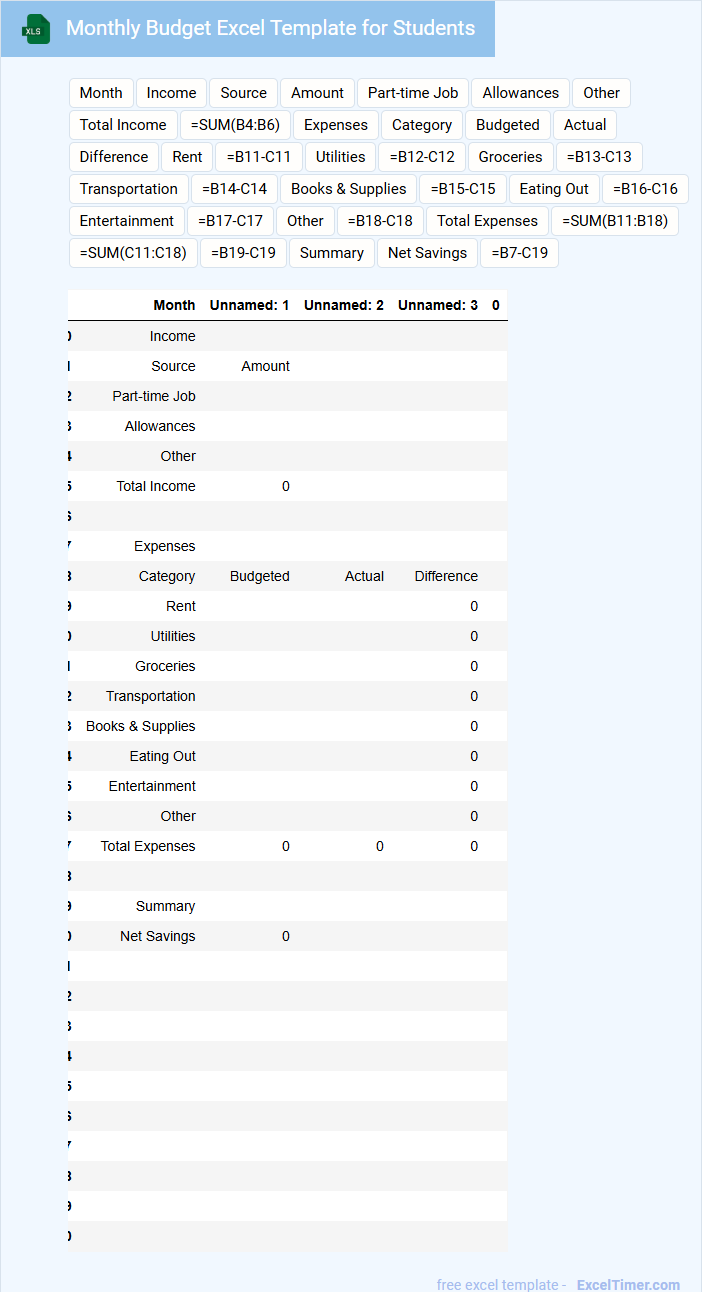

The Monthly Budget Excel Template for Students is a practical tool designed to help students track their income and expenses efficiently. It features customizable categories tailored to student life, such as tuition, books, and entertainment, ensuring accurate financial management. Using this template promotes budgeting discipline and helps students avoid overspending while saving money.

Monthly Budget Excel Template for Students

What does a Monthly Budget Excel Template for Students typically contain and why is it important? This document usually includes sections for tracking income sources, such as allowances or part-time jobs, and categorizes expenses like tuition, rent, groceries, and leisure activities. It is important because it helps students manage their finances efficiently, avoid overspending, and save money for future needs.

To make the most out of this template, students should regularly update their actual expenses versus planned budget and analyze the differences to adjust spending habits. Additionally, including a savings goal section can encourage financial discipline and long-term planning.

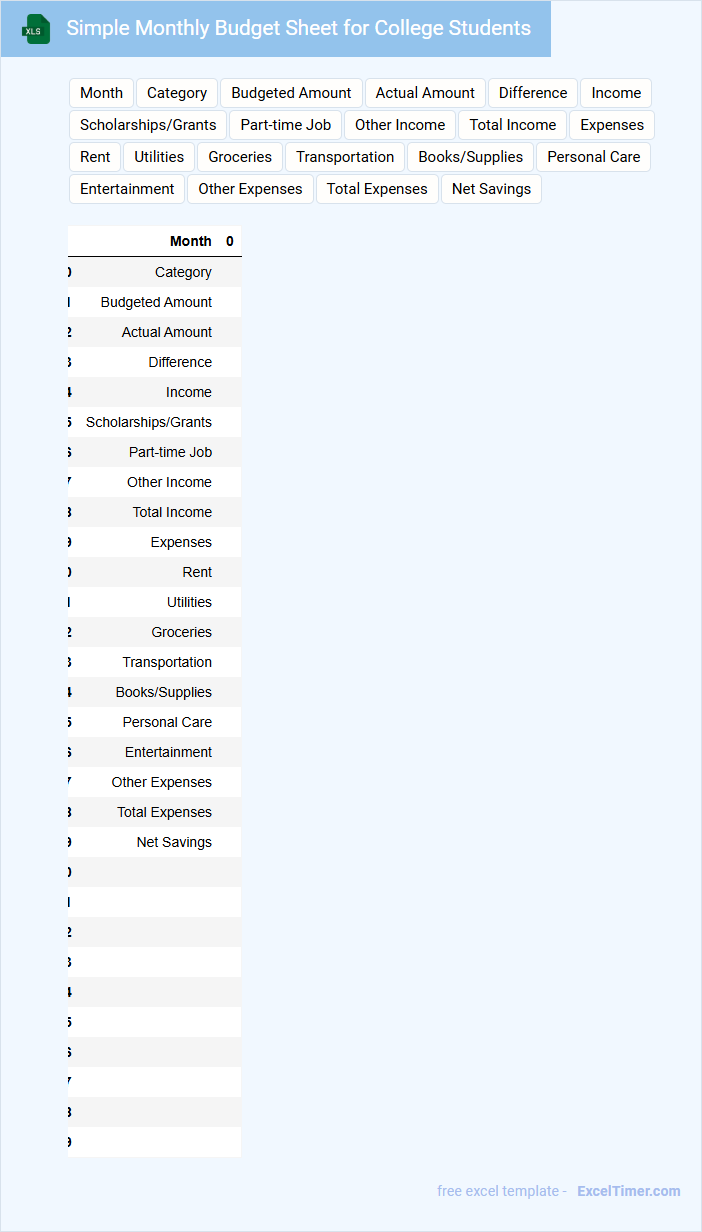

Simple Monthly Budget Sheet for College Students

What does a Simple Monthly Budget Sheet for College Students usually contain? It typically includes categories such as income sources, fixed and variable expenses, and savings goals. This document helps students track their spending, manage their finances effectively, and plan for future expenses.

What is an important suggestion for using this budget sheet? Regularly updating the sheet with actual expenses and comparing them to planned amounts ensures accurate financial awareness. Additionally, prioritizing essential costs like tuition and rent can help avoid overspending on non-essential items.

Monthly Expense Tracker with Categories for Students

A Monthly Expense Tracker for students is a document designed to monitor and categorize monthly spending. It typically includes sections for different expense categories such as food, transportation, and entertainment. This helps students manage their budget effectively and identify areas where they can save money.

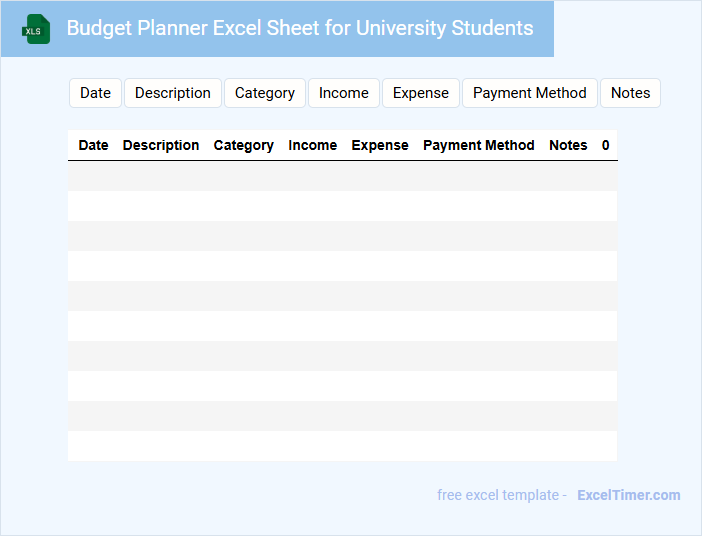

Budget Planner Excel Sheet for University Students

A Budget Planner Excel Sheet for university students typically contains categories such as tuition fees, accommodation, food expenses, and personal spending. It helps students organize and track their monthly income and expenditures efficiently. This document is essential for managing finances during academic years.

Important elements to include are clear expense categories, monthly income sources, and automatic calculations for savings and overspending alerts. Proper use of this planner fosters financial discipline and prevents unnecessary debt. Students should regularly update their entries to maintain accurate budgeting.

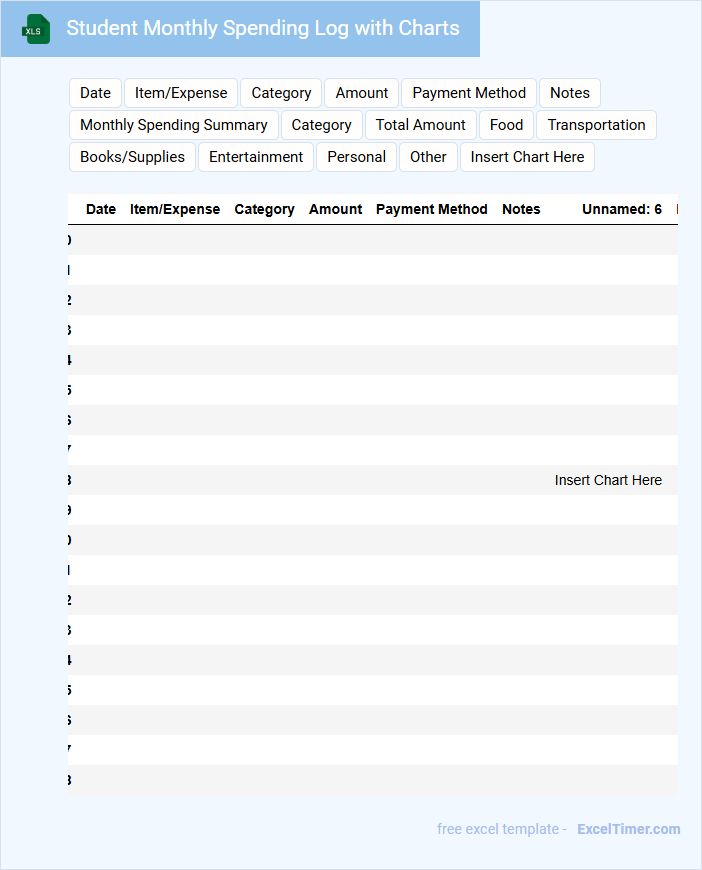

Student Monthly Spending Log with Charts

This Student Monthly Spending Log typically contains detailed records of daily expenses categorized by type, such as food, transportation, and entertainment. It helps students track their financial habits and manage their budget effectively over the month. Interactive charts visualize spending patterns, highlighting areas for potential savings and better money management.

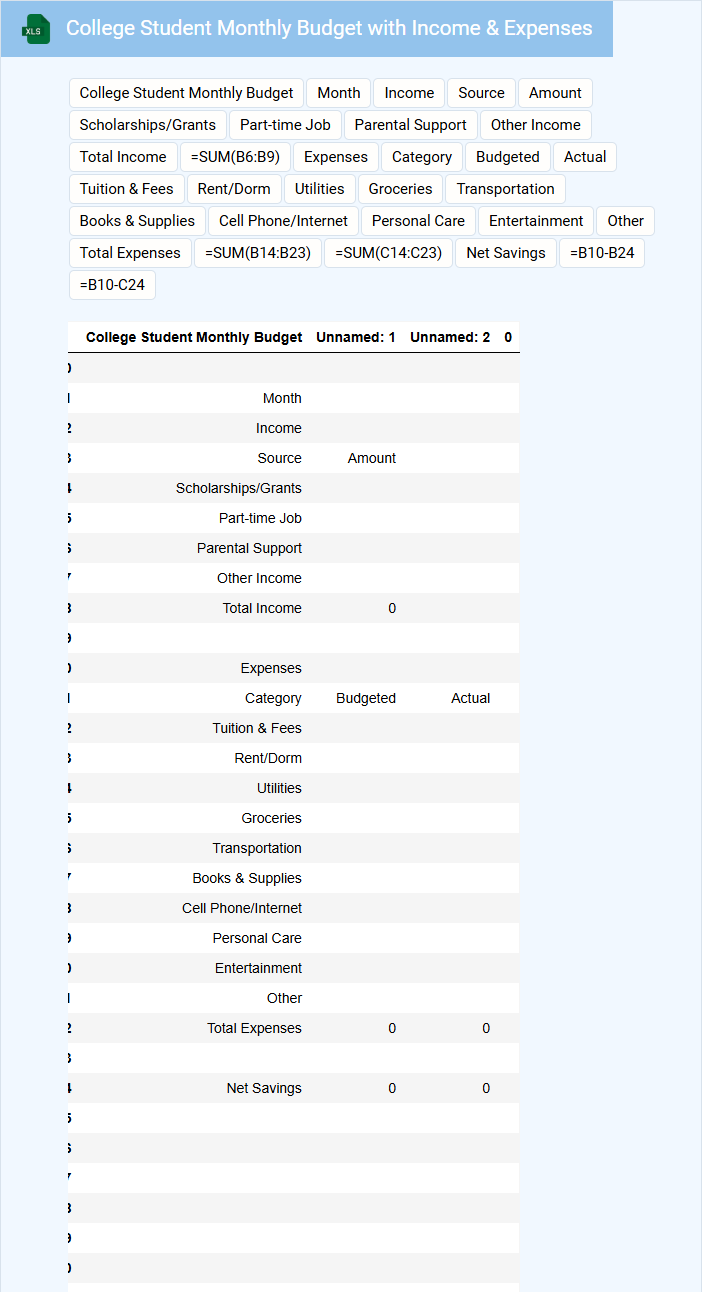

College Student Monthly Budget with Income & Expenses

A College Student Monthly Budget document typically contains detailed records of income sources and monthly expenses. It helps students manage their finances effectively by tracking tuition, rent, food, transportation, and entertainment costs. Including a clear summary of total income versus total expenses is essential to maintain financial balance. The document often highlights fixed and variable expenses to identify areas for potential savings and financial planning. Proper categorization of spending allows students to prioritize needs over wants and avoid unnecessary debt. Regularly updating and reviewing this budget ensures better control over monthly finances.

Personal Finance Tracker for Students in Excel

What information is typically included in a Personal Finance Tracker for Students in Excel? This type of document usually contains sections for tracking income, expenses, savings, and budgets to help students manage their finances effectively. It also often features categorized spending, visual charts, and summary tables to provide a clear overview of financial habits and goals.

What important elements should be considered when creating a Personal Finance Tracker for Students in Excel? Including automated calculations, easy-to-update categories, and goal-setting features can enhance usability and motivation. Additionally, ensuring data privacy and incorporating reminders for bill payments are crucial for maintaining accurate and secure financial records.

Monthly Savings Tracker for Students

What does a Monthly Savings Tracker for Students usually contain and why is it important? This document typically includes sections for tracking income, expenses, and savings goals each month, helping students monitor their financial habits. It allows students to identify spending patterns and make informed decisions to improve their money management skills.

For effective tracking, it's important to regularly update the tracker with accurate data and set realistic savings goals. Additionally, including categories for necessary versus discretionary spending can provide clearer insights into areas to cut back and boost savings.

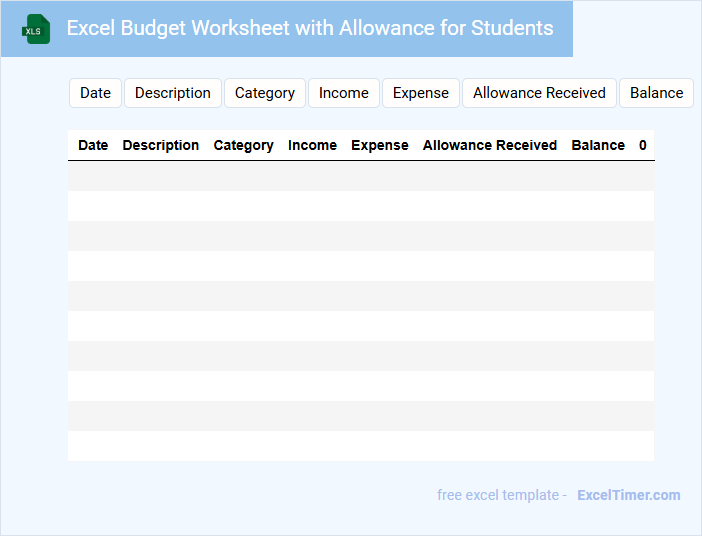

Excel Budget Worksheet with Allowance for Students

An Excel Budget Worksheet with Allowance for Students is a detailed financial document designed to track income and expenses specifically tailored for student needs. It typically contains categories for tuition, books, living expenses, and a monthly allowance, helping students manage their money effectively. Including clear sections for savings and unexpected costs ensures a thorough and practical budgeting tool.

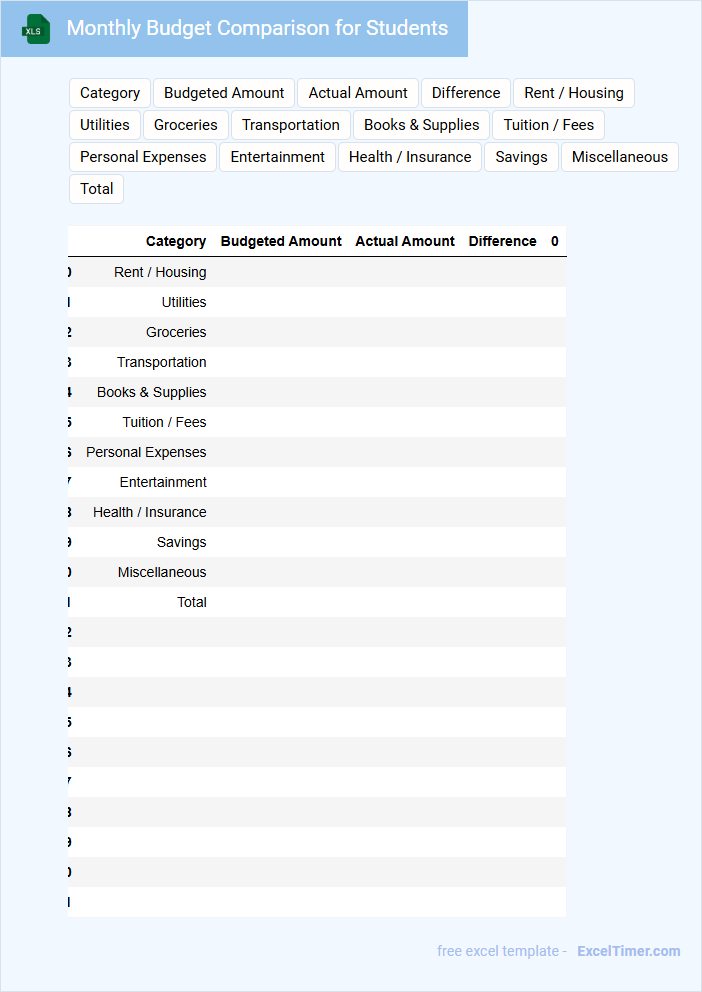

Monthly Budget Comparison for Students

A Monthly Budget Comparison for Students typically contains a detailed overview of income sources and expenses to help manage finances effectively.

- Income Tracking: Record all sources of income including allowances, part-time jobs, and scholarships.

- Expense Categorization: Break down expenses into categories such as rent, groceries, transportation, and entertainment.

- Comparison Analysis: Compare actual spending against planned budget to identify savings and overspending trends.

Student Budget Template with Debt Tracker

A Student Budget Template with Debt Tracker typically contains sections for tracking monthly income, essential expenses, and outstanding debts. It helps students manage their finances by organizing expenses and monitoring repayments systematically. Incorporating debt tracking ensures students stay aware of their liabilities while maintaining a balanced budget.

Important elements to include are clearly categorized income sources, fixed and variable expenses, and a dedicated debt tracker with payment schedules. Visual aids like charts or graphs can enhance understanding and motivation to adhere to the budget. Regularly updating the template encourages responsible financial habits and prevents overspending.

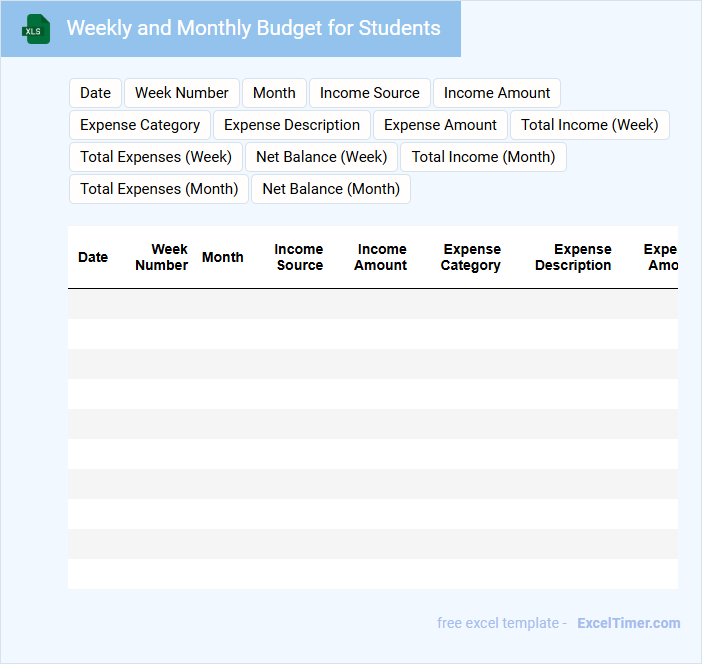

Weekly and Monthly Budget for Students

A weekly and monthly budget for students typically contains detailed records of income, expenses, and savings goals to help manage finances effectively. It includes categories such as tuition fees, groceries, transportation, and entertainment to provide a comprehensive overview of spending habits. Maintaining this document encourages financial discipline and ensures timely payment of essential bills. An important suggestion is to regularly update the budget to reflect any changes in income or unexpected expenses. Prioritizing essential costs over discretionary spending helps prevent debt accumulation. Utilizing budgeting tools or apps can simplify tracking and provide visual insights into financial health.

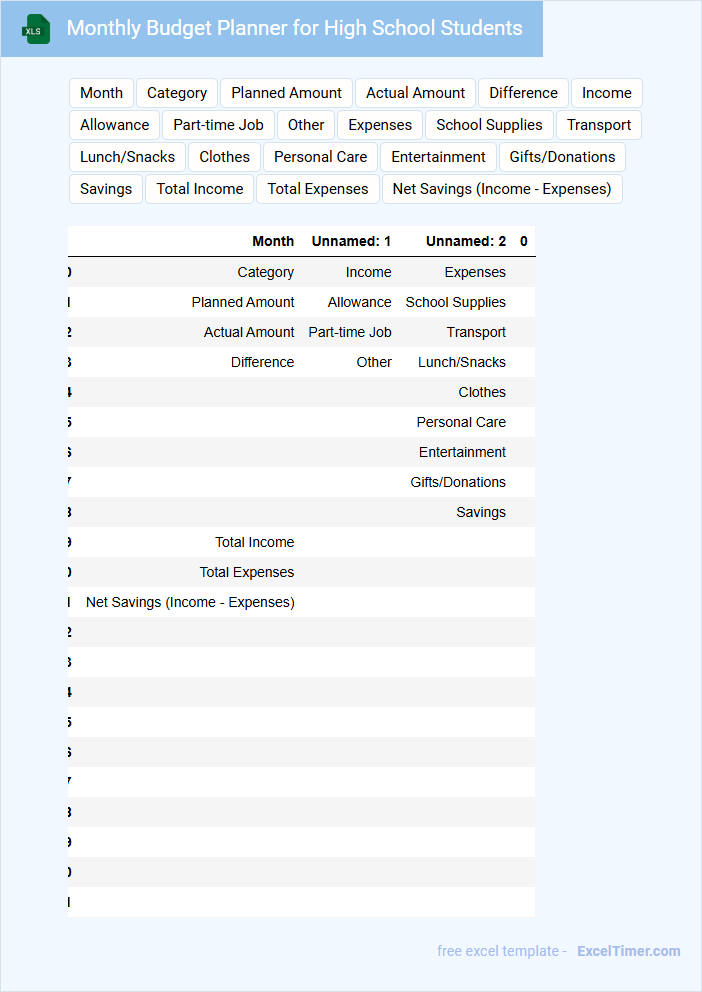

Monthly Budget Planner for High School Students

What information is typically included in a Monthly Budget Planner for High School Students? This document usually contains sections for tracking income sources such as allowances or part-time jobs, and detailed expense categories like school supplies, entertainment, and savings. It helps students develop financial literacy by organizing expenses, setting spending limits, and monitoring savings goals.

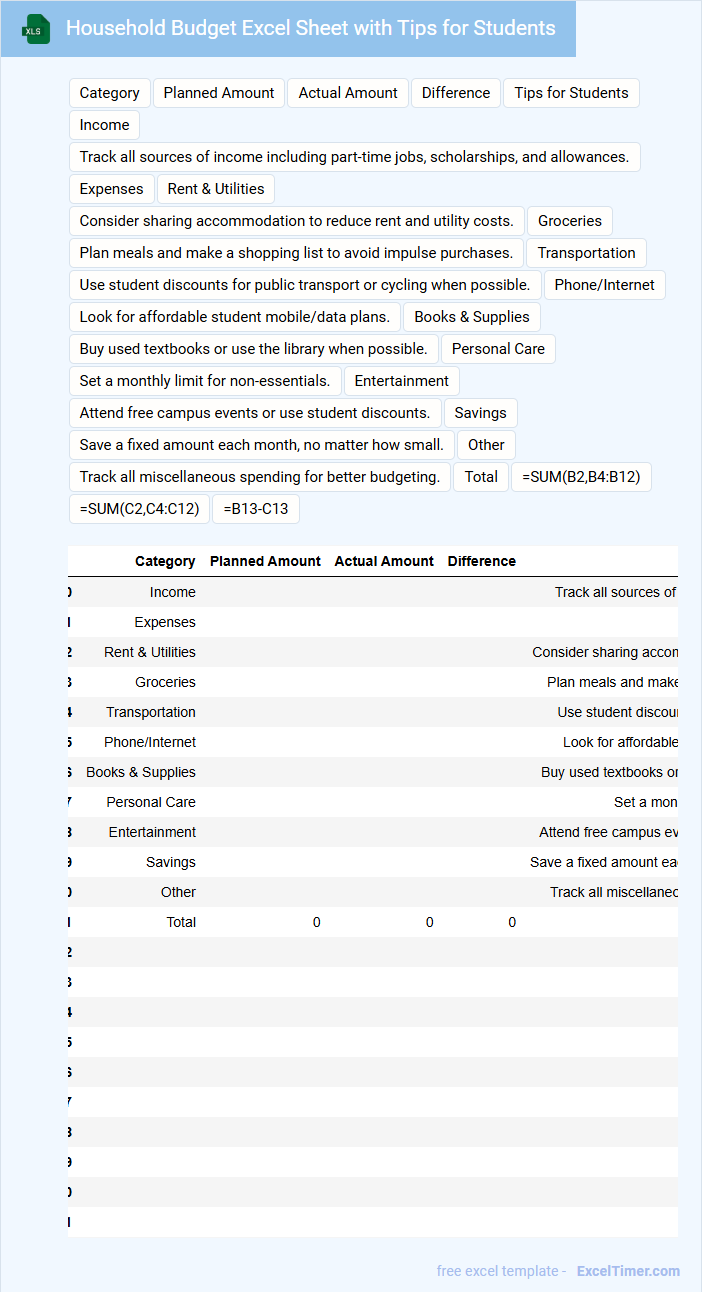

Household Budget Excel Sheet with Tips for Students

A Household Budget Excel Sheet is a practical tool designed to help individuals track and manage their income and expenses efficiently. It typically contains categories such as rent, utilities, groceries, transportation, and savings to provide a clear overview of financial health.

For students, this sheet can be invaluable in developing responsible spending habits and avoiding unnecessary debt. Including tips on setting limits and prioritizing essential costs will enhance budgeting success.

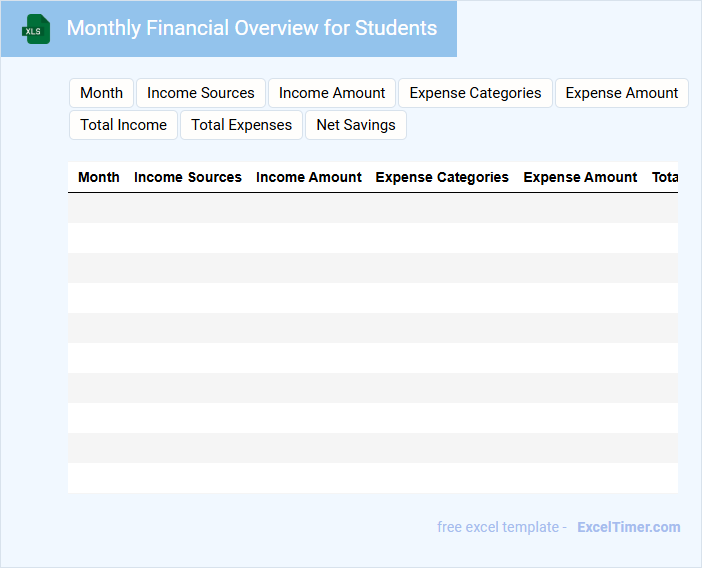

Monthly Financial Overview for Students

A Monthly Financial Overview for students typically includes a summary of income, expenses, and savings within a given month. It helps students track their budgeting habits and identify areas for financial improvement. Key components often cover tuition fees, accommodation costs, and discretionary spending.

Important elements to include are a clear categorization of expenses, a comparison against the budget, and tips for managing unexpected costs. Visual aids like charts can enhance understanding and engagement with financial data. Regular updates promote financial awareness and responsibility among students.

What key categories should be included in a student's monthly budget spreadsheet?

A student's monthly budget spreadsheet should include key categories such as tuition fees, rent or housing expenses, groceries, transportation costs, utilities, study materials, and personal expenses. Including income sources like scholarships, part-time job earnings, and allowances ensures accurate financial tracking. Allocating funds for savings and emergency expenses helps maintain financial stability throughout the academic year.

How can you use Excel formulas to track and calculate monthly income versus expenses?

Use Excel formulas like SUM to total your monthly income and expenses, enabling clear budget tracking. Apply the IF function to categorize transactions, helping you monitor spending patterns effectively. Your budget balance can be calculated by subtracting total expenses from total income using a simple formula.

Which Excel chart is most effective for visualizing spending patterns in a student budget?

A pie chart is most effective for visualizing spending patterns in a student budget because it clearly shows the proportion of each expense category relative to the total monthly budget. Bar charts are useful for comparing individual spending categories across different months. Line charts help track spending trends over time, highlighting increases or decreases in expenses.

What features in Excel help students set and monitor savings goals each month?

Excel offers features such as customizable budget templates, interactive charts, and conditional formatting to help students set and monitor monthly savings goals. The built-in functions like SUM, IF, and VLOOKUP enable automatic tracking of income and expenses. Data validation and goal seek tools assist in maintaining discipline and adjusting budgets to meet savings targets effectively.

How can conditional formatting in Excel highlight overspending in specific budget categories?

Conditional formatting in Excel for a Monthly Budget document automatically highlights cells where spending exceeds the allocated budget in specific categories. It uses rules to compare actual expenses against budget limits and applies color codes, such as red fill, to signal overspending. This visual alert helps students quickly identify and manage budget categories that need attention.