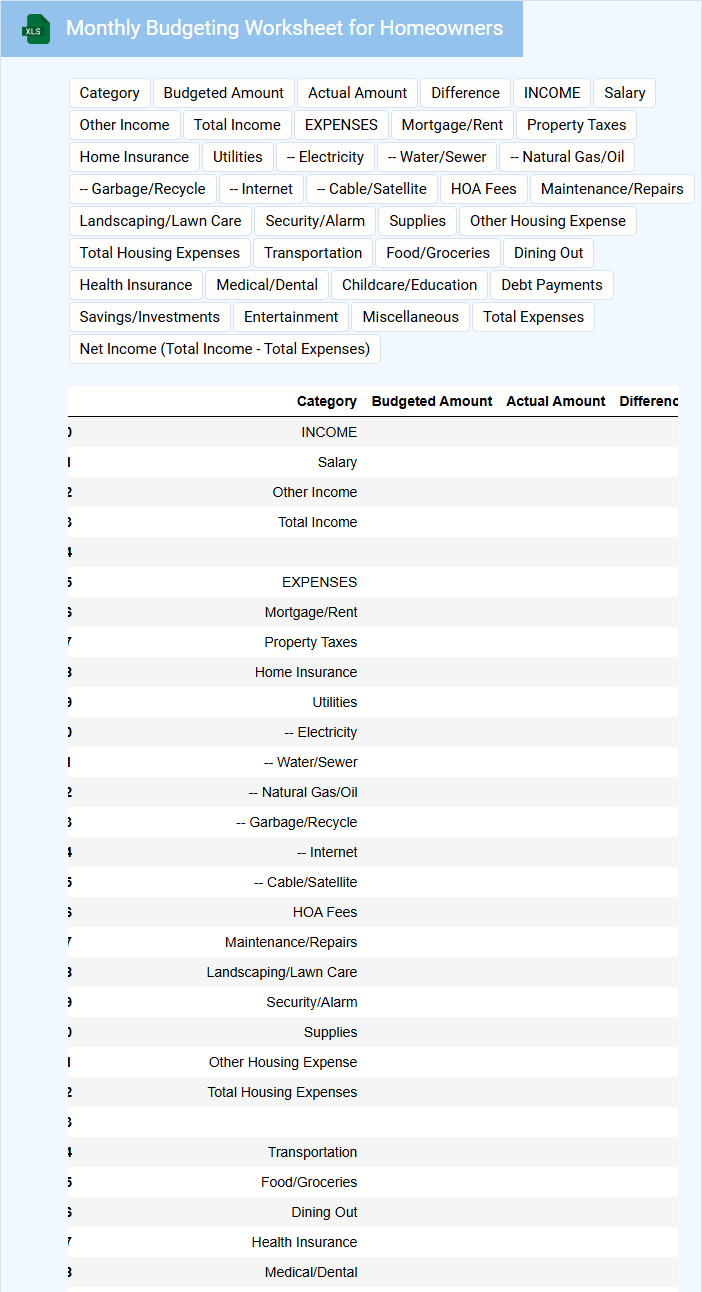

Monthly Budgeting Worksheet for Homeowners

A Monthly Budgeting Worksheet for homeowners typically contains detailed sections for tracking income, fixed and variable expenses, and savings goals. It helps individuals monitor their financial health and plan for upcoming bills such as mortgage payments, utilities, and maintenance costs. Keeping an updated worksheet can prevent overspending and ensure timely payments.

Important elements to include are categorized expense lists, emergency fund allocation, and a comparison of budgeted versus actual spending. Additionally, incorporating reminders for periodic home-related expenses like property taxes and insurance premiums enhances financial preparedness. Regular updating and reviewing of this document can support better financial decision-making throughout the year.

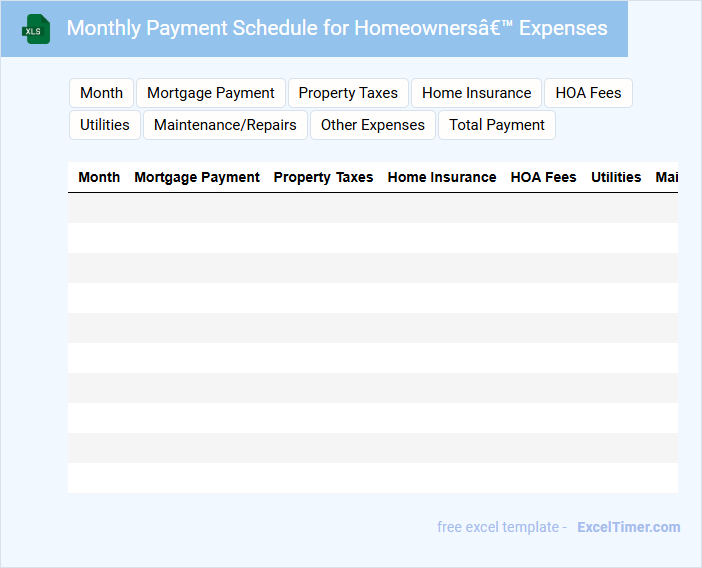

Monthly Payment Schedule for Homeowners’ Expenses

What information is typically included in a Monthly Payment Schedule for Homeowners' Expenses? This document usually contains a detailed list of all anticipated monthly expenses related to homeownership, such as mortgage payments, property taxes, insurance, utilities, and maintenance costs. It helps homeowners track and plan their finances effectively by providing a clear overview of recurring payments.

What is an important consideration when using a Monthly Payment Schedule for Homeowners' Expenses? Ensuring all expenses are accurately estimated and updated regularly is crucial to avoid unexpected shortfalls. Additionally, including a buffer for irregular or emergency repairs can help maintain financial stability.

What categories should be included in a homeowner's monthly expense Excel sheet?

A homeowner's monthly expense Excel sheet should include categories such as mortgage or rent payments, utilities (electricity, water, gas), property taxes, insurance (homeowners and flood), maintenance and repairs, HOA fees, and landscaping costs. Tracking these categories helps manage budget effectively and identify areas for potential savings. Including a section for unexpected expenses ensures accurate financial planning for homeowners.

How can you use Excel formulas to automatically calculate total monthly expenses?

Use the SUM formula to automatically calculate total monthly expenses in Excel by adding all individual expense cells, for example, =SUM(B2:B10). Apply Excel functions like SUMIF or SUMPRODUCT to calculate specific categories or conditional expenses efficiently. Properly structured expense categories and consistent data entries ensure accurate automatic calculations for homeowners tracking monthly costs.

Which expenses should be listed as fixed vs. variable in a homeowner's budget spreadsheet?

Fixed expenses in a homeowner's budget spreadsheet include mortgage payments, property taxes, homeowners insurance, and HOA fees. Variable expenses cover utilities, maintenance, repairs, landscaping, and monthly energy consumption. Accurately categorizing these costs improves budget tracking and financial planning for homeowners.

How can conditional formatting in Excel highlight overspending in specific monthly categories?

Conditional formatting in Excel highlights overspending by applying color-coded rules to your Monthly Expense document, such as turning cells red when expenses exceed budgeted amounts. This visual cue helps you quickly identify categories where spending surpasses limits set for each month. Using formulas linked to your budget thresholds ensures your expense tracking stays accurate and proactive.

What is the best way to visualize trends in monthly expenses using Excel charts or graphs?

Line charts are the best option for visualizing trends in monthly expenses for homeowners because they clearly show changes over time. Use data series representing different expense categories to compare patterns across months. Adding markers and labels enhances clarity and helps identify significant fluctuations.