The Monthly Rental Income Excel Template for Property Owners streamlines tracking rental payments, expenses, and overall cash flow, ensuring accurate financial management. This tool helps property owners monitor income consistency and identify potential discrepancies quickly. Maintaining organized records enhances tax preparation and supports informed decision-making for maximizing rental profitability.

Monthly Rental Income Tracker for Property Owners

A Monthly Rental Income Tracker for Property Owners is a document used to systematically record and monitor rental payments received each month. It helps in managing cash flow and ensuring timely rent collection.

- Track each tenant's monthly rent payment and due dates.

- Record any additional charges or maintenance expenses linked to the property.

- Summarize total income and outstanding balances for financial review.

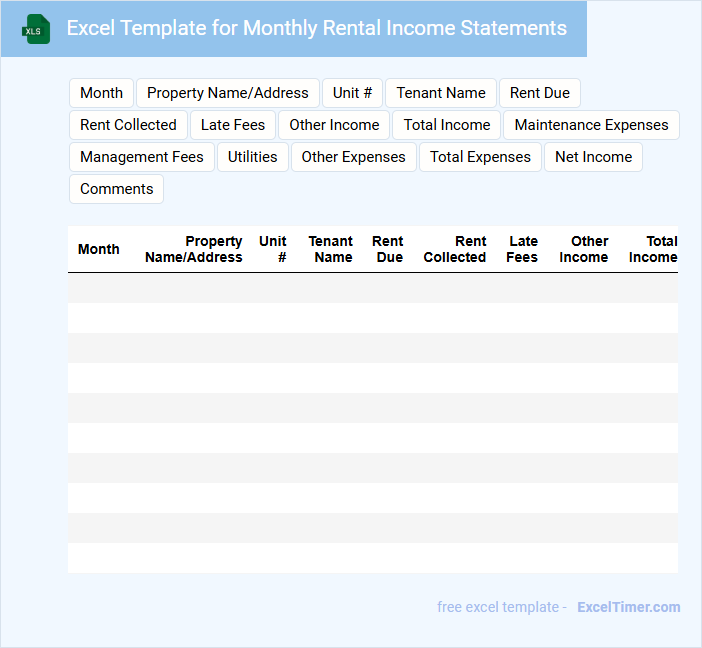

Excel Template for Monthly Rental Income Statements

An Excel Template for Monthly Rental Income Statements is typically a structured document designed to track and summarize rental income and related expenses on a monthly basis. It usually contains sections for listing tenant payments, due rents, and expense categories such as maintenance or utilities. This template helps landlords efficiently monitor cash flow and identify any discrepancies or unpaid rent.

For optimal use, it's important to include clear headers, customizable fields for different properties, and automated calculations for total income and expenses. Ensuring accuracy in data entry and regularly updating records will enhance financial management. Additionally, incorporating graphs or summary tables can provide quick visual insights into rental performance trends.

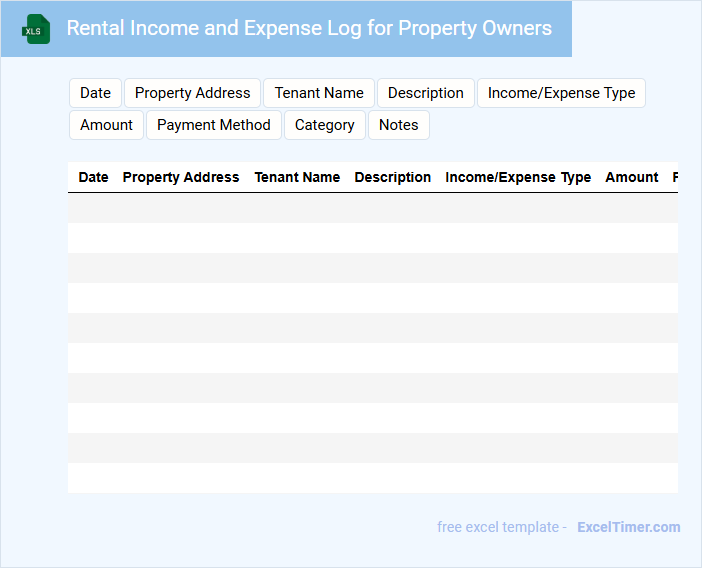

Rental Income and Expense Log for Property Owners

A Rental Income and Expense Log is a document typically used by property owners to track all revenues and costs associated with their rental properties. It contains detailed records of rent payments received, maintenance expenses, utility bills, and other property-related financial transactions. Keeping this log organized and up-to-date is essential for accurate tax reporting and effective property management.

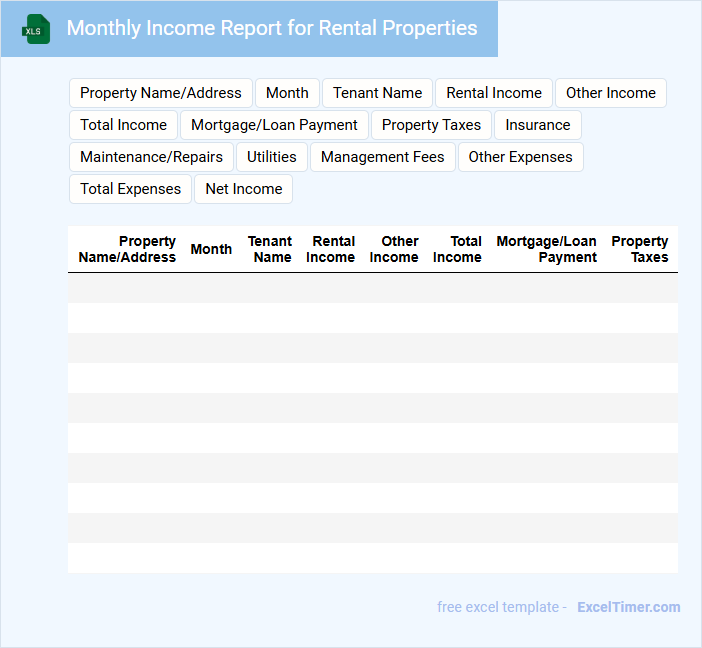

Monthly Income Report for Rental Properties

What information is typically included in a Monthly Income Report for Rental Properties?

This type of document usually contains details about rental income received, expenses paid, and net profit or loss for the month. It helps property owners track financial performance and make informed decisions about their investments.

Important Suggestions

Include accurate records of rent payments, maintenance costs, and any vacancies. Consistently updating the report ensures clear financial insights and aids in tax preparation.

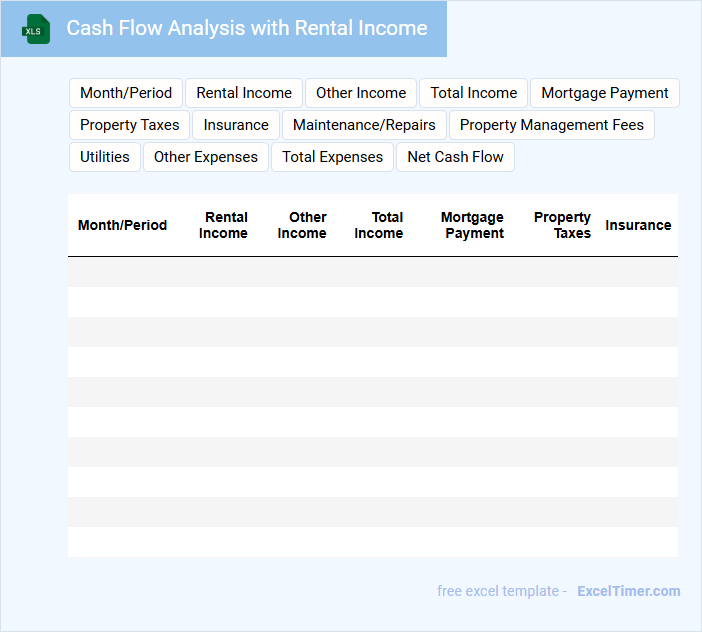

Cash Flow Analysis with Rental Income

What information does a Cash Flow Analysis with Rental Income typically contain?

This type of document usually includes detailed records of rental income, operating expenses, loan payments, and net cash flow. It is designed to help property owners assess the profitability and sustainability of their rental investments. Important elements to include are accurate income tracking, expense categorization, and projections for future cash flow.

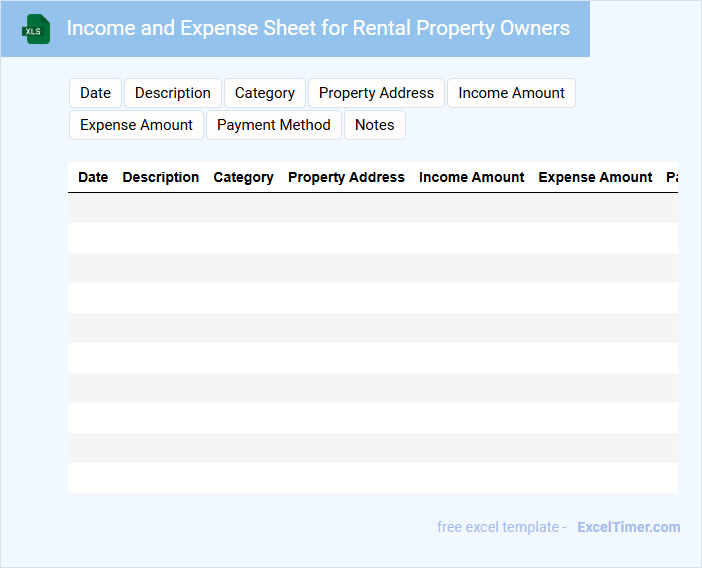

Income and Expense Sheet for Rental Property Owners

An Income and Expense Sheet for Rental Property Owners is a financial document that tracks the revenue and costs associated with rental properties. It helps owners monitor profitability and manage budgets effectively.

- Include detailed income sources such as rent and additional fees.

- Record all expenses including maintenance, utilities, and taxes separately.

- Update entries regularly to ensure accurate financial analysis.

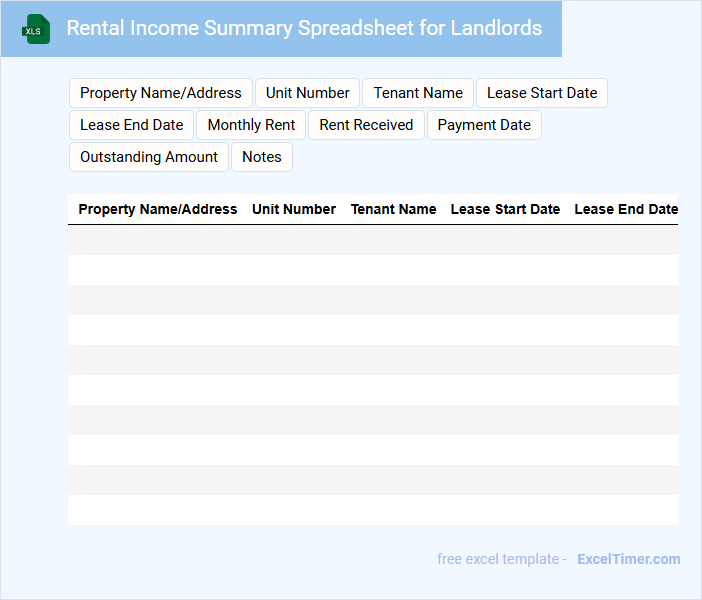

Rental Income Summary Spreadsheet for Landlords

A Rental Income Summary Spreadsheet for Landlords is a document that tracks rental payments received from tenants and summarizes financial data. It helps landlords manage their property income efficiently and identify any discrepancies in payments.

- Include detailed records of each tenant's rent payments and due dates.

- Highlight any late or missed payments for easy follow-up.

- Summarize monthly and annual rental income totals for financial review.

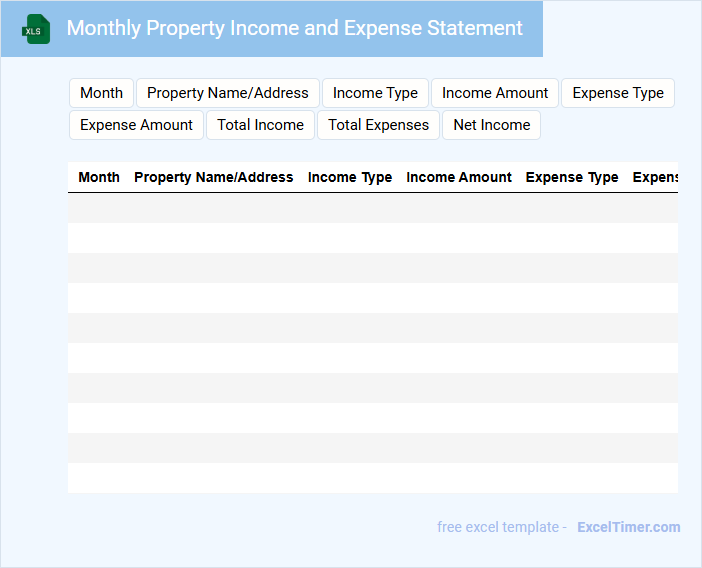

Monthly Property Income and Expense Statement

The Monthly Property Income and Expense Statement is a crucial financial document that summarizes the revenues and costs associated with a property on a monthly basis. It typically includes details such as rental income, maintenance expenses, utilities, and property management fees. This statement helps property owners and investors monitor financial performance and make informed decisions.

Excel Tracker for Rental Income and Deductions

What information does an Excel tracker for rental income and deductions usually contain? It typically includes detailed records of rental payments received, dates, and sources, as well as itemized deductions like repairs, maintenance, and other related expenses. This document helps landlords efficiently monitor their rental cash flow and accurately prepare for tax filings.

What important features should be included in such a tracker? It is essential to have clear categorization for income and expenses, automated calculations for totals and balances, and space for notes or additional details to ensure thorough record-keeping. These features improve financial transparency and simplify accounting processes.

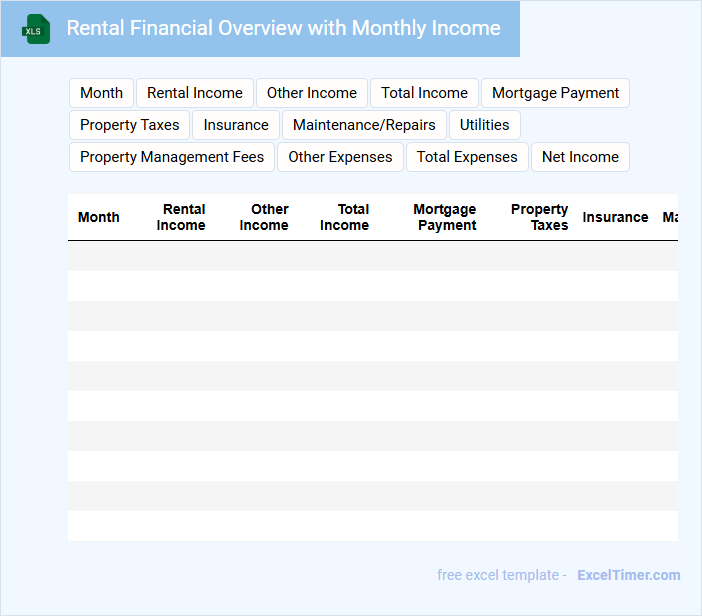

Rental Financial Overview with Monthly Income

A Rental Financial Overview typically contains a detailed summary of income and expenses related to rental properties. It outlines monthly income, including rent collected and additional revenue sources, providing insight into cash flow. Important considerations include tracking consistent payment patterns and identifying any irregularities promptly.

Key elements to include are the exact amounts received each month, any outstanding payments, and associated costs such as maintenance and management fees. This document aids in assessing the profitability and financial health of rental investments. Accurate record-keeping ensures transparency and facilitates effective financial planning.

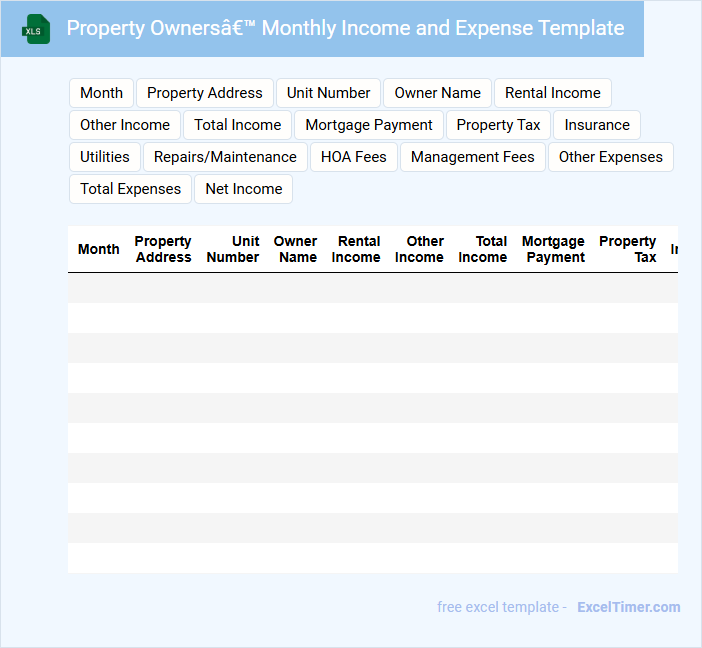

Property Owners’ Monthly Income and Expense Template

What information is typically included in a Property Owners' Monthly Income and Expense Template? This type of document usually contains detailed records of all rental income received and expenses incurred for property management within a given month. It helps property owners track financial performance, identify trends, and make informed decisions regarding budgeting and investments.

What important elements should property owners focus on when using this template? Owners should ensure accurate categorization of income and expenses, timely data entry, and clear documentation of any irregular costs or income sources. Consistent monitoring of this template can enhance financial control and optimize property profitability.

Monthly Rental Payment Tracker for Multiple Properties

The Monthly Rental Payment Tracker for multiple properties is a document designed to monitor and record rent payments from various tenants across different locations. It helps landlords or property managers maintain an organized overview of incoming payments, due dates, and any outstanding balances.

Typically, this type of document contains property details, tenant information, rental amounts, payment dates, and status updates for each month. A vital suggestion is to regularly update the tracker to ensure accurate financial records and timely follow-ups on late payments.

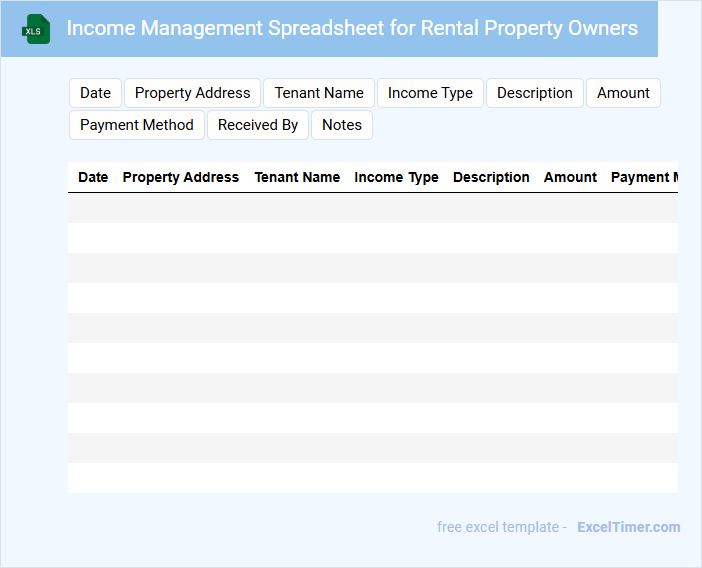

Income Management Spreadsheet for Rental Property Owners

What information is typically included in an Income Management Spreadsheet for Rental Property Owners? This type of document usually contains detailed records of rental income, expenses, and profit calculations related to rental properties. It helps owners track financial performance, manage cash flows, and prepare for tax reporting efficiently.

What important features should be included for effective income management? The spreadsheet should incorporate clear categories for income sources, consistent expense tracking, automated calculations for net income, and charts or summaries to visualize cash flow trends for better decision-making.

Monthly Rental Revenue Sheet with Expense Tracking

A Monthly Rental Revenue Sheet with Expense Tracking is a crucial document used by property managers and landlords to monitor income and expenditures related to rental properties. It typically contains detailed records of rental payments received, maintenance costs, utility bills, and other associated expenses. This document helps in evaluating profitability and ensuring financial transparency throughout the rental period.

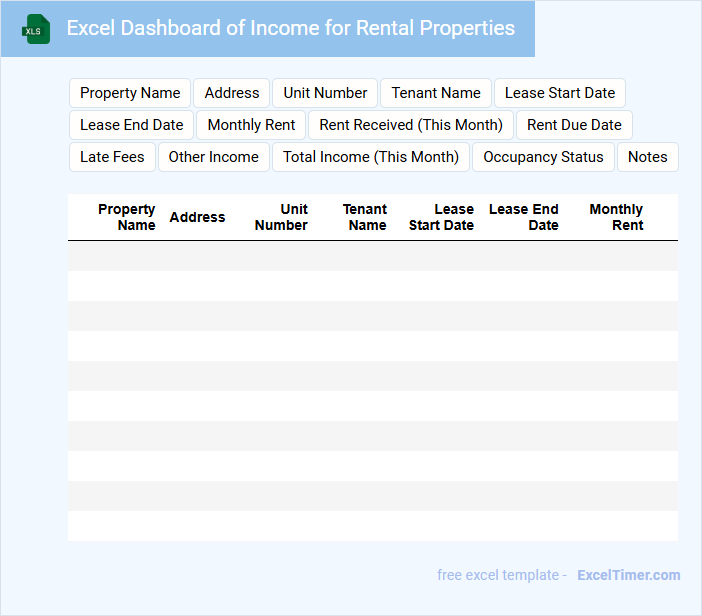

Excel Dashboard of Income for Rental Properties

An Excel Dashboard for Income from Rental Properties typically contains a comprehensive overview of rental income, expenses, and net profit. It includes charts and tables that visualize monthly cash flow, occupancy rates, and property-specific financial performance. This type of document is essential for tracking financial health and making informed investment decisions.

How do you accurately record monthly rental income for multiple properties in an Excel document?

To accurately record monthly rental income for multiple properties in an Excel document, create separate columns for property names, rental amounts, payment dates, and tenant details. Use formulas like SUMIFS to track income per property and analyze total revenue across all properties. Your organized data will enable precise financial reporting and easy income monitoring.

What Excel formulas help automate the calculation of total monthly rental income?

Excel formulas like SUM can automate the calculation of total monthly rental income by adding individual rents across properties. Using SUMPRODUCT helps multiply rent amounts by occupancy status to get accurate totals. Incorporating IF formulas allows adjustment of income based on conditions like payment status or discounts.

How can you track overdue or unpaid rent each month in an organized Excel format?

Create a dedicated Excel sheet with columns for Tenant Name, Rent Due Date, Amount Due, Amount Paid, Payment Date, and Outstanding Balance. Use conditional formatting to highlight overdue payments based on the current date and the Due Date. Implement formulas like SUMIF to calculate total overdue amounts and generate monthly reports for effective rent tracking.

Which columns and data fields are essential for a comprehensive monthly rental income tracker?

Essential columns for a comprehensive monthly rental income tracker include Property ID, Tenant Name, Rental Period, Rent Amount, Payment Date, Payment Status, and Late Fees. Additional fields like Maintenance Costs, Security Deposit, and Notes enhance financial accuracy and record-keeping. Organizing these data points facilitates clear tracking of rental income and expenses for property owners.

How can conditional formatting be used to highlight discrepancies or late payments in rental income records?

Conditional formatting in Excel can highlight discrepancies or late payments in monthly rental income by applying color codes based on payment status or due dates. Use rules to flag cells with missing payments, amounts less than expected rent, or dates past the payment deadline. This visual alert system helps property owners quickly identify and address issues in rental income records.