The Monthly Savings Goal Excel Template for Young Professionals simplifies budgeting by allowing users to track income, expenses, and savings targets in one place. This customizable template helps young professionals set realistic financial goals, monitor progress, and adjust spending habits efficiently. Its user-friendly design enhances financial discipline and supports long-term wealth building.

Monthly Savings Goal Tracker for Young Professionals

This type of document is typically used to monitor and manage monthly savings objectives, tailored specifically for young professionals. It provides a clear overview of progress and helps in maintaining financial discipline.

- Include sections for income, expenses, and savings targets to track financial inflow and outflow effectively.

- Incorporate motivational quotes or tips to encourage consistent savings habits.

- Use visual aids like charts or graphs to easily assess progress towards monthly goals.

Excel Spreadsheet for Monthly Savings Goals of Young Professionals

An Excel Spreadsheet for Monthly Savings Goals of Young Professionals typically contains fields for tracking income, expenses, and targeted savings amounts. It often includes formulas to calculate savings progress and visualize trends over time through charts or graphs. Key components also involve categorizing expenses and setting realistic monthly savings targets to promote financial discipline.

To optimize usability, ensure clear labeling of all columns and include conditional formatting to highlight when savings goals are met or missed. Incorporating a section for notes or adjustments can help users adapt their goals based on changing financial circumstances. Additionally, providing a summary dashboard with total savings and percentage achieved enhances motivation and clarity.

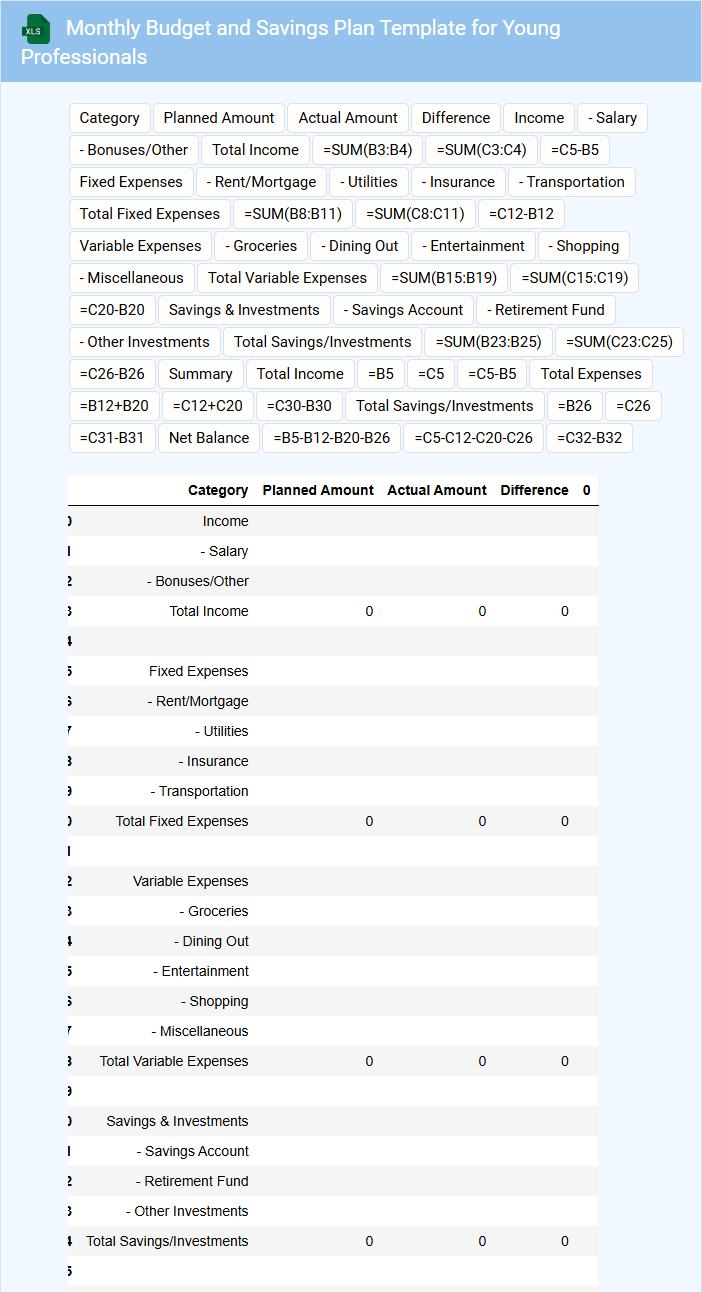

Monthly Budget and Savings Plan Template for Young Professionals

The Monthly Budget and Savings Plan Template is a crucial document designed to help young professionals track their income, expenses, and savings goals effectively. It typically contains categorized expense sections, income sources, and a summary of savings targets. This structured approach encourages financial discipline and promotes long-term financial stability.

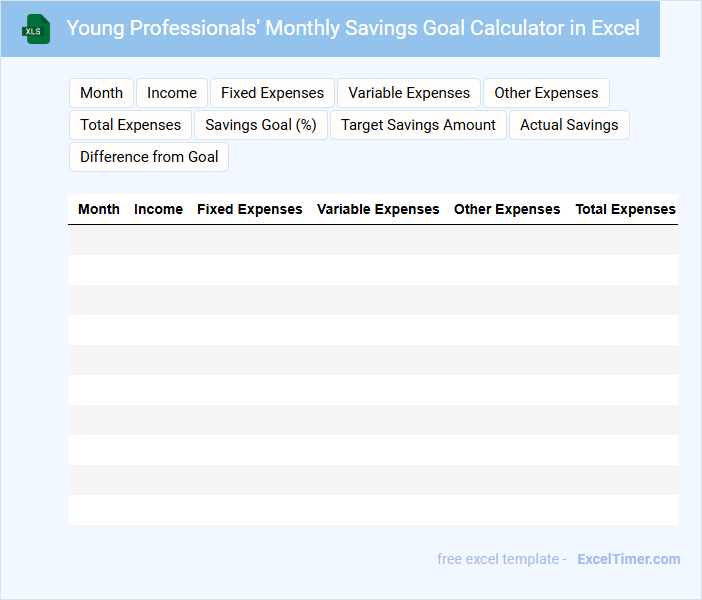

Young Professionals' Monthly Savings Goal Calculator in Excel

This document typically contains a detailed savings goal calculator designed for young professionals to track and optimize their monthly savings. It includes input fields for income, expenses, and desired savings targets, alongside formulas that automatically calculate necessary adjustments.

It also provides helpful tips on budgeting and financial planning to ensure realistic and achievable goals. Incorporating visual aids like charts or progress bars for quick assessment is highly recommended.

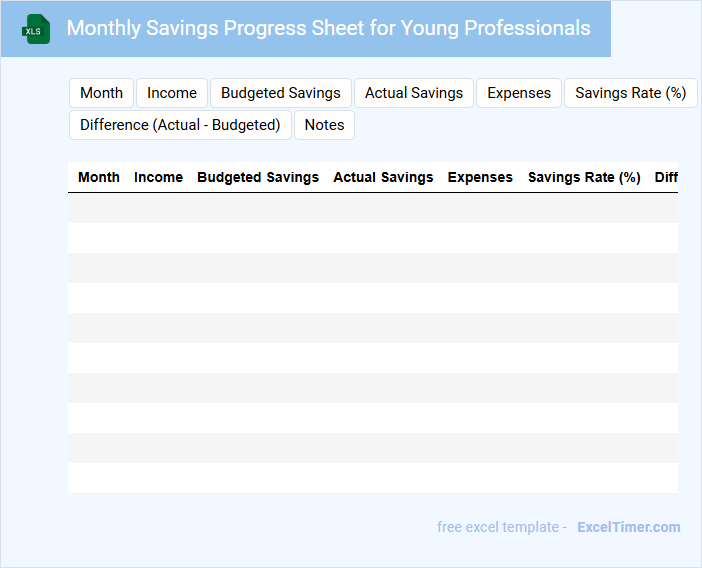

Monthly Savings Progress Sheet for Young Professionals

This document typically contains a detailed breakdown of monthly income, expenses, and savings goals aimed at tracking financial progress. It helps young professionals visualize their savings journey and identify spending patterns. Consistent updates ensure accuracy and usefulness over time.

Important elements include setting realistic targets and including sections for emergency funds and investment contributions. The sheet encourages accountability and financial discipline through regular reviews. Consider integrating graphs for a clearer financial overview.

Excel Tracker for Monthly Savings Goals of Young Professionals

An Excel tracker for monthly savings goals typically contains fields for income, expenses, savings targets, and progress updates. It helps users visually monitor their financial habits and stay on track with their budgeting plans.

For young professionals, including a clear summary of monthly savings and a goal completion percentage is essential. This aids in maintaining motivation and adjusting spending behaviors effectively.

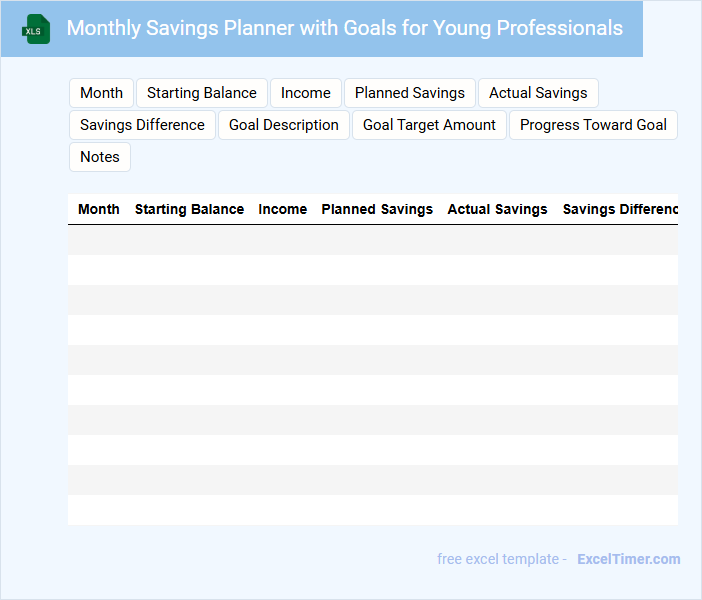

Monthly Savings Planner with Goals for Young Professionals

A Monthly Savings Planner with Goals for Young Professionals typically contains a detailed breakdown of income, expenses, and savings targets. It helps users track their financial progress and stay motivated towards achieving specific monetary goals.

Important elements include setting realistic savings amounts, categorizing essential and discretionary spending, and regularly reviewing progress. Consistent updates and goal adjustments are key to maintaining effective financial discipline.

Simple Savings Goal Worksheet for Young Professionals (Excel)

What information is typically included in a Simple Savings Goal Worksheet for Young Professionals (Excel)? This type of document usually contains fields for setting financial goals, tracking income and expenses, and timelines for achieving savings targets. It helps young professionals clearly outline their monetary objectives and monitor their progress effectively.

What important features should be considered when using this worksheet? Key elements include realistic goal setting, regular updating of actual savings versus targets, and including categories for unexpected expenses. These features ensure the worksheet remains practical and useful for managing personal finances.

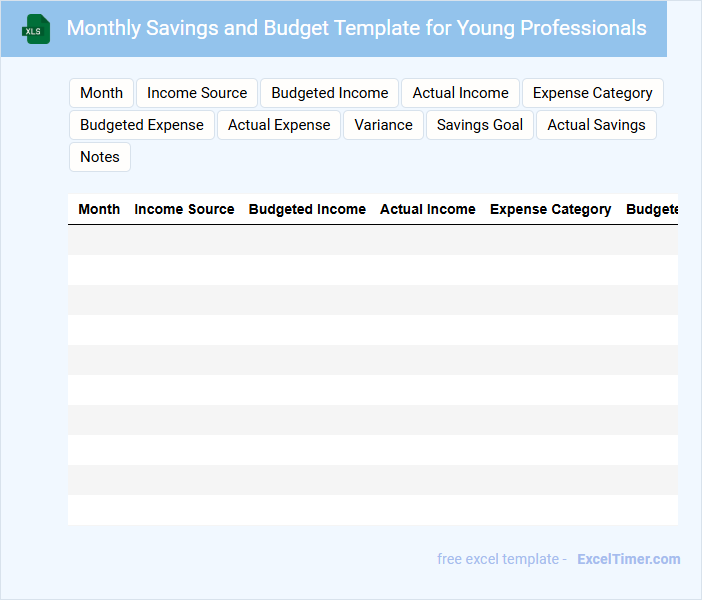

Monthly Savings and Budget Template for Young Professionals

What information is typically included in a Monthly Savings and Budget Template for Young Professionals? This type of document usually contains detailed categories for income, fixed expenses, variable expenses, and savings goals to help users track their financial habits effectively. It is designed to provide a clear overview of monthly cash flow, enabling young professionals to manage their finances with discipline and make informed decisions.

What important features should be considered when creating or using this template? It is essential to include realistic budgeting categories tailored to common expenses for young professionals, such as rent, utilities, student loans, and entertainment. Additionally, suggesting automatic savings options and highlighting emergency fund contributions will encourage responsible financial planning and long-term security.

Excel Template for Setting Monthly Savings Goals of Young Professionals

An Excel template for setting monthly savings goals typically contains pre-designed tables, formulas, and charts that help users track their income, expenses, and savings targets. It is tailored to assist young professionals in managing their finances efficiently by providing a clear overview of monthly financial goals.

Such a document often includes sections for budgeting, forecasting, and visual progress indicators to maintain motivation and accountability. Including customizable categories and automated calculations is important for adaptability and accuracy.

Monthly Personal Savings Tracker with Goals for Young Professionals

A Monthly Personal Savings Tracker is a practical tool designed to help young professionals monitor and manage their finances efficiently. It typically contains sections for tracking income, expenses, and savings progress on a monthly basis. Including clear goals and visual progress indicators is essential to maintain motivation and achieve financial milestones effectively.

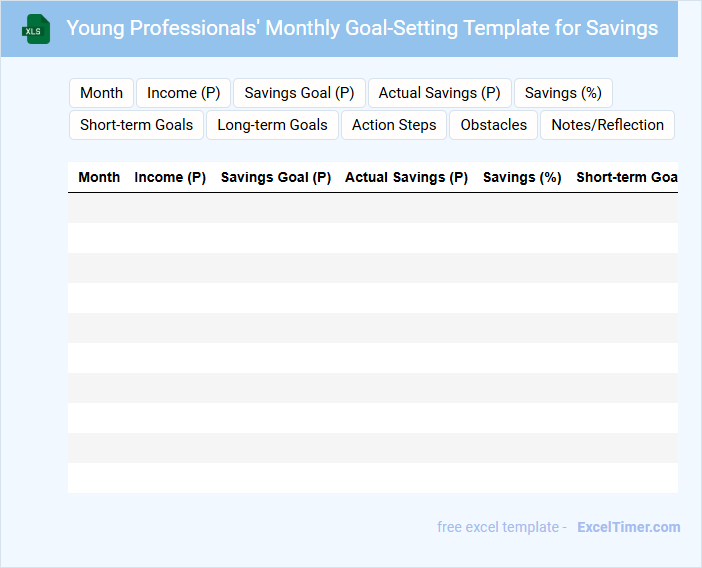

Young Professionals' Monthly Goal-Setting Template for Savings

This goal-setting template is designed to help young professionals clearly outline their savings objectives each month. It typically includes sections for income, expenses, and specific savings targets to track progress efficiently.

Key elements often involve identifying priority savings goals and setting realistic deadlines. Including reminders about budgeting and tracking habits can significantly improve financial discipline.

Consider adding motivational quotes to keep users inspired throughout their savings journey.

Monthly Savings Target Spreadsheet for Young Professionals

A Monthly Savings Target Spreadsheet for Young Professionals is a document designed to help users plan and track their savings goals effectively each month. It typically includes financial data organized to provide clear insights into spending and saving habits.

- Include categorized income and expenses to monitor cash flow accurately.

- Set realistic monthly savings targets aligned with financial objectives.

- Incorporate progress tracking features for motivation and adjustment.

Excel Dashboard for Tracking Monthly Savings Goals of Young Professionals

This document typically contains visual representations and summaries of monthly savings goals to help young professionals monitor their progress effectively. It combines data analysis with intuitive graphics to enhance financial decision-making and motivation.

- Include clear and concise summary charts of monthly savings versus goals.

- Incorporate automated calculations for tracking cumulative savings over time.

- Utilize interactive elements like slicers or drop-downs for personalized views.

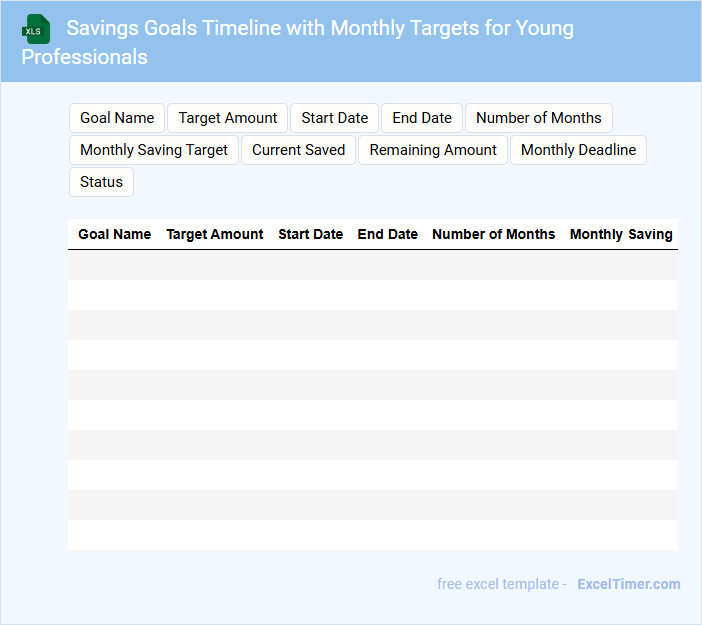

Savings Goals Timeline with Monthly Targets for Young Professionals

What does a Savings Goals Timeline with Monthly Targets for Young Professionals usually contain? This document typically outlines a structured financial plan featuring specific savings objectives set over a defined timeline, broken down into achievable monthly targets. It helps young professionals track their progress, stay motivated, and manage their finances effectively to reach key milestones such as emergency funds, investments, or major purchases.

What is an important consideration when creating this type of document? It is essential to set realistic and personalized monthly savings targets based on income and expenses, ensuring the timeline is flexible enough to accommodate life changes. Additionally, including periodic reviews and adjustments fosters long-term commitment and financial discipline.

What are the key components to consider when setting a monthly savings goal in Excel?

Key components for setting a monthly savings goal in Excel include inputting your fixed expenses, variable costs, and desired savings amount. Use formulas to calculate the difference between your income and expenses, ensuring your savings target is realistic and achievable. Your budget should also include automatic updates for changes in income or spending habits to track progress effectively.

How do you use Excel formulas to calculate the ideal percentage of income to save each month?

Using Excel formulas, you can calculate your ideal monthly savings percentage by dividing your target savings amount by your total monthly income and multiplying by 100. For example, if your savings goal is in cell B2 and your income is in cell B3, the formula = (B2 / B3) * 100 returns the savings percentage. This approach ensures Young Professionals track and adjust their finances toward consistent savings goals.

Which Excel features help track progress toward a monthly savings target for young professionals?

Excel features such as conditional formatting highlight progress toward monthly savings goals by visually differentiating achieved and pending amounts. The SUM function calculates total savings accumulated, while data validation ensures accurate entry of monthly deposits. PivotTables summarize savings trends over time, aiding young professionals in monitoring and adjusting their financial strategies.

How can you automate monthly savings calculations and reminders using Excel tools?

Automate your monthly savings calculations in Excel by using built-in functions like SUM and IF to track progress against your goal. Set up conditional formatting to highlight when targets are met or missed, prompting timely attention. Use Excel's Power Automate integration or simple VBA macros to create automated reminders, ensuring consistent savings behavior.

What Excel chart types best visualize monthly savings goals and achievements?

Column charts effectively compare monthly savings goals and actual achievements, highlighting progress over time. Line charts reveal trends in your savings growth, helping identify consistent patterns. Combining both in a combo chart offers a clear visualization of goals versus achievements across months.