The Monthly Budget Excel Template for Freelancers streamlines financial tracking by organizing income, expenses, and savings in a clear, customizable format. It helps freelancers manage irregular cash flow effectively and plan for tax payments and business investments. Utilizing this template ensures accurate budgeting, enabling better financial decisions and stability throughout the month.

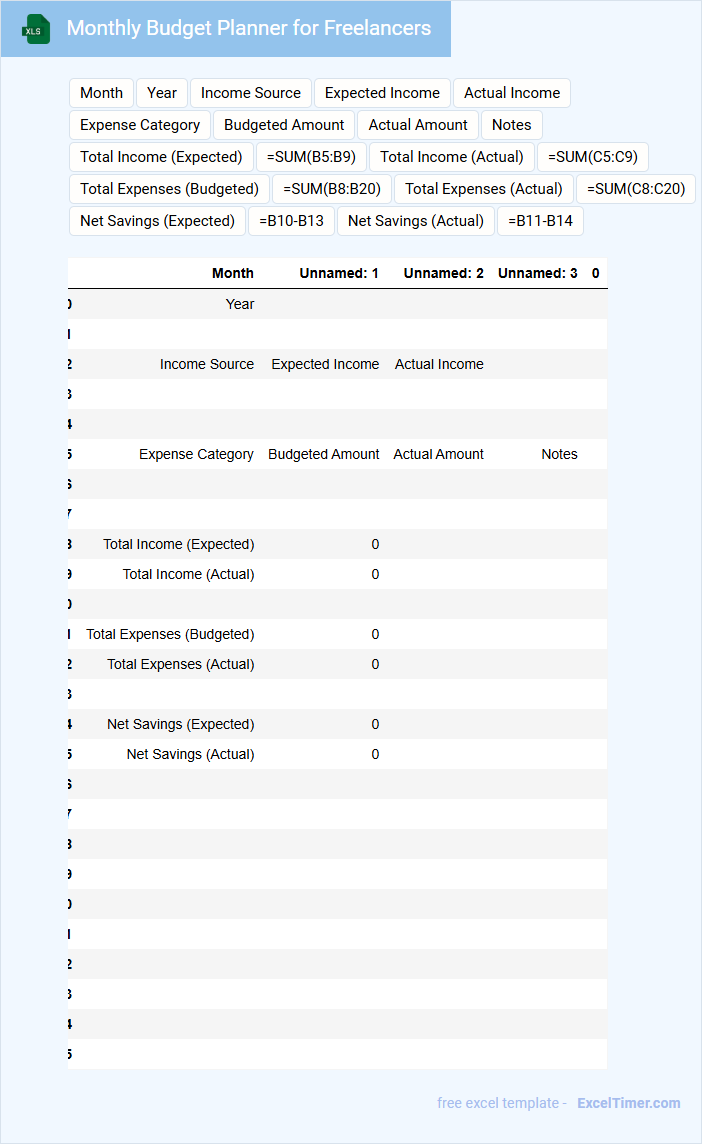

Monthly Budget Planner for Freelancers

A Monthly Budget Planner for freelancers is a specialized document designed to track income and expenses effectively. It typically includes sections for project revenues, fixed costs, and variable expenses.

Essential elements such as tax estimations, savings goals, and payment deadlines help maintain financial stability. Incorporating reminders for invoice tracking and emergency funds is highly recommended.

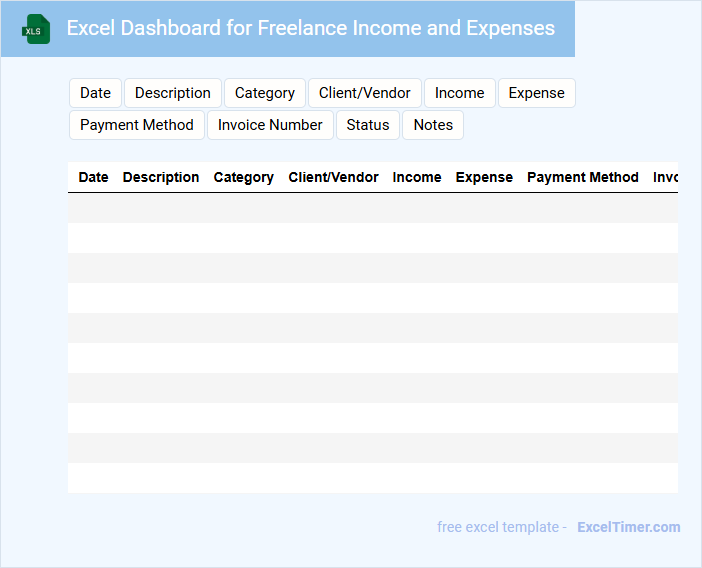

Excel Dashboard for Freelance Income and Expenses

What information is typically included in an Excel Dashboard for Freelance Income and Expenses? This type of document usually contains detailed records of income sources, categorized expenses, and summary visualizations such as charts and graphs to track financial performance. It is designed to provide freelancers with a clear, organized overview of their cash flow and profitability to aid in budgeting and tax preparation.

What important elements should be included to optimize its usefulness? Key components include real-time updates, clear categorization of income and expenses, customizable filters, and summary metrics like net profit and tax estimates. Incorporating interactive features and data validation enhances accuracy and usability, ensuring that freelancers can make informed financial decisions efficiently.

Monthly Expense Tracker for Freelancers

What information does a Monthly Expense Tracker for Freelancers typically contain?

This document usually includes detailed records of income and expenses categorized by type, date, and payment method to help freelancers monitor their financial health accurately. It plays a crucial role in budgeting, tax preparation, and identifying spending patterns to optimize profitability.

Important elements to consider are consistent categorization of expenses, timely updates, and integration with invoicing or accounting software to ensure precision and efficiency in financial management.

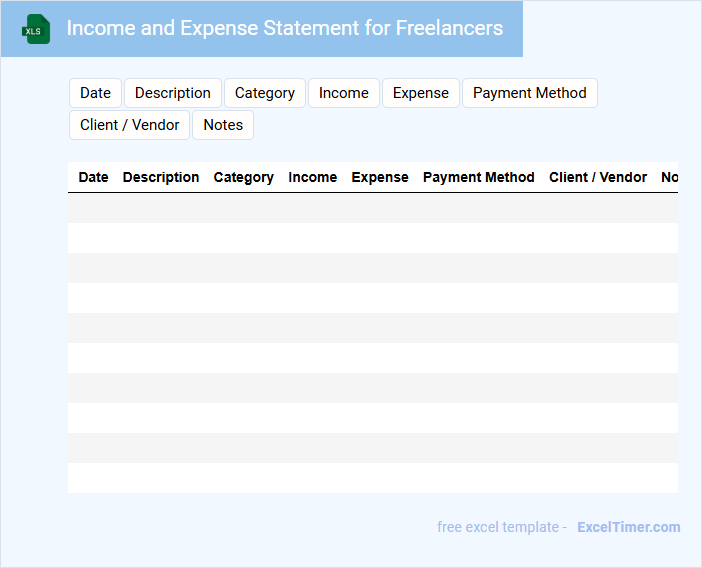

Income and Expense Statement for Freelancers

An Income and Expense Statement for freelancers typically contains a detailed record of all earnings and costs incurred during a specific period. This document helps track financial performance and prepare for tax obligations. It is essential to accurately categorize income sources and deductible expenses for clear financial management.

Monthly Financial Report for Freelance Professionals

The Monthly Financial Report for Freelance Professionals typically contains detailed records of income and expenses, including invoices sent and payments received. It also tracks tax deductions and budget allocations to ensure accurate financial management.

Including a summary of cash flow and outstanding payments is crucial for maintaining financial stability. Regularly updating this report helps freelancers monitor profitability and plan for future growth effectively.

Cash Flow Tracker with Charts for Freelancers

A Cash Flow Tracker for freelancers is a document designed to monitor income and expenses over time, helping to maintain financial stability. It usually contains detailed records of all earnings, payments, bills, and other financial transactions, often summarized with graphical charts for easier analysis.

This type of document is essential for freelancers to forecast financial trends and manage irregular income more effectively. Including visual charts can quickly highlight cash flow patterns, making budgeting and tax preparation more efficient.

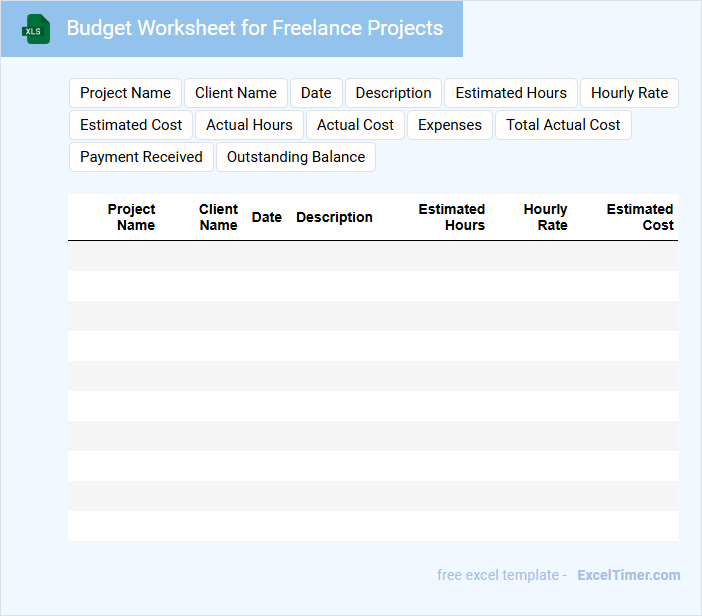

Budget Worksheet for Freelance Projects

A Budget Worksheet for freelance projects typically contains detailed sections for tracking estimated costs, actual expenses, and income related to various project tasks. It helps freelancers manage their finances effectively by organizing all financial aspects in one place.

Important elements to include are labor costs, material expenses, and contingency funds to cover unexpected costs. Keeping this document updated regularly ensures accurate forecasting and better project profitability.

Invoice and Payment Log for Freelancers

What information is typically included in an Invoice and Payment Log for Freelancers? An Invoice and Payment Log for Freelancers usually contains details about services provided, payment amounts, due dates, and payment status. It helps freelancers keep track of how much they have earned and which invoices are still pending payment.

What important aspects should freelancers focus on when maintaining an Invoice and Payment Log? Freelancers should ensure accurate recording of client details, invoice numbers, dates, and payment terms. Maintaining clarity and organization in the log can prevent disputes and improve financial management.

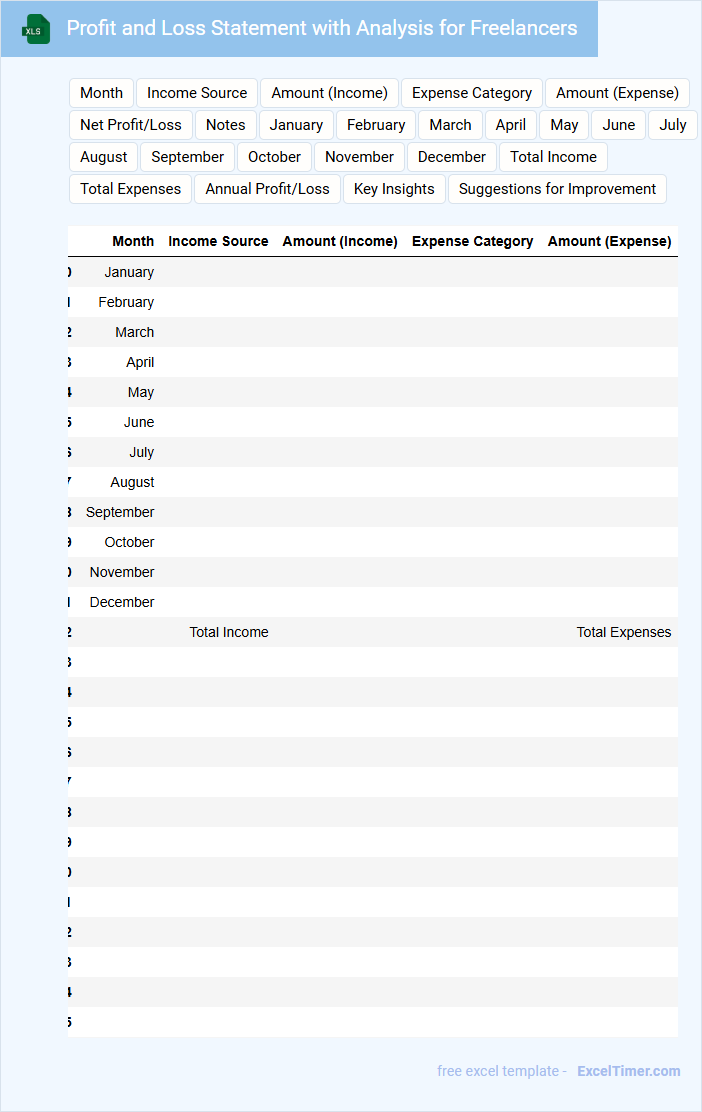

Profit and Loss Statement with Analysis for Freelancers

A Profit and Loss Statement with Analysis for Freelancers typically contains detailed records of income and expenses to assess profitability and financial health over a specific period.

- Revenue tracking: It highlights all sources of freelance income to clearly understand earnings.

- Expense categorization: It organizes business-related costs to monitor and control spending effectively.

- Profit analysis: It calculates net profit or loss to evaluate overall financial performance and inform strategic decisions.

Freelancer Monthly Earnings Tracker

A Freelancer Monthly Earnings Tracker is a document used to monitor income earned on a monthly basis. It typically contains sections for project details, payment dates, and total amounts received. This tracker helps freelancers maintain organized financial records and identify income patterns.

Important elements to include are accurate date entries, client names, payment statuses, and cumulative totals. Ensuring consistency and timely updates will provide a clear picture of earnings over time. Additionally, integrating categories for different types of projects can enhance financial analysis.

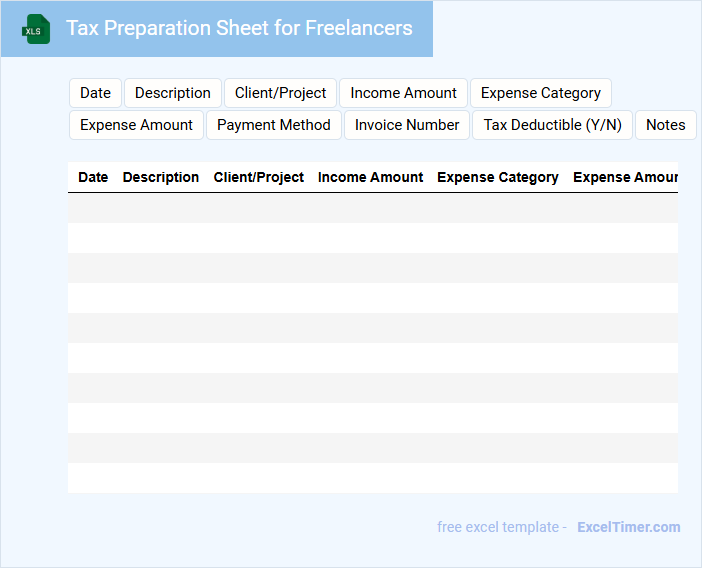

Tax Preparation Sheet for Freelancers

A Tax Preparation Sheet for freelancers typically includes detailed records of income, expenses, and deductible items throughout the fiscal year. It serves as an organized summary to ensure accurate reporting and compliance with tax regulations.

Important elements often include categorized receipts, invoices, and mileage logs to substantiate claims. Consistently updating and verifying this information can simplify tax filing and maximize potential deductions.

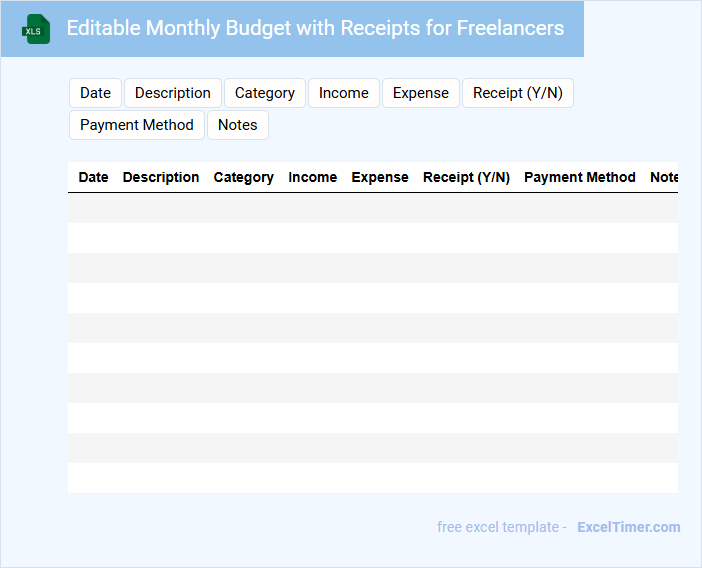

Editable Monthly Budget with Receipts for Freelancers

An Editable Monthly Budget document for freelancers typically contains sections for income tracking, expense categorization, and receipt management. It helps freelancers monitor their cash flow and maintain financial organization.

Including detailed receipts ensures accurate record-keeping and simplifies tax filing. Always ensure the document is easy to update and review regularly for effective budgeting.

Detailed Spending Overview for Freelance Incomes

A Detailed Spending Overview for freelance incomes typically contains a comprehensive breakdown of all expenses related to freelance work. This includes categories such as equipment costs, software subscriptions, travel expenses, and marketing fees.

It also highlights the tracking of income sources and payment schedules to maintain financial clarity. To ensure accuracy, it's important to regularly update and categorize expenses to optimize tax deductions and budgeting.

Savings and Goals Tracker for Freelancers

A Savings and Goals Tracker for freelancers typically contains detailed sections to monitor income, expenses, and savings targets. It also includes customizable budget plans tailored to fluctuating freelance earnings.

This document is essential for maintaining financial stability and achieving specific monetary goals over time. An important suggestion is to regularly update the tracker to reflect real-time changes in income and expenses for accurate financial planning.

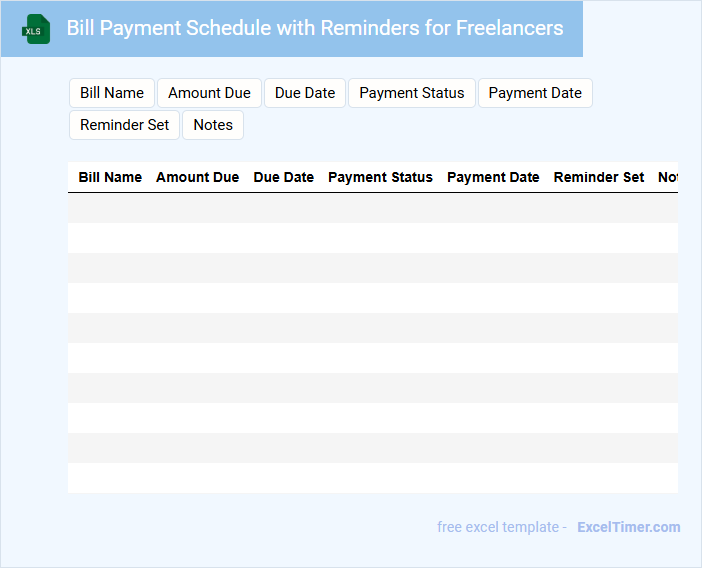

Bill Payment Schedule with Reminders for Freelancers

A Bill Payment Schedule for freelancers typically contains a detailed timeline of upcoming invoices and due dates to ensure timely payments. It often includes reminders for each payment to help manage cash flow efficiently and avoid late fees. Additionally, the document may list client details, payment amounts, and preferred payment methods to streamline the billing process.

What essential income and expense categories should be included in a freelancer's monthly budget Excel document?

A freelancer's monthly budget Excel document should include essential income categories such as client payments, project bonuses, and passive income. Key expense categories to track are software subscriptions, equipment costs, taxes, insurance, and marketing expenses. Your budget should also account for savings and emergency funds to ensure financial stability.

How can you use Excel formulas to automatically calculate total monthly income and expenses?

Use Excel formulas like SUM to automatically calculate your total monthly income and expenses by adding relevant cells in your budget sheet. Apply SUM to income categories to get total earnings and to expense categories for total spending. This ensures accurate tracking and easy updates as you input new financial data.

What methods in Excel help track irregular or variable client payments throughout the month?

Excel features like PivotTables analyze irregular or variable client payments by summarizing and categorizing transaction data efficiently. Using the SUMIFS function allows precise tracking of payments based on multiple criteria such as client name and date ranges. Conditional Formatting highlights late or inconsistent payments, aiding freelancers in maintaining accurate monthly budget records.

How can conditional formatting in Excel highlight budget overruns or critical cash flow thresholds?

Conditional formatting in Excel can automatically highlight budget overruns by applying color-coded rules when your expenses exceed set limits. This visual alert helps you quickly identify critical cash flow thresholds, ensuring timely adjustments in your monthly budget. Use customized formulas or preset conditions to track spending categories relevant to your freelancing income and expenses.

What Excel features can be used to set and monitor monthly financial goals for freelancers?

Excel features such as PivotTables enable freelancers to analyze income and expenses dynamically, while Conditional Formatting highlights budget variances for quick review. Data Validation ensures accurate input of financial figures, and built-in formulas like SUMIFS and IF statements facilitate goal tracking by calculating totals and variances. Dashboard elements like charts and sparklines provide visual summaries to monitor monthly financial progress effectively.