The Quarterly Tax Summary Excel Template for Consultants streamlines tax tracking by organizing income, expenses, and deductions in one easy-to-use spreadsheet. This tool helps consultants accurately calculate quarterly tax liabilities, ensuring timely payments and avoiding penalties. Its customizable format supports efficient financial management tailored to consulting professionals' unique tax requirements.

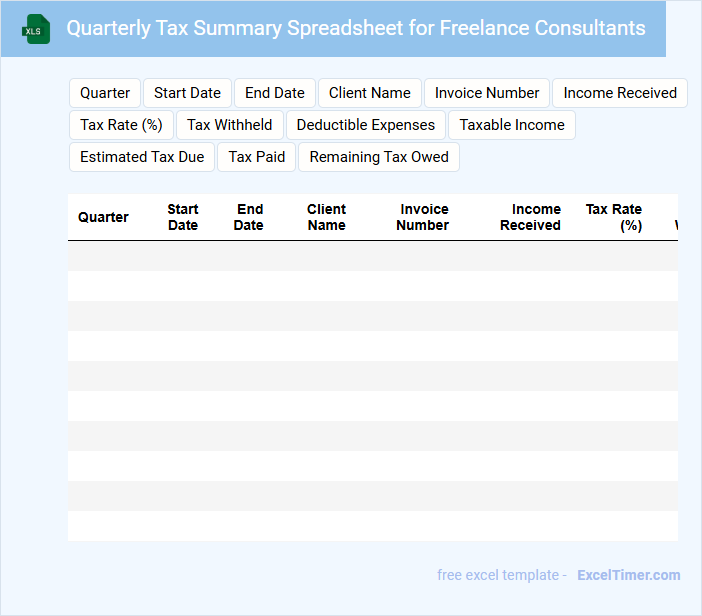

Quarterly Tax Summary Spreadsheet for Freelance Consultants

A Quarterly Tax Summary Spreadsheet for freelance consultants typically contains detailed records of income, expenses, and tax payments made during the quarter. It helps track deductible expenses and calculates estimated tax liabilities efficiently.

This document is essential for organizing financial information to ensure accurate tax filings. Important suggestions include consistently updating entries and categorizing expenses clearly for easier review and compliance.

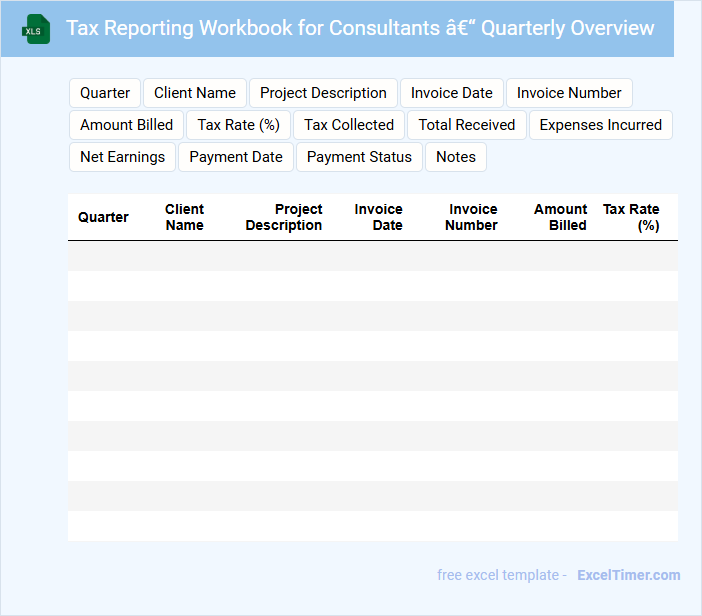

Tax Reporting Workbook for Consultants – Quarterly Overview

The Tax Reporting Workbook for consultants typically contains detailed financial data, expense tracking, and income summaries specific to quarterly tax periods. It helps ensure accurate calculations for tax liabilities and deductions by consolidating necessary documents and receipts. Proper categorization and timely updates of records are essential for effective tax reporting and compliance.

Quarterly Income & Tax Tracker with Consultant-Specific Fields

This document is a Quarterly Income & Tax Tracker designed to monitor income and taxes on a quarterly basis, specifically tailored for consultants. It typically includes fields for individual consultant earnings, tax deductions, and payment schedules to ensure accurate financial management. Highlighting consultant-specific details allows for precise tracking and compliance with tax regulations unique to freelance or contract work.

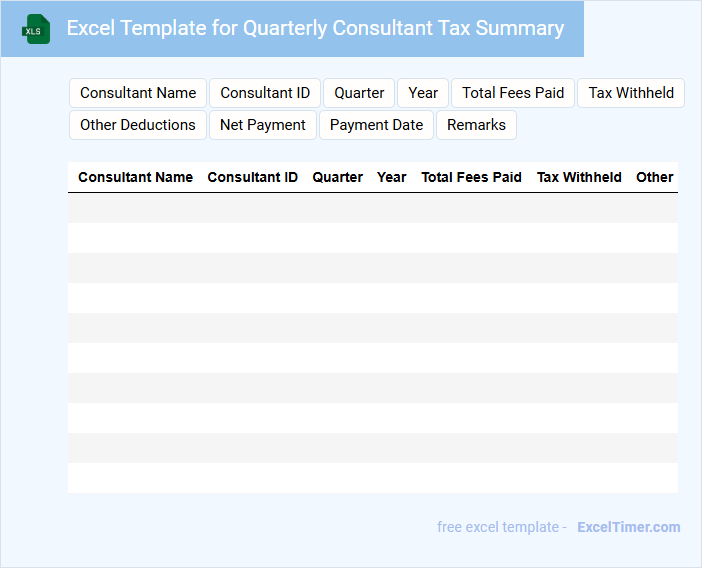

Excel Template for Quarterly Consultant Tax Summary

This document is typically an Excel template designed to summarize quarterly tax information for consultants. It helps in organizing income, expenses, and tax calculations efficiently.

- Include separate sections for income, deductible expenses, and tax liabilities.

- Ensure formulas accurately calculate quarterly totals and tax amounts.

- Provide clear labels and instructions for easy data entry by the consultant.

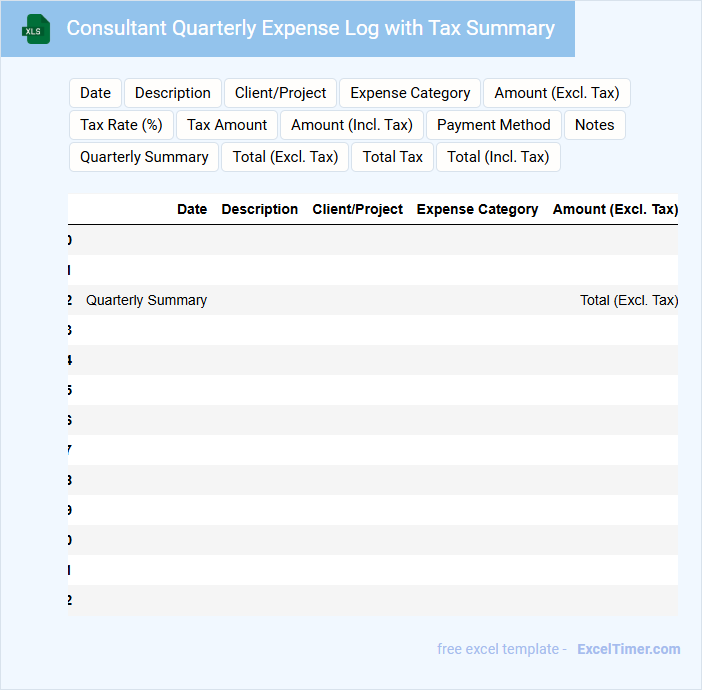

Consultant Quarterly Expense Log with Tax Summary

A Consultant Quarterly Expense Log with Tax Summary is a financial document used to track and organize expenses incurred by a consultant over a three-month period. It helps in accurate tax reporting and reimbursement processes.

- Include detailed receipts and categorize expenses for clarity.

- Summarize total expenses alongside applicable tax amounts.

- Ensure dates and business purpose are clearly documented for each entry.

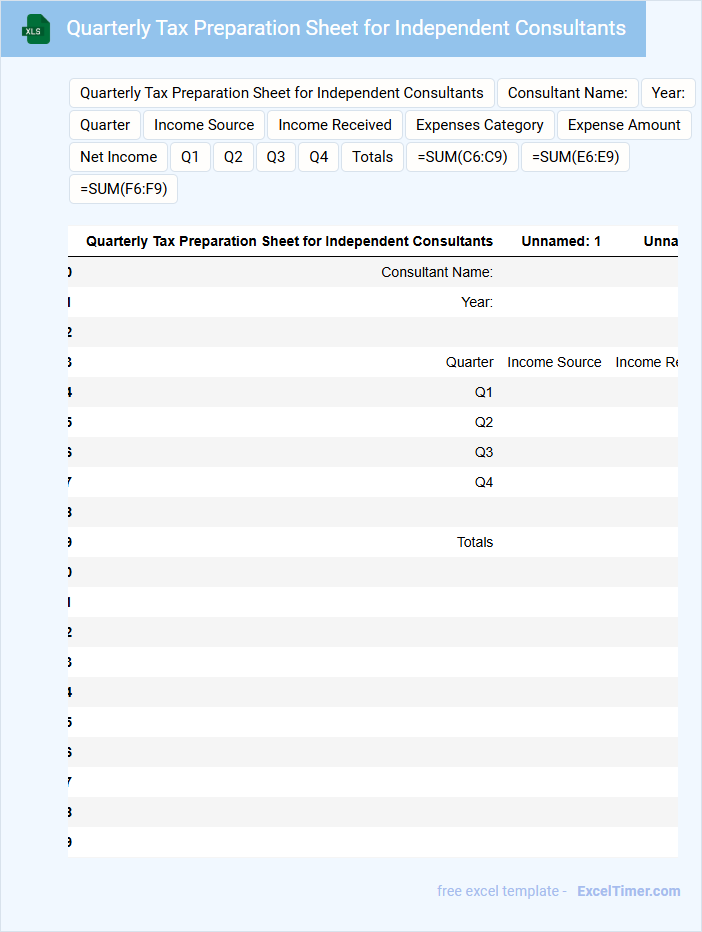

Quarterly Tax Preparation Sheet for Independent Consultants

Quarterly Tax Preparation Sheets for Independent Consultants typically contain detailed income records, expense tracking, and tax deduction information to streamline tax filing.

- Accurate Income Documentation: Track all sources of income meticulously for precise tax calculations.

- Expense Categorization: Organize expenses into deductible categories to maximize tax benefits.

- Tax Due Estimation: Calculate estimated quarterly tax payments to avoid penalties.

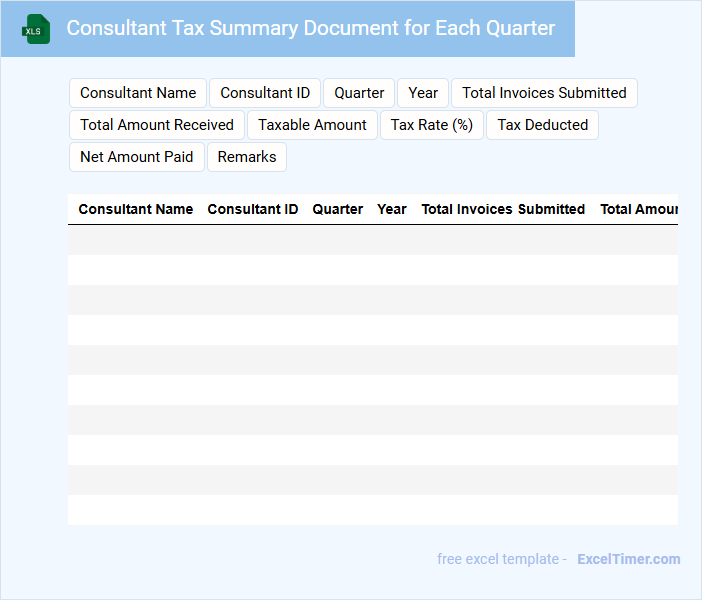

Consultant Tax Summary Document for Each Quarter

A Consultant Tax Summary Document for Each Quarter typically contains detailed financial transactions and tax-related information relevant to the consultant's earnings and deductions. It is essential for accurate tax reporting and compliance with tax regulations.

- Include a clear summary of all income received during the quarter.

- Detail any tax deductions or credits applicable to the consultant.

- Provide dates and descriptions of transactions to support tax calculations.

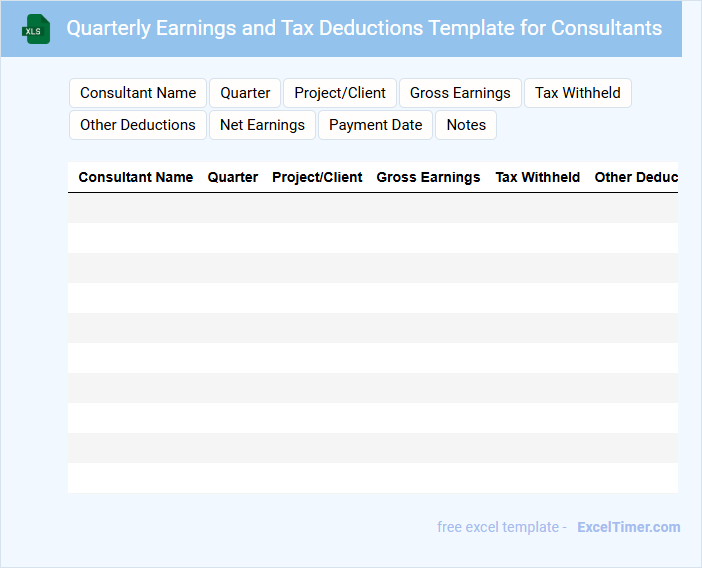

Quarterly Earnings and Tax Deductions Template for Consultants

This document is a Quarterly Earnings and Tax Deductions Template designed specifically for consultants. It typically contains detailed records of income earned within a quarter, alongside itemized tax deductions applicable to consulting expenses. This helps in accurate tax reporting and financial management throughout the fiscal year.

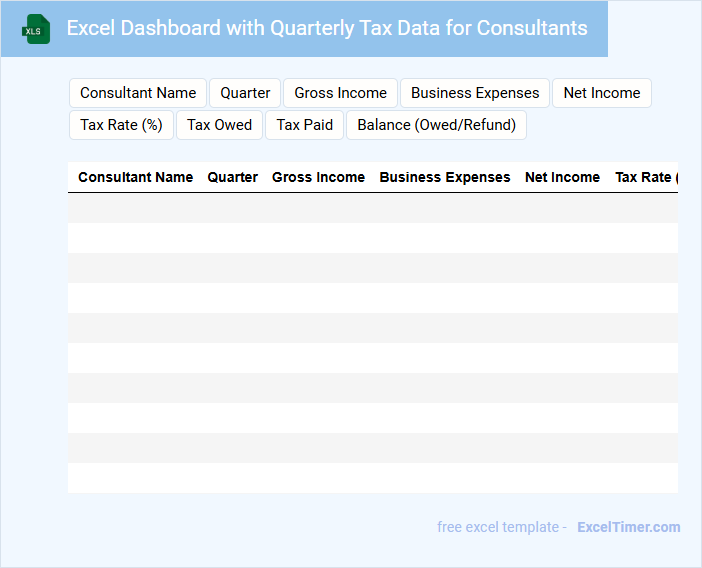

Excel Dashboard with Quarterly Tax Data for Consultants

An Excel Dashboard with Quarterly Tax Data for Consultants organizes financial information efficiently, enabling quick insights into tax liabilities and trends. It typically includes visual elements like charts, tables, and conditional formatting to highlight key figures and variations over fiscal quarters. For clarity and usability, it is essential to ensure data accuracy, update frequency, and user-friendly navigation within the dashboard.

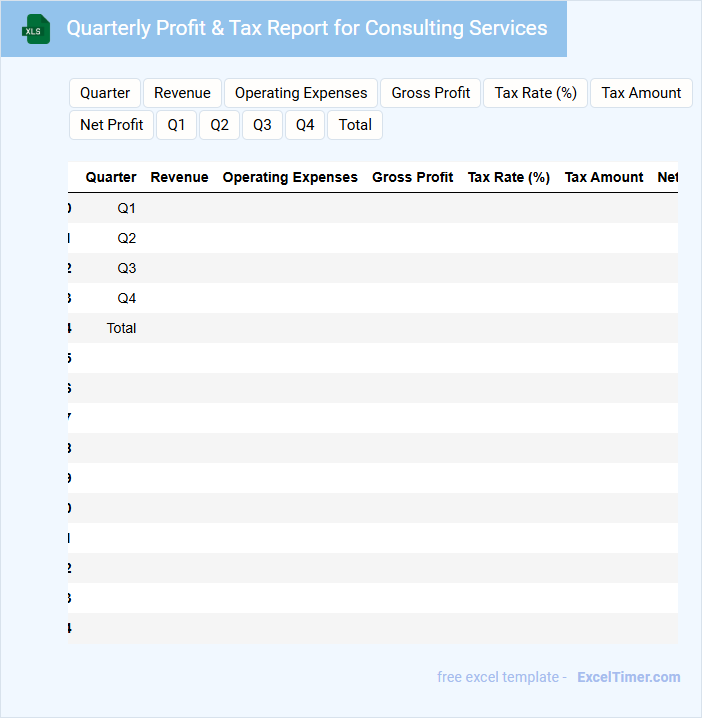

Quarterly Profit & Tax Report for Consulting Services

The Quarterly Profit & Tax Report for consulting services typically contains detailed financial data, including revenue, expenses, and net profit for the quarter. It also includes tax calculations and compliance details relevant to the consulting industry. This document is essential for assessing business performance and ensuring accurate tax reporting.

Important considerations for this report include accurate tracking of all consulting income streams, careful documentation of deductible expenses, and adherence to relevant tax laws and deadlines. Including clear summaries and visual aids such as charts can enhance understanding. Timely review and filing help avoid penalties and support strategic financial planning.

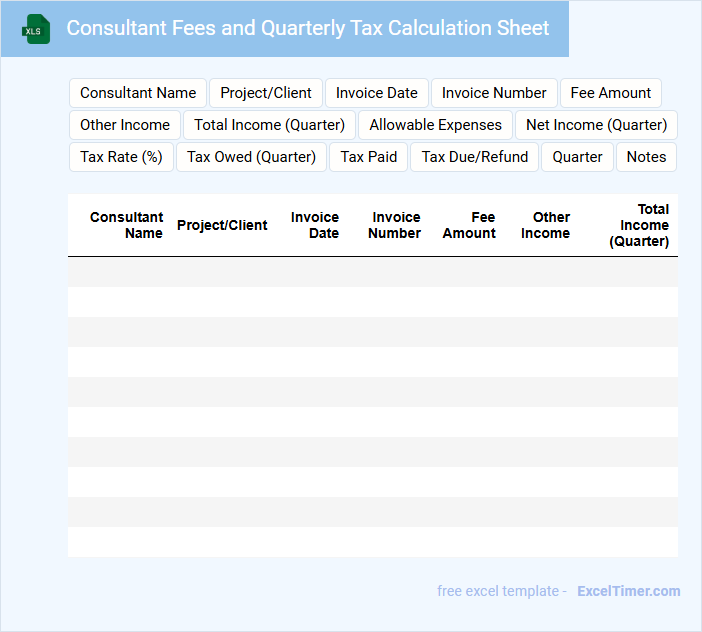

Consultant Fees and Quarterly Tax Calculation Sheet

A Consultant Fees and Quarterly Tax Calculation Sheet typically contains detailed records of consulting payments and related tax computations for a specific period.

- Consultant Fees: Document the amount, date, and nature of each consultant payment accurately.

- Tax Calculations: Include precise quarterly tax deductions, liabilities, and relevant tax codes.

- Summary Section: Provide a comprehensive overview of total fees and taxes owed or paid for clear financial tracking.

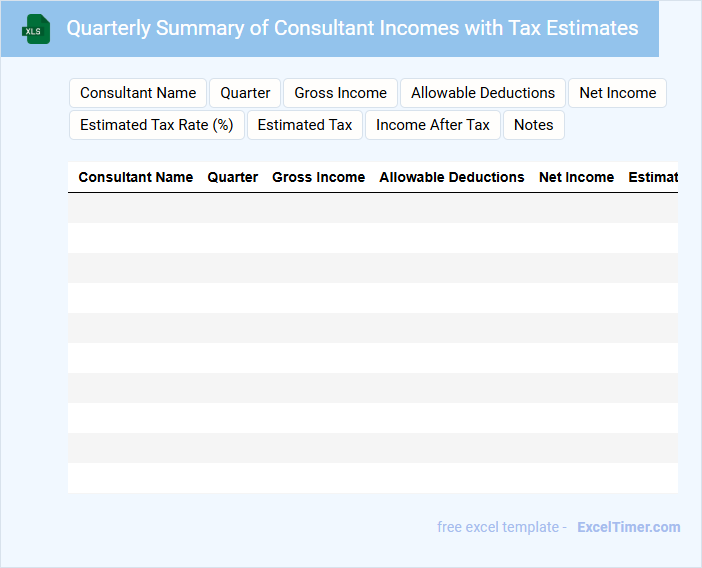

Quarterly Summary of Consultant Incomes with Tax Estimates

What information is typically included in a Quarterly Summary of Consultant Incomes with Tax Estimates? This document usually contains detailed records of all consultant earnings within the quarter, including invoices, payments received, and any outstanding amounts. It also provides estimated tax liabilities based on these incomes to help consultants plan for their tax obligations accurately.

What is an important consideration when preparing this summary? Ensuring accurate and up-to-date tax rates and regulations is crucial, as this affects the precision of the tax estimates and the consultant's financial planning. Additionally, maintaining clear documentation and reconciliation of all income sources enhances transparency and reduces the risk of errors.

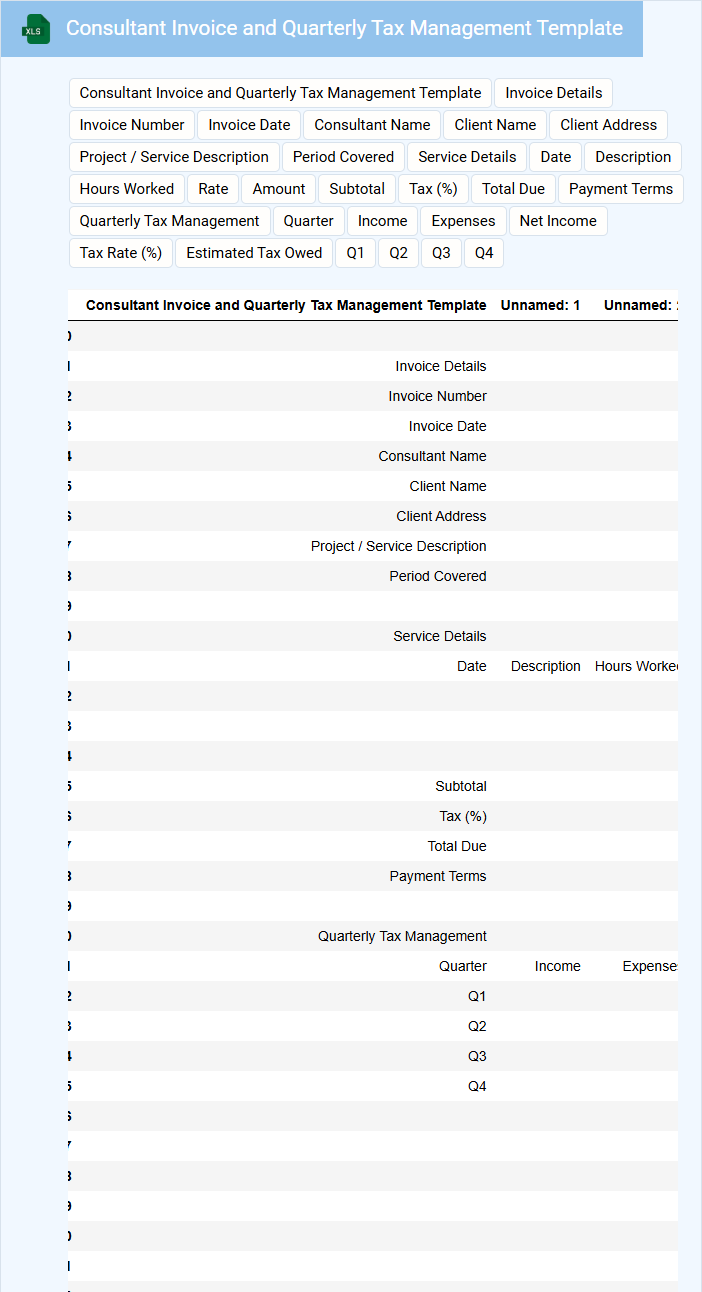

Consultant Invoice and Quarterly Tax Management Template

What information is typically included in a Consultant Invoice and Quarterly Tax Management Template? This type of document usually contains detailed billing information such as consultant services provided, hours worked, rates, total amount due, and payment terms. Additionally, it includes sections for tracking quarterly tax obligations, ensuring accurate tax calculations and timely submissions.

Why is it important to use a structured template for Consultant Invoices and Quarterly Tax Management? Using a well-organized template helps maintain clear communication with clients and ensures compliance with tax regulations. It also simplifies record-keeping, making it easier to manage finances and prepare for audits or tax filings.

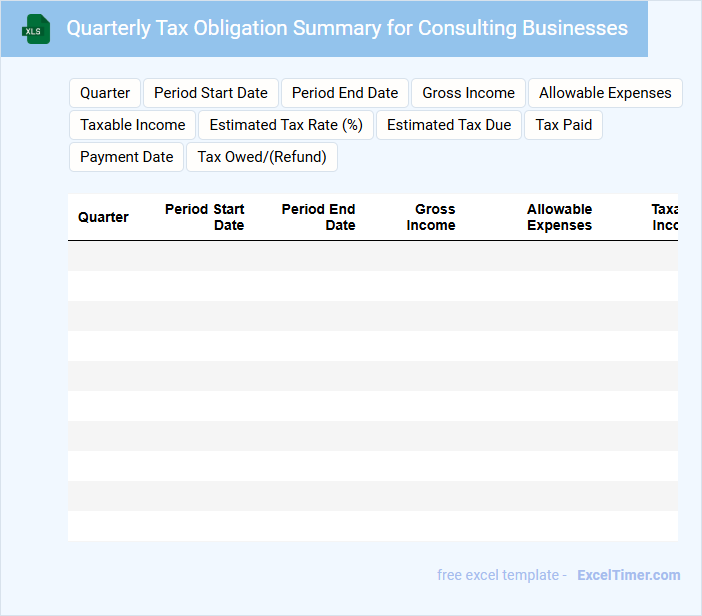

Quarterly Tax Obligation Summary for Consulting Businesses

The Quarterly Tax Obligation Summary for consulting businesses typically contains detailed records of income, deductible expenses, and tax payments made during the quarter. It serves as a crucial document for tracking tax liabilities and ensuring compliance with tax regulations. Accurate record-keeping and timely submission can prevent penalties and streamline the annual tax filing process.

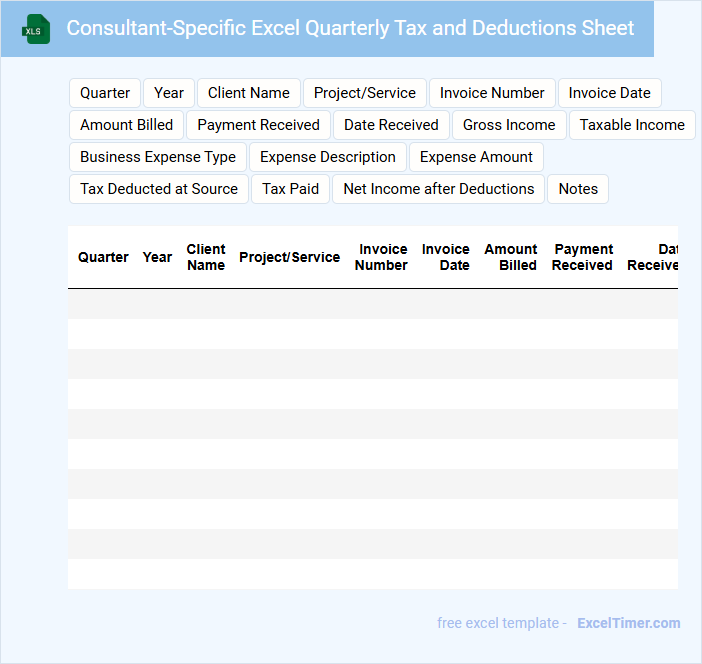

Consultant-Specific Excel Quarterly Tax and Deductions Sheet

What information is typically included in a Consultant-Specific Excel Quarterly Tax and Deductions Sheet? This document usually contains detailed records of a consultant's earnings, tax withholdings, and various deductions calculated on a quarterly basis. It helps in ensuring accurate tax reporting and financial planning specific to the consultant's engagements and compliance requirements.

What key details should a Quarterly Tax Summary for consultants include in an Excel document?

A Quarterly Tax Summary for consultants in Excel should include detailed income records, tax withheld amounts, deductible expenses, and net taxable income. Your summary must also feature tax payment deadlines and calculated estimated taxes due each quarter. Clear headings and organized data ensure accurate tax tracking and compliance.

Which formulas are essential for accurately summarizing quarterly income and expenses?

Essential formulas for accurately summarizing quarterly income and expenses in an Excel Quarterly Tax Summary for Consultants include SUMIFS to total income and expenses based on date ranges, VLOOKUP or INDEX-MATCH to retrieve specific tax rates or categories, and IFERROR to handle any calculation errors. The use of PivotTables also enables dynamic aggregation of financial data by quarter. Employing these formulas ensures precise and efficient financial tracking for tax reporting.

How should deductible business expenses be categorized and tracked in the summary?

Deductible business expenses for consultants should be categorized by expense type such as travel, office supplies, and professional services in the Quarterly Tax Summary. Each category must include date, amount, and vendor details to ensure accurate tracking and compliance. Proper categorization facilitates precise tax deductions and simplifies audit processes.

What columns are necessary to calculate estimated quarterly tax payments owed?

Essential columns to calculate estimated quarterly tax payments for consultants include Gross Income, Business Expenses, Net Income, Tax Deductions, Tax Credits, and Estimated Tax Rate. Additional columns like Prior Tax Payments and Penalties may refine accuracy. Including Payment Due Dates supports timely tax compliance.

How can the Excel document highlight discrepancies or missing tax-related information for consultants?

The Excel document can use conditional formatting to highlight discrepancies or missing tax-related information by flagging cells with inconsistent or incomplete data. Formulas such as IFERROR and VLOOKUP identify mismatches between reported amounts and tax brackets, alerting users to errors. Data validation rules ensure all required fields are completed, helping maintain accurate quarterly tax summaries for consultants.