The Monthly Rent Collection Excel Template for Property Managers streamlines tracking tenant payments and rent due dates in one organized spreadsheet. It ensures accurate financial records, minimizes errors, and simplifies monthly reporting for efficient property management. Customizable fields allow easy adaptation to various property portfolios and rent structures.

Monthly Rent Collection Tracker for Property Managers

What information does a Monthly Rent Collection Tracker for Property Managers typically contain? This type of document usually includes tenant details, rent due dates, payment statuses, and amounts collected each month. It helps property managers efficiently monitor rent payments, identify overdue rents, and maintain accurate financial records.

What is an important feature to include in this tracker? Ensuring the tracker has clear status indicators such as "Paid," "Pending," or "Late" can greatly improve management efficiency. Additionally, incorporating space for notes about payment issues or communication can enhance tenant relationship tracking.

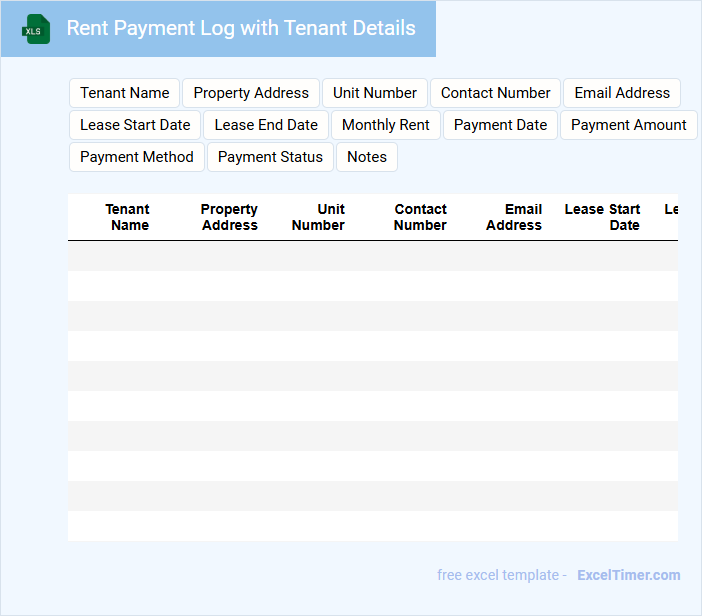

Rent Payment Log with Tenant Details

A Rent Payment Log with Tenant Details typically contains records of rental payments made by tenants, including dates, amounts, and payment methods. It also includes tenant information such as names, contact details, and lease terms to ensure accurate tracking. Maintaining this document helps landlords monitor timely payments and manage tenant accounts efficiently.

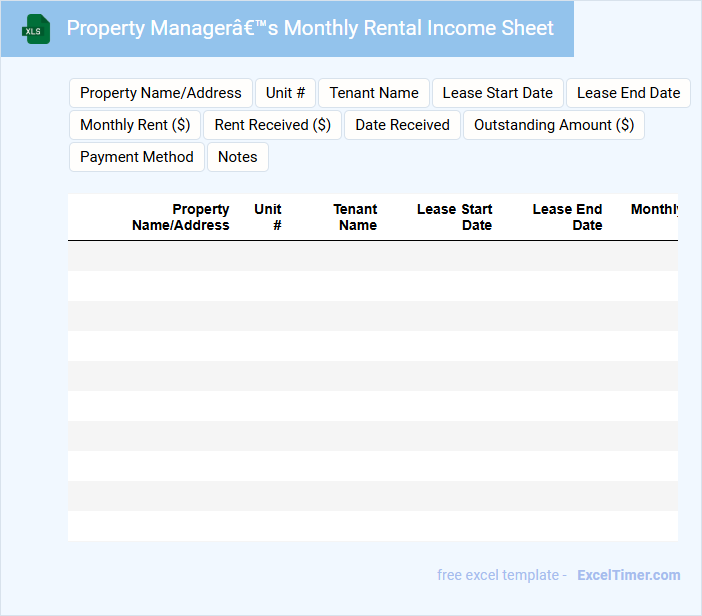

Property Manager’s Monthly Rental Income Sheet

What information is typically included in a Property Manager's Monthly Rental Income Sheet? This document usually contains detailed records of rental income received from tenants, including payment dates and amounts. It also tracks outstanding balances and summarizes total income for financial reporting purposes.

Why is maintaining an accurate rental income sheet important? Keeping precise records helps property managers monitor cash flow, identify late payments quickly, and provide transparent financial statements to property owners. It is essential for effective budgeting, tax preparation, and ensuring the financial health of the rental properties.

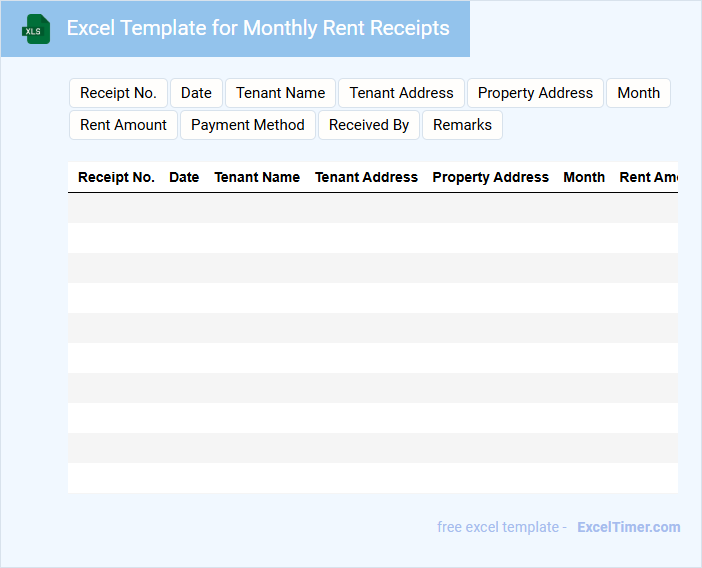

Excel Template for Monthly Rent Receipts

What information is typically included in an Excel Template for Monthly Rent Receipts? This type of document usually contains details such as the tenant's name, rental property address, payment date, amount paid, and payment method. It helps landlords keep an organized record of monthly rent transactions for tracking and reference purposes.

What important features should be included in an Excel Template for Monthly Rent Receipts? It is essential to have clear fields for payment confirmation, space for landlord and tenant signatures, and automated calculations for totals or outstanding balances. Including these elements ensures accuracy, transparency, and ease of use in managing rent payments.

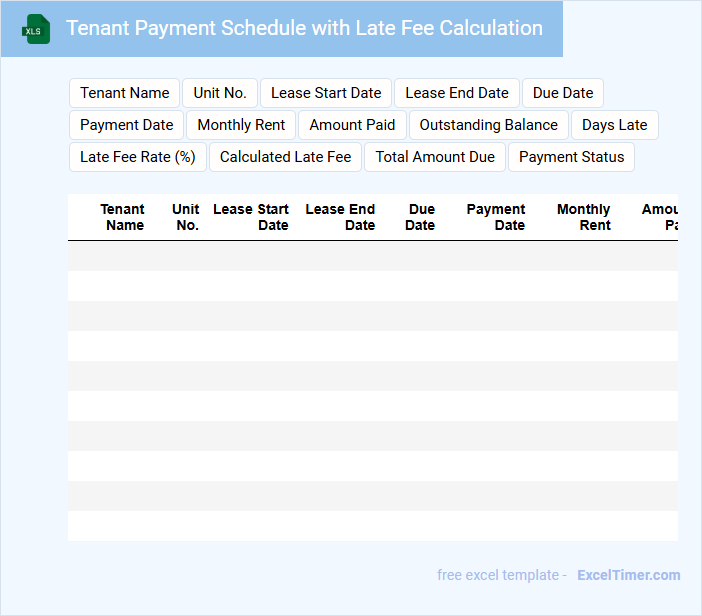

Tenant Payment Schedule with Late Fee Calculation

The Tenant Payment Schedule typically outlines the due dates, amounts, and methods for rent payments within a lease agreement. It often includes provisions for late fee calculation to ensure timely payments and mitigate delays. An important recommendation is to clearly state the grace period and exact penalty rates to avoid disputes.

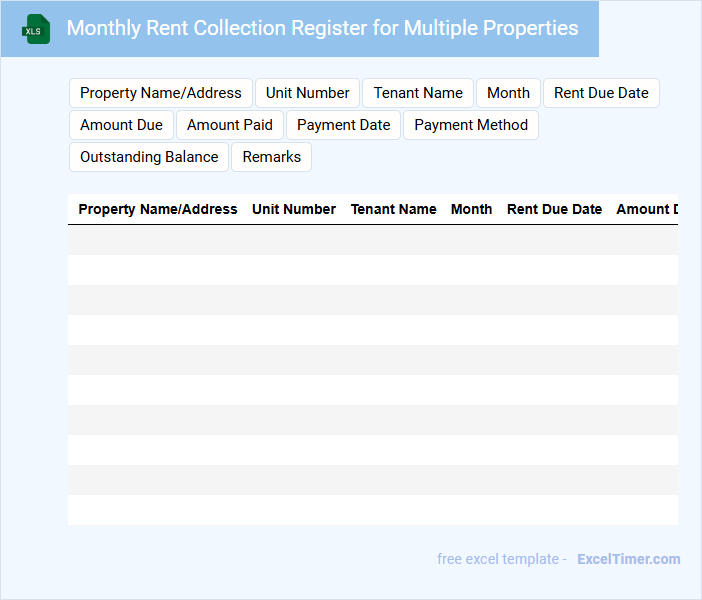

Monthly Rent Collection Register for Multiple Properties

Monthly Rent Collection Register for Multiple Properties is a comprehensive record used by landlords or property managers to track rent payments across various rental units. It typically includes tenant details, payment dates, amounts received, and any outstanding balances to ensure accurate financial management. Keeping this register updated helps in monitoring income flow and identifying any late or missed payments promptly.

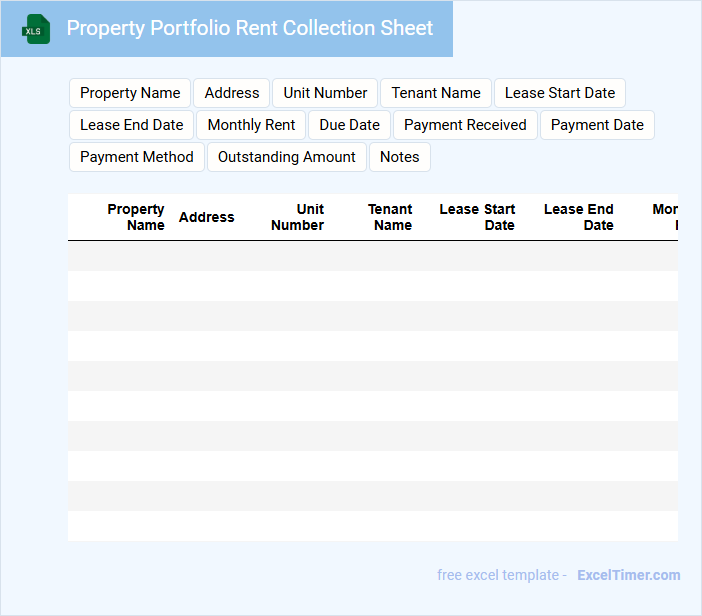

Property Portfolio Rent Collection Sheet

A Property Portfolio Rent Collection Sheet is typically a detailed record used by property managers or landlords to track rental income across multiple properties. It contains tenant information, rent due dates, amounts paid, and outstanding balances. This document helps ensure accurate financial management and timely collection of rents.

An important suggestion is to regularly update the sheet to reflect payments and any changes in tenant status. Including a clear summary of total rent collected and pending balances can enhance financial clarity. Additionally, maintaining organized backups of this document is crucial for accountability and dispute resolution.

Rent Due and Received Tracker for Landlords

A Rent Due and Received Tracker document is essential for landlords to monitor timely rent payments and outstanding balances efficiently. It typically contains tenant details, due dates, amounts owed, and received payments, ensuring transparency and accuracy in rental transactions. Using this tracker helps landlords maintain organized records, reduce missed payments, and simplify financial management.

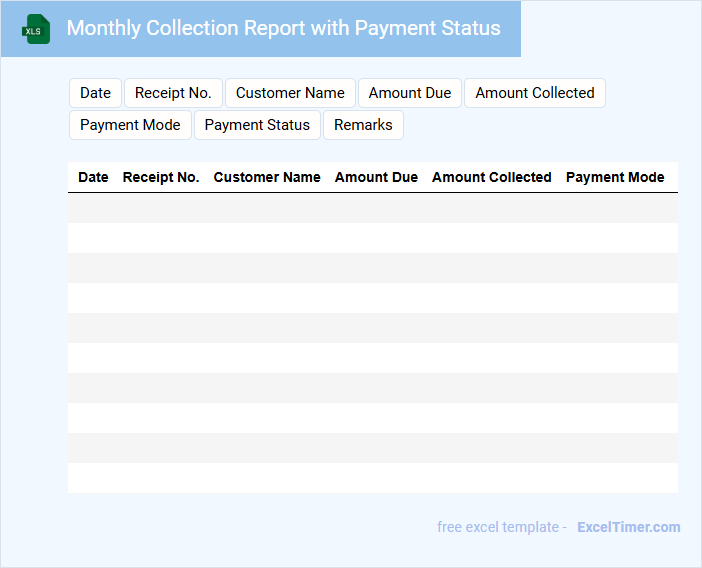

Monthly Collection Report with Payment Status

A Monthly Collection Report with Payment Status typically contains summarized financial data regarding receivables collected and outstanding payments within a given month.

- Payment Summary: Detailed list of payments received and pending balances for accurate tracking.

- Customer Details: Identification of clients with overdue payments for timely follow-up.

- Collection Trends: Analysis of payment patterns to improve future cash flow management.

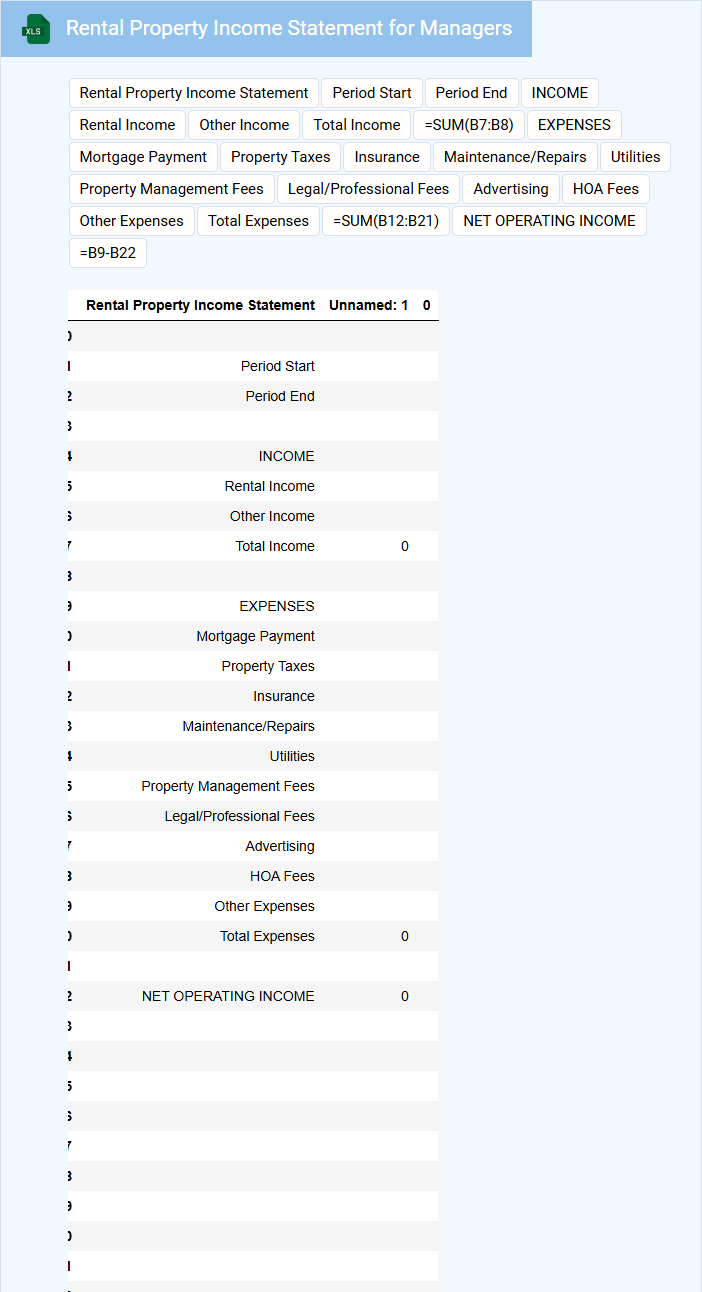

Rental Property Income Statement for Managers

What information does a Rental Property Income Statement for Managers typically contain? This document usually includes detailed records of rental income, operating expenses, and net profit or loss for a rental property. It helps property managers assess financial performance and make informed decisions about property management and budgeting.

What is the most important aspect to include in a Rental Property Income Statement for Managers? Accurate tracking of all income and expenses is crucial to ensure clear financial visibility. Additionally, including categories such as maintenance costs, vacancy rates, and management fees can provide comprehensive insights for effective property management.

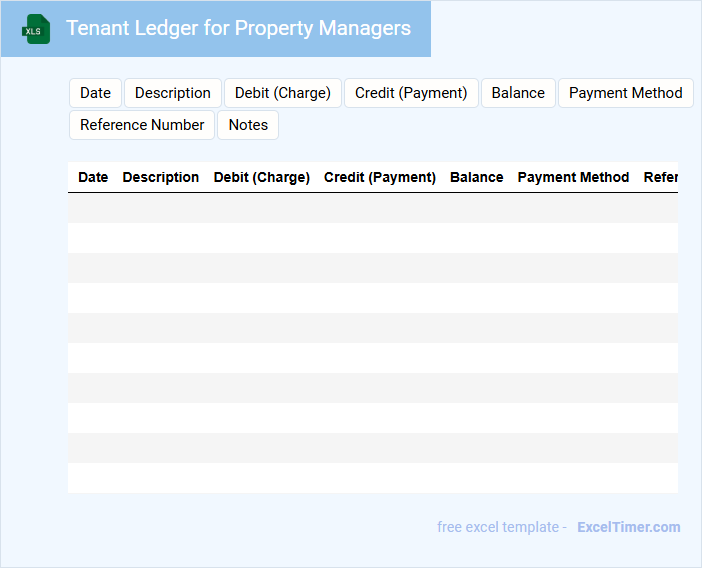

Tenant Ledger for Property Managers

A Tenant Ledger for Property Managers is a detailed document that tracks the financial transactions between a tenant and the property management. It helps in maintaining transparency and accurate records of rent payments, fees, and balances.

Key elements to focus on ensure clarity, accuracy, and easy reference for both parties involved.

- Include dates, amounts, and descriptions for every transaction.

- Regularly update the ledger to reflect current balances.

- Use clear headings and consistent formatting for readability.

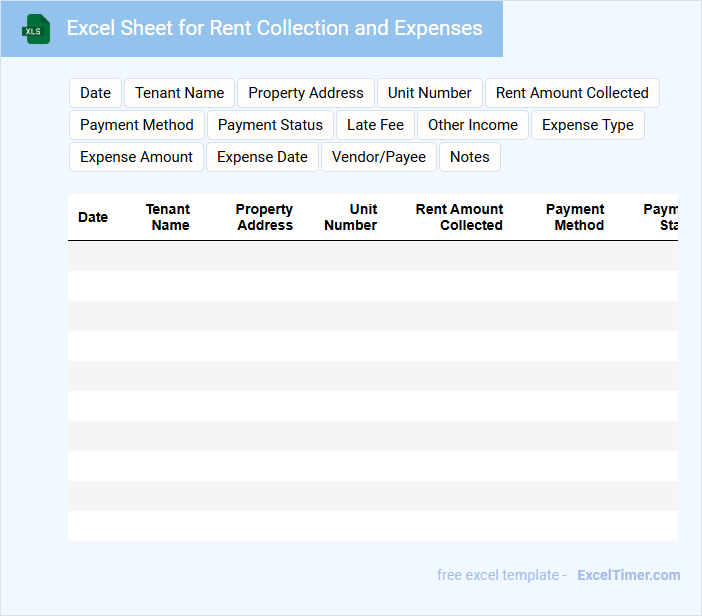

Excel Sheet for Rent Collection and Expenses

An Excel sheet for rent collection and expenses typically contains detailed records of tenant payments and property-related costs to streamline financial management.

- Accurate rent tracking: It is essential to maintain up-to-date payment status for all tenants to avoid discrepancies.

- Expense categorization: Properly categorizing expenses helps in budgeting and identifying cost-saving opportunities.

- Regular updates: Consistently updating the sheet ensures real-time financial oversight and easier reporting.

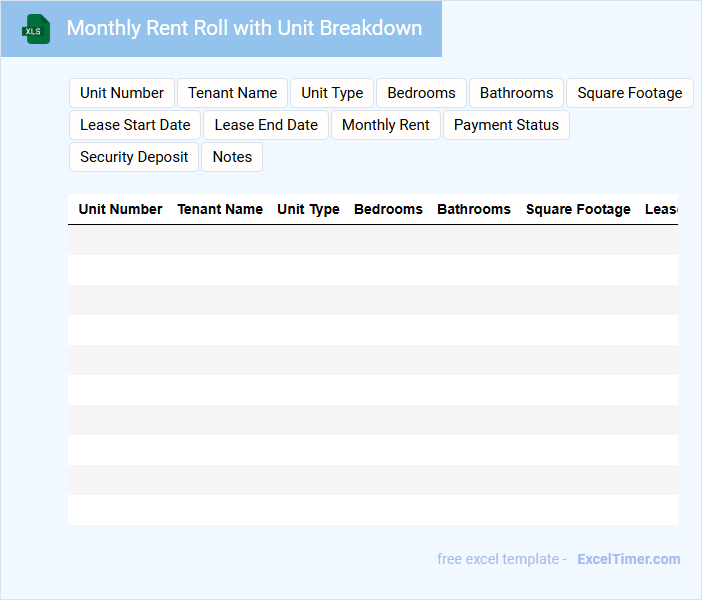

Monthly Rent Roll with Unit Breakdown

What information is typically included in a Monthly Rent Roll with Unit Breakdown? This document usually contains detailed data about each rental unit within a property, including tenant names, lease terms, monthly rent amounts, and payment status. It provides a clear and organized snapshot of rental income and occupancy on a unit-by-unit basis.

Why is it important to ensure accuracy and up-to-date information in a Monthly Rent Roll with Unit Breakdown? Accurate and current details help landlords, property managers, and investors track financial performance, identify vacancies or delinquencies, and make informed decisions about property management and leasing strategies. Regular updates improve transparency and support effective financial analysis.

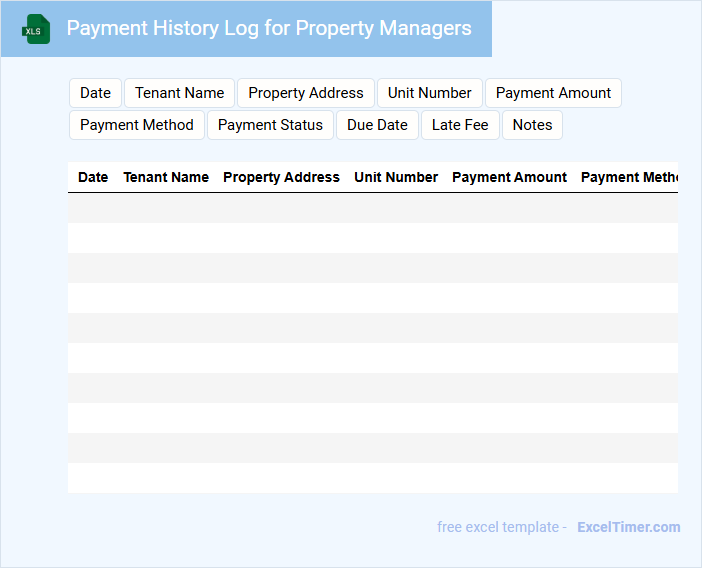

Payment History Log for Property Managers

The Payment History Log for property managers is a detailed record of all financial transactions related to rent and other tenant payments. It typically contains tenant names, payment amounts, dates, and methods of payment to ensure transparency and accuracy. Keeping this document organized is essential for tracking overdue payments and resolving disputes efficiently.

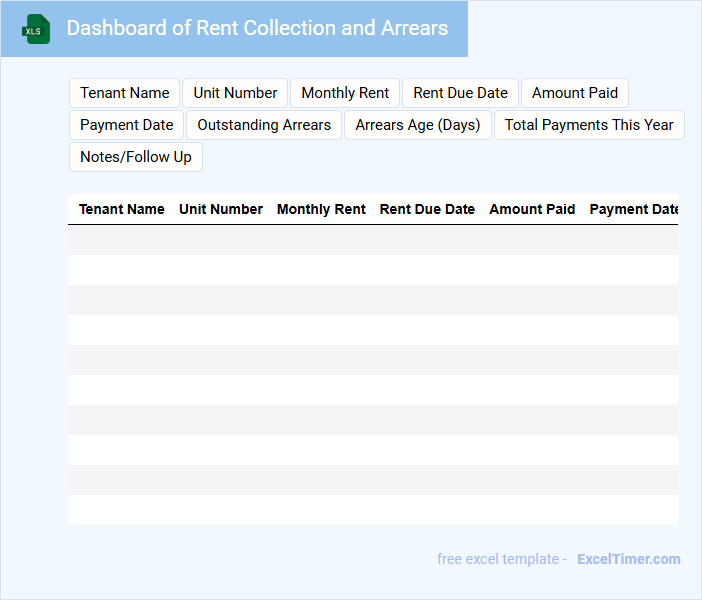

Dashboard of Rent Collection and Arrears

A Dashboard of Rent Collection and Arrears is a crucial tool for property managers to monitor financial performance. It typically contains data on rent payments, outstanding balances, and payment trends over time. This dashboard helps identify delinquent tenants and optimize revenue collection strategies.

What are the essential columns to include when tracking monthly rent collection in an Excel document?

Essential columns for tracking monthly rent collection in Excel include Tenant Name, Property Address, Rent Due Date, Rent Amount, Payment Date, Payment Status, and Outstanding Balance. Incorporate columns for Payment Method and Late Fees to enhance financial accuracy. Include Notes for special conditions or communication details related to each tenant's payment.

How can formulas or conditional formatting be used to highlight overdue rent payments?

Formulas in Excel can calculate overdue rent by comparing payment due dates with the current date, while conditional formatting highlights overdue payments in red or bold for quick identification. You can apply rules that automatically flag cells where rent is unpaid past the due date, ensuring timely follow-up. This method streamlines your rent collection process and reduces manual tracking errors.

What method can be used in Excel to automatically calculate total monthly rent collected versus outstanding balances?

Use the SUMIF function in Excel to automatically calculate total monthly rent collected by summing payments marked as received. Apply a formula like =SUMIF(StatusRange, "Paid", RentAmountRange) to total collected rents. Calculate outstanding balances with =SUMIF(StatusRange, "Pending", RentAmountRange) to track unpaid amounts efficiently.

How can property managers organize tenant information to easily reference due dates and payment history?

Organize tenant information in your Excel document by creating separate columns for tenant name, monthly rent amount, due date, and payment status. Use conditional formatting to highlight overdue payments and insert filters to quickly sort by due dates or payment history. This system enables property managers to efficiently track and reference rent collection data.

What data validation techniques can be applied to minimize errors in rent collection records within the Excel document?

Applying data validation techniques such as setting monthly rent amount ranges, using drop-down lists for payment status, and enforcing date restrictions for payment dates minimizes errors in your rent collection records. These rules help ensure consistent and accurate data entry, reducing discrepancies in financial tracking. Leveraging Excel's built-in validation options enhances the reliability of your monthly rent collection management.