The Monthly Payroll Calculator Excel Template for Startups streamlines salary calculations, tax deductions, and allowances, ensuring accurate and efficient payroll management. Startups benefit from customizable fields that adapt to varying employee structures and compliance with local tax regulations. This tool reduces manual errors and saves valuable time during payroll processing each month.

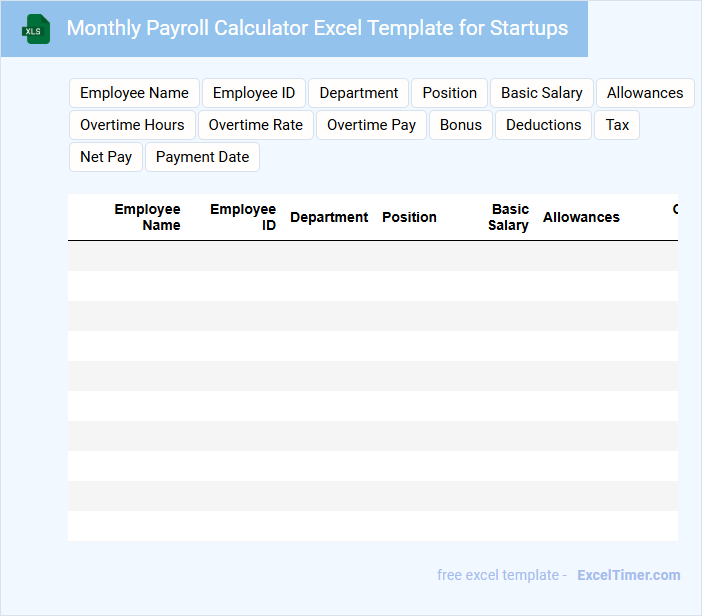

Monthly Payroll Calculator Excel Template for Startups

A Monthly Payroll Calculator Excel Template is an essential tool for startups to streamline their employee salary calculations efficiently. It typically contains sections for employee details, working hours, salary components, tax deductions, and net pay.

Such a document ensures accurate payroll processing and helps maintain financial records systematically. It's important to include tax regulations and benefits calculations to comply with legal requirements and avoid errors.

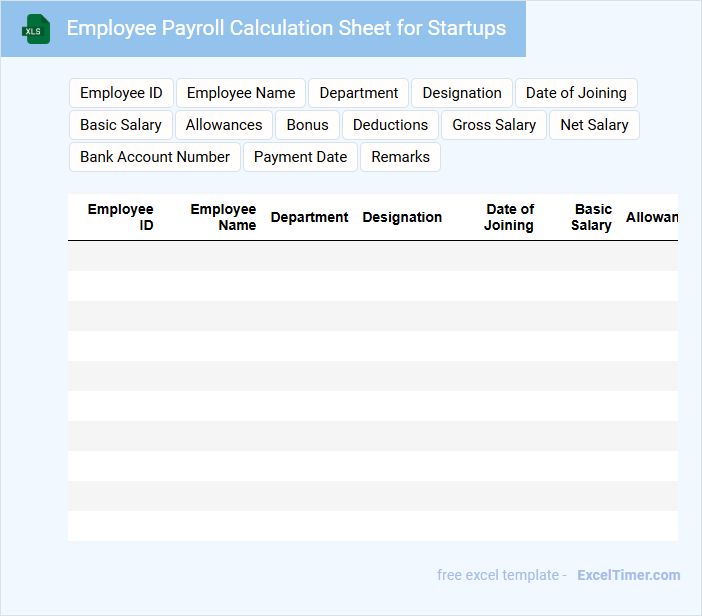

Employee Payroll Calculation Sheet for Startups

What information is typically included in an Employee Payroll Calculation Sheet for Startups? This document usually contains detailed records of employee wages, hours worked, tax deductions, and net pay calculations. It helps startups maintain accurate financial records and ensure compliance with payroll regulations.

What important aspects should startups consider when preparing a payroll calculation sheet? Startups should ensure timely updates of tax rates and benefits, include overtime and bonuses accurately, and maintain confidentiality to protect employee information. Clear documentation supports transparency and reduces payroll errors.

Salaries and Deductions Tracker for Startups

A Salaries and Deductions Tracker is an essential document for startups to systematically record employee compensation and associated deductions. It usually contains detailed entries of gross salaries, tax withholdings, insurance, and other statutory deductions for accurate payroll management. This tool helps ensure compliance with labor laws while maintaining financial transparency within the organization.

Important considerations for this tracker include regularly updating salary changes, clearly categorizing each type of deduction, and integrating it with accounting software for seamless data management. Ensuring confidentiality and access control is crucial to protect sensitive employee information. Additionally, providing summarized reports can aid leadership in budgeting and payroll forecasting.

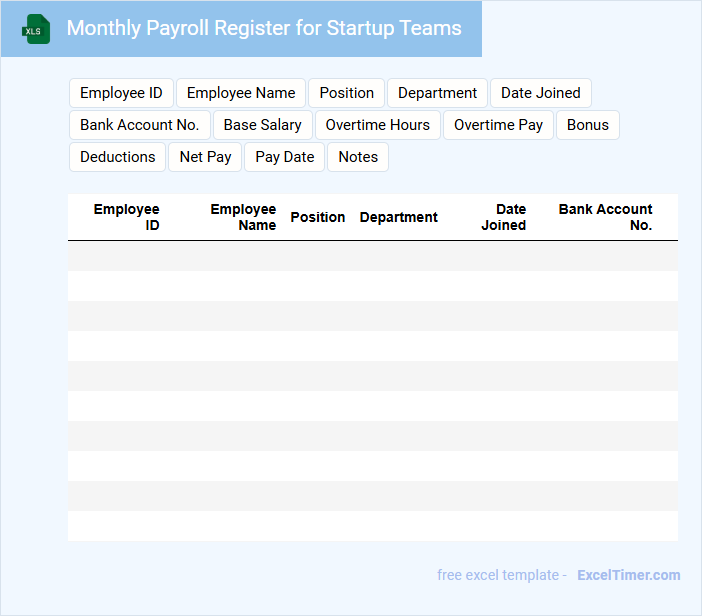

Monthly Payroll Register for Startup Teams

A Monthly Payroll Register for Startup Teams typically contains detailed records of employee payments, deductions, and tax information for accurate financial and legal compliance.

- Employee Payment Details: Includes gross wages, bonuses, and hours worked to ensure accurate salary calculations.

- Deductions and Benefits: Lists all deductions like taxes, insurance, and retirement contributions for transparent accounting.

- Compliance and Reporting: Maintains records for tax filing and legal compliance to avoid penalties.

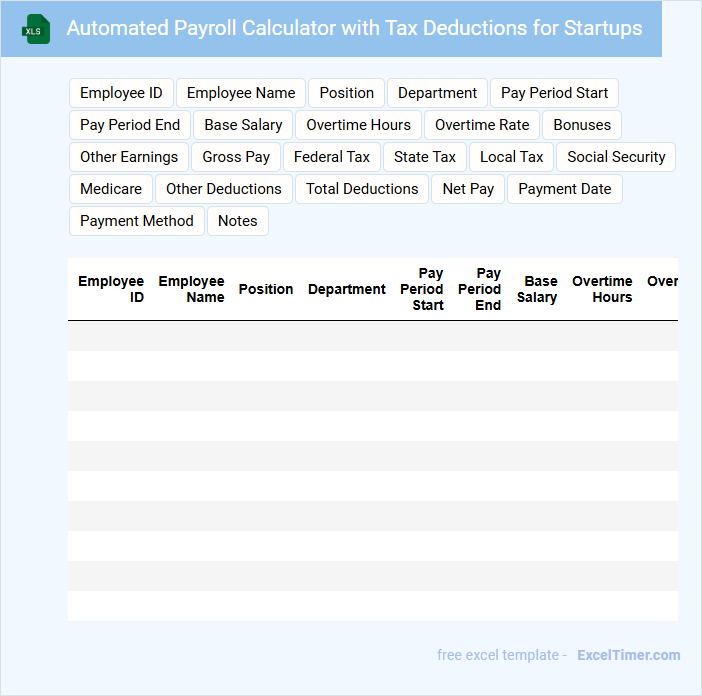

Automated Payroll Calculator with Tax Deductions for Startups

An Automated Payroll Calculator is a specialized tool that simplifies the process of managing employee salaries by accurately calculating wages and tax deductions. This document typically contains detailed formulas, tax rates, and compliance guidelines tailored for startups. It is essential to ensure accuracy, legal conformity, and ease of use for efficient payroll processing.

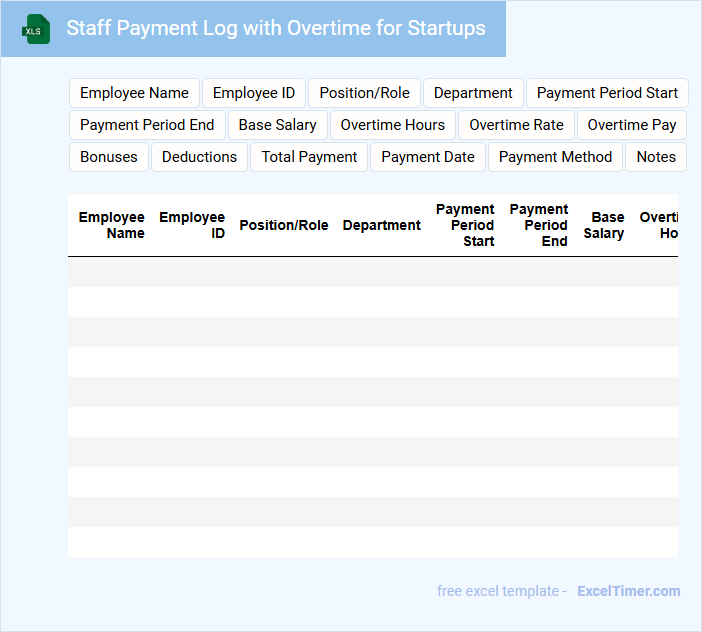

Staff Payment Log with Overtime for Startups

What information does a Staff Payment Log with Overtime for Startups typically contain? This document usually records employees' regular working hours, overtime hours, and corresponding payment details. It helps startups track payroll expenses accurately and ensures compliance with labor regulations.

Why is maintaining a Staff Payment Log with Overtime important for startups? Keeping detailed and transparent payment records prevents payroll disputes and supports financial planning. It is also crucial for evaluating labor costs and managing budget allocations effectively.

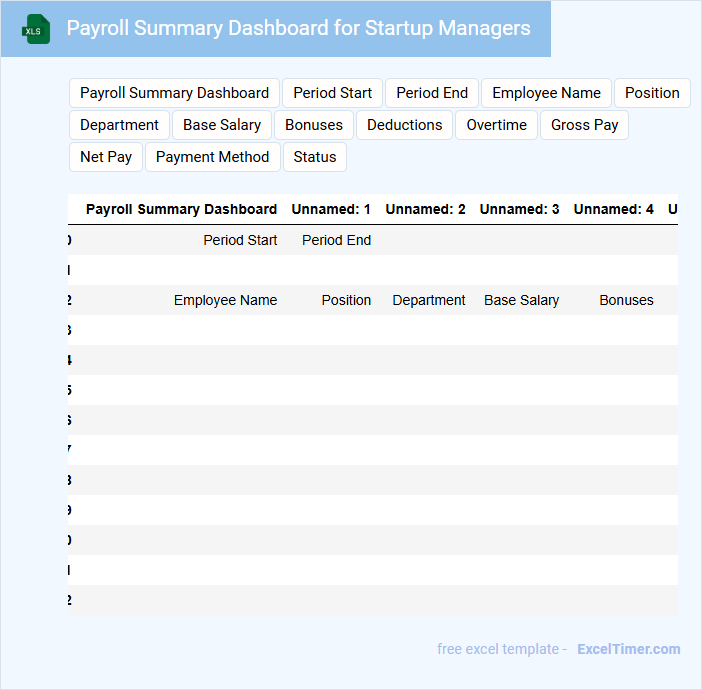

Payroll Summary Dashboard for Startup Managers

What information does a Payroll Summary Dashboard for Startup Managers typically contain? This document usually includes an overview of employee salaries, deductions, bonuses, and tax withholdings, providing a clear summary of total payroll expenses. It helps managers monitor payroll costs and ensure compliance with financial regulations efficiently.

What are the important elements to include in a Payroll Summary Dashboard? Key components should highlight total payroll amounts, departmental salary breakdowns, payment dates, and any outstanding payroll liabilities. Including visual charts and alerts for discrepancies or upcoming payment deadlines can further optimize decision-making.

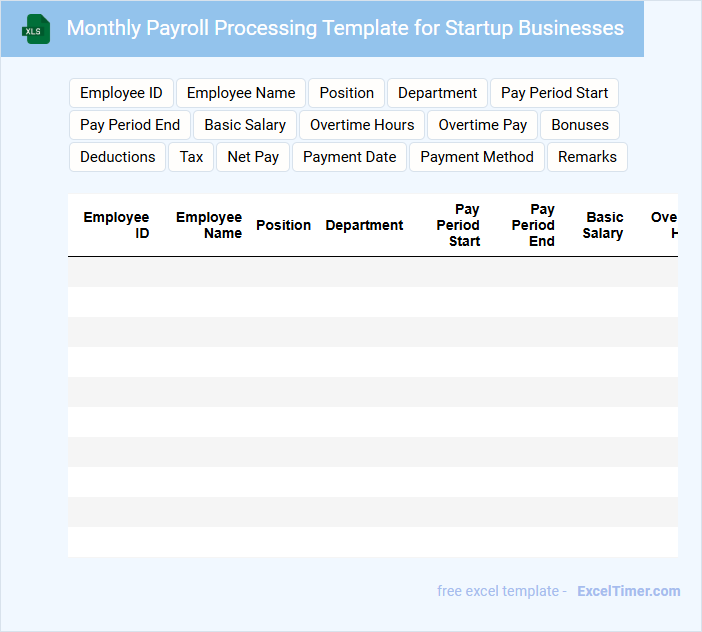

Monthly Payroll Processing Template for Startup Businesses

A Monthly Payroll Processing Template for startup businesses is usually a structured document that outlines employee salaries, deductions, bonuses, and net pay for each pay period. It helps streamline the payroll system by providing a consistent and organized format to manage financial transactions accurately.

This template often includes sections for employee details, tax withholdings, benefits, and overtime calculations to ensure compliance with labor laws and tax regulations. It is important to regularly update the template to reflect changes in salary structures, tax policies, and employee status to maintain accuracy and efficiency.

Payroll Expense Tracker with Benefits for Startups

A Payroll Expense Tracker with Benefits for Startups is a document used to monitor and manage employee compensation along with associated benefits costs. It helps startups maintain accurate financial records and ensures compliance with payroll regulations.

- Include detailed employee salary and wage information for clear payroll accounting.

- Track all benefits expenses such as health insurance, retirement contributions, and bonuses.

- Regularly update the tracker to reflect changes in payroll taxes and regulatory requirements.

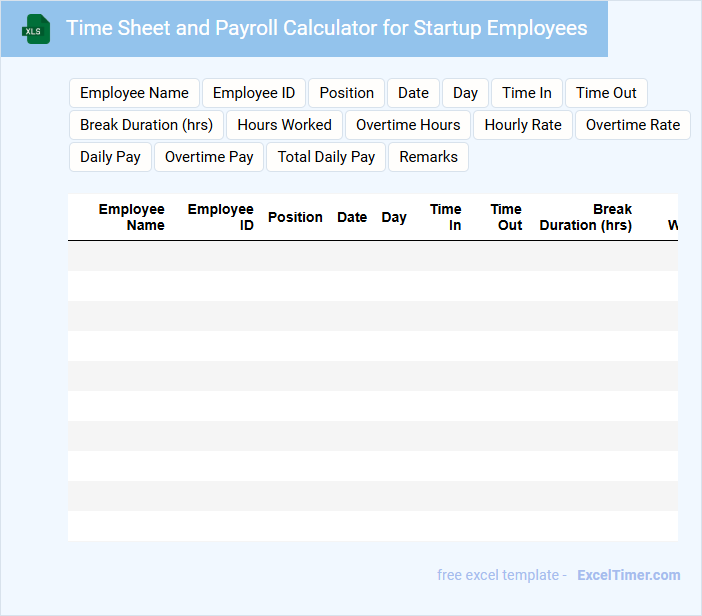

Time Sheet and Payroll Calculator for Startup Employees

What information is typically included in a Time Sheet and Payroll Calculator for Startup Employees? This document usually contains detailed records of employees' working hours, including start and end times, breaks, and overtime. It also incorporates payroll calculations such as wages, deductions, taxes, and net pay to ensure accurate compensation.

Why is it important to maintain precise and up-to-date Time Sheets and Payroll Calculators in startups? Accurate tracking helps prevent payroll errors, ensures compliance with labor laws, and facilitates timely payment. Additionally, a reliable system supports budgeting and financial planning, which are crucial for the growth and sustainability of a startup.

Monthly Salary Calculator with Leave Tracker for Startups

The Monthly Salary Calculator is a vital tool used to compute employee wages accurately based on attendance and work hours. It often integrates a Leave Tracker to monitor absences and adjust salaries accordingly.

This document typically contains detailed fields for employee information, salary components, leave types, and calculation formulas. Ensuring data accuracy and compliance with labor laws are crucial for startups to maintain transparency and trust.

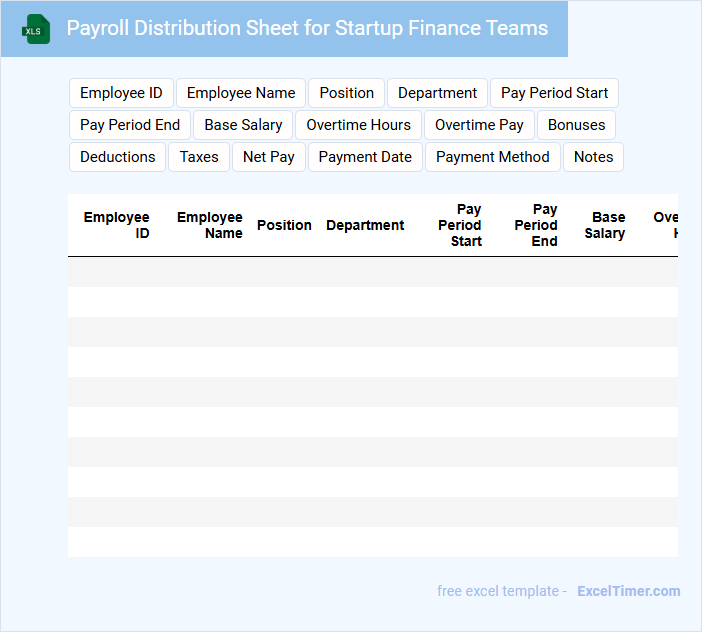

Payroll Distribution Sheet for Startup Finance Teams

Payroll Distribution Sheet is a crucial document used by startup finance teams to manage and track employee salary payments. It typically contains detailed information such as employee names, payment amounts, payment dates, and tax deductions. Ensuring accuracy in this financial record helps maintain transparency and compliance with payroll regulations.

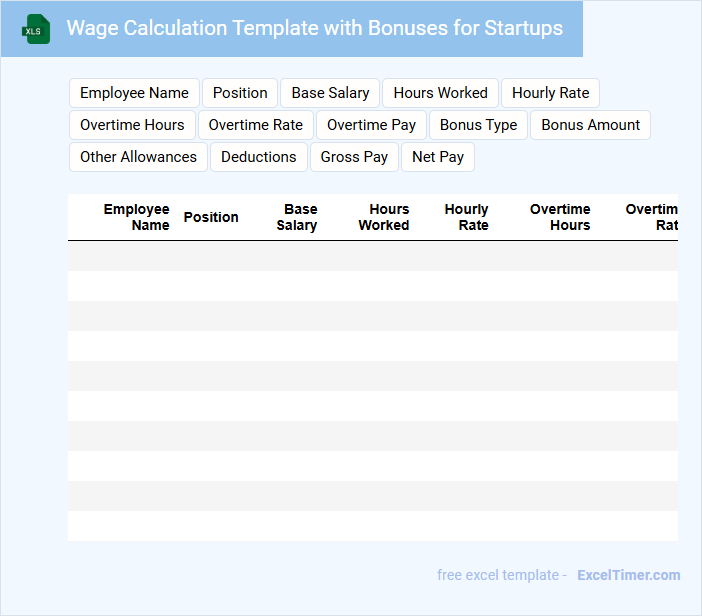

Wage Calculation Template with Bonuses for Startups

What information is typically included in a Wage Calculation Template with Bonuses for Startups? This document usually contains employee base salaries, bonus structures, and any additional compensation details. It helps startups accurately calculate wages, ensuring fair pay and proper financial planning.

What are important considerations when using this template? It is crucial to clearly define bonus eligibility criteria and payment schedules to avoid misunderstandings. Additionally, regularly updating the template to reflect changes in compensation policies ensures accuracy and compliance.

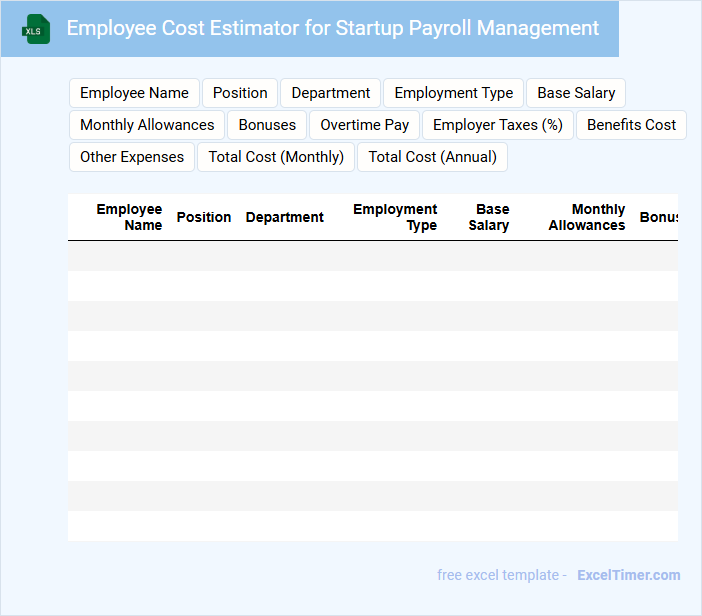

Employee Cost Estimator for Startup Payroll Management

The Employee Cost Estimator document provides a detailed breakdown of all expenses related to employee compensation in a startup. It typically includes salaries, benefits, taxes, and other payroll-related costs to ensure accurate budgeting.

For effective Payroll Management, this document helps startups forecast monthly and annual payroll expenses precisely. Ensuring up-to-date cost factors and compliance with labor laws is crucial for accuracy and legal adherence.

Payroll Payment Schedule for Startup Organizations

What information does a Payroll Payment Schedule for Startup Organizations typically contain? This document usually includes the dates on which employees will receive their wages, the pay periods covered, and the methods of payment. It helps ensure timely and organized salary disbursements while maintaining compliance with labor laws.

Why is it important for startups to create a Payroll Payment Schedule? Establishing a clear payment timeline fosters employee trust and financial planning while reducing payroll errors and disputes. It is essential to regularly review and update the schedule to accommodate growth and legal changes.

What key employee data fields must be included in a Monthly Payroll Calculator for accurate salary computation?

Your Monthly Payroll Calculator must include key employee data fields such as employee name, job title, base salary, hours worked, overtime hours, tax withholding rates, and benefit deductions. Accurate input of attendance records and bonus or commission amounts enhances precise salary computation. Including these fields ensures reliable monthly payroll processing tailored to startup needs.

How should deductions (taxes, benefits, loans) be structured and automated in the payroll ?

In your Monthly Payroll Calculator for Startups, structure deductions by categorizing taxes, benefits, and loans as separate line items with predefined formulas linked to employee salary inputs. Automate calculations using Excel functions like SUM and IF to adjust deduction amounts based on individual employee data and regulatory rates. This setup ensures accurate, real-time payroll processing and simplifies compliance management.

What formulas and data validation rules are essential to prevent payroll calculation errors?

Essential formulas for your Monthly Payroll Calculator include SUM for total salaries, IF functions for conditional bonuses or deductions, and ROUND to ensure precise currency values. Data validation rules such as restricting input to valid numerical ranges for hours worked and salary rates help prevent entry errors. Implementing these ensures accurate, error-free payroll calculations tailored to startup needs.

How can the Excel document be designed to differentiate between full-time, part-time, and contract employees' payment structures?

Design the Excel Monthly Payroll Calculator with separate worksheets or tables for full-time, part-time, and contract employees, each containing tailored columns like fixed salary, hourly rate, and contract terms. Use data validation dropdowns to categorize employees and employ formulas to calculate payments based on hours worked, salary, or contract specifics. Incorporate dynamic summary sections to aggregate total payroll costs by employee type for startup budget management.

Which dynamic features (such as drop-down menus or pivot tables) should be implemented for ease of updating and generating payroll reports?

Implement drop-down menus for employee roles and payment types to streamline data entry in your Monthly Payroll Calculator for Startups. Use pivot tables to dynamically summarize payroll expenses by department or payment period, enabling fast and accurate report generation. These features ensure your payroll data remains organized and easy to update as your startup grows.