The Monthly Budget Excel Template for College Students helps manage expenses by tracking income, bills, and spending categories effectively. It simplifies financial planning, ensuring students stay within their budget and avoid unnecessary debt. Customizable features allow for personalized budget adjustments based on changing financial needs.

Monthly Budget Tracker for College Students

A Monthly Budget Tracker is a document designed to help college students manage their income and expenses effectively. It typically contains sections for recording monthly earnings, categorized spending, and savings goals. This tool is essential for fostering financial discipline and ensuring that students live within their means while meeting their academic and personal needs.

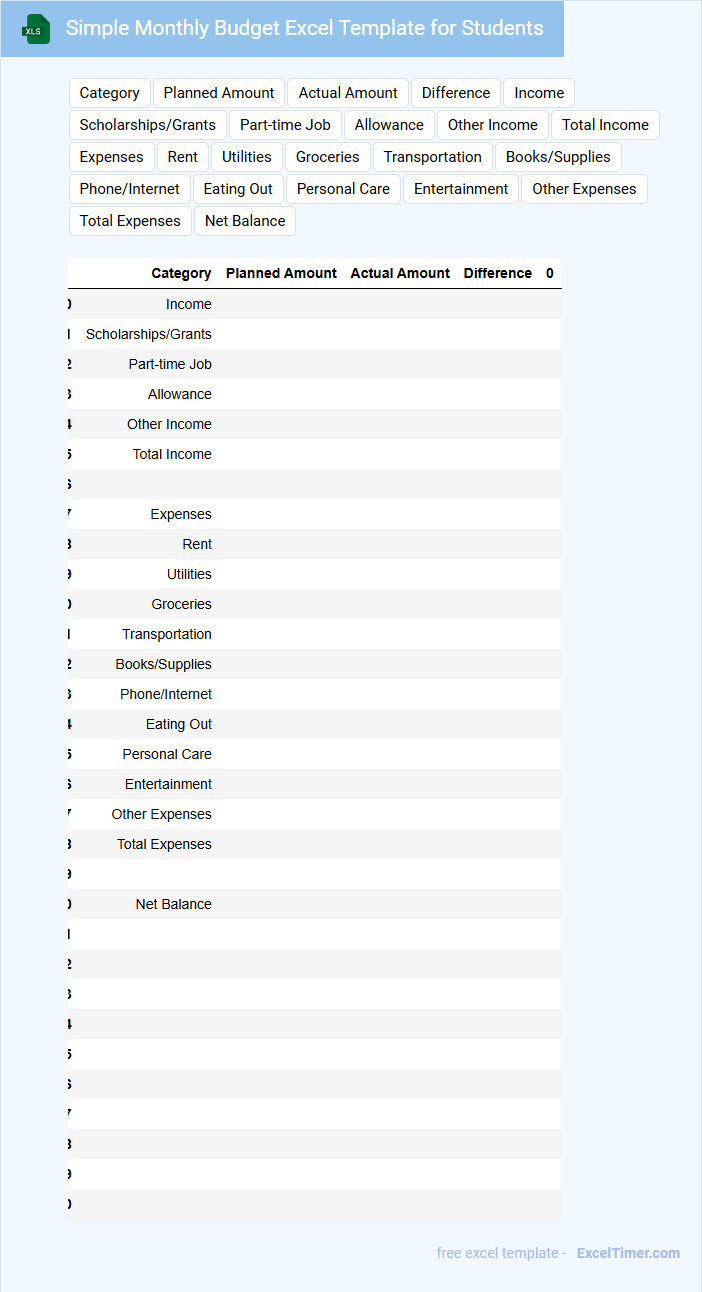

Simple Monthly Budget Excel Template for Students

A Simple Monthly Budget Excel Template for students is a structured document designed to track income and expenses on a monthly basis. It helps students manage their finances by organizing rent, groceries, tuition, and entertainment costs clearly.

Typically, this type of document contains categorized sections like income, fixed expenses, variable expenses, and savings goals. Including a summary dashboard with charts is important for visualizing spending trends and staying on budget.

College Student Monthly Expense Tracker

A College Student Monthly Expense Tracker is a document that helps students monitor their monthly expenditures to manage their budget effectively. It typically includes categories like rent, groceries, transportation, and entertainment. Using this tracker can improve financial awareness and prevent overspending.

Important elements to include are clear expense categories, income sources, and a summary of total spending versus budgeted amounts. Regularly updating the tracker ensures accuracy and helps identify areas to cut costs. Consistent use supports better money management skills throughout college life.

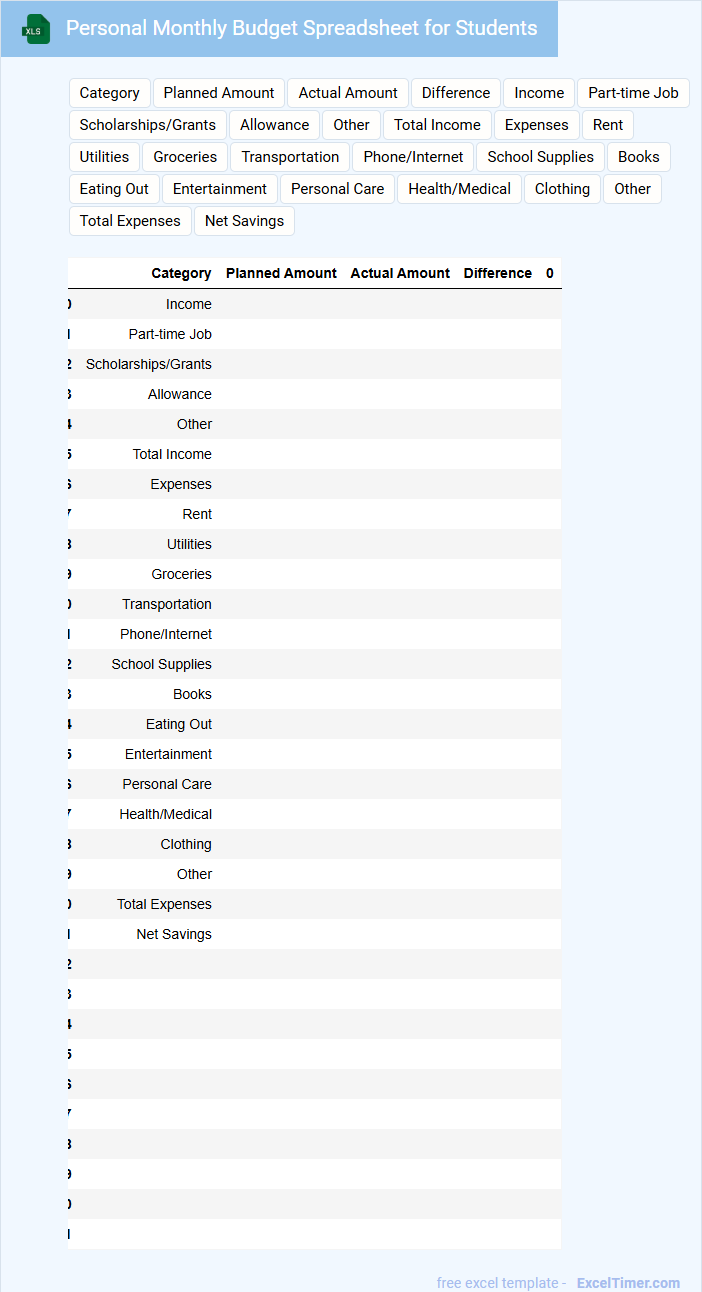

Personal Monthly Budget Spreadsheet for Students

What information is typically included in a Personal Monthly Budget Spreadsheet for Students? This document usually contains detailed sections for tracking income sources such as part-time jobs or allowances, along with various expenses like tuition fees, textbooks, meals, transportation, and entertainment. It helps students organize their finances, monitor spending patterns, and plan for savings effectively.

What is an important consideration when creating a Personal Monthly Budget Spreadsheet for Students? Ensuring that the budget is realistic and adaptable to changing monthly expenses is vital, along with including categories relevant to student life like study materials and social activities. This approach promotes financial discipline and helps students manage limited resources responsibly.

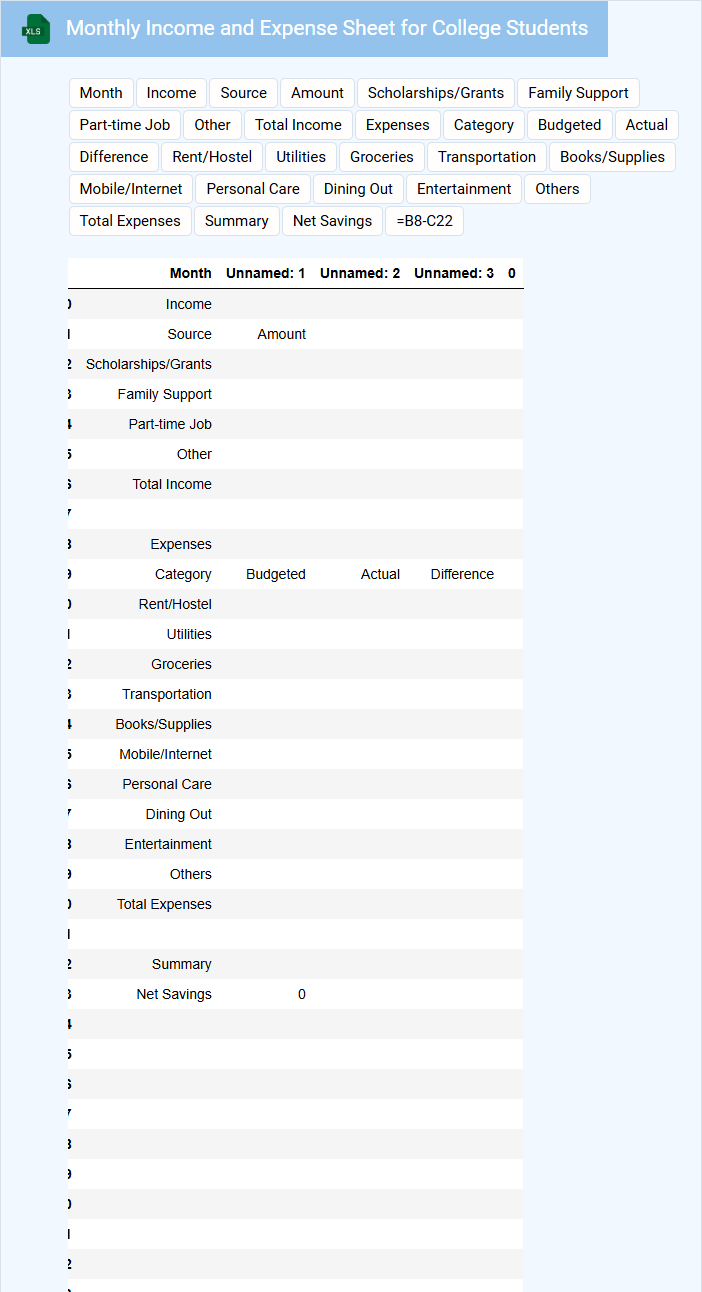

Monthly Income and Expense Sheet for College Students

What information does a Monthly Income and Expense Sheet for College Students usually contain? It typically includes details of all income sources such as allowances, part-time job earnings, and scholarships. It also records monthly expenses like rent, food, transportation, and study materials, providing a clear overview of financial management.

Why is it important for college students to maintain this document? Keeping an accurate monthly income and expense sheet helps students track their spending habits and avoid overspending. This practice promotes budgeting skills and financial responsibility, essential for managing limited resources effectively during college life.

Excel Budget Planner for Students with Limited Income

An Excel Budget Planner for students with limited income is designed to help manage and track financial resources effectively. It typically contains sections for income, expenses, savings goals, and debt repayment. The planner is essential for developing good financial habits and ensuring students live within their means.

Important features include customizable categories for various student expenses such as tuition, food, transportation, and entertainment. It should also offer automatic calculations for remaining balances and alert users to overspending. Visual aids like charts and graphs can enhance understanding and motivation.

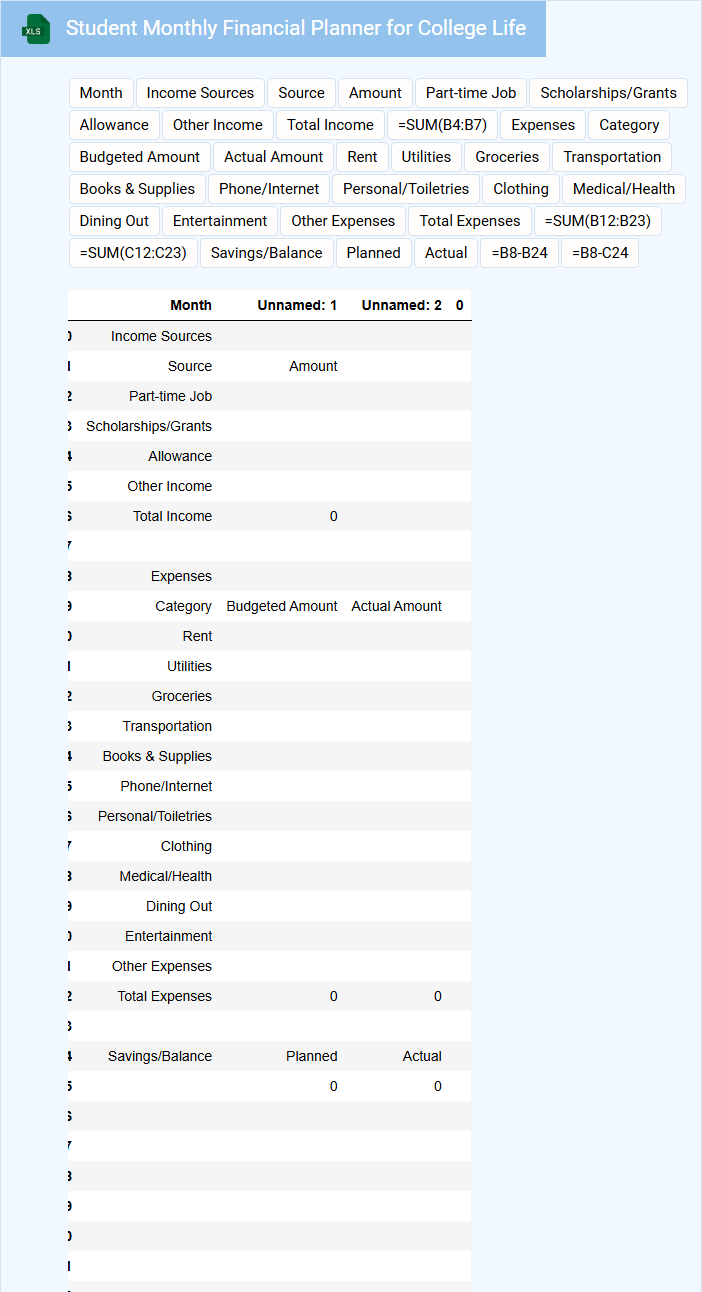

Student Monthly Financial Planner for College Life

A Student Monthly Financial Planner for College Life typically contains detailed budgeting tools, expense tracking, and savings goals tailored for managing a student's finances effectively.

- Income Tracking: Record all sources of monthly income, including part-time jobs and allowances.

- Expense Categories: Categorize spending into essentials like tuition, rent, food, and discretionary expenses.

- Savings Goals: Set realistic monthly targets for emergency funds or future expenses to build financial security.

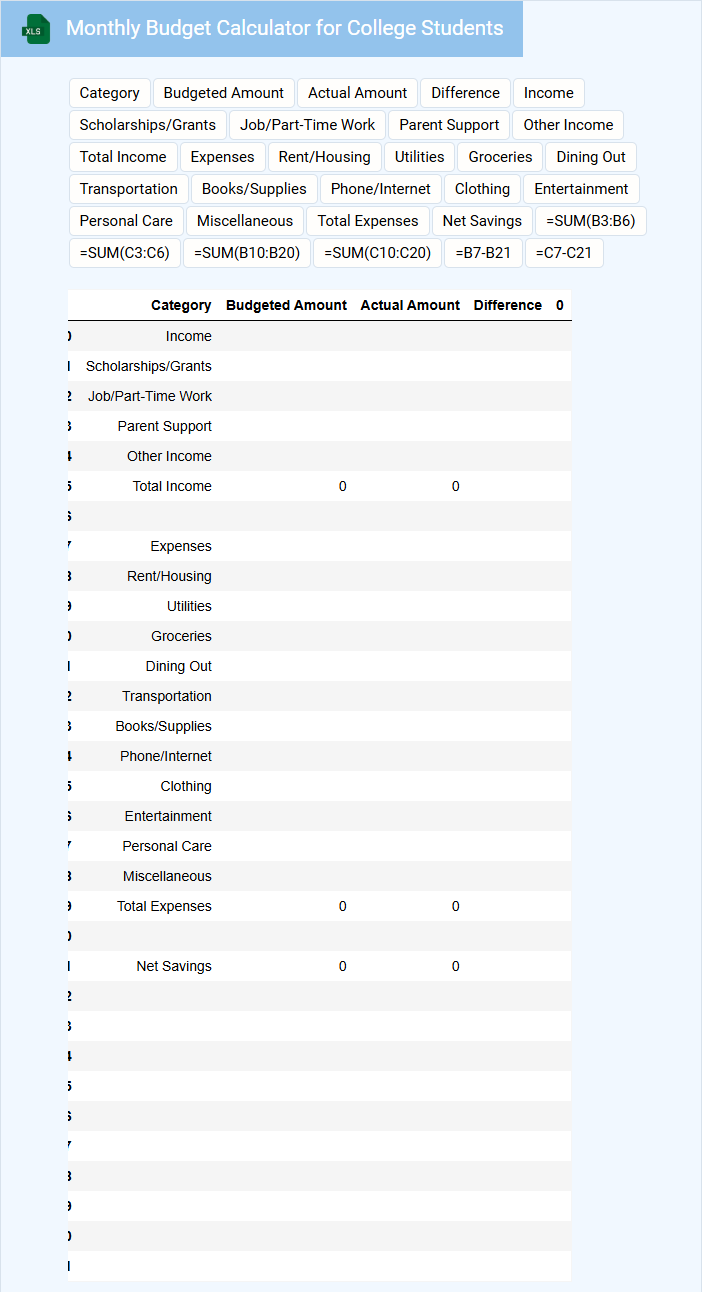

Monthly Budget Calculator for College Students

A Monthly Budget Calculator for college students is a practical tool designed to help manage expenses effectively. It typically includes income sources, fixed and variable expenses, and savings goals tailored to student life. Utilizing this document enables better financial planning and promotes responsible money management throughout the academic year.

Important elements to include are accurate income tracking from part-time jobs or allowances, clear categorization of expenses such as tuition, rent, food, transportation, and entertainment, and a section for unexpected costs. It is also crucial to incorporate reminders for bill due dates and tips on minimizing unnecessary expenditures. This ensures a comprehensive and user-friendly budgeting experience for students.

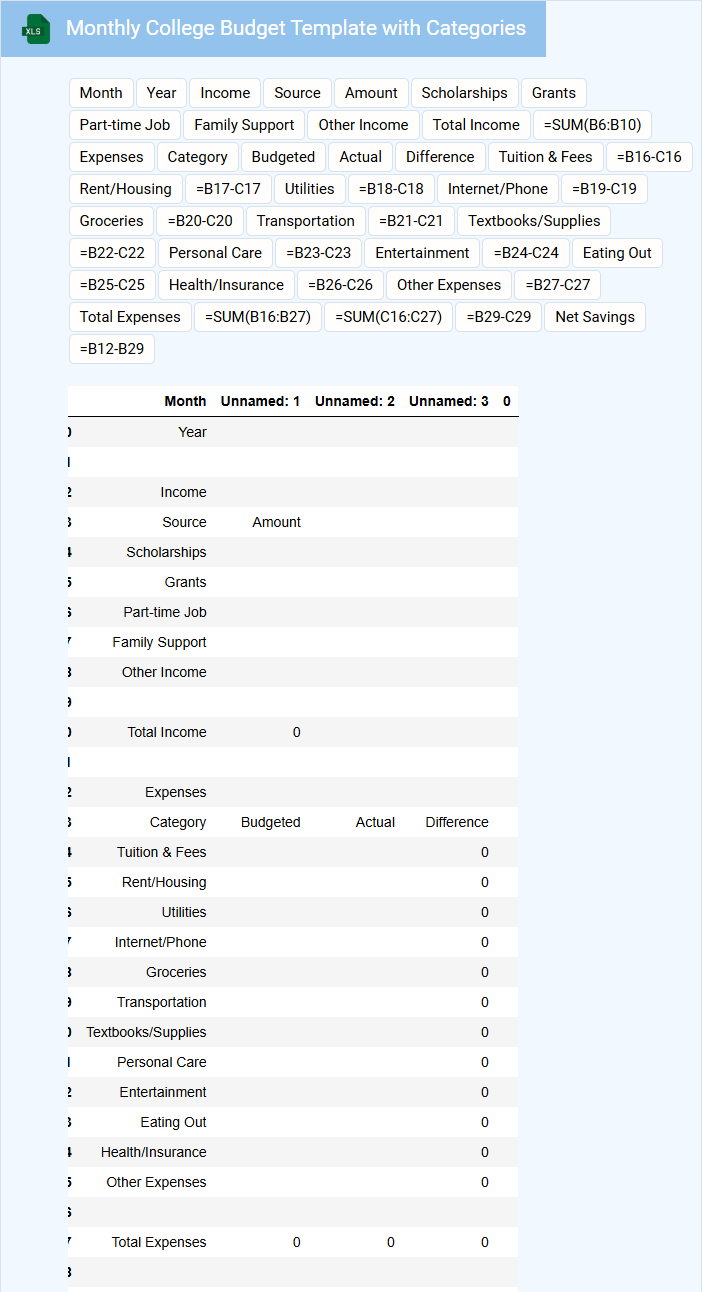

Monthly College Budget Template with Categories

A Monthly College Budget Template with Categories is a structured document used by students to track their income and expenses throughout the month, ensuring financial stability and planning. It helps organize spending into specific categories to better manage and optimize personal finances during college life.

- Include categories such as tuition, housing, food, transportation, and entertainment to cover all typical expenses.

- Regularly update the budget to reflect actual spending and adjust for any unexpected costs.

- Use the template to set financial goals, like saving for emergencies or paying off student loans.

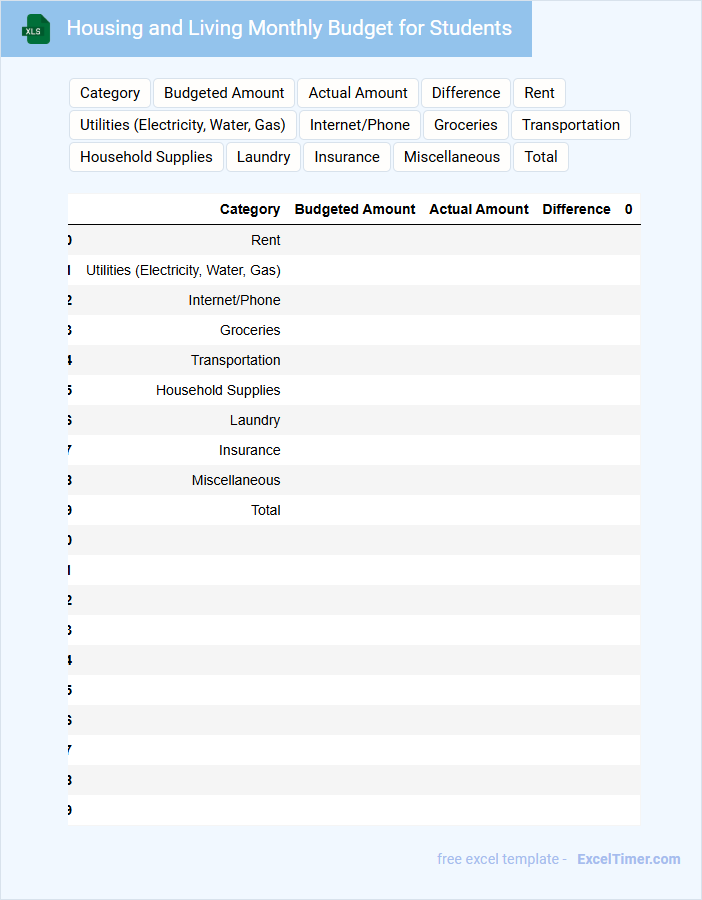

Housing and Living Monthly Budget for Students

A Housing and Living Monthly Budget for Students is a financial document that outlines projected expenses related to accommodation and daily living. It helps students manage their finances effectively during their academic period.

- Include rent, utilities, and groceries as primary expense categories.

- Track monthly income sources such as allowances, scholarships, or part-time work.

- Allow a contingency amount for unexpected costs like repairs or medical emergencies.

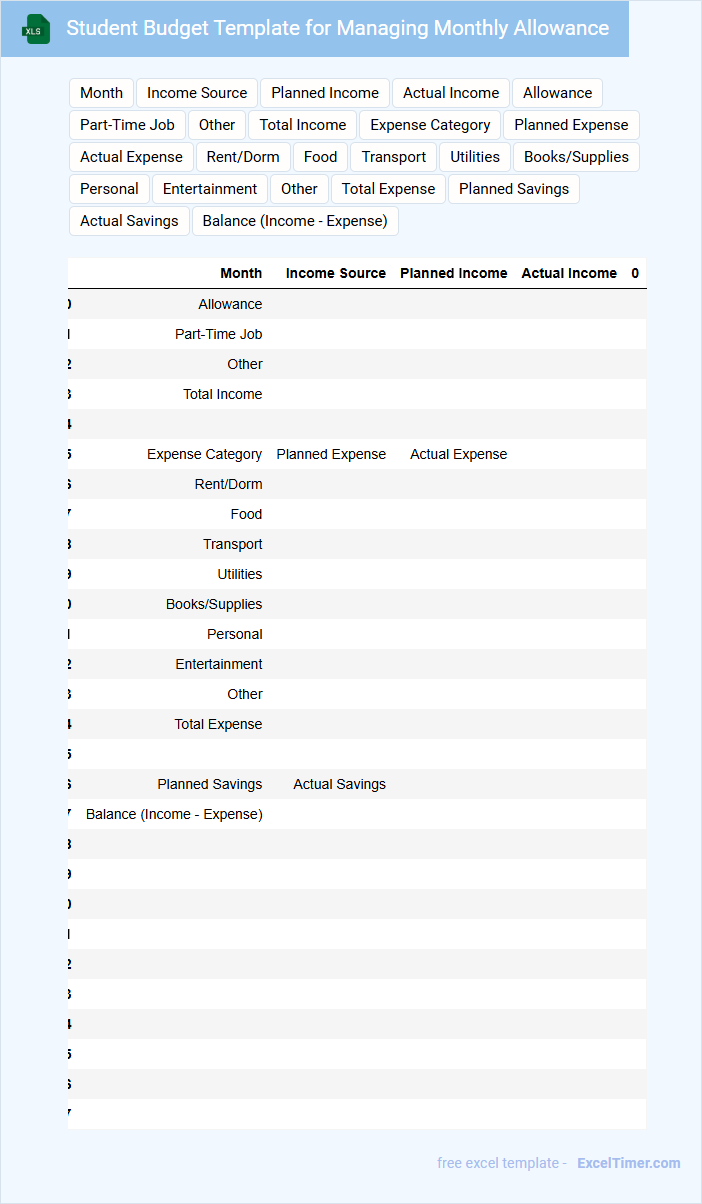

Student Budget Template for Managing Monthly Allowance

A Student Budget Template for Managing Monthly Allowance is a structured document designed to help students track their income and expenses effectively. It provides a clear overview to ensure financial discipline and avoid overspending.

- Include categories for essential expenses such as tuition, food, and transportation.

- Track savings goals to encourage financial responsibility and planning.

- Update the budget regularly to reflect changes in income or expenditures.

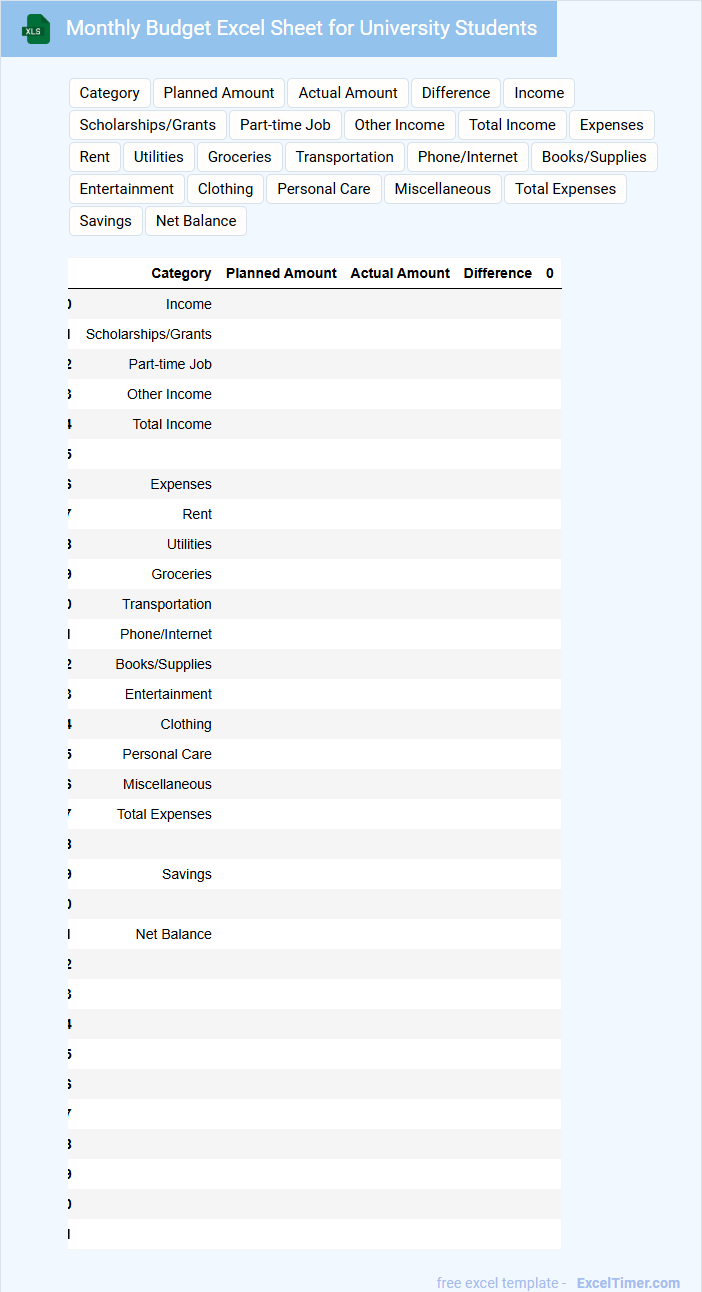

Monthly Budget Excel Sheet for University Students

A Monthly Budget Excel Sheet for university students typically contains income sources, such as part-time jobs or allowances, and various expense categories like tuition, books, housing, and transportation. It helps students manage their finances effectively by tracking spending and savings goals each month.

Important elements to include are clear expense categories, automatic total calculations, and space for notes on unexpected costs or financial adjustments. Using color coding for different types of expenses can also enhance usability and clarity.

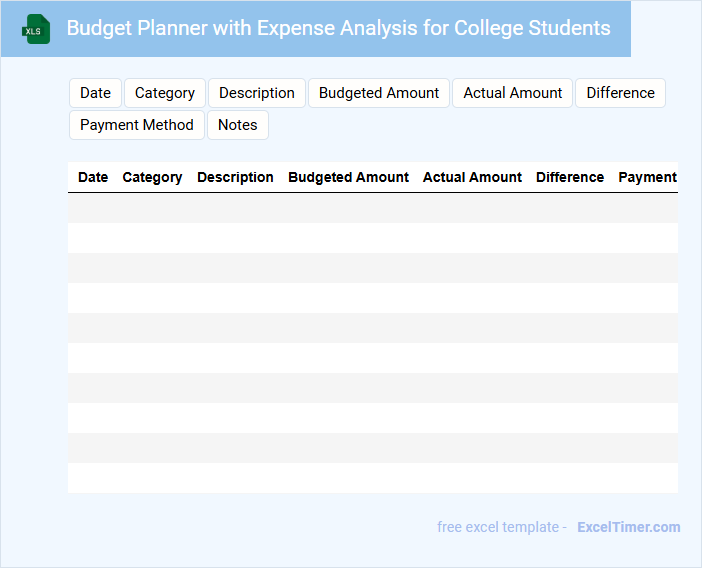

Budget Planner with Expense Analysis for College Students

A Budget Planner with Expense Analysis for College Students is a document designed to help manage and track monthly income alongside various expenditures. It provides a clear overview to optimize spending habits and promote financial responsibility.

- Include categorized expenses such as tuition, food, transportation, and entertainment.

- Incorporate a section for tracking income sources like scholarships, part-time jobs, or allowances.

- Provide visual aids like charts or graphs to summarize spending patterns effectively.

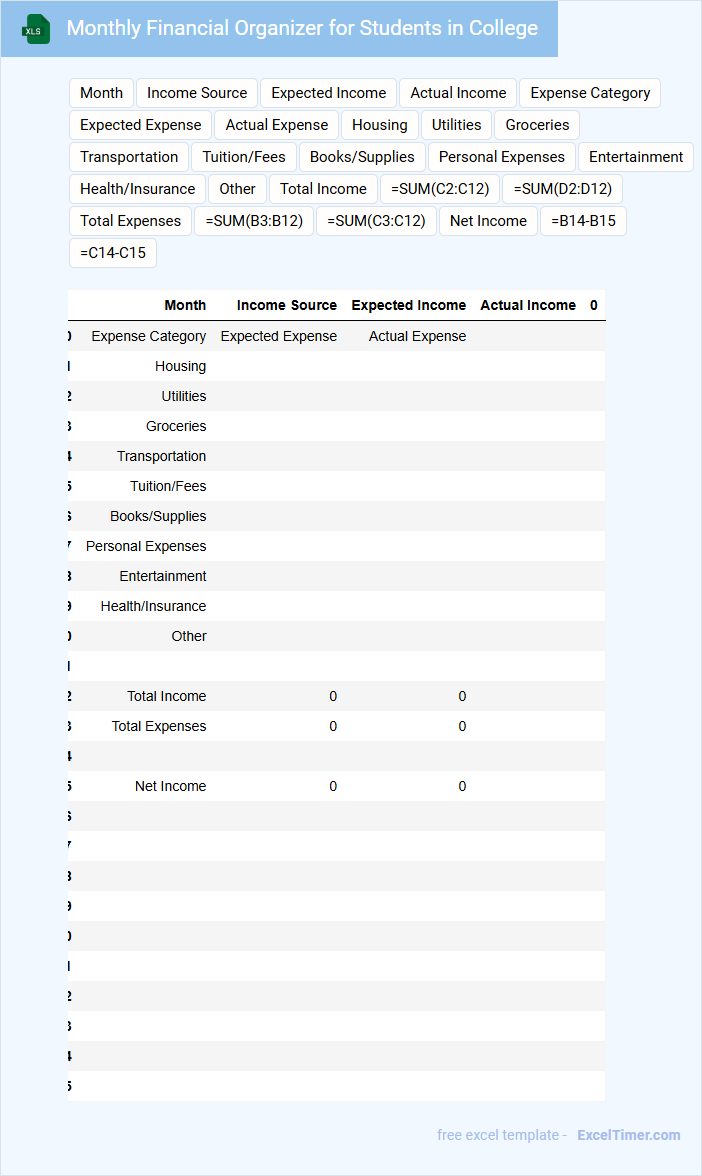

Monthly Financial Organizer for Students in College

A Monthly Financial Organizer for college students is a document that helps track income, expenses, and savings on a monthly basis. It usually contains sections for budgeting tuition fees, books, living expenses, and entertainment costs.

This organizer aids in managing finances effectively, preventing overspending, and ensuring financial goals are met. Including expense categories and a summary sheet is an important feature to maintain clarity and control.

Basic Monthly Budget Worksheet with Student Focus

A Basic Monthly Budget Worksheet with a student focus typically contains categorized income and expense entries tailored to a student's financial situation. It includes sections for tuition, textbooks, housing, food, and transportation costs to help students manage their finances effectively. The worksheet aims to provide a clear overview of monthly cash flow, enabling better financial planning and savings. For students, it is important to include scholarship or part-time job income and prioritize essential expenses to avoid debt. Tracking variable costs, such as entertainment and groceries, helps identify areas for potential savings. Additionally, setting realistic goals and regularly updating the worksheet ensures continued financial accountability. Using this worksheet fosters financial literacy and encourages responsible money management habits that benefit students beyond their academic years. It supports decision-making related to spending, saving, and investing, which are crucial for long-term financial stability. Making it user-friendly with clear instructions can increase its effectiveness for students new to budgeting.

What are the essential categories to include in a monthly budget for college students?

Essential categories in a monthly budget for college students include tuition and fees, rent or housing costs, groceries and dining, transportation, textbooks and supplies, utilities, and personal expenses. Tracking these categories helps manage finances effectively and avoid debt. Including savings for emergencies and entertainment ensures a balanced and realistic budget.

How can Excel formulas help track and manage income versus expenses each month?

Excel formulas enable college students to automatically calculate total income and expenses by summing relevant cells, ensuring accurate monthly tracking. Functions like SUM and IF help categorize spending and highlight overspending areas by comparing budgeted versus actual amounts. Visual tools such as conditional formatting and charts further assist in managing cash flow and staying within budget limits.

What is the importance of setting savings goals within a student budget spreadsheet?

Setting savings goals within a student budget spreadsheet helps you track progress toward financial priorities and build an emergency fund. It encourages disciplined spending by allocating specific amounts for savings each month. Clear savings targets increase motivation and financial security throughout college life.

How can conditional formatting in Excel highlight overspending in specific budget categories?

Conditional formatting in Excel can highlight overspending in your monthly budget by automatically changing the cell color when expenses exceed the allocated amount. This visual alert helps you quickly identify budget categories where spending surpasses limits. You can set custom rules to compare actual expenses against your budgeted values for precise monitoring.

What strategies can students use to update and review their Excel budget regularly for accuracy?

To maintain accuracy in your Monthly Budget Excel document, regularly input all expenses and income as they occur, ensuring real-time updates. Use built-in Excel tools like filters and conditional formatting to quickly identify discrepancies and overspending. Schedule a weekly review session to analyze spending patterns and adjust budget categories based on actual data.