The Monthly Expenses Excel Template for Small Businesses helps track and manage all business costs efficiently, ensuring financial clarity. It includes customizable categories to monitor expenses such as utilities, supplies, and payroll, making budgeting easier. Accurate expense tracking supports better decision-making and improves cash flow management.

Monthly Expenses Tracker for Small Businesses

A Monthly Expenses Tracker for small businesses is a crucial document used to monitor and manage outgoing costs over a specified period. It typically contains detailed records of various expenses such as rent, utilities, salaries, and supplies. Maintaining this tracker helps ensure financial accountability and aids in budgeting and forecasting.

Important elements to include are clear categorization of expenses, consistent date entries, and a summary section for total monthly spending. Additionally, incorporating notes or remarks about unusual expenses can enhance clarity. Regular review and reconciliation with bank statements are also vital for accuracy.

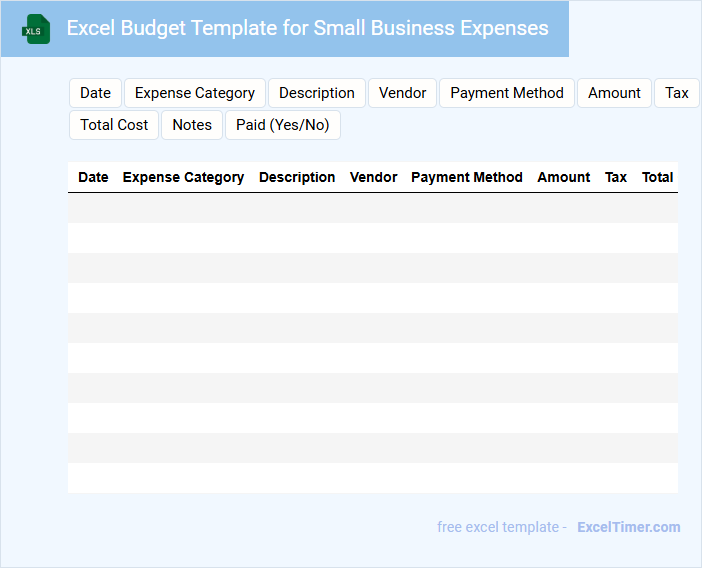

Excel Budget Template for Small Business Expenses

What information is typically included in an Excel Budget Template for Small Business Expenses? This type of document usually contains categories of expenses such as rent, utilities, salaries, marketing, and supplies, along with columns for projected and actual costs. It helps small business owners track their spending, manage cash flow, and make informed financial decisions throughout the year.

What is an important consideration when using an Excel Budget Template for Small Business Expenses? It is crucial to update the template regularly with accurate data to reflect real-time financial status. Including customizable categories and clear expense tracking will enhance budgeting accuracy and business planning.

Monthly Expense Report for Small Business Owners

What information is typically included in a Monthly Expense Report for Small Business Owners? This document usually contains detailed records of all business expenses incurred within the month, such as office supplies, utilities, payroll, and marketing costs. It helps owners track spending patterns and make informed financial decisions for better budgeting and cash flow management.

Expense Log with Monthly Overview for Small Businesses

An Expense Log with Monthly Overview for Small Businesses is a document designed to track daily expenditures and summarize financial activity over each month. It helps business owners monitor cash flow and identify spending patterns to maintain budget control.

- Include detailed categories for all expenses to ensure accurate tracking.

- Regularly update the log to avoid missing any transactions or receipts.

- Review the monthly summary to analyze trends and adjust budgets accordingly.

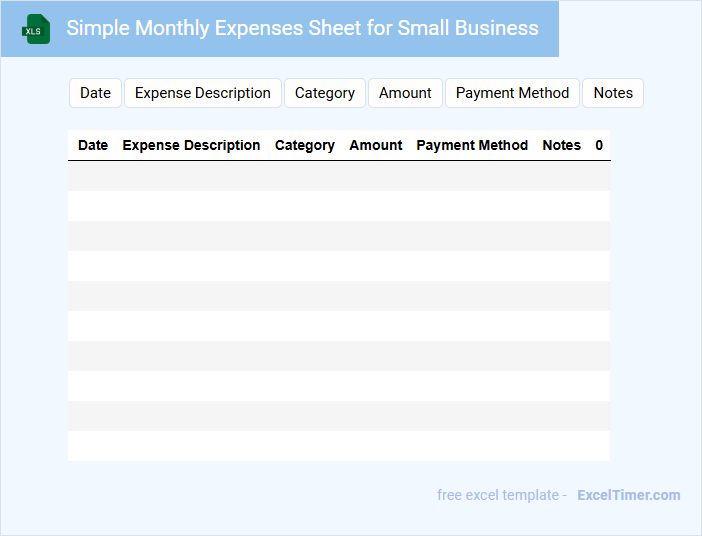

Simple Monthly Expenses Sheet for Small Business

A Simple Monthly Expenses Sheet for small businesses typically contains detailed records of all monthly outflows including rent, utilities, salaries, and supplies. It serves as a crucial tool for tracking business expenses and ensuring financial stability by preventing overspending. Accurate documentation helps in budgeting, forecasting, and identifying cost-saving opportunities.

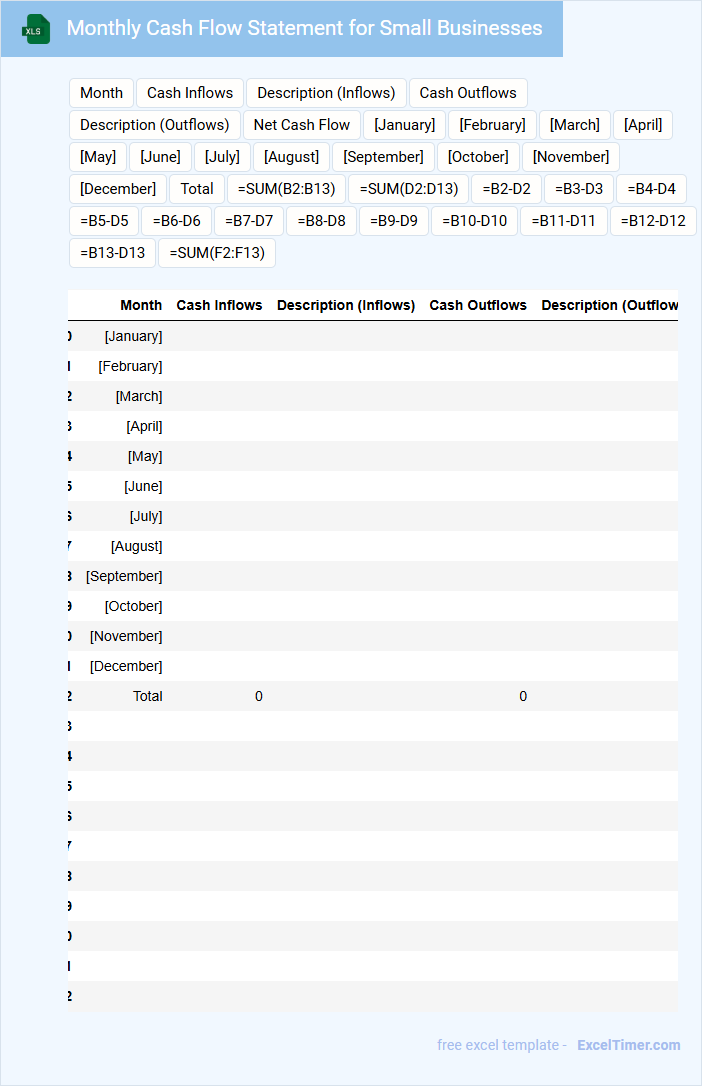

Monthly Cash Flow Statement for Small Businesses

The Monthly Cash Flow Statement for small businesses is a financial document that tracks the inflows and outflows of cash within a month. It helps in understanding the liquidity and operational efficiency of the business. These statements typically include cash receipts, payments, and net cash changes.

Maintaining an accurate and timely cash flow report is crucial for managing expenses and planning future investments. It provides insights into the business's ability to meet short-term obligations and avoid cash shortages. Small businesses should regularly review this document to make informed financial decisions.

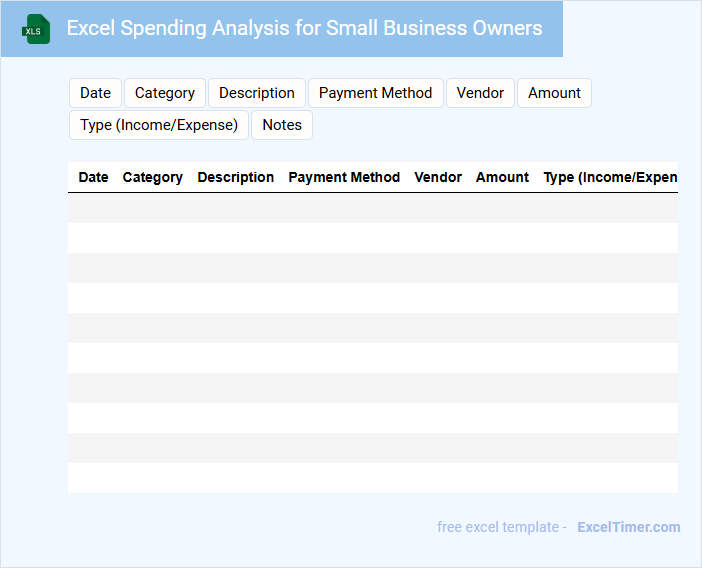

Excel Spending Analysis for Small Business Owners

An Excel Spending Analysis document typically contains detailed records of expenses, categorized and tracked over a specific period. It helps small business owners identify spending patterns and manage budgets effectively. This type of report often includes charts and summaries to visualize financial data clearly.

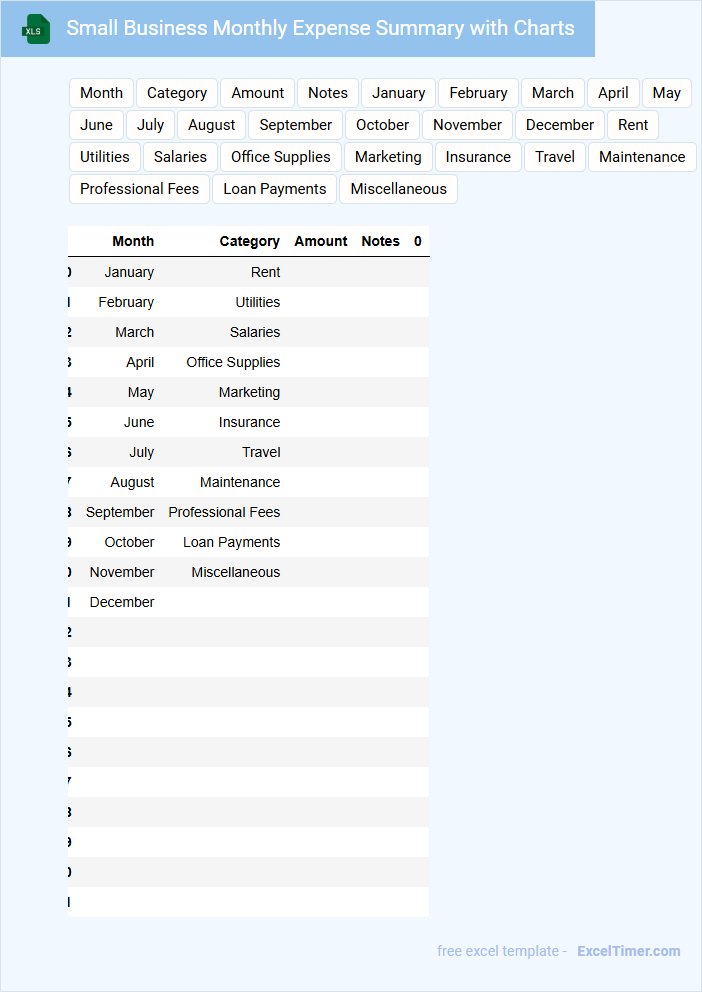

Small Business Monthly Expense Summary with Charts

A Small Business Monthly Expense Summary document typically contains an overview of all expenses incurred by the business within a specific month, often categorized by type. It provides insights into spending patterns and helps in budgeting and financial planning.

- Include detailed expense categories such as rent, utilities, supplies, and payroll for clarity.

- Incorporate visual charts like pie charts or bar graphs to highlight major expense areas effectively.

- Summarize total monthly expenses alongside comparisons to previous months to track spending trends.

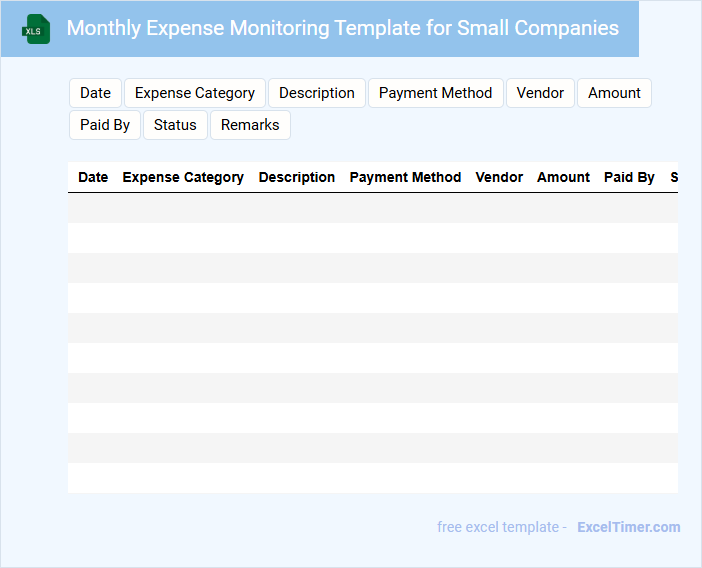

Monthly Expense Monitoring Template for Small Companies

This Monthly Expense Monitoring Template for small companies is designed to track and categorize all business-related expenditures systematically. It aids in maintaining a clear overview of spending patterns over time.

Using this template helps in budgeting effectively and identifying cost-saving opportunities for better financial management. Regular monitoring ensures small businesses stay within their financial limits and make informed decisions.

Important elements to include are categorized expense headings, date of transaction, payment method, and notes for clarification.

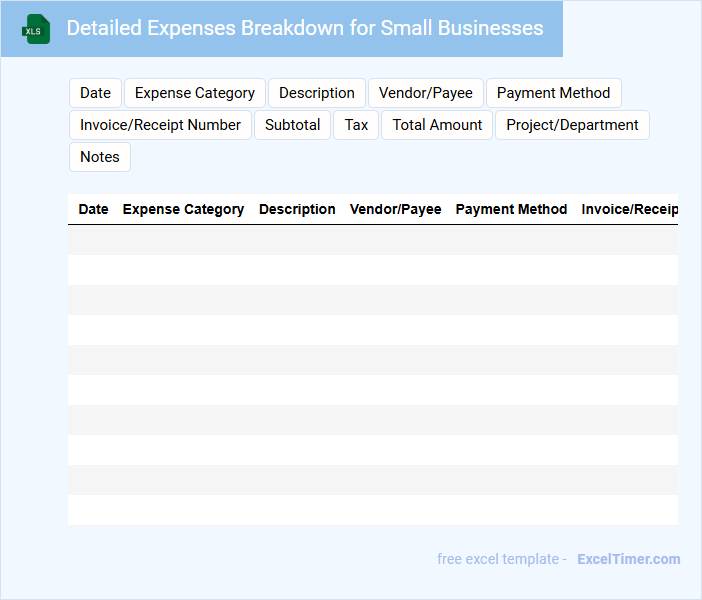

Detailed Expenses Breakdown for Small Businesses

A Detailed Expenses Breakdown for small businesses typically contains an itemized list of all costs incurred during a specific period. This document helps in tracking financial outflows and budgeting effectively. It is essential for maintaining accurate financial records and supporting tax filings.

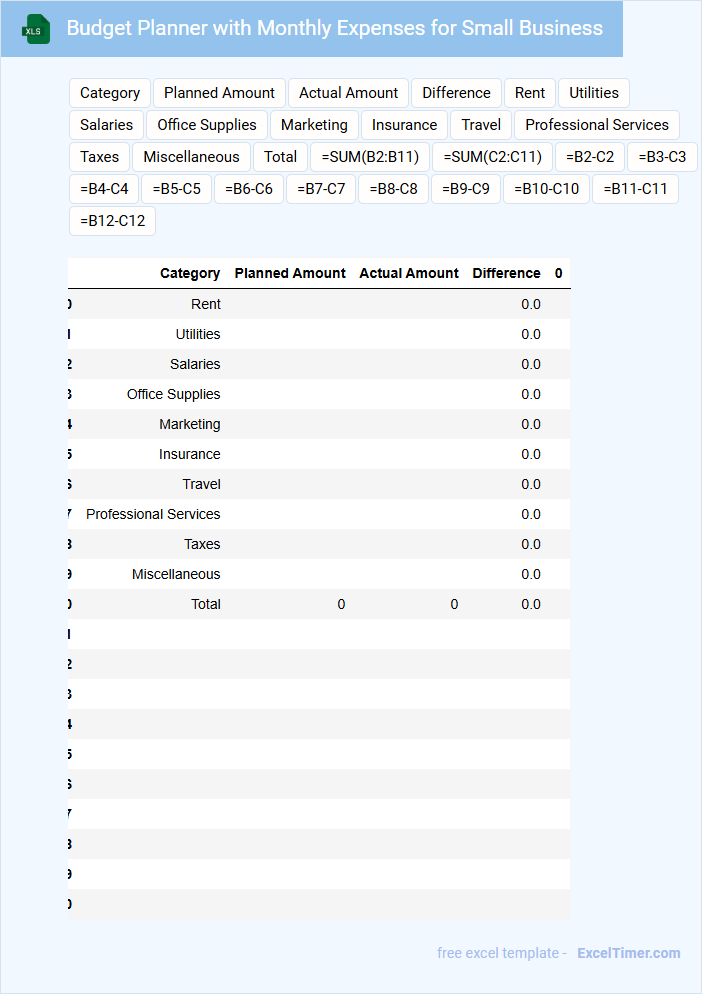

Budget Planner with Monthly Expenses for Small Business

Budget Planner with Monthly Expenses for Small Business

What information does a Budget Planner with Monthly Expenses for a Small Business typically contain? This type of document usually includes detailed sections for tracking income, fixed and variable expenses, and monthly cash flow projections. It helps business owners monitor their financial health, make informed decisions, and plan for future growth effectively.

What are the important elements to consider when creating this document? Key aspects include accurate categorization of expenses, realistic estimation of revenues, and regular updates to reflect changing business conditions. Incorporating a contingency fund and analyzing trends over several months can also improve financial stability and planning accuracy.

Monthly Expense Tracker with Categories for Small Business

A Monthly Expense Tracker is a vital document used by small businesses to record and monitor all outgoing costs within a specified period. It typically contains categorized expenses such as rent, utilities, supplies, and salaries to help identify spending patterns. Maintaining this document assists in budgeting more accurately and controlling business finances effectively.

Important elements to include are clear category labels, dates of transactions, amounts spent, and notes for unusual expenses. Ensuring accuracy and regular updates will provide a reliable overview of financial health. Additionally, integrating visual charts or summaries can enhance understanding and decision-making.

Small Business Expense Report with Receipts Tracker

A Small Business Expense Report is a document that records all financial expenditures made by a business within a specific period. It typically includes detailed expense categories, dates, amounts, and supporting receipts to ensure accurate bookkeeping. For effective tracking, it is important to organize receipts chronologically and reconcile them regularly with bank statements.

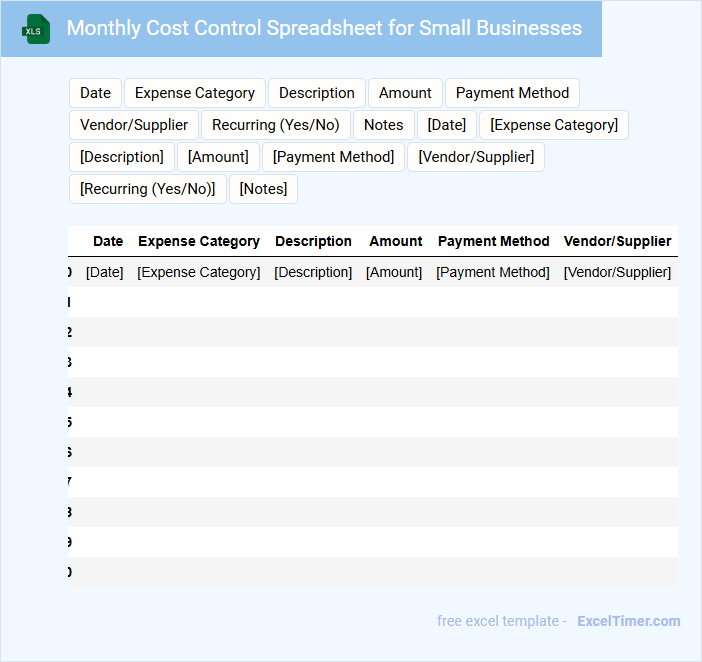

Monthly Cost Control Spreadsheet for Small Businesses

A Monthly Cost Control Spreadsheet is a crucial tool for small businesses to track and manage their expenses efficiently. It typically contains detailed entries of various cost categories such as rent, utilities, payroll, and miscellaneous expenses. This document helps in maintaining budget discipline and identifying areas to reduce costs.

For optimal use, ensure that all expense data is updated regularly and categorized accurately. Incorporate formulas to automatically calculate totals and variances from budgeted amounts. Additionally, include a summary section to visualize monthly spending trends and support informed financial decisions.

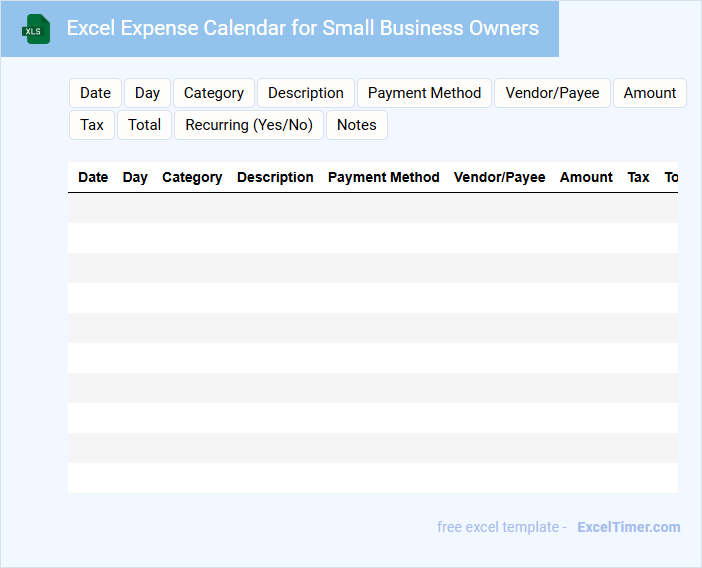

Excel Expense Calendar for Small Business Owners

An Excel Expense Calendar for Small Business Owners typically contains detailed records of daily expenditures along with scheduled payments and due dates. It helps in tracking cash flow and managing budgets effectively.

Key features often include categories for various expense types, date-wise organization, and summary sections to monitor overall spending. Ensuring accuracy and updating the calendar regularly are important for financial clarity.

What categories are essential for tracking monthly expenses in a small business Excel document?

Essential categories for tracking monthly expenses in a small business Excel document include Rent or Lease, Utilities (Electricity, Water, Internet), Salaries and Wages, Office Supplies, Marketing and Advertising, Insurance, and Professional Services. Accurate categorization helps monitor cash flow, optimize budget allocation, and identify cost-saving opportunities. Including Loan Payments and Tax Obligations ensures comprehensive expense management aligned with financial reporting requirements.

How can automated formulas in Excel help calculate total monthly expenditures?

Automated formulas in Excel streamline the calculation of total monthly expenditures by instantly summing various expense categories, such as rent, utilities, and supplies. These formulas reduce manual errors and save time by updating totals automatically when new data is entered. Small business owners can leverage functions like SUM and SUMIF to efficiently monitor and analyze their monthly financial outflows.

What methods can be used to visualize expense trends over multiple months?

To visualize expense trends over multiple months, you can use line charts, bar graphs, or stacked area charts in your Excel document. These methods highlight changes and patterns in spending, making it easier for you to analyze financial performance. Pivot tables combined with sparklines also offer dynamic, detailed insights into monthly expense fluctuations.

How should recurring and one-time expenses be differentiated in an Excel sheet?

In your Excel sheet for Monthly Expenses for Small Businesses, differentiate recurring expenses by listing them in a dedicated column with a fixed frequency, such as monthly or quarterly, to enable consistent tracking. One-time expenses should be recorded separately with the specific date and categorized to avoid skewing budget forecasts. Utilizing distinct color coding or Excel tables can visually separate these expense types for clearer financial analysis.

What best practices ensure accuracy and consistency in monthly expense tracking for small businesses?

Accurate and consistent monthly expense tracking for small businesses relies on categorizing expenses clearly, using standardized templates like Excel spreadsheets, and regularly reconciling entries with bank statements. You should implement automated formulas to minimize manual errors and maintain detailed receipts as supporting documentation. Regular reviews and updates to your expense tracking system ensure reliable financial data for informed decision-making.