The Monthly Bills Organizer Excel Template for Students helps track and manage all monthly expenses efficiently, ensuring bills are paid on time and budget is maintained. It includes customizable categories for utilities, rent, subscriptions, and more, making financial management straightforward. Using this template promotes financial responsibility and helps students avoid late fees and overspending.

Monthly Bills Tracker Excel Template for Students

A Monthly Bills Tracker Excel Template for students is designed to help manage and monitor monthly expenses efficiently. It typically includes categories for rent, utilities, groceries, and entertainment to organize spending.

This type of document helps students maintain financial discipline by providing a clear overview of their cash flow. Key suggestions include regularly updating the tracker and setting a budget to avoid overspending.

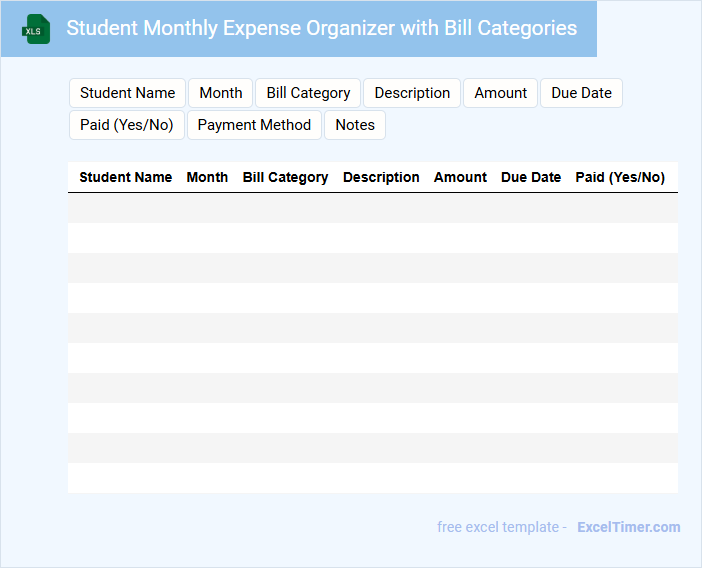

Student Monthly Expense Organizer with Bill Categories

A Student Monthly Expense Organizer with Bill Categories is a document designed to help students track their monthly spending and manage their finances efficiently. It typically categorizes expenses to provide clear insights into where money is being spent.

- Include categories such as tuition, groceries, transportation, and entertainment to cover all major expenses.

- Maintain a consistent format for entering dates, amounts, and payment methods to ensure accuracy.

- Regularly review and update the organizer to identify spending patterns and adjust budgets accordingly.

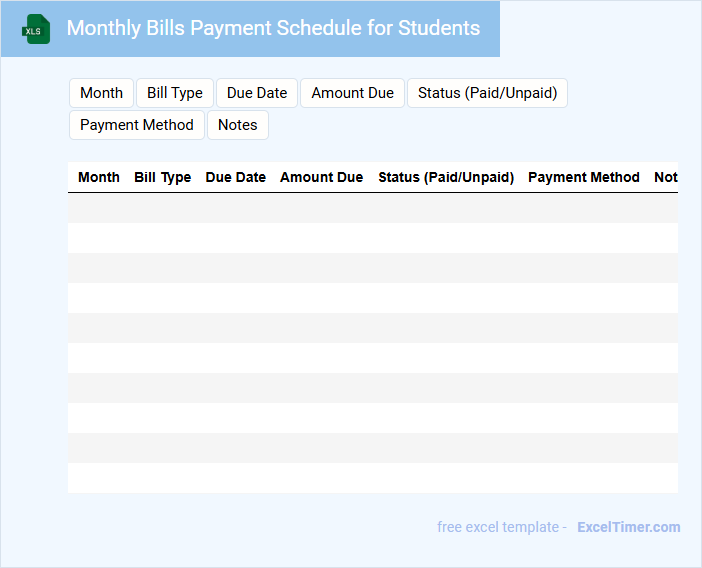

Monthly Bills Payment Schedule for Students

A Monthly Bills Payment Schedule for students is a structured document that outlines all recurring expenses related to their academic and personal life. It typically includes rent, utilities, tuition installments, and other essential bills. This schedule helps students manage their finances effectively and avoid missed payments.

Maintaining an updated payment timeline ensures timely settlements and reduces financial stress during the semester. It also serves as a budgeting tool to plan for miscellaneous expenses and emergencies. Prioritizing due dates and setting reminders are crucial for staying on track.

Excel Budget Planner with Monthly Bills for College Students

An Excel Budget Planner with Monthly Bills for College Students typically contains detailed financial tracking tools to help manage income, expenses, and savings efficiently.

- Income Tracking: It includes sections to log and monitor various sources of monthly income.

- Expense Categorization: It categorizes bills and expenses to identify spending patterns clearly.

- Savings Goals: It incorporates features to set and track monthly savings targets to promote financial discipline.

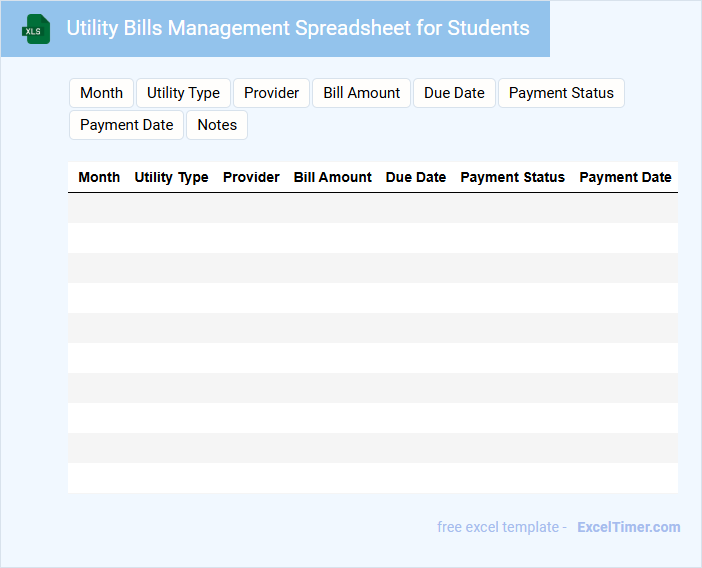

Utility Bills Management Spreadsheet for Students

Utility Bills Management Spreadsheets for students typically contain detailed records of monthly expenses related to electricity, water, gas, and internet services. These documents help students organize their financial obligations and track their spending effectively. A well-structured spreadsheet ensures timely payments, avoiding late fees and financial stress.

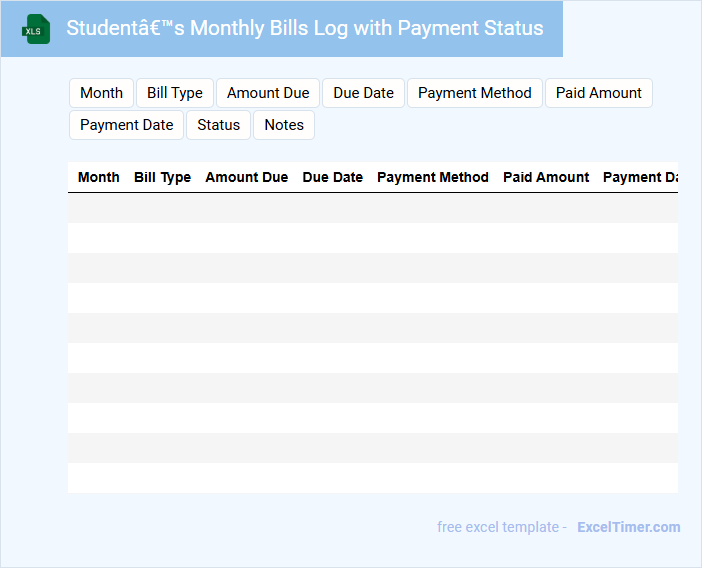

Student’s Monthly Bills Log with Payment Status

A Student's Monthly Bills Log is a document used to track and organize all monthly expenses related to a student's academic and living costs. It typically contains details such as the due dates, payment amounts, and current payment status for each bill. Maintaining this log helps in ensuring timely payments and avoiding any overdue charges or service interruptions.

For effective use, it is important to include clear payment deadlines, payment methods, and a section for notes on any discrepancies or pending issues. Utilizing color codes or status indicators can enhance readability and quick status assessment. Regular updates to this log enable better budget management and financial planning throughout the academic year.

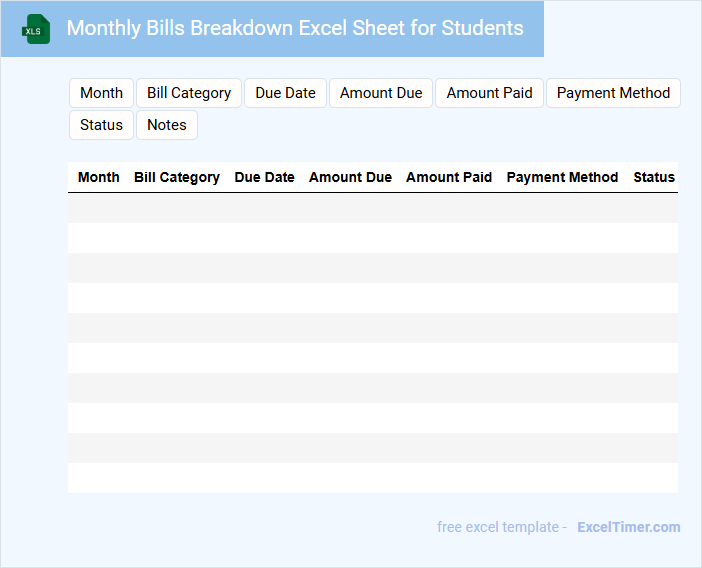

Monthly Bills Breakdown Excel Sheet for Students

A Monthly Bills Breakdown Excel Sheet for students is typically a detailed document that tracks various monthly expenses such as rent, utilities, groceries, and transportation. It helps students manage their finances by providing a clear overview of their spending habits and outstanding bills.

This document usually contains categorized expense entries, payment due dates, and total amounts for each month. Including a section for notes or reminders can be an important feature to prevent missed payments and maintain budget discipline.

Personal Finance Tracker with Monthly Bills for Students

A Personal Finance Tracker with Monthly Bills for Students typically contains detailed records of income, expenses, and monthly bills to help manage finances effectively. It includes categories such as tuition fees, rent, groceries, and entertainment, making it easier to monitor spending habits. This document serves as an essential tool for budgeting and ensuring timely payments to avoid late fees.

Key suggestions for using this tracker include regularly updating expenses, prioritizing essential bills, and setting savings goals to build financial discipline. Students should also categorize expenses to identify areas where they can cut costs and increase savings. Using digital spreadsheets or apps can improve accuracy and accessibility for better financial management.

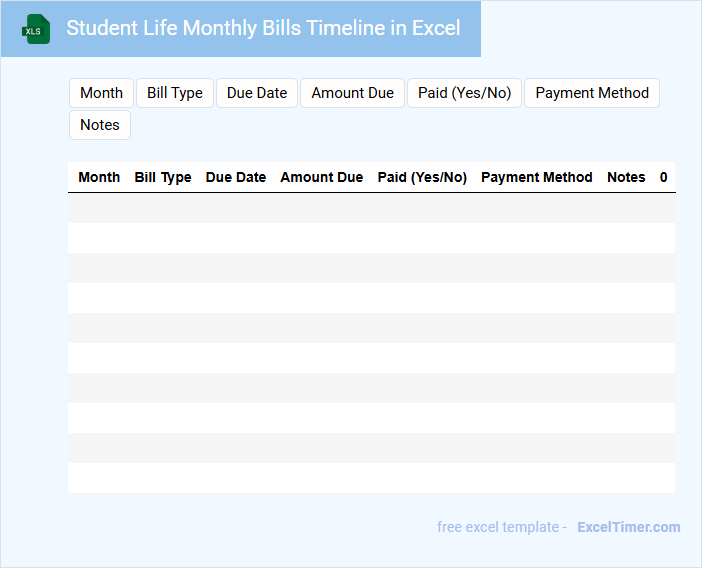

Student Life Monthly Bills Timeline in Excel

A Student Life Monthly Bills Timeline in Excel typically contains a detailed schedule of recurring expenses such as rent, utilities, groceries, and subscriptions, organized by due date each month. This document helps students manage their finances by providing clear visibility of when payments are expected and ensuring timely budgeting. It is crucial for tracking spending patterns, avoiding late fees, and maintaining financial stability during student life.

Key components should include the bill name, amount due, due date, payment status, and any notes on changes or upcoming costs. Using conditional formatting and formulas can help automatically highlight overdue payments and calculate totals for monthly expenses. Prioritizing accuracy and regular updates will maximize the utility of the timeline as a reliable financial planning tool.

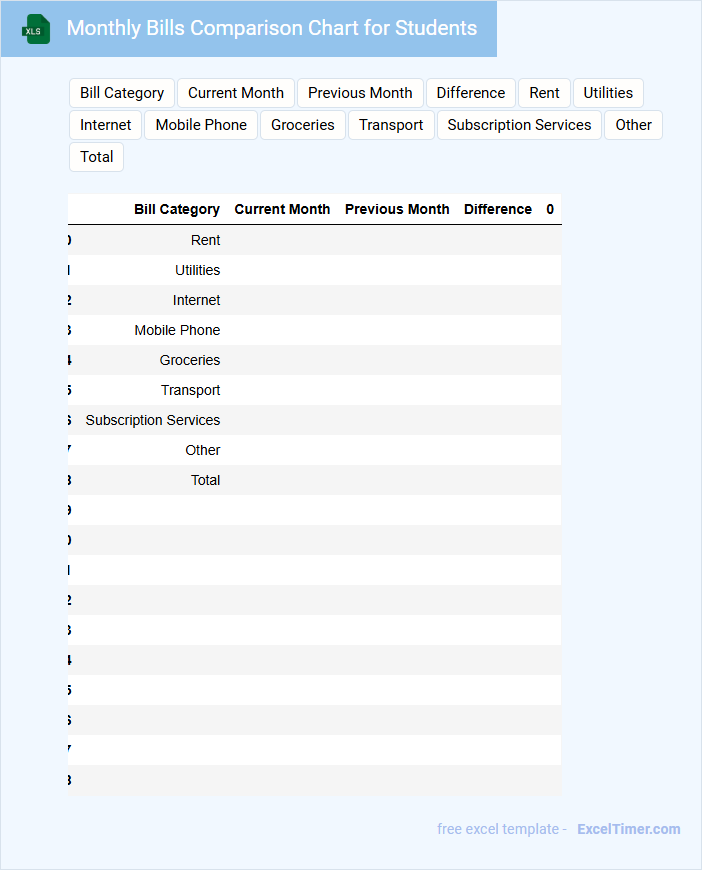

Monthly Bills Comparison Chart for Students

What information is typically included in a Monthly Bills Comparison Chart for Students? This document usually contains a detailed list of various monthly expenses such as rent, utilities, internet, and groceries, allowing students to track and compare their spending over different months. It helps in budgeting by highlighting spending patterns and identifying areas to save money efficiently.

What is an important consideration when creating a Monthly Bills Comparison Chart for Students? Ensuring accurate and consistent data entry for each bill category is crucial to maintain the chart's reliability and usefulness. Additionally, including visual aids such as graphs or color coding can enhance clarity and quick understanding of spending trends.

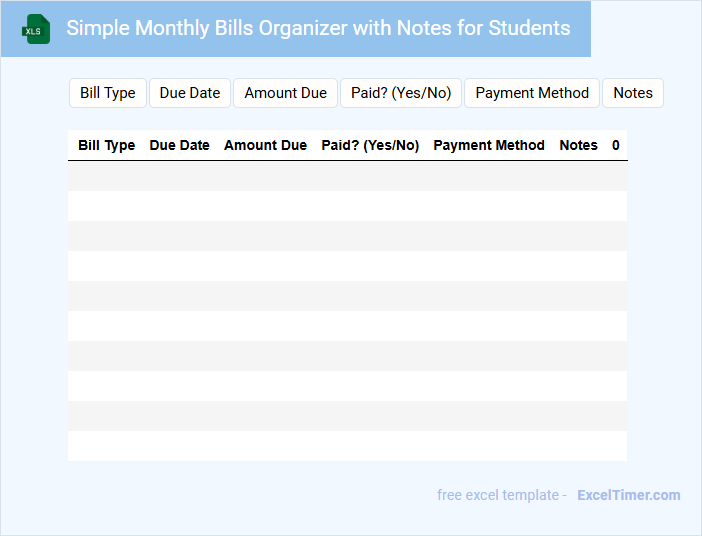

Simple Monthly Bills Organizer with Notes for Students

This document typically contains a streamlined way for students to track their monthly bills and jot down relevant notes for better financial management.

- Expense Categories: Clearly labeled sections for different types of bills such as rent, utilities, and subscriptions.

- Payment Dates: A dedicated area to record due dates to avoid late fees.

- Notes Section: Space to add reminders or additional information related to each bill.

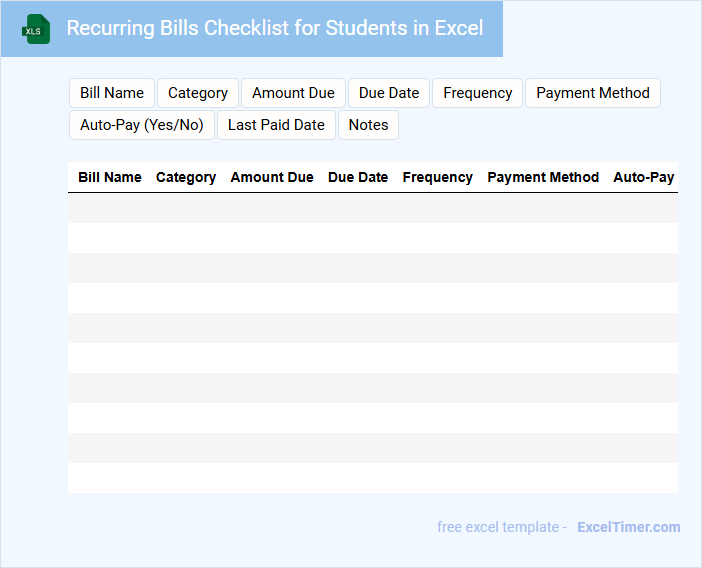

Recurring Bills Checklist for Students in Excel

This type of document typically contains a detailed list of recurring expenses tailored for students to help track and manage their budget efficiently.

- Monthly expenses: It outlines regular bills such as rent, utilities, and subscriptions.

- Payment deadlines: The checklist highlights important due dates to avoid late fees.

- Budgeting tips: It includes recommendations to prioritize essential payments and control discretionary spending.

Dorm Expense Tracker with Monthly Bills for Students

A Dorm Expense Tracker with Monthly Bills is a document designed to help students manage their living costs efficiently. It typically contains detailed records of rent, utilities, groceries, and other monthly expenses. This tool is essential for budgeting and ensuring timely payments while avoiding unnecessary financial stress.

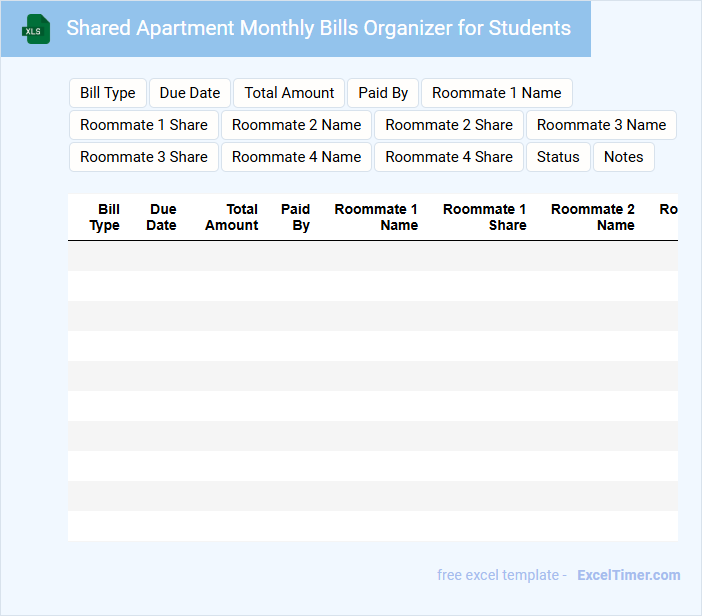

Shared Apartment Monthly Bills Organizer for Students

This document typically contains a detailed list of all monthly expenses shared among roommates, such as rent, utilities, internet, and groceries. It serves as a financial tracker to ensure transparency and fairness in cost distribution.

For students, keeping an organized record helps prevent misunderstandings and promotes accountability. Including payment deadlines and individual contributions can greatly enhance the efficiency of bill management.

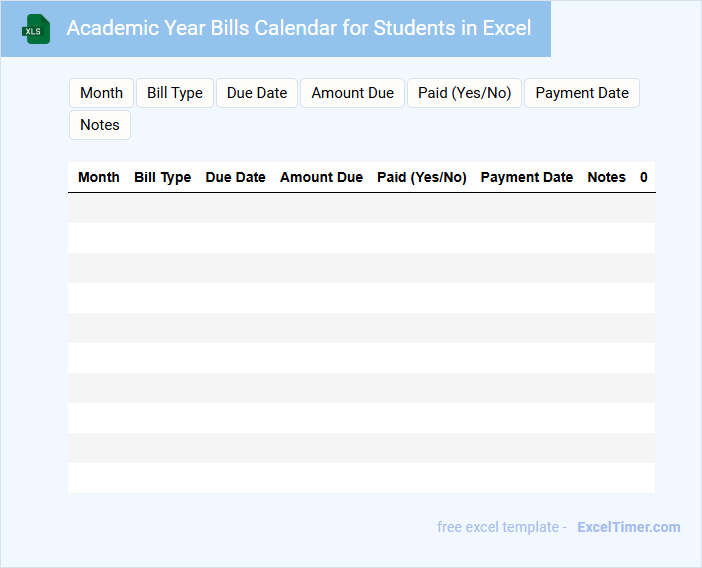

Academic Year Bills Calendar for Students in Excel

An Academic Year Bills Calendar for students in Excel typically contains important dates and deadlines for tuition payments, fee submissions, and other financial obligations throughout the academic year. It helps students stay organized by clearly highlighting due dates and payment schedules in a structured, easy-to-read format. Ensuring accuracy and timely updates are essential for effective financial planning and avoiding late fees.

How do you categorize different types of monthly bills in the organizer for easy tracking?

Your Monthly Bills Organizer categorizes expenses into essential groups such as rent, utilities, subscriptions, and groceries, enabling clear tracking and budgeting. Each category includes specific columns for due dates, amounts, and payment status to maintain organization. This structure ensures you can quickly monitor and manage all your monthly financial obligations efficiently.

What formula can you use to automatically calculate the total expenses for each month?

Use the SUM function in Excel to automatically calculate total monthly expenses by selecting the range of expense cells for that month, for example, =SUM(B2:B10). This formula adds all numeric values within the specified range, providing an accurate total of monthly bills. Applying this formula to each month's column streamlines tracking and budgeting for students.

How can you set up due date reminders or alerts for upcoming payments in Excel?

To set up due date reminders in Excel for a Monthly Bills Organizer for Students, use conditional formatting by highlighting cells with due dates approaching within a specified range (e.g., 3 days). Apply formulas like =TODAY()+3>=DueDate to automatically change cell colors, alerting students of upcoming payments. Incorporate data validation and add comments to enhance clarity and prevent missed deadlines.

Which Excel feature helps visualize spending trends over several months?

The Excel feature that helps visualize spending trends over several months is the Line Chart. This tool allows you to track fluctuations in your monthly bills, making it easier to manage your budget. Using the Line Chart in your Monthly Bills Organizer can improve your financial awareness and planning.

How do you efficiently update and manage changes in bill amounts or categories?

To efficiently update and manage changes in bill amounts or categories in a Monthly Bills Organizer for Students, use Excel's built-in features like Tables and Data Validation for dynamic data entry and consistency. Implement formulas such as SUMIFS to automatically recalculate totals based on updated categories or amounts. Utilize conditional formatting to highlight changes or inconsistencies, ensuring accurate and organized bill tracking.