The Monthly Savings Excel Template for Couples helps partners track and manage their joint finances effectively by organizing monthly income, expenses, and savings goals in one place. It provides clear visualization through charts and automatic calculations, making it easier to monitor progress and adjust budgets as needed. Using this template promotes financial transparency and cooperation, strengthening money management between couples.

Monthly Savings Tracker for Couples

A Monthly Savings Tracker for couples is a financial document designed to monitor and manage joint savings effectively. It usually contains details like income, expenses, savings goals, and progress updates for each month. Tracking these elements helps couples stay aligned on their financial objectives and encourages accountability.

Important things to include are clear savings targets, categories for different types of expenses, and a review section to discuss progress together. Using visual aids like charts or graphs can enhance understanding and motivation. Consistent updating ensures that both partners remain engaged in achieving their financial goals.

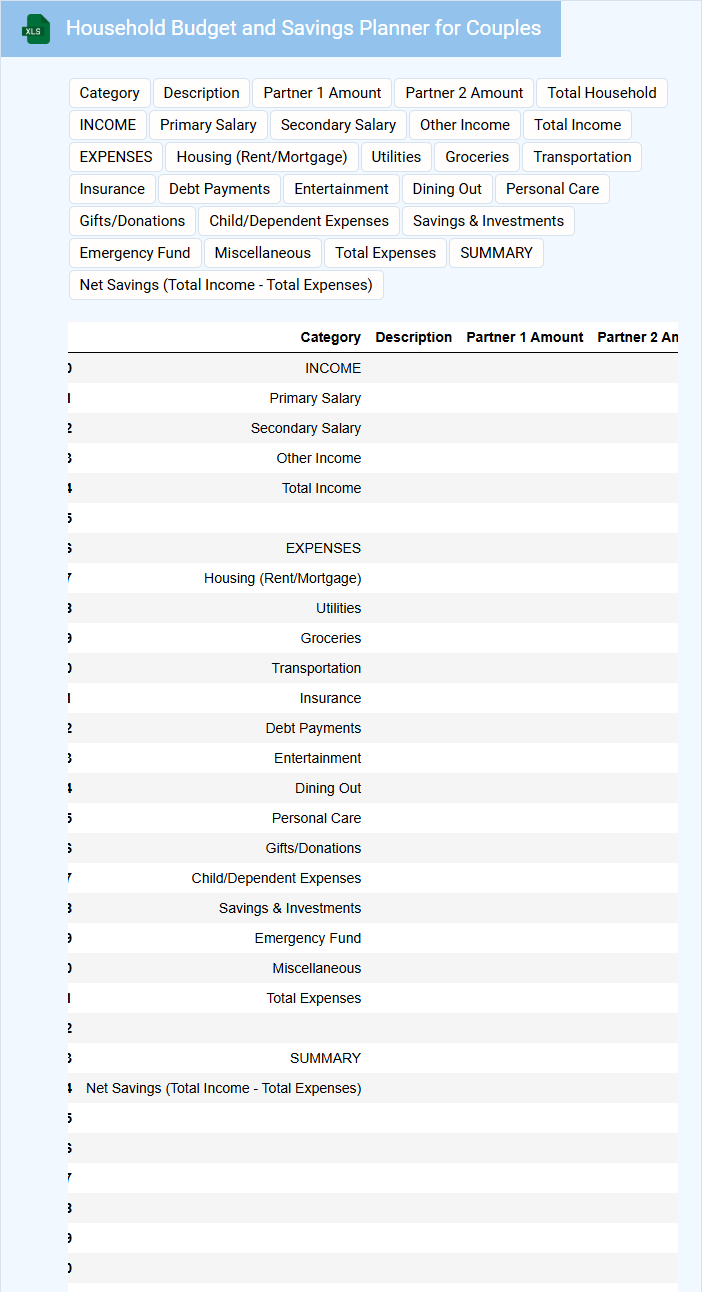

Household Budget and Savings Planner for Couples

What information is typically included in a Household Budget and Savings Planner for Couples? This type of document usually contains detailed records of income sources, monthly expenses, and savings goals to help couples manage their finances effectively. It also includes sections for tracking debt repayments and emergency funds, ensuring a comprehensive financial overview.

What are important considerations when using a Household Budget and Savings Planner for Couples? It is crucial to maintain open communication between partners to agree on budget limits and savings priorities. Regularly updating the planner and reviewing financial progress together can enhance accountability and foster shared financial goals.

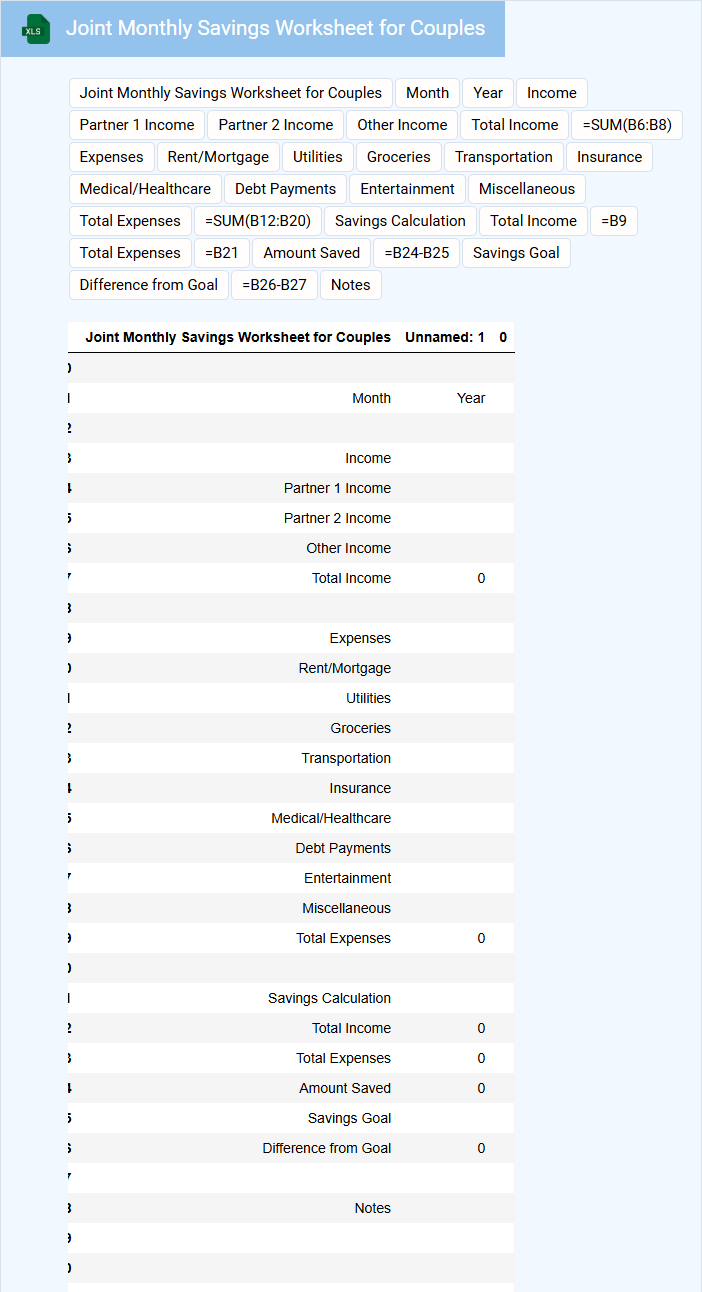

Joint Monthly Savings Worksheet for Couples

What is typically included in a Joint Monthly Savings Worksheet for Couples? This document usually contains detailed sections for tracking income, monthly expenses, and shared savings goals to help couples manage their finances collaboratively. It describes the allocation of funds toward joint priorities and highlights spending patterns to optimize saving strategies effectively.

What important elements should couples consider when using this worksheet? Couples should ensure clear categorization of fixed and variable expenses and set realistic savings targets aligned with their financial goals. Regularly updating the worksheet and openly communicating about changes in income or expenses is crucial for maintaining transparency and achieving shared financial success.

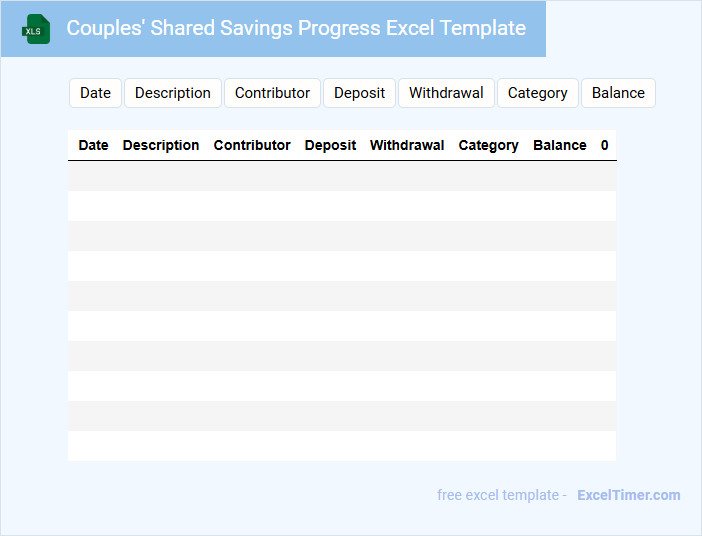

Couples' Shared Savings Progress Excel Template

What information is typically included in a Couples' Shared Savings Progress Excel Template? This document usually contains detailed records of both partners' contributions, savings goals, and progress tracking over time. It helps couples collaboratively manage their finances by visualizing their joint savings and motivating them to reach their financial objectives together.

Why is it important to regularly update and review this template? Consistently entering accurate data ensures that couples have a clear understanding of their financial status and can make informed decisions. Regular reviews promote transparency, accountability, and strengthen financial communication within the relationship.

Monthly Expense and Savings Log for Couples

What information is typically included in a Monthly Expense and Savings Log for Couples? This document usually contains detailed records of joint and individual expenses, income sources, and savings goals for each month. It helps couples track their financial habits, identify spending patterns, and plan for future financial stability effectively.

Why is it important to maintain this log consistently? Regular updates ensure accurate budgeting and prevent misunderstandings about shared finances. It is recommended to include categories for fixed and variable expenses, set realistic savings targets, and review the log together monthly to foster transparency and financial teamwork.

Savings Goals Planner for Couples

A Savings Goals Planner for Couples is a financial tool designed to help partners collaboratively set and track their money-saving objectives. It typically includes sections for defining goals, timelines, and monthly contribution amounts.

This document promotes transparency and accountability between partners, fostering better communication about shared financial priorities. Tracking progress regularly is an important practice to ensure goals are met efficiently.

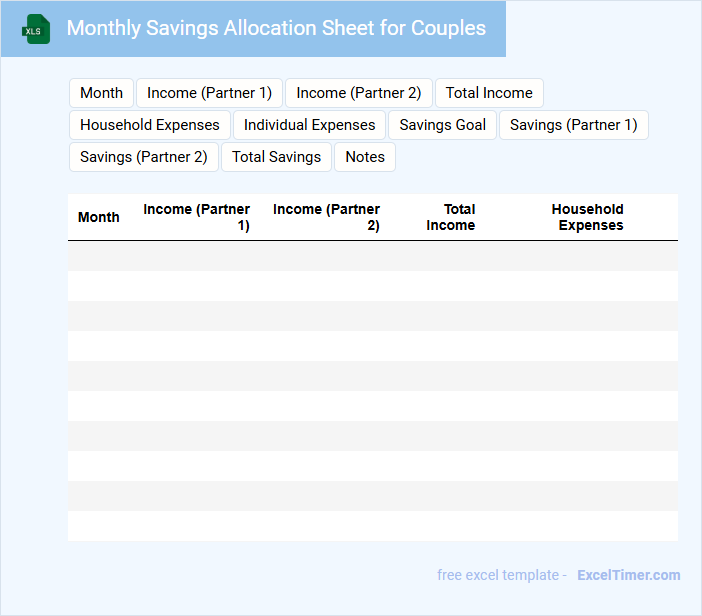

Monthly Savings Allocation Sheet for Couples

The Monthly Savings Allocation Sheet for Couples is a financial tool designed to help partners track and distribute their savings effectively each month. It usually contains detailed breakdowns of income sources, individual and joint expenses, and designated savings targets. Utilizing such a document encourages transparency and collaborative financial planning between couples.

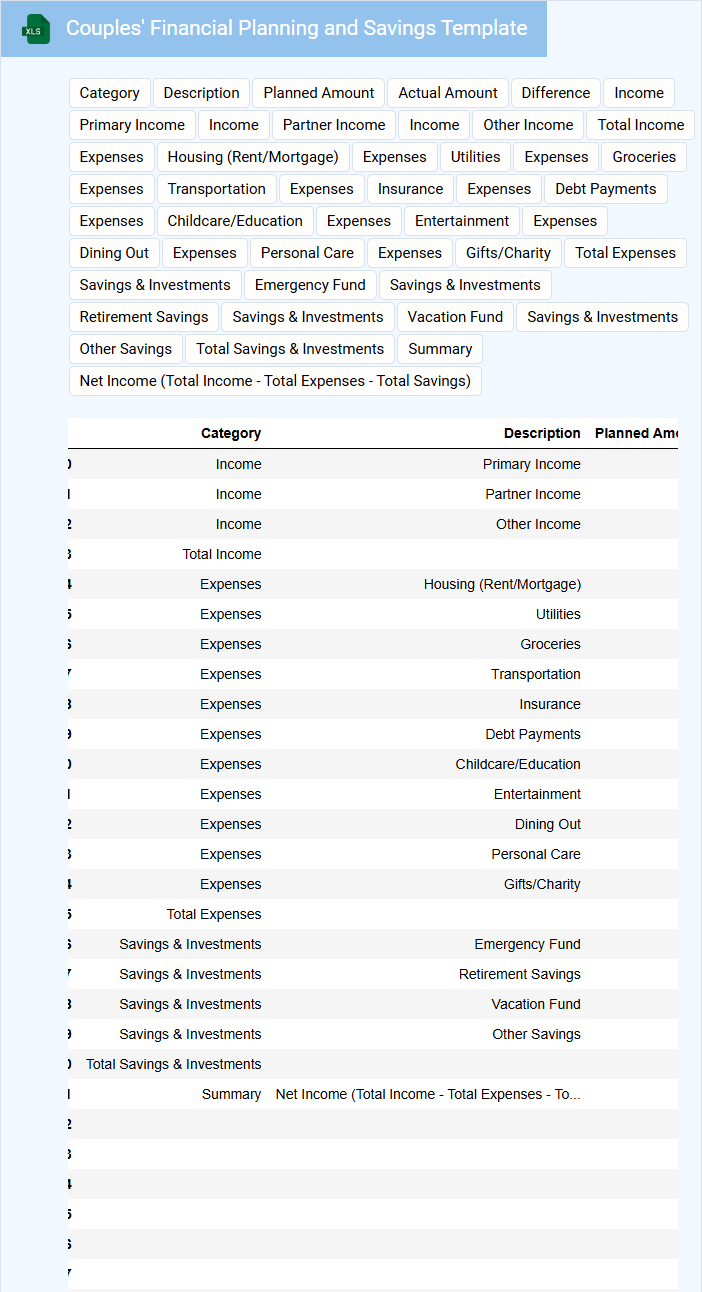

Couples' Financial Planning and Savings Template

What information is typically included in a Couples' Financial Planning and Savings Template? This type of document usually contains sections for income details, expense tracking, debt management, and savings goals. It helps couples organize their finances collaboratively and plan effectively for future financial security.

What important elements should couples focus on when using this template? They should prioritize clear communication about financial responsibilities, establish joint savings targets, and regularly update the template to reflect changes in income or expenses for better financial alignment.

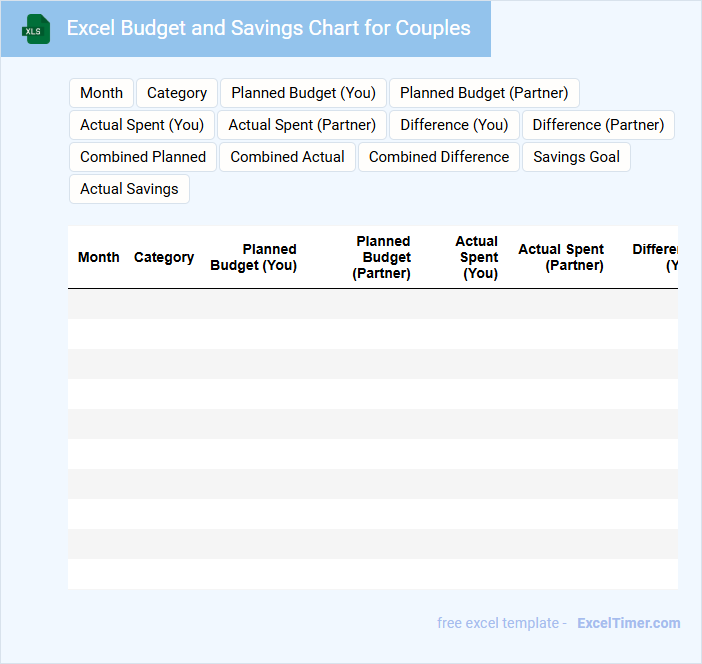

Excel Budget and Savings Chart for Couples

An Excel Budget and Savings Chart for Couples typically contains detailed entries of income, expenses, and savings goals to help partners manage their finances collaboratively. It often includes categories for monthly bills, discretionary spending, and planned savings, allowing users to track and adjust their budget efficiently. Using this chart encourages transparency and joint financial decision-making, which is crucial for maintaining a healthy financial relationship.

Tracking Monthly Savings for Couples

This document typically contains detailed records of each partner's savings contributions every month, enabling a clear overview of financial progress. It helps couples maintain transparency and align their financial goals effectively.

- Include an overview of individual and combined savings to track overall progress.

- Set monthly savings targets and monitor any deviations promptly.

- Record expenses and income sources to identify opportunities for increased savings.

Couples’ Monthly Income and Savings Tracker

What is typically included in a Couples' Monthly Income and Savings Tracker? This document usually contains detailed records of all income sources and monthly savings contributions for both partners. It helps couples monitor their financial progress and plan budgets effectively.

Why is it important to consistently update this tracker? Regular updates ensure accurate financial insights, allowing couples to identify spending patterns and adjust saving goals. This practice promotes financial transparency and strengthens joint financial planning.

Savings Plan Spreadsheet for Couples

A Savings Plan Spreadsheet for Couples is a financial tool designed to help partners track and manage their joint savings goals effectively. It typically contains sections for income, expenses, and monthly contributions, enabling clear visualization of progress. Such a document fosters transparency and cooperation in handling shared finances.

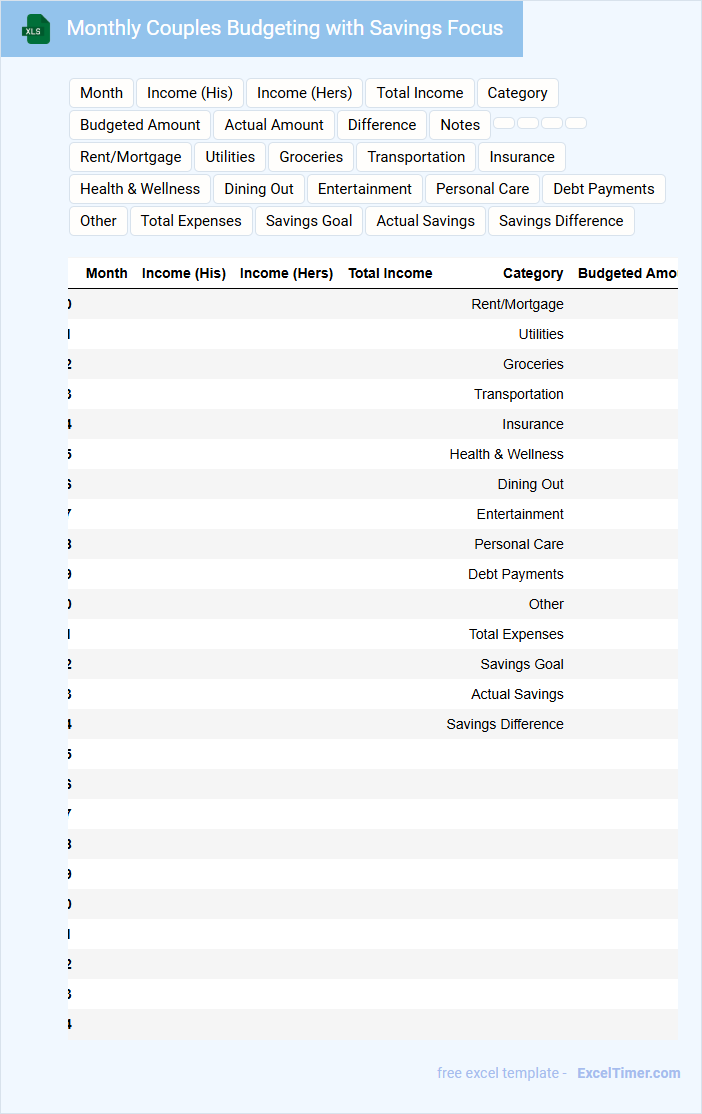

Monthly Couples Budgeting with Savings Focus

A Monthly Couples Budgeting document typically contains detailed income sources, categorized expenses, and a planned savings target to ensure financial harmony. It helps couples allocate funds responsibly while tracking spending habits and adjusting for unexpected costs. An important focus of this document is setting mutual savings goals to build a secure financial future together.

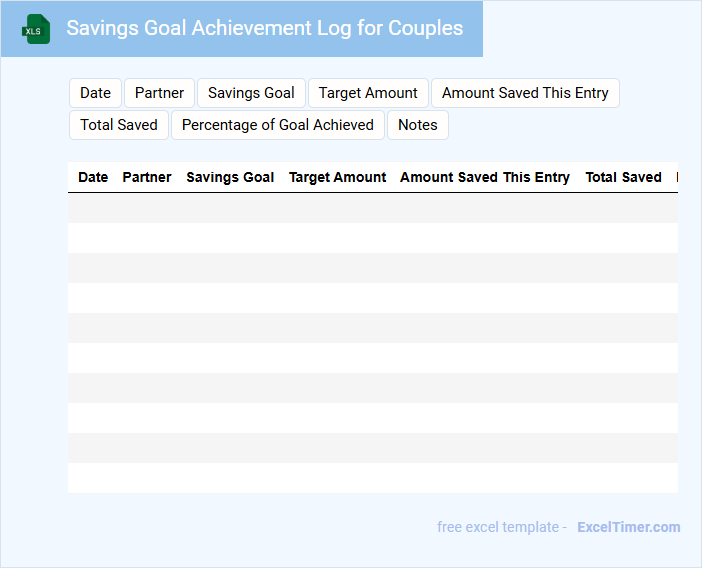

Savings Goal Achievement Log for Couples

A Savings Goal Achievement Log for couples typically contains detailed records of financial milestones and contributions made towards joint savings objectives. It helps partners track their progress over time and stay motivated to reach their target amounts.

Important components include dates, amounts saved, and notes on any changes to the goal or strategies used. Establishing clear communication and mutual accountability is essential for successfully managing shared financial goals.

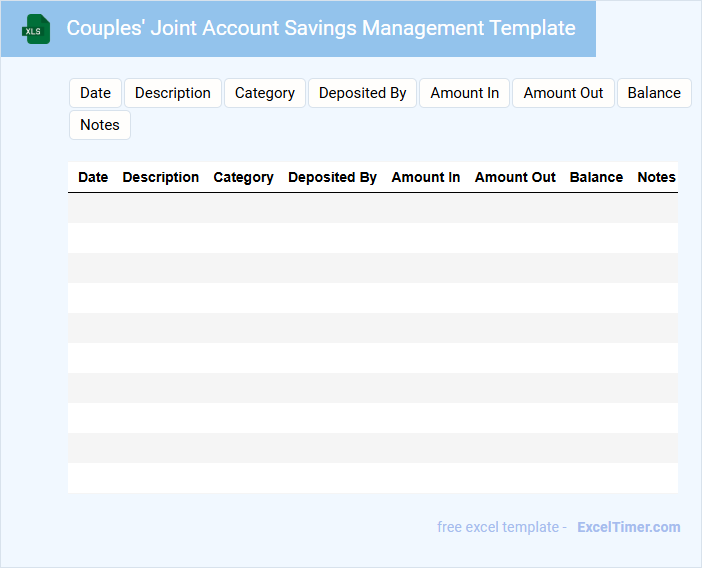

Couples' Joint Account Savings Management Template

Couples' Joint Account Savings Management Template typically contains detailed records of shared income, expenses, and savings goals. It is designed to help couples transparently manage their finances and achieve common financial objectives.

- Track monthly contributions and withdrawals to maintain balance awareness.

- Set specific savings targets to encourage disciplined financial planning.

- Review and adjust budget allocations periodically to accommodate changing needs.

What specific categories should couples include when tracking monthly savings in an Excel document?

Couples should include specific categories such as housing, utilities, groceries, transportation, entertainment, and emergency funds when tracking monthly savings in an Excel document. Your savings plan benefits from separating discretionary expenses like dining out and vacations. Including debt repayments and retirement contributions ensures a comprehensive financial overview.

How can couples automate savings calculations using formulas in Excel?

Couples can automate savings calculations in Excel by using formulas like SUM to total monthly incomes and expenses, and subtracting expenses from incomes to find net savings. The IF function can track whether savings goals are met each month, while the PMT formula helps calculate contributions needed for future targets. Employing Excel tables and named ranges further streamlines dynamic updates and accurate savings tracking.

How should couples set target savings goals and progress indicators in their monthly spreadsheet?

Couples should set target savings goals based on combined income, essential expenses, and future financial priorities such as emergency funds, vacations, or home purchases. Use clear progress indicators like percentage saved and remaining balance to track monthly achievements effectively. Your monthly spreadsheet can include separate categories for each goal, enabling accurate monitoring and adjustments over time.

What are effective ways for couples to visualize their savings trends in Excel charts?

Couples can effectively visualize their savings trends in Excel by using line charts to display monthly savings growth over time and stacked bar charts to compare contributions from each partner. Utilizing pivot tables helps summarize data dynamically, while adding trendlines highlights overall savings patterns and forecast future growth. Customizing chart elements with labels and colors ensures clarity and makes financial progress easy to interpret.

How can couples track individual versus joint contributions to monthly savings within one document?

Couples can create separate columns in an Excel document labeled "Individual Contributions" and "Joint Contributions" to accurately track monthly savings. Using formulas like SUMIFS, they can categorize and total each partner's deposits alongside shared amounts for clear comparison. This method ensures transparent financial tracking and aids in budgeting decisions by displaying precise contribution breakdowns.