The Monthly Salary Sheet Excel Template for Restaurants is designed to streamline payroll management by accurately calculating employee wages, including hours worked, overtime, and deductions. It ensures transparency and efficiency in salary processing, helping restaurant managers maintain organized financial records. Regular use of this template minimizes errors and saves time during payroll cycles.

Monthly Salary Sheet with Attendance Tracker for Restaurants

A Monthly Salary Sheet with Attendance Tracker for Restaurants is a crucial document that combines employee payment details with their daily attendance records. It typically includes information such as employee names, working hours, days present, leaves taken, and the calculated salary based on attendance. This sheet helps management ensure accurate payroll processing and monitor staff attendance effectively.

Important considerations include verifying attendance accuracy to prevent payroll errors, including overtime and deductions clearly, and maintaining confidentiality of employee financial data. Using automated tools can enhance efficiency and reduce manual mistakes. Regular updates and cross-checks with attendance logs ensure transparency and trust between employees and management.

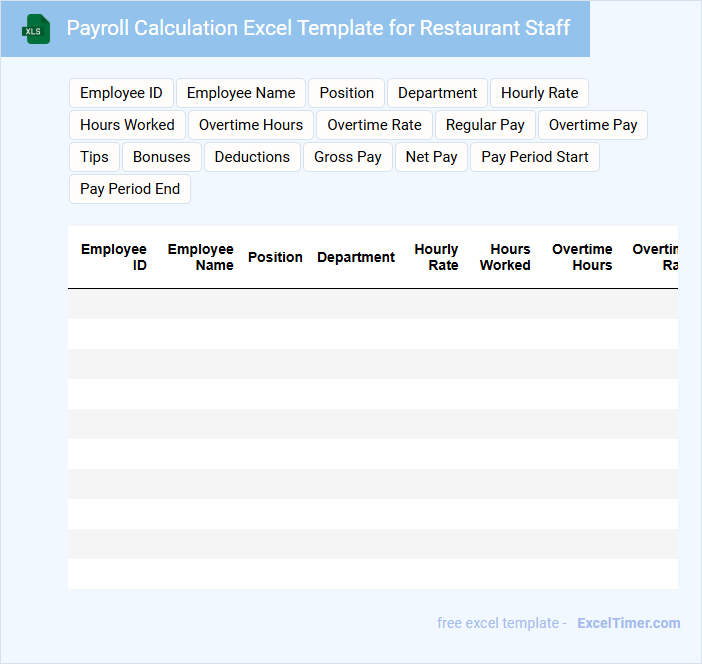

Payroll Calculation Excel Template for Restaurant Staff

This Payroll Calculation Excel Template is designed specifically for managing the salaries of restaurant staff efficiently. It typically contains employee details, hours worked, hourly rates, and automatic salary calculations.

The template also includes tax deductions, bonuses, and shift differentials to ensure accurate payroll processing. Regularly updating attendance records and tax information is an important suggestion for maintaining accuracy.

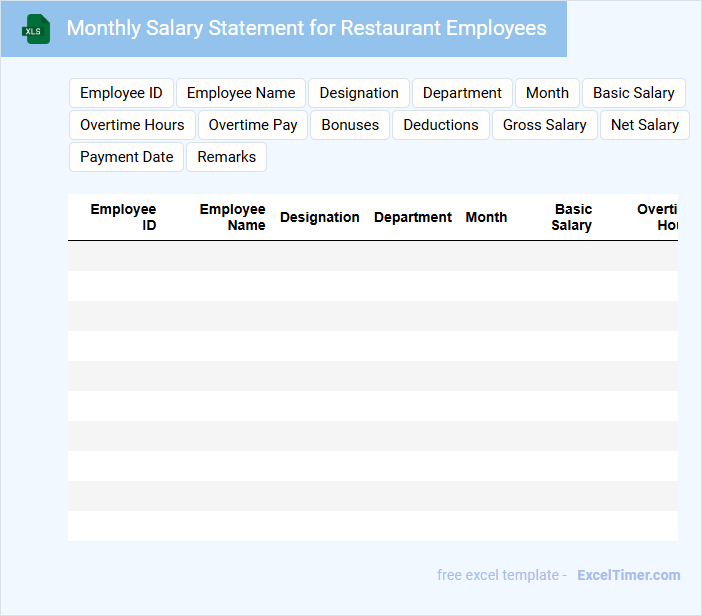

Monthly Salary Statement for Restaurant Employees

What information is typically included in a Monthly Salary Statement for Restaurant Employees? This document generally contains details such as the employee's name, position, total hours worked, hourly or monthly wage, and any deductions or bonuses applied during the pay period. It serves as a transparent record that helps employees understand their earnings and deductions clearly.

What important elements should be highlighted in this statement? Emphasizing clear breakdowns of base salary, overtime pay, tips (if applicable), taxes, and other deductions is essential to ensure accuracy and trust. Additionally, including the pay period dates and contact information for payroll inquiries enhances clarity and employee satisfaction.

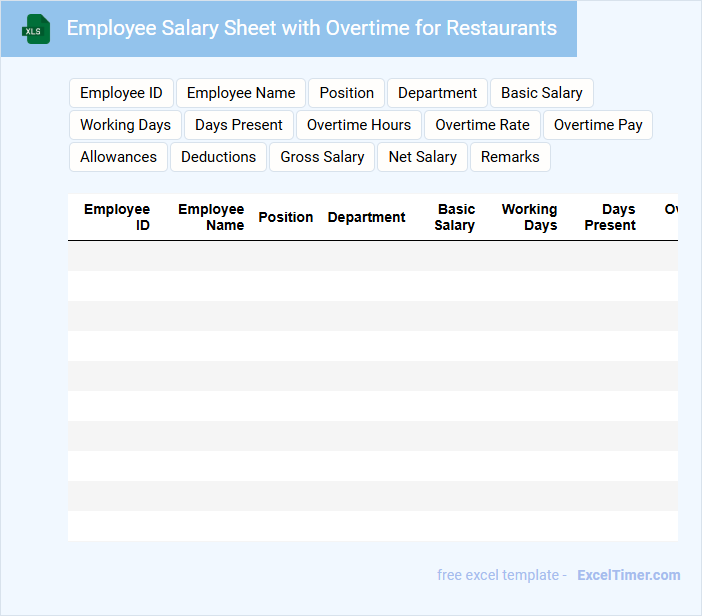

Employee Salary Sheet with Overtime for Restaurants

An Employee Salary Sheet with Overtime for restaurants typically contains detailed records of each employee's basic salary, hours worked, and overtime calculations. This document ensures accurate payroll processing by capturing regular and extra hours specifically tailored to the restaurant's work schedule.

It also includes deductions, bonuses, and net pay to provide a comprehensive financial overview for payroll management. Maintaining clear and precise entries in this sheet is crucial for compliance with labor laws and employee trust.

For optimal use, it is important to regularly update the sheet with actual attendance and overtime approvals to avoid payroll discrepancies.

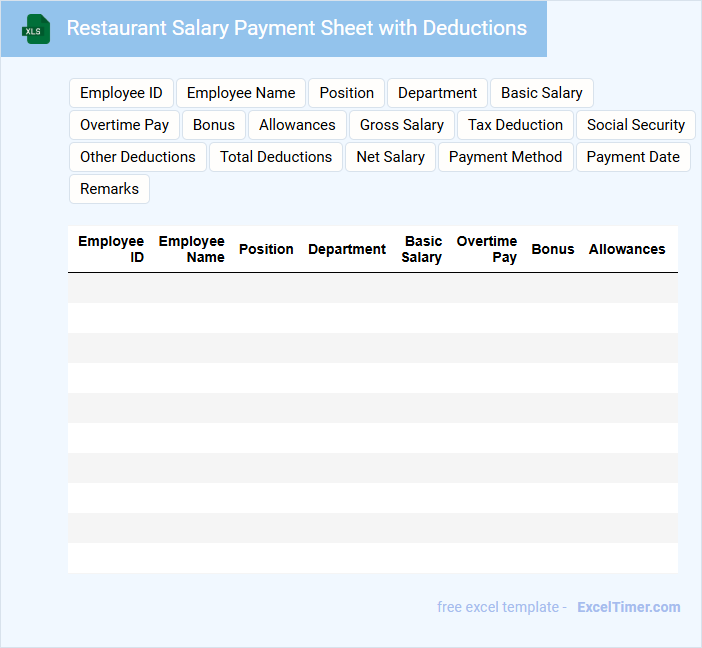

Restaurant Salary Payment Sheet with Deductions

A Restaurant Salary Payment Sheet with Deductions typically contains detailed employee salary information, including gross pay, deductions, and net pay.

- Employee Details: Name, position, and employee ID should be clearly listed for accurate identification.

- Salary Breakdown: Include gross salary, applicable taxes, and other deductions such as benefits or loans.

- Payment Summary: Clearly state the net salary payable after all deductions for transparency and record-keeping.

Monthly Wage Calculation Sheet for Restaurant Team

A Monthly Wage Calculation Sheet for a restaurant team typically contains detailed records of employee working hours, hourly rates, and total wages earned during the month. It also includes any deductions, bonuses, and overtime pay to ensure accuracy in salary distribution. This document is essential for transparent payroll management and compliance with labor laws.

Important aspects to consider in this sheet are clear employee identification, precise tracking of hours worked, and accurate calculation formulas. Including sections for allowances, tips, and tax deductions can improve its comprehensiveness. Regular updates and secure storage of the sheet help maintain reliability and accountability.

Restaurant Staff Monthly Salary Register in Excel

A Restaurant Staff Monthly Salary Register in Excel is a document used to systematically record and manage the monthly wages of restaurant employees. It typically contains employee details, working hours, salary components, deductions, and net pay. This register helps ensure accurate payroll processing and compliance with labor regulations.

Important elements to include are employee names, roles, attendance, gross salary, deductions like taxes and benefits, and final net salary. Using formulas in Excel can automate calculations and reduce errors, enhancing efficiency. Regularly updating and securely storing this document is crucial for transparency and financial management.

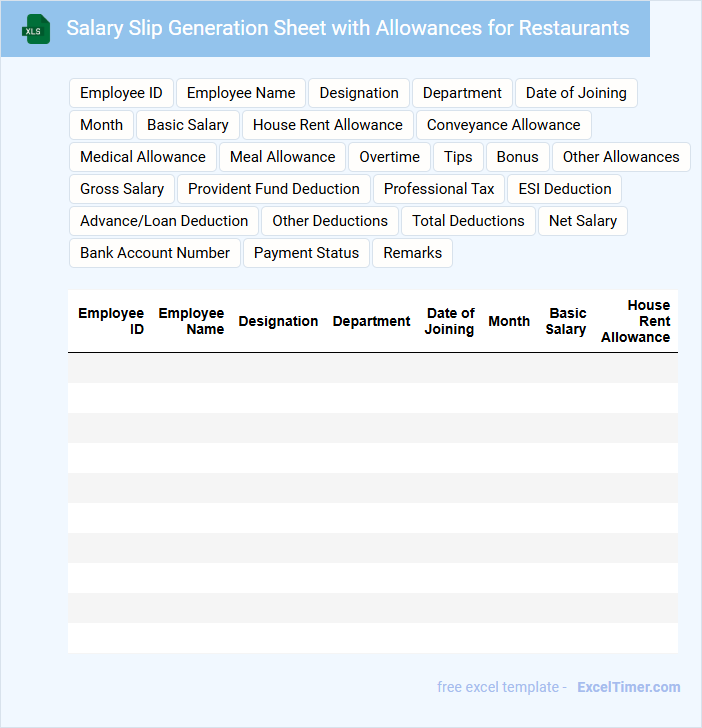

Salary Slip Generation Sheet with Allowances for Restaurants

What information is typically included in a Salary Slip Generation Sheet with Allowances for Restaurants? This document usually contains employee details, basic salary, various allowances such as food, transport, and overtime, as well as deductions like taxes and social security. It serves as an essential record for both employers and employees to ensure accurate salary computation and transparency.

What is an important consideration when creating a Salary Slip Generation Sheet for restaurants? It is crucial to clearly itemize all allowances and deductions relevant to restaurant staff, including tips or service charges if applicable. Ensuring compliance with labor laws and providing a clear summary helps prevent disputes and maintains trust between the employer and staff.

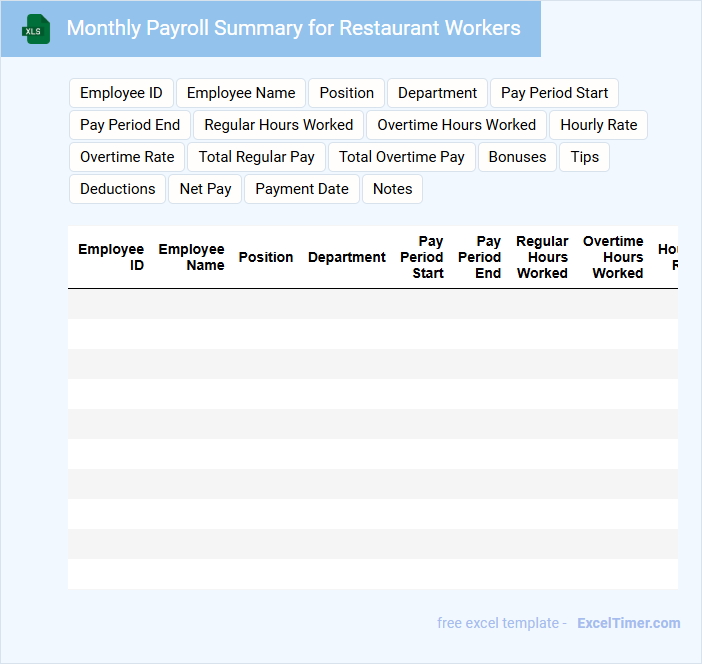

Monthly Payroll Summary for Restaurant Workers

What information is typically included in a Monthly Payroll Summary for Restaurant Workers? This document usually contains details such as employee names, total hours worked, hourly rates, gross pay, deductions, and net pay for the month. It helps both the employer and employees keep track of wage payments and ensure accurate financial records for payroll management.

Restaurant Employee Salary Management Sheet with Advance Tracking

A Restaurant Employee Salary Management Sheet is a document used to record and organize employee wages and payments efficiently. It typically includes details such as employee names, roles, hours worked, base salary, and any deductions or advances taken. This sheet also helps in tracking advance payments to ensure clear and transparent financial management.

To optimize this document, it is important to consistently update payment records, include a clear breakdown of salary components, and monitor advance repayments diligently. Incorporating date-wise tracking and categorizing employees by department or position can improve clarity. Additionally, maintaining a backup and using digital formats with formulas or automation enhances accuracy and ease of use.

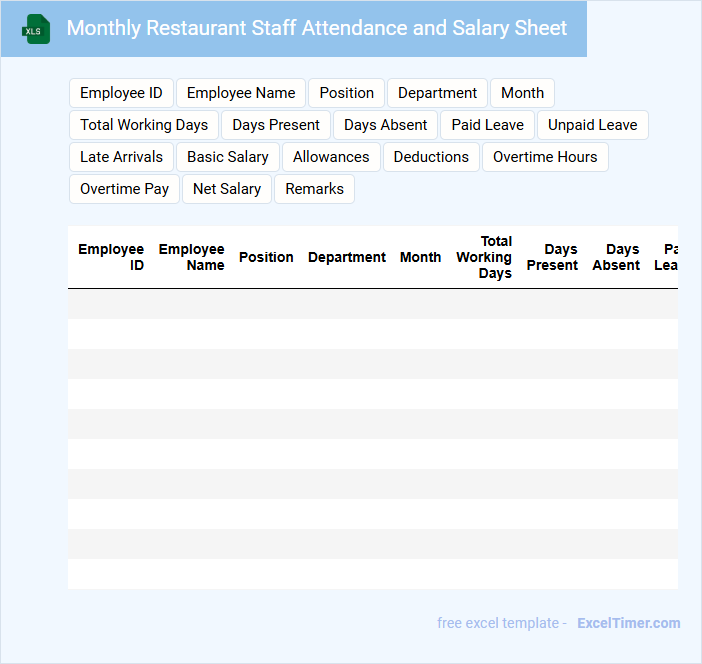

Monthly Restaurant Staff Attendance and Salary Sheet

The Monthly Restaurant Staff Attendance and Salary Sheet typically contains detailed records of employee attendance, including days worked, leaves taken, and hours logged. It also incorporates salary calculations based on attendance, overtime, and deductions. Maintaining this document accurately ensures transparent payroll management and helps in performance tracking.

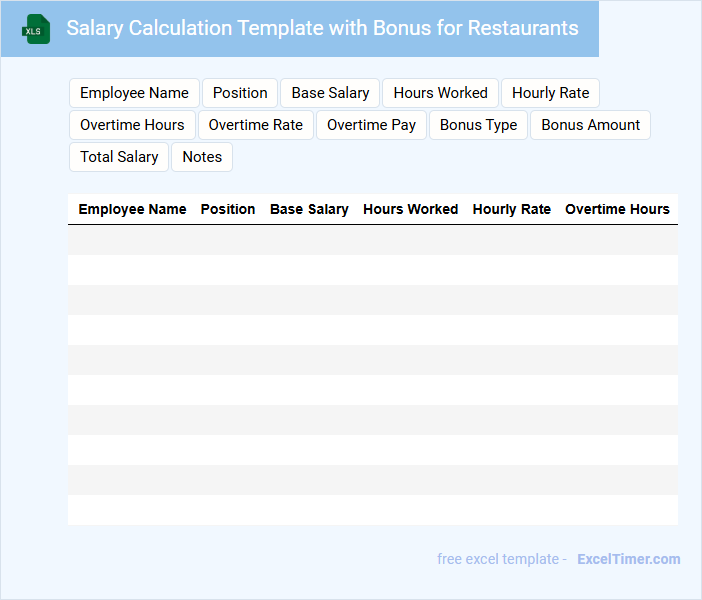

Salary Calculation Template with Bonus for Restaurants

What information is typically included in a Salary Calculation Template with Bonus for Restaurants? This document usually contains employee salary details, including base pay, hours worked, and bonus calculations based on performance or sales targets. It helps ensure accurate payroll processing and motivates staff by clearly outlining bonus eligibility criteria.

Wages and Salary Register Sheet for Restaurant Employees

The Wages and Salary Register Sheet for restaurant employees typically includes detailed records of employee names, job titles, hours worked, and gross pay. This document ensures accurate tracking of earnings and deductions for each pay period.

It is important to maintain compliance with labor laws and update the register regularly to reflect changes in wages or working hours. Accurate documentation helps in payroll processing and resolving any discrepancies.

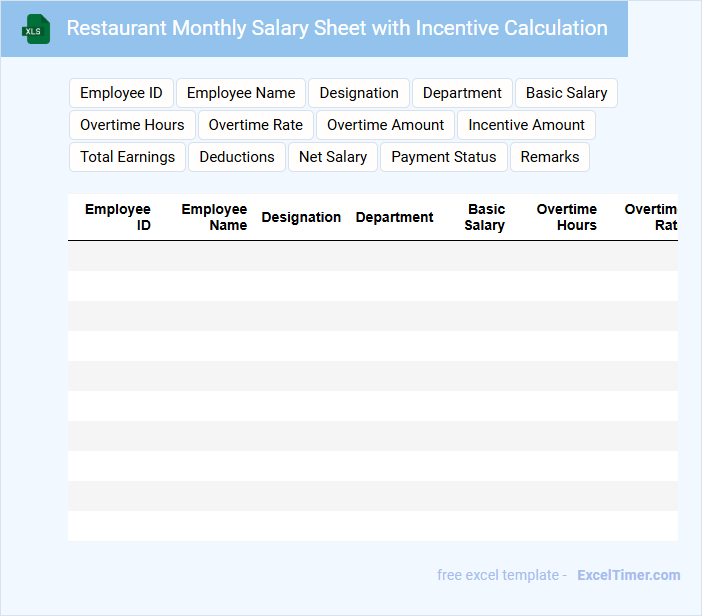

Restaurant Monthly Salary Sheet with Incentive Calculation

What information is typically included in a Restaurant Monthly Salary Sheet with Incentive Calculation? This document usually contains details about each employee's base salary, hours worked, and any additional incentives earned throughout the month. It provides a clear breakdown of total compensation, combining fixed pay and performance-based bonuses.

Why is it important to include accurate incentive calculations in the salary sheet? Accurate incentive calculations motivate employees by transparently linking their performance to rewards. Ensuring precision in these figures also helps maintain trust and simplifies payroll processing for the restaurant management.

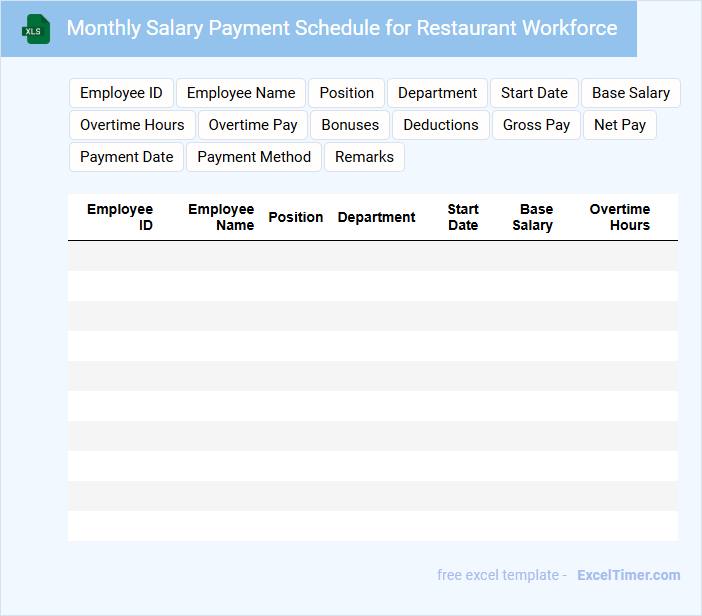

Monthly Salary Payment Schedule for Restaurant Workforce

A Monthly Salary Payment Schedule for a Restaurant Workforce outlines the dates and procedures for salary distribution within the establishment. It ensures timely and organized payments, helping maintain staff satisfaction and operational efficiency.

- Include clear payment dates for all employee categories.

- Specify the salary calculation method, including overtime and tips.

- Ensure compliance with labor laws and tax regulations.

What are the essential columns to include in a restaurant's monthly salary sheet?

Your restaurant's monthly salary sheet should include essential columns such as Employee Name, Position, Days Worked, Hours Worked, Base Salary, Overtime Hours, Overtime Pay, Bonuses, Deductions, and Net Salary. Including these key data points ensures accurate payroll management and clear tracking of wages. Properly organizing this information helps streamline your restaurant's financial operations and employee compensation.

How do you calculate total monthly wages for each employee in Excel?

To calculate total monthly wages for each employee in your Monthly Salary Sheet for Restaurants, multiply the total hours worked by the hourly wage rate in Excel using the formula =Hours_Worked*Hourly_Rate. Sum any additional bonuses or tips by including them in the formula as = (Hours_Worked*Hourly_Rate) + Bonuses. This calculation ensures accurate tracking of each employee's total monthly earnings.

What formula can be used to automatically deduct taxes or other withholdings?

Use the formula =Salary * TaxRate to calculate tax deductions automatically, where Salary refers to the employee's monthly salary and TaxRate is the applicable withholding percentage. Apply =Salary - (Salary * TaxRate) to determine the net salary after deductions. Incorporate additional withholdings by summing each deduction in separate columns and subtracting the total from the gross salary.

How can Excel help in tracking overtime hours and extra payments for restaurant staff?

Excel helps you efficiently track overtime hours and extra payments for restaurant staff by using customizable formulas and templates designed for monthly salary sheets. It allows you to input regular and overtime hours, automatically calculate additional wages, and generate detailed reports for payroll accuracy. This ensures precise compensation management and simplifies financial record-keeping for your restaurant.

Which Excel features aid in summarizing total salary costs by department or staff role?

PivotTables in Excel efficiently summarize total salary costs by department or staff role in a Monthly Salary Sheet for Restaurants. The SUMIF and SUMIFS functions aggregate salary data based on specific criteria, such as departments or job titles. Conditional Formatting visually highlights salary ranges and discrepancies for enhanced data analysis.