Monthly Cash Flow Excel Template for Startups provides a structured and customizable way to track income and expenses, helping new businesses manage their finances effectively. It enables startups to forecast cash inflows and outflows, ensuring liquidity and avoiding financial shortfalls. Using this template improves budgeting accuracy and supports informed decision-making crucial for business growth.

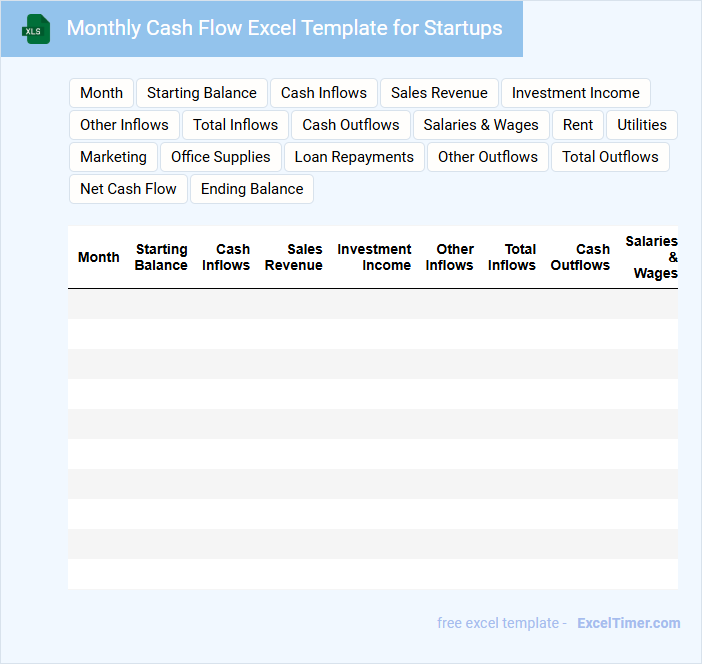

Monthly Cash Flow Excel Template for Startups

A Monthly Cash Flow Excel Template for startups is a financial document that tracks the inflow and outflow of cash over a specific period. It helps startups monitor their liquidity and ensure they have enough cash to cover operational expenses.

This template typically contains sections for income sources, expenses, and net cash flow projections. An important consideration is to regularly update the template to reflect real-time financial data for accurate forecasting.

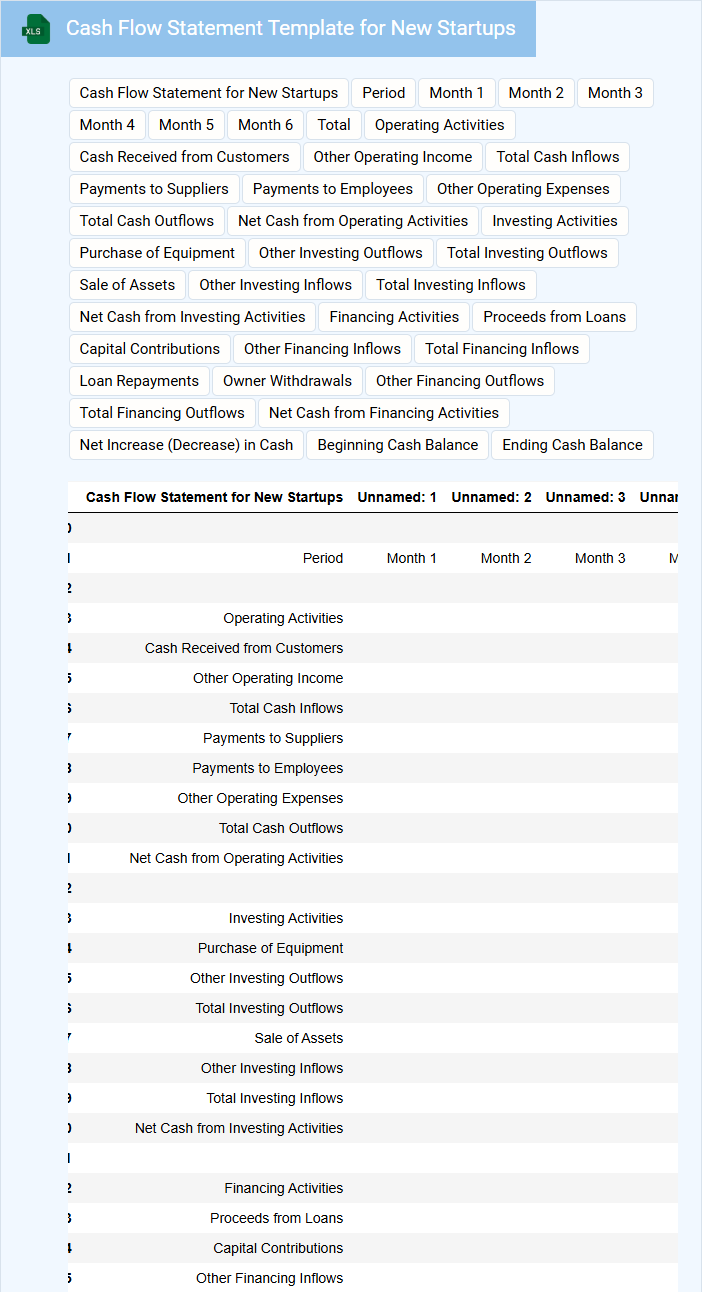

Cash Flow Statement Template for New Startups

A Cash Flow Statement Template for new startups typically contains detailed information about the inflows and outflows of cash within a specific period. It includes sections for operating, investing, and financing activities, helping entrepreneurs track liquidity and financial health. This document is essential for managing cash effectively and ensuring the startup can meet its financial obligations.

Important elements to include are accurate projections of sales revenue, anticipated expenses, and planned investments. It's crucial to regularly update the template to reflect actual cash movements and forecast future cash needs. Additionally, highlighting periods of potential cash shortages enables proactive financial planning and stability.

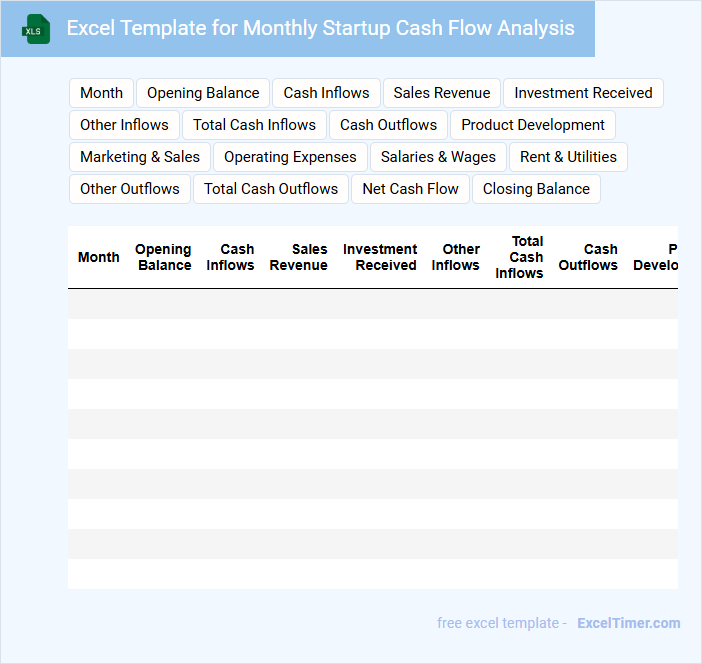

Excel Template for Monthly Startup Cash Flow Analysis

An Excel Template for Monthly Startup Cash Flow Analysis typically contains detailed entries of all incoming and outgoing cash flows, organized by date and category. It helps startups track their liquidity and manage financial resources efficiently.

This document often includes projections of revenues, expenses, and net cash flow to identify potential shortfalls early. To optimize its use, regularly update the template with actual figures and review trends to make informed strategic decisions.

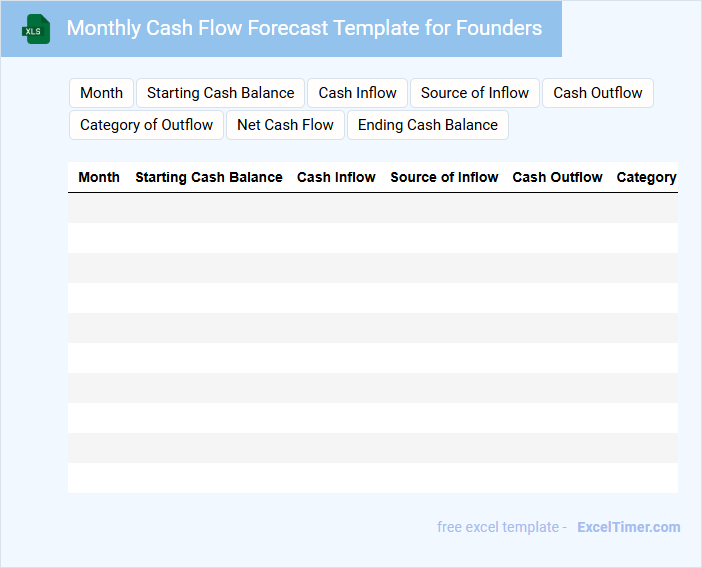

Monthly Cash Flow Forecast Template for Founders

What is typically included in a Monthly Cash Flow Forecast Template for Founders? This type of document usually contains projected income, expenses, and net cash flow for each month to help founders manage their finances and plan ahead. It provides a clear overview of the company's expected liquidity, enabling better decision-making and risk assessment.

What important elements should founders focus on when using this template? Founders should ensure accuracy in estimating revenue streams and factoring in all fixed and variable costs. Additionally, regularly updating the forecast with actual figures and reviewing it against financial goals can significantly improve business sustainability and growth.

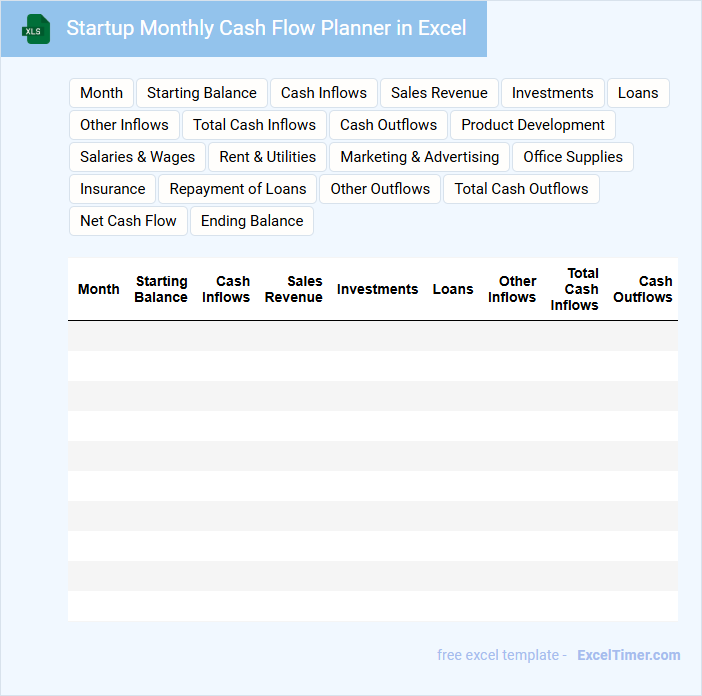

Startup Monthly Cash Flow Planner in Excel

A Startup Monthly Cash Flow Planner in Excel is typically a financial document that tracks the inflow and outflow of cash on a monthly basis to help startups manage their liquidity. It provides a clear snapshot of the company's financial health over time.

- Include detailed categories for revenues and expenses to ensure comprehensive tracking.

- Regularly update the planner to reflect actual performance against projections.

- Use visual charts to quickly identify trends and potential cash shortages.

Financial Cash Flow Tracker for Early-Stage Startups

A Financial Cash Flow Tracker for Early-Stage Startups is a document used to monitor the inflow and outflow of cash within a startup to ensure liquidity and operational stability. It helps founders manage their finances effectively while anticipating future cash needs.

- Include detailed records of all cash receipts and payments to maintain accurate tracking.

- Regularly update projections to forecast future cash flow trends and identify potential shortfalls.

- Highlight key expenses and revenue streams to prioritize cost management and growth opportunities.

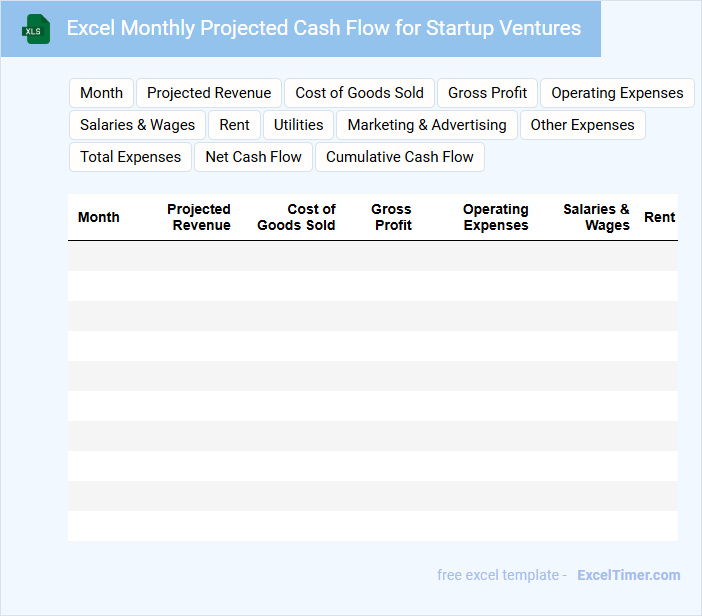

Excel Monthly Projected Cash Flow for Startup Ventures

An Excel Monthly Projected Cash Flow document typically contains detailed forecasts of income and expenses for startup ventures, helping entrepreneurs manage their financial health. It usually includes projections for sales revenue, operating costs, and cash inflows and outflows on a month-by-month basis. Ensuring accuracy in assumptions and regularly updating the sheet are crucial for making informed financial decisions.

Startup Cash Flow Sheet with Monthly Tracking

A Startup Cash Flow Sheet is a financial document that tracks the inflow and outflow of cash over a specific period, usually monthly. It helps startups monitor liquidity and ensure they have enough cash to cover operational expenses. This document typically contains sections for revenue, expenses, investments, and financing activities.

Monthly tracking in a cash flow sheet allows startups to identify trends and forecast future cash needs accurately. Maintaining detailed and up-to-date records is crucial for making informed financial decisions. It's important to include clear categories and regularly update actual versus projected figures to optimize cash management.

Simple Monthly Cash Flow Statement for Startups

What information is typically included in a Simple Monthly Cash Flow Statement for Startups? This document usually contains details of all cash inflows and outflows within a month, including revenue, expenses, and net cash flow. It helps startups track their financial health and ensure they have enough liquidity to cover their operational costs.

What is an important aspect to focus on when preparing this statement? It is crucial to accurately categorize all sources of income and expenses to avoid cash shortages and enable informed decision-making. Startups should regularly update the statement to reflect real-time financial status and anticipate future cash needs.

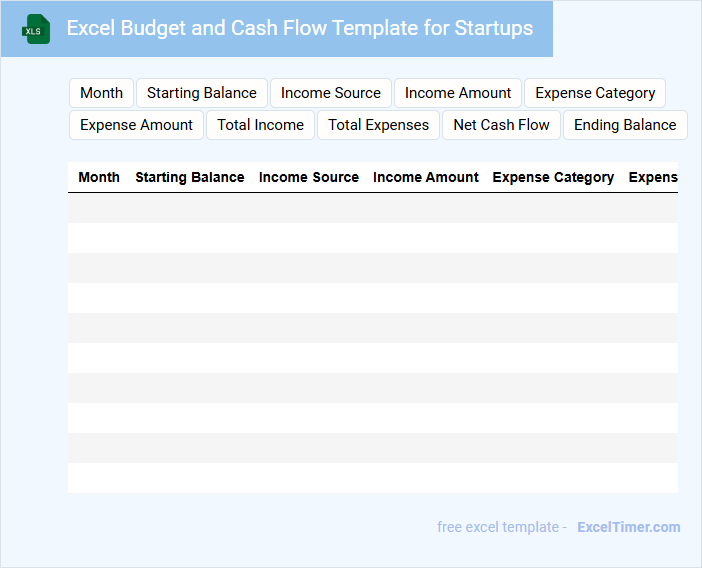

Excel Budget and Cash Flow Template for Startups

An Excel Budget and Cash Flow Template for Startups typically contains detailed financial projections and tracking tools to help new businesses manage their income and expenses efficiently.

- Comprehensive Budget Planning: It includes sections for forecasting revenues, fixed and variable costs, and capital expenditures.

- Cash Flow Monitoring: It provides a timeline view of cash inflows and outflows to ensure liquidity is maintained.

- Scenario Analysis: It allows startups to test different financial assumptions and prepare for various business conditions.

Monthly Operating Cash Flow Excel Sheet for Startups

A Monthly Operating Cash Flow Excel Sheet for startups is a vital financial tool that tracks incoming and outgoing cash related to core business operations. It typically contains detailed entries on sales revenue, operating expenses, and net cash flow to help manage liquidity. Startups use this document to forecast cash positions and ensure sufficient funds to sustain daily activities.

Key components to include are accurate recording of revenue streams, fixed and variable costs, and adjustments for non-cash items. It's important to regularly update the sheet with actual data to maintain financial visibility and support informed decision-making. Automating calculations and incorporating visual charts can also enhance understanding and presentation of cash flow trends.

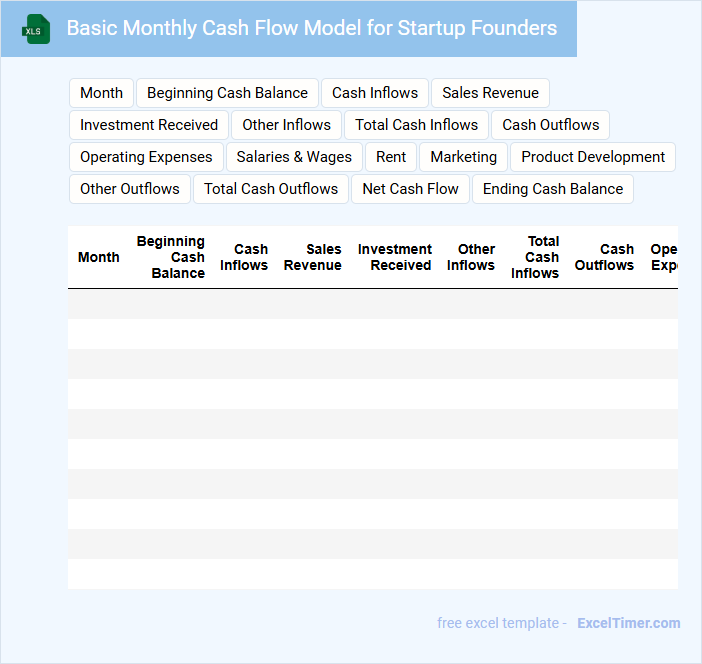

Basic Monthly Cash Flow Model for Startup Founders

A Basic Monthly Cash Flow Model for startup founders typically contains projections of incoming revenue and outgoing expenses on a monthly basis. It helps founders understand their liquidity, plan for future funding needs, and manage operational costs effectively.

Key elements include estimated sales, fixed and variable costs, cash inflows, and outflows, along with a running cash balance. For accuracy, it is important to regularly update assumptions based on real financial data and include a buffer for unexpected expenses.

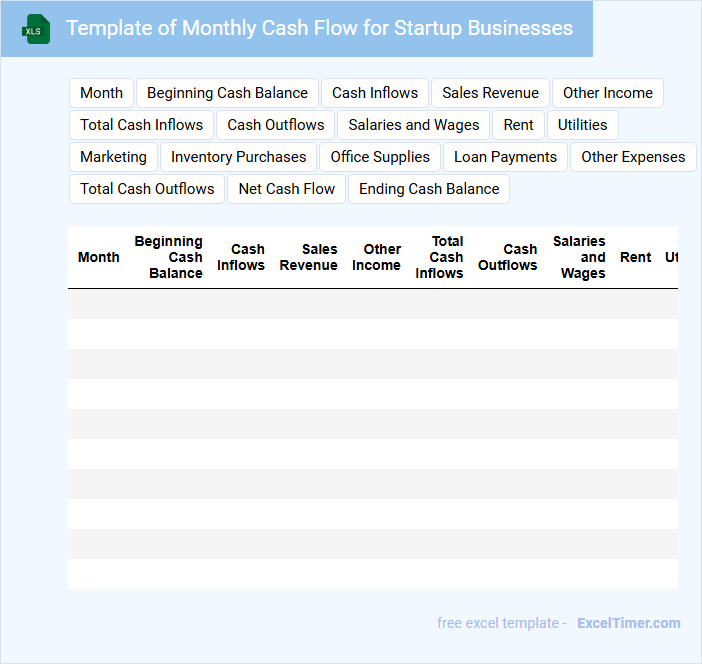

Template of Monthly Cash Flow for Startup Businesses

Monthly Cash Flow templates for startup businesses typically outline expected cash inflows and outflows to help manage financial stability and plan for growth.

- Cash Inflows: Track all sources of revenue including sales, investments, and loans.

- Cash Outflows: Record all expenses such as operational costs, salaries, and payments to suppliers.

- Net Cash Flow: Calculate the difference between inflows and outflows to monitor liquidity and avoid cash shortages.

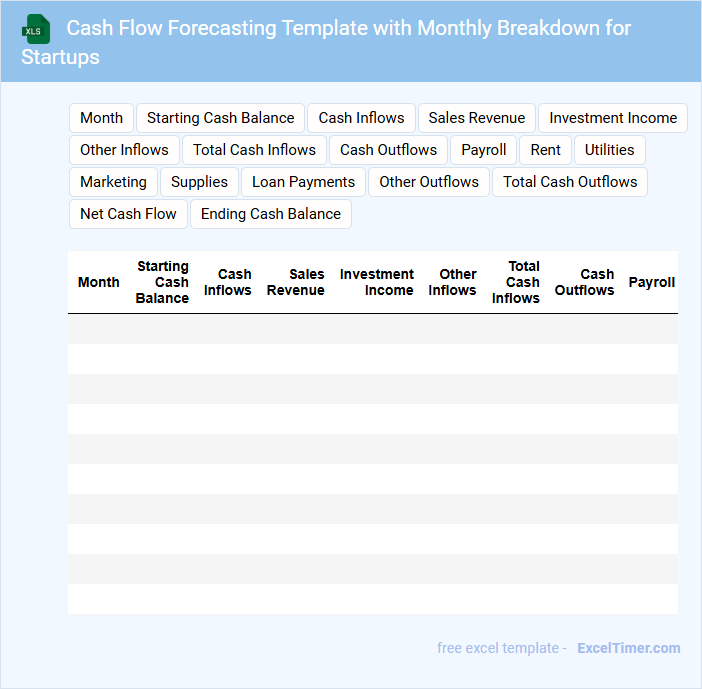

Cash Flow Forecasting Template with Monthly Breakdown for Startups

Cash Flow Forecasting Templates are essential tools for startups to project their expected cash inflows and outflows on a monthly basis. These documents typically contain detailed sections for revenue estimation, expense tracking, and net cash position. A monthly breakdown helps entrepreneurs anticipate funding needs and ensure liquidity throughout the early stages of their business.

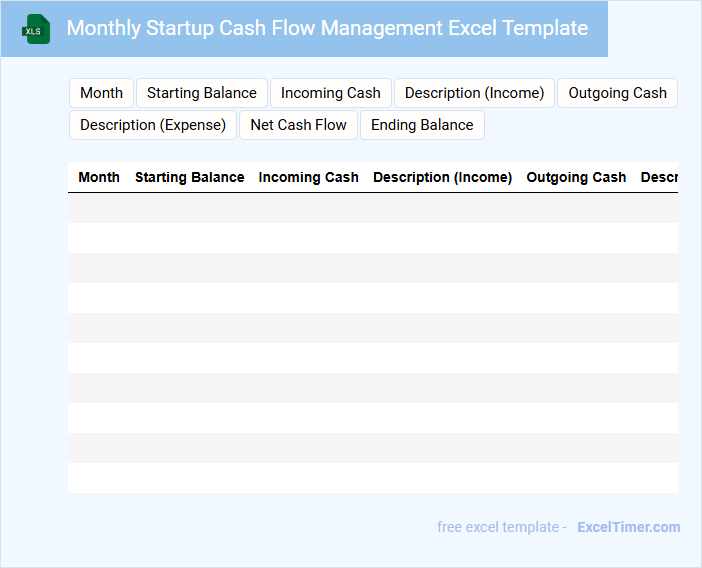

Monthly Startup Cash Flow Management Excel Template

A Monthly Startup Cash Flow Management Excel Template is a financial tool designed to help new businesses track their cash inflows and outflows on a monthly basis. It typically contains sections for recording income, expenses, and net cash flow, enabling startups to maintain liquidity and plan for future expenditures. This template is crucial for managing operational costs, ensuring sufficient working capital, and making informed financial decisions.

Important elements to include are detailed categories for revenue streams, fixed and variable expenses, and a summary section showing net cash flow position each month. Additionally, incorporating formulas for automatic balance updates and visual charts can enhance usability and provide quick insights. Regular updates and realistic forecasting within the template are essential to support effective budget management and cash flow optimization.

What are the key components that make up a monthly cash flow statement for startups?

A monthly cash flow statement for startups includes cash inflows such as sales revenue, investment funding, and loans. Key outflows encompass operating expenses, payroll, rent, and loan repayments. Tracking net cash flow each month helps startups manage liquidity and financial stability.

How does tracking monthly cash inflows and outflows impact startup financial planning?

Tracking monthly cash inflows and outflows provides startups with accurate insights into their liquidity and financial health. This data enables precise budgeting, ensures timely expense management, and helps anticipate funding needs to avoid cash shortages. Effective monitoring supports strategic decision-making, fostering sustainable growth and investor confidence.

Which common expenses should be included in a startup's monthly cash flow document?

Your monthly cash flow document for startups should include common expenses such as rent, salaries, utilities, marketing costs, and software subscriptions. Tracking these key outflows helps provide a clear picture of your financial health. Accurate recording ensures better cash management and informed decision-making.

How can forecasting cash flow help identify potential funding gaps for startups?

Forecasting cash flow enables startups to predict periods when expenses will exceed revenues, highlighting potential funding gaps in advance. This proactive insight allows founders to secure necessary capital or adjust spending before cash shortfalls occur. Accurate cash flow projections improve financial planning and ensure sustained operational stability.

What role does the monthly cash flow statement play in investor reporting and decision-making?

The monthly cash flow statement provides investors with a detailed overview of a startup's liquidity and operational efficiency by tracking cash inflows and outflows. It helps identify funding needs, assess financial health, and predict future cash availability. Accurate cash flow data enables investors to make informed decisions about investment risks and growth potential.