Monthly Payroll Excel Template for Cafes streamlines employee salary calculations, making payroll management efficient and error-free. This customizable template includes sections for hours worked, wage rates, taxes, and deductions, ensuring accurate paychecks every month. Small cafe owners benefit from its user-friendly design, helping maintain financial records and comply with labor regulations effortlessly.

Monthly Payroll Tracker for Cafes

What information is typically included in a Monthly Payroll Tracker for Cafes? This document usually contains detailed records of employee work hours, wages, and deductions for each month. It helps in accurately calculating total payroll expenses and ensuring timely salary payments while maintaining compliance with labor regulations.

What is an important aspect to consider when creating a Monthly Payroll Tracker for Cafes? Ensuring accuracy and consistency in recording hours and wage rates is crucial, as cafes often have part-time and hourly employees with variable schedules. Additionally, including sections for tips and overtime pay can help reflect true employee compensation.

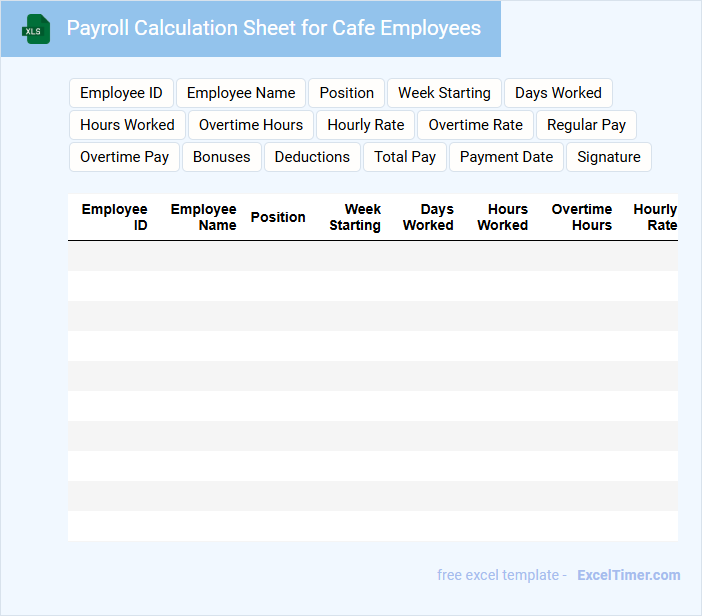

Payroll Calculation Sheet for Cafe Employees

This Payroll Calculation Sheet for Cafe Employees typically contains detailed records of employee working hours, wages, deductions, and net pay for accurate salary processing.

- Employee Details: Ensure all employee names and IDs are correctly listed for individual payroll tracking.

- Hours and Rates: Accurately record daily or weekly work hours and apply correct hourly or salary rates.

- Deductions and Benefits: Include all applicable tax deductions, benefits, and allowances for precise net pay calculation.

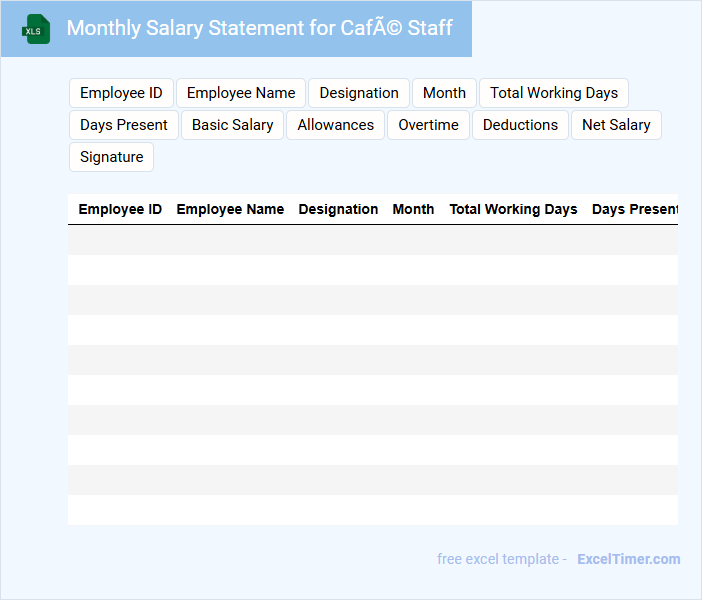

Monthly Salary Statement for Café Staff

A Monthly Salary Statement for café staff usually contains detailed information about the employee's earnings, including base salary, bonuses, and deductions for the month. It also provides a summary of hours worked and any overtime or leave taken during the period.

Ensuring accuracy in the statement is crucial for maintaining transparency and trust between the employer and staff. Including clear identification details and a breakdown of all components helps prevent disputes and supports proper record-keeping.

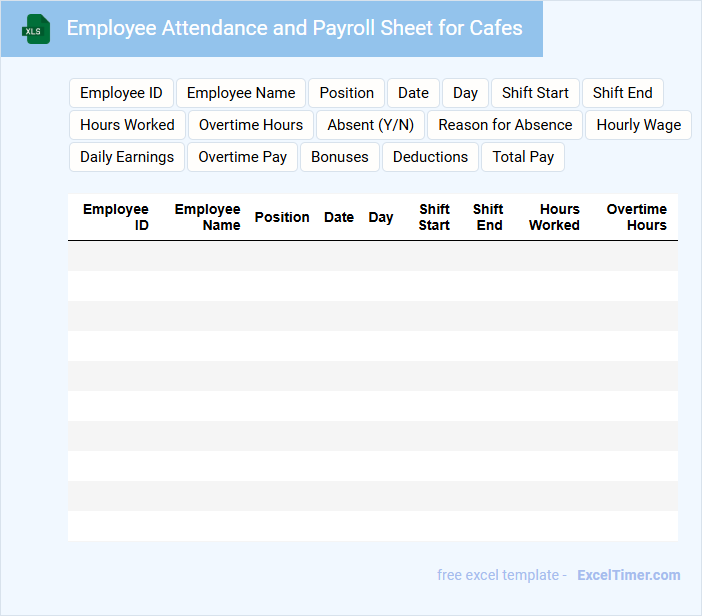

Employee Attendance and Payroll Sheet for Cafes

The Employee Attendance and Payroll Sheet is a crucial document for managing workforce records in cafes. It typically contains details such as employee working hours, attendance status, wages, and deductions. Maintaining accurate records ensures timely payment and compliance with labor regulations.

For cafes, it is important to include shift schedules, overtime tracking, and tips allocation separately in the sheet. Clear categorization helps in transparent payroll processing and simplifies financial audits. Regular updates and cross-verification with attendance logs are recommended for accuracy.

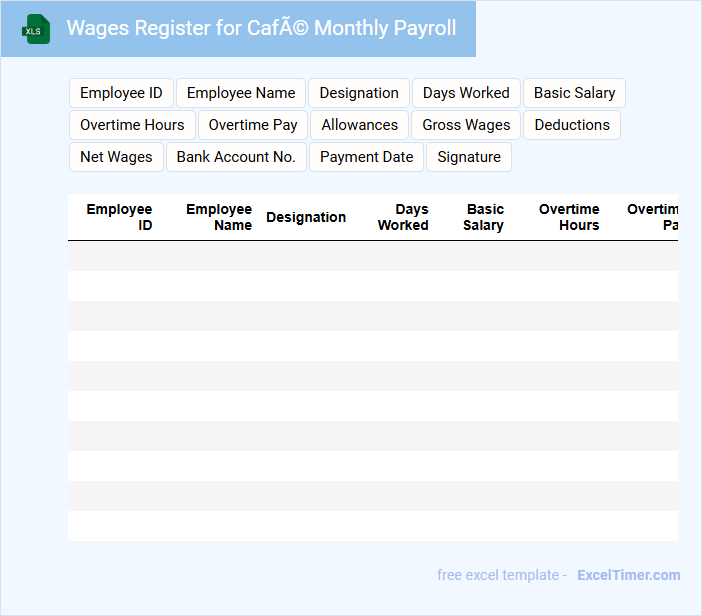

Wages Register for Café Monthly Payroll

This document typically contains detailed records of employee wages and related payroll information for a café on a monthly basis.

- Employee details: Includes names, roles, and identification numbers of all café staff.

- Hours worked and rates: Records daily or weekly hours worked along with corresponding wage rates.

- Deductions and net pay: Lists all applicable deductions, taxes, and the final net pay for each employee.

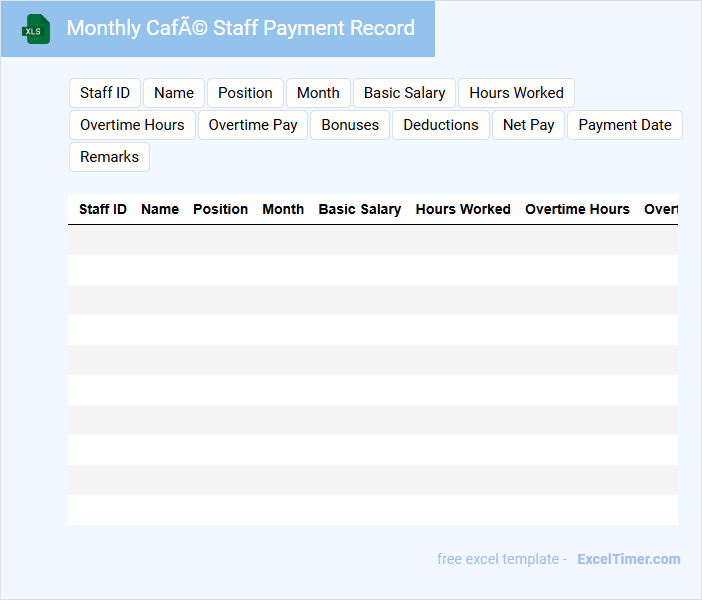

Monthly Café Staff Payment Record

What information is typically included in a Monthly Café Staff Payment Record? This document usually contains detailed records of each staff member's working hours, wages, and any bonuses or deductions applicable for the month. It is essential for ensuring accurate payroll processing and verifying staff compensation.

Why is maintaining an accurate Monthly Café Staff Payment Record important? Accurate records help prevent payment disputes and support compliance with labor laws. Additionally, it facilitates transparent financial management and aids in budgeting for future staffing costs.

Payroll Slip Generator for Cafés

A Payroll Slip Generator for cafés is a software tool designed to create detailed payroll slips for café employees. It typically contains employee details, salary breakdown, tax deductions, and net pay. An important consideration is ensuring accurate calculation of hourly wages, tips, and applicable taxes to maintain compliance and employee trust.

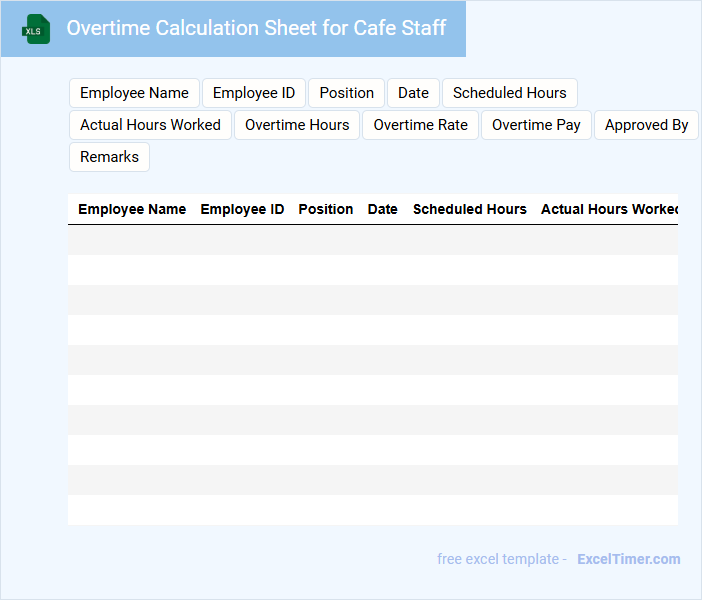

Overtime Calculation Sheet for Cafe Staff

An Overtime Calculation Sheet for cafe staff typically contains detailed records of hours worked beyond regular shifts, including daily time logs and total overtime hours. It also tracks employee names, dates, and applicable overtime rates to ensure accurate compensation.

This document helps management monitor extra work hours and ensures compliance with labor laws. Including clear formulas and breakdowns of hours can improve transparency and reduce payroll errors.

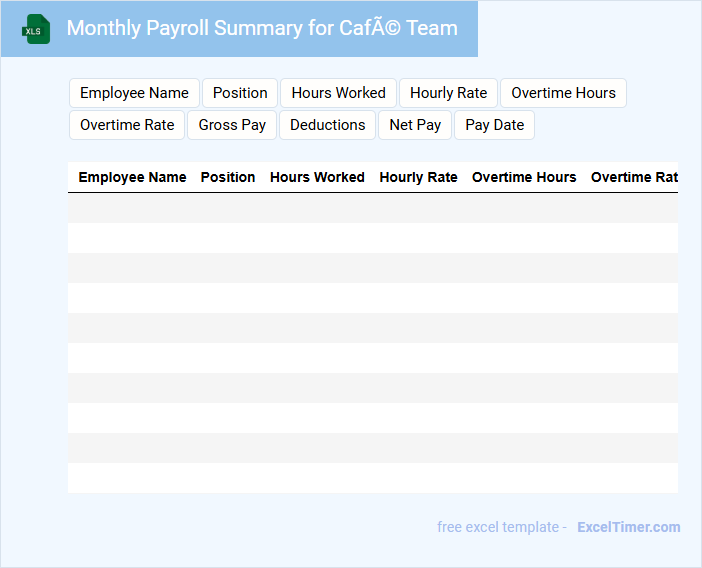

Monthly Payroll Summary for Café Team

The Monthly Payroll Summary for a café team typically contains detailed records of each employee's hours worked, gross wages, deductions, and net pay within the month. This document helps in ensuring accurate and transparent salary distribution while maintaining compliance with labor laws. It is crucial for financial auditing and serves as a reference for resolving any payroll discrepancies.

Payroll Deductions Tracker for Cafés

The Payroll Deductions Tracker for cafés is a specialized document designed to systematically record and manage various employee payroll deductions. It usually contains details such as tax withholdings, benefit contributions, and other mandatory or voluntary deductions. Tracking these deductions accurately ensures compliance with labor laws and helps maintain transparent financial records.

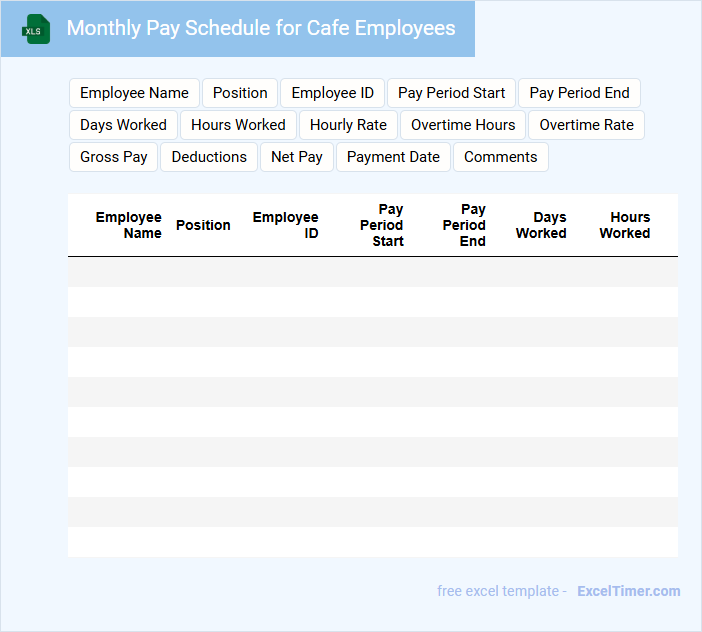

Monthly Pay Schedule for Cafe Employees

A Monthly Pay Schedule for Cafe Employees typically outlines the specific dates and procedures for salary disbursement to ensure timely and accurate payments.

- Payment Dates: Clearly state the exact days employees will receive their wages each month.

- Payroll Procedures: Include detailed steps for processing payments to avoid any discrepancies.

- Overtime and Deductions: Specify how additional hours worked and any deductions will be calculated and reflected.

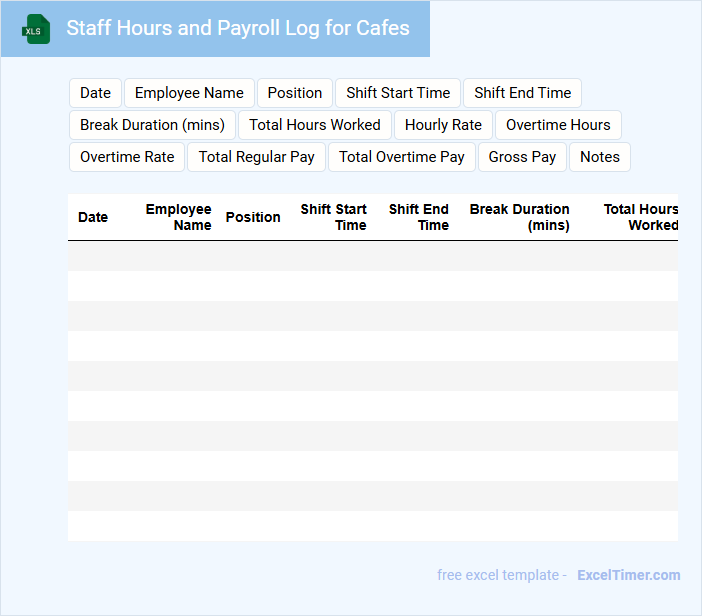

Staff Hours and Payroll Log for Cafes

What information does a Staff Hours and Payroll Log for Cafes typically contain? This document records employees' working hours, including clock-in and clock-out times, as well as breaks taken. It also details payroll calculations, such as wages based on hours worked and any applicable overtime or bonuses.

Why is maintaining an accurate Staff Hours and Payroll Log important? Accurate logs ensure fair compensation for staff and compliance with labor laws, preventing disputes and payroll errors. It is also crucial for budgeting and financial tracking within the café's operations.

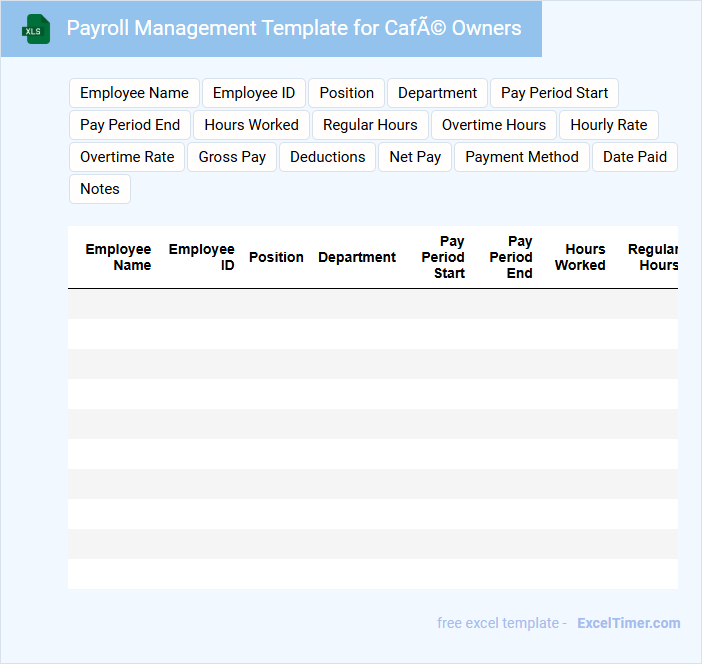

Payroll Management Template for Café Owners

Payroll Management Template for Café Owners typically contains detailed employee payment records, including wages, hours worked, tax deductions, and benefits. It also includes sections for calculating overtime, bonuses, and compliance with local labor laws. Ensuring accuracy and timely updates in this document is crucial to maintain proper financial records. An important aspect of this template is incorporating tax filing and deduction details to simplify payroll processing and avoid legal issues. It should also have clear fields for employee identification and payment schedules. Regular audits of the payroll data help in minimizing errors and improving financial transparency.

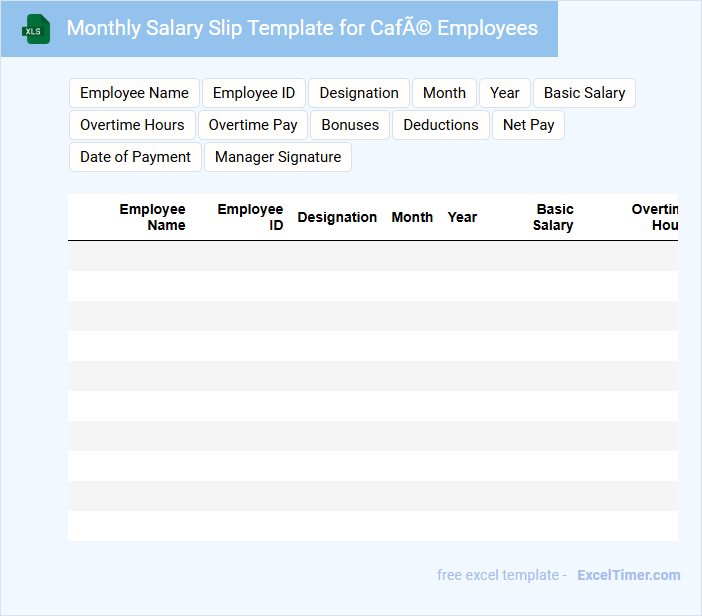

Monthly Salary Slip Template for Café Employees

A Monthly Salary Slip Template for Café Employees typically contains detailed information about the employee's earnings and deductions for the month. It serves as an official proof of salary payment and helps in maintaining transparent financial records.

- Include employee details such as name, designation, and employee ID.

- List all components of the salary including basic pay, allowances, and bonuses.

- Clearly mention deductions like tax, provident fund, and any other applicable charges.

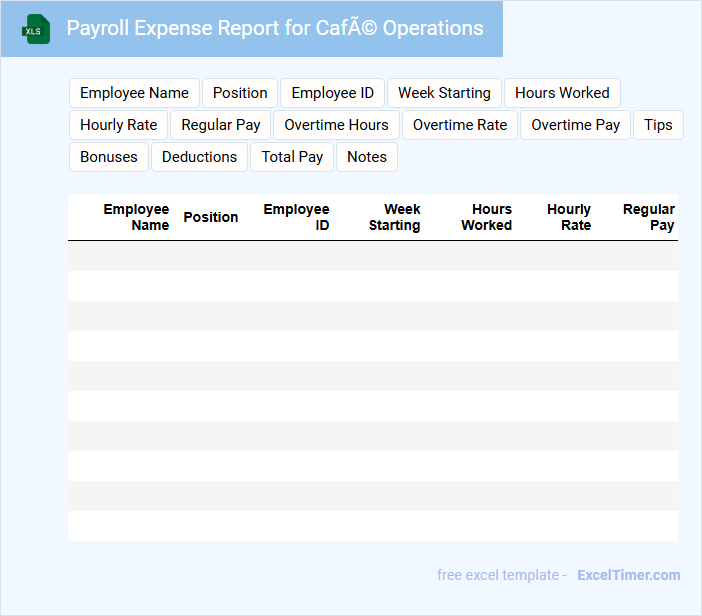

Payroll Expense Report for Café Operations

The Payroll Expense Report for Café Operations typically includes a detailed breakdown of employee wages, hours worked, and various payroll taxes. This document is essential for tracking labor costs and ensuring accurate financial records.

It also highlights overtime, benefits, and deductions related to café staff payments. Regular review of this report helps optimize staffing budgets and maintain compliance with labor laws.

Important considerations include accurate time tracking, categorizing expenses by role, and reconciling with the general ledger for precise accounting.

What key components should be included in a monthly payroll sheet for cafes (e.g., wages, overtime, tips, deductions)?

Your monthly payroll sheet for cafes should include key components such as wages, overtime pay, and tips to accurately calculate employee earnings. It must also account for deductions like taxes, Social Security, and benefits contributions for compliance and proper net pay calculation. Including employee details and payment dates ensures organized payroll management and transparency.

How do you structure employee work schedules and shift records in the payroll document?

Employee work schedules and shift records in a Monthly Payroll Excel document for cafes are structured using columns for employee names, dates, shift start and end times, and total hours worked per shift. Separate rows are used for each day worked, ensuring accurate tracking of hours and overtime. Formulas calculate daily and monthly totals, facilitating precise payroll processing and attendance management.

What formulas are essential for calculating gross and net pay for café staff each month?

Essential formulas for calculating gross pay in a cafe payroll Excel document include multiplying hourly wage by hours worked (e.g., =HourlyRate*HoursWorked). To determine net pay, subtract deductions such as taxes and benefits from gross pay using formulas like =GrossPay - SUM(Deductions). Including functions like SUM, IF for overtime, and VLOOKUP for tax rates ensures accurate monthly payroll calculations.

How should statutory deductions (tax, insurance, pension) be managed and documented in Excel?

Statutory deductions for tax, insurance, and pension should be calculated accurately based on current government rates and entered into dedicated columns within your Excel payroll sheet. Use separate sheets or tables to record detailed deduction rules and employee-specific data, ensuring transparency and easy updates. Your payroll document must include formulas that automatically update deductions monthly, allowing clear audit trails and regulatory compliance.

What methods ensure payroll accuracy and prevent common errors in monthly café payroll tracking?

Accurate payroll for cafes relies on automated time tracking systems and integrated payroll software to minimize manual entry errors. Regular audits and reconciliation of employee hours, wages, and tax withholdings ensure compliance and prevent discrepancies. You can enhance payroll accuracy by maintaining clear communication with staff and updating records promptly.