The Monthly Bill Payment Excel Template for Freelancers is designed to help track and manage recurring expenses efficiently, ensuring timely payments each month. It features customizable fields for bills, due dates, amounts, and payment status, providing clear visibility of financial obligations. This template is essential for freelancers aiming to maintain organized finances and avoid late fees.

Monthly Bill Payment Tracker for Freelancers

A Monthly Bill Payment Tracker for Freelancers is a document designed to help freelancers manage their recurring expenses efficiently. It typically contains a detailed list of bills, due dates, and payment statuses.

This tracker ensures timely payments, helping to avoid late fees and maintain good credit. Including categories for bill types and payment methods is highly recommended for better organization.

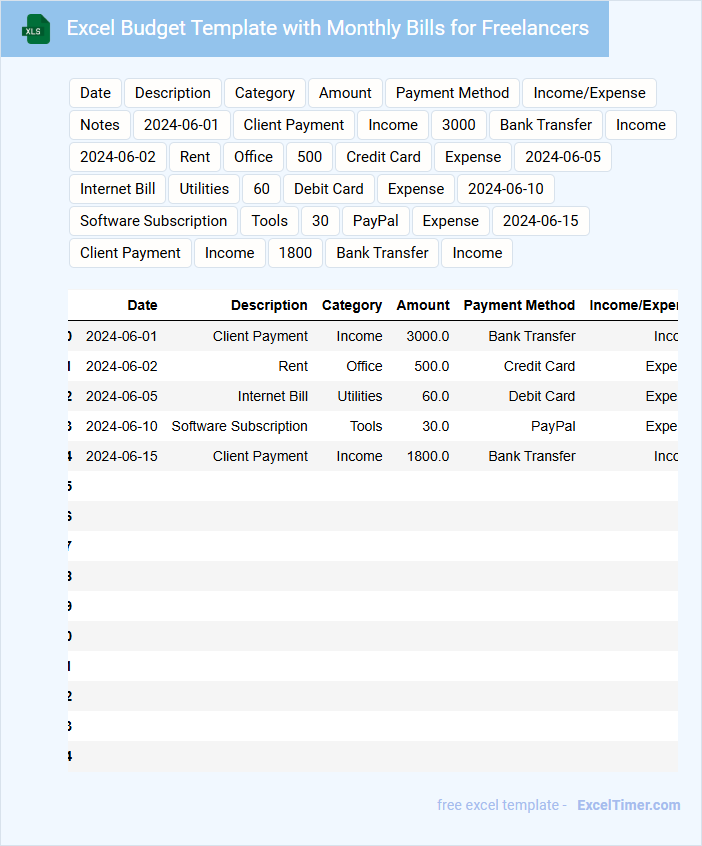

Excel Budget Template with Monthly Bills for Freelancers

An Excel Budget Template with Monthly Bills for Freelancers is designed to help individuals track their income and expenses efficiently. It typically contains sections for recording monthly bills, income sources, and savings goals, all organized in a clear, user-friendly layout. This type of document allows freelancers to monitor their cash flow and make informed financial decisions throughout the year.

Important elements to include are categorized expense fields, automated calculations for totals and balances, and a summary dashboard for quick financial insights. Additionally, incorporating reminders for due dates and a separate tab for irregular income can greatly enhance usability. Ensuring the template is customizable will allow freelancers to tailor it to their specific budgeting needs.

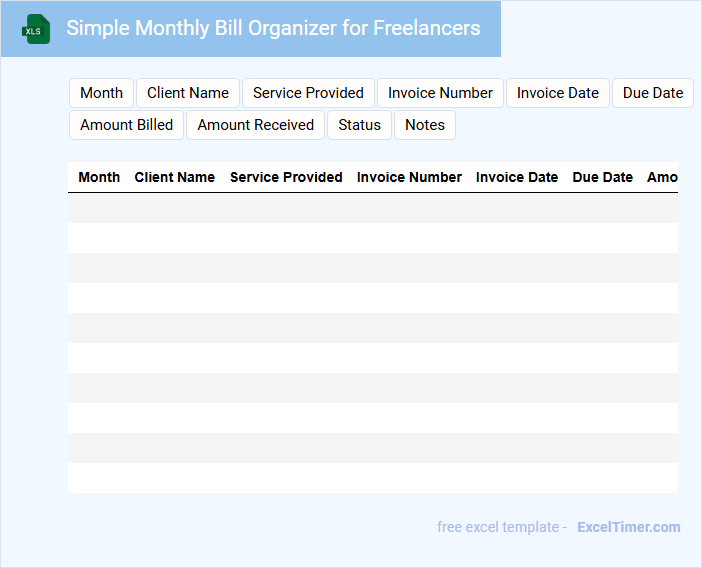

Simple Monthly Bill Organizer for Freelancers

Simple Monthly Bill Organizer for Freelancers typically contains records of income, expenses, and payment schedules essential for financial tracking.

- Income tracking: Detailed logs of all received payments to monitor earnings accurately.

- Expense categorization: Clear listing of business-related costs to manage deductions and budgeting.

- Payment deadlines: Organized due dates to ensure timely bill settlements and avoid penalties.

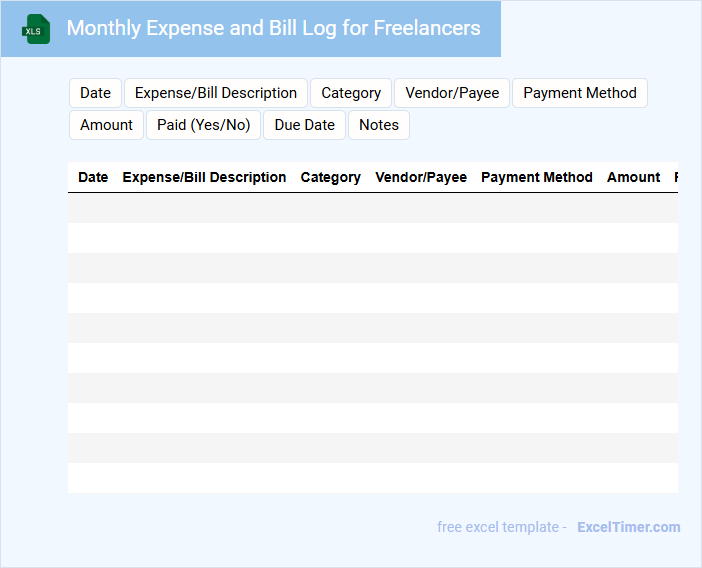

Monthly Expense and Bill Log for Freelancers

A Monthly Expense and Bill Log for Freelancers typically contains detailed records of all expenses and bills incurred during the month, including dates, amounts, and payment methods. This document helps freelancers track their financial activities, manage their budget, and prepare accurate tax filings. To maximize its effectiveness, it is important to regularly update entries and categorize expenses clearly for better financial analysis.

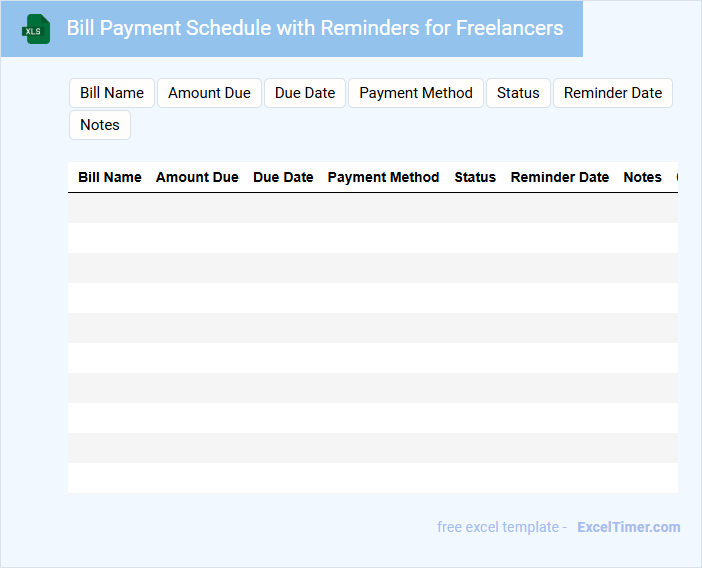

Bill Payment Schedule with Reminders for Freelancers

This document typically outlines scheduled payment dates and automated reminders tailored for freelancers to efficiently manage their income and deadlines.

- Clear timeline: Ensure all payment deadlines are clearly stated to avoid missed payments or delays.

- Reminder setup: Incorporate automated notifications well ahead of due dates to help maintain timely submissions.

- Payment details: Include client information, invoice numbers, and amounts to track payments accurately.

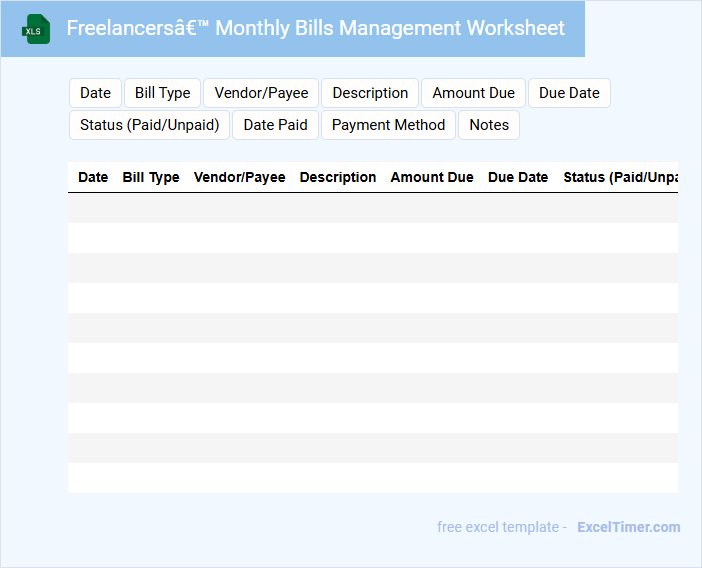

Freelancers’ Monthly Bills Management Worksheet

Freelancers' Monthly Bills Management Worksheet is a document used to organize and track monthly expenses and payments. It helps freelancers maintain financial clarity and ensure timely bill settlements.

- Include detailed categories for different types of bills such as utilities, subscriptions, and client payments.

- Record due dates and payment statuses to avoid missed deadlines and late fees.

- Keep a running total of expenses to monitor cash flow and budget efficiently.

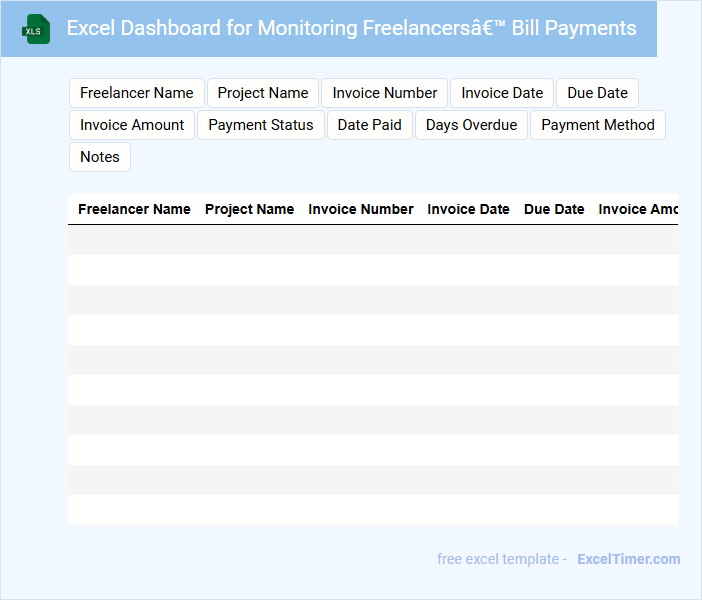

Excel Dashboard for Monitoring Freelancers’ Bill Payments

This document typically contains an organized Excel dashboard designed to efficiently track and monitor freelancers' bill payments.

- Comprehensive Payment Records: Maintain detailed logs of all invoices, payment dates, and outstanding balances.

- Visual Data Representation: Utilize charts and graphs to quickly assess payment statuses and trends.

- Automated Alerts and Reminders: Set up notifications for upcoming due dates and delayed payments to ensure timely processing.

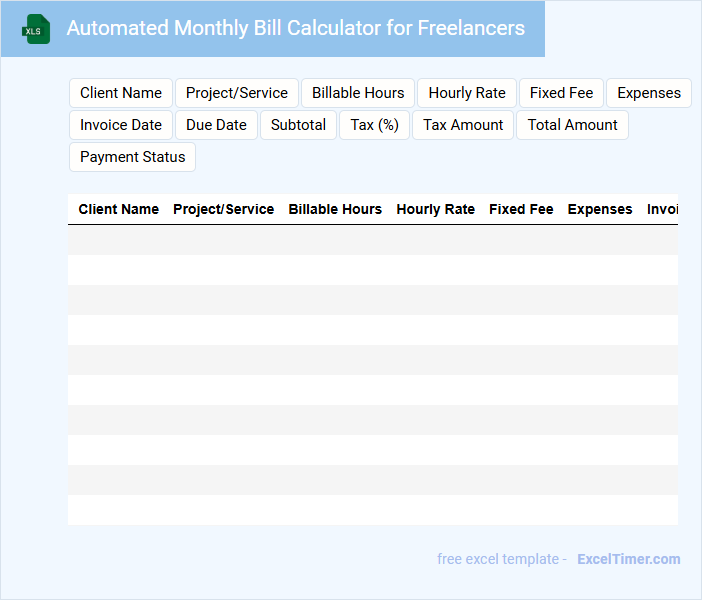

Automated Monthly Bill Calculator for Freelancers

The Automated Monthly Bill Calculator for freelancers is a tool designed to streamline the billing process by automatically calculating the total amount due based on hours worked, rates, and expenses. It helps freelancers maintain accurate records and ensures timely invoicing to clients.

Important factors to consider include integrating flexible rate settings and clear expense tracking to accommodate different projects and clients. A user-friendly interface and detailed summary reports enhance its practicality and efficiency.

Payment Due Date Tracker with Notes for Freelancers

A Payment Due Date Tracker is essential for freelancers to efficiently manage their incoming payments and deadlines. It helps in organizing invoice dates and tracking which payments are outstanding or overdue.

This document usually contains client details, invoice numbers, payment amounts, due dates, and space for relevant notes. Including reminders and follow-up actions ensures timely payments and clear communication with clients.

Monthly Bills and Invoices Tracker for Freelancers

A Monthly Bills and Invoices Tracker for freelancers is a crucial document that helps organize and monitor financial transactions on a monthly basis. It typically contains detailed records of all bills payable, invoices issued, payment statuses, and due dates to ensure timely financial management. Maintaining accuracy in this document aids freelancers in tracking income, managing cash flow, and preparing for taxes efficiently.

To optimize the effectiveness of the tracker, freelancers should include columns for invoice numbers, client names, payment deadlines, amounts, payment method, and status updates. Using clear categories and regular updates ensures that no payments are missed or overlooked. Additionally, integrating reminders and notes for follow-ups can significantly enhance financial control and professionalism.

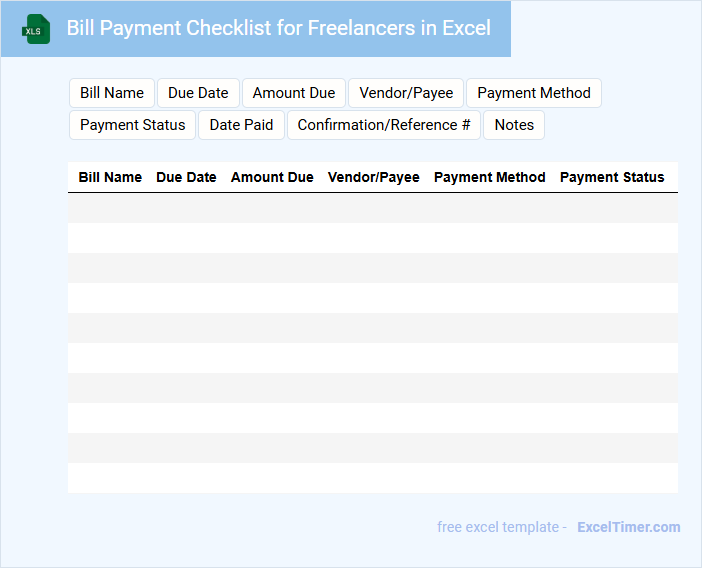

Bill Payment Checklist for Freelancers in Excel

A Bill Payment Checklist for freelancers in Excel is a structured document designed to track and manage payment deadlines efficiently. It ensures that all invoices and bills are paid on time, preventing late fees and maintaining good financial standing.

This type of checklist typically contains fields such as bill description, due date, amount, payment method, and status. A critical suggestion is to regularly update the Excel file and set reminders for due dates to avoid missed payments.

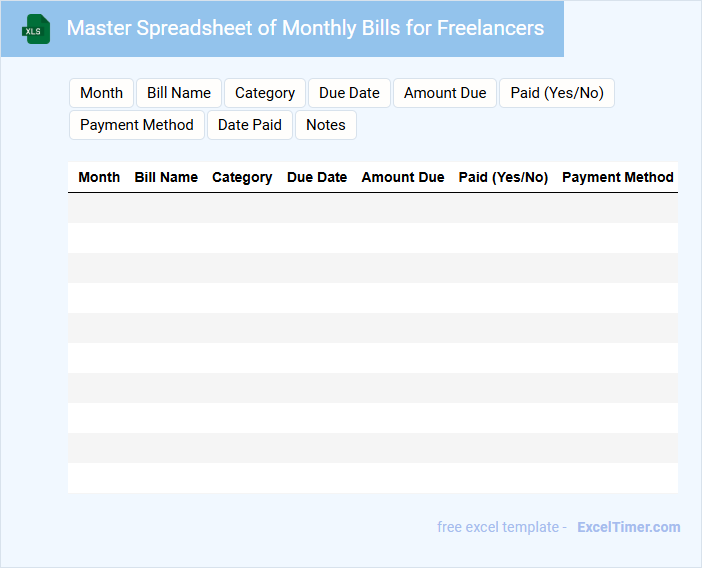

Master Spreadsheet of Monthly Bills for Freelancers

A Master Spreadsheet of Monthly Bills for freelancers typically contains detailed records of income and expenses, organized by date and category. It helps track payments, due dates, and budget allocations to ensure financial stability. Maintaining accuracy and consistency in this document is crucial for effective freelance business management.

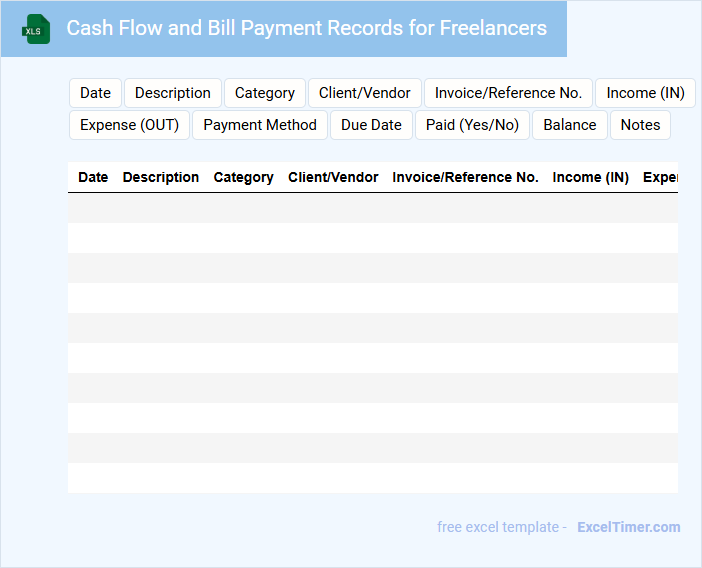

Cash Flow and Bill Payment Records for Freelancers

What information is typically included in Cash Flow and Bill Payment Records for freelancers? These records usually contain detailed listings of all income received and expenses paid, including dates, amounts, and payment methods. Maintaining accurate and up-to-date entries helps freelancers track their financial health and prepare for tax obligations efficiently.

Why is it important for freelancers to keep organized cash flow and bill payment records? Proper documentation ensures timely bill payments, prevents overdue charges, and aids in effective budgeting. Freelancers should also regularly reconcile their records with bank statements to avoid discrepancies and improve financial planning.

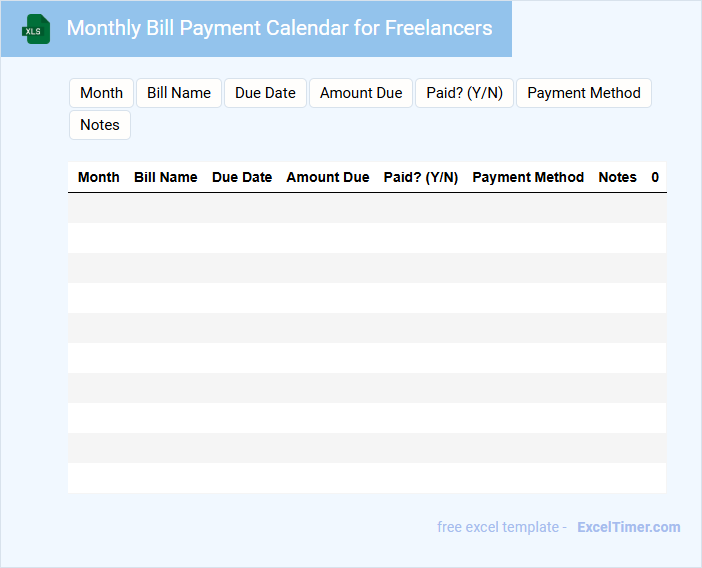

Monthly Bill Payment Calendar for Freelancers

A Monthly Bill Payment Calendar for Freelancers is a document that outlines all recurring and one-time expenses due within a month, helping to manage cash flow effectively. It serves as a financial tool to avoid missed payments and late fees.

- Include due dates and amounts for each bill to stay organized.

- Highlight priority payments that impact credit or service continuity.

- Incorporate reminders to confirm payments and track receipts.

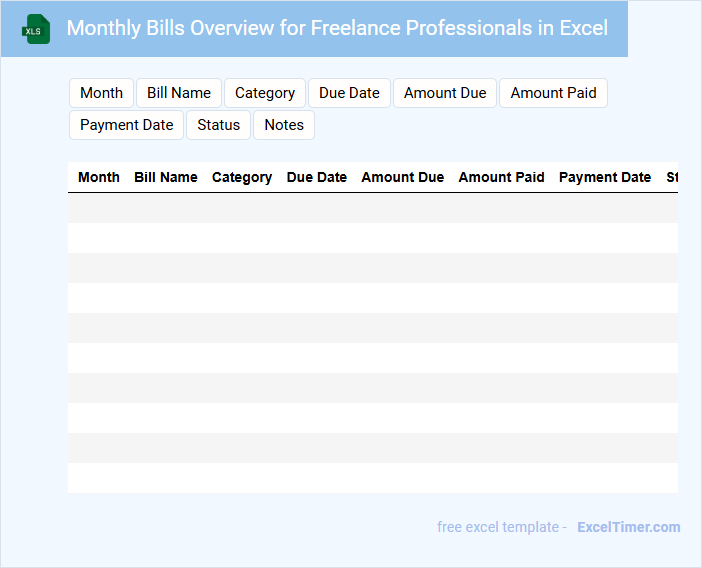

Monthly Bills Overview for Freelance Professionals in Excel

A Monthly Bills Overview for Freelance Professionals in Excel typically contains a detailed record of all recurring and one-time expenses within a month to help manage cash flow efficiently. This document is essential for tracking payments, budgeting, and tax preparation.

- List all monthly bills with due dates and amounts to avoid late payments.

- Include categories for different expenses such as utilities, subscriptions, and professional services for easy analysis.

- Use formulas to calculate totals and highlight overdue or upcoming bills for better financial control.

What essential details should be included in a freelancer's monthly bill payment tracker in Excel?

A freelancer's monthly bill payment tracker in Excel should include essential details such as invoice number, client name, payment due date, payment amount, payment status, and payment method. Including categories for project description and payment received date enhances clarity and financial management. Tracking overdue payments and notes for follow-up ensures timely reminders and organized cash flow monitoring.

How can conditional formatting highlight overdue payments in a bill payment spreadsheet?

Conditional formatting in your Excel sheet can automatically highlight overdue payments by comparing due dates with the current date, using formulas like =TODAY()>DueDate. This feature visually emphasizes unpaid bills past their deadlines, enabling quick identification and management. Applying distinct color codes further enhances the clarity of your monthly bill payment tracking for freelancers.

Which Excel functions best automate the calculation of total expenses and pending dues each month?

Excel functions like SUM and SUMIF best automate the calculation of total expenses and pending dues each month in your Monthly Bill Payment document for Freelancers. SUM efficiently totals all bill amounts, while SUMIF filters and adds only pending dues based on payment status criteria. Using these functions streamlines tracking of your monthly financial obligations.

How should recurring vs. one-time bills be organized and differentiated in the document?

Organize recurring bills in a dedicated section or tab labeled "Recurring Payments" with columns for due date, amount, and frequency to track consistency. Separate one-time bills in another section titled "One-Time Payments" with fields for payment date, vendor, and amount for clear differentiation. Use color-coding or tags to visually distinguish bill types, enhancing quick identification and management within the Excel document.

What methods can ensure data security and privacy for sensitive payment information in an Excel file?

Encrypt your Excel file with a strong password to protect sensitive payment information from unauthorized access. Use Excel's built-in data protection features, such as hiding columns or sheets containing confidential payment details. Regularly back up your file and limit access to trusted users to maintain data security and privacy.