The Monthly Expense Excel Template for College Students helps track and manage personal finances efficiently, ensuring students stay within their budget. It includes categorized expense entries, automatic calculations, and visual charts for clear financial insights. Using this template promotes financial discipline and prevents overspending during college life.

Monthly Expense Tracker for College Students

A Monthly Expense Tracker for College Students is a document designed to help students monitor and manage their monthly expenditures effectively. It provides a clear overview of where money is being spent to promote better budgeting habits.

- Include categories such as housing, food, transportation, and entertainment to organize expenses clearly.

- Record expenses daily or weekly to maintain accuracy and avoid missing any costs.

- Compare monthly spending against a set budget to identify areas for potential savings.

Budget Spreadsheet for College Student Expenses

A budget spreadsheet for college student expenses typically contains detailed categories such as tuition fees, housing costs, food, transportation, and personal spending. It helps students track their income sources like scholarships, part-time jobs, or parental support against their expenses. Maintaining this document assists in managing finances efficiently and avoiding overspending.

Important elements to include are clear expense categories, realistic monthly income estimates, and regular updates to reflect changes in spending habits. Utilizing formulas for automatic calculations and setting financial goals can improve budget accuracy and planning. Additionally, including a savings section encourages building an emergency fund or preparing for future expenses.

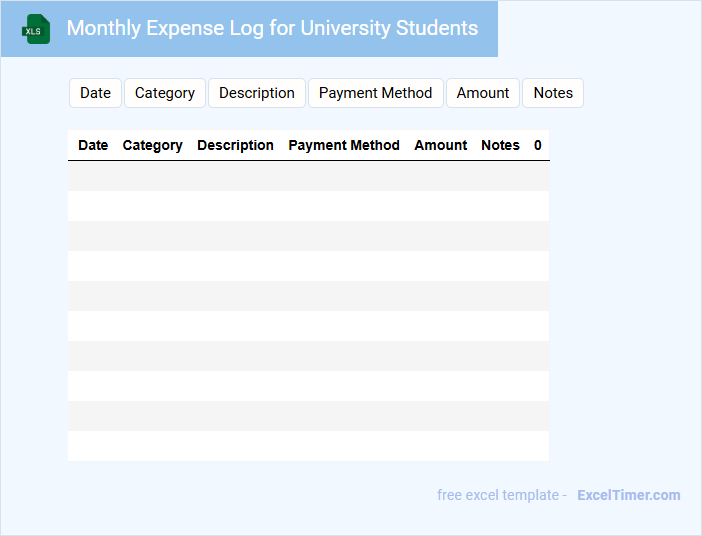

Monthly Expense Log for University Students

A Monthly Expense Log for university students typically contains detailed records of all monthly expenditures, including rent, food, transportation, and study materials. It helps students track their spending habits and manage their budgets effectively. Maintaining this log regularly promotes financial awareness and prevents overspending.

Important elements to include are categories for fixed and variable expenses, date and amount of each transaction, and a summary section for total monthly expenses. Additionally, adding a comparison with the budgeted amounts can highlight areas that need adjustment. Using digital tools or apps can enhance accuracy and ease of tracking.

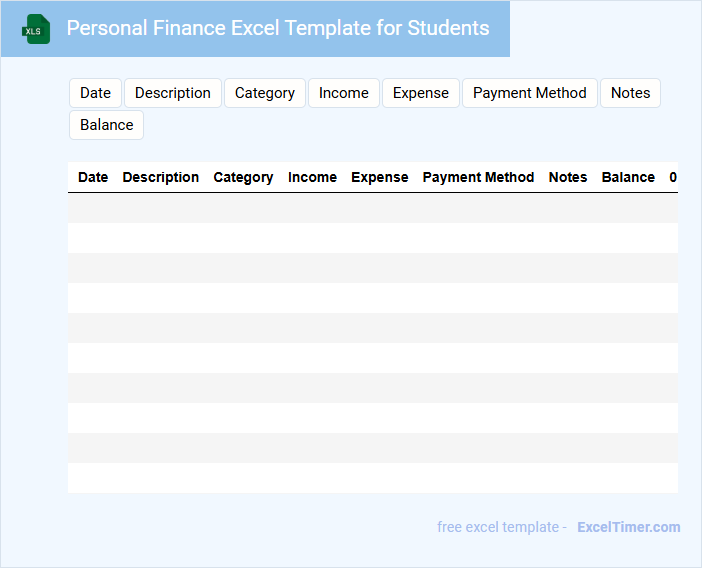

Personal Finance Excel Template for Students

This Personal Finance Excel Template for students typically contains sections for budgeting, tracking expenses, and monitoring savings. It helps students organize their monthly income and expenditures efficiently, offering a clear overview of their financial health. Important features often include customizable categories, visual charts, and automated calculations to simplify personal finance management.

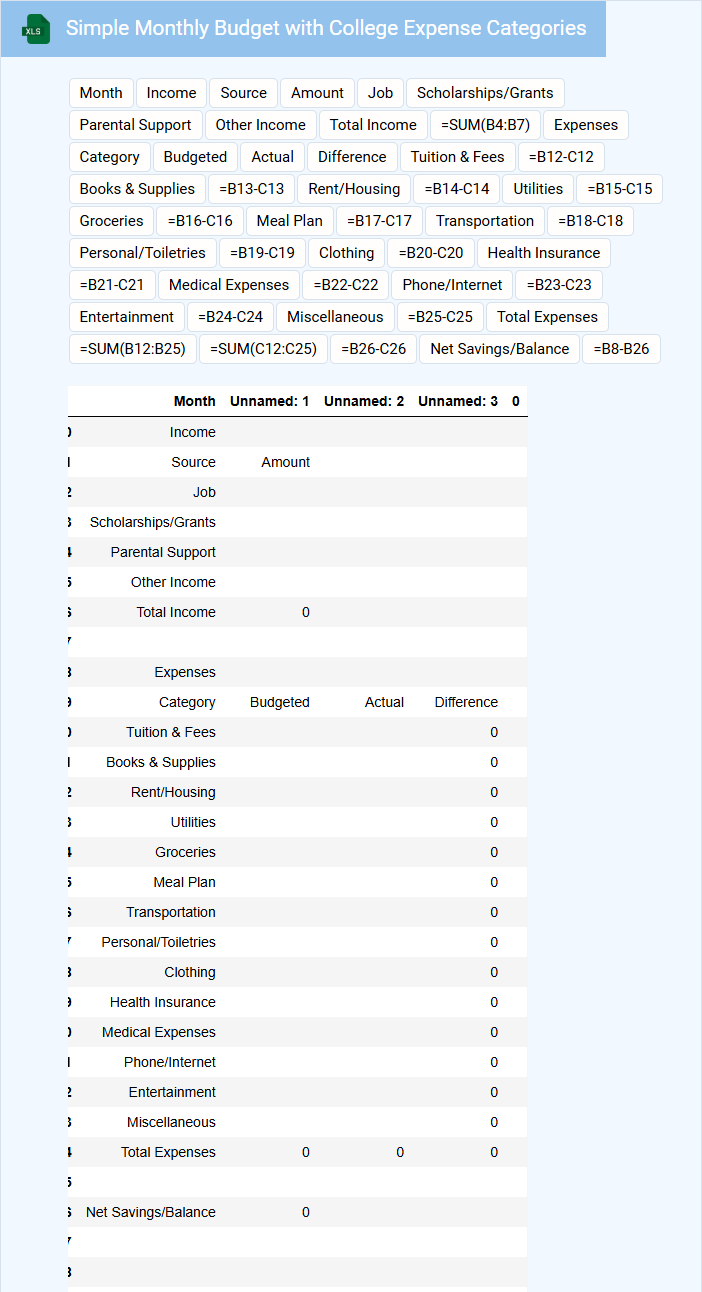

Simple Monthly Budget with College Expense Categories

A Simple Monthly Budget is a financial plan that outlines income and expenses for a specific period, typically a month. It helps individuals manage their money by tracking various spending categories, ensuring they do not overspend. When focused on College Expense Categories, it includes tuition, housing, books, transportation, and personal costs to provide a clear picture of student finances.

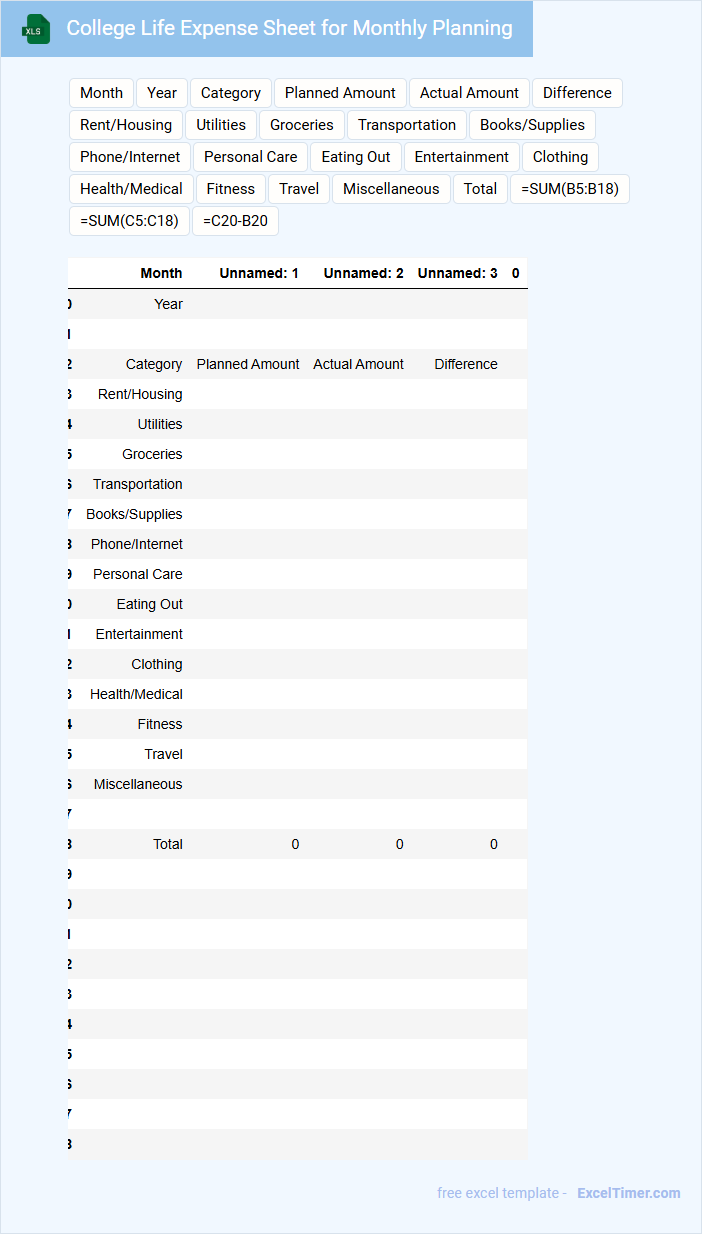

College Life Expense Sheet for Monthly Planning

This document typically contains detailed records of monthly income and expenses to help college students manage their budgets effectively.

- Income Tracking: It is crucial to document all sources of income including scholarships, part-time jobs, or allowances.

- Expense Categorization: Expenses should be grouped into fixed (e.g., rent, tuition) and variable costs (e.g., food, entertainment) for clarity.

- Savings Goal: Setting a monthly savings target encourages financial discipline and prepares for unexpected costs.

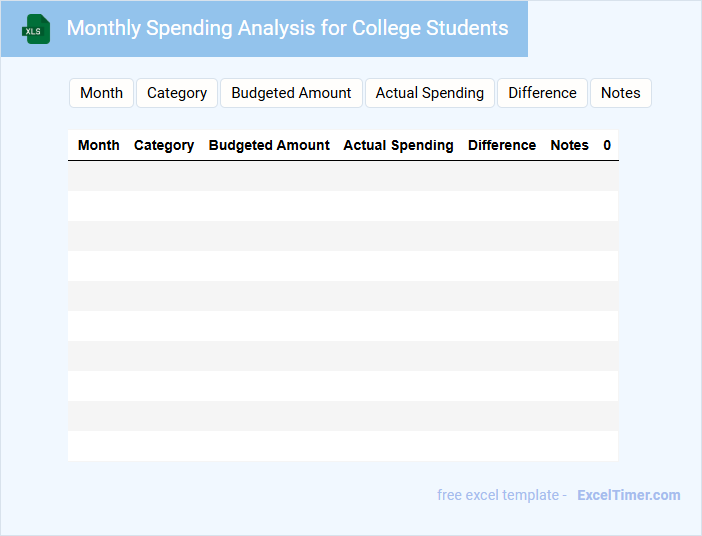

Monthly Spending Analysis for College Students

What information is typically included in a Monthly Spending Analysis for College Students? This document usually contains detailed records of a student's income and expenses over a month, including categories such as tuition, housing, food, transportation, and entertainment. It helps students understand their spending habits and identify areas where they can save money.

What is an important aspect to focus on in this analysis? Tracking variable versus fixed expenses is crucial because it allows students to manage discretionary spending and plan for necessary costs. Additionally, including a comparison with budget goals can help students maintain financial discipline and avoid overspending.

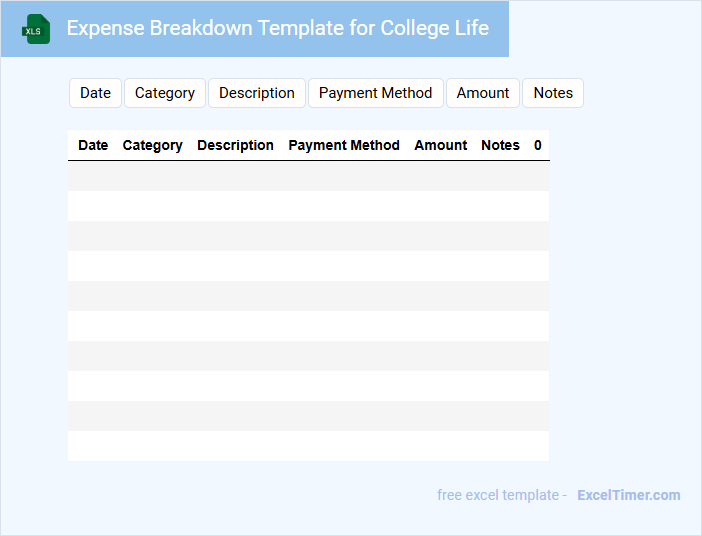

Expense Breakdown Template for College Life

An Expense Breakdown Template for College Life typically contains categories and detailed listings of various costs incurred during college. It helps students budget efficiently by tracking tuition, housing, food, and miscellaneous expenses.

- Include fixed and variable expenses to cover all possible costs accurately.

- Use clear categories like tuition, rent, groceries, transportation, and entertainment.

- Provide monthly and semester summaries for better financial planning.

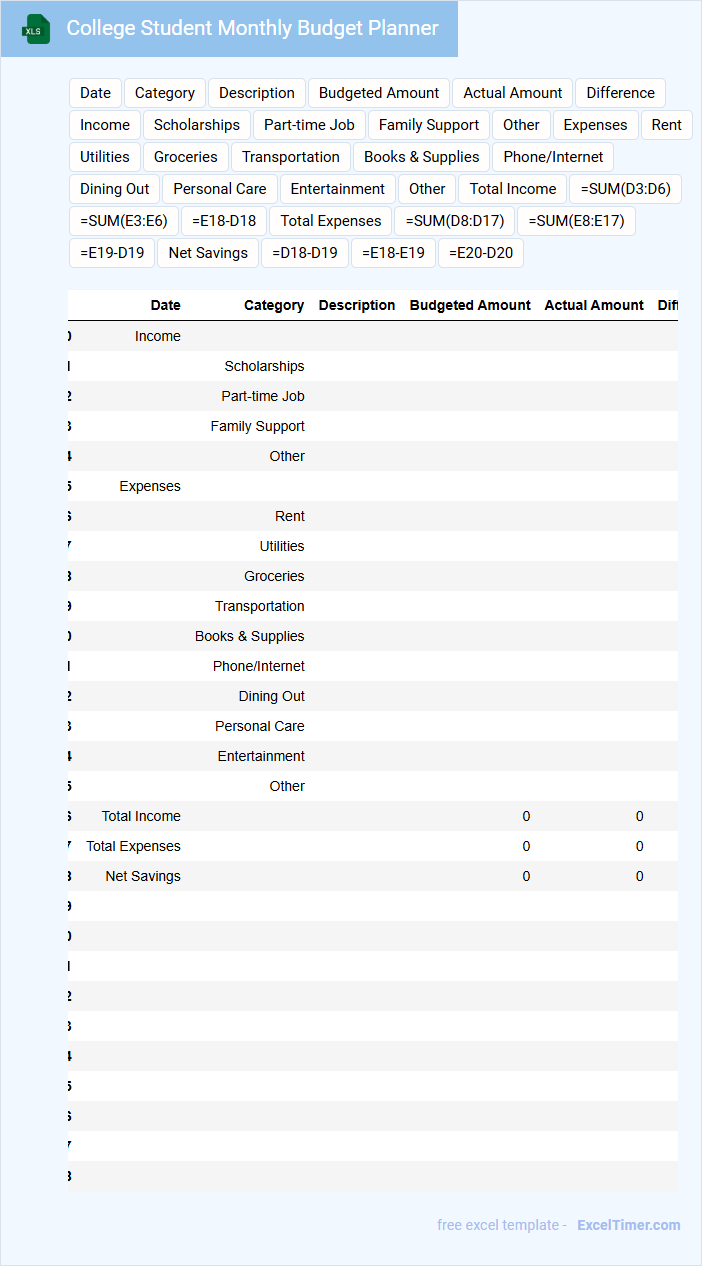

College Student Monthly Budget Planner

What information does a College Student Monthly Budget Planner typically contain? This type of document usually includes sections for tracking income sources such as allowances or part-time jobs, as well as detailed expense categories like rent, groceries, tuition, and entertainment. It helps students organize and monitor their spending to ensure financial responsibility and avoid overspending each month.

What important aspects should be considered when using this planner? Key elements to focus on are setting realistic budget limits, updating expenses regularly for accuracy, and incorporating savings goals to prepare for emergencies or future expenses. Maintaining discipline and reviewing the planner monthly can significantly enhance a student's financial management skills.

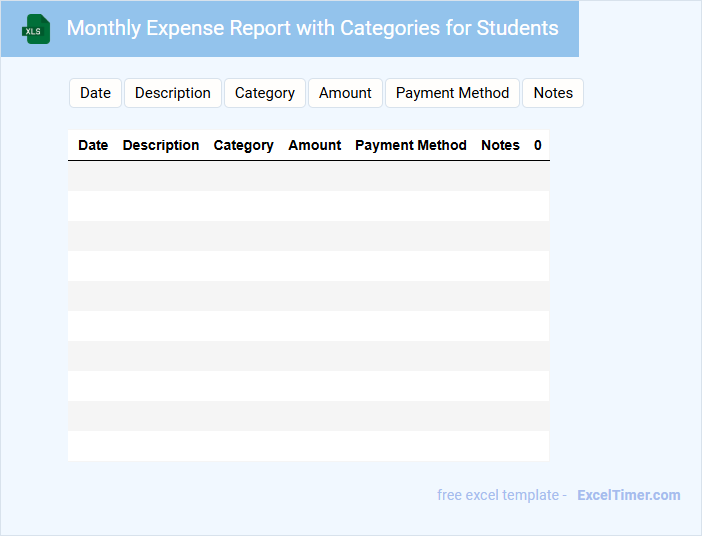

Monthly Expense Report with Categories for Students

What information does a Monthly Expense Report with Categories for Students typically contain? It usually includes detailed records of all expenses categorized by type, such as food, transportation, and education supplies. This helps students track their spending habits and manage their budgets more effectively.

Why is it important to use categories in a Monthly Expense Report for students? Categorizing expenses makes it easier to identify areas where money can be saved and ensures a balanced allocation of funds. It also promotes financial awareness and responsibility among students.

University Student Spending Tracker with Charts

This document typically contains a detailed expenditure log that helps university students monitor their daily, weekly, or monthly spending. It includes categorized financial entries and visual charts such as pie or bar graphs for effective data interpretation. An important suggestion is to ensure the tracker is updated regularly to maintain accurate budgeting and financial awareness.

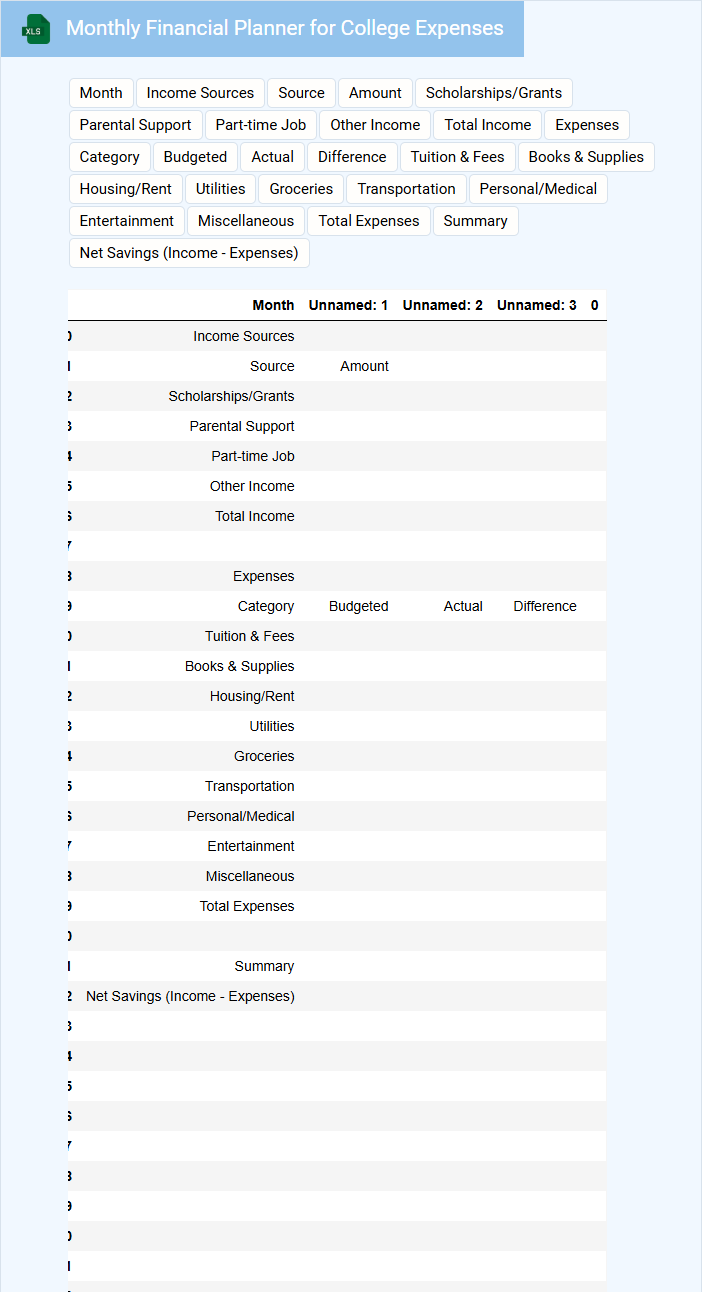

Monthly Financial Planner for College Expenses

A Monthly Financial Planner for college expenses typically contains a detailed breakdown of income sources, fixed and variable expenses, and savings goals. It helps students and parents track tuition fees, accommodation costs, and daily living expenses to ensure effective budget management. Including emergency funds and periodic review sections is crucial for maintaining financial stability throughout the academic year.

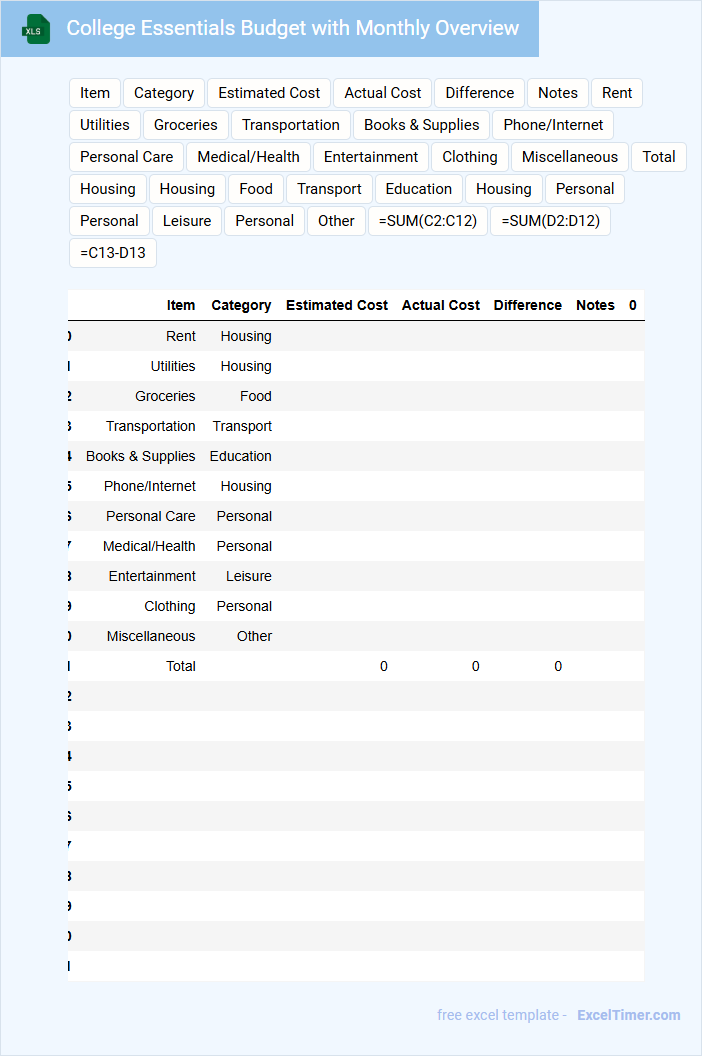

College Essentials Budget with Monthly Overview

The College Essentials Budget with Monthly Overview is a crucial document that outlines all necessary expenses a student might encounter during their academic year. It typically includes categories such as tuition, housing, food, supplies, and personal expenses, helping to track and manage finances effectively. This budget assists in planning monthly payments and preventing overspending by providing a clear breakdown of anticipated costs.

Student Expense Sheet for Monthly Tracking

A Student Expense Sheet for Monthly Tracking is a document designed to help students monitor and manage their monthly expenditures efficiently.

- Expense Categories: Clearly define categories such as food, transportation, and entertainment to maintain organized records.

- Budget Limits: Set monthly spending limits to avoid overspending and encourage savings.

- Regular Updates: Consistently update the sheet to reflect daily expenses for accurate tracking and analysis.

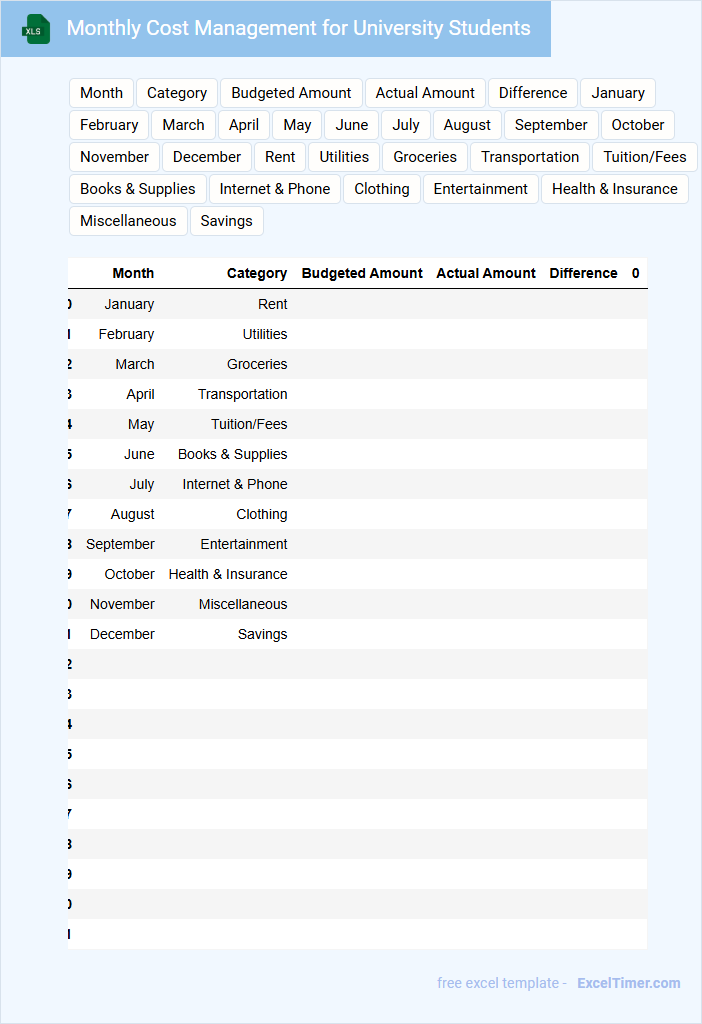

Monthly Cost Management for University Students

What information is typically included in a Monthly Cost Management document for university students? This type of document usually contains detailed records of income, expenses, and budget allocations specific to student life. It helps students track their spending, plan for upcoming costs, and manage their finances efficiently to avoid debt.

What important aspects should be considered when creating a Monthly Cost Management plan? Students should prioritize categorizing essential expenses such as tuition, housing, food, and transportation while also setting aside funds for emergencies and leisure activities. Regularly reviewing and adjusting the budget ensures financial stability throughout the academic year.

What are the essential categories to include in a monthly expense tracker for college students in Excel?

Essential categories in a monthly expense tracker for college students in Excel include Tuition and Fees, Rent or Housing, Groceries and Food, Transportation, Utilities, Study Materials, and Personal Expenses. Tracking these categories helps in managing finances effectively and identifying areas for potential savings. Incorporating a summary section with total expenses and comparison against budget enhances financial planning.

How can you use formulas to automatically calculate total monthly expenses in an Excel document?

Use the SUM formula to automatically calculate your total monthly expenses by selecting all expense cells in your Excel document. Apply =SUM(B2:B10) where B2 to B10 contains your expense amounts. This method ensures accurate and quick updates as you enter new data.

What Excel features help visualize spending patterns and identify budget areas needing attention?

Excel features like PivotTables summarize monthly expenses by category, enabling detailed spending analysis. Conditional Formatting highlights overspending by marking cells that exceed set budget limits in red. Creating charts, such as Pie or Column Charts, visually presents spending distribution and trends for college students.

How can you set up conditional formatting in Excel to flag overspending in specific categories?

To set up conditional formatting in Excel for your Monthly Expense document, select the cells in your expense category column, then go to Home > Conditional Formatting > New Rule. Choose "Format only cells that contain," set the rule to highlight values greater than your predefined budget limit for each category, and pick a formatting style like a red fill. This visual alert helps you quickly identify and control overspending in specific categories.

What is the best way to organize and update recurring versus one-time expenses in an Excel sheet for college budgeting?

Organize recurring expenses in a dedicated column labeled "Recurring" with consistent monthly amounts, while placing one-time expenses in a separate "One-Time" column with corresponding dates. Use Excel formulas like SUMIF or FILTER to dynamically total each category, ensuring accurate monthly budget tracking. Update the sheet regularly by adding new expenses in their respective columns and adjusting formulas to reflect changes automatically.