The Monthly Profit and Loss Excel Template for Etsy Sellers helps track income and expenses, providing a clear overview of monthly financial performance. It simplifies the process of calculating net profit by organizing sales, fees, and costs in one place. Accurate record-keeping using this template supports better budgeting and strategic decision-making for Etsy entrepreneurs.

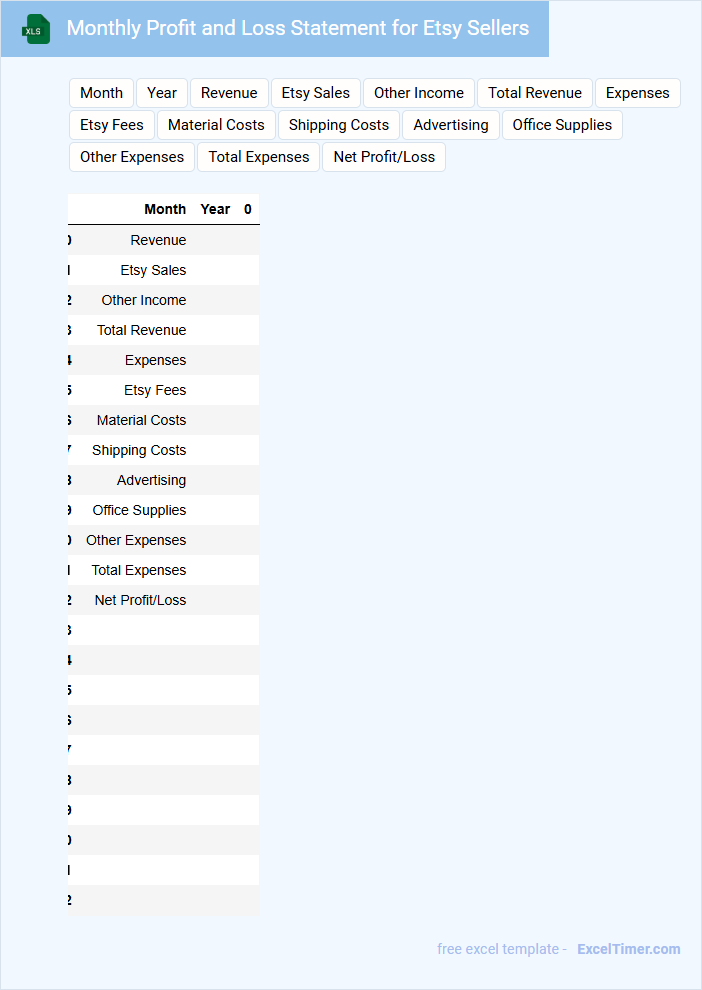

Monthly Profit and Loss Statement for Etsy Sellers

A Monthly Profit and Loss Statement for Etsy Sellers is a financial document summarizing income and expenses over a specific month, providing insight into business profitability. It helps sellers track performance and make informed decisions.

- Include detailed sales revenue from all Etsy listings.

- Record all expenses such as materials, shipping, and platform fees.

- Highlight net profit or loss to assess overall financial health.

Etsy Seller Monthly Income and Expense Tracker

What information is typically included in an Etsy Seller Monthly Income and Expense Tracker? This type of document usually contains detailed records of monthly sales revenue, listing fees, shipping costs, and other expenses related to running an Etsy store. It helps sellers monitor profitability and manage cash flow effectively by organizing all financial transactions in one place.

What is an important suggestion for using an Etsy Seller Monthly Income and Expense Tracker? It is essential to consistently update the tracker with accurate data to avoid discrepancies and gain clear insights into financial performance. Additionally, categorizing expenses properly enables better tax preparation and strategic business planning.

Monthly P&L Report for Etsy Shop Owners

The Monthly P&L Report for Etsy Shop Owners typically contains a summary of income, expenses, and net profit for efficient business tracking.

- Revenue Details: Breakdown of all sales including product categories and discounts applied.

- Expense Tracking: Itemized costs such as materials, shipping, and Etsy fees.

- Profit Analysis: Clear calculation of net profit to evaluate business performance monthly.

Profit and Loss Spreadsheet for Etsy Sellers

What information is typically included in a Profit and Loss Spreadsheet for Etsy Sellers? This document usually contains detailed records of all revenue generated from sales, costs of goods sold, and various business expenses related to running an Etsy shop. It provides a clear view of net profit or loss over a specific period, helping sellers understand financial performance and make informed decisions.

What important factors should Etsy sellers consider when using this spreadsheet? It is essential to accurately track all sales transactions, include fees such as listing and transaction fees, and regularly update inventory costs to maintain precision. Monitoring seasonal trends and differentiating between variable and fixed expenses will enhance the effectiveness of financial analysis.

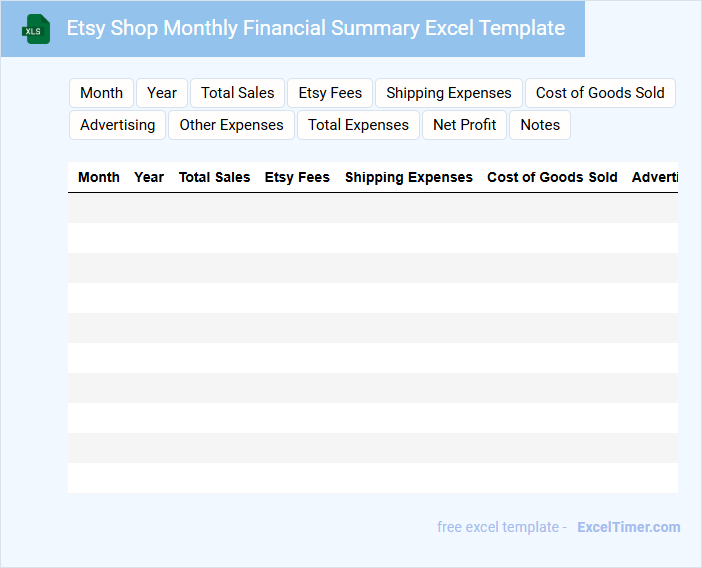

Etsy Shop Monthly Financial Summary Excel Template

An Etsy Shop Monthly Financial Summary Excel Template typically contains detailed records of sales, expenses, and profits, allowing shop owners to track their financial performance each month. It includes sections for revenue sources, cost of goods sold, and overhead expenses to provide a comprehensive overview.

This document is essential for maintaining accurate financial records, making tax preparation easier, and helping identify trends in the business. One important suggestion is to regularly update the template with all transactions to ensure data accuracy and insightful financial analysis.

Monthly Sales and Expenses Tracker for Etsy Businesses

What information is typically included in a Monthly Sales and Expenses Tracker for Etsy Businesses? This document usually contains detailed records of monthly sales, revenue, and all business-related expenses, helping sellers monitor their financial health. It also often includes categories for product costs, shipping fees, advertising expenses, and net profit calculation to provide a clear overview of monthly performance.

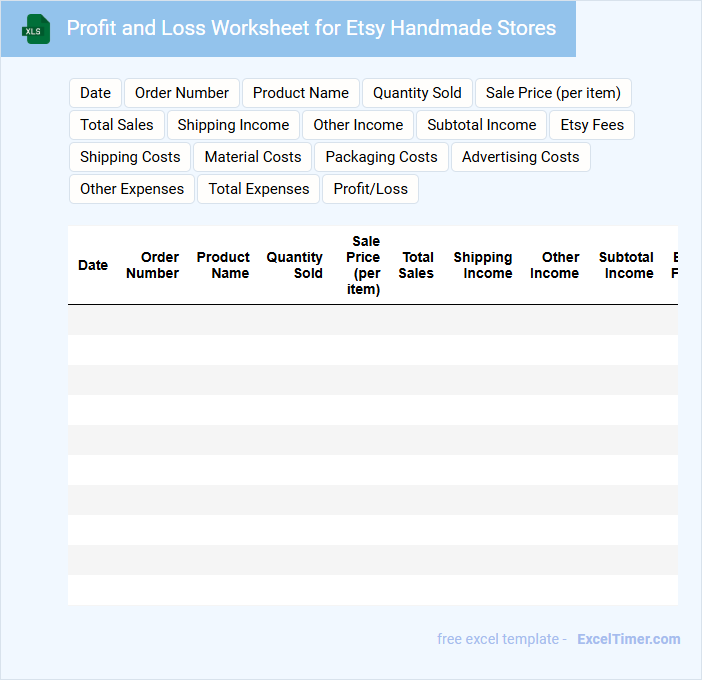

Profit and Loss Worksheet for Etsy Handmade Stores

A Profit and Loss Worksheet for Etsy Handmade Stores typically contains detailed records of income and expenses related to the business. It helps sellers track revenue from sales, cost of materials, and other operational expenses. This document is crucial for understanding overall profitability and financial health.

Important elements to include are total sales, cost of goods sold, shipping fees, Etsy fees, and advertising expenses. Regularly updating this worksheet enables better budget management and tax preparation. Ensuring accuracy in recording transactions will provide clearer insights into business performance.

Monthly Profit Breakdown for Etsy Sellers

A Monthly Profit Breakdown for Etsy Sellers is a detailed financial document that tracks income and expenses over a given month to evaluate profitability. This report helps sellers understand their financial performance and make informed business decisions.

- Include total sales revenue and cost of goods sold to calculate gross profit.

- List all operating expenses such as shipping, fees, and marketing costs clearly.

- Highlight net profit and compare it with previous months for trend analysis.

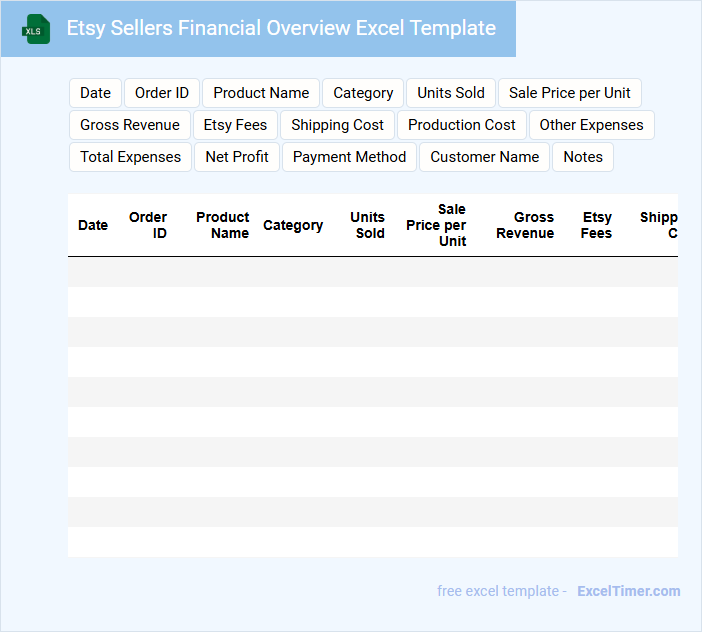

Etsy Sellers Financial Overview Excel Template

An Etsy Sellers Financial Overview Excel Template typically contains essential financial data such as sales records, expenses, profits, and taxes. This document helps sellers track their monthly and annual performance efficiently. It often includes customizable charts and summary tables for quick analysis.

Important elements to include are accurate transaction logs, categorized expense tracking, and clear profit margins. Regularly updating the template ensures reliable financial insights for better decision-making. Additionally, integrating tax calculations and inventory cost management can enhance financial control.

Monthly Income Statement with Expense Tracker for Etsy Sellers

A Monthly Income Statement with Expense Tracker for Etsy Sellers is a financial document used to record and analyze monthly earnings and expenditures related to an Etsy shop. It helps sellers monitor profitability and manage business finances effectively.

- Include all sources of income from Etsy sales and related revenue streams.

- Track all business expenses, such as materials, shipping, and Etsy fees.

- Summarize net profit or loss to evaluate financial health monthly.

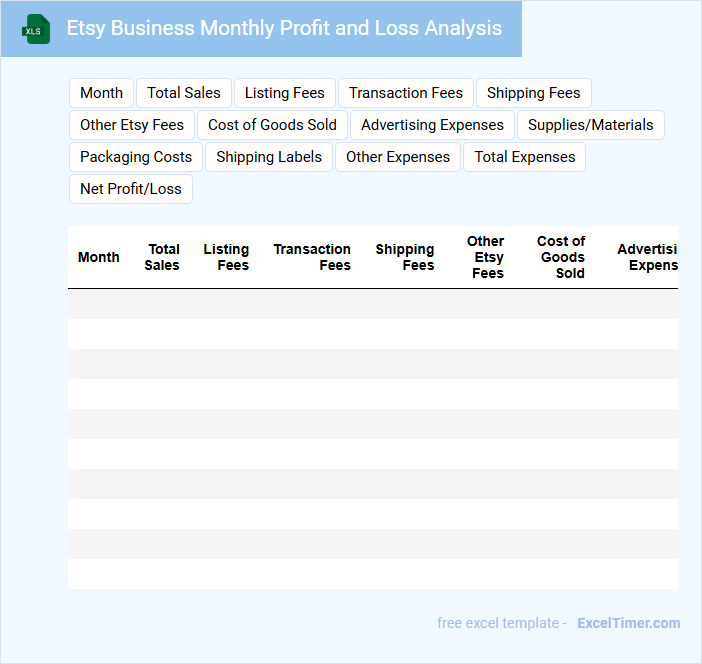

Etsy Business Monthly Profit and Loss Analysis

What information is typically contained in an Etsy Business Monthly Profit and Loss Analysis? This document usually includes detailed records of all income generated from sales and all expenses incurred during the month, providing a clear picture of the business's financial performance. It helps Etsy sellers track profitability, identify cost trends, and make informed decisions to optimize operations.

What important factors should be considered when preparing this analysis? Key elements to focus on include accurately categorizing income and expenses, consistently updating records, and reviewing trends over time to identify opportunities for growth or cost reduction. Ensuring data accuracy and timely analysis supports better financial planning and business sustainability.

Monthly Financial Tracker for Etsy Store Owners

A Monthly Financial Tracker for Etsy Store Owners typically contains detailed records of income, expenses, and profit to help manage and optimize store finances efficiently.

- Income Monitoring: Track all sources of revenue including sales, shipping fees, and discounts to understand overall earnings.

- Expense Categorization: Record costs such as materials, shipping, advertising, and Etsy fees to identify spending patterns.

- Profit Analysis: Calculate net profit monthly to assess store performance and make informed business decisions.

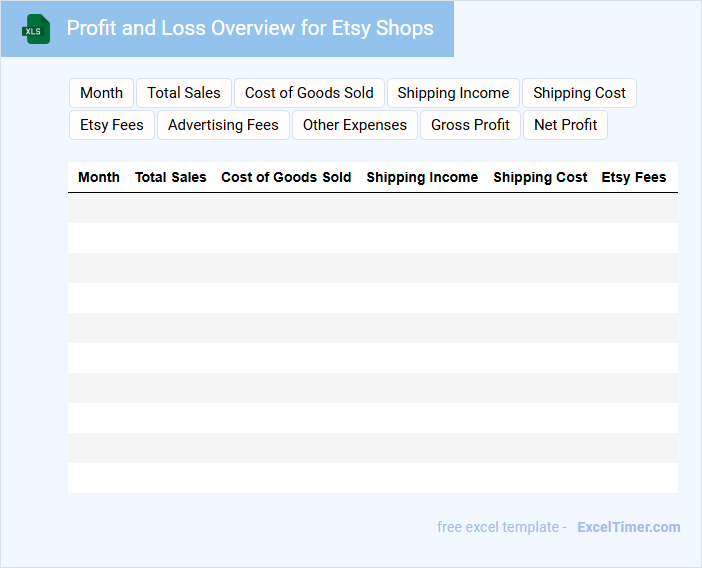

Profit and Loss Overview for Etsy Shops

What information does a Profit and Loss Overview for Etsy Shops typically contain? This document usually includes detailed records of all revenues, costs, and expenses related to the shop's operations, providing a clear picture of financial performance over a specific period. It helps Etsy sellers track profitability, manage cash flow, and make informed business decisions.

What important factors should be included in this overview? Key components like total sales, cost of goods sold (COGS), operating expenses, and net profit are essential for accuracy. Additionally, categorizing expenses and tracking trends over time can help identify areas for cost reduction and revenue growth.

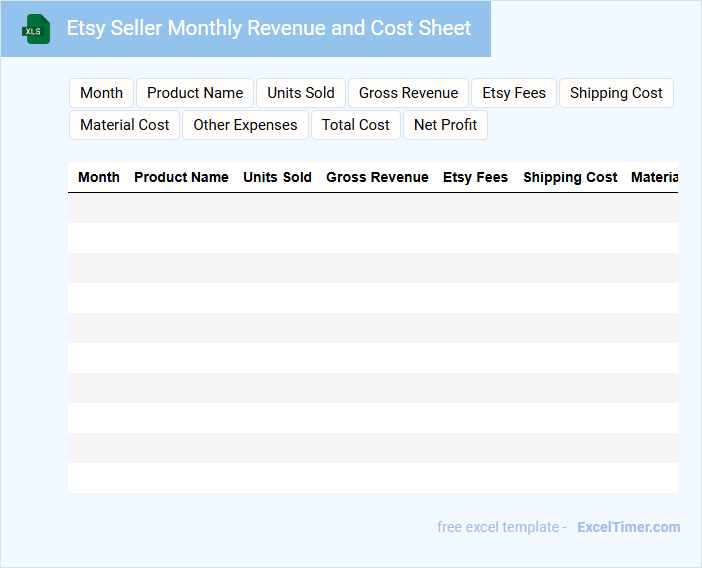

Etsy Seller Monthly Revenue and Cost Sheet

The Etsy Seller Monthly Revenue and Cost Sheet is a financial document that tracks income and expenses related to an Etsy shop's operations. It typically includes details on monthly sales, cost of goods sold, and various operating expenses such as shipping and advertising. This document is crucial for analyzing profitability and making informed business decisions.

Key elements to include are accurate revenue records, detailed cost breakdowns, and periodic updates. Ensuring data consistency and using clear categories for expenses improves financial tracking and budgeting. Regular review of this sheet helps optimize pricing strategies and manage cash flow effectively.

Monthly Cash Flow and Profit Tracker for Etsy Sellers

This document typically contains a summary of monthly income and expenses to help Etsy sellers monitor their financial performance.

- Income Sources: Tracks all revenue streams including sales, shipping fees, and discounts applied.

- Expenses Overview: Lists costs such as materials, marketing, platform fees, and shipping supplies.

- Profit Calculation: Summarizes net profit by subtracting total expenses from total income to gauge business health.

What are the key columns needed in an Excel sheet to track monthly income and expenses for Etsy sales?

Key columns for tracking monthly income and expenses in an Etsy sales Excel sheet include Date, Sales Revenue, Product Costs, Shipping Fees, Etsy Fees, Advertising Expenses, and Net Profit. Including Payment Processing Fees and Refunds enhances accuracy in profit calculation. Categorizing expenses by type streamlines financial analysis and tax reporting.

How can formulas be used in Excel to automatically calculate monthly net profit for an Etsy shop?

Excel formulas like =SUM() can total monthly sales and expenses, while =A1-B1 calculates net profit by subtracting total costs from total revenue. Using functions such as =SUMIF() allows sellers to categorize income and expenses by type or date for accurate monthly calculations. Incorporating these formulas automates profit analysis, streamlining financial tracking for Etsy shops.

What Excel functions help categorize and summarize different types of Etsy expenses (e.g., materials, shipping, fees)?

Excel functions like SUMIF, VLOOKUP, and PivotTables help categorize and summarize Etsy expenses such as materials, shipping, and fees. Using SUMIF allows you to total expenses based on specific categories, while PivotTables enable dynamic data grouping and analysis for monthly profit and loss tracking. Your Etsy seller Excel document benefits from these functions by providing clear insights into expense distribution.

How does one create a visual chart in Excel to represent profit and loss trends over multiple months?

To create a visual chart in Excel representing profit and loss trends over multiple months, first organize your data with months in one column and corresponding profit and loss figures in adjacent columns. Highlight the data range, then insert a Line Chart or a Column Chart from the Insert tab to clearly display trends over time. Customize the chart with titles, labels, and distinct colors for profit and loss to enhance clarity and insights.

Why is it important to regularly update and reconcile Etsy sales data in your Excel monthly profit and loss document?

Regularly updating and reconciling Etsy sales data in your Excel monthly profit and loss document ensures accurate tracking of revenue, expenses, and net profit. It helps identify discrepancies, prevent financial errors, and provide clear insights for informed business decisions. Consistent data management supports better cash flow analysis and tax reporting for Etsy sellers.