The Monthly Financial Report Excel Template for Accountants streamlines financial data tracking and analysis, helping professionals monitor income, expenses, and cash flow efficiently. It includes customizable sheets for balance sheets, profit and loss statements, and budget comparisons, ensuring accurate monthly reporting. This template enhances decision-making by providing clear visual summaries and automated calculations tailored to accounting needs.

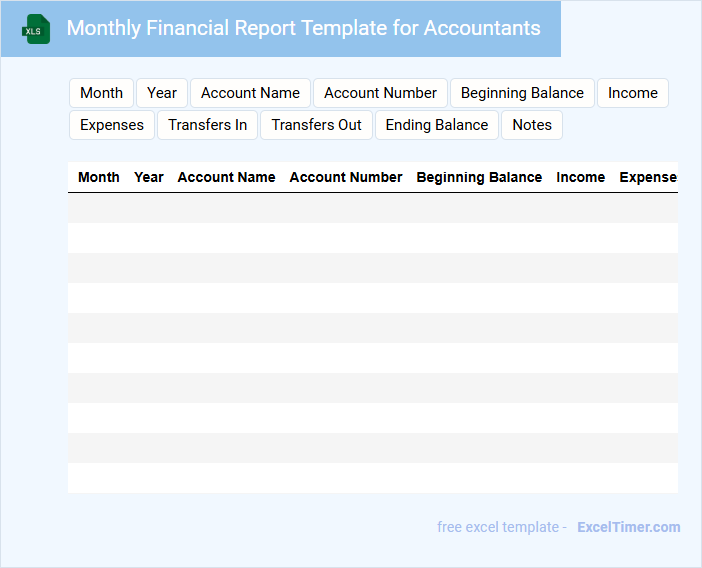

Monthly Financial Report Template for Accountants

What does a Monthly Financial Report Template for Accountants typically include?

This type of document usually contains detailed summaries of income, expenses, profits, and financial ratios for the month. It helps accountants track financial performance, identify trends, and ensure compliance with budgets and regulations.

Important elements to include are clear sections for revenue, costs, profit margins, and notes on significant variances. Incorporating visual aids like graphs and charts enhances readability and aids quick decision-making.

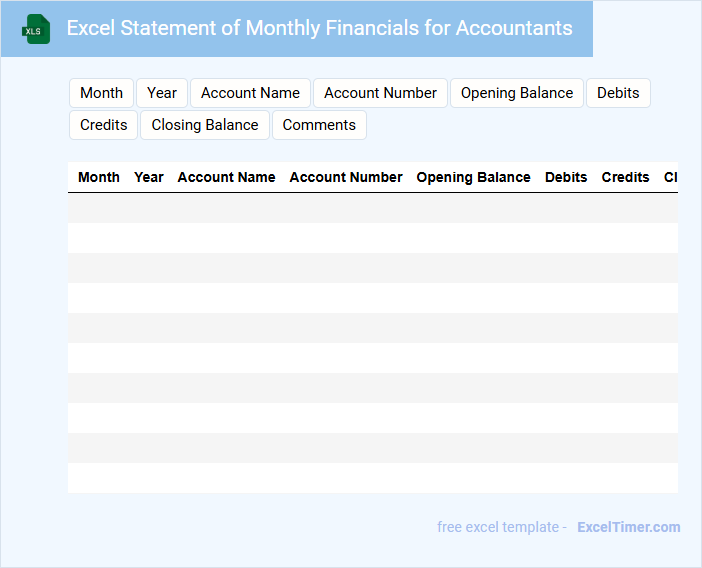

Excel Statement of Monthly Financials for Accountants

What information does an Excel Statement of Monthly Financials for Accountants typically contain? This document usually includes detailed records of income, expenses, assets, and liabilities for a specific month. It helps accountants monitor financial performance and ensure accuracy in reporting.

Why is it important to maintain accuracy and consistency in this document? Accurate data entry and consistent formatting are crucial to avoid errors and facilitate easy analysis. Including clear labels and using formulas to automate calculations improves efficiency and reliability.

Income and Expense Tracker Template for Accountants

An Income and Expense Tracker Template is a structured document designed to help accountants efficiently record and monitor financial transactions. It typically contains sections for categorizing income sources, tracking various expenses, and summarizing net profit or loss.

Accountants benefit from using this template as it ensures accurate financial reporting and aids in budget management. Including a section for notes or receipts referencing is an important feature to enhance clarity and accountability.

Monthly Profit and Loss Report for Accountants

The Monthly Profit and Loss Report is a financial document that summarizes the revenues, costs, and expenses incurred during a specific month. It provides a clear overview of the company's operational performance and profitability for accountants. Regular analysis of this report helps identify trends and areas for financial improvement.

This report usually contains details such as total income, cost of goods sold, operating expenses, and net profit or loss. For accountants, it is important to ensure accuracy in data entry and reconciliation with other financial records to maintain integrity. Timely preparation and review of the report enable informed decision-making and strategic planning.

Monthly Budget Tracking Excel Template for Accountants

What information is typically included in a Monthly Budget Tracking Excel Template for Accountants? This document usually contains detailed sections for income, expenses, and variance analysis to help track financial performance over the month. It is designed to organize financial data efficiently, allowing accountants to monitor budgets against actual spending and ensure accurate financial reporting.

What are the important features to include in this template? Key elements should include categorized expense tracking, automated calculations, clear visualizations like charts and graphs, and sections for notes or comments to highlight significant budget deviations. Additionally, incorporating monthly summaries and customizable fields enhances usability and ensures thorough financial oversight.

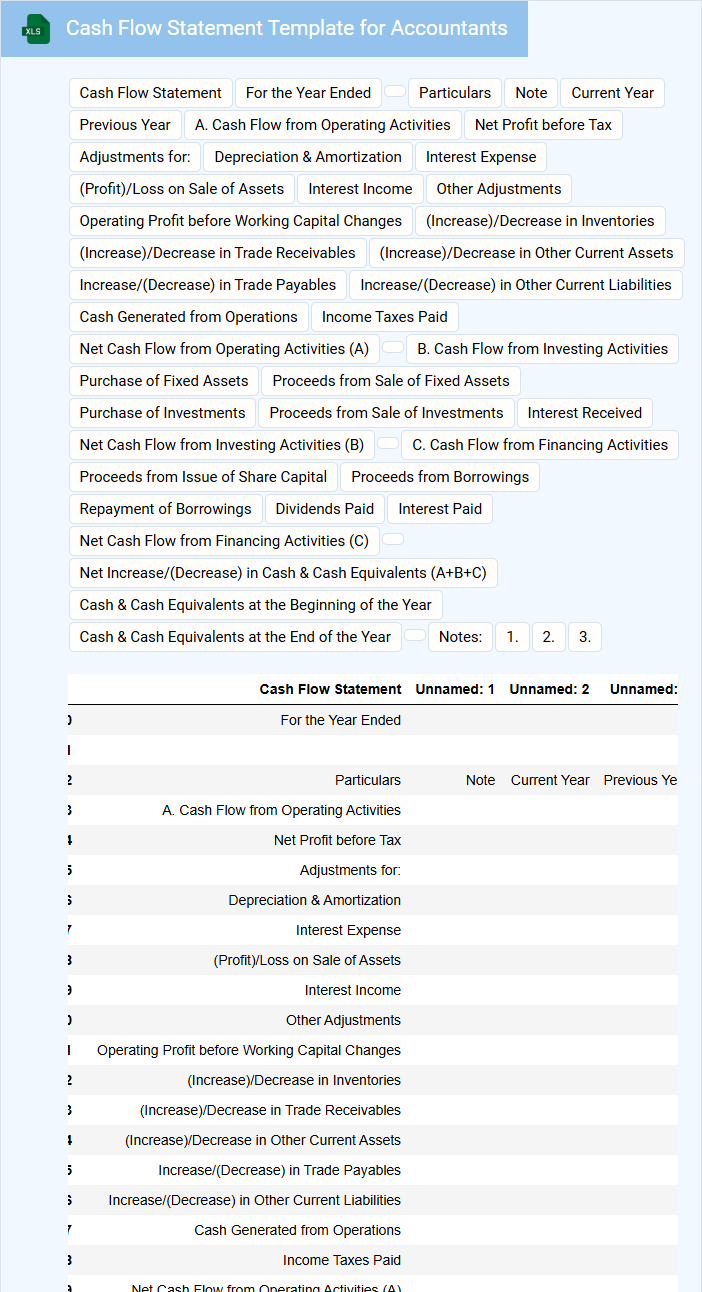

Cash Flow Statement Template for Accountants

What essential information does a Cash Flow Statement Template for Accountants typically contain? This type of document usually includes detailed sections for operating, investing, and financing activities to track the inflow and outflow of cash. It helps accountants assess the company's liquidity, financial health, and cash management efficiency.

What important factors should be considered when using a Cash Flow Statement Template? It is crucial to ensure accuracy in categorizing cash flows and consistently update the template to reflect real-time data. Additionally, incorporating notes explaining significant cash movements can provide better clarity and aid financial decision-making.

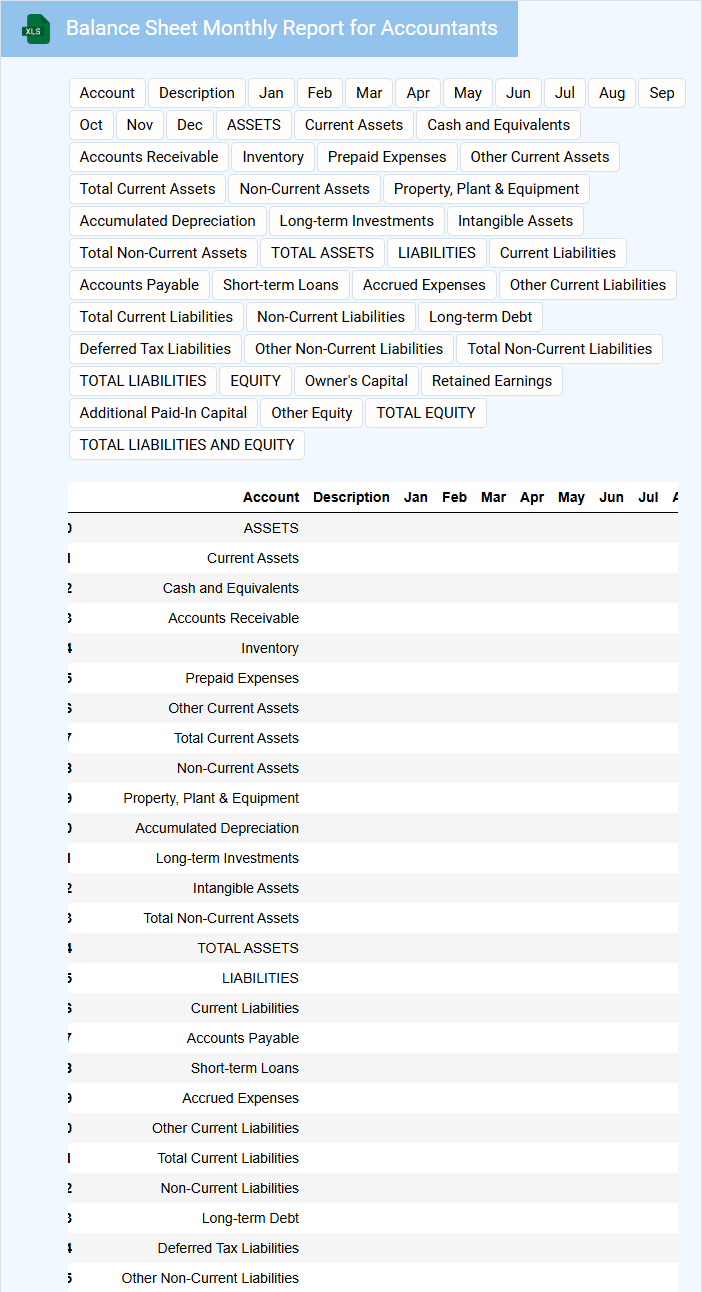

Balance Sheet Monthly Report for Accountants

The Balance Sheet Monthly Report is a financial document summarizing a company's assets, liabilities, and equity at a specific point in time. It provides accountants with a snapshot of the organization's financial position for the month. This report is essential for assessing liquidity, financial stability, and guiding strategic decision-making.

Key elements to focus on include the accurate reconciliation of accounts, timely updates of asset valuations, and clear identification of outstanding liabilities. Accountants should ensure consistency in data entry and regular review of changes to equity. Emphasizing these factors enhances the report's reliability and usefulness for stakeholders.

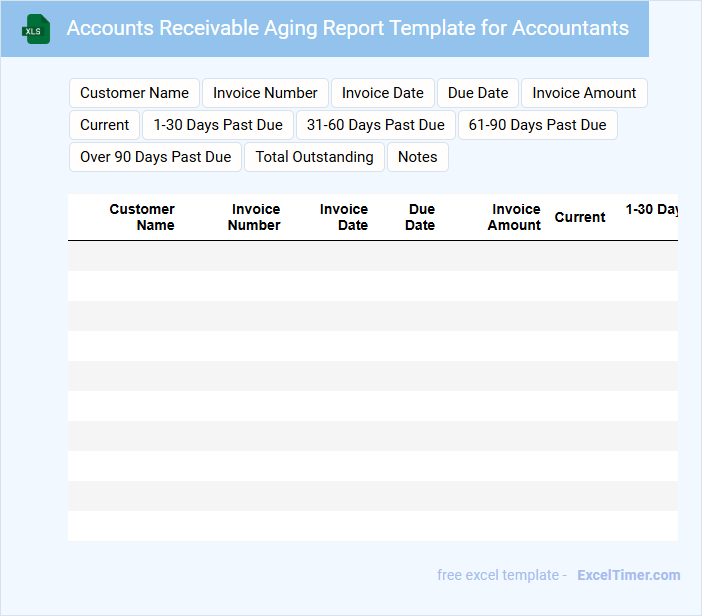

Accounts Receivable Aging Report Template for Accountants

The Accounts Receivable Aging Report is a crucial document used to track outstanding invoices categorized by the length of time they have been unpaid. It helps accountants monitor customer balances and identify overdue accounts to prioritize collection efforts. This report typically contains customer names, invoice dates, due dates, and aging periods such as 30, 60, 90 days, or more.

For an optimized template, ensure clear columns for each aging category and sortable data to quickly identify delinquent accounts. Incorporating summary totals and visual indicators like color codes can enhance readability. Including notes or reminders for follow-up actions is also an important feature to improve account management efficiency.

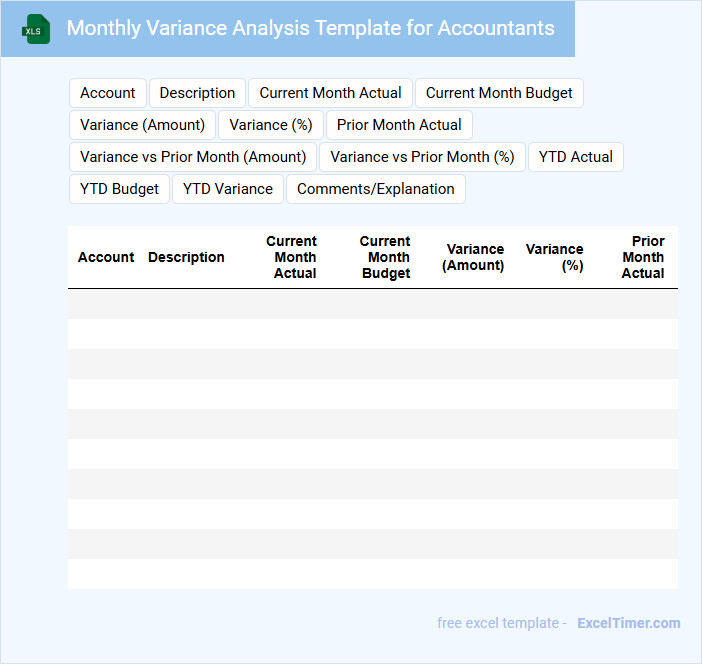

Monthly Variance Analysis Template for Accountants

A Monthly Variance Analysis Template typically contains detailed comparisons between actual financial outcomes and budgeted or forecasted figures. It highlights deviations in revenues, expenses, and other key financial metrics to assist accountants in pinpointing areas of concern or opportunity.

This document is essential for maintaining financial control and improving forecasting accuracy over time. Accountants should ensure the template includes clear variance explanations and actionable insights to drive strategic decision-making.

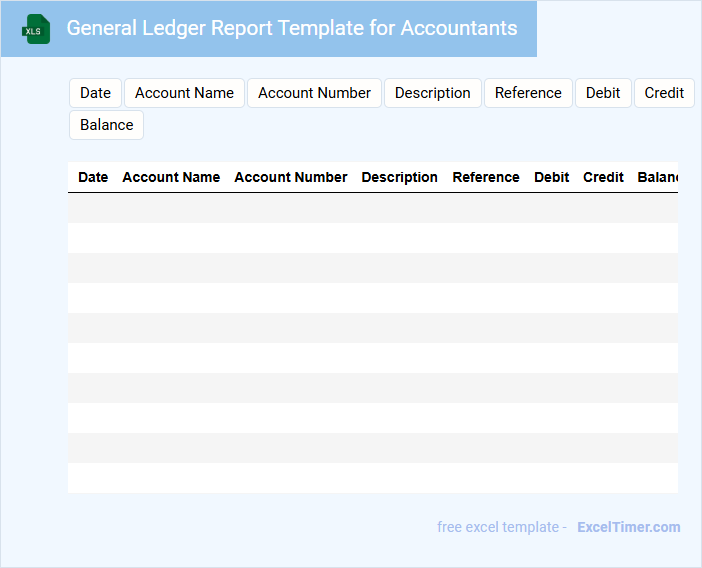

General Ledger Report Template for Accountants

The General Ledger Report is a comprehensive document that details all financial transactions within an accounting period. It aggregates the data from various accounts, providing a clear overview of debit and credit movements.

This report is crucial for accountants to ensure accuracy and completeness of financial records. Important elements to include are the date, account names, transaction descriptions, and amounts for transparency and easy auditing.

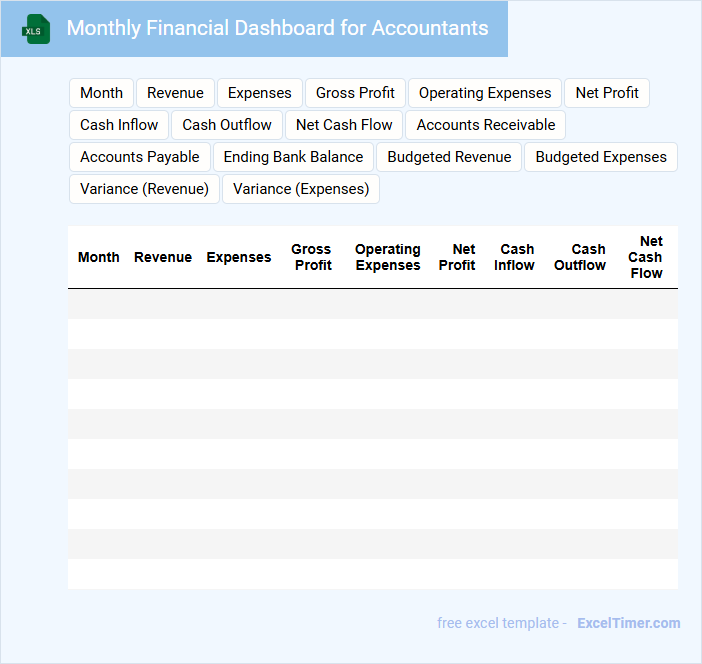

Monthly Financial Dashboard for Accountants

The Monthly Financial Dashboard is a crucial document that provides accountants with a comprehensive overview of an organization's financial performance over the past month. It typically contains key metrics such as revenues, expenses, profit margins, and cash flow summaries to help monitor financial health.

This dashboard also includes visual elements like charts and graphs to make data interpretation faster and more intuitive. To ensure effectiveness, it is important to maintain accuracy, timely updates, and clear categorization of financial data.

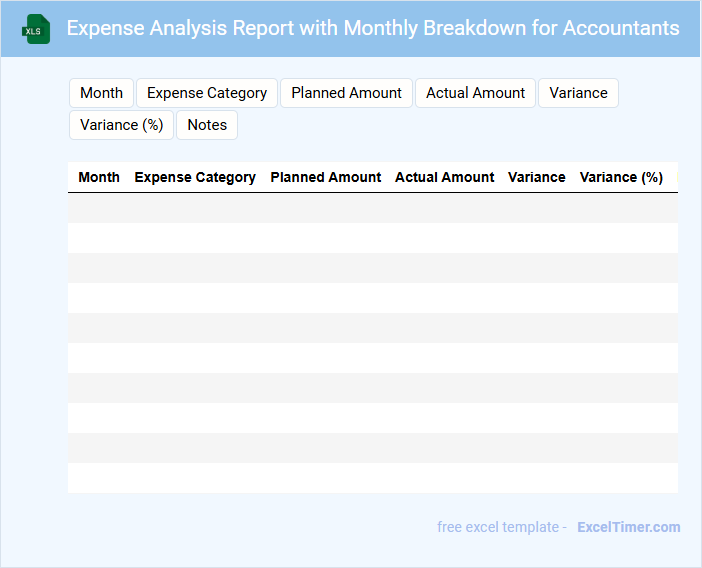

Expense Analysis Report with Monthly Breakdown for Accountants

An Expense Analysis Report with a monthly breakdown provides a detailed overview of a company's expenditures, helping accountants track spending patterns. It categorizes expenses by month, allowing for clear identification of trends and anomalies.

This report is essential for budgeting and financial planning, ensuring accurate cost control and allocation. Including comparative data from previous periods enhances its usefulness for strategic decision-making.

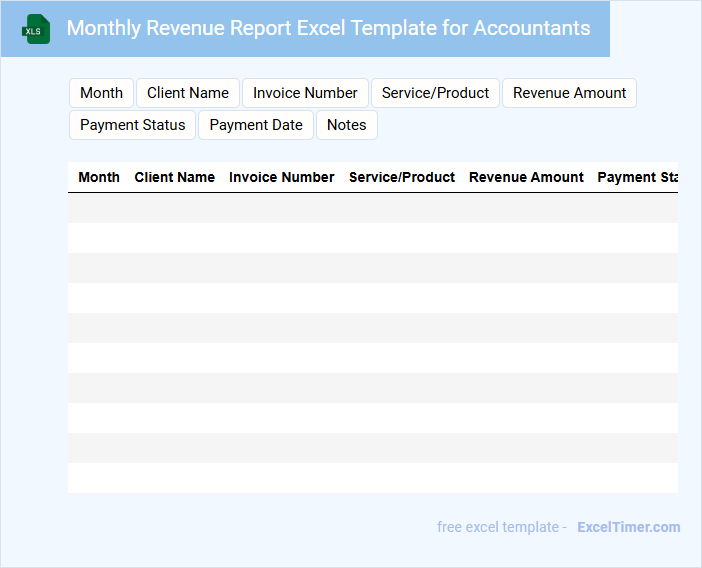

Monthly Revenue Report Excel Template for Accountants

A Monthly Revenue Report Excel Template is typically used to track and analyze the income generated by a business over a specific month. It contains detailed data such as sales figures, revenue streams, and comparative monthly performance metrics.

For accountants, this template is essential for ensuring accurate financial records and identifying trends in revenue growth or decline. Including clear charts and automated calculations can significantly enhance the usability of the report.

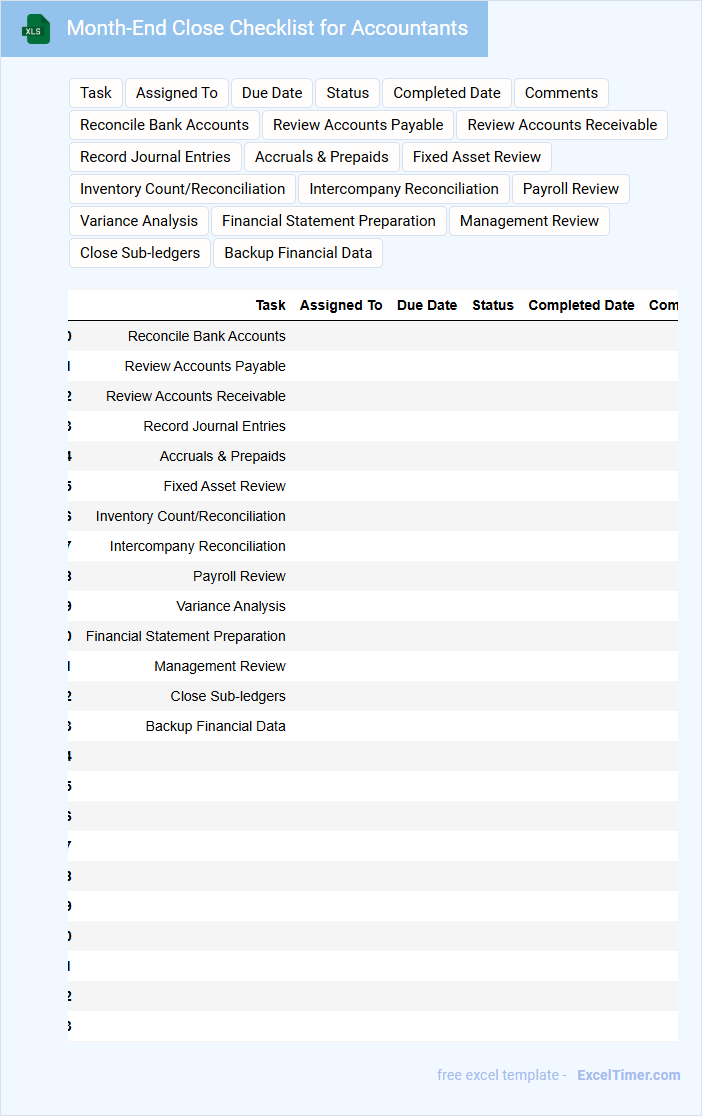

Month-End Close Checklist for Accountants

What information is typically included in a Month-End Close Checklist for Accountants? This document generally contains detailed steps and procedures required to finalize a company's financial records for the month, ensuring accuracy and compliance. It helps accountants systematically verify transactions, reconcile accounts, and prepare financial statements.

What is important to consider when using a Month-End Close Checklist? It is essential to ensure the checklist is comprehensive, covering all key areas such as account reconciliations, journal entries, and review of expenses. Additionally, timely completion and clear assignment of responsibilities help maintain an efficient closing process and reduce errors.

Financial KPI Tracking Sheet for Accountants

A Financial KPI Tracking Sheet for accountants typically contains key performance indicators that monitor financial health, such as revenue, expenses, profit margins, and cash flow. It often includes monthly or quarterly data entries to analyze trends and make informed decisions. Essential for accuracy, this document should also highlight variance analysis and budget comparisons.

What key financial metrics should be included in a monthly financial report for accurate performance evaluation?

A monthly financial report for accountants should include key metrics such as revenue, expenses, net profit, cash flow, and accounts receivable/payable balances for accurate performance evaluation. Your report must also highlight gross margin, operating margin, and budget variance to track financial health and operational efficiency. Including these metrics ensures a comprehensive view of your organization's financial status and aids in informed decision-making.

How should revenue and expense categories be structured for clear month-to-month comparisons?

Organize revenue and expense categories into distinct groups such as Operating Income, Non-Operating Income, Fixed Expenses, and Variable Expenses for clear month-to-month comparisons. Use consistent subcategories like Sales Revenue, Service Income, Salaries, Rent, Utilities, and Marketing to enhance detailed analysis. Maintain uniform category labels across months to ensure accuracy and ease in trend identification.

What are the essential steps to ensure the accuracy and completeness of data entered into the report?

Ensure data accuracy in a Monthly Financial Report by verifying source documents, performing regular reconciliations, and using error-checking formulas in Excel. Implement data validation rules and maintain consistent formatting to enhance completeness and reduce entry errors. Conduct periodic reviews and cross-check figures against prior reports to identify discrepancies early.

How can Excel formulas and functions (e.g., SUMIFS, VLOOKUP, Pivot Tables) automate recurring monthly calculations?

Excel formulas such as SUMIFS and VLOOKUP streamline monthly financial reporting by automatically aggregating and retrieving relevant transaction data based on specific criteria. Pivot Tables provide dynamic summaries, enabling accountants to analyze and visualize key financial metrics with ease. Your monthly calculations become more accurate and efficient, reducing manual errors and saving valuable time.

Which visualizations (charts, graphs) best represent trends and variances in monthly financial data for stakeholders?

Line charts effectively display trends in revenue, expenses, and profit over multiple months, highlighting growth patterns. Bar graphs compare monthly variances in budget versus actual figures, making deviations clear to stakeholders. Waterfall charts visualize cumulative financial impacts, illustrating how individual factors contribute to overall monthly performance.