The Monthly Income and Expense Excel Template for Airbnb Hosts helps track rental revenue and operational costs efficiently, ensuring precise financial management. It includes customizable categories for income sources and expenses, facilitating easy budget analysis and tax preparation. Using this template boosts profitability by providing clear insights into cash flow and financial trends.

Monthly Income and Expense Tracker for Airbnb Hosts

What information is typically included in a Monthly Income and Expense Tracker for Airbnb Hosts? This document usually contains detailed records of all income earned from Airbnb bookings and various expenses related to property maintenance, cleaning, and utilities. It helps hosts monitor profitability and manage financial aspects efficiently.

Why is it important for Airbnb hosts to maintain this tracker? Keeping an accurate and up-to-date tracker helps hosts identify trends, control costs, and optimize pricing strategies. Consistent tracking also ensures better tax preparation and financial planning throughout the year.

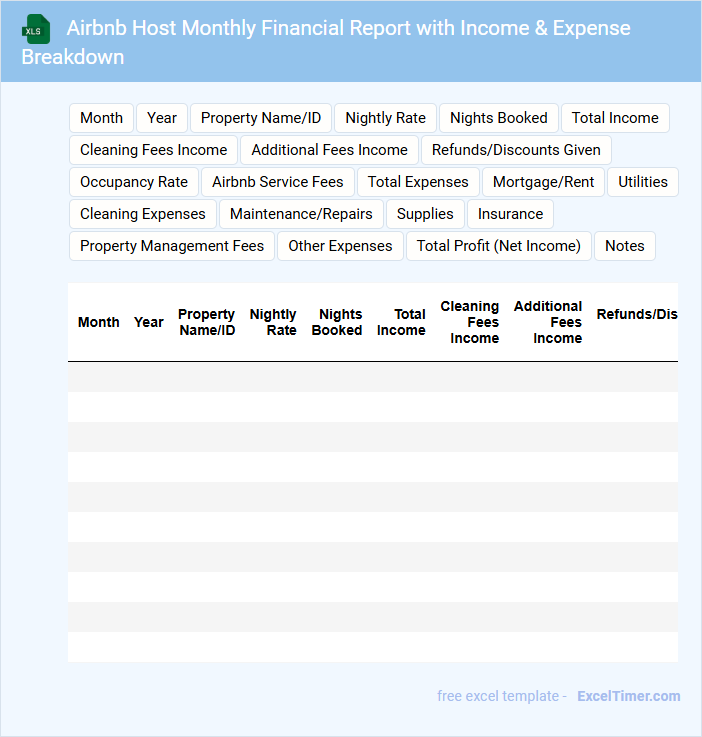

Airbnb Host Monthly Financial Report with Income & Expense Breakdown

An Airbnb Host Monthly Financial Report typically contains detailed records of rental income and associated expenditures over a month. It provides a clear breakdown of earnings, fees, maintenance costs, and other expenses incurred. This document helps hosts monitor profitability and make informed financial decisions.

To optimize this report, ensure accuracy in recording all transactions and categorize each expense clearly. Include comparative data from previous months for trend analysis. Additionally, highlight any unexpected costs or income fluctuations to better plan future budgets.

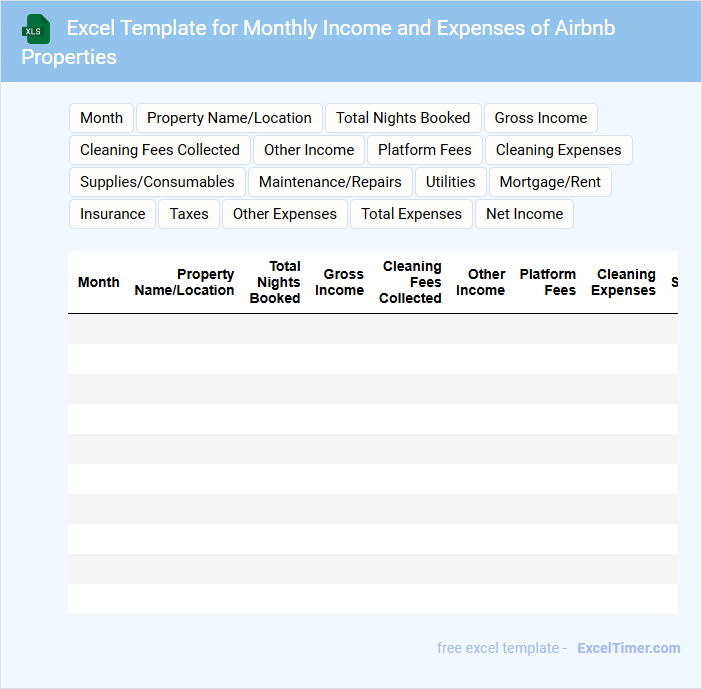

Excel Template for Monthly Income and Expenses of Airbnb Properties

This Excel template for Monthly Income and Expenses of Airbnb Properties is designed to help property owners track and manage their financial performance efficiently.

- Income Tracking: Record rental income, cleaning fees, and additional services revenue.

- Expense Categorization: Organize costs such as maintenance, utilities, and supplies for clear accounting.

- Financial Summary: Generate monthly profit/loss reports and cash flow overviews for informed decision-making.

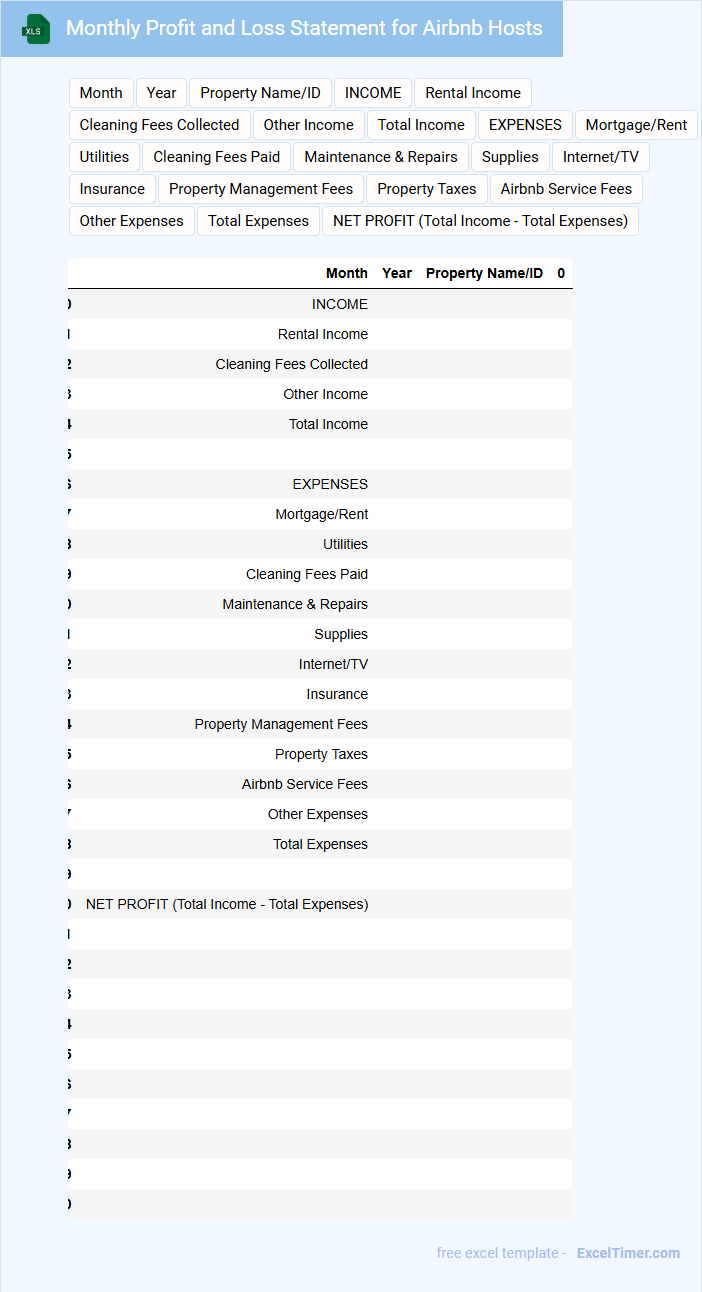

Monthly Profit and Loss Statement for Airbnb Hosts

The Monthly Profit and Loss Statement for Airbnb hosts is a financial document summarizing income and expenses over a specific month. It typically contains revenue from bookings, operating costs, and net profit or loss. This statement helps hosts track financial performance and make informed business decisions.

Important elements to include are detailed listings of rental income, cleaning and maintenance costs, platform fees, and taxes. Hosts should ensure accuracy in documenting all expenses to optimize profitability. Regular review of this statement aids in budget planning and identifying cost-saving opportunities.

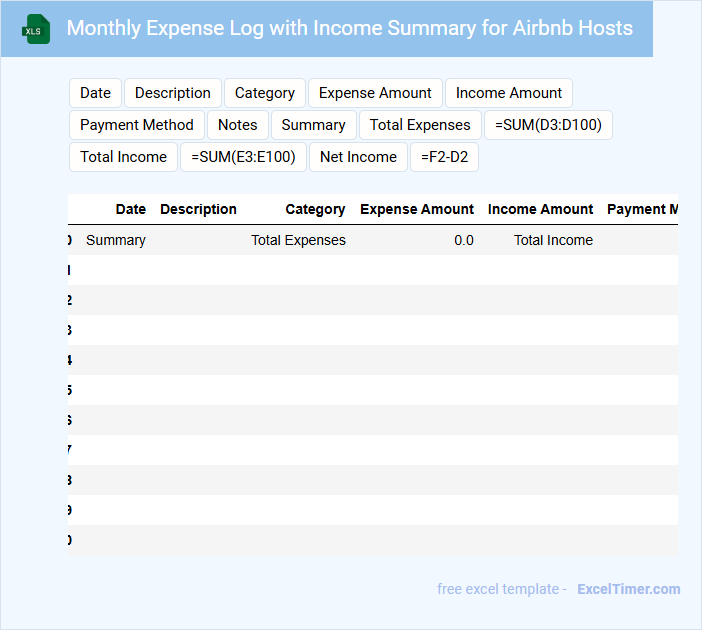

Monthly Expense Log with Income Summary for Airbnb Hosts

A Monthly Expense Log with Income Summary for Airbnb Hosts typically contains a detailed record of monthly earnings and expenditures related to hosting activities.

- Income tracking: A clear summary of rental income received from guests.

- Expense categorization: Organized listing of costs such as cleaning, maintenance, and utilities.

- Financial analysis: Insights on profitability and cash flow for informed decision-making.

Airbnb Monthly Income and Expense Spreadsheet for Hosts

An Airbnb Monthly Income and Expense Spreadsheet is typically used by hosts to track their rental earnings and monitor all related costs on a monthly basis. This document helps in organizing financial data such as booking revenues, cleaning fees, maintenance expenses, and other variable costs associated with hosting.

It is essential for financial planning and tax preparation, providing clear insights into profitability and cash flow. Ensuring accuracy and regularly updating the spreadsheet will help hosts optimize their business performance effectively.

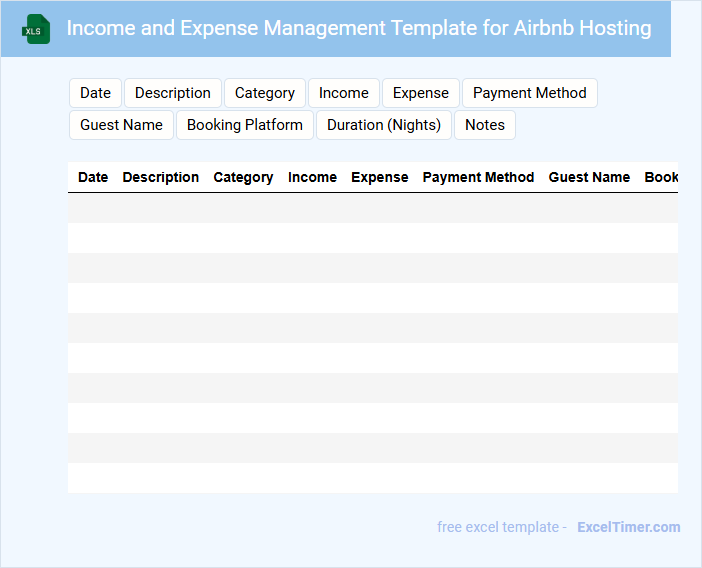

Income and Expense Management Template for Airbnb Hosting

An Income and Expense Management Template for Airbnb hosting is a crucial document that helps track all financial transactions related to rental activities. It typically contains sections for recording income from bookings, categories for various expenses, and summaries to monitor profitability. Using such a template ensures efficient financial management and aids in tax preparation.

Monthly Airbnb Host Financial Tracker with Category Breakdown

The Monthly Airbnb Host Financial Tracker is a document designed to help hosts monitor their income and expenses on a monthly basis. It usually contains detailed records of bookings, revenue, and various operational costs categorized for easy analysis.

This tracker often includes sections for categories like cleaning fees, maintenance, utilities, and taxes, providing a comprehensive overview of financial performance. An important suggestion is to regularly update and reconcile the data to maintain accurate financial insights and improve budgeting strategies.

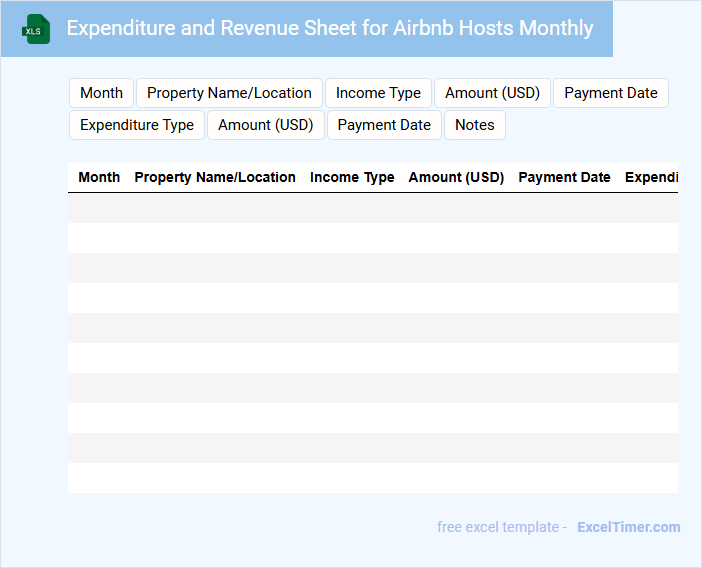

Expenditure and Revenue Sheet for Airbnb Hosts Monthly

An Expenditure and Revenue Sheet for Airbnb hosts monthly typically contains detailed records of all income generated from bookings and associated expenses such as cleaning fees, maintenance costs, and service charges. This document helps hosts track financial performance, manage budgets effectively, and plan future investments. It is important to update this sheet regularly for accurate financial analysis and tax reporting.

Monthly Income Report for Airbnb Hosts with Expense Tracker

The Monthly Income Report for Airbnb hosts is a detailed document that outlines earnings and expenses related to property rentals. It typically includes income from bookings, cleaning fees, and any additional services provided. An integrated expense tracker is crucial for monitoring costs such as maintenance, utilities, and platform fees to ensure accurate profit calculation.

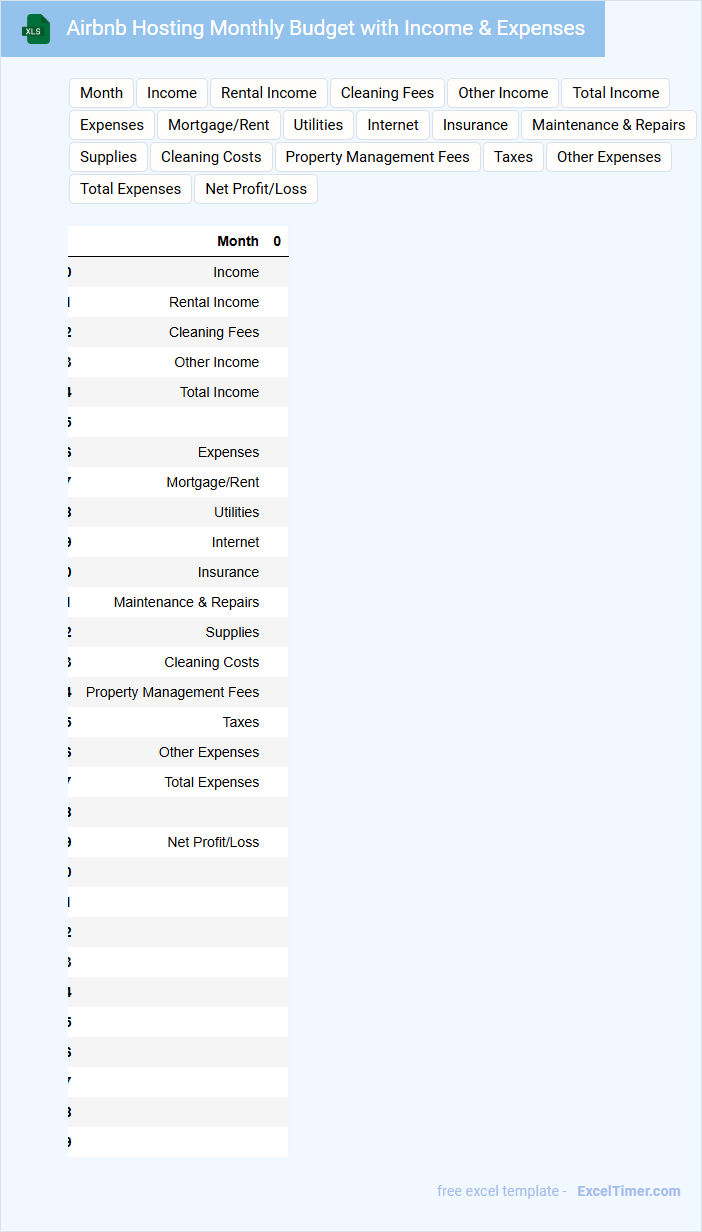

Airbnb Hosting Monthly Budget with Income & Expenses

An Airbnb Hosting Monthly Budget document typically contains detailed records of all income and expenses related to hosting activities. It helps hosts track their financial performance, including rental income, cleaning fees, maintenance costs, and other operational expenses. Maintaining this document ensures better financial planning and profitability analysis over time.

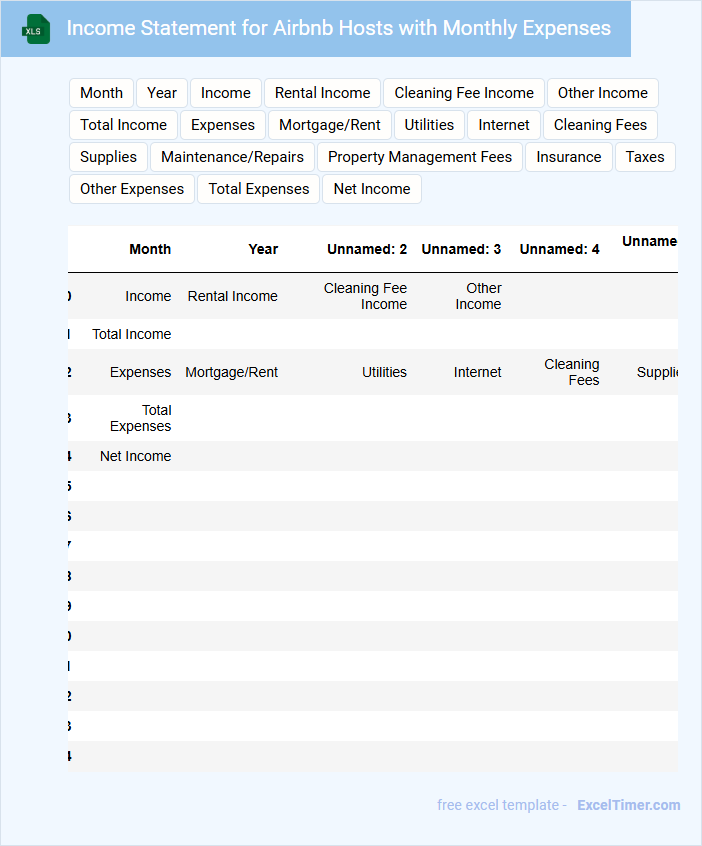

Income Statement for Airbnb Hosts with Monthly Expenses

The Income Statement for Airbnb Hosts is a financial document that summarizes revenues and expenses over a specific period. It typically includes monthly rental income, cleaning fees, and operating expenses such as utilities and maintenance. This statement helps hosts track profitability and manage cash flow effectively.

Monthly Financial Dashboard for Airbnb Hosts

What information is typically contained in a Monthly Financial Dashboard for Airbnb Hosts? This document usually includes detailed income summaries, expense breakdowns, occupancy rates, and profit margins specifically tailored for Airbnb operations. It helps hosts track their financial performance, identify trends, and make informed decisions about pricing and property management strategies.

What important aspects should be highlighted in this dashboard? Key components should include monthly revenue by property, categorized expenses (cleaning, maintenance, fees), booking frequency, seasonal variations, and comparative performance metrics. Emphasizing clear visualization and real-time updates ensures hosts can quickly react to changes and optimize their rental income effectively.

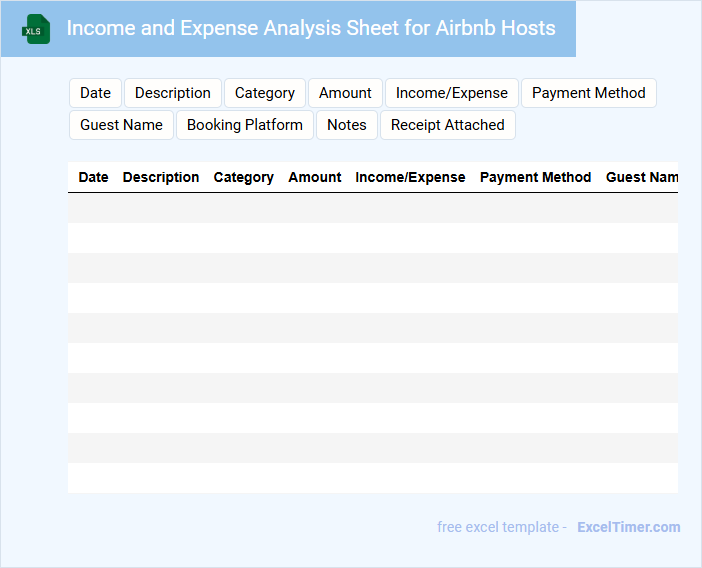

Income and Expense Analysis Sheet for Airbnb Hosts

An Income and Expense Analysis Sheet for Airbnb hosts typically contains detailed records of all earnings from bookings and associated costs such as cleaning fees, maintenance, utilities, and platform commissions. This document helps hosts monitor financial performance and identify trends over time. Keeping accurate and updated entries is crucial for effective financial management.

Important elements include categorizing expenses correctly and regularly reconciling the sheet with actual bank statements to avoid discrepancies. The sheet should also include occupancy rates and average nightly rates to assess profitability comprehensively. Utilizing this document supports informed decision-making to optimize income and control expenses.

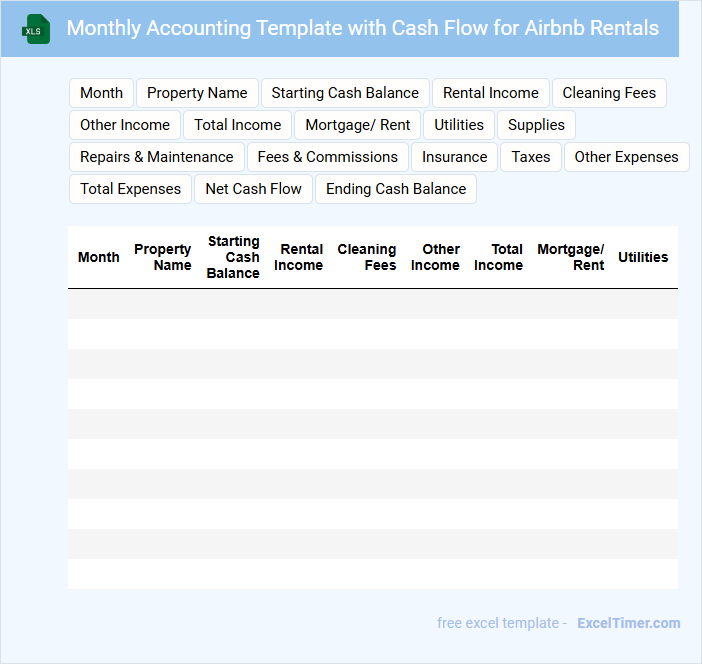

Monthly Accounting Template with Cash Flow for Airbnb Rentals

A Monthly Accounting Template with Cash Flow for Airbnb Rentals typically contains detailed records of income, expenses, and net cash flow related to property rentals. It helps landlords track financial performance, manage budgets, and prepare for tax filings. Ensuring accuracy in documenting rental income, maintenance costs, and occupancy rates is crucial for effective financial management.

What are the primary categories of monthly income and expense an Airbnb host should track in an Excel document?

Your Excel document for Monthly Income and Expense as an Airbnb host should track primary income categories such as rental income, cleaning fees, and extra guest fees. Key expense categories include mortgage or rent, utilities, maintenance, cleaning costs, and platform service fees. Accurate tracking of these categories helps optimize profitability and manage your hosting finances efficiently.

How can Excel formulas help calculate net profit for Airbnb hosts each month?

Excel formulas automate the calculation of net profit for Airbnb hosts by subtracting total monthly expenses from total monthly income. Functions like SUM aggregate income sources and expense categories, enabling accurate financial tracking. This streamlined approach enhances budgeting and financial decision-making for hosts.

Which columns or data fields are essential for recording recurring and one-time expenses in the monthly tracking sheet?

Essential columns for tracking Airbnb hosts' monthly income and expenses include Date, Expense Type (Recurring or One-Time), Description, Amount, Payment Method, and Category (e.g., utilities, cleaning, maintenance). Including a column for Vendor or Service Provider helps in identifying recurring service charges. A Notes field enables detailed tracking of specific expense circumstances or irregularities.

How does organizing income and expenses by specific dates improve monthly financial analysis for Airbnb hosts?

Organizing income and expenses by specific dates allows you to track daily cash flow patterns and identify peak booking periods accurately. This detailed date-specific data enhances budget forecasting and highlights trends such as seasonality or unexpected expenses. Precise monthly financial analysis enables better decision-making and maximizes your Airbnb rental profitability.

What conditional formatting techniques can highlight overspending or income shortfalls in a monthly Airbnb Excel spreadsheet?

Use conditional formatting with red fill to highlight expense cells exceeding your set budget limits, signaling overspending. Apply a green fill to income cells that meet or surpass your monthly targets, emphasizing positive cash flow. Data bars can visually compare monthly income against expenses, making it easier for you to spot income shortfalls.