The Monthly Payroll Excel Template for Startups streamlines employee salary calculations and tax deductions, ensuring accuracy and saving time for new businesses. This customizable template supports tracking multiple employees, managing bonuses, and generating monthly payment summaries. Reliable payroll management is crucial for startups to maintain compliance and employee satisfaction.

Monthly Payroll Excel Template for Startups

The Monthly Payroll Excel Template for startups is a crucial document designed to manage employee salaries accurately and efficiently. It typically contains employee details, salary calculations, deductions, and payment summaries. Ensuring data accuracy and timely updates is essential for maintaining financial compliance and employee satisfaction.

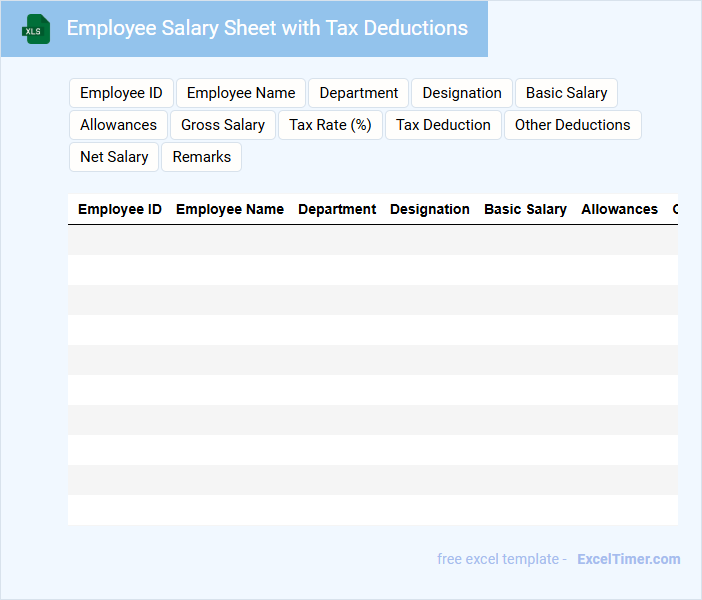

Employee Salary Sheet with Tax Deductions

Employee Salary Sheets with Tax Deductions typically contain detailed information about an employee's earnings and the taxes subtracted by the employer.

- Gross Salary: The total amount earned by the employee before any deductions.

- Tax Deductions: Various taxes withheld such as income tax, social security, and other statutory contributions.

- Net Salary: The final amount payable to the employee after all deductions.

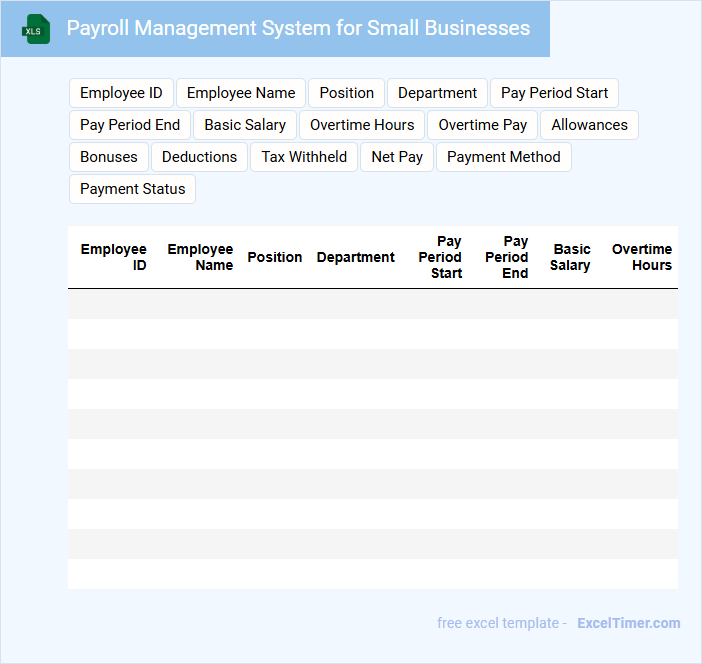

Payroll Management System for Small Businesses

The Payroll Management System document typically contains detailed descriptions of software functionalities designed to automate employee payment processes. It outlines key components such as salary calculations, tax deductions, attendance tracking, and compliance with labor laws. Additionally, it provides implementation guidelines to ensure accurate and efficient payroll processing for small businesses.

Important aspects to consider include seamless integration with accounting systems, data security, and user-friendly interfaces to simplify payroll management. Regular updates for legal compliance and automated report generation enhance transparency and accuracy. Prioritizing scalability will accommodate business growth without compromising performance or usability.

Monthly Expenses Tracker for Payroll

What information is typically included in a Monthly Expenses Tracker for Payroll? This type of document usually contains detailed records of employee salaries, bonuses, tax deductions, and other payroll-related expenses. It helps organizations monitor their monthly payroll costs accurately to maintain budget control and ensure timely payment.

Why is it important to maintain a Monthly Expenses Tracker for Payroll? Keeping an organized and up-to-date tracker ensures compliance with tax regulations, prevents payroll errors, and facilitates financial planning. Including categories such as employee names, pay periods, gross pay, deductions, and net pay makes the tracker comprehensive and effective.

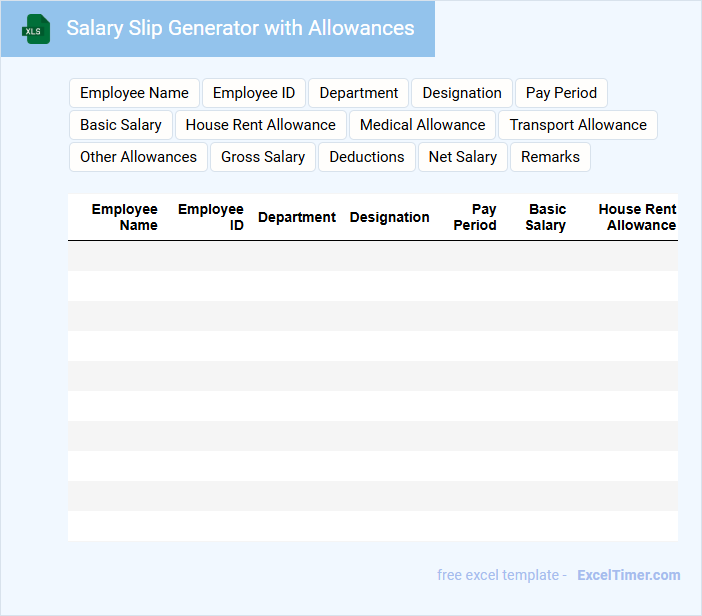

Salary Slip Generator with Allowances

A Salary Slip Generator with Allowances is a tool designed to create detailed salary slips that include various allowances for employees. It typically helps in automating payroll processes and ensuring accurate salary calculations.

- Include all components such as basic salary, allowances, deductions, and net pay.

- Ensure compliance with local tax and labor laws.

- Provide clear breakdowns and customizable formats for transparency.

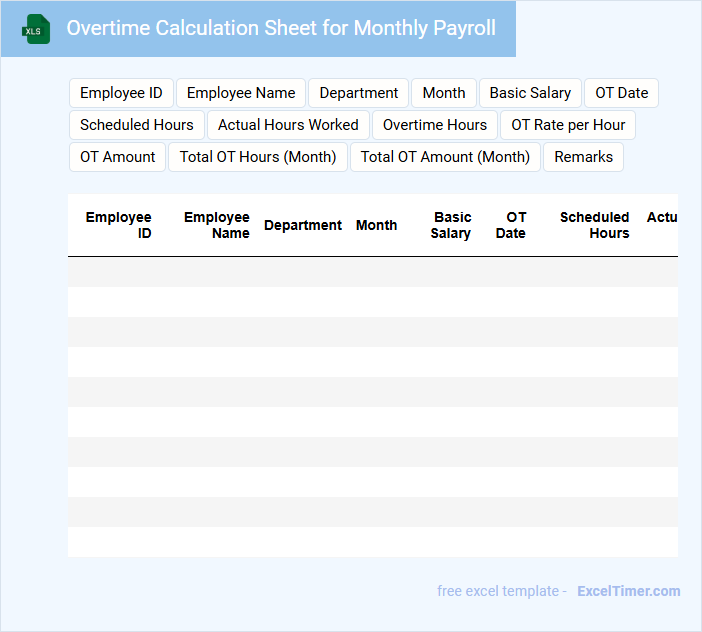

Overtime Calculation Sheet for Monthly Payroll

An Overtime Calculation Sheet for Monthly Payroll typically contains detailed records of employee work hours exceeding regular schedules, including dates, hours worked, and overtime rates. This document ensures accurate compensation by accounting for all extra time worked beyond standard hours.

It is crucial for payroll departments to maintain precise and timely data to avoid errors in salary disbursement and comply with labor regulations. Regular updates and verification of entries improve transparency and support audit processes.

Attendance and Payroll Tracker for Startups

An Attendance and Payroll Tracker is essential for startups to efficiently monitor employee working hours and manage salary computations. This document typically contains records of attendance, leave, overtime, and payroll details. For accuracy, it is important to ensure real-time data entry and automated calculations.

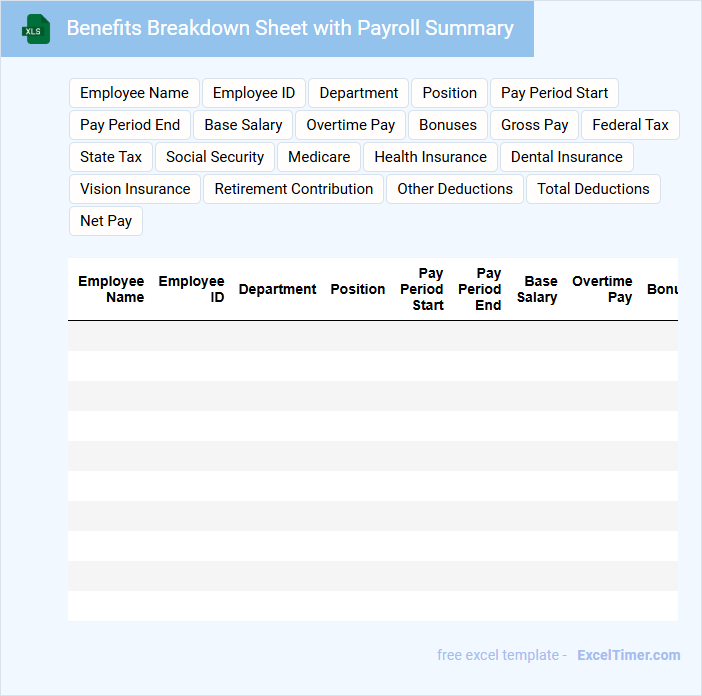

Benefits Breakdown Sheet with Payroll Summary

A Benefits Breakdown Sheet with Payroll Summary is a document that details employee benefits alongside their payroll information. It includes data such as health insurance, retirement contributions, and wage deductions.

This document helps employers and employees clearly understand compensation and benefits distribution. Ensuring accuracy and confidentiality are important aspects when handling this sheet.

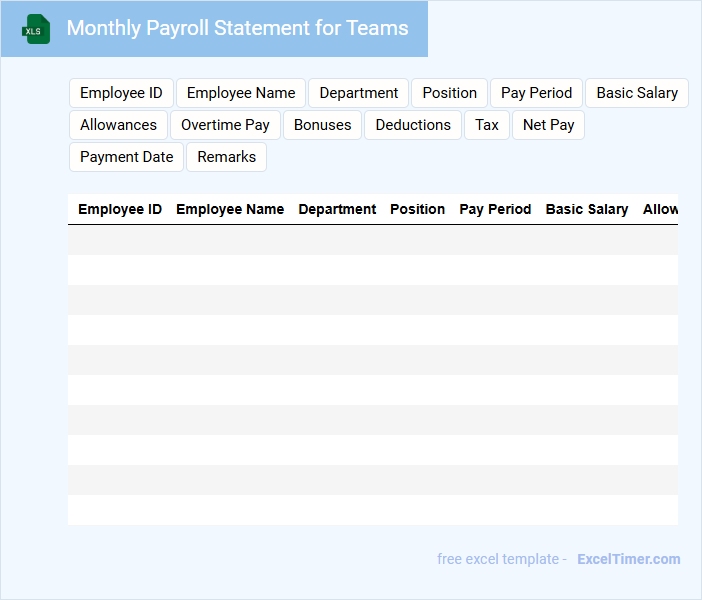

Monthly Payroll Statement for Teams

A Monthly Payroll Statement is a document detailing the total earnings, deductions, and net pay of each employee within a team for a given month. It serves as an official record for both employers and employees to verify salary transactions.

Key components usually include hours worked, salary rates, taxes, benefits, and any additional bonuses or deductions. Ensuring accuracy and confidentiality is crucial when handling these statements to maintain trust and compliance.

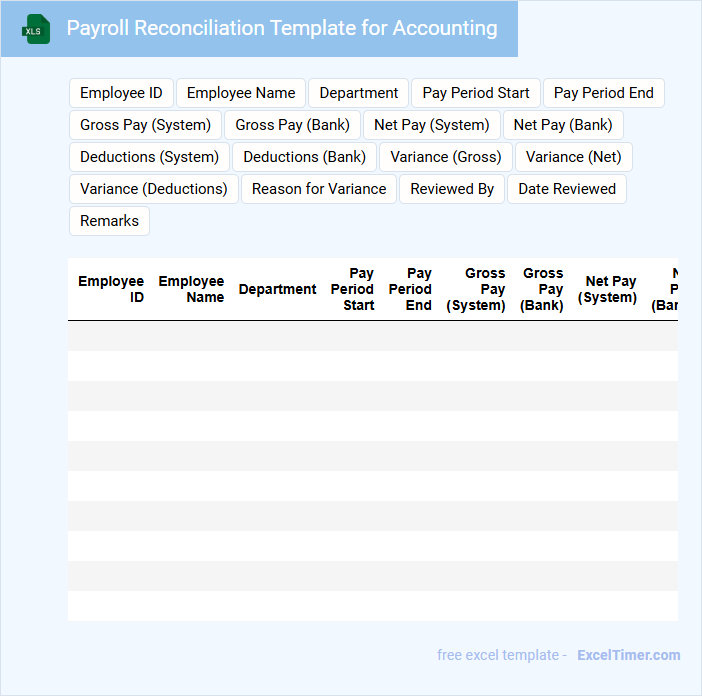

Payroll Reconciliation Template for Accounting

Payroll Reconciliation Template for Accounting is a crucial document used to verify payroll data against accounting records. This template helps ensure accuracy in employee payments and tax deductions by cross-checking payroll totals with general ledger entries. Regular use of this document prevents discrepancies, aiding in precise financial reporting and compliance.

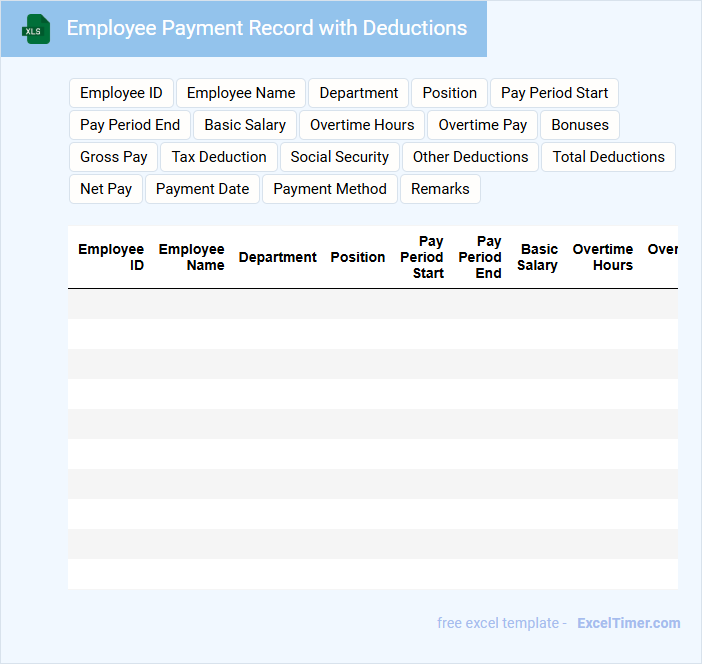

Employee Payment Record with Deductions

What information is typically contained in an Employee Payment Record with Deductions? This type of document usually includes details about an employee's gross wages, various deductions such as taxes, benefits, and other withholdings, and the net pay amount. It helps in maintaining accurate financial records and ensures transparency in payroll processing.

What important aspects should be considered when preparing this record? Ensuring accuracy in calculation of deductions, clear labeling of each deduction type, and compliance with legal and tax regulations are crucial for both employers and employees. Proper documentation also aids in resolving payroll disputes and simplifies auditing processes.

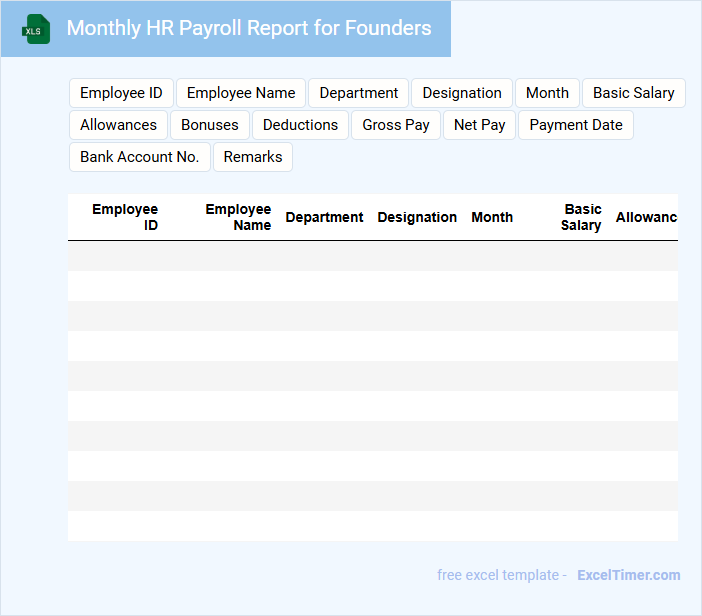

Monthly HR Payroll Report for Founders

A Monthly HR Payroll Report for founders typically contains detailed information on employee salaries, bonuses, deductions, and benefits processed within the month. It ensures transparency and accuracy in payroll management, reflecting the company's financial commitments to its staff.

This document also includes summaries of tax withholdings and compliance with labor laws, crucial for legal and auditing purposes. Founders should pay close attention to data accuracy and timely submission to avoid financial discrepancies and regulatory penalties.

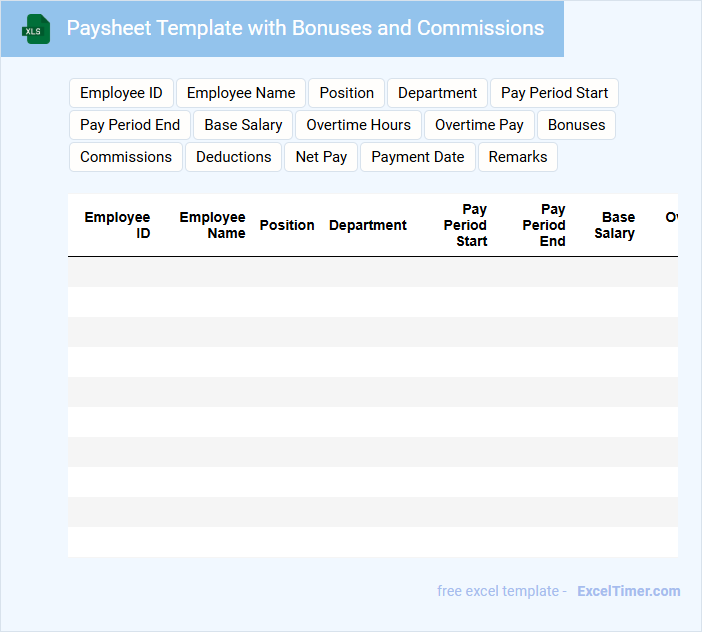

Paysheet Template with Bonuses and Commissions

A paysheet template with bonuses and commissions is a detailed financial document designed to track employee earnings, including base salary, incentives, and variable payments. It usually contains sections for regular wages, bonus amounts, commission rates, and total compensation, helping businesses manage payroll efficiently. Incorporating clear categories and formulas ensures accuracy and simplifies tax and accounting processes.

Wage Distribution Sheet for Growing Companies

A Wage Distribution Sheet for growing companies typically contains detailed records of employee salaries, bonuses, and deductions. This document helps ensure transparent and accurate payroll management, which is crucial as the workforce expands. It is important to regularly update and verify the sheet to maintain compliance with labor laws and prevent payroll errors.

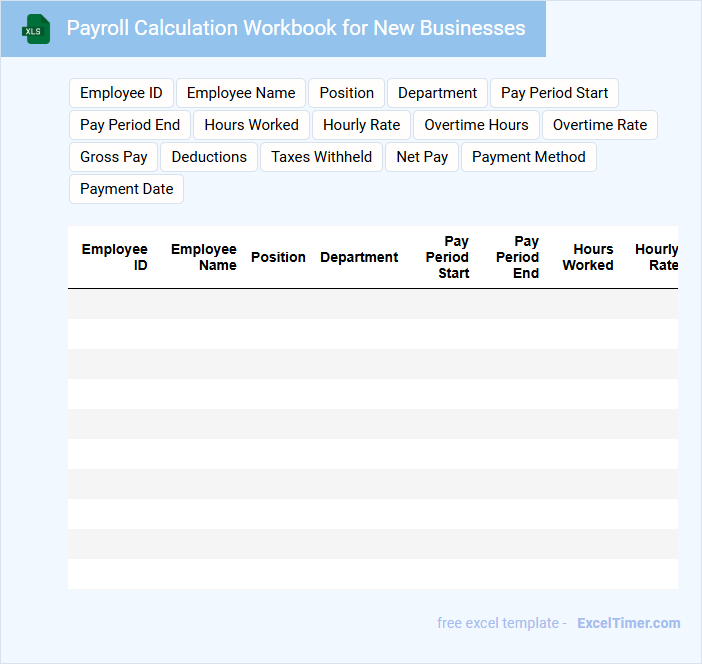

Payroll Calculation Workbook for New Businesses

A Payroll Calculation Workbook for new businesses is a structured document designed to organize and automate payroll processing tasks. It typically contains employee details, salary computations, tax deductions, and benefit calculations. Ensuring accuracy and compliance with tax regulations is crucial for smooth payroll management in startups.

What essential payroll components (e.g., salaries, taxes, benefits) should be included in a startup's monthly payroll Excel sheet?

A startup's monthly payroll Excel sheet should include essential components such as employee salaries, federal and state tax withholdings, Social Security and Medicare contributions, and payroll taxes. It must also account for employee benefits like health insurance, retirement contributions, and any bonuses or commissions. Accurate tracking of deductions and net pay ensures compliance and financial clarity for payroll management.

How can you structure an Excel document to automatically calculate gross and net pay for each employee every month?

Structure your Excel document with columns for employee hours, hourly rates, and tax deductions to automatically calculate gross and net pay each month. Use formulas like =Hours*Rate for gross pay and =GrossPay-Taxes for net pay. Incorporate lookup tables for tax rates and benefits to ensure accurate, dynamic payroll calculations tailored to your startup's needs.

Which Excel formulas and functions are most effective for tracking payroll deductions and contributions in real time?

Excel formulas like SUMIFS and VLOOKUP efficiently track payroll deductions and contributions by enabling real-time aggregation and data retrieval. Using IF statements combined with AND/OR functions helps apply conditional logic for complex payroll rules. Your payroll tracking improves by integrating Excel's dynamic named ranges and pivot tables for accurate, up-to-date analysis.

How should you organize payroll data in Excel to ensure compliance and facilitate easy auditing for startups?

Organize payroll data in Excel by creating separate columns for employee details, payment dates, gross pay, deductions, taxes, and net pay to maintain clarity and compliance. Use consistent formatting and data validation to prevent errors and enable automatic calculations, ensuring accuracy. Implement hidden sheets for tax rates and deduction codes to simplify updates and facilitate efficient auditing for startups.

What are the best practices for securing sensitive payroll information within an Excel document for a startup?

Protect your startup's payroll information in an Excel document by enabling password encryption and restricting access to authorized personnel only. Use Excel's built-in data protection features like cell locking and hiding sensitive columns to prevent unauthorized viewing or editing. Regularly back up your payroll file and consider storing it in a secure, encrypted cloud service to ensure data integrity and confidentiality.