The Quarterly Cash Flow Analysis Excel Template for Real Estate Investors provides a structured format to track and project income and expenses over three months. It helps investors evaluate property performance, identify cash flow trends, and make informed financial decisions. Accurate cash flow analysis is crucial for maximizing returns and ensuring sustainable investment growth.

Quarterly Cash Flow Analysis Excel Template for Real Estate Investors

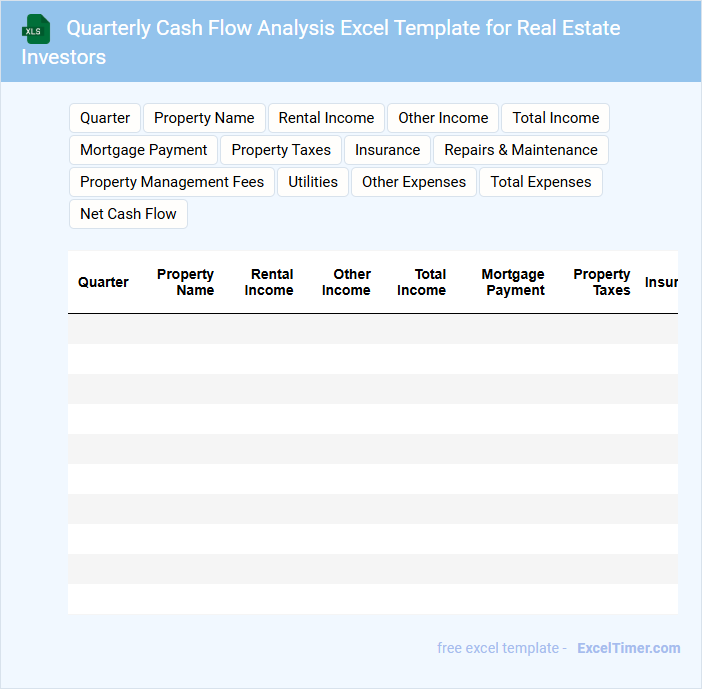

The Quarterly Cash Flow Analysis Excel Template is designed to help real estate investors track and manage their cash flow effectively over three-month periods. This document typically contains sections for income, expenses, net cash flow, and projections. It is essential for investors to regularly update this template to make informed financial decisions and optimize their investment strategy.

Excel Cash Flow Tracker for Quarterly Real Estate Investments

An Excel Cash Flow Tracker for Quarterly Real Estate Investments is a crucial financial document used to monitor income and expenses over a specific period. It typically contains detailed records of rental income, maintenance costs, mortgage payments, and other investment-related transactions. This tool helps investors analyze profitability and make informed decisions for future investments.

Important considerations include ensuring accurate data entry, regularly updating cash flow figures, and incorporating formulas to automate calculations. Including clear categories for cash inflows and outflows enhances clarity. Additionally, visual elements like charts can provide quick insights into financial trends.

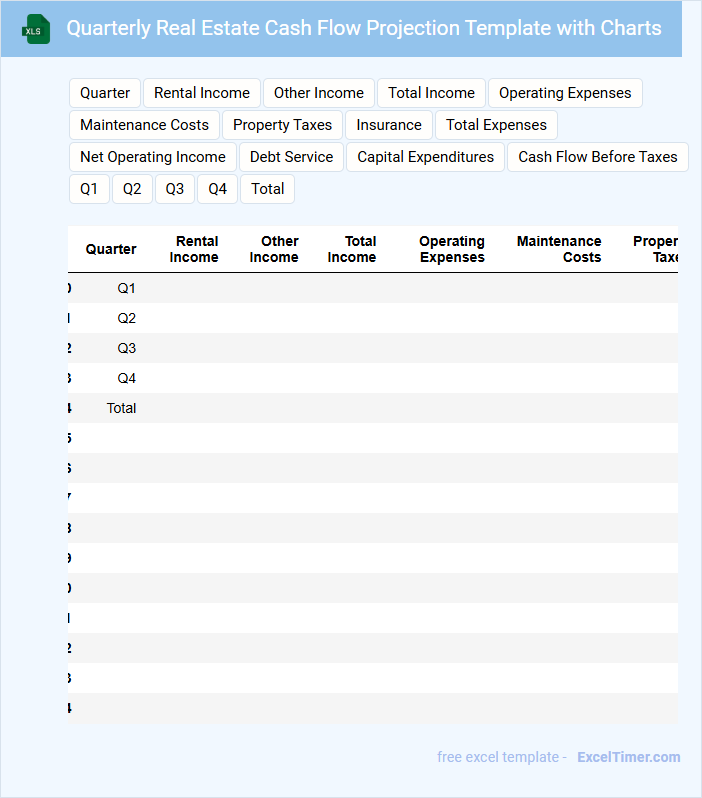

Quarterly Real Estate Cash Flow Projection Template with Charts

What information is typically included in a Quarterly Real Estate Cash Flow Projection Template with Charts? This type of document usually contains detailed forecasts of income, expenses, and net cash flow related to real estate investments over a three-month period. It incorporates charts to visually represent financial trends, helping stakeholders quickly understand cash inflows and outflows for better decision-making.

What important elements should be emphasized in this template? Key components include accurate rental income estimations, maintenance and operational cost projections, loan payment schedules, and contingency reserves. Additionally, clear and intuitive charts are essential for highlighting cash flow patterns and supporting strategic planning.

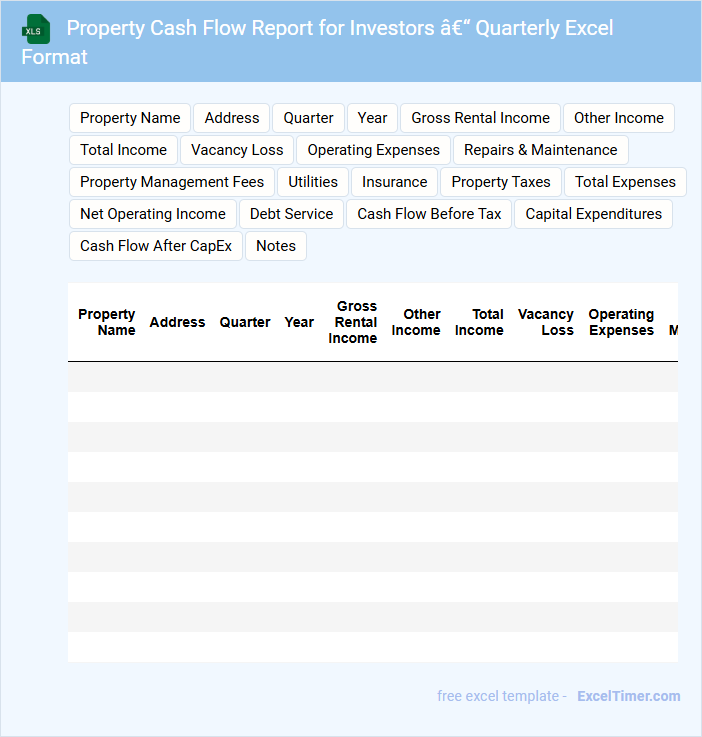

Property Cash Flow Report for Investors – Quarterly Excel Format

A Property Cash Flow Report for investors is a detailed financial document that tracks income and expenses related to a real estate investment on a quarterly basis. It typically includes sections such as rental income, operating expenses, debt service, and net cash flow, all organized in an easy-to-read Excel format. This report helps investors monitor the profitability and financial health of their property investments over time.

Key elements to include in the report are accurate categorization of income and expenses, clear presentation of cash inflows and outflows, and summary metrics like net operating income (NOI) and cash-on-cash return. Ensuring data is updated quarterly allows for timely investment decisions and performance assessments. Additionally, including trend analysis and notes on market conditions can provide deeper insights for investors.

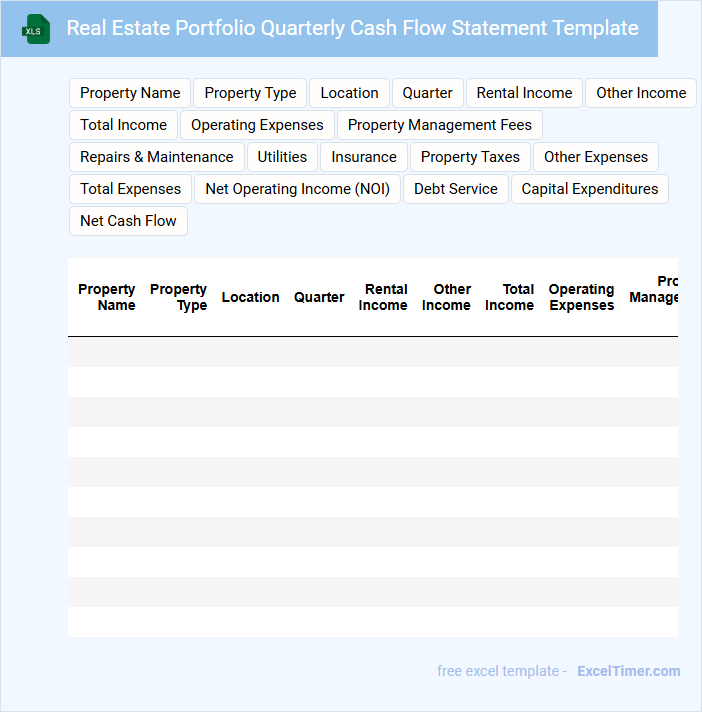

Real Estate Portfolio Quarterly Cash Flow Statement Template

A Real Estate Portfolio Quarterly Cash Flow Statement Template typically contains detailed summaries of income and expenses related to various real estate assets over a three-month period. It highlights cash inflows and outflows from rental properties, investment gains, and operational costs to provide a clear financial picture. This document is essential for tracking portfolio performance and identifying areas requiring cost management or income improvement. Ensure accuracy in recording all transactions and categorize them clearly to enhance analysis and decision-making.

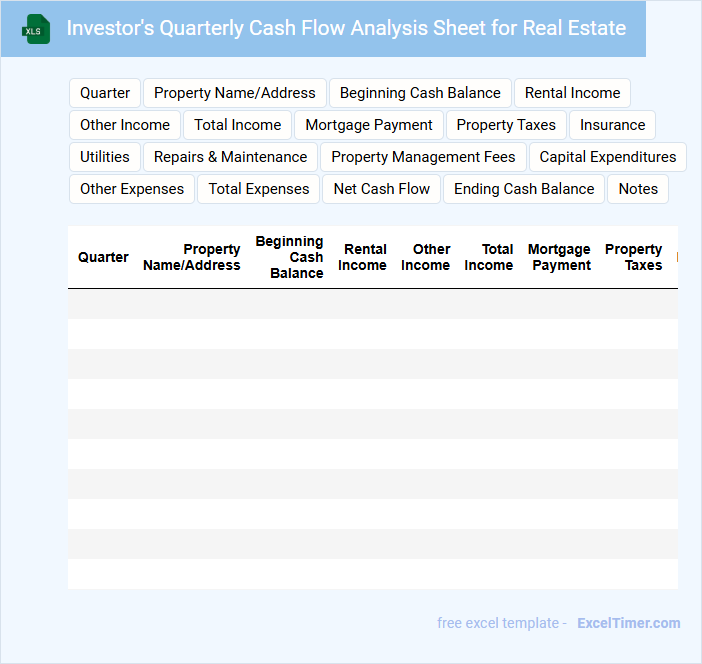

Investor's Quarterly Cash Flow Analysis Sheet for Real Estate

The Investor's Quarterly Cash Flow Analysis Sheet for real estate typically contains detailed records of income, expenses, and net cash flow related to property investments. It highlights rental income, mortgage payments, maintenance costs, and any additional financial activities that impact overall profitability.

This document helps investors track financial performance over time and make informed decisions regarding property management and future investments. An important recommendation is to ensure timely updates and accurate data entry for reliable quarterly analysis.

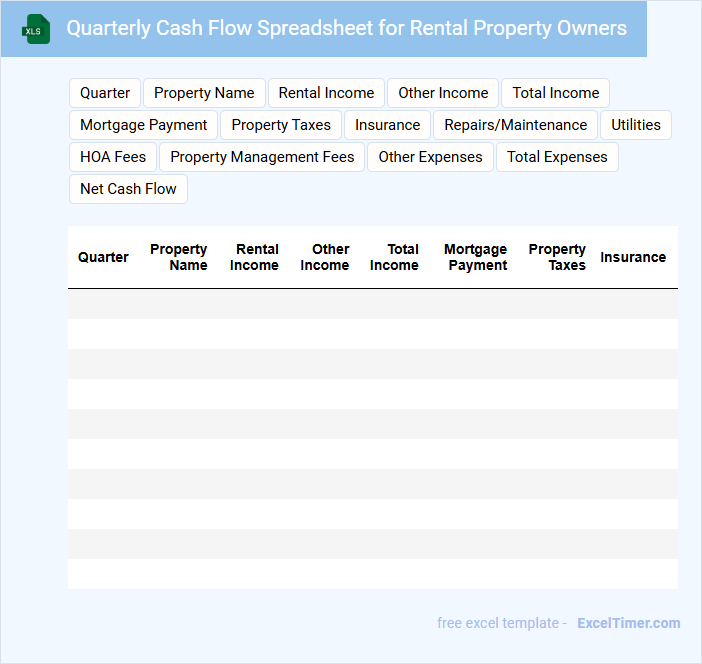

Quarterly Cash Flow Spreadsheet for Rental Property Owners

A Quarterly Cash Flow Spreadsheet for rental property owners is a financial document used to track income and expenses over a three-month period. It helps landlords monitor the profitability of their rental properties by summarizing rent collections, maintenance costs, and other related cash flows.

Key elements include rental income, mortgage payments, property taxes, and operational expenses recorded in detail. For accuracy, it is important to regularly update the spreadsheet and reconcile it with actual bank statements.

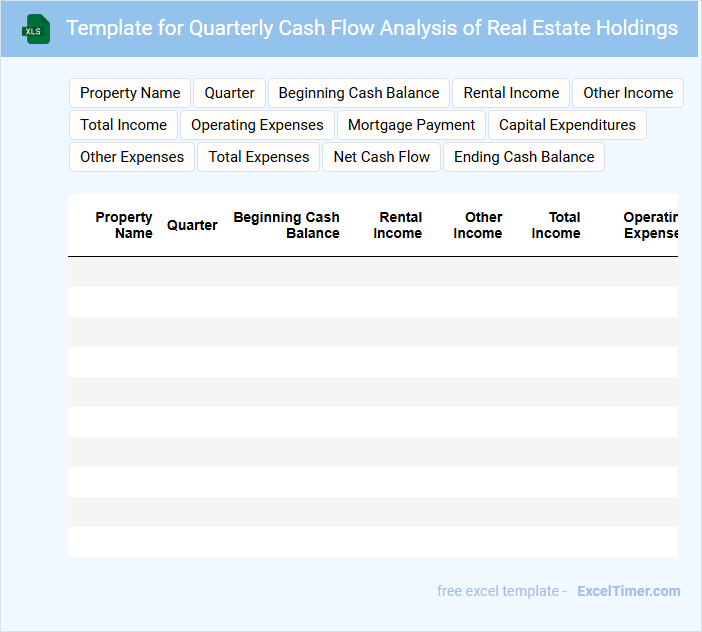

Template for Quarterly Cash Flow Analysis of Real Estate Holdings

The Template for Quarterly Cash Flow Analysis of real estate holdings typically contains detailed income and expense records over a three-month period. It highlights rental income, operational costs, and net cash flow to provide a clear financial overview. This document is essential for tracking profitability and making informed investment decisions.

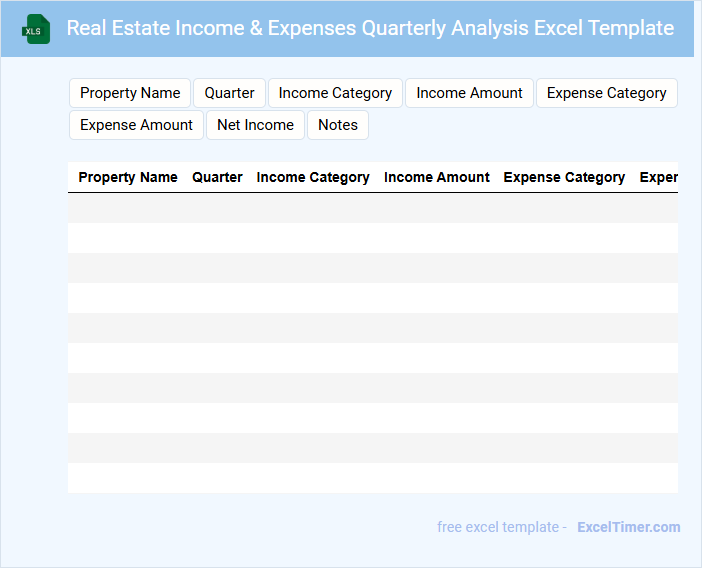

Real Estate Income & Expenses Quarterly Analysis Excel Template

The Real Estate Income & Expenses Quarterly Analysis Excel Template is designed to help property owners and investors track financial performance over a three-month period. It typically contains sections for rental income, operating expenses, and net profit calculations. This document is essential for maintaining organized financial records and making informed investment decisions.

When using this template, it is important to ensure accuracy in entering income and expenses to reflect true profitability. Regular updates and reconciliations with bank statements enhance reliability. Additionally, incorporating a summary dashboard can provide quick insights into quarterly trends and cash flow management.

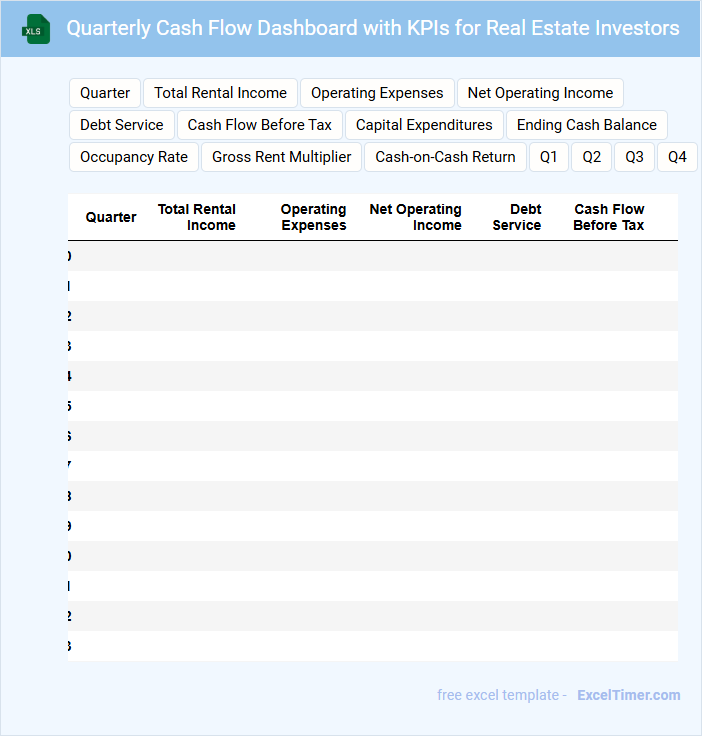

Quarterly Cash Flow Dashboard with KPIs for Real Estate Investors

A Quarterly Cash Flow Dashboard typically contains key financial metrics that help real estate investors monitor their investment performance over each quarter. This document includes inflows, outflows, net cash flow, and critical KPIs such as ROI and occupancy rates. It is essential for investors to regularly review this dashboard to make informed decisions and optimize their portfolio profitability.

Excel Template for Tracking Quarterly Rental Cash Flow

An Excel Template for Tracking Quarterly Rental Cash Flow typically contains detailed financial data to monitor rental income and expenses on a quarterly basis.

- Income Records: It includes all rental payments received and any other related income sources for each quarter.

- Expense Tracking: It captures all rental-related expenses such as maintenance, repairs, and management fees.

- Summary Reports: It provides consolidated cash flow statements and profit/loss summaries for effective financial analysis.

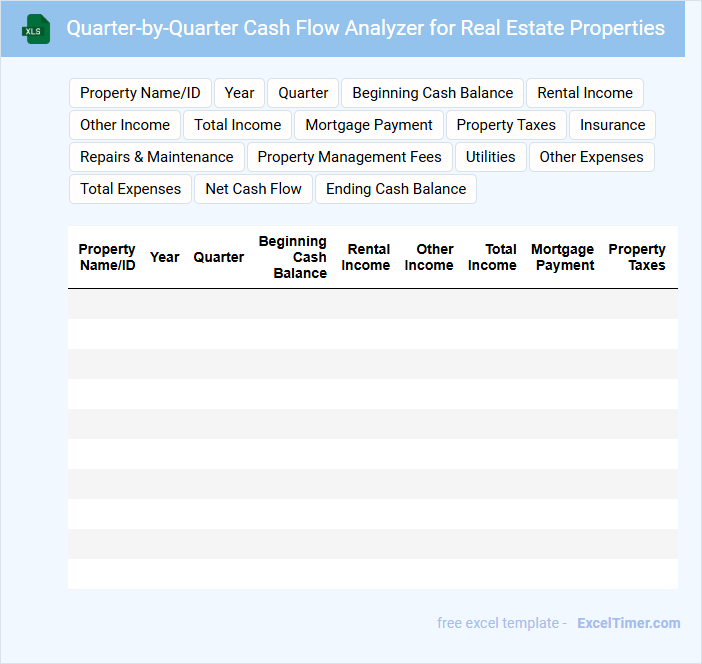

Quarter-by-Quarter Cash Flow Analyzer for Real Estate Properties

A Quarter-by-Quarter Cash Flow Analyzer for Real Estate Properties is a financial document that tracks income and expenses on a quarterly basis to evaluate property profitability. It helps investors make informed decisions by highlighting patterns in cash flow over time.

- Include detailed revenue sources such as rental income and ancillary fees.

- Account for all operating expenses like maintenance, taxes, and insurance.

- Incorporate projections and actuals for accurate performance comparison.

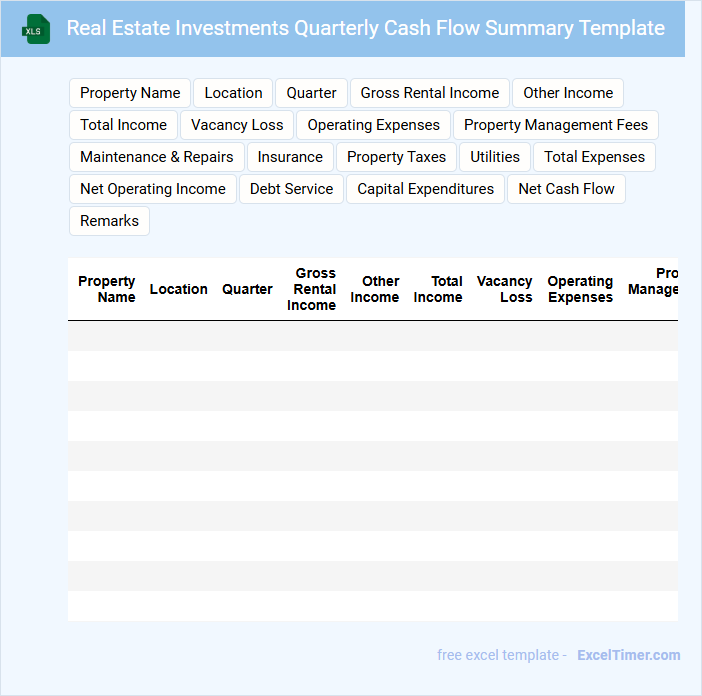

Real Estate Investments Quarterly Cash Flow Summary Template

The Real Estate Investments Quarterly Cash Flow Summary Template is typically used to track and analyze cash inflows and outflows generated from real estate properties over a three-month period. It provides an overview of rental income, operating expenses, and net cash flow to assess investment performance.

This document helps investors make informed decisions by highlighting trends and identifying potential issues in property management. Including detailed property descriptions and clear categorization of income and expenses is essential for accuracy and clarity.

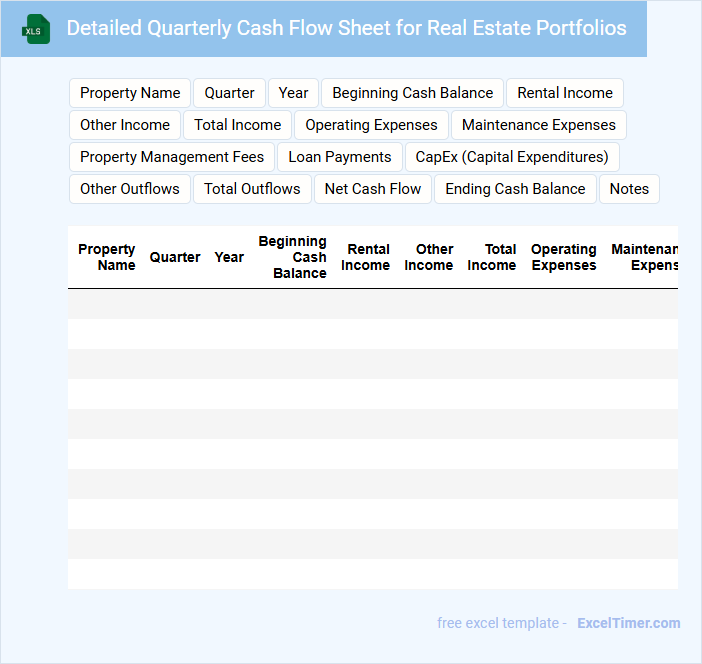

Detailed Quarterly Cash Flow Sheet for Real Estate Portfolios

A Detailed Quarterly Cash Flow Sheet for Real Estate Portfolios typically contains comprehensive records of all cash inflows and outflows associated with real estate investments over a three-month period. It helps investors track the financial performance and liquidity of their portfolios effectively.

- Include clear categorization of income sources such as rent, dividends, and sales proceeds.

- Detail all operating expenses including maintenance, taxes, and management fees.

- Provide a summary of net cash flow and projections for upcoming quarters.

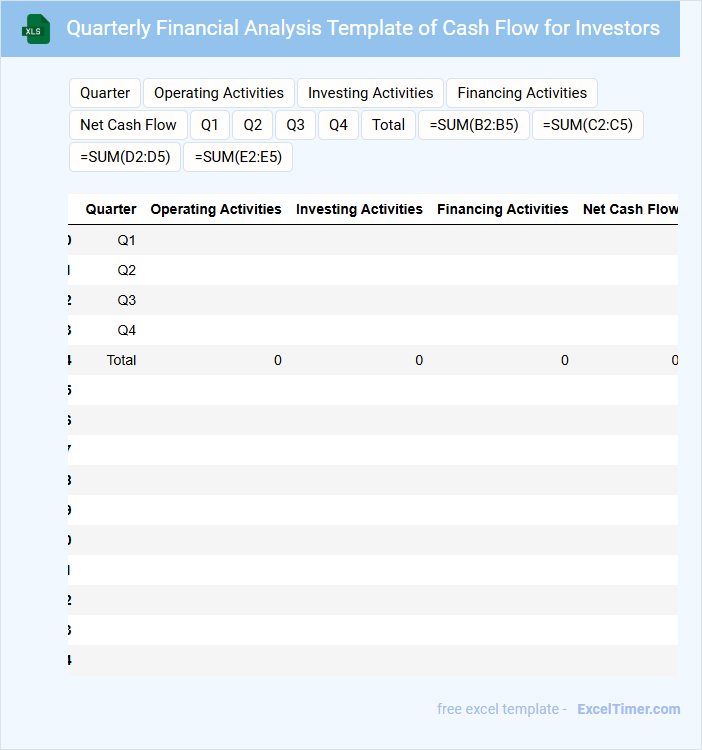

Quarterly Financial Analysis Template of Cash Flow for Investors

A Quarterly Financial Analysis Template of Cash Flow is a crucial document used to track and evaluate the cash inflows and outflows over a three-month period. It usually contains sections on operating, investing, and financing activities to provide a clear picture of a company's liquidity and financial health. Investors rely on this report to make informed decisions about the company's ability to generate cash and sustain operations.

What are the key categories (income, expenses, financing) to include in a quarterly cash flow analysis for real estate investments?

Key categories for a quarterly cash flow analysis in real estate investments include rental income, property management fees, and maintenance expenses. Financing costs should cover mortgage payments, interest expenses, and any refinancing fees. Including tax liabilities and capital expenditures ensures a comprehensive financial overview.

How do you accurately record and track rental income and other revenue sources in an Excel quarterly cash flow document?

Accurately record rental income and other revenue sources in an Excel quarterly cash flow document by creating separate columns for each income type with specific labels such as "Rental Income," "Late Fees," and "Other Revenue." Use consistent date entries and apply formulas like SUMIFS to aggregate income by quarter. Regularly update and reconcile with bank statements to ensure data accuracy and completeness.

What is the impact of variable and fixed operating expenses on quarterly net cash flow calculations in real estate?

Variable and fixed operating expenses directly affect your quarterly net cash flow by altering total costs associated with property management and maintenance. Fixed expenses, such as property taxes and insurance, remain constant each quarter, providing predictable outflows, while variable expenses, like repairs and utilities, fluctuate with property usage and market conditions. Accurate inclusion of both expense types ensures precise cash flow analysis, critical for informed real estate investment decisions.

How should principal and interest payments be reflected in the cash flow analysis to provide true cash position visibility?

Principal payments should be recorded as financing cash outflows, reducing loan balances without affecting operational cash flow, while interest payments are operating expenses impacting net cash flow. Your quarterly cash flow analysis must separate these payments to accurately reflect true cash position and investment performance. Proper categorization ensures clear insight into available liquidity versus financing obligations.

What Excel formulas and tools (e.g., SUM, IF, conditional formatting) enhance the clarity and accuracy of quarterly cash flow reporting for investors?

Excel formulas such as SUM and IF improve quarterly cash flow reporting by aggregating total inflows and outflows while categorizing positive and negative cash flows. Conditional formatting highlights key variances and trends, enabling investors to quickly identify critical changes in cash position. Utilizing PivotTables and data validation further enhances data organization and accuracy in real estate quarterly cash flow analysis.