The Monthly Mileage Log Excel Template for Rideshare Drivers provides an efficient way to track daily miles driven, helping drivers accurately record their expenses and maximize tax deductions. This template includes customizable fields for dates, trip purposes, start and end locations, and total mileage, ensuring precise documentation. Maintaining a detailed monthly log is crucial for rideshare drivers to validate their business-related travel and optimize financial management.

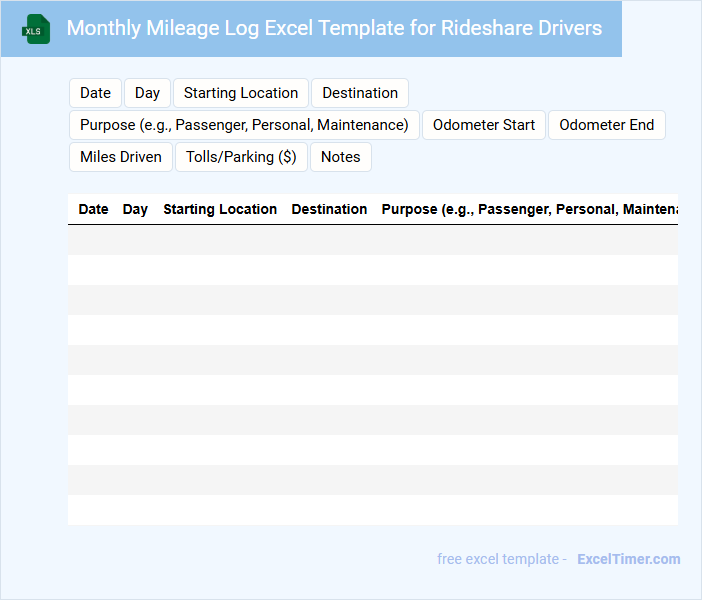

Monthly Mileage Log Excel Template for Rideshare Drivers

A Monthly Mileage Log Excel Template for rideshare drivers typically contains detailed records of miles driven for each trip throughout the month. It includes columns for date, start location, end location, purpose of trip, and total miles driven.

This document helps drivers accurately track their driving distances for tax deductions and reimbursement purposes. Keeping an organized and up-to-date log is essential for maximizing tax benefits and ensuring compliance with IRS regulations.

Vehicle Usage Record with Monthly Tracking for Rideshare Drivers

A Vehicle Usage Record is a document that tracks the daily mileage, fuel consumption, and maintenance activities of a vehicle, primarily for rideshare drivers. It helps in monitoring monthly expenses and ensuring proper tax documentation. Maintaining accurate records is crucial for optimizing operational efficiency and complying with legal requirements.

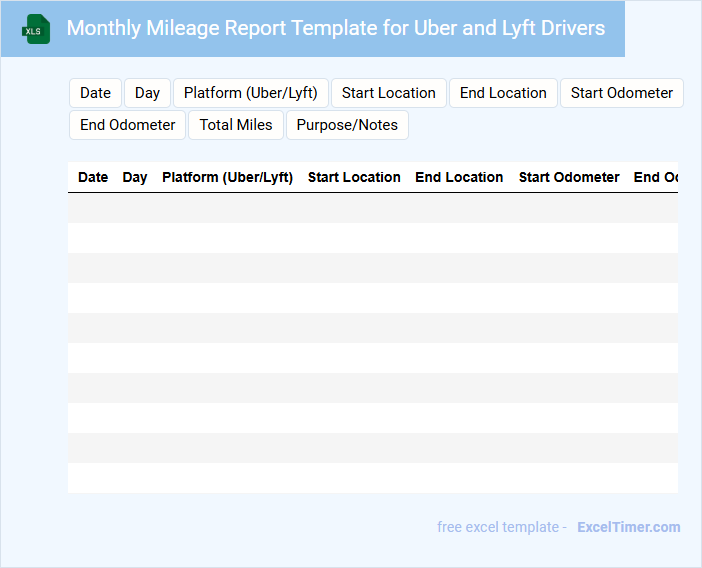

Monthly Mileage Report Template for Uber and Lyft Drivers

A Monthly Mileage Report Template for Uber and Lyft drivers is designed to help track the total distance driven each month. This document typically includes fields for recording trip dates, starting and ending mileage, and total miles driven. An essential aspect is maintaining accurate mileage logs to maximize tax deductions and ensure proper reimbursement.

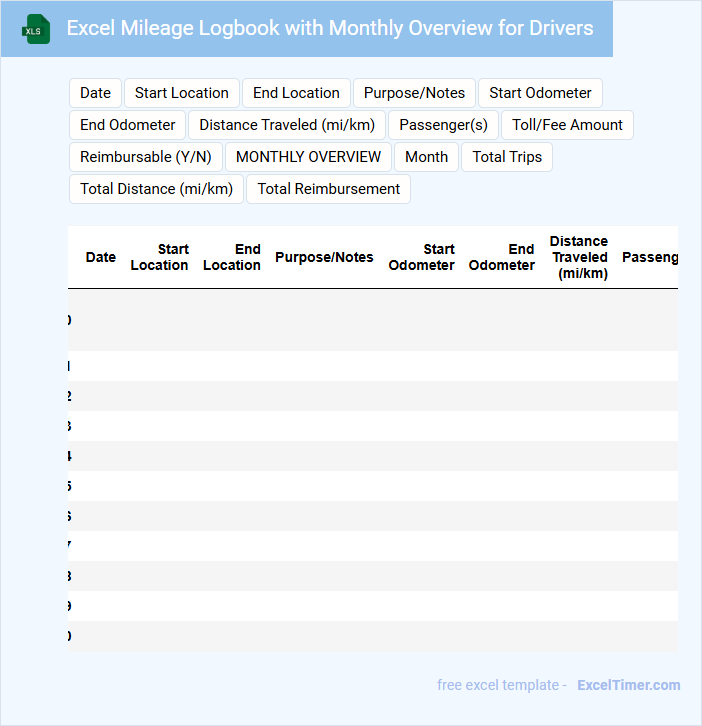

Excel Mileage Logbook with Monthly Overview for Drivers

An Excel Mileage Logbook is a structured document used by drivers to record and track their vehicle mileage for work or personal purposes. It typically contains daily entries of trip details, including starting and ending odometer readings, dates, and purposes of trips. A monthly overview section summarizes total miles driven, helping users monitor their travel and calculate reimbursements efficiently.

For maximum effectiveness, ensure to include clear columns for date, trip purpose, starting and ending mileage, and total distance. Automating monthly summaries with Excel formulas enhances accuracy and saves time. Additionally, maintaining consistent and detailed entries supports accurate record-keeping for tax deductions or reimbursement claims.

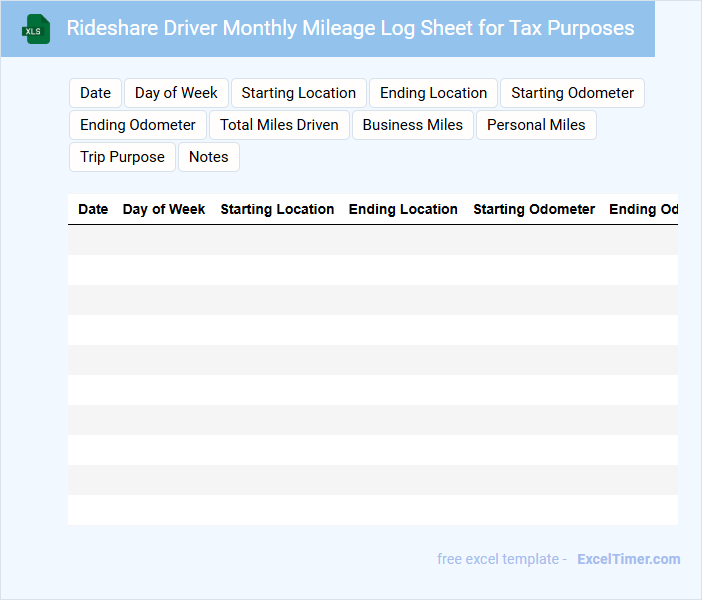

Rideshare Driver Monthly Mileage Log Sheet for Tax Purposes

A Rideshare Driver Monthly Mileage Log Sheet typically contains detailed records of miles driven for business purposes throughout the month. It includes dates, starting and ending locations, total miles driven, and purpose of each trip. Maintaining accurate logs is crucial for maximizing tax deductions and avoiding potential audits.

Monthly Distance Tracker Excel Template for Rideshare Operators

The Monthly Distance Tracker Excel Template is designed to help rideshare operators efficiently monitor and log the total miles driven each month. This document typically contains fields for trip dates, start and end locations, mileage readings, and notes on specific rides. For optimal use, it is important to regularly update the tracker to ensure accurate record-keeping for expenses and tax deductions.

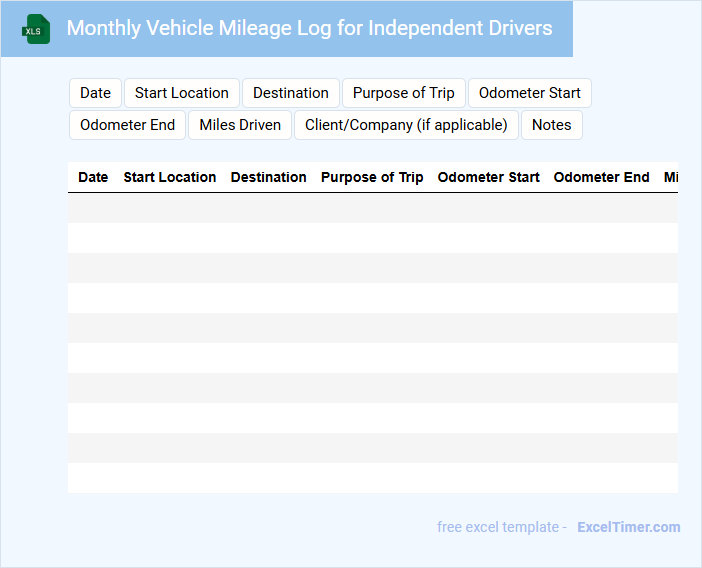

Monthly Vehicle Mileage Log for Independent Drivers

A Monthly Vehicle Mileage Log is a crucial document for independent drivers to track their total miles driven each month. It typically contains dates, starting and ending odometer readings, trip purposes, and total miles traveled. Maintaining accurate records helps with expense tracking and tax deductions.

Comprehensive Monthly Mileage Log with Expense Tracker for Rideshare

What does a Comprehensive Monthly Mileage Log with Expense Tracker for Rideshare typically contain? This document usually includes detailed records of daily rideshare trips, capturing mileage, dates, and destinations to ensure accurate tracking for tax purposes. Additionally, it tracks related expenses such as fuel, maintenance, and tolls, helping drivers manage their finances effectively.

Why is it important to maintain this type of log consistently? Consistent record-keeping ensures accurate reimbursement submissions and maximizes tax deductions by providing verifiable proof of business use. It is suggested to include detailed notes for each trip and to update the log daily to avoid errors and omissions.

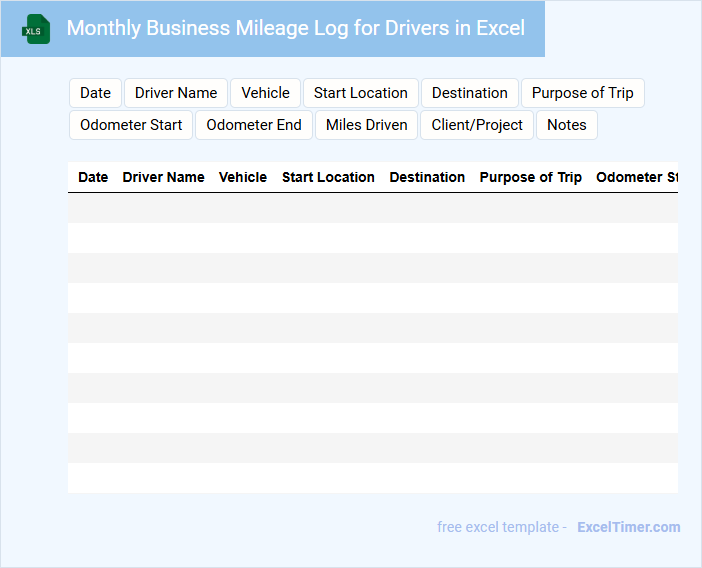

Monthly Business Mileage Log for Drivers in Excel

What information is typically included in a Monthly Business Mileage Log for Drivers in Excel? This document usually contains detailed records of each trip taken by drivers, including dates, starting and ending locations, purpose of the trip, and the total miles driven. It serves as an essential tool for tracking business-related vehicle usage for expense reimbursement and tax deduction purposes.

What are some important considerations when maintaining a Monthly Business Mileage Log? It is crucial to ensure accuracy in recording all trip details to comply with IRS requirements and company policies, while regularly updating the log to avoid missing information. Additionally, organizing data clearly in Excel with consistent formatting helps in easy analysis and reporting.

Mileage Tracker with Monthly and Trip Details for Rideshare Drivers

A Mileage Tracker document is designed to record and organize the distance traveled by rideshare drivers for each trip and month. It typically contains detailed logs of starting and ending locations, trip dates, and total miles driven. This information is crucial for accurate expense reporting and tax deductions.

Important elements to include are trip start and end times, purpose of the trip, and odometer readings before and after each trip. Monthly summaries help to review overall mileage patterns and ensure compliance with IRS guidelines. Keeping consistent and detailed records supports maximizing deductible expenses and maintaining transparent financial documentation.

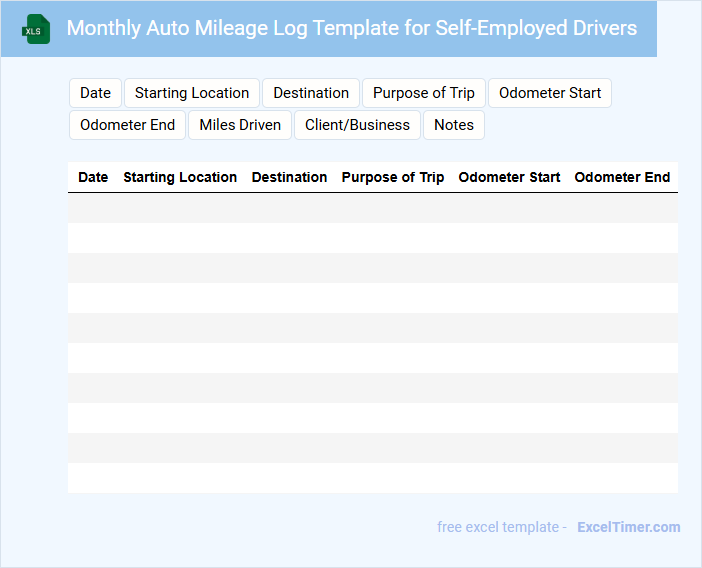

Monthly Auto Mileage Log Template for Self-Employed Drivers

A Monthly Auto Mileage Log Template for self-employed drivers is a structured document used to track vehicle usage for business purposes. It typically contains fields for date, starting and ending odometer readings, total miles driven, and purpose of each trip. Maintaining accurate records in this log is crucial for maximizing tax deductions and ensuring compliance with IRS regulations.

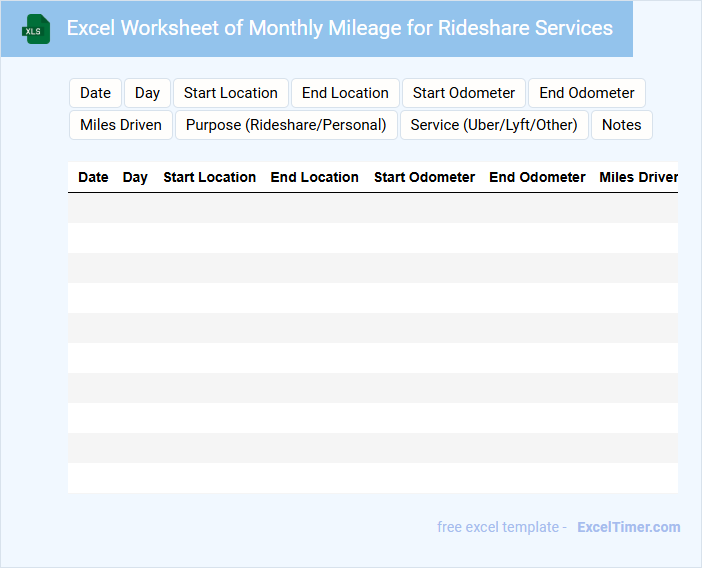

Excel Worksheet of Monthly Mileage for Rideshare Services

What information is typically contained in an Excel Worksheet of Monthly Mileage for Rideshare Services? This document usually includes detailed records of daily trips, total miles driven, and dates of each ride to accurately track mileage over the month. It helps rideshare drivers calculate earnings, fuel expenses, and prepare for tax deductions effectively.

Monthly Trip and Mileage Tracker for Rideshare Professionals

A Monthly Trip and Mileage Tracker for rideshare professionals is a crucial document that records all trips taken, including start and end locations, mileage, and trip duration. It ensures accurate tracking of business expenses and helps in maximizing tax deductions.

This document typically contains detailed logs of each ride, total miles driven, fare amounts, and any additional expenses related to vehicle use. Regularly updating this tracker and maintaining organized records are important for efficient financial management and compliance with tax regulations.

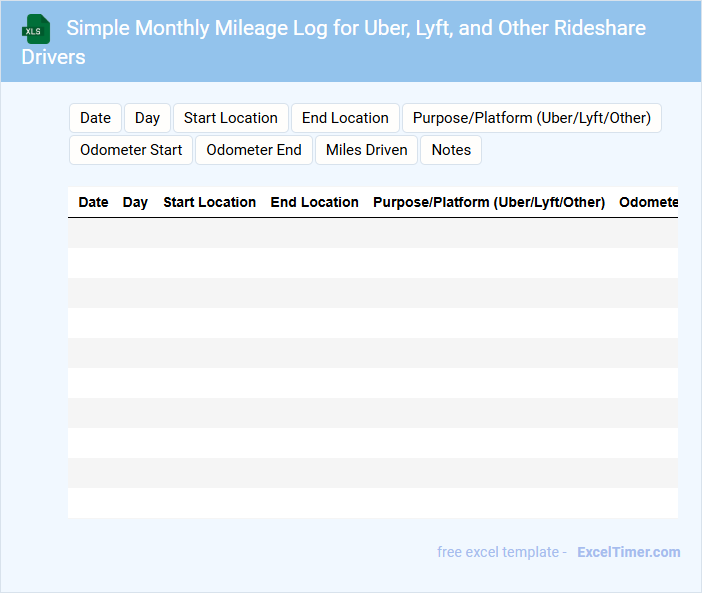

Simple Monthly Mileage Log for Uber, Lyft, and Other Rideshare Drivers

What information is typically contained in a Simple Monthly Mileage Log for Uber, Lyft, and other rideshare drivers? This type of document usually includes the date, starting and ending odometer readings, total miles driven, and purpose of each trip. It helps drivers accurately track their business mileage for tax deduction purposes and to maintain organized records.

What important details should be included to optimize the log's usefulness? It's essential to record trip dates, starting and ending locations, reason for the trip (e.g., rideshare driving), and total miles driven each day. Keeping the log updated daily ensures accuracy and compliance with IRS requirements.

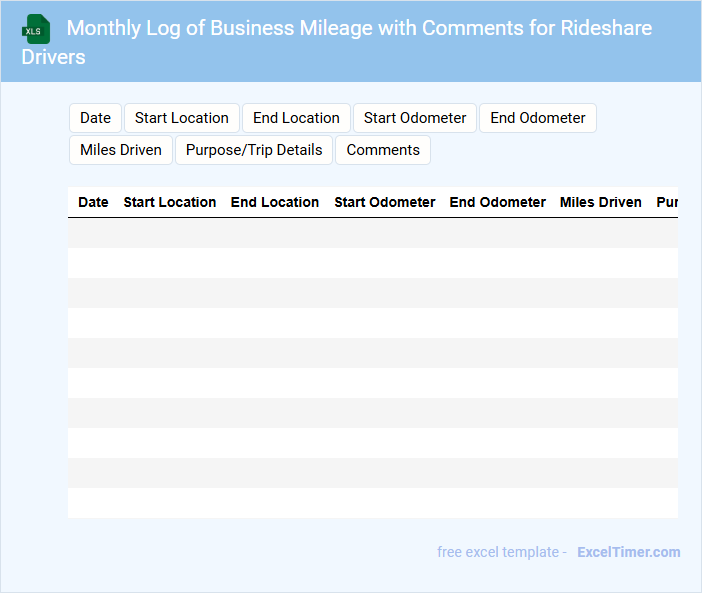

Monthly Log of Business Mileage with Comments for Rideshare Drivers

A Monthly Log of Business Mileage with Comments for Rideshare Drivers documents the distances traveled for business purposes, ensuring accurate record-keeping for tax and reimbursement. It typically includes dates, mileage, routes, and relevant comments for each ride.

- Include precise start and end locations for every trip.

- Record mileage before and after each ride to maintain accuracy.

- Add detailed comments explaining the purpose of each trip.

What key columns should be included in a monthly mileage log for rideshare drivers in Excel?

A monthly mileage log for rideshare drivers in Excel should include key columns such as Date, Start Time, End Time, Starting Odometer, Ending Odometer, Total Miles Driven, Ride Type, and Purpose of Trip. Including columns for Passenger Count and Earnings helps track performance and income. Your log ensures accurate mileage tracking for tax deductions and efficient record-keeping.

How can date and trip purpose be efficiently categorized for tax reporting purposes?

Date and trip purpose in your Monthly Mileage Log for Rideshare Drivers can be efficiently categorized by using separate columns with standardized dropdown lists for trip purposes such as "Business," "Personal," or "Commuting." Employing consistent date formats like YYYY-MM-DD ensures accuracy and simplifies filtering during tax reporting. This structured approach enhances data organization and facilitates precise mileage deduction claims.

What formulas can automate total monthly mileage and distinguish between business and personal use?

Use the SUM formula to calculate your total monthly mileage by adding all daily entries. Apply SUMIF to separate business and personal miles, summing values based on a designated category column. These formulas automate mileage tracking for accurate rideshare expense reporting.

How can drivers use conditional formatting to highlight incomplete or missing mileage entries?

You can use conditional formatting in your Monthly Mileage Log to highlight incomplete or missing mileage entries by setting rules that identify empty cells or values below a certain threshold. Apply a rule that formats cells with no input or zero mileage in a distinct color, making it easy to spot gaps or errors. This technique helps rideshare drivers maintain accurate records and ensure all trips are properly logged.

What data validation methods ensure accurate and consistent log entries in the Excel document?

Data validation in your Monthly Mileage Log for Rideshare Drivers includes setting drop-down lists for vehicle types and trip categories, applying date restrictions to prevent future or invalid dates, and using numeric limits to ensure mileage entries fall within realistic ranges. These methods reduce errors by restricting inputs to predefined options and valid formats. Consistent use of data validation enhances accuracy and reliability of your mileage records.