![]()

The Monthly Expense Tracker Excel Template for Households helps users efficiently monitor and categorize their monthly spending to stay within budget. It includes customizable categories, automated calculations, and visual charts for easy expense analysis. Tracking household expenses with this template enhances financial awareness and supports better money management decisions.

Monthly Expense Tracker Excel Template for Households

A Monthly Expense Tracker Excel Template for Households typically contains a structured layout to record, categorize, and analyze monthly spending to help manage budgets effectively.

- Expense Categories: Clearly defined sections for various spending types such as groceries, utilities, and entertainment.

- Summary Dashboard: A visual summary with charts and totals to provide quick insights into spending patterns.

- Automatic Calculations: Formulas to automatically sum expenses and compare them against budget limits.

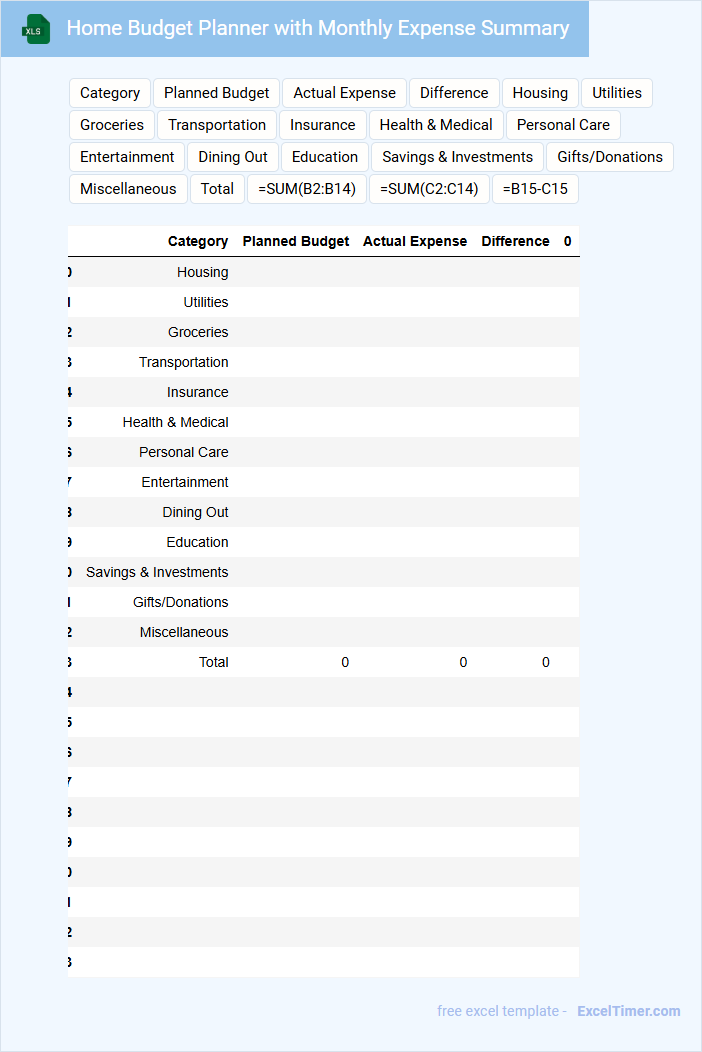

Home Budget Planner with Monthly Expense Summary

This type of document typically contains an organized overview of income, expenses, and savings to help manage personal finances effectively.

- Income Tracking: Record all sources of income accurately to understand your total monthly earnings.

- Expense Categorization: List and categorize all monthly expenses to identify spending patterns and areas for reduction.

- Summary Analysis: Provide a clear monthly expense summary that highlights savings, overspending, and budget adjustments.

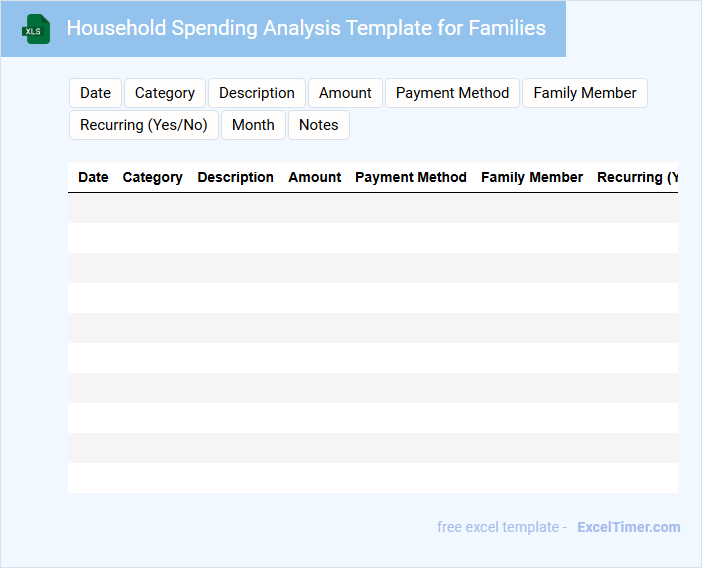

Household Spending Analysis Template for Families

A Household Spending Analysis Template for families typically contains detailed categories of monthly expenses such as groceries, utilities, education, and entertainment. It helps families track and organize their spending patterns efficiently.

These templates often include sections for income sources, savings goals, and debt payments to provide a comprehensive financial overview. An important suggestion is to regularly update the template to reflect changing expenses and priorities.

Excel Template for Monthly Home Expense Tracking

An Excel Template for Monthly Home Expense Tracking typically contains categorized sections for incomes, fixed expenses, and variable expenses. It allows users to input daily or monthly expenditures and automatically calculates totals and balances.

This document often includes charts or graphs for visual representation of spending patterns and budget comparisons. A critical suggestion is to regularly update the template to ensure accurate financial monitoring and planning.

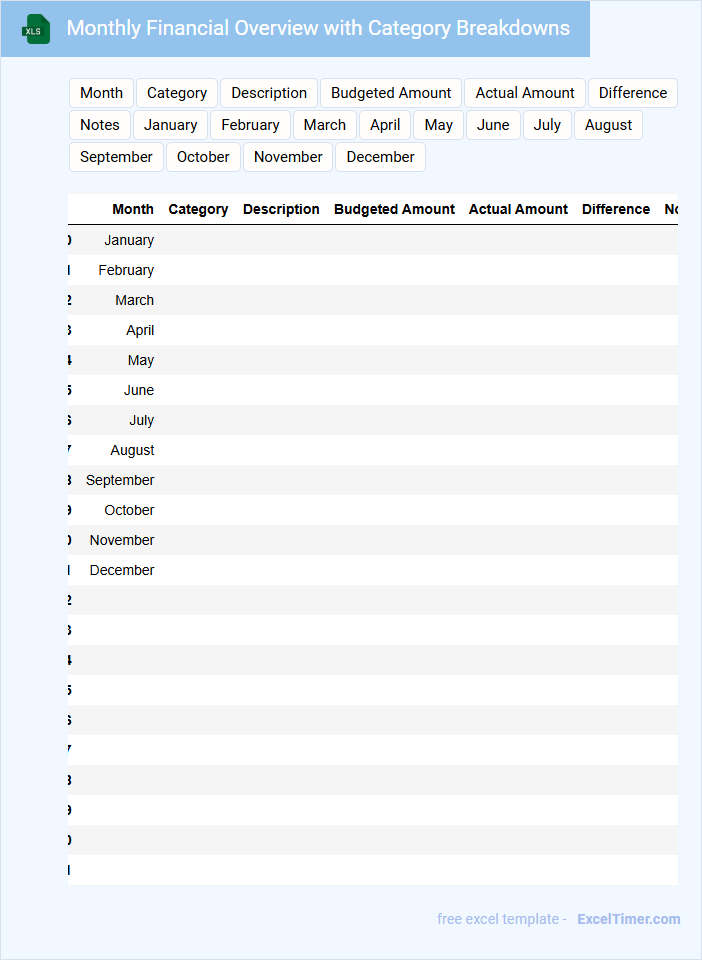

Monthly Financial Overview with Category Breakdowns

A Monthly Financial Overview typically contains a summary of income, expenses, and net savings or losses for the month. It highlights key financial trends and provides a snapshot of overall financial health.

The document often includes detailed Category Breakdowns to show spending and income by specific areas such as housing, food, transportation, and entertainment. This helps identify where money is allocated and opportunities for budgeting adjustments.

It is important to regularly update the data and ensure accuracy for effective financial planning and decision-making.

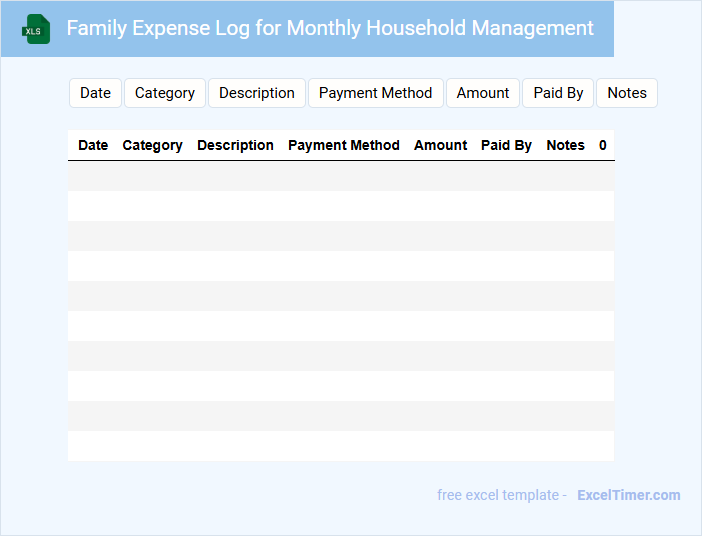

Family Expense Log for Monthly Household Management

What information is typically included in a Family Expense Log for Monthly Household Management? This type of document usually contains detailed records of all household expenditures, including groceries, utilities, rent or mortgage, transportation, and entertainment costs. It serves as a tool to monitor spending habits, budget effectively, and ensure financial stability for the family each month.

What is an important consideration when maintaining a Family Expense Log? Consistency in recording expenses daily or weekly is crucial to maintain accuracy and provide a clear overview of spending patterns. Additionally, categorizing expenses thoughtfully helps identify areas for potential savings and supports more informed financial decision-making.

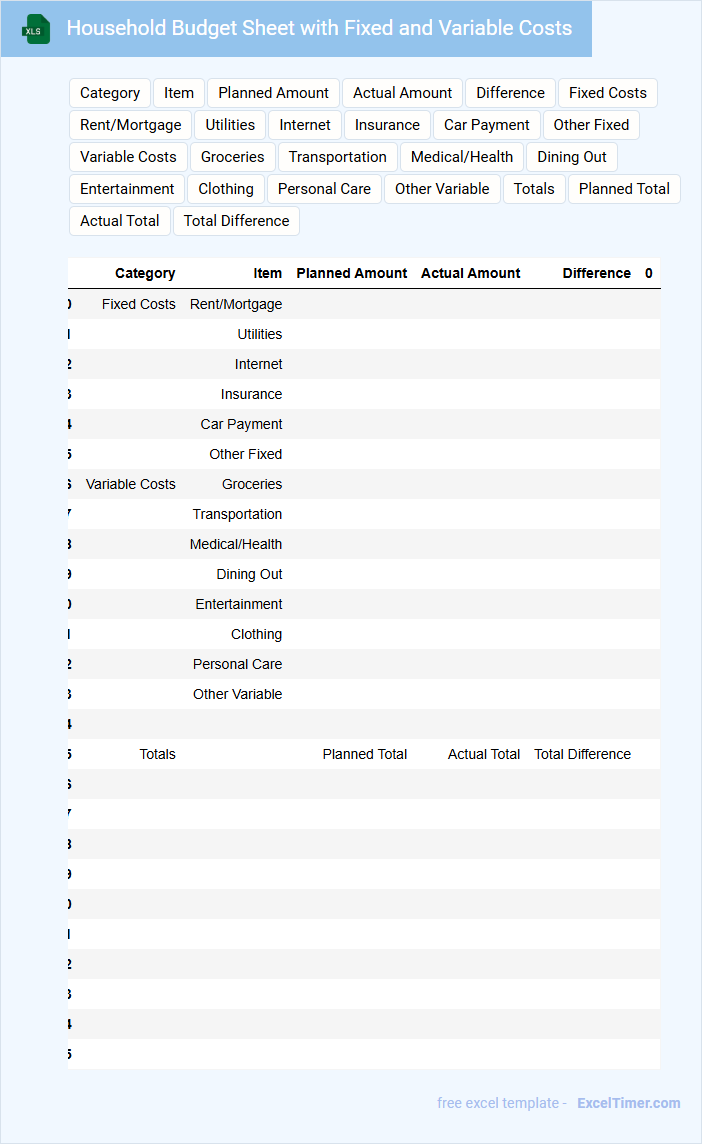

Household Budget Sheet with Fixed and Variable Costs

A Household Budget Sheet with Fixed and Variable Costs typically contains a detailed record of regular expenses categorized by their consistency and variability to help manage finances effectively.

- Fixed Costs: these are recurring expenses that remain constant each month, such as rent or mortgage payments.

- Variable Costs: these expenses fluctuate monthly, including groceries, utilities, and entertainment.

- Tracking and Analysis: regularly updating and reviewing the sheet ensures better control over spending and savings goals.

Monthly Expense Comparison Template for Homes

What information does a Monthly Expense Comparison Template for Homes typically contain?

This document usually includes detailed categories of household expenses such as utilities, groceries, rent or mortgage, and maintenance costs organized by month. It allows homeowners to track, compare, and analyze their spending patterns over time to identify areas for budget optimization. Using such a template helps in making informed financial decisions and managing home expenses efficiently.

It is important to regularly update the template with accurate expense data and categorize costs clearly to ensure meaningful comparisons. Additionally, incorporating visual aids like charts or graphs can enhance understanding and highlight trends effectively.

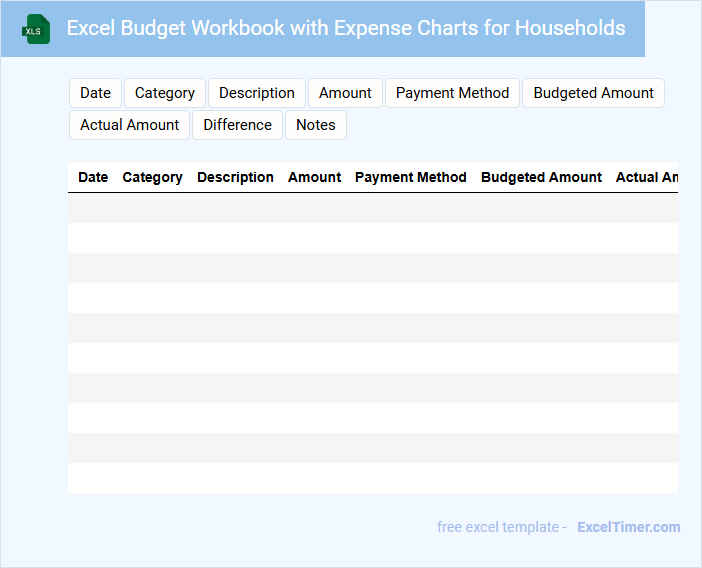

Excel Budget Workbook with Expense Charts for Households

An Excel Budget Workbook for households typically contains detailed worksheets to track income, expenses, savings, and financial goals. It includes various categories such as utilities, groceries, and entertainment for comprehensive expense management.

Expense charts visually represent spending patterns, making it easier to identify areas to reduce costs and optimize budgeting. Using formulas and automatic updates ensures accuracy and efficiency in managing household finances.

Important suggestions include regularly updating entries, categorizing expenses clearly, and setting monthly budget limits to prevent overspending.

Household Monthly Expense Spreadsheet with Income Tracking

A Household Monthly Expense Spreadsheet is a document designed to record and categorize all monthly income and expenses, helping users manage their finances effectively. It typically includes sections for tracking various income sources, fixed and variable expenses, and savings goals. This type of document is essential for maintaining a clear overview of where money is going and planning future budgets.

Important elements to include are clearly labeled categories for expenses, customizable income entries, and summary fields that calculate totals and differences automatically. Incorporating visual aids like charts or graphs can further enhance understanding of spending patterns over time. Consistent and accurate data entry is crucial for maximizing the usefulness of this financial tool.

Simple Monthly Tracker for Household Expenses

A Simple Monthly Tracker for Household Expenses typically contains categorized records of income, bills, groceries, and miscellaneous spending to help monitor financial health. It includes dates, amounts, and budget limits to clearly outline where money is allocated throughout the month. This document is essential for identifying spending patterns and ensuring expenses do not exceed income.

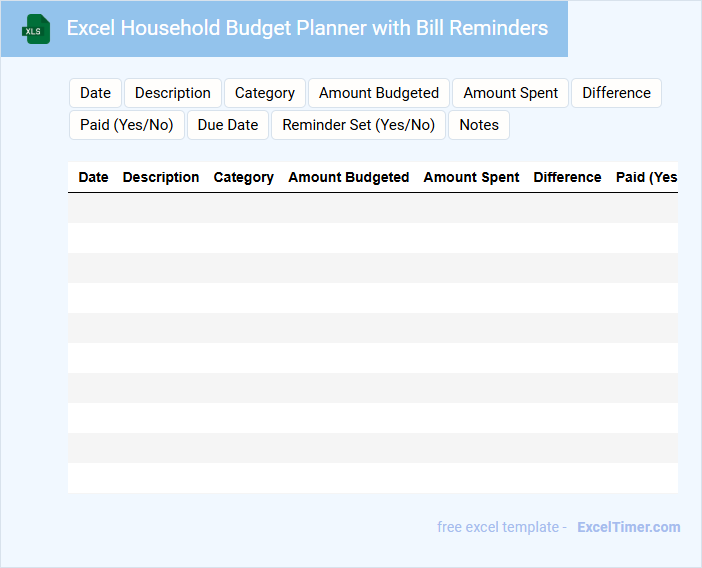

Excel Household Budget Planner with Bill Reminders

An Excel Household Budget Planner is a document designed to help individuals or families manage their monthly income, expenses, and savings effectively. It typically contains categorized expense lists, income sources, and summary charts for financial overview. Including bill reminders within the planner is important to track due dates and avoid late payments.

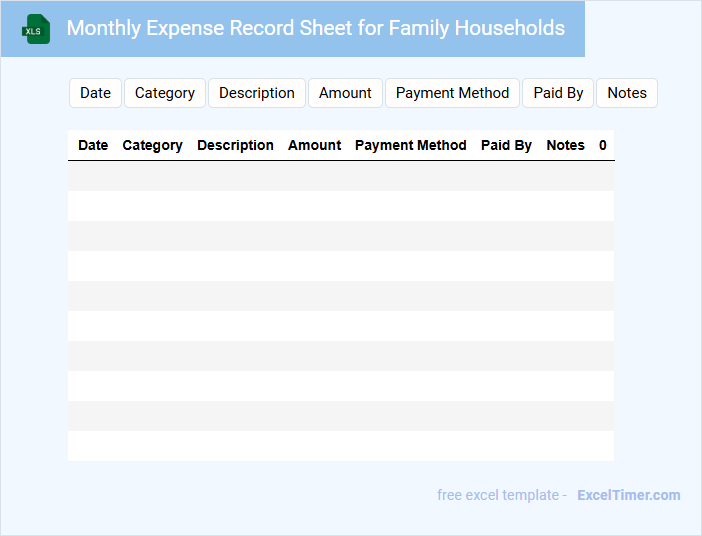

Monthly Expense Record Sheet for Family Households

A Monthly Expense Record Sheet for family households is typically used to track and organize all household expenses over a month. It helps families monitor spending patterns and identify areas to save money.

This type of document usually contains categories such as groceries, utilities, rent or mortgage, transportation, and entertainment. Keeping detailed and accurate records ensures better budget management and financial planning for the family.

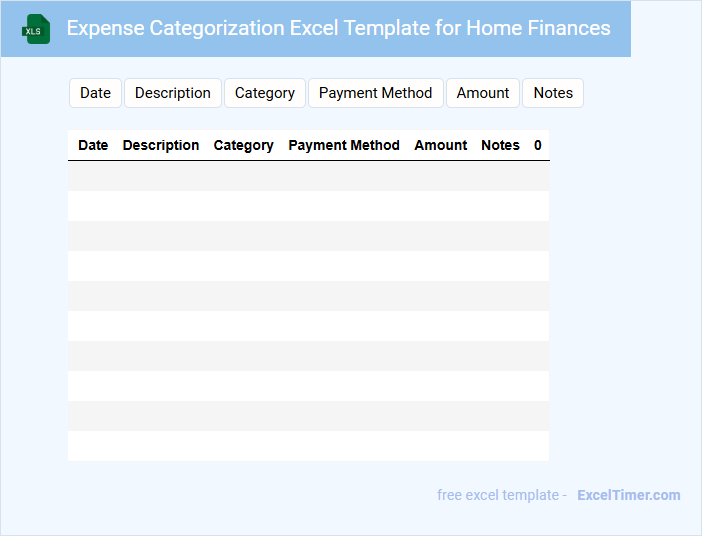

Expense Categorization Excel Template for Home Finances

An Expense Categorization Excel Template for home finances is designed to systematically organize and track personal spending. It typically includes categories like groceries, utilities, entertainment, and transportation to help users understand where their money goes.

These templates often contain columns for date, description, amount, and category, enabling effective budgeting and financial planning. Using such a template encourages better money management and aids in identifying areas to reduce expenses for improved savings.

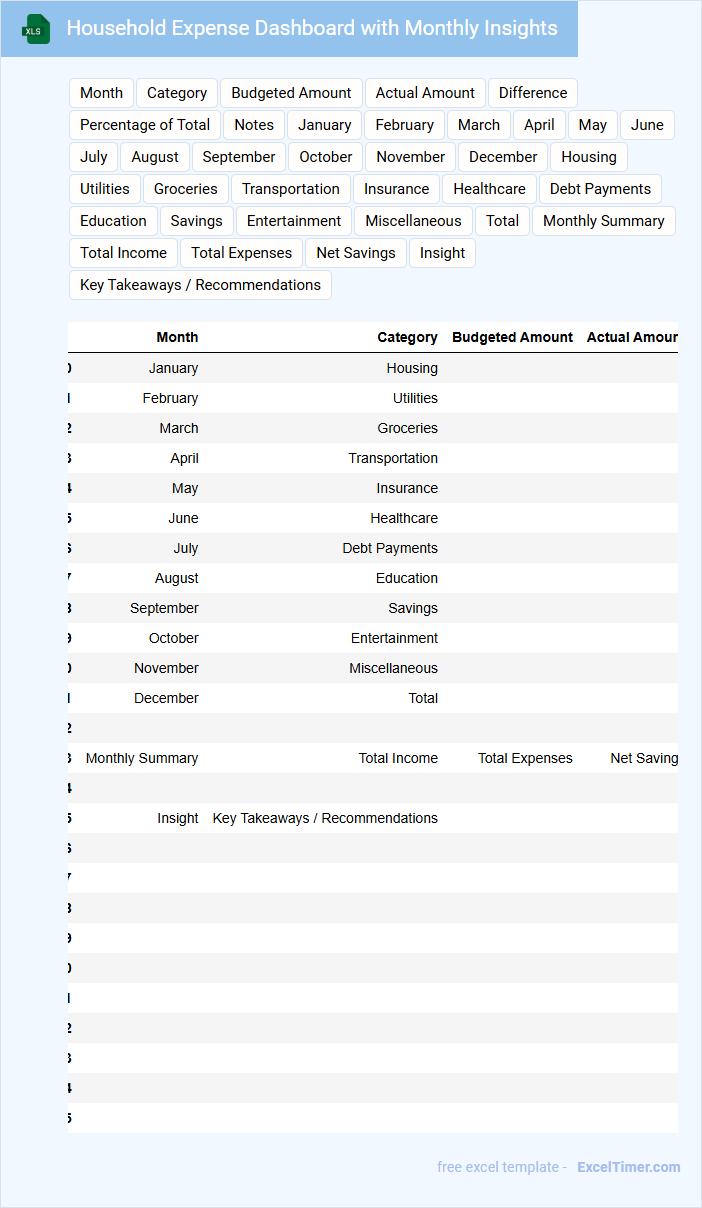

Household Expense Dashboard with Monthly Insights

A Household Expense Dashboard is a financial tool designed to track and visualize monthly spending patterns. It typically contains categorized expense data, income details, and savings goals for better budget management. Important features include clear monthly insights, alerts for overspending, and trend analysis to help users make informed decisions.

What are the essential categories to include in a household monthly expense tracker?

A household monthly expense tracker should include essential categories such as housing costs, utilities, groceries, transportation, and healthcare. Tracking these categories helps you monitor spending patterns and manage your budget effectively. Including savings and entertainment expenses ensures a comprehensive overview of your financial health.

How can you use Excel formulas to automatically total your monthly expenses?

Use the SUM function in Excel to automatically total your monthly expenses by selecting the range of cells containing your expense amounts. For example, enter =SUM(B2:B30) to calculate the total of expenses listed from cell B2 to B30. This formula updates dynamically as you add or change values, ensuring accurate monthly expense tracking.

What methods can you use to visualize expense data in Excel (e.g., charts or graphs)?

Use bar charts to compare monthly expenses by category for clear visual insights. Pie charts effectively display the proportion of each expense type within the total budget. Line graphs track expense trends over time, highlighting increases or decreases in household spending.

How would you set up a system in Excel to compare budgeted vs. actual expenses?

Create a Monthly Expense Tracker in Excel by listing expense categories in rows and months in columns, then input budgeted amounts alongside actual expenses. Use formulas like SUM and simple subtraction to calculate differences and highlight overspending with conditional formatting. Your system will offer clear visual insights to manage and adjust household finances effectively.

What steps should you take to ensure data accuracy and consistency in your monthly tracker?

To ensure data accuracy and consistency in your Monthly Expense Tracker, regularly validate entries against receipts and bank statements. Use Excel features like data validation, drop-down lists, and conditional formatting to minimize input errors. Implement a standardized categorization system and conduct periodic audits to maintain reliable tracking.