The Monthly Budget Planner Excel Template for College Students is designed to help manage income, expenses, and savings efficiently throughout the academic year. It offers customizable categories for rent, groceries, tuition, and entertainment, enabling precise tracking and financial planning. Using this template promotes better spending habits and helps students avoid debt by visualizing their monthly cash flow clearly.

Monthly Budget Planner Excel Template for College Students

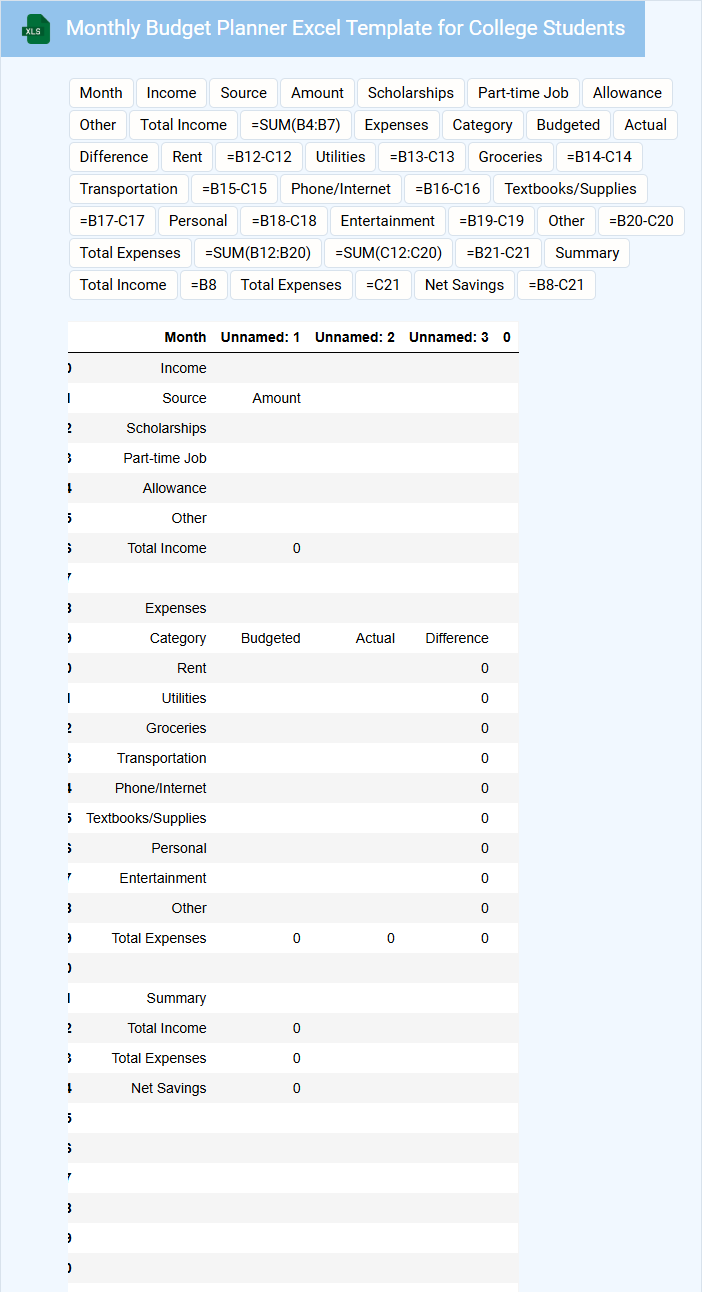

The Monthly Budget Planner Excel Template for college students is an essential tool designed to help manage finances effectively. It typically contains sections for tracking income, expenses, savings, and financial goals. This document aids students in maintaining financial discipline and avoiding debt throughout the academic year.

Important features to include are categorized expense tracking, automatic calculations for totals and balances, and visual charts for better financial insight. Additionally, customizable fields for unique spending habits can enhance usability. A reminder section for upcoming bills and deadlines is also highly recommended.

Income and Expense Tracker for College Students

An Income and Expense Tracker for College Students is a practical document designed to help manage and monitor financial inflows and outflows effectively.

- Income Sources: Document all regular and occasional income, such as scholarships, part-time jobs, and allowances.

- Expense Categories: Track essential spending areas including tuition, textbooks, food, transportation, and entertainment.

- Budget Review: Regularly analyze spending patterns to identify saving opportunities and avoid overspending.

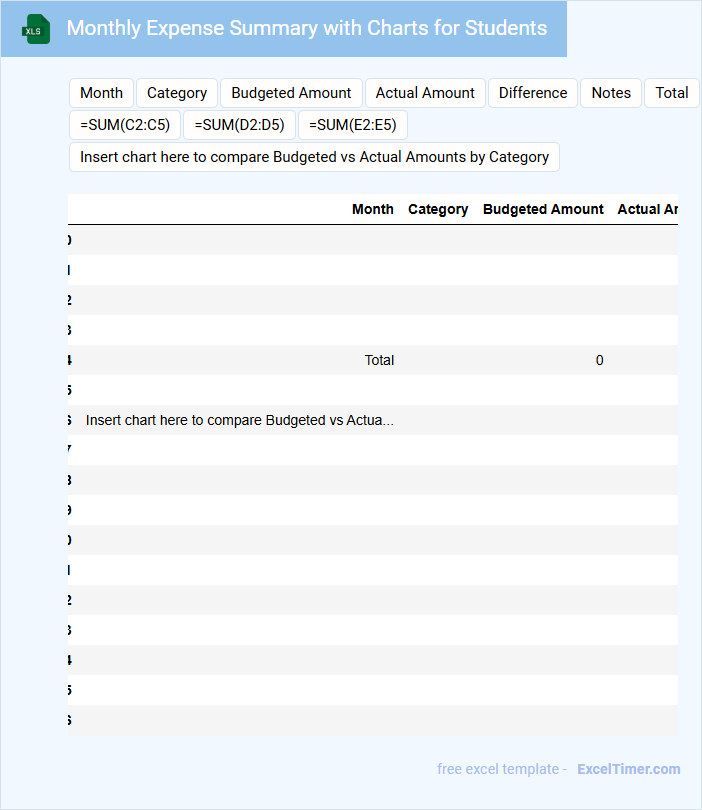

Monthly Expense Summary with Charts for Students

A Monthly Expense Summary for students typically contains detailed records of their spending categorized by types such as food, transportation, and entertainment. It often includes visual charts like pie charts or bar graphs to help students easily understand their spending patterns. This document helps in budgeting effectively and identifying areas where expenses can be reduced.

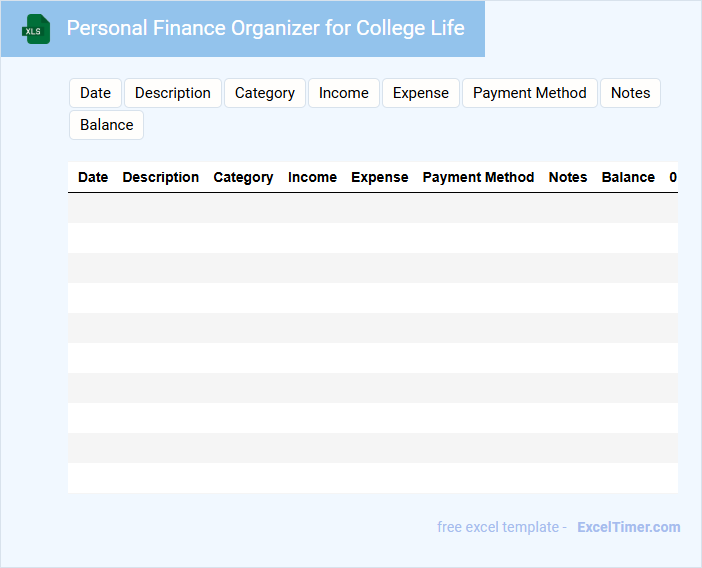

Personal Finance Organizer for College Life

A Personal Finance Organizer for college life typically contains detailed sections for budgeting, tracking expenses, and managing income sources such as scholarships, part-time jobs, and allowances. It helps students gain a clear understanding of their financial situation by organizing monthly spending and savings goals.

Important elements include a monthly budget planner, expense tracker, and reminders for bill payments to ensure timely management of finances. Incorporating a goal-setting section encourages better money habits and long-term financial planning during college years.

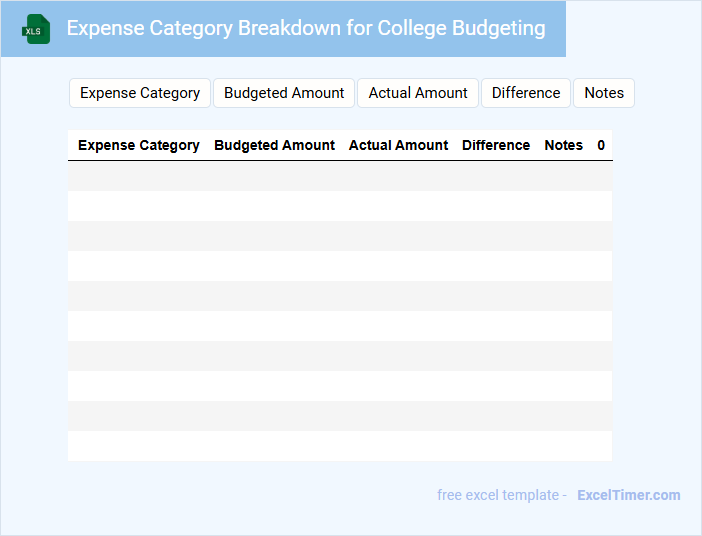

Expense Category Breakdown for College Budgeting

The Expense Category Breakdown document typically outlines all the major spending areas involved in college budgeting, such as tuition, housing, food, and supplies. It helps students and families understand where funds are allocated to manage finances effectively.

For effective budgeting, it is crucial to regularly update the breakdown to reflect changes in expenses or lifestyle. Ensuring clarity in each category aids in identifying potential savings and prioritizing spending.

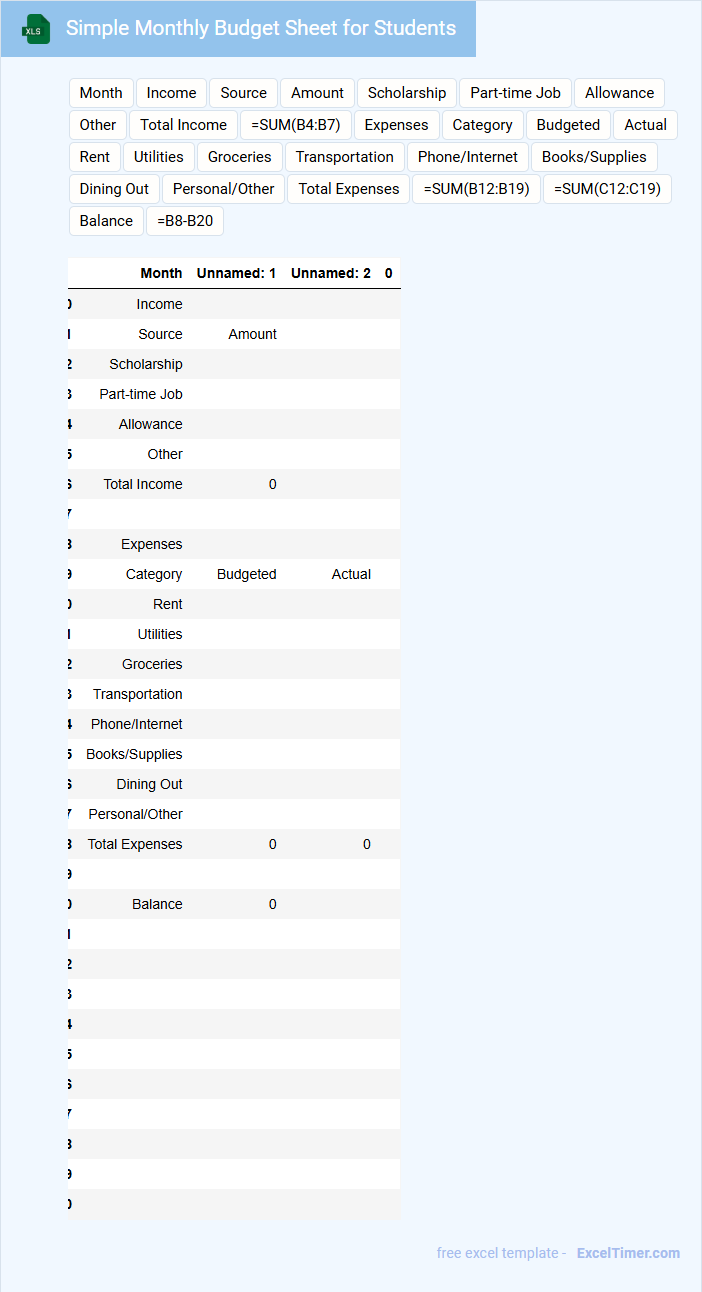

Simple Monthly Budget Sheet for Students

What information is typically included in a Simple Monthly Budget Sheet for Students? This document usually contains categories such as income sources, fixed expenses, variable expenses, and savings goals. It helps students track their financial inflows and outflows, enabling better money management and financial planning.

Why is it important for students to maintain a monthly budget sheet? Maintaining this sheet encourages disciplined spending habits and identifies areas for potential savings. It also supports students in avoiding debt and achieving their financial objectives efficiently.

College Student Savings Tracker with Monthly Overview

This type of document, a College Student Savings Tracker, typically contains detailed records of income, expenses, and savings goals. It provides a monthly overview to help students monitor their financial progress over time. Keeping track of all transactions ensures accurate budgeting and financial planning.

Important elements include categorized spending, monthly savings targets, and visual summaries like charts or graphs. Incorporating reminders for bill due dates and unexpected expenses can optimize financial management. This helps students maintain control over their finances and avoid overspending.

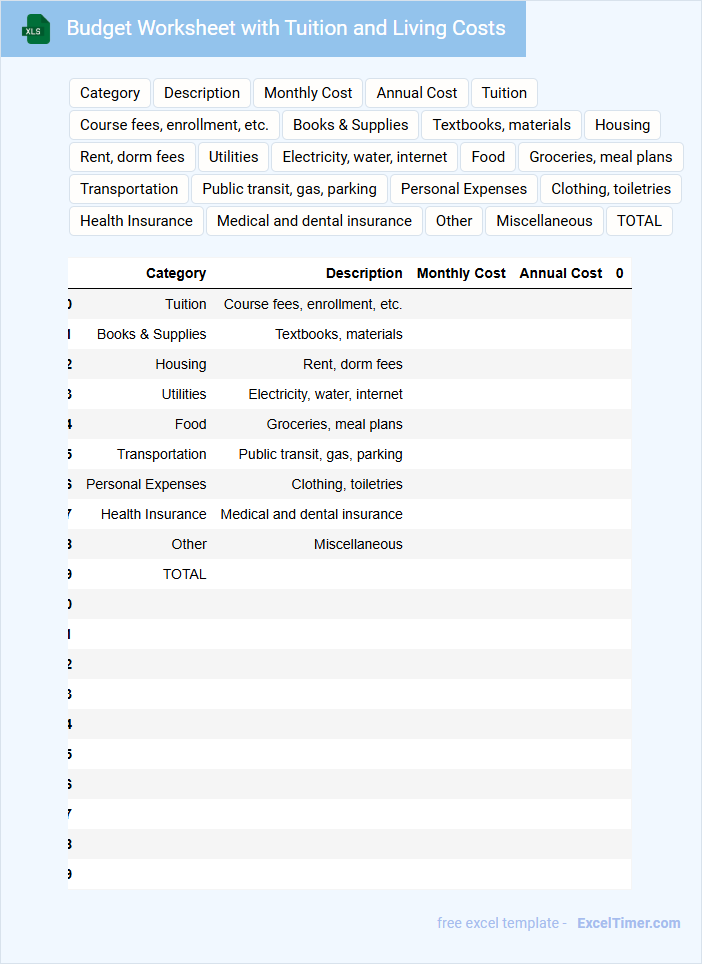

Budget Worksheet with Tuition and Living Costs

What information is typically included in a Budget Worksheet with Tuition and Living Costs? This type of document usually contains detailed estimations of tuition fees, housing expenses, food, transportation, and personal costs. It helps students and families plan their finances effectively by providing a clear overview of all expected expenditures.

What is an important element to consider when using this worksheet? It is crucial to include both fixed costs like tuition and variable costs such as utilities and groceries to ensure an accurate budget. Keeping track of actual expenses versus estimates can also help adjust future financial planning.

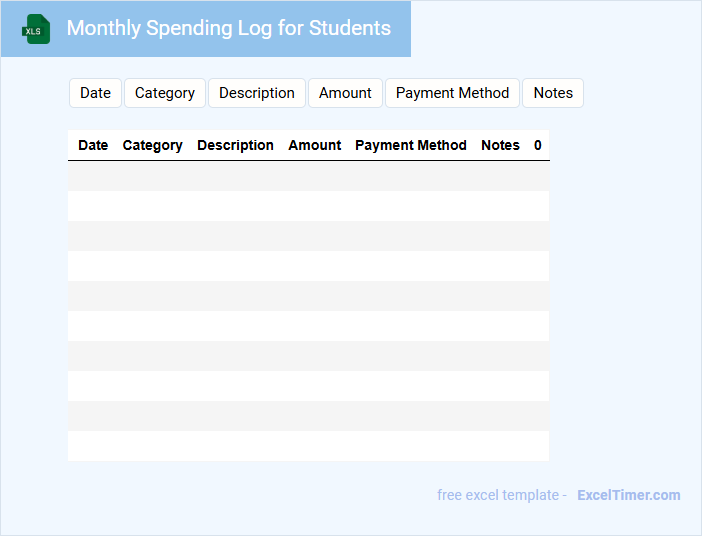

Monthly Spending Log for Students

A Monthly Spending Log for students is a document that helps track daily expenses to manage finances effectively. It usually contains categories such as food, transportation, entertainment, and school supplies. This detailed record allows students to identify spending patterns and control unnecessary expenses.

Maintaining a budget-friendly log encourages responsible financial habits essential for student life. Including sections for income and savings goals can enhance financial awareness. Regularly updating the log ensures accuracy and helps students stay on track with their financial objectives.

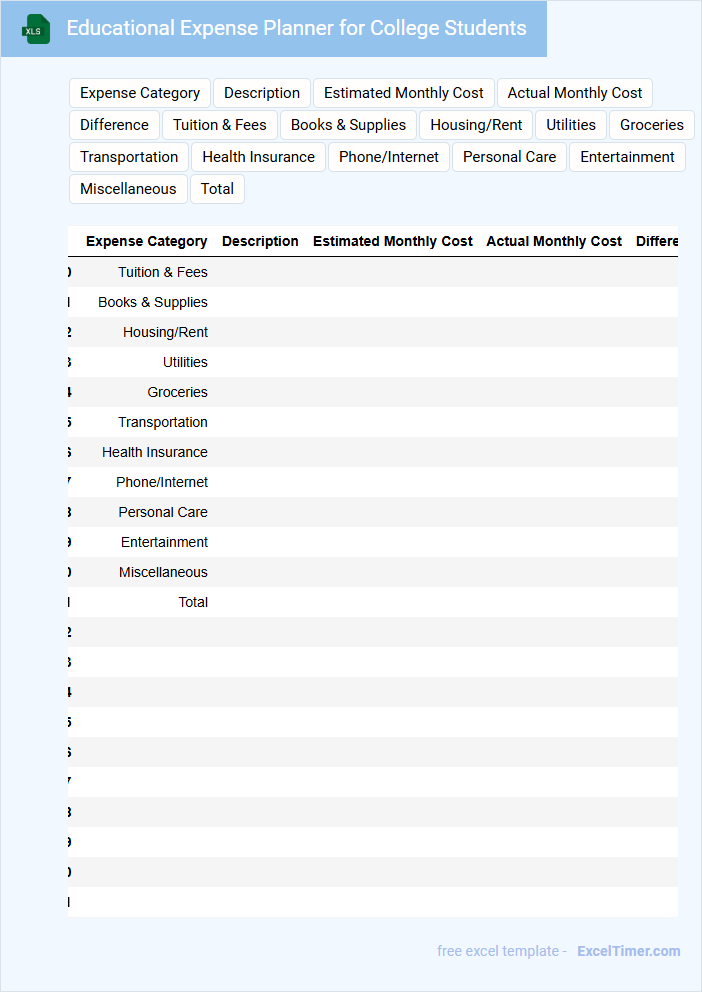

Educational Expense Planner for College Students

An Educational Expense Planner for college students is a document designed to help manage and forecast the costs associated with higher education. It typically includes tuition fees, housing, books, and other living expenses to provide a comprehensive budget overview. This planner empowers students to make informed financial decisions and avoid unexpected debt during their academic journey.

Weekly Expense Tracker for Monthly Budgeting

A Weekly Expense Tracker is a document designed to record and monitor all expenditures on a weekly basis. It helps individuals or families manage their cash flow effectively.

This type of document usually contains categories for different types of expenses, dates, and amounts spent. It allows users to compare weekly spending against their monthly budget goals.

For effective budgeting, it is important to consistently update the tracker and review spending patterns weekly to make necessary adjustments.

Monthly Bills Organizer with Payment Tracker

What information is typically included in a Monthly Bills Organizer with Payment Tracker? This type of document usually contains a list of all recurring monthly bills, their due dates, amounts, and payment statuses. It helps users systematically manage their finances by tracking when bills are paid, ensuring no payments are missed and helping to avoid late fees.

What is an important feature to include in a Monthly Bills Organizer with Payment Tracker? Incorporating clear sections for each bill category, such as utilities, subscriptions, and loans, with automated reminders or status updates can greatly enhance organization and timely payment. Additionally, allowing space for notes on payment methods or confirmation numbers adds valuable tracking detail.

Allowance and Part-Time Income Tracker for Students

The Allowance and Part-Time Income Tracker is a document designed to help students monitor their earnings and expenses effectively. It typically contains sections for daily income, allowances received, and spending categories to provide clear financial insights. This tracker assists in budgeting and encourages responsible money management habits among students.

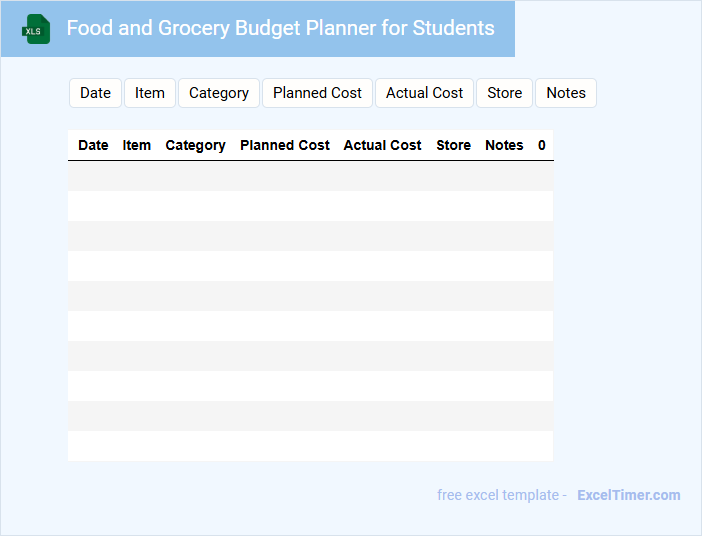

Food and Grocery Budget Planner for Students

A Food and Grocery Budget Planner for students is designed to help manage and track spending on groceries and meals efficiently. It usually contains sections for listing monthly income, grocery expenses, and meal planning to avoid unnecessary purchases. An important suggestion is to categorize expenses and set realistic spending limits to maintain financial discipline.

Monthly Debt Payment Tracker for College Students

A Monthly Debt Payment Tracker for college students is a document designed to help individuals monitor their debt repayments regularly. It usually contains fields for listing various debts, due dates, minimum payment amounts, and actual payments made. This type of tracker aids in budgeting and ensuring timely payments to avoid late fees and reduce financial stress.

What categories should be included in a college student's monthly budget planner in Excel?

Your monthly budget planner in Excel should include essential categories such as tuition fees, rent or dorm expenses, groceries, transportation, textbooks and supplies, entertainment, and personal savings. Tracking these categories helps manage your finances efficiently and avoid overspending. Including utilities, healthcare, and miscellaneous expenses ensures a comprehensive budget overview for college life.

How can formulas be used to automatically calculate total income and expenses in the budget document?

Formulas like SUM() can automatically calculate total income and expenses by adding values from designated income and expense cells in the Monthly Budget Planner. Using cell references ensures dynamic updates when data changes, providing accurate running totals. This streamlines budget tracking and helps college students manage finances efficiently.

Which Excel features help students track spending against their monthly budgets?

Excel features like pivot tables and conditional formatting help students track spending against their monthly budgets. Data validation and built-in formulas enable accurate entry and automatic calculation of expenses. Your use of charts visualizes spending patterns, making budget management more intuitive.

How can conditional formatting highlight overspending in specific budget categories?

Conditional formatting in a Monthly Budget Planner highlights overspending by automatically changing the cell color when expenses exceed the set budget limit in specific categories. Users can set rules comparing expense values to budgeted amounts, triggering alerts like red fills or bold text for easy identification. This visual cue enables college students to quickly adjust spending habits and maintain financial discipline.

What is the importance of setting financial goals within a Monthly Budget Planner for college students?

Setting financial goals within a Monthly Budget Planner helps college students manage expenses, track income, and prioritize savings effectively. Clear goals improve your spending decisions and prevent unnecessary debt. This focus increases financial awareness and supports long-term financial stability during and after college.