The Quarterly Budget Excel Template for Small Business is designed to help small business owners track income and expenses efficiently over three-month periods. It provides customizable categories and automatic calculations to ensure accurate financial forecasting and cash flow management. Using this template improves budgeting accuracy, supports informed decision-making, and simplifies quarterly financial reviews.

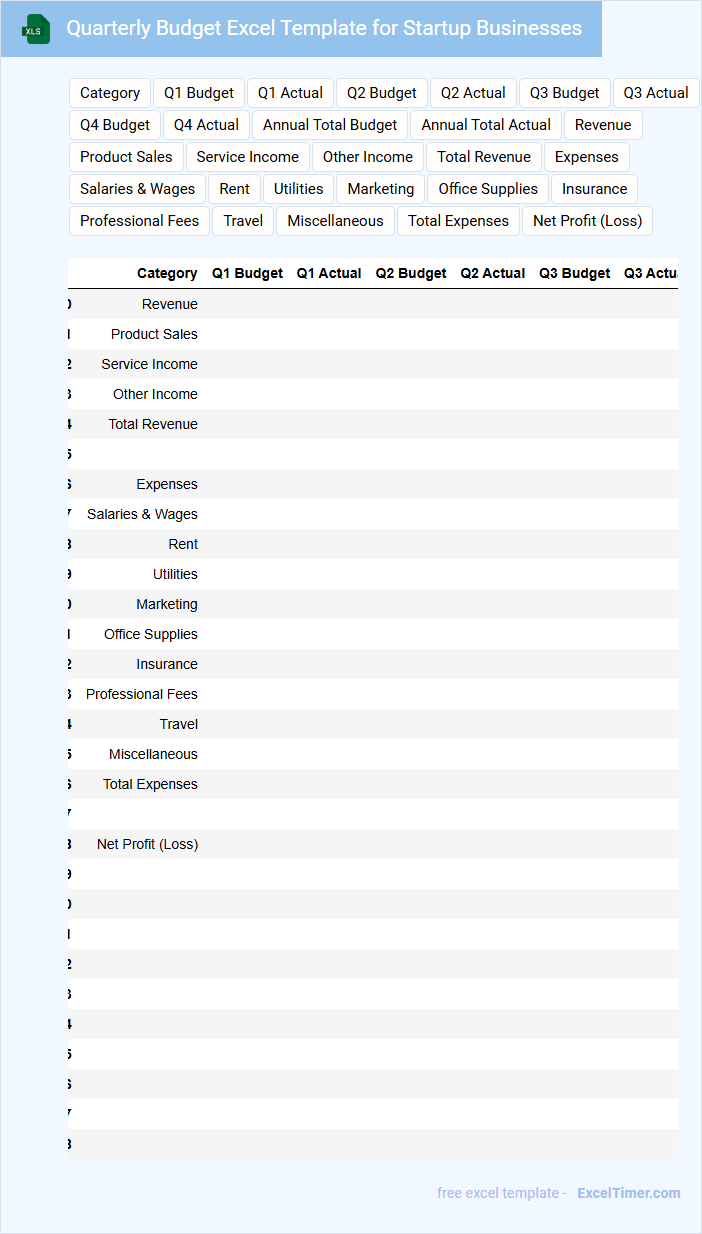

Quarterly Budget Excel Template for Startup Businesses

The Quarterly Budget Excel Template for startup businesses is designed to help entrepreneurs plan and track their financial activities every three months. It typically contains sections for revenue projections, expense tracking, and cash flow analysis. Utilizing this template ensures better financial management and informed decision-making for business growth.

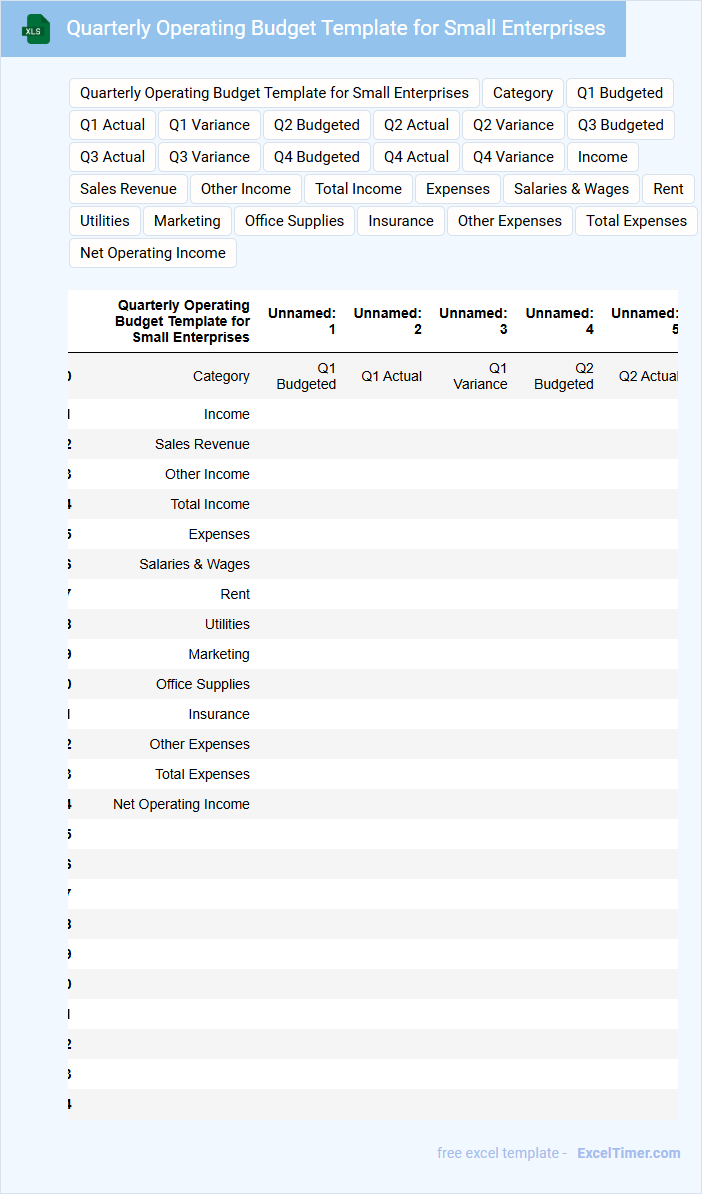

Quarterly Operating Budget Template for Small Enterprises

The Quarterly Operating Budget Template for small enterprises typically includes projected revenues, operating expenses, and cash flow estimates for each quarter. It helps businesses plan their finances and allocate resources efficiently. Regularly updating this budget ensures better financial control and decision-making throughout the year.

This type of document often contains sections for sales forecasts, cost of goods sold, administrative expenses, and marketing budgets. Including contingency plans and variance analysis is crucial for adapting to unexpected changes in the business environment. Maintaining accurate and realistic data inputs enhances the effectiveness of budgeting and financial planning.

Quarterly Expense Tracking Template for Small Business

What information is typically included in a Quarterly Expense Tracking Template for Small Business? This document usually contains detailed records of all business expenses categorized by type, date, and amount incurred within the quarter. It helps businesses monitor spending, identify cost-saving opportunities, and prepare accurate financial reports for informed decision-making.

What is a key consideration when using this template? Ensuring consistent and timely entry of accurate expense data is crucial to maintain the reliability of financial tracking and budgeting efforts. Additionally, including categories for both fixed and variable expenses can provide a clearer picture of business cash flow trends over time.

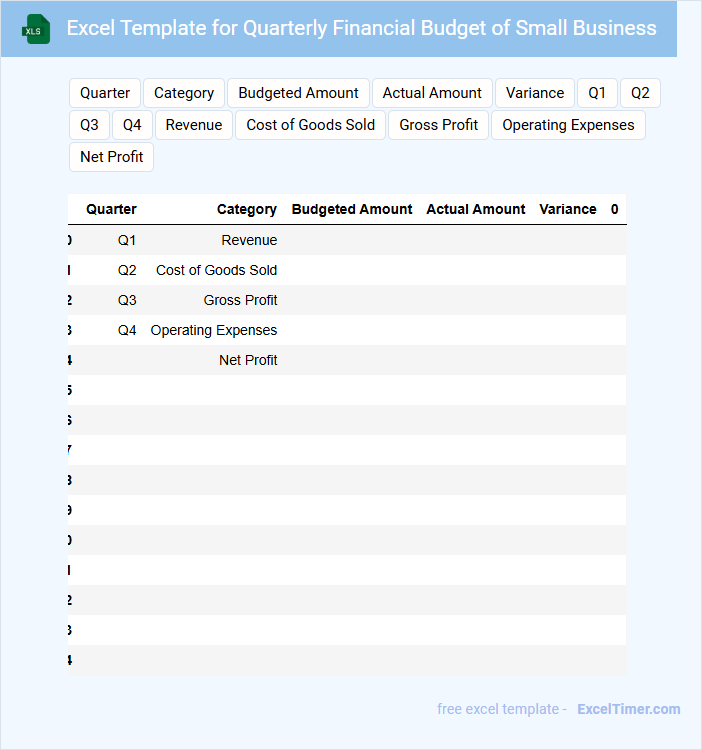

Excel Template for Quarterly Financial Budget of Small Business

An Excel Template for Quarterly Financial Budget typically contains sections for income, expenses, and profit projections. It also includes detailed categories to track various small business financial activities efficiently.

This document allows for easy data input and automatic calculations to help monitor financial health regularly. A crucial aspect to focus on is ensuring accuracy and regular updates to maintain reliable budgeting insights.

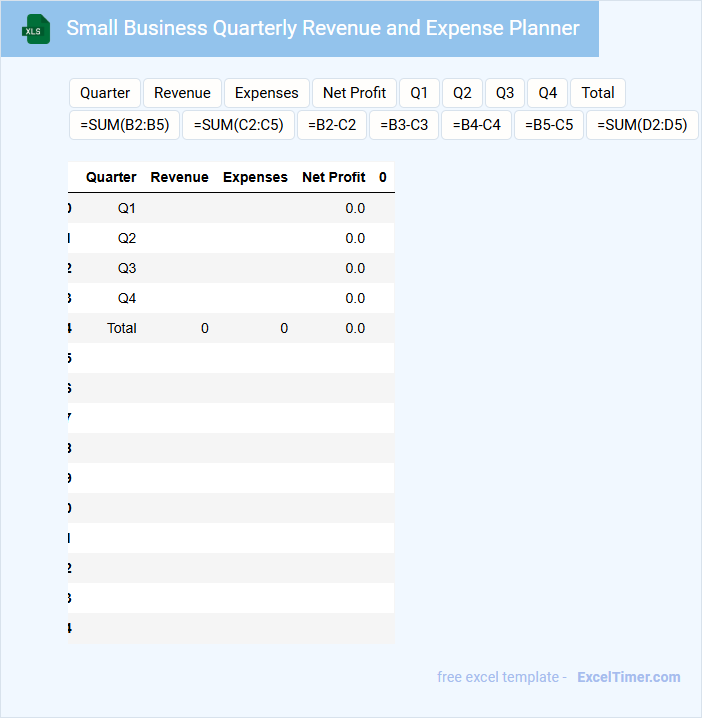

Small Business Quarterly Revenue and Expense Planner

The Small Business Quarterly Revenue and Expense Planner typically contains detailed records of income and outgoing costs over a three-month period. It helps in tracking financial performance and identifying trends.

This document is essential for budgeting, forecasting, and making informed decisions to improve profitability. Regularly updating this planner ensures accurate financial management and resource allocation.

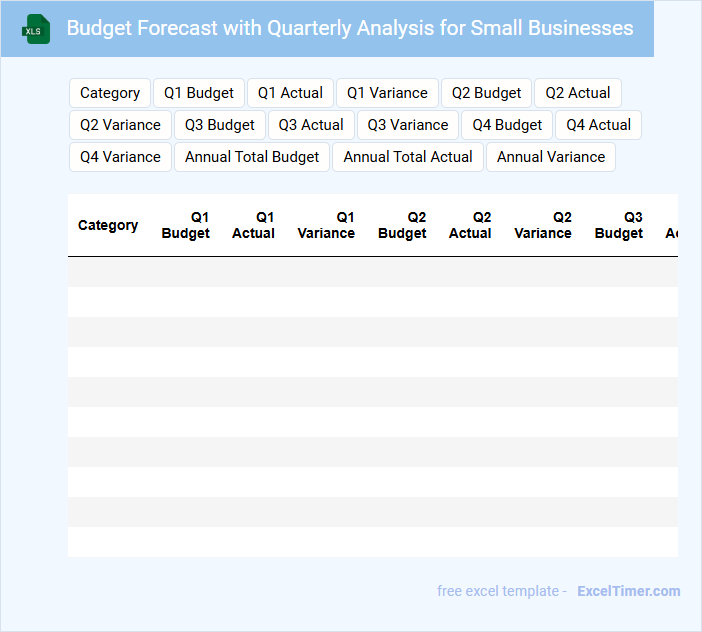

Budget Forecast with Quarterly Analysis for Small Businesses

A Budget Forecast with Quarterly Analysis for small businesses typically contains projected income, expenses, and cash flow for each quarter of the fiscal year. It helps business owners anticipate financial performance and adjust strategies accordingly. Important aspects include accurate historical data, market trends, and contingency plans for unexpected changes.

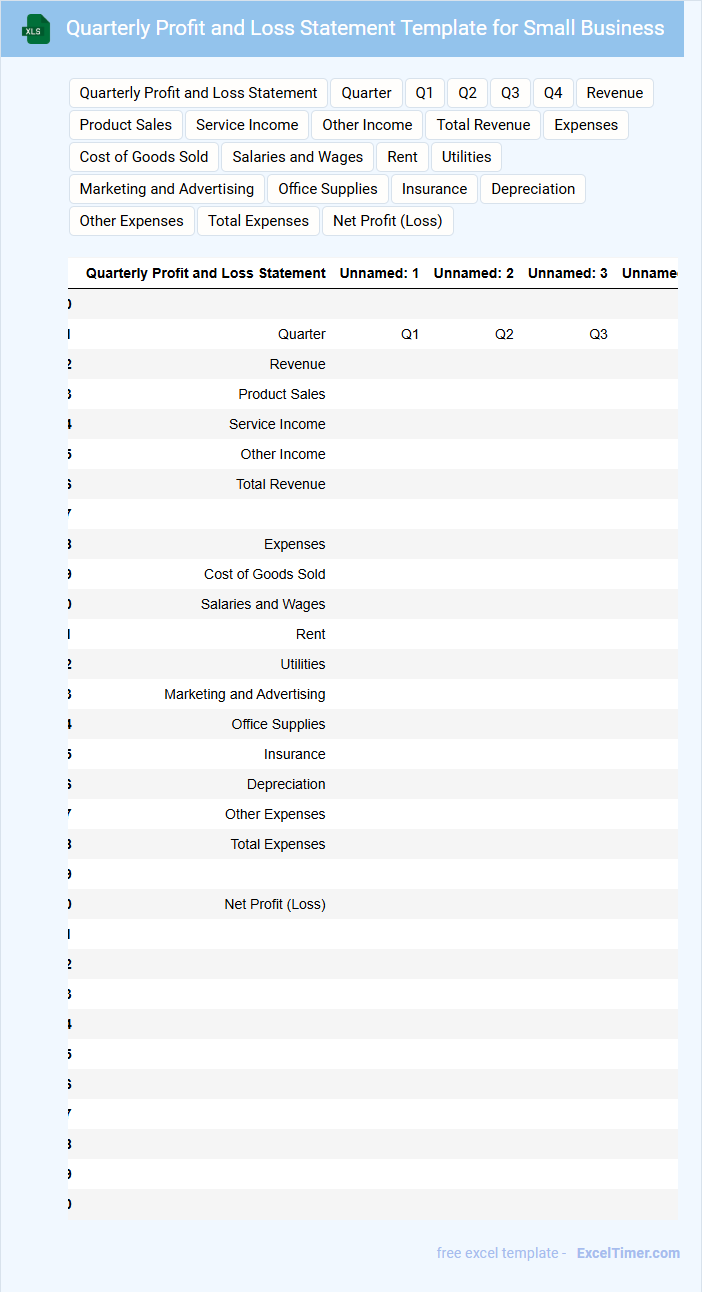

Quarterly Profit and Loss Statement Template for Small Business

What information does a Quarterly Profit and Loss Statement Template for Small Business typically contain? This document usually includes a detailed summary of revenues, costs, and expenses incurred during a quarter, offering insight into the business's profitability. It helps small business owners track financial performance, helping them make informed decisions.

Why is it important to use a Quarterly Profit and Loss Statement Template for Small Business? Using an optimized template ensures consistency in reporting and saves time, allowing entrepreneurs to focus on growth. Key suggestions include including clear categories for income and expenses, ensuring accuracy in data entry, and regularly reviewing the statements to identify trends and opportunities.

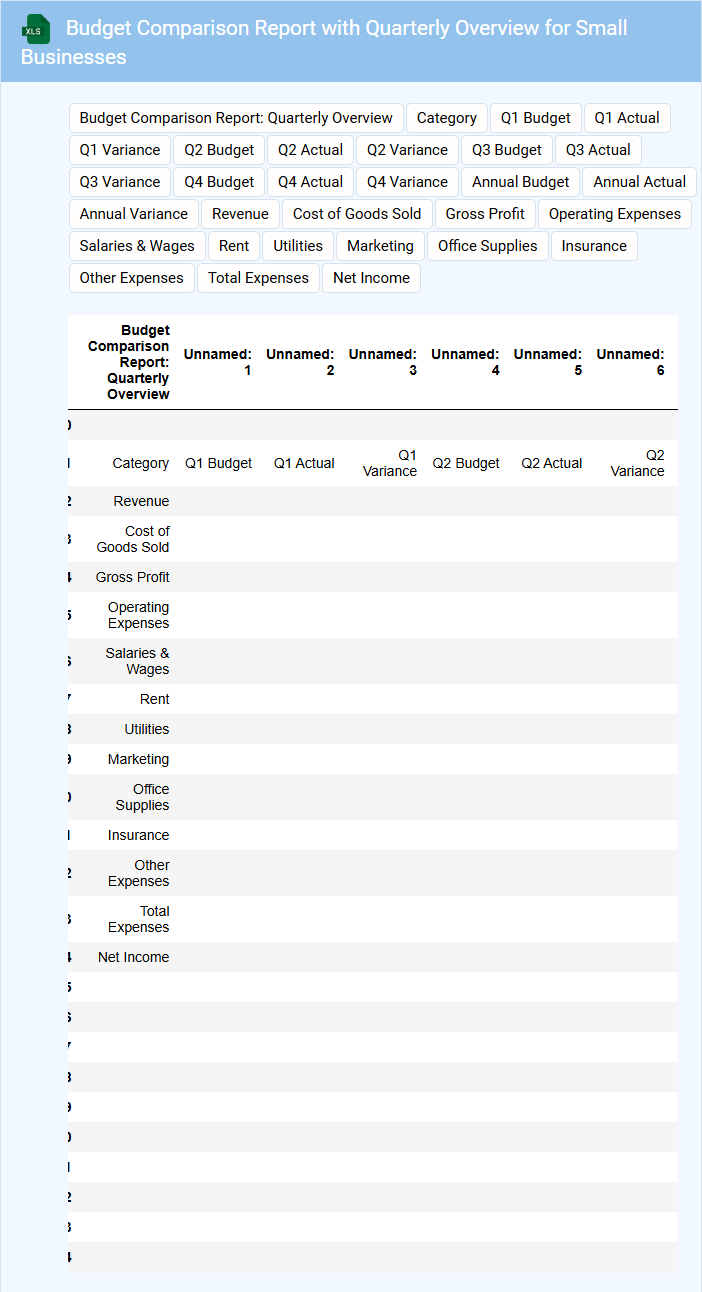

Budget Comparison Report with Quarterly Overview for Small Businesses

What information does a Budget Comparison Report with Quarterly Overview for Small Businesses typically contain?

This type of document usually includes detailed financial data comparing budgeted versus actual expenses and revenues over each quarter. It helps small businesses track their financial performance, identify trends, and make informed decisions. An effective report highlights variances, quarterly trends, and provides insights into areas requiring cost control or investment.

What is an important consideration when creating a Budget Comparison Report with Quarterly Overview for Small Businesses?

Ensuring accuracy and clarity in presenting the financial data is crucial for actionable insights. Important elements include consistent categorization of expenses, clear visualization of variances, and contextual explanations for significant deviations. Additionally, incorporating recommendations helps small businesses quickly understand next steps to optimize their budgets.

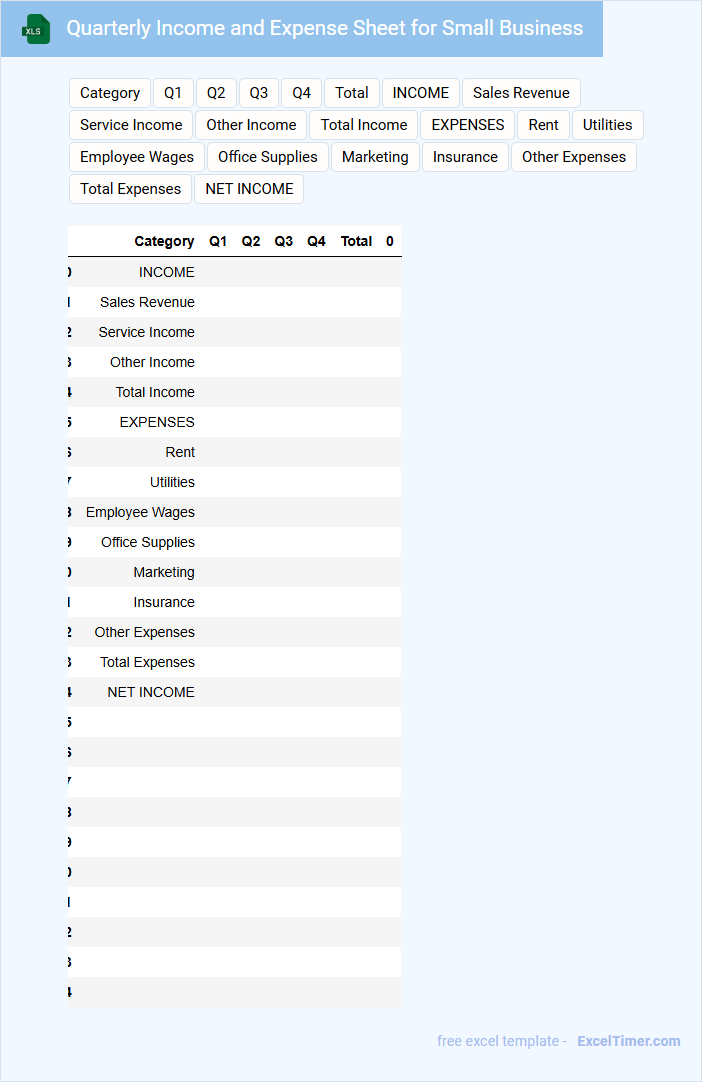

Quarterly Income and Expense Sheet for Small Business

The Quarterly Income and Expense Sheet is a financial document that summarizes a small business's revenues and costs over a three-month period. It provides clear insights into profitability and cash flow trends.

This sheet typically includes detailed categories like sales income, operating expenses, and net profit. Maintaining accurate records and updating this document regularly is essential for informed decision-making and tax preparation.

Cash Flow Management Template for Small Business Quarterly Budget

A Cash Flow Management Template for Small Business Quarterly Budget is a vital tool for tracking income and expenses over three months. It typically contains sections for projected revenues, fixed and variable costs, and net cash flow analysis. This document helps business owners anticipate cash shortages and plan accordingly.

To enhance its effectiveness, ensure the template includes clear categorization of cash inflows and outflows, allows for regular updates, and provides summary charts for quick financial insights. Additionally, integrating space for notes on unexpected expenses or seasonal trends can improve forecasting accuracy. Prioritizing these elements supports informed decision-making and financial stability.

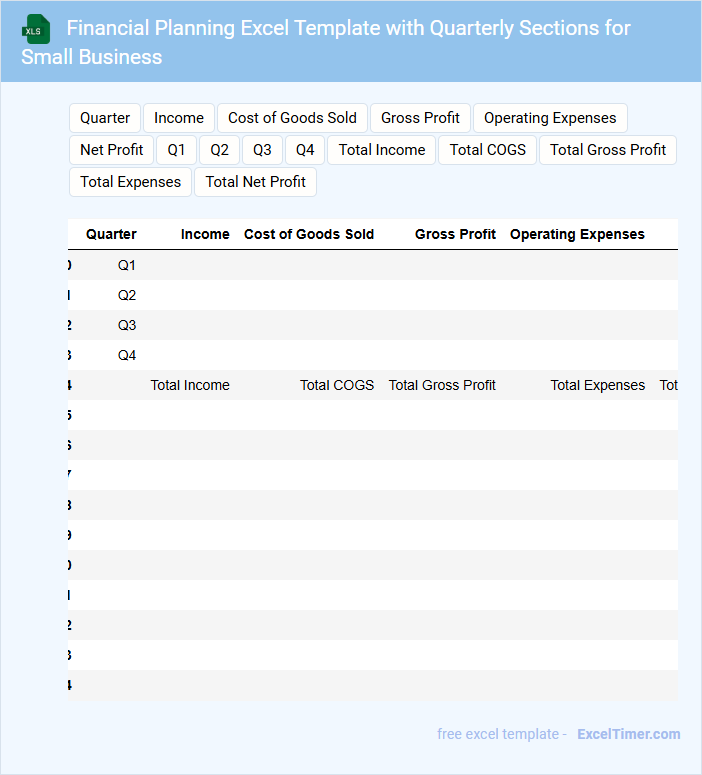

Financial Planning Excel Template with Quarterly Sections for Small Business

This document typically contains detailed financial projections and budgeting tools tailored for small businesses. It is organized into quarterly sections to facilitate periodic financial review and adjustments.

- Include clear income and expense categories to track cash flow effectively.

- Incorporate formulas for automatic calculations to reduce errors.

- Ensure sections for goals and notes to support strategic financial planning.

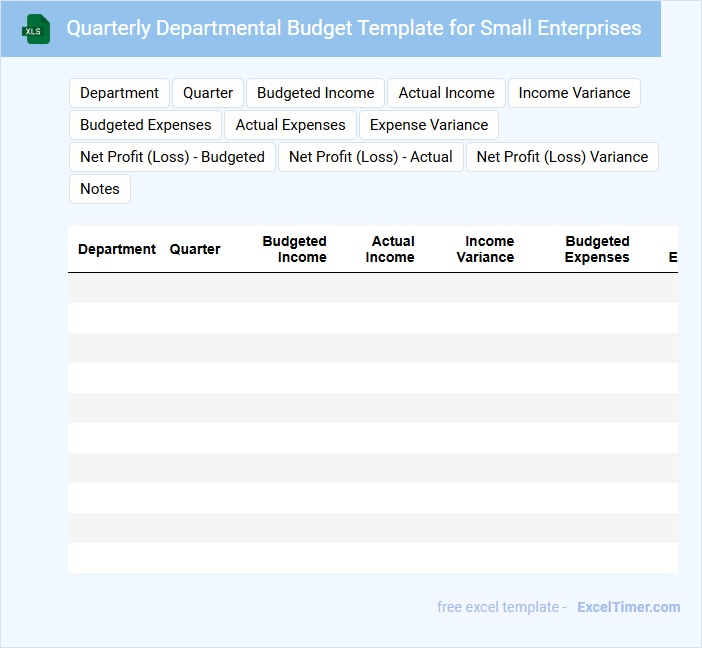

Quarterly Departmental Budget Template for Small Enterprises

What information is typically included in a Quarterly Departmental Budget Template for Small Enterprises? This document usually contains projected income, expenses, and detailed allocation of funds for each department over a quarter. It helps small businesses manage resources efficiently and track financial performance against planned budgets.

What is an important consideration when using this template? It is crucial to regularly update and review the budget to reflect actual spending and adjust forecasts as needed, ensuring departments stay aligned with financial goals and avoid overspending.

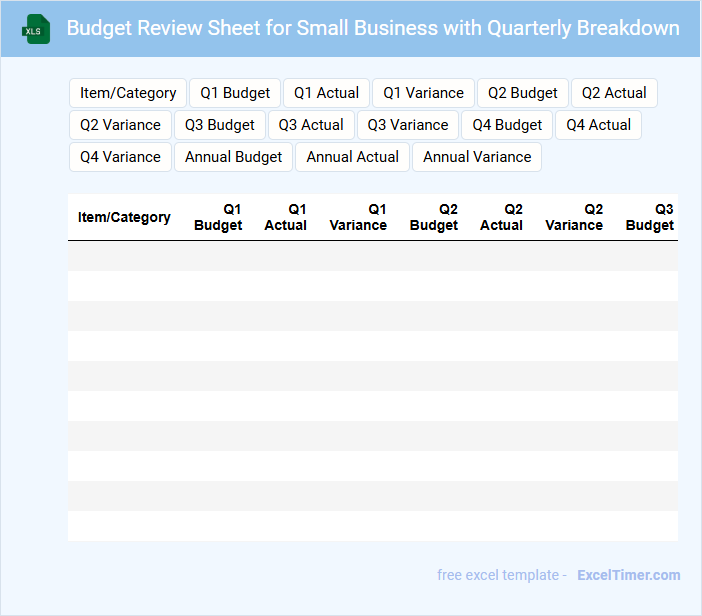

Budget Review Sheet for Small Business with Quarterly Breakdown

A Budget Review Sheet for small business is a financial document that tracks income and expenses over a specific period. It helps in identifying spending patterns and areas where costs can be optimized. This type of document typically contains sections for revenue, fixed and variable costs, and notes for financial observations.

The Quarterly Breakdown allows businesses to analyze performance in manageable time frames, facilitating better decision-making. It highlights trends and seasonal fluctuations that impact cash flow and profitability. Including clear headers and summary totals ensures the sheet remains easy to review and interpret.

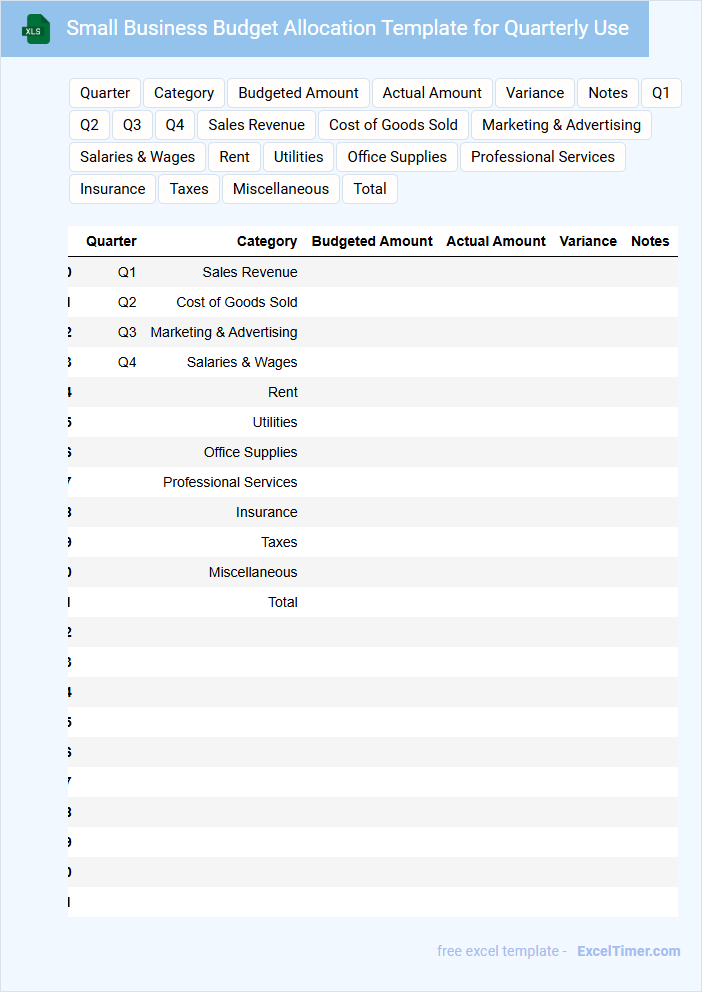

Small Business Budget Allocation Template for Quarterly Use

What does a Small Business Budget Allocation Template for Quarterly Use typically include and why is it important? This type of document usually contains detailed sections for projected income, fixed and variable expenses, and allocated funds for marketing, operations, and contingencies. It helps small businesses plan financial resources efficiently each quarter to ensure sustainable growth and avoid overspending.

Excel Dashboard for Quarterly Budget Tracking of Small Business

An Excel Dashboard for Quarterly Budget Tracking typically contains visual summaries of financial data such as income, expenses, and profit margins. It presents key performance indicators with charts, tables, and trend lines for easy analysis.

This document is crucial for small business owners to monitor budget adherence, identify cost-saving opportunities, and make informed financial decisions. Regular updates and accuracy in data entry are essential for its effectiveness.

Ensure the dashboard includes clear labels, interactive filters, and automated calculations to enhance usability and accuracy.

What key revenue and expense categories should be included in a quarterly budget for a small business?

A quarterly budget for a small business should include key revenue categories such as sales revenue, service income, and other operational income. Essential expense categories include salaries and wages, rent, utilities, marketing costs, and inventory purchases. You should also track taxes, loan repayments, and miscellaneous operational expenses to maintain financial accuracy.

How can historical data be utilized in Excel to forecast quarterly cash flow projections?

Historical data in Excel can be utilized to forecast quarterly cash flow projections by analyzing past income and expenses trends using built-in functions like TREND and FORECAST. Creating pivot tables helps summarize financial activities by category and quarter, revealing seasonal cash flow patterns. Integrating historical data with Excel's Data Analysis Toolpak enables regression analysis to generate accurate projection models for future quarters.

Which Excel functions and formulas are essential for tracking actual vs. budgeted performance each quarter?

To track actual vs. budgeted performance each quarter, you should use Excel functions like SUMIFS to aggregate data based on specific criteria, IF for conditional logic, and VLOOKUP or XLOOKUP to pull relevant budget figures. Utilizing formulas such as =(Actual-Budget)/Budget calculates variance percentages, providing insight into financial performance. Your quarterly budget spreadsheet becomes a powerful tool for monitoring and managing your small business finances through these essential functions.

What strategies can be used to identify and manage seasonal fluctuations in a quarterly budget spreadsheet?

Use historical sales data and industry trends within your quarterly budget spreadsheet to identify seasonal fluctuations accurately. Implement dynamic forecasting models that adjust budget allocations based on predicted high and low demand periods. You can also incorporate scenario analysis to prepare for unexpected changes in revenue or expenses during seasonal shifts.

How should budget variances be analyzed and visualized in Excel for better decision-making?

Analyze budget variances by comparing actual expenses against projected amounts using Excel formulas like ABS and IF to highlight discrepancies. Visualize these variances with conditional formatting, pivot charts, and sparklines for clear trend identification. Your quarterly budget review improves by integrating dynamic dashboards that update automatically as new data is entered.