The Monthly Client Billing Excel Template for Accountants streamlines invoicing by organizing client details, billing hours, and payment tracking in one place. Its customizable format ensures accurate calculation of fees and timely generation of professional invoices. This template enhances financial management and client communication, saving time and reducing errors.

Monthly Client Billing Tracker for Accountants

A Monthly Client Billing Tracker for Accountants is a document used to monitor and manage the billing details and payment status of clients each month. It helps ensure accuracy in invoicing and timely collections.

- Include client names, billed amounts, and payment due dates for clear tracking.

- Regularly update payment statuses to maintain an accurate financial overview.

- Use this tracker to identify overdue accounts and improve cash flow management.

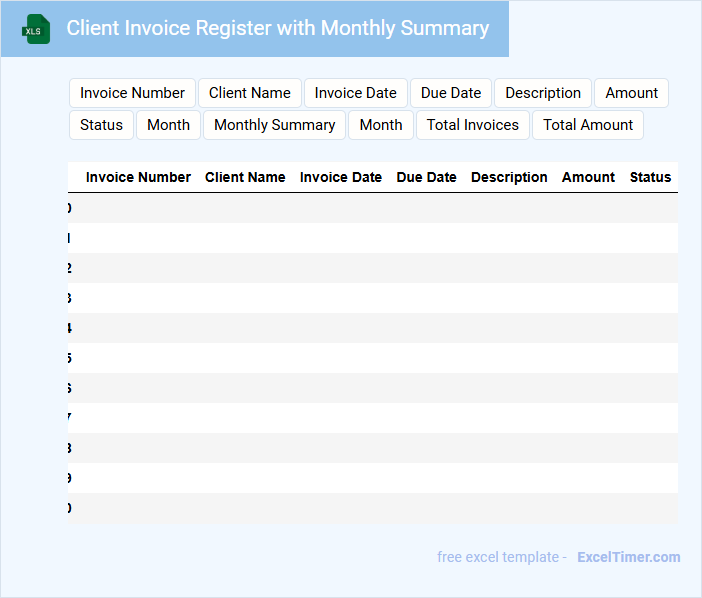

Client Invoice Register with Monthly Summary

A Client Invoice Register with Monthly Summary is a document used to record and track invoices issued to clients over a specific period, typically a month. It provides an organized overview of billing activities and outstanding payments.

- Ensure all invoice details such as dates, amounts, and client names are accurately recorded.

- Include a monthly summary that highlights total invoiced amounts and payments received.

- Regularly update the register to maintain accurate financial records and improve cash flow management.

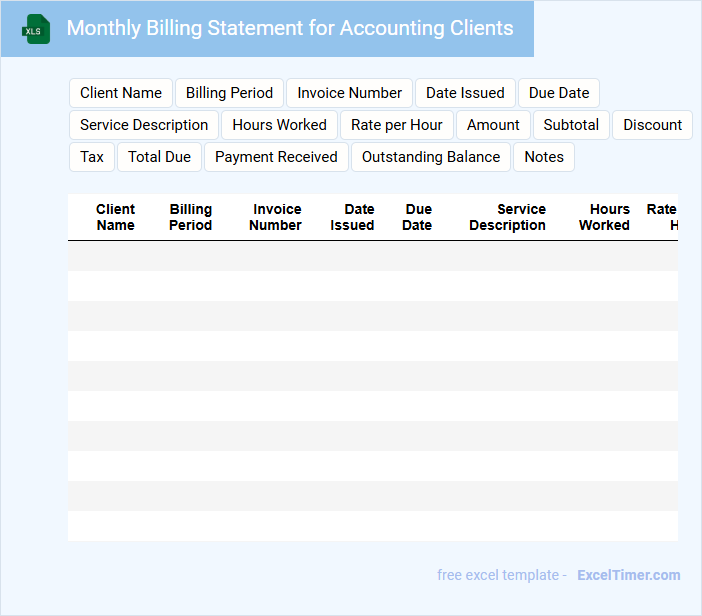

Monthly Billing Statement for Accounting Clients

A Monthly Billing Statement for accounting clients typically contains detailed records of all transactions and services provided within the billing period. It includes itemized charges, payment history, and any outstanding balances to ensure transparency and accuracy. Important elements to include are client information, billing dates, and clear descriptions of each billed service.

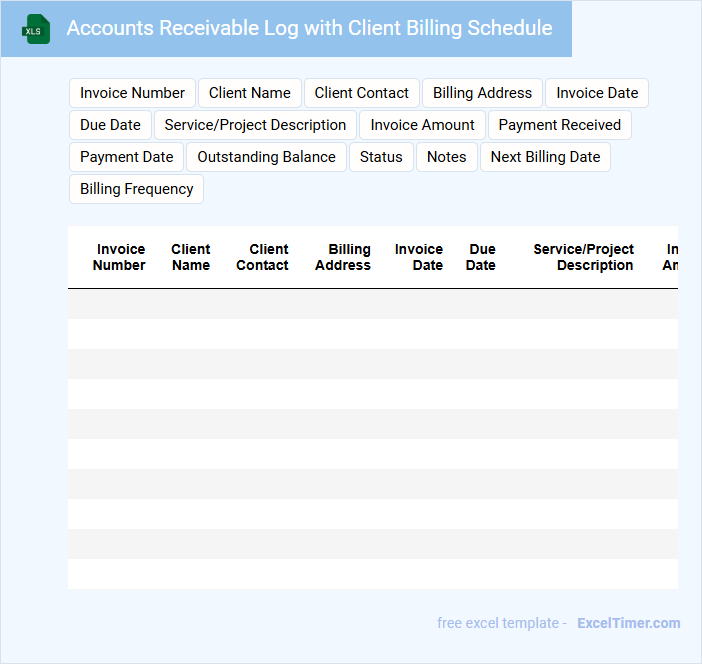

Accounts Receivable Log with Client Billing Schedule

An Accounts Receivable Log with a Client Billing Schedule is a critical financial document that tracks outstanding payments from clients alongside scheduled billing dates. It typically contains client names, invoice numbers, amounts due, payment due dates, and notes on payment status. Maintaining accuracy in this document helps businesses effectively manage cash flow and ensure timely collections.

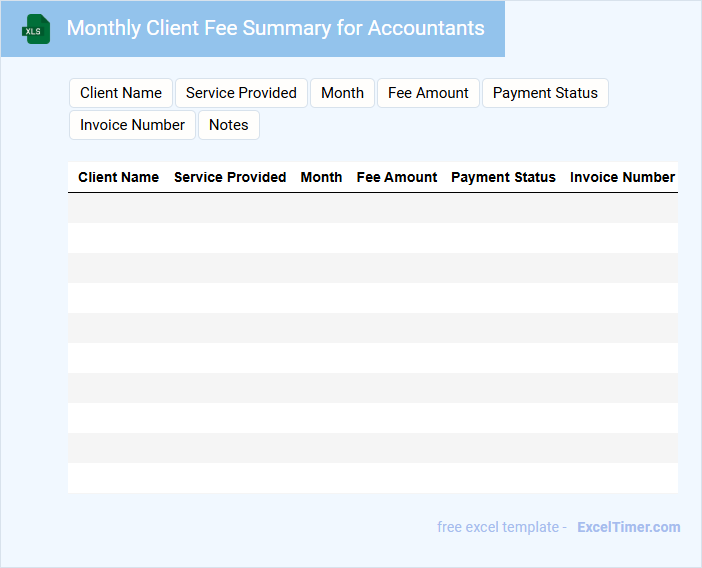

Monthly Client Fee Summary for Accountants

The Monthly Client Fee Summary is a document that outlines the fees charged to clients over the course of a month. It provides a clear breakdown of services rendered and associated costs.

Accountants use this summary to track revenue and ensure accurate billing. It is important to include detailed descriptions and timely updates to maintain transparency.

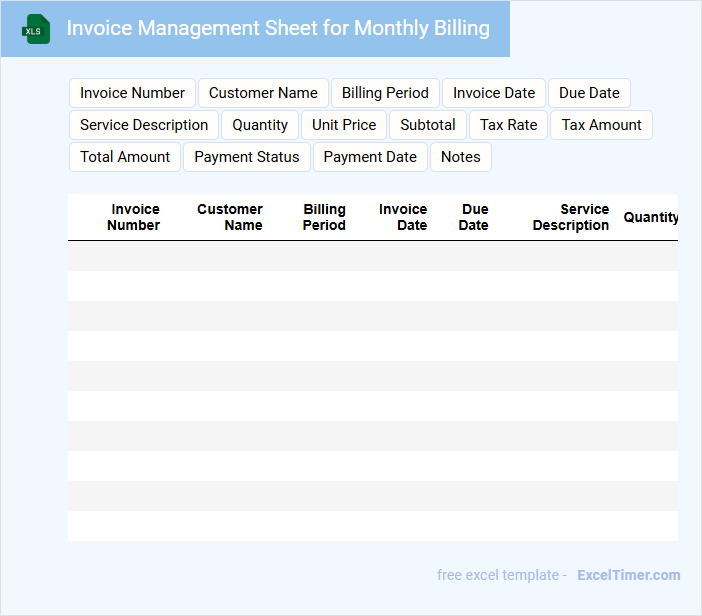

Invoice Management Sheet for Monthly Billing

An Invoice Management Sheet for Monthly Billing is a document that organizes and tracks all invoices generated over a billing cycle to ensure accurate financial records. It typically consolidates client details, billing amounts, and payment statuses in a clear, accessible format.

- Include invoice numbers, client names, and billing dates to maintain clarity.

- Track payment statuses such as pending, paid, or overdue for follow-up.

- Summarize total amounts billed and received to monitor cash flow.

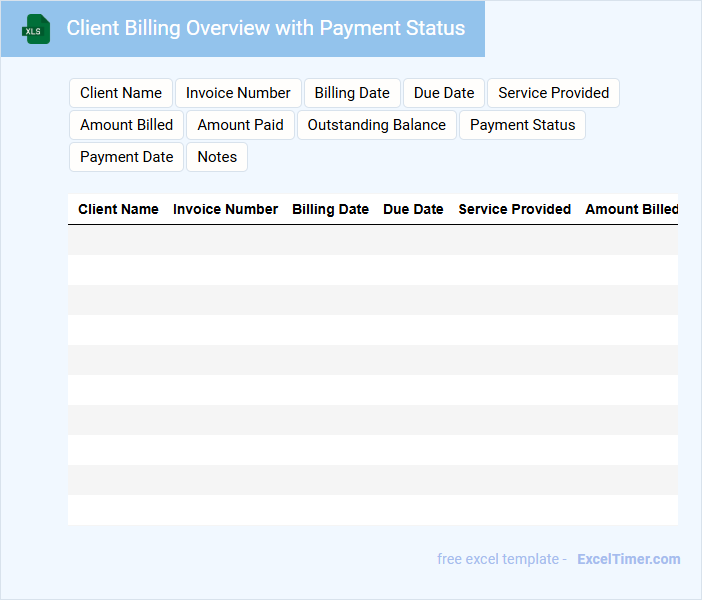

Client Billing Overview with Payment Status

This document typically contains a summary of client billing details along with their current payment status to ensure clear financial tracking and accountability.

- Invoice Summary: A detailed list of all billed items or services for the client.

- Payment Status: Current standing of payments such as paid, pending, or overdue.

- Outstanding Amounts: Total balance due including any late fees or adjustments.

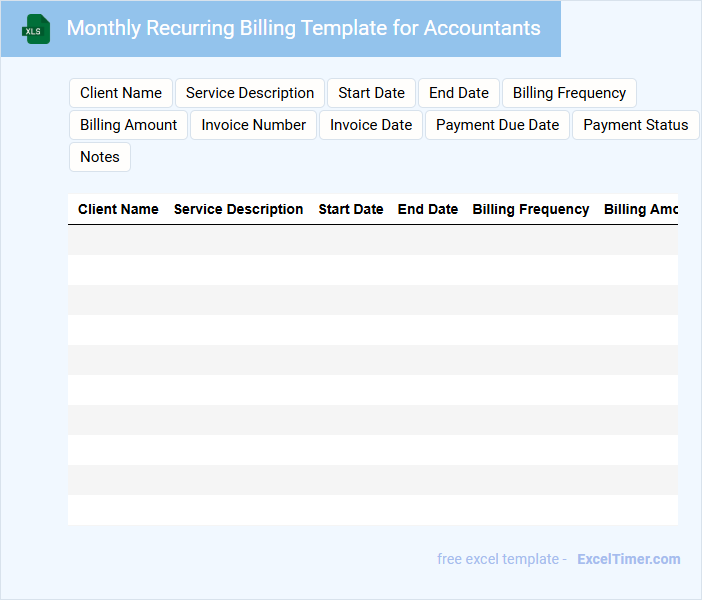

Monthly Recurring Billing Template for Accountants

This Monthly Recurring Billing Template is designed to streamline the invoicing process for accountants by detailing consistent charges and payment schedules. It helps maintain accuracy and clarity in recurring financial transactions. Utilizing this template ensures that all monthly fees are systematically tracked and recorded.

Accountants should focus on customizing the template to reflect client-specific billing cycles and services provided. Including precise descriptions and due dates enhances communication and reduces billing disputes. Regularly updating the template keeps the financial records aligned with any changes in service agreements.

Billing and Collection Tracker for Monthly Clients

A Billing and Collection Tracker for monthly clients is a document designed to monitor and record invoicing and payments over a set period. It helps businesses keep track of outstanding payments and ensures timely collection. This document usually contains client details, billing dates, amounts due, and payment status. Important aspects to include are accurate client information, clear due dates, and a system to flag overdue accounts.

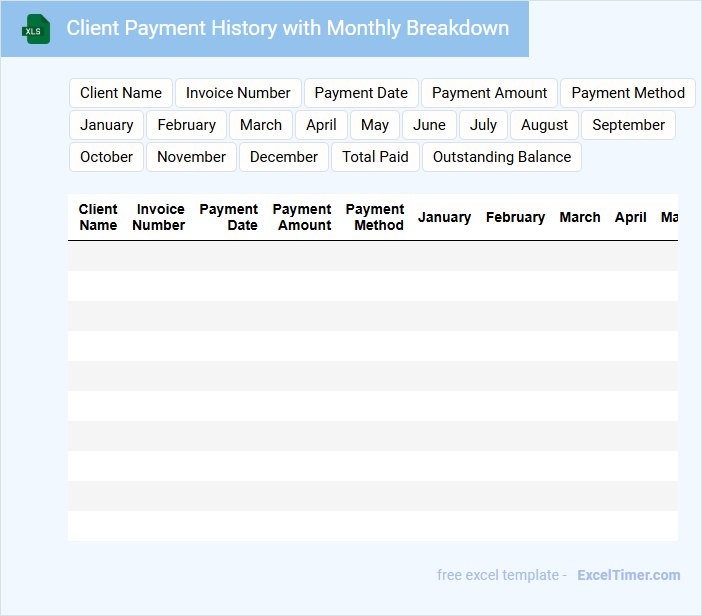

Client Payment History with Monthly Breakdown

Client Payment History with Monthly Breakdown is a document that details the payments made by a client over a specific period, organized by month. It helps track financial transactions and outstanding balances for better financial management.

- Include accurate payment dates and amounts for each month.

- Highlight any missed or late payments clearly.

- Summarize the total payments and outstanding balance at the end.

Monthly Invoice Schedule for Accounting Services

A Monthly Invoice Schedule for accounting services outlines the regular billing dates and payment deadlines throughout the year. It helps maintain clear financial expectations between the client and the service provider.

This document typically includes detailed invoice amounts, services rendered, and due dates. Ensuring timely payments and accurate record-keeping is crucial for smooth accounting operations.

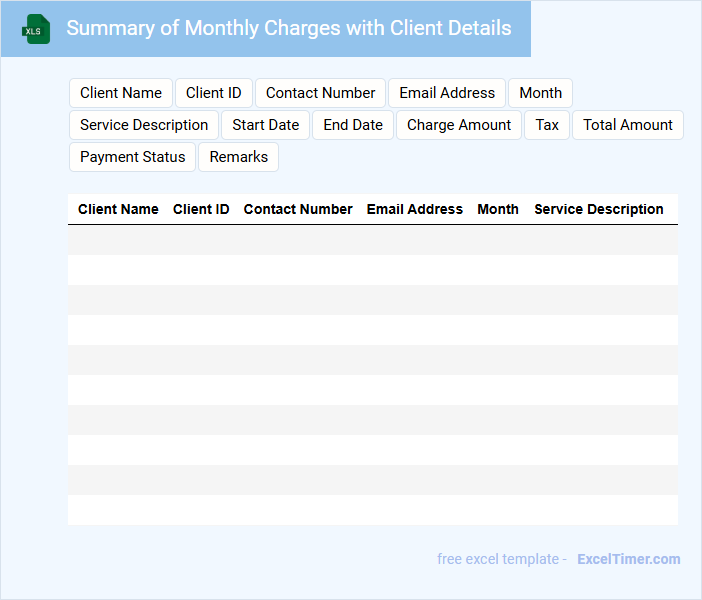

Summary of Monthly Charges with Client Details

The Summary of Monthly Charges document typically contains detailed billing information for a specific client, including individual service costs and total amounts due. It provides a clear overview of charges incurred within the billing period, helping clients understand their expenses. Important elements include the client's name, account number, billing period, itemized charges, and payment due date.

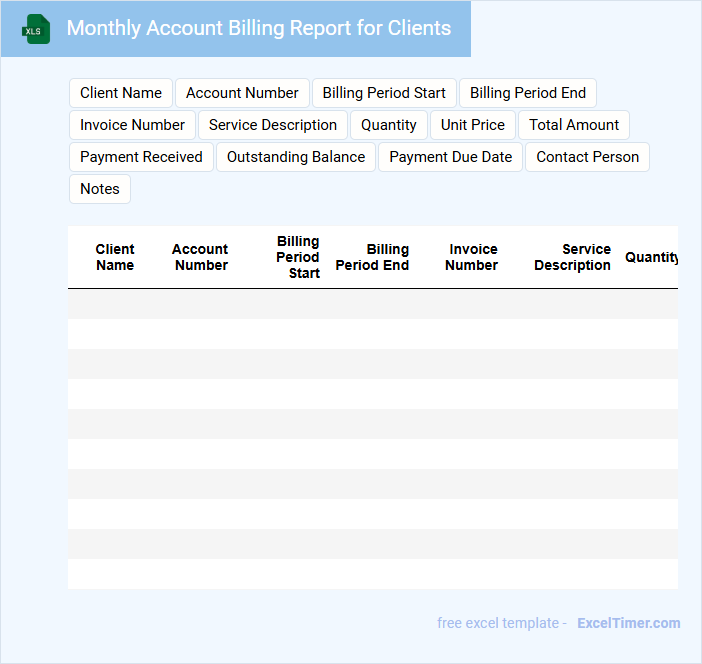

Monthly Account Billing Report for Clients

A Monthly Account Billing Report for Clients is a detailed document outlining the financial transactions and charges incurred during the billing cycle. It provides transparency and clarity on account activities to help clients manage their expenses effectively.

- Include a clear summary of all billed items and corresponding amounts.

- Highlight any discrepancies or unusual charges for client awareness.

- Provide contact information for billing inquiries and support.

Client Ledger with Monthly Billing Updates

The Client Ledger typically contains a detailed record of all financial transactions between a client and a business, including invoices, payments, and adjustments. It provides a chronological account of each entry to maintain transparency and accuracy in billing.

Monthly billing updates highlight recent charges and payments, ensuring clients are aware of their current account status. Keeping this document updated regularly is crucial for accurate financial tracking and dispute resolution.

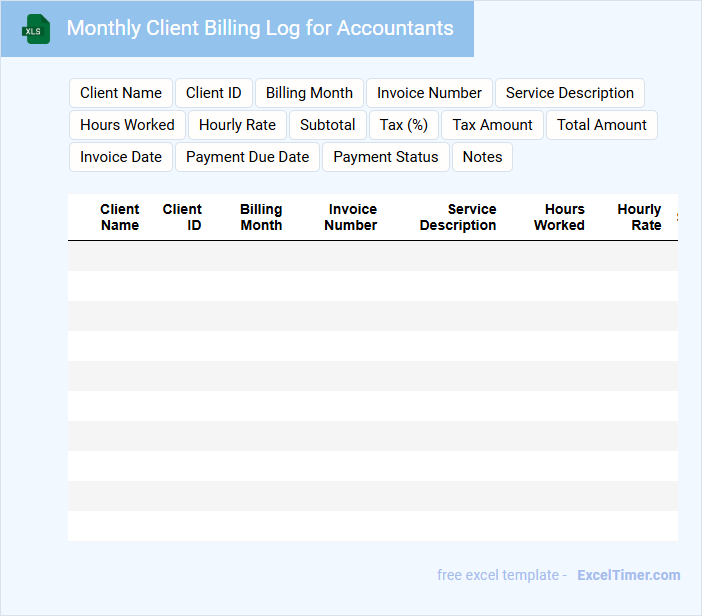

Monthly Client Billing Log for Accountants

A Monthly Client Billing Log for Accountants typically contains detailed records of client invoices, payment statuses, and billing dates.

- Invoice Tracking: Keep accurate records of all invoices issued to ensure timely payments and avoid discrepancies.

- Payment Status: Monitor payment receipts and outstanding balances to maintain clear cash flow management.

- Billing Dates: Record billing cycle dates to ensure all client billings are logged within the correct accounting period.

What key data fields should be included in a monthly client billing Excel document for accuracy and clarity?

A monthly client billing Excel document should include key data fields such as Client Name, Invoice Number, Billing Date, Service Description, Hours Worked, Rate per Hour, Total Amount, Payment Status, and Due Date. Including Tax Amount and Discounts can enhance accuracy for financial calculations. Clear categorization of these fields ensures precise tracking and streamlined invoicing for accountants.

How can formulas be used to automate the calculation of totals, taxes, and outstanding balances in client invoices?

Formulas in Excel automate monthly client billing by calculating totals through SUM functions that aggregate service fees and expenses. Tax amounts are computed using percentage formulas applied to subtotals, ensuring accurate and consistent tax calculations. Outstanding balances update dynamically with subtraction formulas deducting payments made from total invoices, streamlining invoice management for accountants.

What methods can ensure that billing periods and payment due dates are clearly tracked and updated in the spreadsheet?

Using Excel formulas such as EOMONTH to automatically calculate billing periods and conditional formatting to highlight upcoming payment due dates ensures clear tracking. Implementing data validation rules helps maintain consistent date entries, reducing errors. You can also set up reminders with Excel's built-in alerts or integrate with calendar tools for timely updates.

How can Excel's data validation tools minimize errors when entering client and invoice details?

Excel's data validation tools can minimize errors in your Monthly Client Billing by restricting input to predefined formats, such as dates, invoice numbers, or client IDs. Drop-down lists ensure consistent client names, reducing typos and mismatches in billing records. This accuracy helps maintain reliable invoices and streamlines your accounting process.

What best practices should be followed to securely store and manage sensitive client billing information in Excel?

Securely store sensitive client billing information in Excel by using strong password protection and enabling file encryption to prevent unauthorized access. Regularly back up your Excel files to a secure location and limit access to only trusted users within your accounting team. You should also implement data validation and use hidden sheets to manage sensitive details, ensuring compliance with privacy standards.