The Monthly Payroll Excel Template for Nonprofits streamlines salary calculations and tax deductions, ensuring accurate and timely payroll management. This template is tailored to meet the specific regulatory and reporting requirements of nonprofit organizations. Its user-friendly design helps maintain financial transparency and compliance with minimal effort.

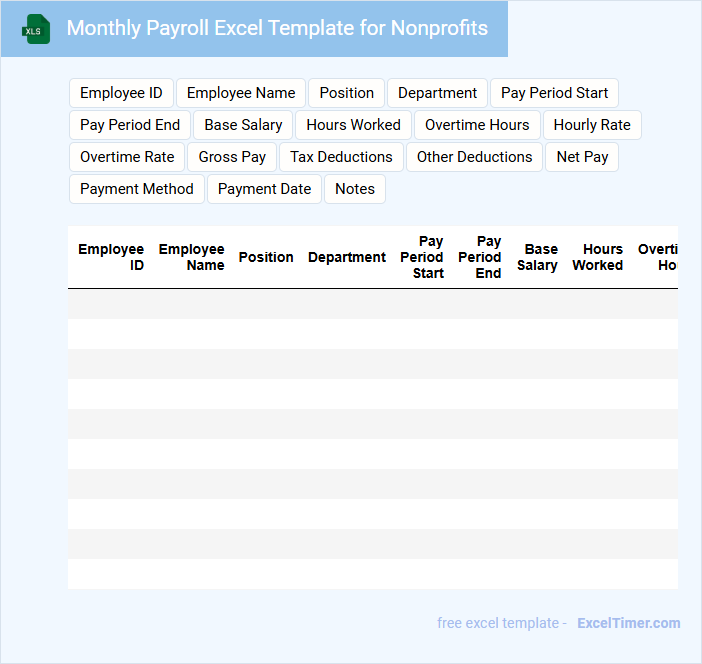

Monthly Payroll Excel Template for Nonprofits

A Monthly Payroll Excel Template for nonprofits is designed to track employee wages, deductions, and net pay efficiently. It helps organizations maintain accurate financial records and ensures timely salary payments.

This template typically contains employee details, hours worked, tax withholdings, and benefit contributions. To optimize payroll processing, it is important to regularly update employee information and comply with nonprofit tax regulations.

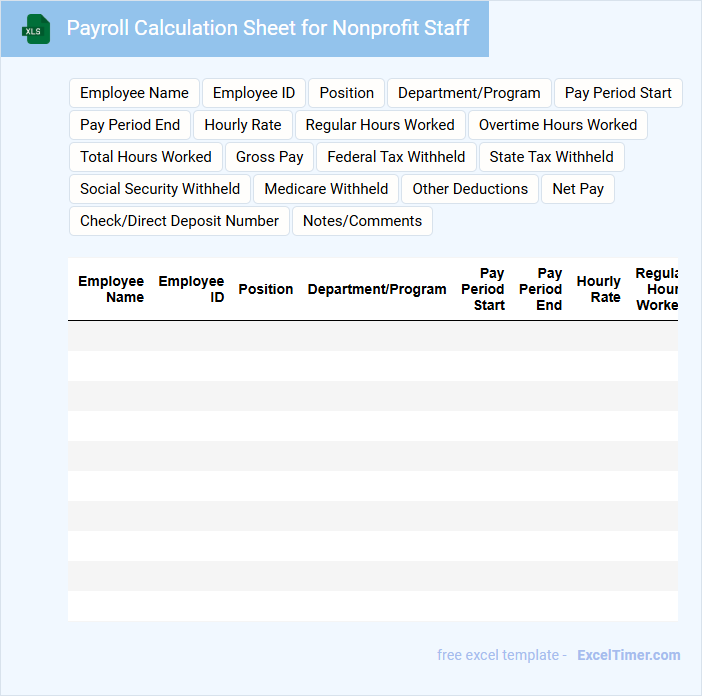

Payroll Calculation Sheet for Nonprofit Staff

Payroll Calculation Sheet for Nonprofit Staff typically contains detailed records of employee wages, deductions, and net pay to ensure accurate and compliant compensation management.

- Employee Information: Includes names, job titles, and identification numbers for precise payroll processing.

- Compensation Details: Documents hours worked, salaries, bonuses, and other income sources relevant to nonprofit staff.

- Deductions and Taxes: Lists mandatory withholdings like taxes, benefits, and retirement contributions specific to nonprofit regulations.

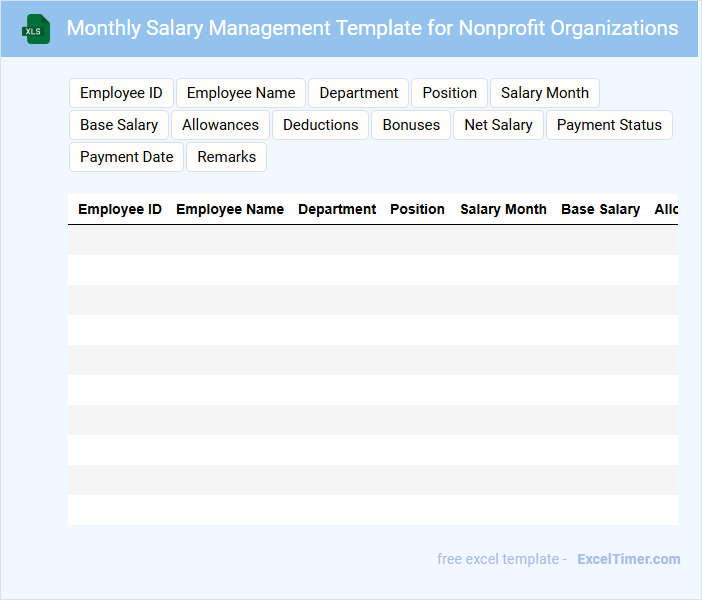

Monthly Salary Management Template for Nonprofit Organizations

This document typically contains structured records of employee salaries, deductions, and benefits tailored for nonprofit organizations.

- Accurate Salary Breakdown: Ensure each employee's salary components and deductions are clearly itemized for transparency.

- Compliance Information: Include relevant tax and regulatory details to maintain nonprofit compliance.

- Budget Tracking: Integrate sections to monitor salary expenses against allocated nonprofit budgets.

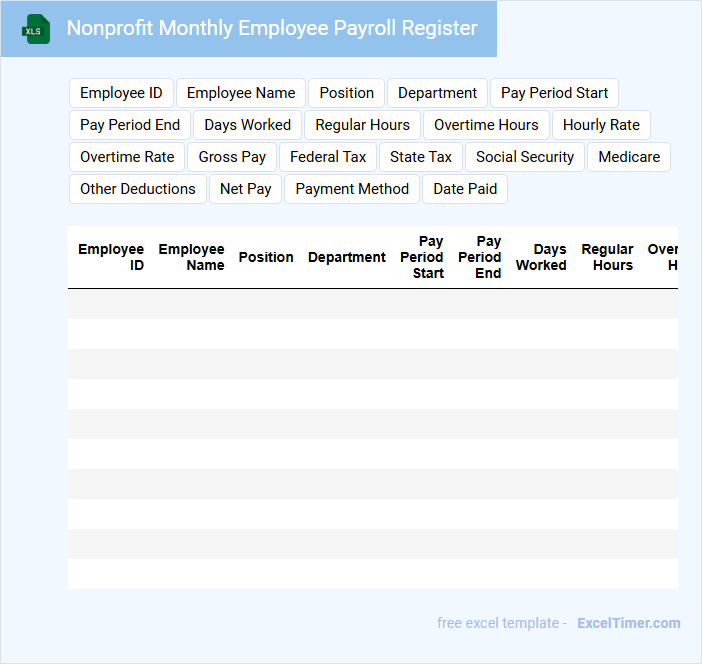

Nonprofit Monthly Employee Payroll Register

The Nonprofit Monthly Employee Payroll Register is a crucial document that records detailed payroll information for all employees within a nonprofit organization each month. It typically includes employee names, hours worked, wages, deductions, and net pay to ensure accurate financial tracking and compliance.

Maintaining an up-to-date payroll register helps in preparing tax documents, budgeting, and auditing processes. It is important to verify all entries regularly for accuracy and adherence to nonprofit regulations to avoid discrepancies.

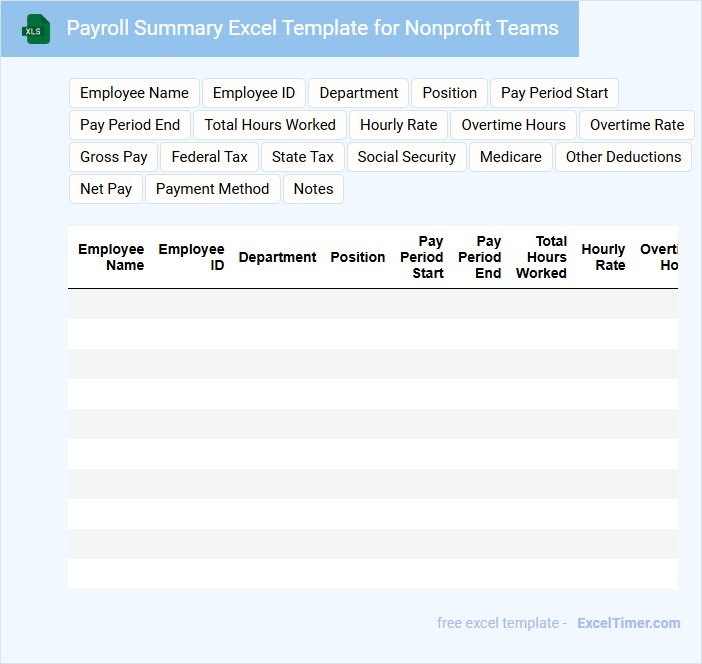

Payroll Summary Excel Template for Nonprofit Teams

A Payroll Summary Excel Template for nonprofit teams typically contains detailed records of employee compensation, including salaries, bonuses, deductions, and net pay. It helps nonprofit organizations maintain accuracy and transparency in managing payroll while complying with relevant regulations. Essential features include clear categorization of payment types, tax withholdings, and summary totals for efficient financial tracking and reporting.

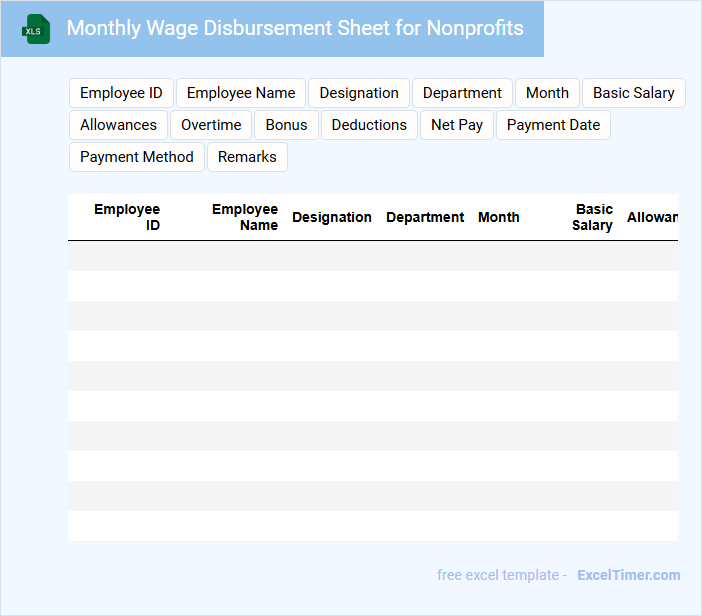

Monthly Wage Disbursement Sheet for Nonprofits

The Monthly Wage Disbursement Sheet for nonprofits typically contains detailed records of employee salaries, including base wages, bonuses, and deductions. It ensures transparency and accountability in how funds are allocated within the organization each month.

This document is essential for maintaining accurate payroll records and complying with legal and financial regulations. Regularly updating and verifying the sheet helps prevent discrepancies and supports smooth financial audits.

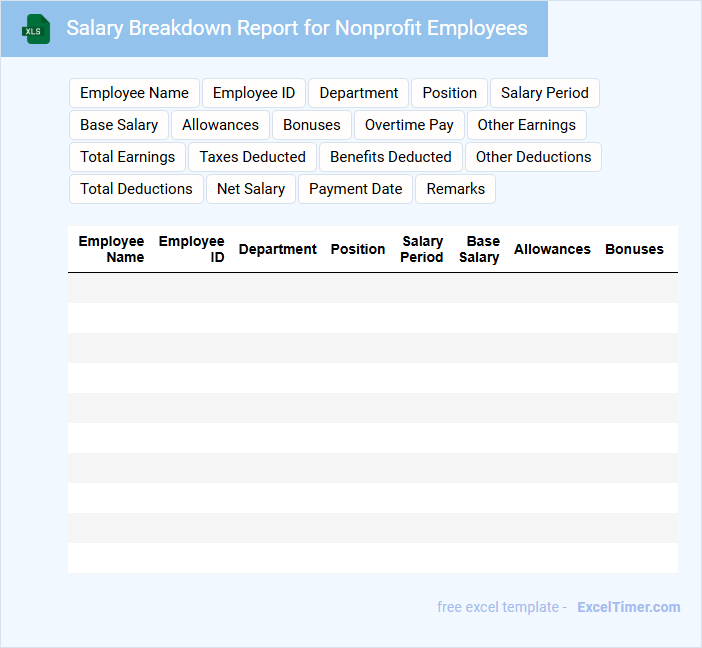

Salary Breakdown Report for Nonprofit Employees

A Salary Breakdown Report for Nonprofit Employees details the various components of employee compensation within a nonprofit organization. It provides transparency and aids in budget planning and salary equity analysis.

- Include base salary, bonuses, and benefits as separate line items.

- Highlight differences in pay by role, department, or tenure to ensure fairness.

- Present totals and averages clearly for easy comparison and decision-making.

Payroll Tracker with Deductions for Nonprofits

A Payroll Tracker with Deductions for nonprofits is a crucial document that records employee salaries and systematically captures all deductions such as taxes, benefits, and retirement contributions. It ensures transparency and compliance with nonprofit financial regulations by accurately reflecting all payroll-related transactions. This tracker also helps nonprofit organizations maintain budget control and streamline financial audits.

Key elements to include are detailed employee information, comprehensive deduction categories, and clear documentation of payment dates and amounts. Incorporating automated calculation features can minimize errors and improve efficiency. Regularly updating and reviewing the tracker is essential for maintaining accuracy and regulatory compliance.

Leave and Payroll Record for Nonprofit Staff

A Leave and Payroll Record for nonprofit staff typically contains detailed information about employee leave balances, payroll calculations, and attendance tracking. This document ensures accurate compensation and compliance with organizational policies and labor laws. It also helps in maintaining transparency and accountability within the nonprofit organization's human resources management.

Nonprofit Payroll Log with Overtime Tracking

A Nonprofit Payroll Log with Overtime Tracking is a document used to record employee work hours and calculate overtime for nonprofit organizations. It ensures accurate payroll processing and compliance with labor laws.

- Include employee details such as name, position, and pay rate.

- Track regular hours separately from overtime hours for clarity.

- Summarize total wages and overtime pay for payroll accuracy.

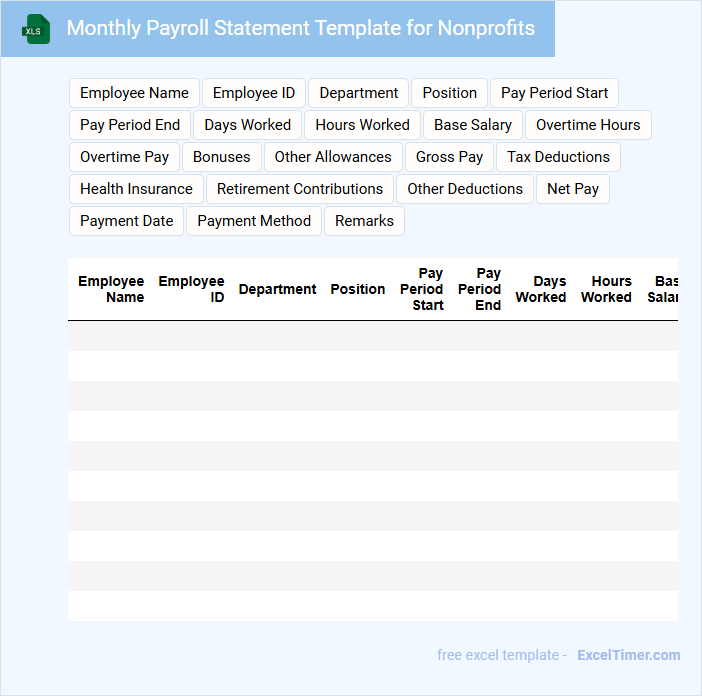

Monthly Payroll Statement Template for Nonprofits

A Monthly Payroll Statement Template for Nonprofits typically includes detailed records of employee wages, hours worked, and deductions for the given month to ensure transparency and compliance. It helps nonprofits manage payroll efficiently while maintaining accurate financial documentation.

- Include clear sections for employee information, pay period, and payment details.

- Ensure compliance with nonprofit tax regulations and reporting requirements.

- Provide space for notes on benefits, bonuses, and deductions specific to nonprofit employees.

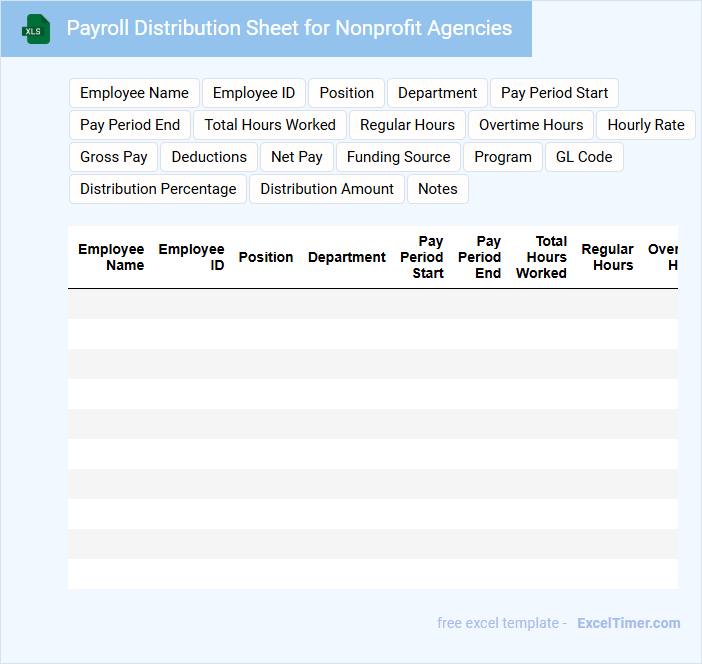

Payroll Distribution Sheet for Nonprofit Agencies

A Payroll Distribution Sheet for Nonprofit Agencies typically contains detailed records of employee wages, hours worked, and the allocation of payroll expenses to various funding sources. This document ensures accurate financial tracking and compliance with grant requirements.

- Include clear identification of each employee with corresponding job titles and pay rates.

- Break down payroll expenses according to specific grants or funding sources.

- Ensure regular updates and approvals from authorized personnel to maintain accuracy.

Wage and Benefit Tracking for Nonprofit Organizations

A wage and benefit tracking document for nonprofit organizations typically contains detailed records of employee salaries, benefits, and related compensation information. It ensures compliance with labor laws and helps maintain transparency in financial management. Accurate tracking is crucial for budgeting and reporting to stakeholders.

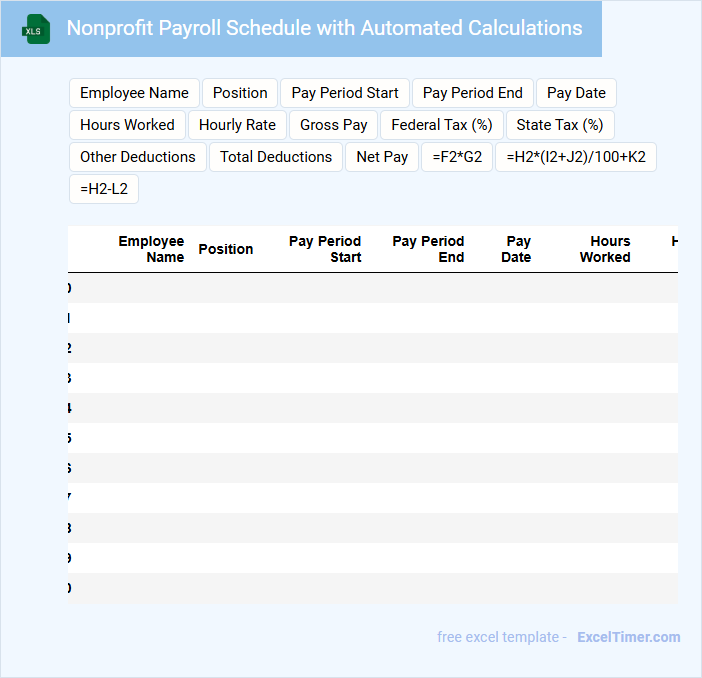

Nonprofit Payroll Schedule with Automated Calculations

A Nonprofit Payroll Schedule is a structured document used to organize and track employee payment periods, including salaries, wages, and deductions specific to nonprofit organizations. It typically contains detailed information such as pay dates, employee names, hours worked, tax withholdings, and benefits contributions. Automated calculations ensure accuracy, minimize errors, and save time during payroll processing.

For optimal use, ensure the schedule integrates compliance checks for nonprofit-specific tax regulations and includes provisions for different employee classifications. It is important to maintain transparency and regularly update the schedule to reflect changes in staffing or payroll policies. Incorporating automated reminders and audit trails enhances accountability and operational efficiency.

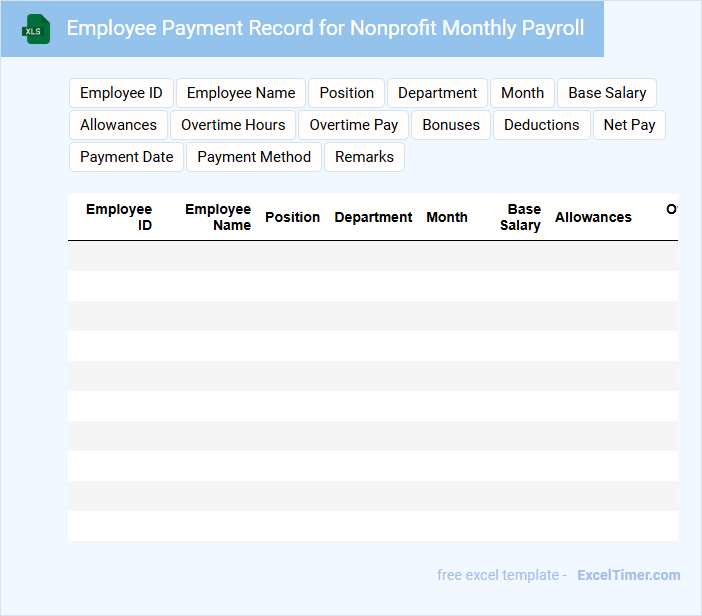

Employee Payment Record for Nonprofit Monthly Payroll

The Employee Payment Record for a nonprofit organization's monthly payroll typically contains detailed information about each employee's earnings, deductions, and net pay. It serves as an essential document for maintaining transparency and ensuring compliance with financial regulations. Accurate record-keeping of this document supports effective budget management and audit readiness.

How do you structure a monthly payroll worksheet for nonprofit staff and volunteers in Excel?

Structure your monthly payroll worksheet by creating separate columns for employee or volunteer names, roles, hours worked, hourly rates, and total pay. Include additional fields for tax deductions, benefits, and any reimbursements specific to nonprofit regulations. Use Excel formulas to automate calculations, ensuring accuracy and easy updates each month.

What essential columns are required for tracking salaries, deductions, and net pay in a nonprofit payroll spreadsheet?

Essential columns for a nonprofit payroll spreadsheet include Employee Name, Employee ID, Position, and Department for identification. Salary Details such as Gross Salary, Hours Worked, and Overtime Hours ensure accurate pay calculation. Deductions like Tax Withheld, Retirement Contributions, Health Insurance, and Other Deductions track mandatory and voluntary withholdings. The spreadsheet must also include Net Pay to reflect the employee's take-home amount, along with Payment Date and Payment Method for record-keeping.

How can Excel formulas automate calculations for taxes and benefit contributions in monthly payroll?

Excel formulas automate monthly payroll calculations by accurately computing taxes and benefit contributions based on predefined rates and thresholds. You can set formulas to deduct federal, state, and local taxes, while simultaneously calculating employer and employee benefit amounts such as health insurance or retirement plan contributions. This automation minimizes errors and saves time, ensuring precise and efficient nonprofit payroll management.

What measures should be implemented in Excel to ensure compliance with nonprofit reporting requirements?

Implement data validation and standardized payroll templates in Excel to ensure accurate and consistent reporting for nonprofit organizations. Use built-in formulas to automate tax calculations and track employee benefits while maintaining detailed records for audit readiness. Your workbook should include clearly defined fields for grant tracking and donation-related payroll adjustments to align with nonprofit compliance standards.

How do you securely manage and update sensitive employee payroll data within an Excel document?

Securely managing and updating sensitive employee payroll data in an Excel document involves enabling password protection and restricting file access to authorized personnel only. Use Excel's data validation and protection features to prevent unauthorized changes and regularly back up the document to secure locations. Implement audit trails by tracking changes and use encryption to safeguard sensitive payroll information.

What are the key components included in a monthly payroll sheet for nonprofit organizations?

A monthly payroll sheet for nonprofit organizations includes employee names, hours worked, pay rates, and total wages. It also tracks tax withholdings, benefits deductions, and employer contributions to comply with regulations. Your document ensures accurate compensation and financial accountability for your nonprofit's payroll management.

How do you account for grant-funded staff salaries in a nonprofit's payroll document?

Grant-funded staff salaries in a nonprofit's monthly payroll document are recorded by allocating wages to specific grant accounts with detailed budget codes. You should ensure accurate tracking by linking each salary entry to the corresponding grant funding source and compliance requirements. This approach maintains transparent financial reporting and supports efficient grant management.

Which Excel functions help automate tax and deduction calculations in monthly payroll for nonprofits?

Excel functions like SUMPRODUCT and VLOOKUP streamline tax and deduction calculations in monthly payroll for nonprofits by automating percentage-based tax rates and lookup tables. IF and nested IF functions handle conditional deductions and eligibility criteria efficiently. Integrating these functions reduces manual errors and ensures accurate payroll processing.

How should you structure employee classifications and roles in an Excel payroll document for nonprofit compliance?

Structure employee classifications in the Excel payroll document by clearly separating roles such as full-time, part-time, contractors, and volunteers to ensure compliance with nonprofit regulations. Include columns for job titles, salary or hourly rates, tax-exempt status, and benefit eligibility specific to nonprofit standards. Ensure payroll categories align with IRS guidelines and state labor laws to accurately track compensation and reporting requirements.

What are the best practices for maintaining payroll confidentiality and data integrity in Excel for nonprofits?

Maintain payroll confidentiality in Excel for nonprofits by encrypting files with strong passwords and restricting access to authorized personnel only. Use Excel's built-in data validation and audit trail features to ensure data integrity and prevent unauthorized modifications. Regularly back up payroll files to secure locations to recover data in case of corruption or loss.