![]()

The Monthly Savings Tracker Excel Template for Families helps households monitor and manage their savings goals efficiently by organizing income, expenses, and saved amounts in one place. It includes built-in formulas to automatically calculate monthly progress, offering clear insights into family finances. Consistent use of this template fosters better budgeting habits and ensures long-term financial stability.

Monthly Savings Tracker Excel Template for Families

A Monthly Savings Tracker Excel Template for families is designed to help monitor and manage household savings effectively. It typically contains sections for income, expenses, savings goals, and progress charts. Using this template fosters better financial planning and encourages consistent saving habits within the family unit.

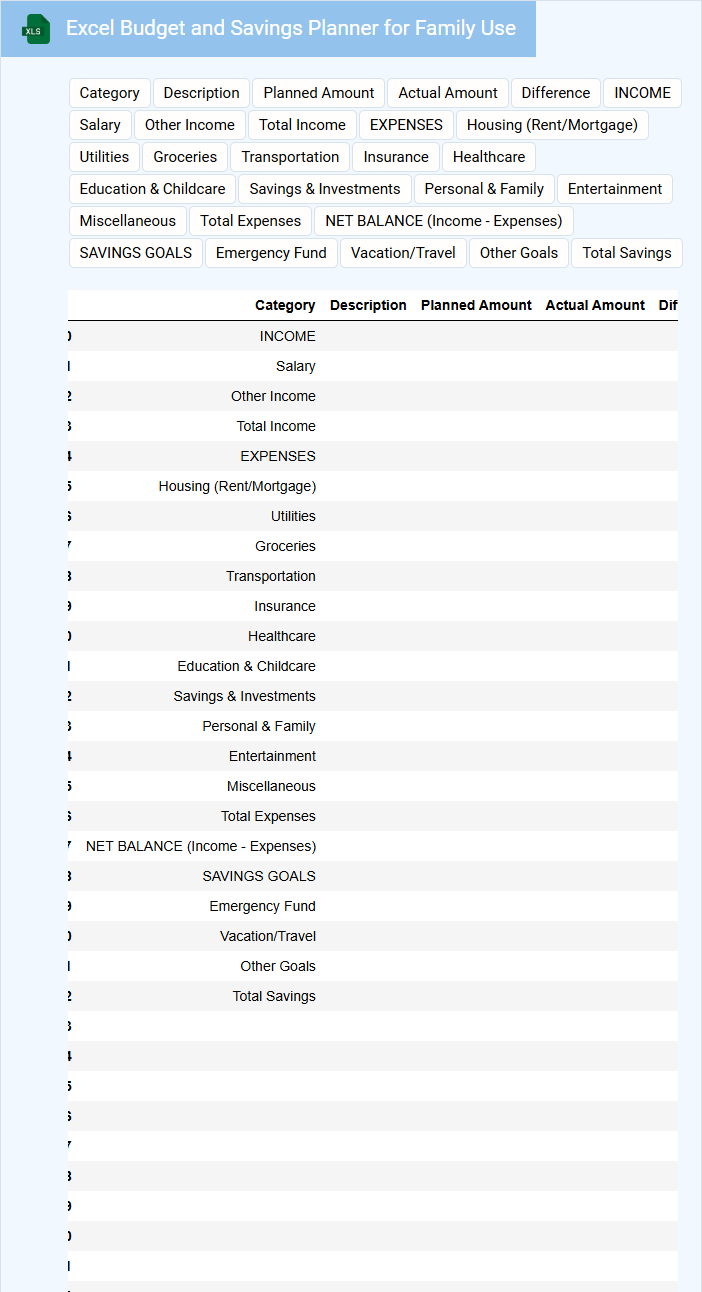

Excel Budget and Savings Planner for Family Use

An Excel Budget and Savings Planner for Family Use is a structured spreadsheet designed to help families track their income, expenses, and savings goals efficiently. It provides a clear financial overview to foster better money management and planning.

- Include categories for monthly income, fixed and variable expenses, and savings targets.

- Utilize formulas for automatic calculations of totals and balances to ensure accuracy.

- Incorporate visual aids like charts or graphs to easily monitor financial progress.

Family Financial Goals Tracker with Monthly Savings

What information does a Family Financial Goals Tracker with Monthly Savings usually contain? This type of document typically includes a list of financial objectives the family aims to achieve, such as saving for emergencies, education, or vacations, along with specific monthly savings targets. It also tracks progress over time by recording actual savings against these targets to help ensure accountability and motivation.

What is an important consideration when using this tracker? It is crucial to set realistic and measurable goals that reflect the family's income and expenses. Regularly reviewing and updating the tracker helps maintain focus and adjust savings plans according to changing financial circumstances.

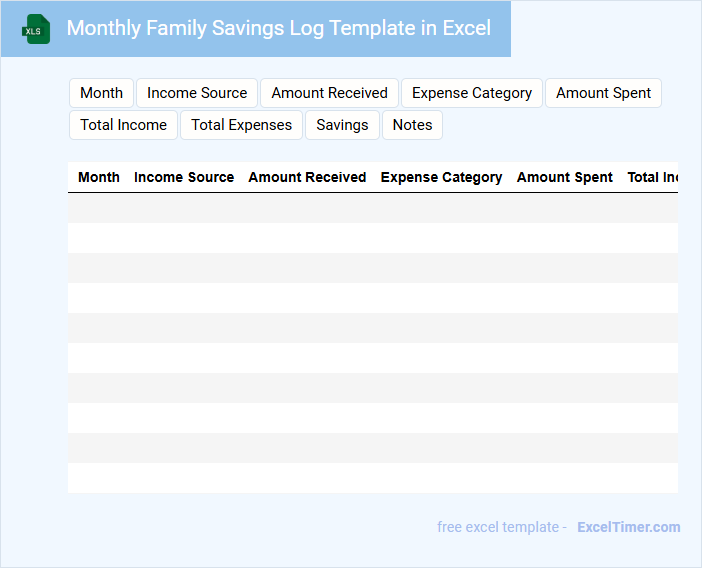

Monthly Family Savings Log Template in Excel

A Monthly Family Savings Log Template in Excel is typically used to track and manage monthly savings goals, expenses, and progress in a structured format.

- Clear categorization: Ensure the template includes distinct categories for income, expenses, and savings to maintain organized records.

- Regular updates: Consistently update the log to reflect accurate and timely financial information for effective tracking.

- Visual summaries: Incorporate charts or graphs within the template to provide a quick overview of savings trends and budget status.

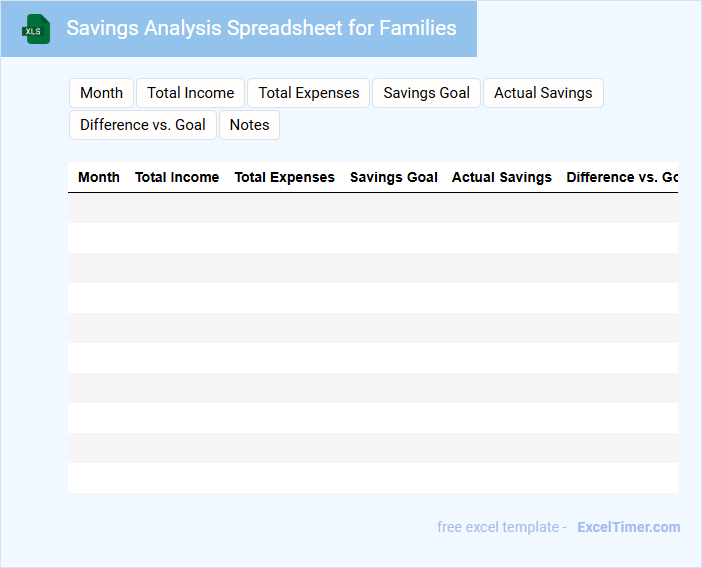

Savings Analysis Spreadsheet for Families

The Savings Analysis Spreadsheet for families typically contains detailed income and expense tracking, enabling users to monitor their financial habits effectively. It includes sections for categorizing expenses, setting savings goals, and forecasting future financial positions. This document serves as a crucial tool for budgeting and enhancing overall financial awareness within households.

Family Expense and Savings Sheet for Each Month

A Family Expense and Savings Sheet for Each Month typically contains detailed records of all income, expenses, and savings to help track financial health. It serves as a tool to monitor spending habits and budget effectively for future needs.

- Include categories for fixed and variable expenses to distinguish recurring from occasional costs.

- Record all income sources precisely to have a clear picture of total earnings.

- Regularly update the sheet to reflect actual spending and adjust savings goals accordingly.

Excel Family Savings Tracker with Charts

An Excel Family Savings Tracker with Charts is typically a document designed to help families monitor their income, expenses, and overall savings progress over time. It often combines raw financial data with visual elements like charts for easier comprehension and analysis.

- Track monthly income and expenses to identify saving opportunities.

- Use charts to visualize savings trends and financial goals.

- Regularly update the tracker for accurate budgeting and planning.

Comprehensive Family Savings Register for Monthly Tracking

The Comprehensive Family Savings Register is a structured document designed to track monthly savings and expenditures in detail. It typically contains sections for income sources, categorized expenses, and savings goals to monitor financial progress over time. Maintaining accuracy and consistency in entries is crucial to ensure effective family budgeting and financial planning.

Monthly Deposit Tracker for Family Savings Accounts

The Monthly Deposit Tracker for Family Savings Accounts is a document that systematically records all deposits made into various family savings accounts each month. It helps monitor contributions and ensures consistent saving habits across all members.

Tracking these deposits allows families to evaluate their financial progress and make informed decisions about future savings goals. An important suggestion is to include columns for date, amount, account name, and depositor for clear and organized record-keeping.

Family Goal-Oriented Savings Tracker with Excel

This document is typically a structured spreadsheet designed to help families monitor and manage their financial goals systematically using Excel.

- Financial goals: Detailed targets such as vacations, education funds, or emergency savings.

- Tracking progress: Regular entries of contributions and expenditures to measure goal advancement.

- Budget allocation: Clear categories and formulas to optimize savings distribution across goals.

Monthly Savings Progress Sheet for Families

A Monthly Savings Progress Sheet for families typically contains detailed records of income, expenses, and the amount saved each month. It helps track financial goals by providing a clear overview of savings trends and cash flow management. Key elements include budget categories, target savings, and actual savings to measure progress effectively.

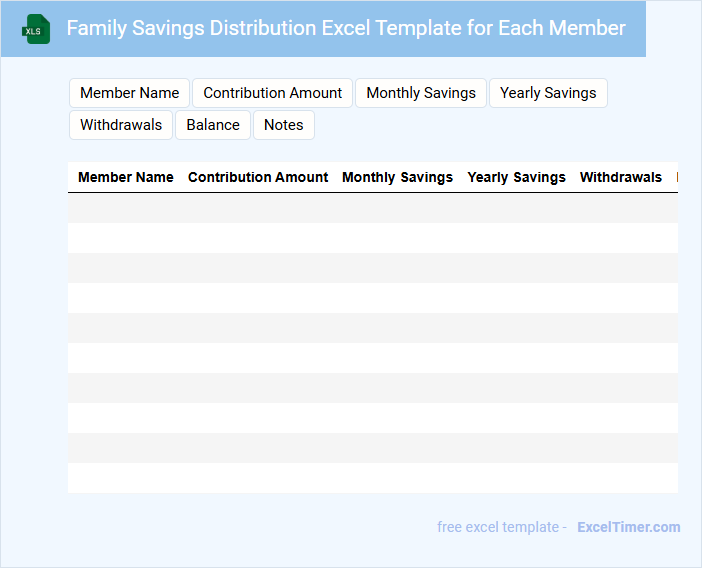

Family Savings Distribution Excel Template for Each Member

What information does a Family Savings Distribution Excel Template typically include? This type of document usually contains detailed entries of total savings, individual contributions, and the allocated distribution amounts for each family member. It helps track the sharing of funds transparently and ensures everyone receives their fair portion.

Excel Monthly Savings and Expense Tracker for Household

An Excel Monthly Savings and Expense Tracker for Household is typically used to monitor and manage personal finances efficiently. This type of document contains detailed records of income, expenses, and savings on a monthly basis. It helps individuals or families identify spending patterns and plan budgets more effectively.

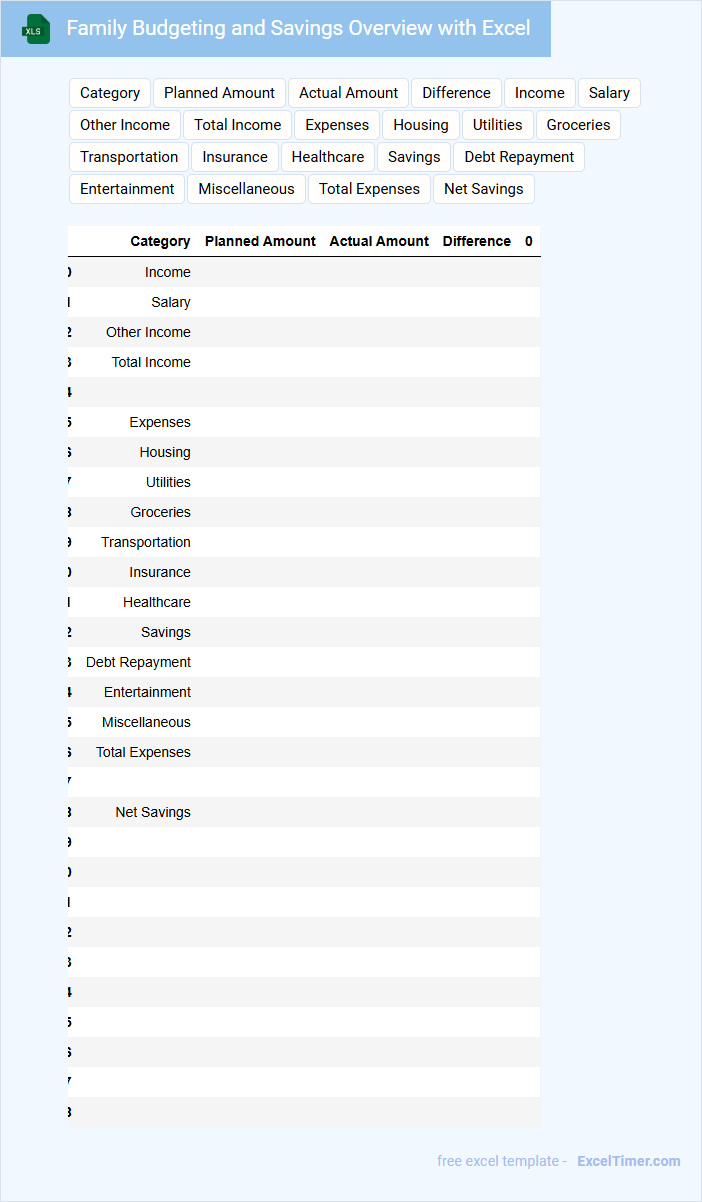

Family Budgeting and Savings Overview with Excel

This document typically contains a comprehensive overview of managing household finances effectively using Excel. It outlines essential categories like income, expenses, savings goals, and budgeting templates. The goal is to help families track their spending and enhance their financial planning skills.

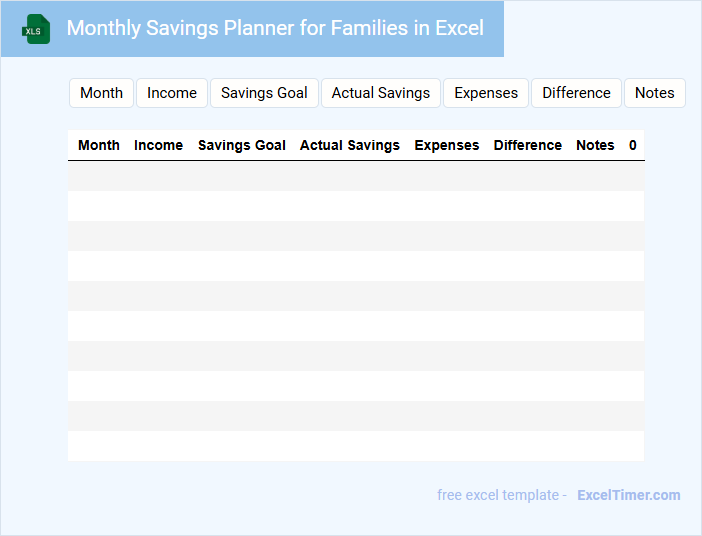

Monthly Savings Planner for Families in Excel

A Monthly Savings Planner for families in Excel typically contains sections for tracking income, expenses, and savings goals. It helps in organizing monthly budgets, monitoring spending, and visualizing progress through charts. Key features often include categorized expense lists, automated calculations, and goal-setting tools to encourage disciplined saving habits.

What essential columns should a Monthly Savings Tracker for families include to monitor income, expenses, and savings effectively?

A Monthly Savings Tracker for families should include essential columns such as Date, Income Source, Total Income, Expense Category, Expense Amount, and Total Expenses. Additionally, columns for Savings Goal, Actual Savings, and Remaining Balance help monitor progress toward financial targets. Including Notes or Comments allows tracking of unusual expenses or income fluctuations for better financial analysis.

How can you use Excel formulas to automatically calculate total savings each month for your family?

Use Excel formulas like SUM to automatically calculate your family's total savings each month by adding individual savings entries. Apply functions such as SUMIF to total savings based on specific categories or months for detailed tracking. Implementing these formulas streamlines monitoring and ensures accurate monthly financial summaries for families.

What features in Excel help you visualize savings trends over time within your tracker?

Excel's built-in features like line charts and sparklines enable clear visualization of your monthly savings trends, highlighting patterns and fluctuations over time. Conditional formatting enhances data analysis by color-coding savings milestones or drops, making it easier to track progress at a glance. PivotTables provide customizable summaries, allowing families to analyze savings by category or time period for deeper insights.

How can you categorize family expenses in an Excel tracker to identify potential savings opportunities?

Categorize family expenses in your Excel Monthly Savings Tracker by grouping costs into essential needs, discretionary spending, and irregular expenses to clearly visualize where money is going. Use specific categories like groceries, utilities, entertainment, and transportation for detailed analysis. This organization helps identify high-spending areas and potential savings opportunities effectively.

Which data validation tools can improve accuracy when entering savings and expense data in the tracker?

Data validation tools such as drop-down lists, date pickers, and numerical range limits can significantly improve accuracy when entering savings and expense data in your Monthly Savings Tracker for Families. Using these tools ensures consistent data entry and reduces errors by restricting inputs to predefined options or valid ranges. Implementing these validations enhances the reliability of your financial tracking and analysis.